Credit

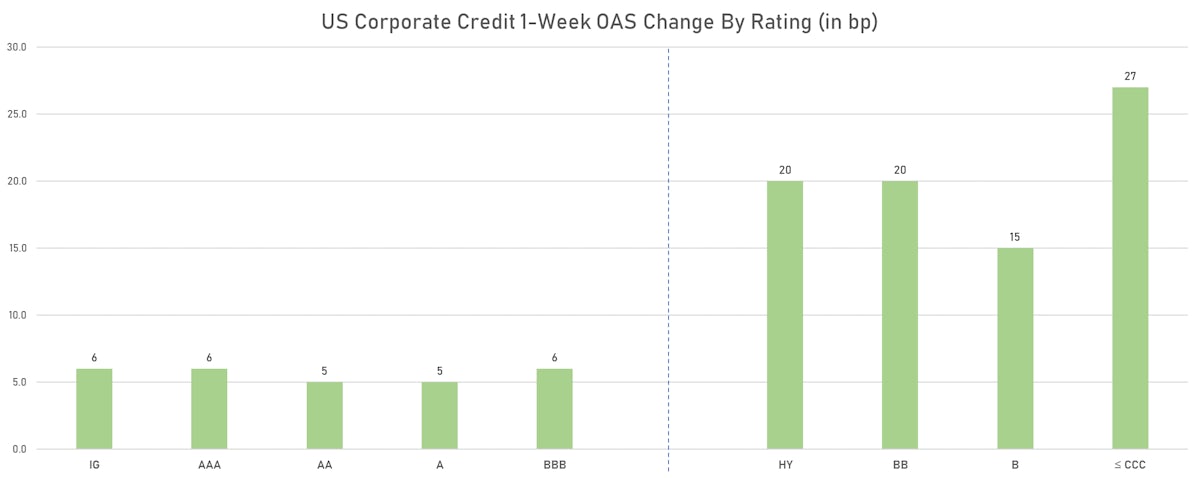

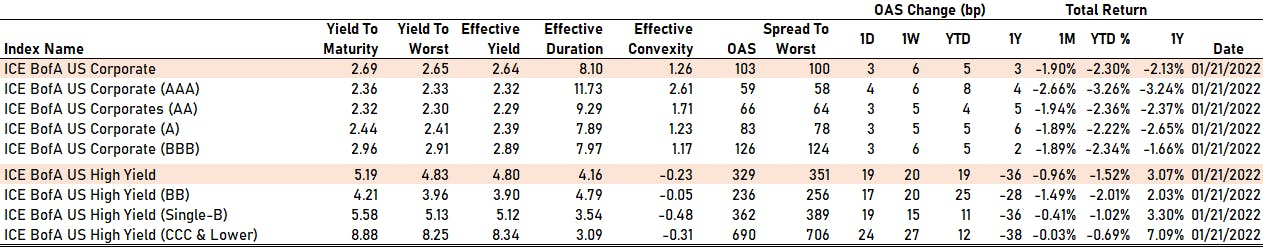

Spreads Wider Across The Credit Complex, With The OAS On ICE BofA US Corporate CCCs Up A Whopping 24bp Today

Weekly volumes of US$ bond issuance (IFR data): 29 Tranches for US$38.79bn in IG (2022 YTD volume US$145.79bn vs 2021 YTD US$108.795bn) and 8 Tranches for US$4.27bn in HY (2022 YTD volume US$16.085bn vs 2021 YTD US$35.545bn)

Published ET

1-Week Change In ICE BofAML US Corporate OAS By Rating | Sources: ϕpost, Refinitiv data

QUICK SUMMARY

- S&P 500 Bond Index was up 0.22% today, with investment grade up 0.28% and high yield down -0.31% (YTD total return: -2.23%)

- The iBoxx USD Liquid Investment Grade Total Return Index was up 0.345% today (Month-to-date: -2.90%; Year-to-date: -2.90%)

- The iBoxx USD Liquid High Yield Total Return Index was down -0.399% today (Month-to-date: -1.73%; Year-to-date: -1.73%)

- ICE BofA US Corporate Index (Investment Grade) spread to worst up 3.0 bp, now at 100.0 bp (YTD change: +5.0 bp)

