Credit

US$ Credit Performing Very Poorly, Along With Equities, As Spreads Widen Across The Complex

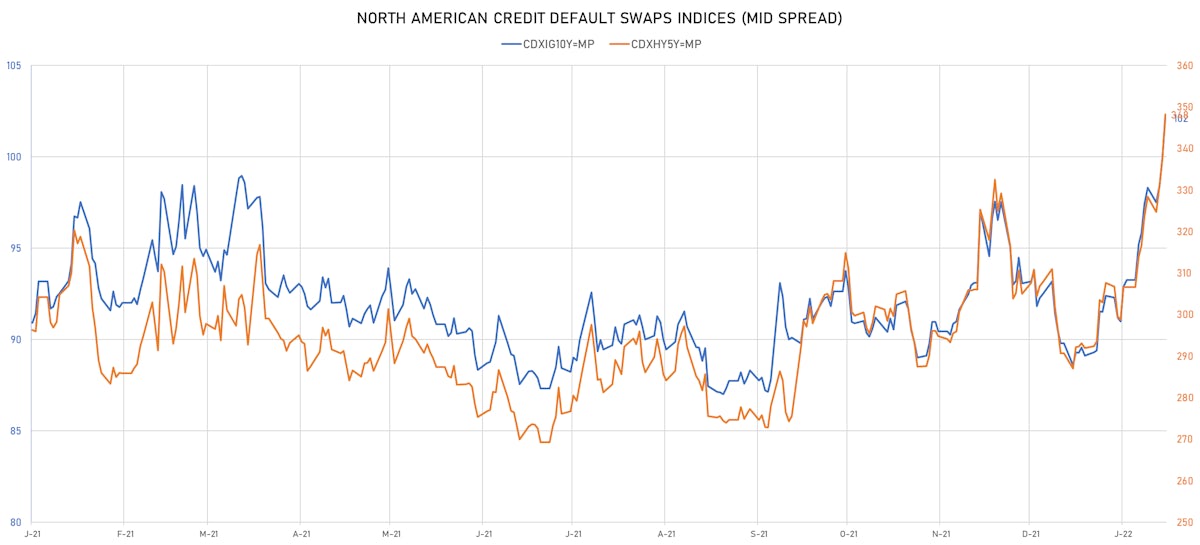

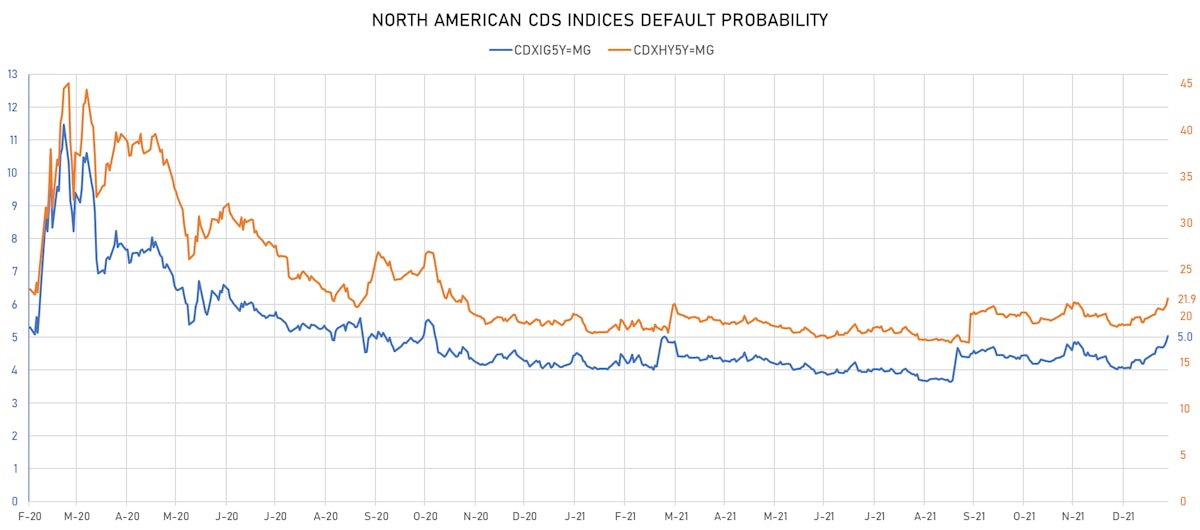

Implied default probabilities are rising in credit derivatives, with a flattening of the term structure (yields are up the most at the front end of the rates curves)

