Credit

Solid Bounce Across USD HY As Equity Drawdown Turns And Risk-On Sentiment Returns

Still another quiet week in terms of corporate bond issuance, but a couple of sizeable FIG deals were priced today with Bank of America raising US$9bn in 5 tranches and Goldman Sachs €2.25 bn in 2 tranches

Published ET

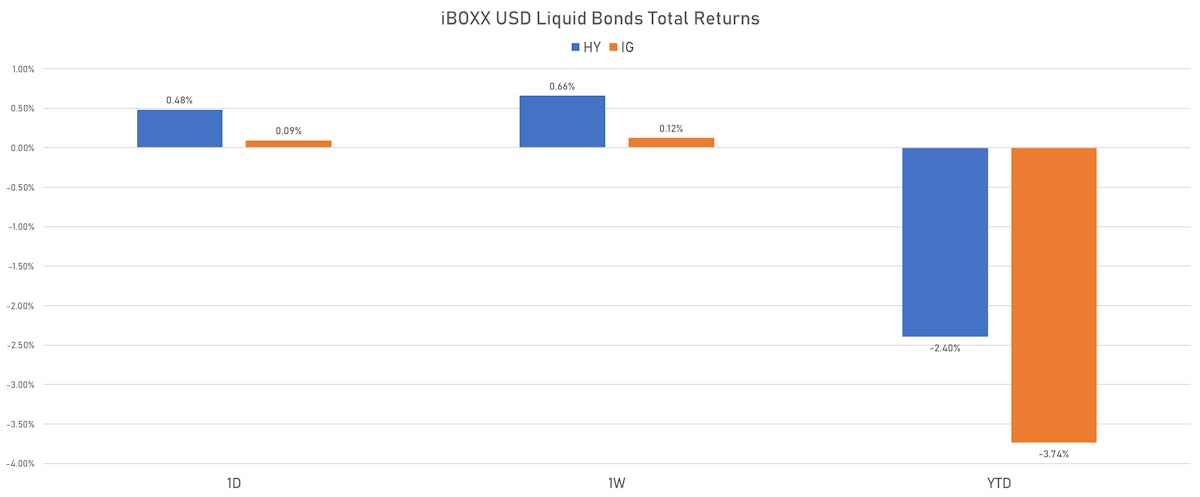

iBOXX USD Liquid Bonds Total Returns For IG & HY | Sources: ϕpost, Refinitiv data

QUICK SUMMARY

- S&P 500 Bond Index was up 0.03% today, with investment grade up 0.00% and high yield up 0.33% (YTD total return: -3.09%)

- The iBoxx USD Liquid Investment Grade Total Return Index was up 0.092% today (Month-to-date: 0.09%; Year-to-date: -3.74%)

- The iBoxx USD Liquid High Yield Total Return Index was up 0.484% today (Month-to-date: 0.48%; Year-to-date: -2.40%)

