Credit

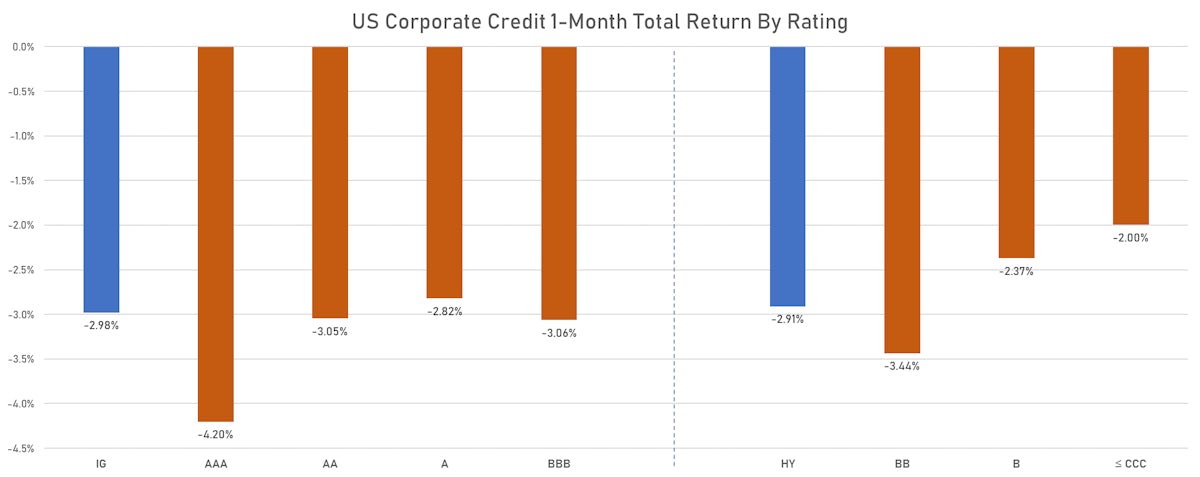

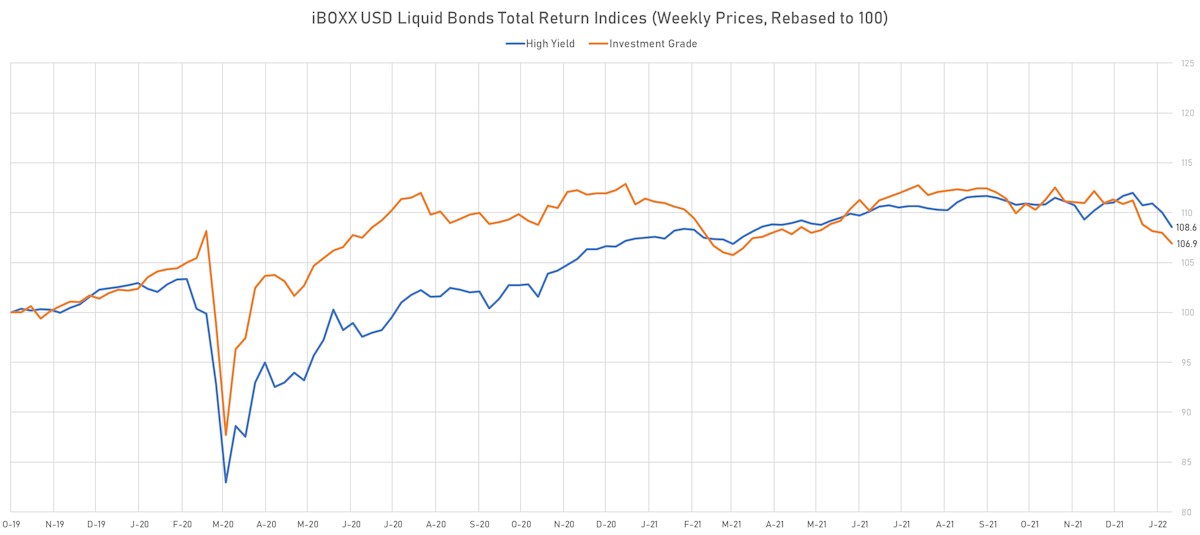

Rising Yields And Widening Spreads Continue To Weigh On US$ Credit, With Liquid Indices Down 3.9% For IG And 3.0% For HY YTD