Published ET

CDX.NA.IG 5Y & CDX.NA.HY 5Y Implied Default Probabilities | Sources: ϕpost, Refinitiv data

QUICK SUMMARY

- S&P 500 Bond Index was up 0.13% today, with investment grade up 0.20% and high yield down -0.54% (YTD total return: -2.93%)

- The iBoxx USD Liquid Investment Grade Total Return Index was up 0.175% today (Month-to-date: -3.79%; Year-to-date: -3.79%)

- The iBoxx USD Liquid High Yield Total Return Index was down -0.729% today (Month-to-date: -2.70%; Year-to-date: -2.70%)

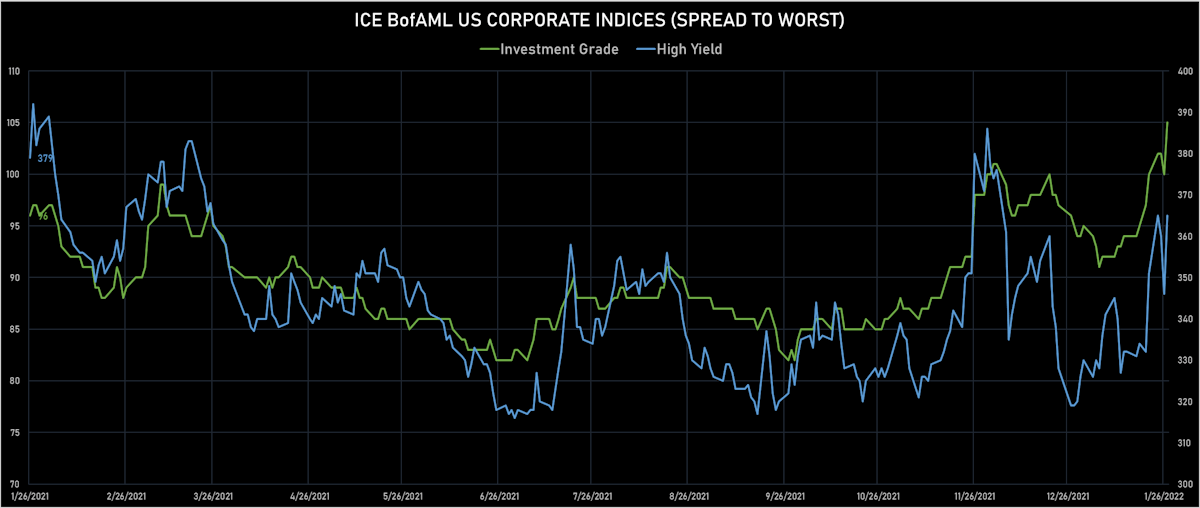

- ICE BofA US Corporate Index (Investment Grade) spread to worst up 5.0 bp, now at 105.0 bp (YTD change: +10.0 bp)

- ICE BofA US High Yield Index spread to worst up 19.0 bp, now at 365.0 bp (YTD change: +35.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index down -0.05% today (YTD total return: +0.4%)