- ICE BofA US High Yield Index spread to worst up 19.0 bp, now at 351.0 bp (YTD change: +21.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index down -0.02% today (YTD total return: +0.6%)

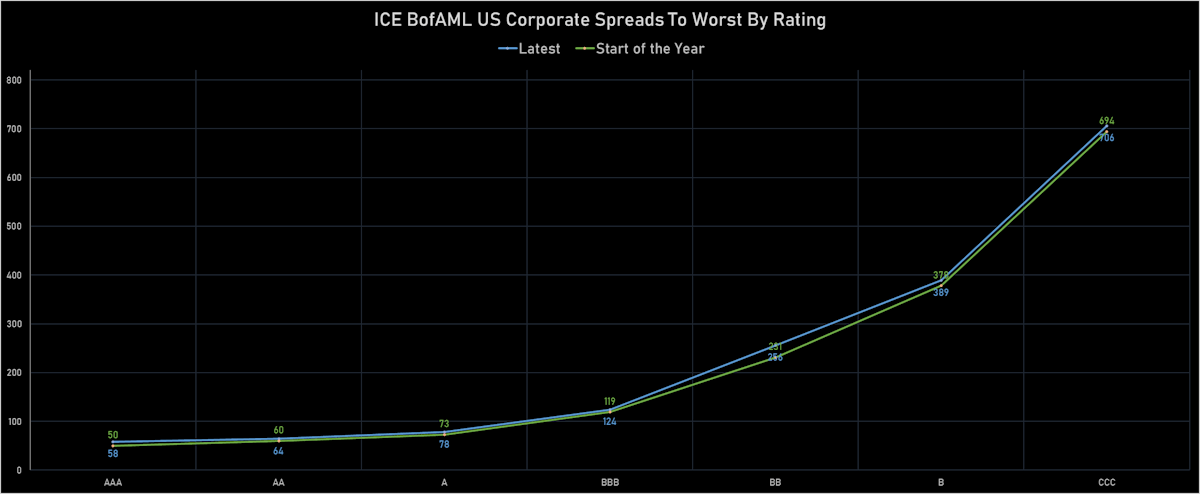

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING

- AAA up by 4 bp at 59 bp

- AA up by 3 bp at 66 bp

- A up by 3 bp at 83 bp

- BBB up by 3 bp at 126 bp

- BB up by 17 bp at 236 bp

- B up by 19 bp at 362 bp

- CCC up by 24 bp at 690 bp

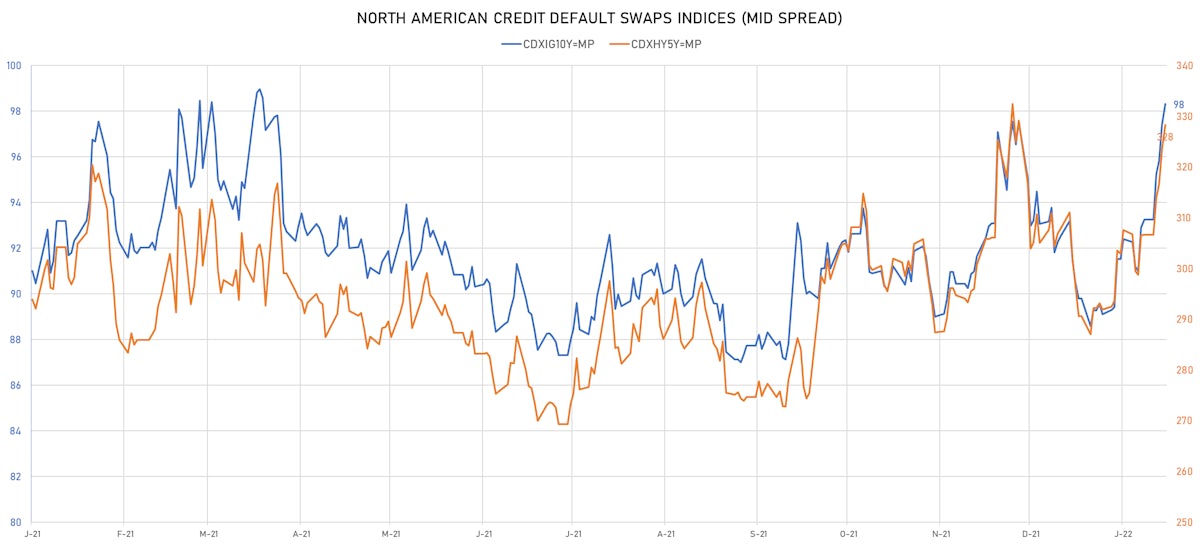

CDS INDICES (mid-spreads)