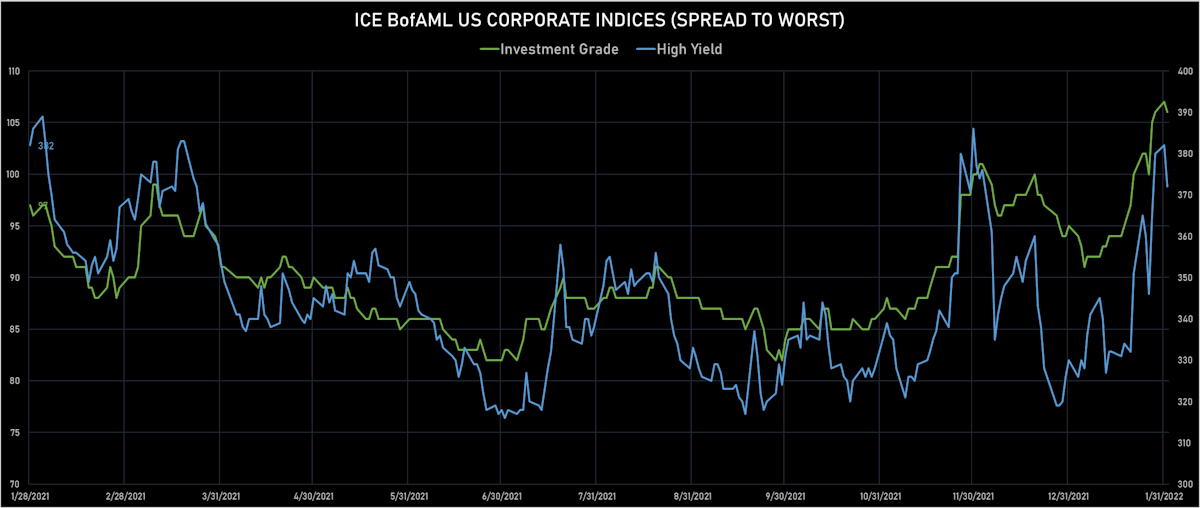

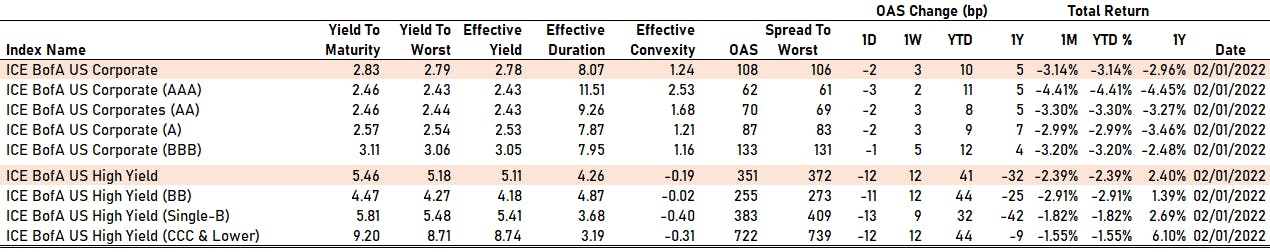

- ICE BofA US Corporate Index (Investment Grade) spread to worst down -1.0 bp, now at 106.0 bp (YTD change: +11.0 bp)

- ICE BofA US High Yield Index spread to worst down -10.0 bp, now at 372.0 bp (YTD change: +42.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index up 0.05% today (YTD total return: +0.2%)

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING

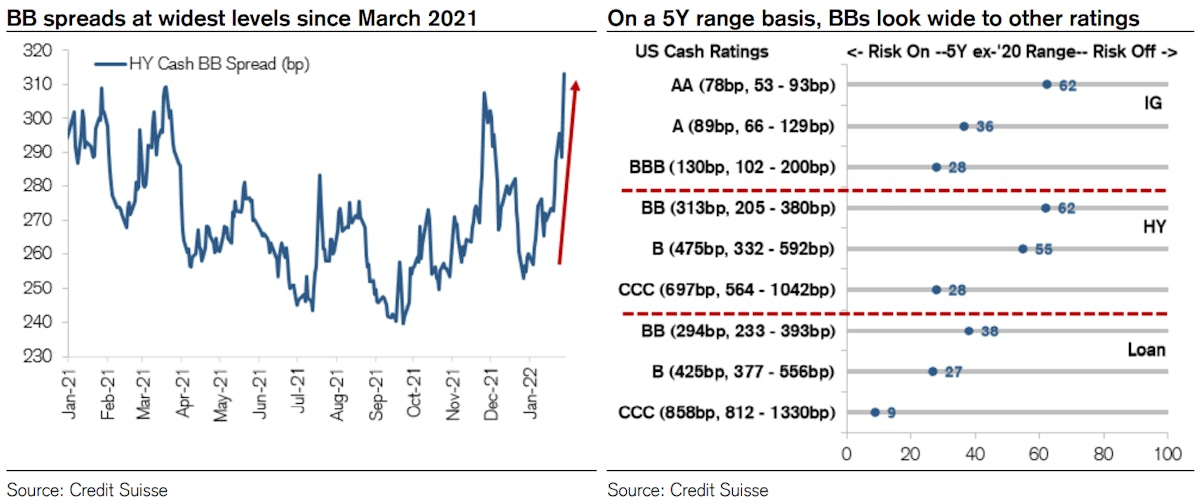

- AAA down by -3 bp at 62 bp

- AA down by -2 bp at 70 bp

- A down by -2 bp at 87 bp

- BBB down by -1 bp at 133 bp

- BB down by -11 bp at 255 bp

- B down by -13 bp at 383 bp

- CCC down by -12 bp at 722 bp

CDS INDICES (mid-spreads)