Rates volatility brought measly volumes of issuance for the week (IFR data): US$ 6.275 bn in 8 tranches for HY (HY 2022 YTD: $22.36bn vs 2021 YTD $49.605 bn) and US$2.6bn in 3 tranches for IG (IG 2022 YTD: $148.39 bn vs 2021 YTD $135.97 bn)

Published ET

iBOXX USD Liquid IG & HY Bonds Total Returns Indices | Sources: ϕpost, Refinitiv data

QUICK SUMMARY

- S&P 500 Bond Index was down -0.18% today, with investment grade down -0.15% and high yield down -0.51% (YTD total return: -3.11%)

- The iBoxx USD Liquid Investment Grade Total Return Index was down -0.075% today (Month-to-date: -3.86%; Year-to-date: -3.86%)

- The iBoxx USD Liquid High Yield Total Return Index was down -0.349% today (Month-to-date: -3.04%; Year-to-date: -3.04%)

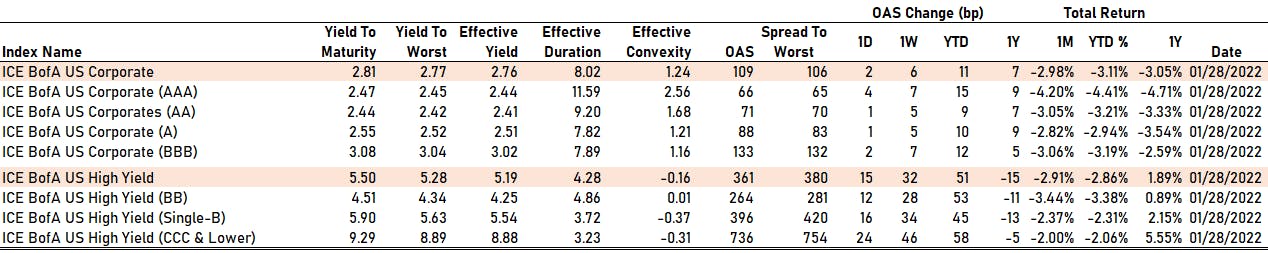

- ICE BofA US Corporate Index (Investment Grade) spread to worst up 1.0 bp, now at 106.0 bp (YTD change: +11.0 bp)

- ICE BofA US High Yield Index spread to worst up 15.0 bp, now at 380.0 bp (YTD change: +50.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index down -0.17% today (YTD total return: +0.2%)