- Markit CDX.NA.IG 5Y up 0.9 bp, now at 98bp (YTD change: +9.2bp)

- Markit CDX.NA.HY 5Y up 4.9 bp, now at 328bp (YTD change: +36.4bp)

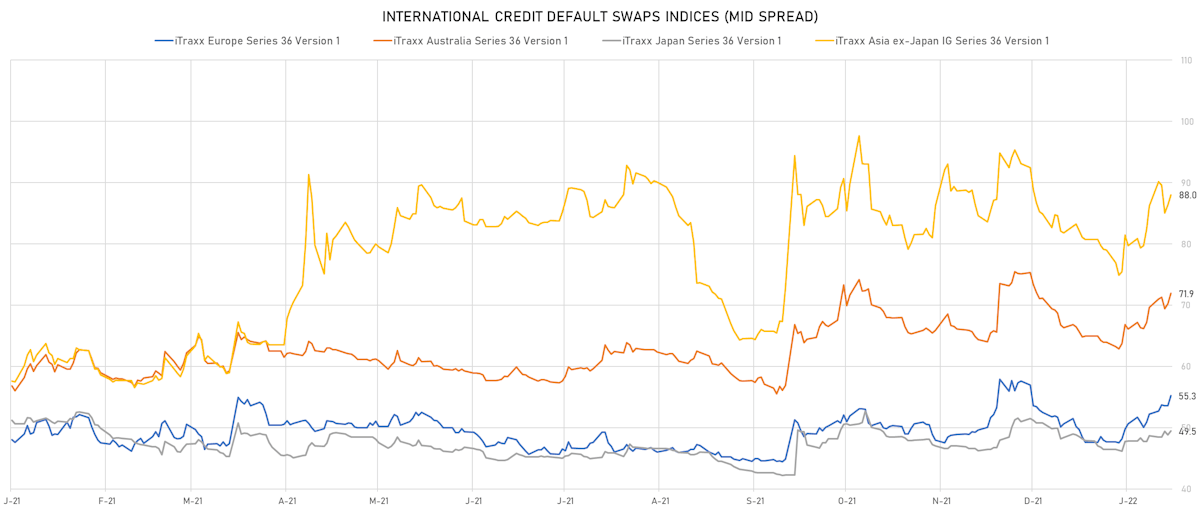

- Markit iTRAXX Europe up 1.7 bp, now at 55bp (YTD change: +7.6bp)

- Markit iTRAXX Japan up 0.7 bp, now at 50bp (YTD change: +3.1bp)

- Markit iTRAXX Asia Ex-Japan up 1.7 bp, now at 88bp (YTD change: +9.0bp)

TOP BONDS MOVES IN THE PAST WEEK - USD HY

- Issuer: Metinvest BV (Amsterdam, Netherlands) | Coupon: 8.50% | Maturity: 23/4/2026 | Rating: B+ | ISIN: XS1806400708 | Z-spread up by 435.2 bp to 1,002.3 bp, with the yield to worst at 11.3% and the bond now trading down to 89.9 cents on the dollar (1Y price range: 89.9-104.5).

- Issuer: Mhp Se (Kiev, Cyprus) | Coupon: 7.75% | Maturity: 10/5/2024 | Rating: B | ISIN: XS1577965004 | Z-spread up by 416.5 bp to 1,034.9 bp, with the yield to worst at 11.0% and the bond now trading down to 93.0 cents on the dollar (1Y price range: 91.5-101.9).