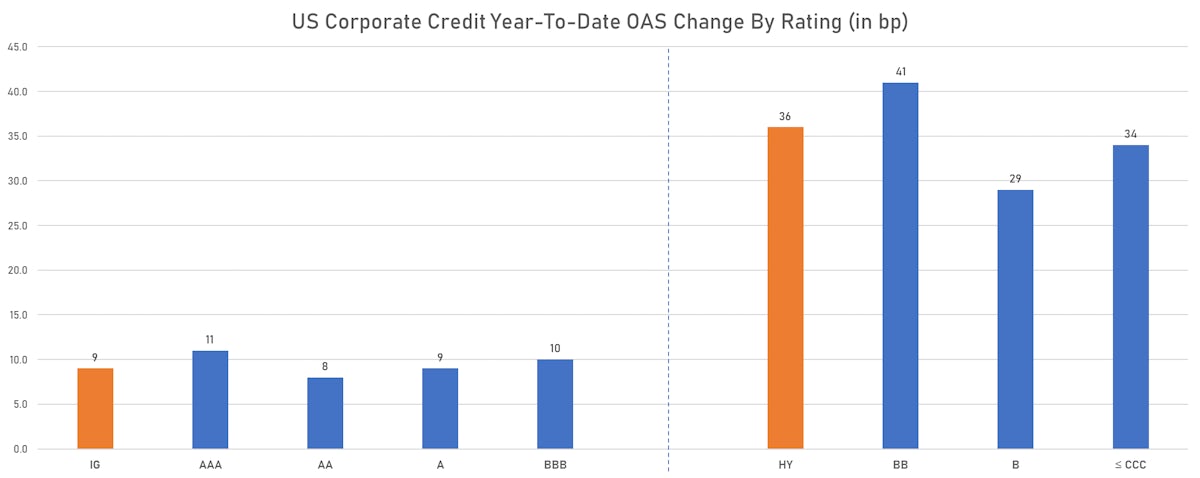

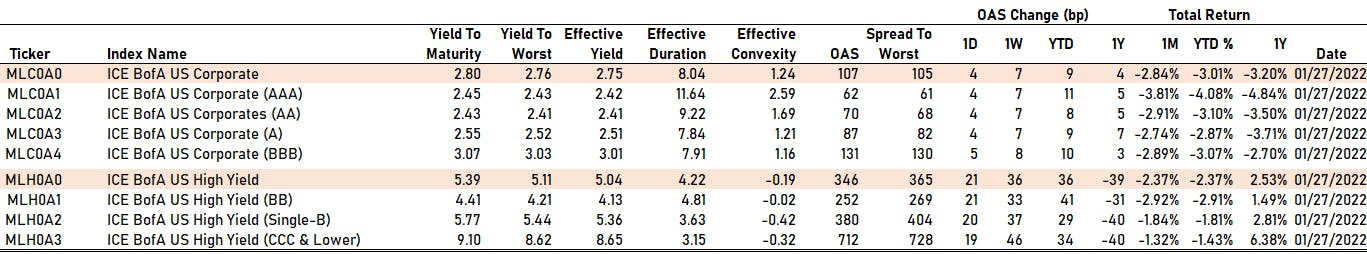

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING

- AAA up by 4 bp at 62 bp

- AA up by 4 bp at 70 bp

- A up by 4 bp at 87 bp

- BBB up by 5 bp at 131 bp

- BB up by 21 bp at 252 bp

- B up by 20 bp at 380 bp

- CCC up by 19 bp at 712 bp

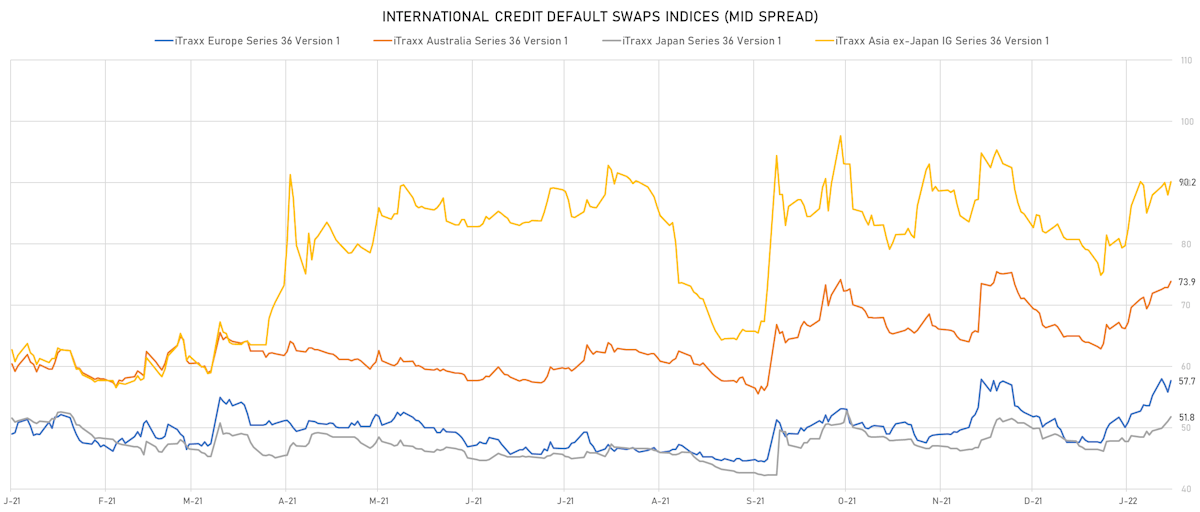

CDS INDICES (mid-spreads)

- Markit CDX.NA.IG 5Y up 2.2 bp, now at 102bp (YTD change: +13.0bp)

- Markit CDX.NA.HY 5Y up 10.6 bp, now at 348bp (YTD change: +56.3bp)

- Markit iTRAXX Europe up 1.9 bp, now at 58bp (YTD change: +10.0bp)

- Markit iTRAXX Japan up 0.7 bp, now at 52bp (YTD change: +5.3bp)