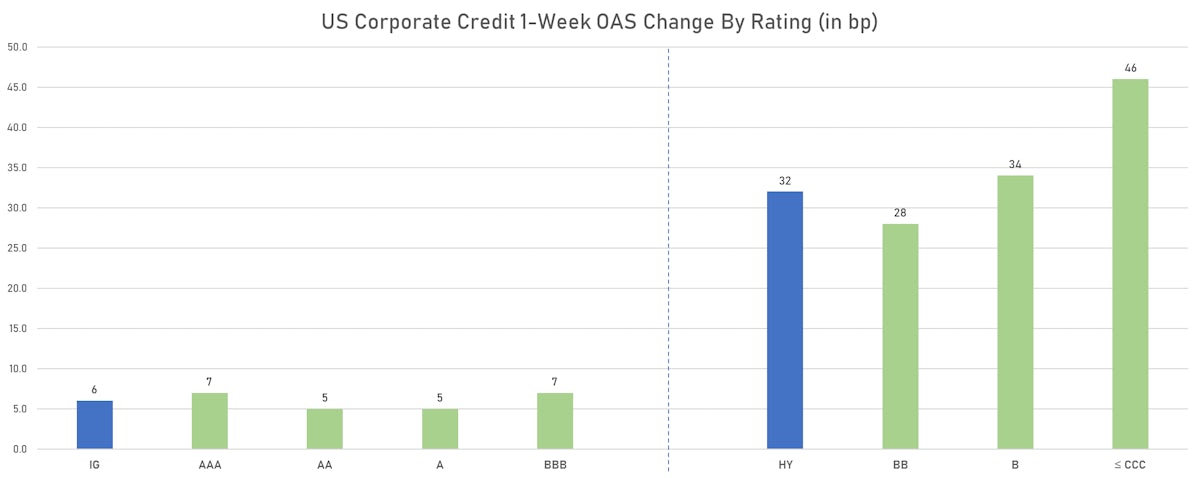

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING

- AAA up by 4 bp at 66 bp

- AA up by 1 bp at 71 bp

- A up by 1 bp at 88 bp

- BBB up by 2 bp at 133 bp

- BB up by 12 bp at 264 bp

- B up by 16 bp at 396 bp

- CCC up by 24 bp at 736 bp

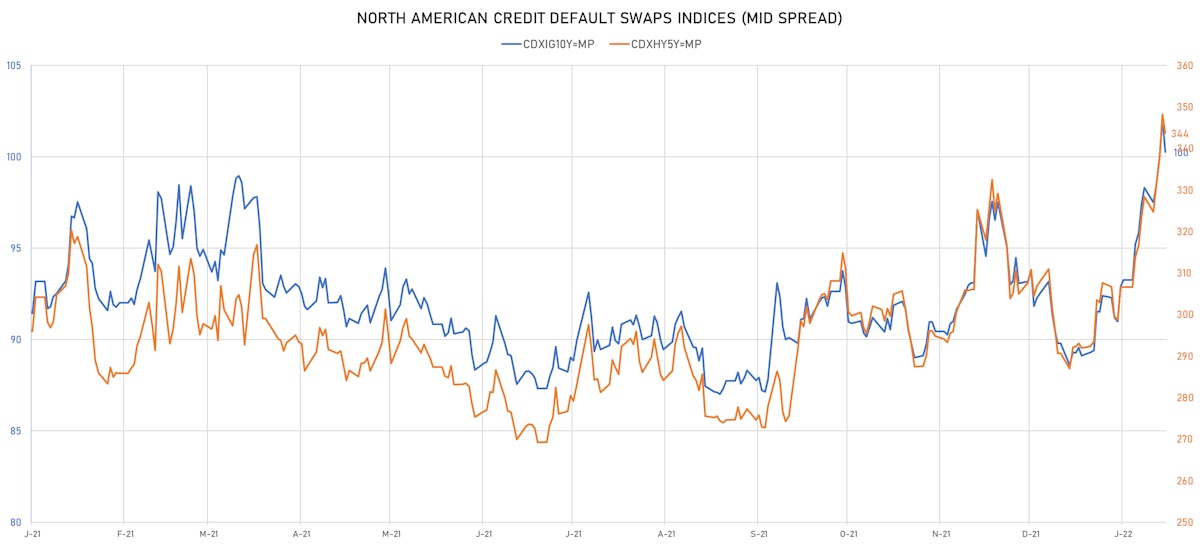

CDS INDICES (mid-spreads)

- Markit CDX.NA.IG 5Y down 1.9 bp, now at 100bp (YTD change: +11.2bp)

- Markit CDX.NA.HY 5Y down 4.4 bp, now at 344bp (YTD change: +51.8bp)

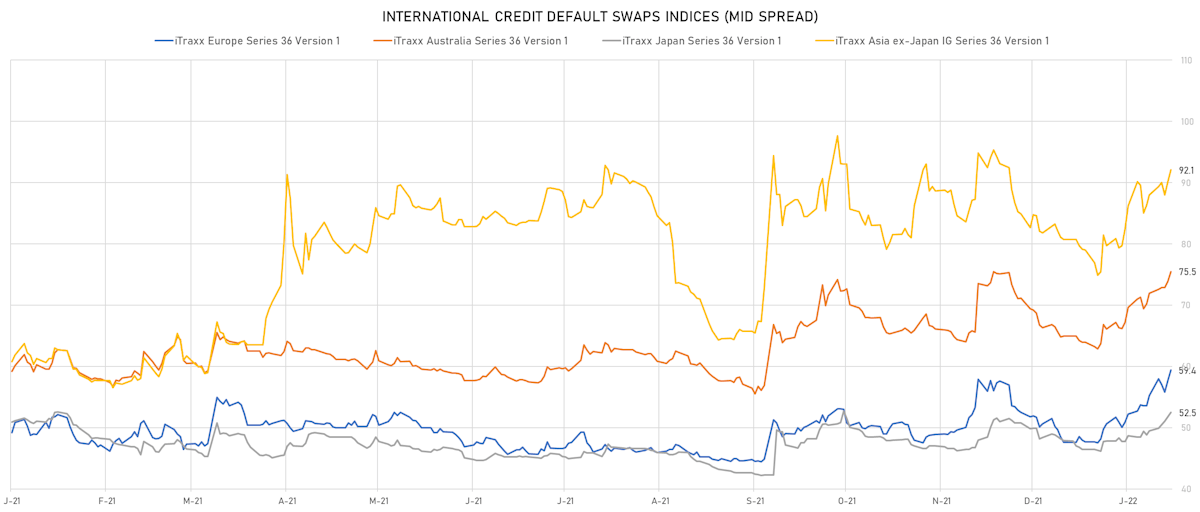

- Markit iTRAXX Europe up 1.7 bp, now at 59bp (YTD change: +11.7bp)