- Issuer: Wanda Properties International Co Ltd (British Virgin Islands) | Coupon: 7.25% | Maturity: 29/1/2024 | Rating: BB- | ISIN: XS1023280271 | Z-spread up by 398.8 bp to 1,100.5 bp, with the yield to worst at 11.2% and the bond now trading down to 92.0 cents on the dollar (1Y price range: 85.1-94.9).

- Issuer: Rail Capital Markets PLC (London, United Kingdom) | Coupon: 7.88% | Maturity: 15/7/2026 | Rating: B | ISIN: XS2365120885 | Z-spread up by 351.6 bp to 1,178.8 bp, with the yield to worst at 13.0% and the bond now trading down to 81.5 cents on the dollar (1Y price range: 81.5-93.5).

- Issuer: CBOM Finance PLC (DUBLIN, Ireland) | Coupon: 4.70% | Maturity: 29/1/2025 | Rating: BB | ISIN: XS2099763075 | Z-spread up by 249.5 bp to 571.6 bp, with the yield to worst at 6.7% and the bond now trading down to 93.8 cents on the dollar (1Y price range: 93.8-101.0).

- Issuer: Kondor Finance PLC (London, United Kingdom) | Coupon: 7.63% | Maturity: 8/11/2026 | Rating: B | ISIN: XS2077601610 | Z-spread up by 244.1 bp to 1,272.2 bp, with the yield to worst at 13.5% and the bond now trading down to 78.8 cents on the dollar (1Y price range: 78.0-87.3).

- Issuer: MHP Lux SA (Luxembourg, Luxembourg) | Coupon: 6.95% | Maturity: 3/4/2026 | Rating: B | ISIN: XS1713469911 | Z-spread up by 229.9 bp to 801.9 bp, with the yield to worst at 9.3% and the bond now trading down to 91.0 cents on the dollar (1Y price range: 87.6-99.6).

- Issuer: Hopson Development Holdings Ltd (Bermuda) | Coupon: 6.80% | Maturity: 28/12/2023 | Rating: B+ | ISIN: XS2353028298 | Z-spread up by 210.5 bp to 1,026.5 bp, with the yield to worst at 10.8% and the bond now trading down to 92.3 cents on the dollar (1Y price range: 90.0-96.4).

- Issuer: GTLK Europe DAC (DUBLIN, Ireland) | Coupon: 5.13% | Maturity: 31/5/2024 | Rating: BB | ISIN: XS1577961516 | Z-spread up by 151.1 bp to 366.1 bp, with the yield to worst at 4.4% and the bond now trading down to 100.5 cents on the dollar (1Y price range: 100.5-105.6).

TOP BONDS MOVES IN THE PAST WEEK - EUR HY

- Issuer: Metinvest BV (Amsterdam, Netherlands) | Coupon: 5.63% | Maturity: 17/6/2025 | Rating: B+ | ISIN: XS2056722734 | Z-spread up by 362.1 bp to 1,024.5 bp, with the yield to worst at 9.8% and the bond now trading down to 87.8 cents on the dollar (1Y price range: 86.0-99.4).

- Issuer: CBOM Finance PLC (Dublin, Ireland) | Coupon: 3.10% | Maturity: 21/1/2026 | Rating: BB | ISIN: XS2281299763 | Z-spread up by 146.6 bp to 584.1 bp, with the yield to worst at 5.7% and the bond now trading down to 90.5 cents on the dollar (1Y price range: 90.2-96.0).

- Issuer: Webuild SpA (Milan, Italy) | Coupon: 3.63% | Maturity: 28/1/2027 | Rating: BB- | ISIN: XS2102392276 | Z-spread up by 71.6 bp to 347.8 bp, with the yield to worst at 3.3% and the bond now trading down to 100.3 cents on the dollar (1Y price range: 100.3-104.2).

- Issuer: Atrium Finance Issuer BV (Amsterdam, Netherlands) | Coupon: 2.63% | Maturity: 5/9/2027 | Rating: BB | ISIN: XS2294495838 | Z-spread up by 66.8 bp to 367.4 bp, with the yield to worst at 3.6% and the bond now trading down to 94.2 cents on the dollar (1Y price range: 94.1-97.7).