- Markit iTRAXX Asia Ex-Japan up 2.2 bp, now at 90bp (YTD change: +11.1bp)

USD CDS SINGLE NAMES - LARGEST MOVES IN THE PAST WEEK

- American Axle & Manufacturing Inc (Country: US; rated: Ba1): up 35.1 bp to 439.6bp (1Y range: 355-449bp)

- Avis Budget Group Inc (Country: US; rated: CCC): up 35.4 bp to 282.7bp (1Y range: 183-403bp)

- MBIA Inc (Country: US; rated: Ba3): up 37.0 bp to 338.0bp (1Y range: 303-565bp)

- Goodyear Tire & Rubber Co (Country: US; rated: LGD2 - 22%): up 37.1 bp to 239.0bp (1Y range: 188-320bp)

- Realogy Group LLC (Country: US; rated: B2): up 40.9 bp to 362.0bp (1Y range: 278-453bp)

- RR Donnelley & Sons Co (Country: US; rated: B2): up 45.8 bp to 216.4bp (1Y range: 119-610bp)

- Xerox Corp (Country: US; rated: LGD4 - 56%): up 46.7 bp to 272.9bp (1Y range: 158-297bp)

- Pitney Bowes Inc (Country: US; rated: LGD2 - 16%): up 48.6 bp to 590.7bp (1Y range: 363-591bp)

- American Airlines Group Inc (Country: US; rated: B2): up 52.3 bp to 810.7bp (1Y range: 596-1,182bp)

- Royal Caribbean Cruises Ltd (Country: US; rated: LGD4 - 59%): up 55.4 bp to 429.5bp (1Y range: 299-678bp)

- Staples Inc (Country: US; rated: B2): up 68.0 bp to 1,131.9bp (1Y range: 687-1,159bp)

- Navient Corp (Country: US; rated: Ba3): up 70.5 bp to 382.1bp (1Y range: -382bp)

- Carnival Corp (Country: US; rated: LGD5 - 72%): up 72.2 bp to 492.0bp (1Y range: 291-565bp)

- Kohls Corp (Country: US; rated: Baa2): up 142.5 bp to 346.0bp (1Y range: 101-346bp)

- Transocean Inc (Country: KY; rated: Caa3): up 268.7 bp to 1,928.4bp (1Y range: 941-2,371bp)

EURO CDS SINGLE NAMES - LARGEST MOVES IN THE PAST WEEK

- Air France KLM SA (Country: FR; rated: B-): up 13.1 bp to 416.1bp (1Y range: 386-699bp)

- Leonardo SpA (Country: IT; rated: WD): up 13.1 bp to 164.0bp (1Y range: 125-228bp)

- Banca Monte dei Paschi di Siena SpA (Country: IT; rated: NP): up 13.4 bp to 273.9bp (1Y range: 145-274bp)

- Hammerson PLC (Country: GB; rated: Baa3): up 13.6 bp to 228.2bp (1Y range: 166-352bp)

- Ladbrokes Coral Group Ltd (Country: GB; rated: WR): up 16.6 bp to 227.8bp (1Y range: 107-229bp)

- Premier Foods Finance PLC (Country: GB; rated: B1): up 18.3 bp to 224.4bp (1Y range: 154-273bp)

- CMA CGM SA (Country: FR; rated: Ba3): up 18.8 bp to 322.3bp (1Y range: 259-495bp)

- Stena AB (Country: SE; rated: B2-PD): up 18.9 bp to 430.4bp (1Y range: 401-728bp)

- Casino Guichard Perrachon SA (Country: FR; rated: WR): up 19.8 bp to 699.1bp (1Y range: 464-779bp)

- Iceland Bondco PLC (Country: GB; rated: LGD3 - 46%): up 20.4 bp to 636.6bp (1Y range: 358-661bp)

- Ineos Group Holdings SA (Country: LU; rated: WR): up 24.8 bp to 171.5bp (1Y range: 125-296bp)

- Ardagh Packaging Finance PLC (Country: IE; rated: B1): up 29.8 bp to 315.5bp (1Y range: 210-318bp)

- Altice Finco SA (Country: LU; rated: Caa1): up 30.2 bp to 461.7bp (1Y range: 333-481bp)

- Novafives SAS (Country: FR; rated: Caa1): up 45.9 bp to 734.2bp (1Y range: 618-976bp)

- Boparan Finance PLC (Country: GB; rated: B3): up 68.7 bp to 1,472.1bp (1Y range: 597-1,564bp)