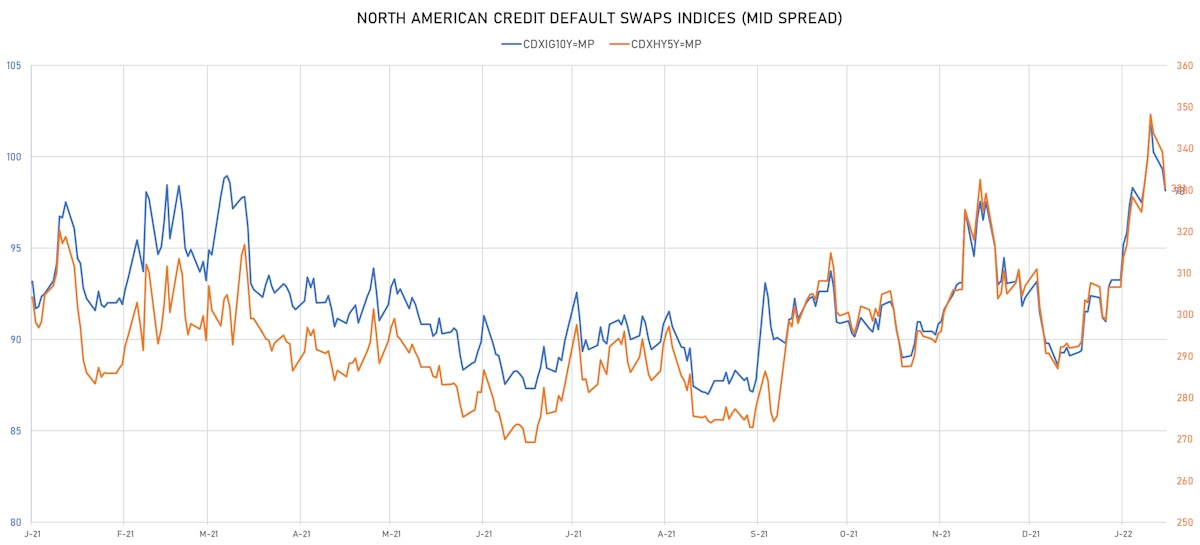

- Markit CDX.NA.IG 5Y down 1.2 bp, now at 98bp (YTD change: +9.1bp)

- Markit CDX.NA.HY 5Y down 8.6 bp, now at 331bp (YTD change: +38.6bp)

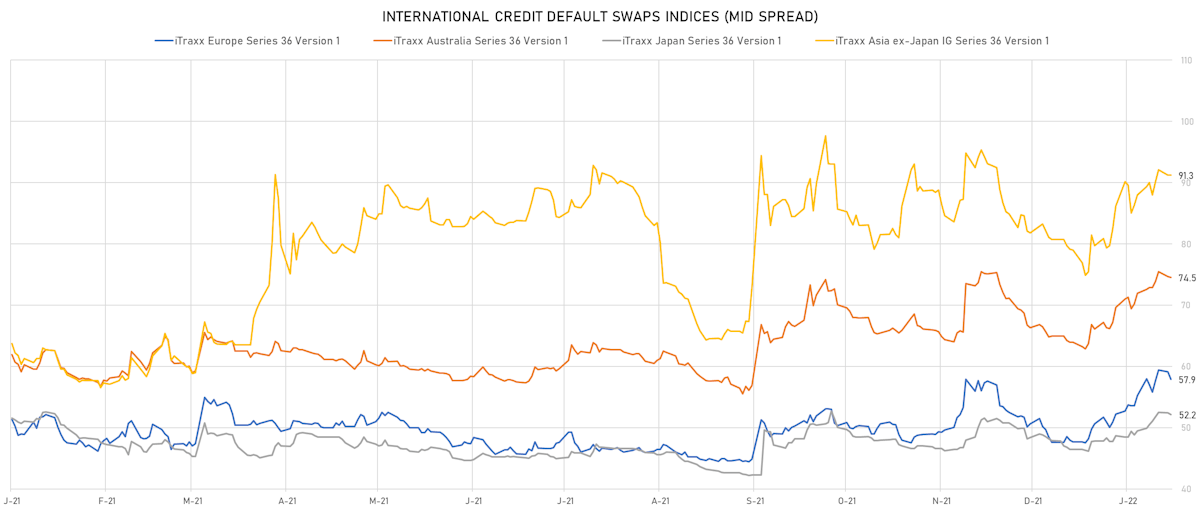

- Markit iTRAXX Europe down 1.2 bp, now at 58bp (YTD change: +10.2bp)