- Issuer: Fortune Star (BVI) Ltd (British Virgin Islands) | Coupon: 3.95% | Maturity: 2/10/2026 | Rating: BB- | ISIN: XS2357132849 | Z-spread up by 66.1 bp to 592.4 bp, with the yield to worst at 5.9% and the bond now trading down to 92.1 cents on the dollar (1Y price range: 90.2-95.0).

- Issuer: Mahle GmbH (Stuttgart, Germany) | Coupon: 2.38% | Maturity: 14/5/2028 | Rating: BB+ | ISIN: XS2341724172 | Z-spread up by 51.2 bp to 320.9 bp, with the yield to worst at 3.3% and the bond now trading down to 94.4 cents on the dollar (1Y price range: 94.2-97.6).

- Issuer: Webuild SpA (Milan, Italy) | Coupon: 5.88% | Maturity: 15/12/2025 | Rating: BB- | ISIN: XS2271356201 | Z-spread up by 49.2 bp to 369.0 bp, with the yield to worst at 3.5% and the bond now trading down to 107.0 cents on the dollar (1Y price range: 107.0-109.5).

- Issuer: Atrium European Real Estate Ltd (Saint Helier, Jersey) | Coupon: 3.00% | Maturity: 11/9/2025 | Rating: BB | ISIN: XS1829325239 | Z-spread up by 45.8 bp to 272.8 bp, with the yield to worst at 2.5% and the bond now trading down to 100.9 cents on the dollar (1Y price range: 100.6-102.9).

- Issuer: Standard Industries Inc (Parsippany, New Jersey (US)) | Coupon: 2.25% | Maturity: 21/11/2026 | Rating: B+ | ISIN: XS2080766475 | Z-spread up by 42.8 bp to 296.4 bp, with the yield to worst at 2.9% and the bond now trading down to 96.5 cents on the dollar (1Y price range: 96.4-98.3).

- Issuer: Banca Monte dei Paschi di Siena SpA (Siena, Italy) | Coupon: 1.88% | Maturity: 9/1/2026 | Rating: CCC+ | ISIN: XS2270393379 | Z-spread up by 36.3 bp to 296.8 bp (CDS basis: -18.8bp), with the yield to worst at 2.7% and the bond now trading down to 95.9 cents on the dollar (1Y price range: 95.8-97.5).

- Issuer: SoftBank Group Corp (Minato-Ku, Japan) | Coupon: 3.38% | Maturity: 6/7/2029 | Rating: BB+ | ISIN: XS2361255057 | Z-spread up by 35.3 bp to 462.7 bp, with the yield to worst at 4.8% and the bond now trading down to 91.3 cents on the dollar (1Y price range: 90.9-93.4).

- Issuer: Nokia Oyj (Espoo, Finland) | Coupon: 2.00% | Maturity: 11/3/2026 | Rating: BB | ISIN: XS1960685383 | Z-spread up by 33.9 bp to 112.2 bp (CDS basis: -37.7bp), with the yield to worst at 1.0% and the bond now trading down to 103.2 cents on the dollar (1Y price range: 103.2-104.7).

- Issuer: Nexi SpA (Milan, Italy) | Coupon: 1.63% | Maturity: 30/4/2026 | Rating: BB- | ISIN: XS2332589972 | Z-spread up by 33.8 bp to 207.0 bp, with the yield to worst at 2.0% and the bond now trading down to 98.1 cents on the dollar (1Y price range: 97.1-99.7).

- Issuer: Jaguar Land Rover Automotive PLC (Coventry, United Kingdom) | Coupon: 4.50% | Maturity: 15/1/2026 | Rating: B+ | ISIN: XS1881005976 | Z-spread up by 32.7 bp to 378.8 bp (CDS basis: -33.4bp), with the yield to worst at 3.5% and the bond now trading down to 102.6 cents on the dollar (1Y price range: 102.5-104.5).

- Issuer: ZF Europe Finance BV (Amsterdam, Netherlands) | Coupon: 3.00% | Maturity: 23/10/2029 | Rating: BB+ | ISIN: XS2010039894 | Z-spread up by 32.6 bp to 262.7 bp, with the yield to worst at 2.7% and the bond now trading down to 100.9 cents on the dollar (1Y price range: 100.8-103.4).