- Markit iTRAXX Japan up 0.8 bp, now at 53bp (YTD change: +6.1bp)

- Markit iTRAXX Asia Ex-Japan up 1.9 bp, now at 92bp (YTD change: +13.0bp)

USD CDS SINGLE NAMES - LARGEST MOVES IN THE PAST WEEK

- Rite Aid Corp (Country: US; rated: B3): down 27.9 bp to 1,132.7bp (1Y range: 497-1,133bp)

- Macy's Inc (Country: US; rated: Ba2): down 25.2 bp to 316.0bp (1Y range: 181-552bp)

- RR Donnelley & Sons Co (Country: US; rated: B2): up 25.5 bp to 219.0bp (1Y range: 119-610bp)

- Avis Budget Group Inc (Country: US; rated: CCC): up 27.5 bp to 294.2bp (1Y range: 183-403bp)

- Realogy Group LLC (Country: US; rated: B2): up 31.7 bp to 388.3bp (1Y range: 278-453bp)

- American Airlines Group Inc (Country: US; rated: B2): up 32.5 bp to 858.3bp (1Y range: 596-1,182bp)

- Tenet Healthcare Corp (Country: US; rated: B2): up 32.5 bp to 332.4bp (1Y range: 242-347bp)

- Pitney Bowes Inc (Country: US; rated: LGD2 - 16%): up 35.2 bp to 600.8bp (1Y range: 363-601bp)

- MBIA Inc (Country: US; rated: Ba3): up 36.4 bp to 351.8bp (1Y range: 303-565bp)

- Xerox Corp (Country: US; rated: LGD4 - 56%): up 42.3 bp to 285.0bp (1Y range: 158-297bp)

- Royal Caribbean Cruises Ltd (Country: US; rated: LGD4 - 59%): up 42.8 bp to 441.6bp (1Y range: 299-678bp)

- Carnival Corp (Country: US; rated: LGD5 - 72%): up 56.7 bp to 519.5bp (1Y range: 291-565bp)

- Navient Corp (Country: US; rated: Ba3): up 69.0 bp to 404.0bp (1Y range: -404bp)

- Transocean Inc (Country: KY; rated: Caa3): up 111.5 bp to 1,988.1bp (1Y range: 941-2,371bp)

EURO CDS SINGLE NAMES - LARGEST MOVES IN THE PAST WEEK

- TUI AG (Country: DE; rated: B3-PD): down 22.2 bp to 665.6bp (1Y range: 607-946bp)

- Banca Monte dei Paschi di Siena SpA (Country: IT; rated: NP): up 10.4 bp to 278.2bp (1Y range: 145-278bp)

- Elo SA (Country: FR; rated: ): up 11.1 bp to 149.2bp (1Y range: 83-242bp)

- Air France KLM SA (Country: FR; rated: B-): up 11.3 bp to 424.4bp (1Y range: 386-699bp)

- Leonardo SpA (Country: IT; rated: WD): up 11.7 bp to 169.0bp (1Y range: 125-228bp)

- Stena AB (Country: SE; rated: B2-PD): up 13.8 bp to 441.1bp (1Y range: 401-728bp)

- thyssenkrupp AG (Country: DE; rated: B1): up 14.3 bp to 250.2bp (1Y range: 205-300bp)

- Premier Foods Finance PLC (Country: GB; rated: B1): up 14.3 bp to 235.2bp (1Y range: 154-273bp)

- Ineos Group Holdings SA (Country: LU; rated: WR): up 20.5 bp to 178.9bp (1Y range: 125-296bp)

- Ardagh Packaging Finance PLC (Country: IE; rated: B1): up 20.8 bp to 328.1bp (1Y range: 210-328bp)

- CMA CGM SA (Country: FR; rated: Ba3): up 22.7 bp to 341.1bp (1Y range: 259-495bp)

- Altice Finco SA (Country: LU; rated: Caa1): up 31.3 bp to 485.5bp (1Y range: 333-486bp)