- Markit iTRAXX Japan down 0.3 bp, now at 52bp (YTD change: +5.8bp)

- Markit iTRAXX Asia Ex-Japan unchanged at 91bp (YTD change: +12.2bp)

USD CDS SINGLE NAMES - LARGEST MOVES IN THE PAST WEEK

- Rite Aid Corp (Country: US; rated: B3): down 61.9 bp to 1,073.2bp (1Y range: 497-1,073bp)

- Staples Inc (Country: US; rated: B2): down 35.8 bp to 1,118.5bp (1Y range: 687-1,159bp)

- Russia, Federation of (Government) (Country: RU; rated: P-3): down 18.2 bp to 221.8bp (1Y range: 77-247bp)

- Olin Corp (Country: US; rated: WR): up 16.2 bp to 178.3bp (1Y range: 130-217bp)

- Avis Budget Group Inc (Country: US; rated: CCC): up 17.0 bp to 291.1bp (1Y range: 183-393bp)

- Bombardier Inc (Country: CA; rated: Caa1): up 18.8 bp to 443.5bp (1Y range: 395-823bp)

- Realogy Group LLC (Country: US; rated: B2): up 21.5 bp to 374.8bp (1Y range: 278-453bp)

- Genworth Holdings Inc (Country: US; rated: B2): up 22.8 bp to 383.5bp (1Y range: 335-676bp)

- Royal Caribbean Cruises Ltd (Country: US; rated: LGD4 - 59%): up 23.6 bp to 403.0bp (1Y range: 299-672bp)

- MBIA Inc (Country: US; rated: Ba3): up 26.2 bp to 356.5bp (1Y range: 303-565bp)

- Tenet Healthcare Corp (Country: US; rated: B2): up 29.4 bp to 318.2bp (1Y range: 242-347bp)

- Carnival Corp (Country: US; rated: LGD5 - 72%): up 29.9 bp to 473.9bp (1Y range: 291-562bp)

- Liberty Interactive LLC (Country: US; rated: Ba3): up 35.5 bp to 504.7bp (1Y range: 287-505bp)

- Navient Corp (Country: US; rated: Ba3): up 47.4 bp to 406.8bp (1Y range: -407bp)

- Pitney Bowes Inc (Country: US; rated: LGD2 - 16%): up 82.5 bp to 656.0bp (1Y range: 363-656bp)

EURO CDS SINGLE NAMES - LARGEST MOVES IN THE PAST WEEK

- Boparan Finance PLC (Country: GB; rated: B3): down 71.0 bp to 1,387.9bp (1Y range: 597-1,564bp)

- TDC Holding A/S (Country: DK; rated: ): down 27.7 bp to 144.9bp (1Y range: 143-178bp)

- Air France KLM SA (Country: FR; rated: B-): up 14.2 bp to 423.5bp (1Y range: 386-685bp)

- Ineos Group Holdings SA (Country: LU; rated: WR): up 15.1 bp to 177.3bp (1Y range: 125-296bp)

- Premier Foods Finance PLC (Country: GB; rated: B1): up 15.7 bp to 232.1bp (1Y range: 154-273bp)

- Jaguar Land Rover Automotive PLC (Country: GB; rated: WD): up 16.0 bp to 410.5bp (1Y range: 339-456bp)

- Telecom Italia SpA (Country: IT; rated: Ba2): up 16.4 bp to 262.0bp (1Y range: 149-270bp)

- Iceland Bondco PLC (Country: GB; rated: LGD3 - 46%): up 17.3 bp to 647.4bp (1Y range: 358-661bp)

- thyssenkrupp AG (Country: DE; rated: B1): up 17.8 bp to 245.3bp (1Y range: 205-300bp)

- Stena AB (Country: SE; rated: B2-PD): up 17.9 bp to 442.6bp (1Y range: 401-728bp)

- Ardagh Packaging Finance PLC (Country: IE; rated: B1): up 19.3 bp to 325.2bp (1Y range: 210-338bp)

- CMA CGM SA (Country: FR; rated: Ba3): up 20.3 bp to 334.5bp (1Y range: 259-476bp)

