Credit

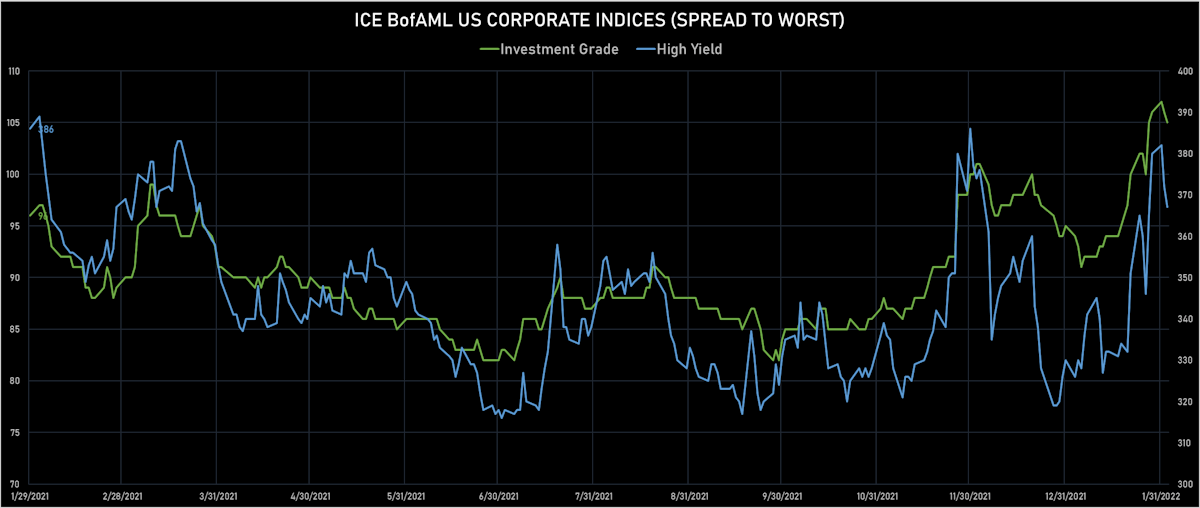

Credit Spreads Tighten Further: HY Cash And CDS Indices Now Both About 15bp Tighter Since Turn In Sentiment Last Week

Investment grade issuers are slowly coming back to market with new billion-dollar offerings priced today from IBM, State Street, Alexandria Real Estate

Published ET

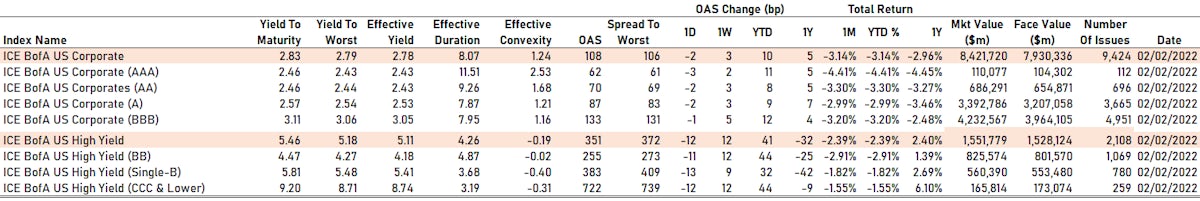

ICE BofAML US Corporate Cash Indices | Sources: ϕpost, Refinitiv data

QUICK SUMMARY

- S&P 500 Bond Index was up 0.30% today, with investment grade up 0.26% and high yield up 0.65% (YTD total return: -2.83%)

- The iBoxx USD Liquid Investment Grade Total Return Index was up 0.211% today (Month-to-date: 0.30%; Year-to-date: -3.54%)

- The iBoxx USD Liquid High Yield Total Return Index was up 0.243% today (Month-to-date: 0.73%; Year-to-date: -2.16%)

- ICE BofA US Corporate Index (Investment Grade) spread to worst down -1.0 bp, now at 105.0 bp (YTD change: +10.0 bp)

- ICE BofA US High Yield Index spread to worst down -5.0 bp, now at 367.0 bp (YTD change: +37.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index up 0.16% today (YTD total return: +0.3%)