- Boparan Finance PLC (Country: GB; rated: B3): up 36.2 bp to 1,502.6bp (1Y range: 597-1,564bp)

- Novafives SAS (Country: FR; rated: Caa1): up 40.5 bp to 767.7bp (1Y range: 618-976bp)

TOP BONDS MOVES IN THE PAST WEEK - USD HY

- Issuer: CBOM Finance PLC (DUBLIN, Ireland) | Coupon: 4.70% | Maturity: 29/1/2025 | Rating: BB | ISIN: XS2099763075 | Z-spread up by 302.2 bp to 664.6 bp, with the yield to worst at 7.6% and the bond now trading down to 91.4 cents on the dollar (1Y price range: 91.4-101.0).

- Issuer: GTLK Europe DAC (DUBLIN, Ireland) | Coupon: 5.13% | Maturity: 31/5/2024 | Rating: BB | ISIN: XS1577961516 | Z-spread up by 275.7 bp to 537.7 bp, with the yield to worst at 6.2% and the bond now trading down to 96.8 cents on the dollar (1Y price range: 96.8-105.6).

- Issuer: Rail Capital Markets PLC (London, United Kingdom) | Coupon: 7.88% | Maturity: 15/7/2026 | Rating: B | ISIN: XS2365120885 | Z-spread up by 245.5 bp to 1,220.7 bp, with the yield to worst at 13.5% and the bond now trading down to 80.3 cents on the dollar (1Y price range: 79.8-93.5).

- Issuer: Mhp Se (Kiev, Cyprus) | Coupon: 7.75% | Maturity: 10/5/2024 | Rating: B | ISIN: XS1577965004 | Z-spread up by 231.6 bp to 1,158.6 bp, with the yield to worst at 12.3% and the bond now trading down to 90.8 cents on the dollar (1Y price range: 90.8-101.9).

- Issuer: GTLK Europe Capital DAC (Ireland) | Coupon: 5.95% | Maturity: 17/4/2025 | Rating: BB | ISIN: XS1713473608 | Z-spread up by 231.1 bp to 546.2 bp, with the yield to worst at 6.5% and the bond now trading down to 97.4 cents on the dollar (1Y price range: 97.1-106.0).

- Issuer: Metinvest BV (Amsterdam, Netherlands) | Coupon: 8.50% | Maturity: 23/4/2026 | Rating: B+ | ISIN: XS1806400708 | Z-spread up by 222.9 bp to 1,049.2 bp, with the yield to worst at 11.8% and the bond now trading down to 88.4 cents on the dollar (1Y price range: 86.6-104.5).

- Issuer: Kondor Finance PLC (London, United Kingdom) | Coupon: 7.63% | Maturity: 8/11/2026 | Rating: B | ISIN: XS2077601610 | Z-spread up by 178.2 bp to 1,407.2 bp, with the yield to worst at 14.8% and the bond now trading down to 75.1 cents on the dollar (1Y price range: 73.9-87.3).

- Issuer: Wanda Properties International Co Ltd (British Virgin Islands) | Coupon: 7.25% | Maturity: 29/1/2024 | Rating: BB- | ISIN: XS1023280271 | Z-spread down by 181.2 bp to 1,047.6 bp, with the yield to worst at 10.8% and the bond now trading up to 92.8 cents on the dollar (1Y price range: 85.1-94.9).

TOP BONDS MOVES IN THE PAST WEEK - EUR HY

- Issuer: Immobiliare Grande Distribuzione SIIQ SpA (Bologna, Italy) | Coupon: 2.13% | Maturity: 28/11/2024 | Rating: BB+ | ISIN: XS2084425466 | Z-spread up by 940.1 bp to 177.5 bp, with the yield to worst at 1.4% and the bond now trading down to 100.9 cents on the dollar (1Y price range: 100.7-101.4).

- Issuer: CBOM Finance PLC (Dublin, Ireland) | Coupon: 3.10% | Maturity: 21/1/2026 | Rating: BB | ISIN: XS2281299763 | Z-spread up by 177.7 bp to 679.8 bp, with the yield to worst at 6.7% and the bond now trading down to 87.2 cents on the dollar (1Y price range: 87.0-96.0).

- Issuer: Adler Real Estate AG (Berlin, Germany) | Coupon: 2.13% | Maturity: 6/2/2024 | Rating: BB- | ISIN: XS1731858715 | Z-spread up by 155.1 bp to 740.0 bp, with the yield to worst at 7.1% and the bond now trading down to 90.8 cents on the dollar (1Y price range: 90.8-94.9).