SELECTED RECENT USD BOND ISSUES

- Embecta Corp (Health Care Supply | Wilmington, United States | Rating: B+): US$500m Note (US29082KAA34), fixed rate (5.00% coupon) maturing on 15 February 2030, priced at 100.00 (original spread of 327 bp), callable (8nc5)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$120m Bond (US3133ENMU19), fixed rate (2.75% coupon) maturing on 2 February 2037, priced at 100.00, callable (15nc1)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$675m Bond (US3133ENMW74), floating rate (SOFR + 4.0 bp) maturing on 2 February 2024, priced at 100.00, callable (2nc1)

- Procter & Gamble Co (Consumer Products | Cincinnati, United States | Rating: AA-): US$1,000m Senior Note (US742718FV65), fixed rate (1.90% coupon) maturing on 1 February 2027, priced at 99.86 (original spread of 27 bp), with a make whole call

- Procter & Gamble Co (Consumer Products | Cincinnati, United States | Rating: AA-): US$850m Senior Note (US742718FW49), fixed rate (2.30% coupon) maturing on 1 February 2032, priced at 99.93 (original spread of 52 bp), with a make whole call

- Bausch Health Companies Inc (Pharmaceuticals | Laval, Canada | Rating: BB): US$1,000m Note (US071734AP21), fixed rate (6.13% coupon) maturing on 1 February 2027, priced at 100.00 (original spread of 447 bp), callable (5nc2)

- MHH Holding BV (Financial - Other | Bant | Rating: NR): US$150m Bond (NO0012428996), floating rate (US3MLIB + 700.0 bp) maturing on 10 February 2025, priced at 100.00, callable (3nc2)

- Rhodia Acetow Management GmbH (Financial - Other | Freiburg Im Breisgau, Germany | Rating: NR): US$600m Note (US15679GAA04), fixed rate (10.50% coupon) maturing on 15 February 2027, priced at 97.00, callable (5nc2)

SELECTED RECENT EUR BOND ISSUES

- Banque Federative du Credit Mutuel SA (Banking | Strasbourg, France | Rating: A+): €1,000m Bond (FR0014007XP9), fixed rate (0.01% coupon) maturing on 7 March 2025, priced at 99.59, non callable

- Inter Media and Communication SpA (Financial - Other | Milan, Hong Kong | Rating: NR): €415m Note (XS2439248472), fixed rate (6.75% coupon) maturing on 9 February 2027, priced at 100.00 (original spread of 710 bp), callable (5nc2)

- NRW Bank (Agency | Dusseldorf, Germany | Rating: AA): €500m Inhaberschuldverschreibung (DE000NWB1W10), fixed rate (0.13% coupon) maturing on 4 February 2030, priced at 99.22 (original spread of 46 bp), non callable

- Ren10 Holding AB (Financial - Other | Stockholm, Luxembourg | Rating: NR): €350m Note (XS2439087441), floating rate (EU03MLIB + 437.5 bp) maturing on 1 February 2027, priced at 100.00, callable (5nc1)

- True Potential LLP (Financial - Other | Newcastle Upon Tyne, United Kingdom | Rating: NR): €360m Note (XS2436311570), fixed rate (5.00% coupon) maturing on 15 February 2027, priced at 100.00 (original spread of 532 bp), callable (5nc2)

NEW ISSUES IN SECURITIZED CREDIT

- Theorem Funding Trust 2022-1 issued a fixed-rate ABS backed by consumer loan in 1 tranche offering a yield to maturity of 1.88%, for a total of US$ 222 m. Bookrunners: Credit Suisse, Goldman Sachs & Co

- Golden Credit Card Trust Series 2022-2 issued a floating-rate ABS backed by receivables in 3 tranches, for a total of US$ 481 m. Bookrunners: RBC Capital Markets

- Golden Credit Card Trust Series 2022-1 issued a fixed-rate ABS backed by receivables in 1 tranche with a yield to maturity of 1.98%, for a total of US$ 500 m. Bookrunners: RBC Capital Markets

- Progress Residential 2022-Sfr1 Trust issued a fixed-rate ABS backed by rental income in 8 tranches, for a total of US$ 623 m. Highest-rated tranche offering a yield to maturity of 2.71%, and the lowest-rated tranche a yield to maturity of 6.03%. Bookrunners: Goldman Sachs & Co, Morgan Stanley International Ltd, Barclays Capital Group, Deutsche Bank Securities Inc, RBC Capital Markets, Wells Fargo Securities LLC, Bank of America Merrill Lynch