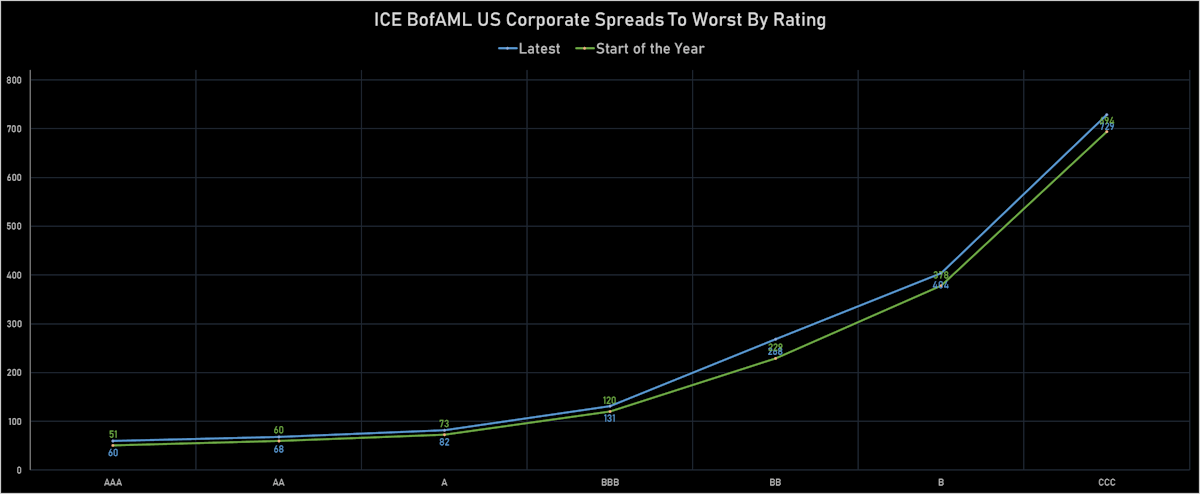

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING

- AAA down by -2 bp at 60 bp

- AA unchanged at 70 bp

- A unchanged at 87 bp

- BBB down by -1 bp at 132 bp

- BB down by -5 bp at 250 bp

- B down by -6 bp at 377 bp

- CCC down by -9 bp at 713 bp

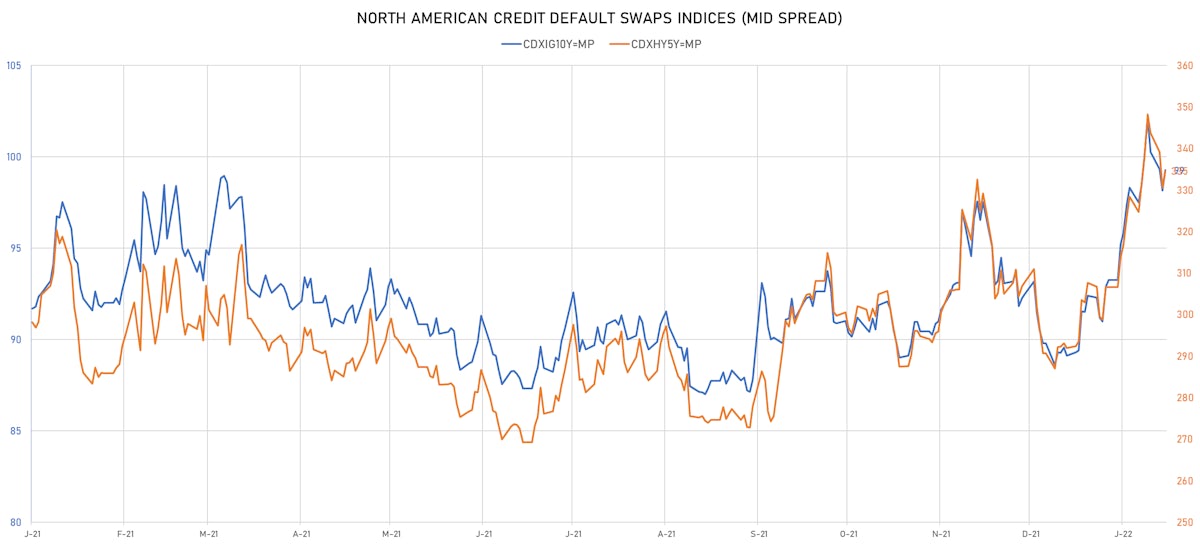

CDS INDICES (mid-spreads)

- Markit CDX.NA.IG 5Y up 1.1 bp, now at 99bp (YTD change: +10.2bp)

- Markit CDX.NA.HY 5Y up 4.0 bp, now at 335bp (YTD change: +42.7bp)