- Issuer: Adler Group SA (Senningerberg, Luxembourg) | Coupon: 1.50% | Maturity: 26/7/2024 | Rating: BB- | ISIN: XS1652965085 | Z-spread up by 153.4 bp to 815.4 bp, with the yield to worst at 7.8% and the bond now trading down to 85.7 cents on the dollar (1Y price range: 85.7-91.1).

- Issuer: Atrium Finance Issuer BV (Amsterdam, Netherlands) | Coupon: 2.63% | Maturity: 5/9/2027 | Rating: BB | ISIN: XS2294495838 | Z-spread up by 127.8 bp to 437.9 bp, with the yield to worst at 4.3% and the bond now trading down to 90.6 cents on the dollar (1Y price range: 90.2-97.7).

- Issuer: Webuild SpA (Milan, Italy) | Coupon: 3.63% | Maturity: 28/1/2027 | Rating: BB- | ISIN: XS2102392276 | Z-spread up by 113.4 bp to 374.4 bp, with the yield to worst at 3.7% and the bond now trading down to 98.8 cents on the dollar (1Y price range: 98.8-104.2).

- Issuer: Adler Group SA (Senningerberg, Luxembourg) | Coupon: 1.88% | Maturity: 14/1/2026 | Rating: BB- | ISIN: XS2283224231 | Z-spread up by 103.1 bp to 738.1 bp, with the yield to worst at 7.5% and the bond now trading down to 81.4 cents on the dollar (1Y price range: 81.4-86.2).

- Issuer: Webuild SpA (Milan, Italy) | Coupon: 5.88% | Maturity: 15/12/2025 | Rating: BB- | ISIN: XS2271356201 | Z-spread up by 81.6 bp to 388.8 bp, with the yield to worst at 3.8% and the bond now trading down to 106.1 cents on the dollar (1Y price range: 106.1-109.5).

- Issuer: SoftBank Group Corp (Minato-Ku, Japan) | Coupon: 3.38% | Maturity: 6/7/2029 | Rating: BB+ | ISIN: XS2361255057 | Z-spread up by 74.4 bp to 514.2 bp, with the yield to worst at 5.3% and the bond now trading down to 88.0 cents on the dollar (1Y price range: 87.8-93.4).

- Issuer: Saipem Finance International BV (Amsterdam, Netherlands) | Coupon: 3.38% | Maturity: 15/7/2026 | Rating: BB- | ISIN: XS2202907510 | Z-spread up by 70.0 bp to 394.1 bp (CDS basis: 5.7bp), with the yield to worst at 3.9% and the bond now trading down to 97.2 cents on the dollar (1Y price range: 98.2-100.7).

- Issuer: Nexi SpA (Milan, Italy) | Coupon: 1.63% | Maturity: 30/4/2026 | Rating: BB- | ISIN: XS2332589972 | Z-spread up by 60.7 bp to 235.5 bp, with the yield to worst at 2.3% and the bond now trading down to 96.7 cents on the dollar (1Y price range: 95.6-99.7).

SELECTED RECENT EUR BOND ISSUES

- Atlas Copco Finance Dac (Financial - Other | Dublin, Sweden | Rating: NR): €500m Senior Note (XS2440690456), fixed rate (0.75% coupon) maturing on 8 February 2032, priced at 99.03 (original spread of 93 bp), callable (10nc10)

- Bpifrance SA (Banking | Maisons-Alfort, France | Rating: NR): €1,250m Bond (FR00140084Y5), fixed rate (0.13% coupon) maturing on 25 November 2028, priced at 99.35 (original spread of 19 bp), non callable

- Investitionsbank Berlin (Banking | Berlin, Germany | Rating: AAA): €500m Inhaberschuldverschreibung (DE000A289KH3), fixed rate (0.25% coupon) maturing on 3 February 2032, priced at 98.67 (original spread of 42 bp), non callable

NEW LOANS

- Goodnight Water Solutions Llc, signed a US$ 400m Term Loan B maturing on 02/14/27, to be used for general corporate purposes.

- ITP, signed a US$ 641m Term Loan B maturing on 02/10/29, to be used for a leveraged buyout.

- ITP, signed a € 100m Revolving Credit Facility, to be used for a leveraged buyout.