- Altice Finco SA (Country: LU; rated: Caa1): up 28.3 bp to 479.1bp (1Y range: 333-492bp)

- Novafives SAS (Country: FR; rated: Caa1): up 71.8 bp to 781.9bp (1Y range: 618-976bp)

- Casino Guichard Perrachon SA (Country: FR; rated: WR): up 96.6 bp to 780.9bp (1Y range: 464-782bp)

SELECTED RECENT USD BOND ISSUES

- Bank of America Corp (Banking | Charlotte, United States | Rating: A-): US$500m Senior Note (US06051GKH10), floating rate (SOFR + 105.0 bp) maturing on 4 February 2028, priced at 100.00, callable (6nc5)

- Bank of America Corp (Banking | Charlotte, United States | Rating: A-): US$3,750m Senior Note (US06051GKK49), floating rate maturing on 4 February 2033, priced at 100.00, callable (11nc10)

- Bank of America Corp (Banking | Charlotte, United States | Rating: A-): US$2,250m Senior Note (US06051GKJ75), floating rate maturing on 4 February 2028, priced at 100.00, callable (6nc5)

- Bank of America Corp (Banking | Charlotte, United States | Rating: A-): US$1,750m Senior Note (US06051GKG37), floating rate maturing on 4 February 2025, priced at 100.00, callable (3nc2)

- Bank of America Corp (Banking | Charlotte, United States | Rating: A-): US$750m Senior Note (US06051GKF53), floating rate (SOFR + 66.0 bp) maturing on 4 February 2025, priced at 100.00, callable (3nc2)

- Corporacion Andina de Fomento (Supranational | Caracas, Venezuela | Rating: A+): US$650m Senior Note (US219868CF16), fixed rate (2.25% coupon) maturing on 8 February 2027, priced at 99.58 (original spread of 71 bp), non callable

- Kommuninvest i Sverige AB (Agency | Orebro, Sweden | Rating: AAA): US$1,000m Senior Note (XS2441084071), fixed rate (1.38% coupon) maturing on 8 May 2024, priced at 99.97 (original spread of 20 bp), non callable

SELECTED RECENT EUR BOND ISSUES

- Goldman Sachs Group Inc (Banking | New York City, United States | Rating: BBB+): €1,250m Senior Note (XS2441552192), fixed rate (1.25% coupon) maturing on 7 February 2029, priced at 99.68 (original spread of 145 bp), callable (7nc6)

- Goldman Sachs Group Inc (Banking | New York City, United States | Rating: BBB+): €1,000m Senior Note (XS2441551970), floating rate (3M Euribor + 100.0 bp) maturing on 7 February 2025, priced at 100.91, callable (3nc2)

- Landesbank Saar (Banking | Saarbruecken, Germany | Rating: A+): €250m Oeffenlicher Pfandbrief (Covered Bond) (DE000SLB4253), fixed rate (0.25% coupon) maturing on 8 February 2029, priced at 99.34 (original spread of 53 bp), non callable

NEW LOANS

- Philip Morris International (A), signed a US$ 2,000m Revolving Credit Facility, to be used for general corporate purposes. It matures on 02/10/27 and initial pricing is set at Term SOFR +17.5bps

- Philip Morris International (A), signed a US$ 1,750m 364d Revolver, to be used for general corporate purposes. It matures on 01/31/23 and initial pricing is set at Term SOFR +15bps

- Citrix Systems Inc (BBB), signed a US$ 1,000m Revolving Credit Facility, to be used for a leveraged buyout.

- Citrix Systems Inc (BBB), signed a US$ 4,000m Bridge Loan maturing on 02/01/23, to be used for a leveraged buyout

- Citrix Systems Inc (BBB), signed a US$ 7,050m Term Loan B, to be used for leveraged buyout.

- Del Monte Foods Inc (B), signed a US$ 525m Term Loan B, to be used for refin/ret bank debt.

NEW ISSUES IN SECURITIZED CREDIT

- BAML Commercial Mortgage Securities Trust 2022-Dklx issued a floating-rate CMBS in 6 tranches, for a total of US$ 360 m. Highest-rated tranche offering a spread over the floating rate of 115bp, and the lowest-rated tranche a spread of 496bp. Bookrunners: Bank of America Merrill Lynch