- Issuer: Adler Group SA (Senningerberg, Luxembourg) | Coupon: 1.50% | Maturity: 26/7/2024 | Rating: BB- | ISIN: XS1652965085 | Z-spread down by 83.0 bp to 566.0 bp, with the yield to worst at 5.3% and the bond now trading up to 90.9 cents on the dollar (1Y price range: 87.1-91.1).

SELECTED RECENT USD BOND ISSUES

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, New Jersey, United States | Rating: AA+): US$300m Bond (US3133ENMK37), floating rate (AB3DM + -1.5 bp) maturing on 29 January 2024, priced at 100.00, non callable

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$125m Bond (US3133ENMP24), fixed rate (2.23% coupon) maturing on 27 January 2032, priced at 100.00 (original spread of 93 bp), callable (10nc3)

- Goldman Sachs Group Inc (Banking | New York City, New York, United States | Rating: BBB+): US$566m Unsecured Note (XS1970494487) zero coupon maturing on 10 February 2062, non callable

- JPMorgan Chase & Co (Banking | New York City, New York, United States | Rating: A-): US$285m Unsecured Note (XS1450779233) zero coupon maturing on 14 February 2057, priced at 100.00, non callable

- Antares Holdings LP (Financial - Other | Toronto, Ontario, Canada | Rating: NR): US$550m Senior Note (US03666HAE18), fixed rate (3.75% coupon) maturing on 15 July 2027, priced at 99.01 (original spread of 240 bp), callable (5nc5)

- Erste Group Bank AG (Banking | Wien, Wien, Austria | Rating: A): US$150m Inhaberschuldverschreibung (AT0000A2VC95), fixed rate (1.00% coupon) maturing on 3 March 2027, priced at 100.00, non callable

- International Petroleum Corp (Oil and Gas | Vancouver, British Columbia, Canada | Rating: B+): US$300m Bond (NO0012423476), fixed rate (7.25% coupon) maturing on 1 February 2027, priced at 100.00, callable (5nc3)

SELECTED RECENT EUR BOND ISSUES

- Bank of Nova Scotia (Banking | Toronto, Ontario, Canada | Rating: A): €300m Senior Note (XS2436798347), fixed rate (1.14% coupon) maturing on 25 January 2034, priced at 100.00, non callable

- Canadian Imperial Bank of Commerce (Banking | Toronto, Canada | Rating: A+): €1,500m Unsecured Note (XS2436885748), floating rate maturing on 26 January 2024, priced at 100.00, non callable

NEW LOANS

- East West Manufacturing LLC (B-), signed a US$ 275m Term Loan B, to be used for leveraged buyout. It matures on 02/02/29 and initial pricing is set at Term SOFR +575bp

NEW ISSUES IN SECURITIZED CREDIT

- Allegany Park Clo issued a floating-rate CLO in 5 tranches, for a total of US$ 460 m. Highest-rated tranche offering a spread over the floating rate of 130bp, and the lowest-rated tranche a spread of 640bp. Bookrunners: Wells Fargo Securities LLC

- Servpro Master Issuer LLC Series 2022-1 issued a fixed-rate ABS backed by business cashflow in 1 tranche, for a total of US$ 260 m. Highest-rated tranche offering a yield to maturity of 3.13%, and the lowest-rated tranche a yield to maturity of 3.13%. Bookrunners: Barclays Capital Group

- Stwd 2022-Fl3 Ltd issued a floating-rate CLO in 6 tranches, for a total of US$ 843 m. Highest-rated tranche offering a spread over the floating rate of 125bp, and the lowest-rated tranche a spread of 325bp. Bookrunners: Morgan Stanley International Ltd, JP Morgan & Co Inc, Wells Fargo Securities LLC

- Lendingpoint 2022-A Asset Securitization Trust issued a fixed-rate ABS backed by consumer loan in 5 tranches, for a total of US$ 400 m. Highest-rated tranche offering a yield to maturity of 1.68%, and the lowest-rated tranche a yield to maturity of 7.02%. Bookrunners: Credit Suisse, Guggenheim Securities LLC