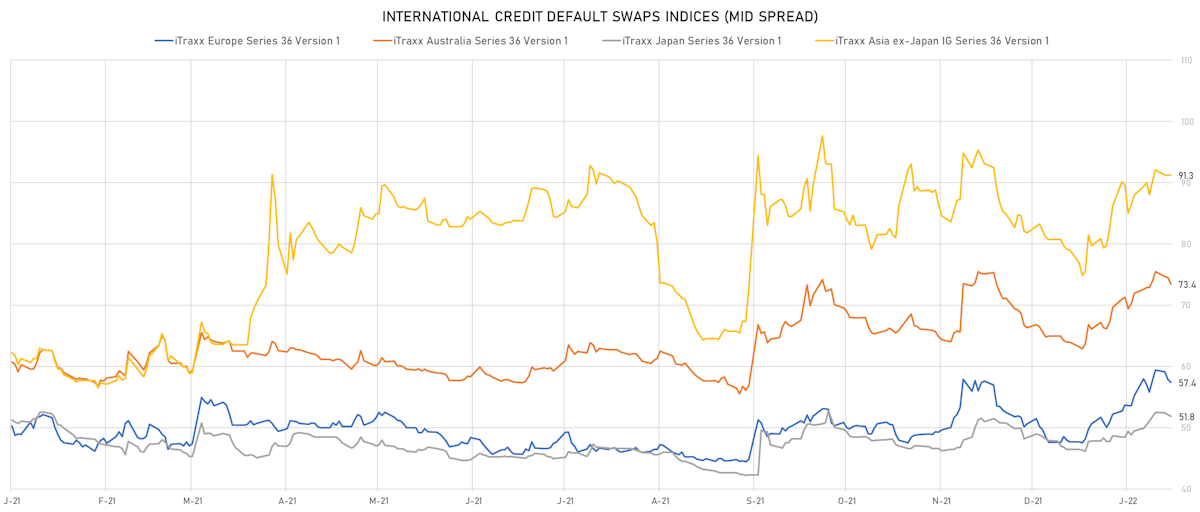

- Markit iTRAXX Europe down 0.5 bp, now at 57bp (YTD change: +9.7bp)

- Markit iTRAXX Japan down 0.3 bp, now at 52bp (YTD change: +5.4bp)

- Markit iTRAXX Asia Ex-Japan unchanged at 91bp (YTD change: +12.2bp)

TOP BONDS MOVES IN THE PAST WEEK - USD HY

- Issuer: Hopson Development Holdings Ltd (Bermuda) | Coupon: 6.80% | Maturity: 28/12/2023 | Rating: B+ | ISIN: XS2353028298 | Z-spread up by 673.0 bp to 1,579.1 bp, with the yield to worst at 16.3% and the bond now trading down to 84.0 cents on the dollar (1Y price range: 84.0-96.4).

- Issuer: Sealed Air Corp (Charlotte, North Carolina (US)) | Coupon: 5.13% | Maturity: 1/12/2024 | Rating: BB | ISIN: USU81193AN11 | Z-spread up by 64.6 bp to 150.1 bp (CDS basis: -63.1bp), with the yield to worst at 2.7% and the bond now trading down to 105.4 cents on the dollar (1Y price range: 105.4-107.0).

- Issuer: Videotron Ltd (Pre-Merger) (MONTREAL, Canada) | Coupon: 5.38% | Maturity: 15/6/2024 | Rating: BB+ | ISIN: USC96225AA22 | Z-spread up by 60.3 bp to 171.5 bp, with the yield to worst at 2.9% and the bond now trading down to 104.8 cents on the dollar (1Y price range: 104.3-107.0).

- Issuer: Bonitron DAC (DUBLIN, Ireland) | Coupon: 9.00% | Maturity: 22/10/2025 | Rating: B- | ISIN: XS2243344434 | Z-spread up by 59.2 bp to 850.1 bp, with the yield to worst at 9.5% and the bond now trading down to 97.5 cents on the dollar (1Y price range: 97.4-101.0).

- Issuer: Southeast Supply Header LLC (Houston, Texas (US)) | Coupon: 4.25% | Maturity: 15/6/2024 | Rating: BB- | ISIN: USU83854AB29 | Z-spread up by 55.5 bp to 263.4 bp, with the yield to worst at 3.6% and the bond now trading down to 100.4 cents on the dollar (1Y price range: 99.9-102.8).

- Issuer: Shangrao City Construction Investment Development Group Co Ltd (Shangrao, China (Mainland)) | Coupon: 4.38% | Maturity: 21/10/2023 | Rating: BB+ | ISIN: XS2232375928 | Z-spread up by 54.7 bp to 253.7 bp, with the yield to worst at 3.2% and the bond now trading down to 101.1 cents on the dollar (1Y price range: 100.8-101.8).

- Issuer: Sensata Technologies BV (Almelo, Netherlands) | Coupon: 4.88% | Maturity: 15/10/2023 | Rating: BB- | ISIN: USN78840AH33 | Z-spread up by 53.2 bp to 196.4 bp, with the yield to worst at 2.8% and the bond now trading down to 102.9 cents on the dollar (1Y price range: 102.4-105.1).

- Issuer: StoneCo Ltd (George Town, Cayman Islands) | Coupon: 3.95% | Maturity: 16/6/2028 | Rating: BB- | ISIN: USG85158AA43 | Z-spread up by 53.1 bp to 572.5 bp, with the yield to worst at 7.2% and the bond now trading down to 82.5 cents on the dollar (1Y price range: 82.5-88.1).

- Issuer: Turkiye Cumhuriyeti Ziraat Bankasi AS (Ankara, Turkey) | Coupon: 5.13% | Maturity: 29/9/2023 | Rating: B | ISIN: XS1691349010 | Z-spread down by 57.7 bp to 453.0 bp, with the yield to worst at 5.0% and the bond now trading up to 99.3 cents on the dollar (1Y price range: 96.4-99.3).

- Issuer: Metinvest BV (Amsterdam, Netherlands) | Coupon: 8.50% | Maturity: 23/4/2026 | Rating: B+ | ISIN: XS1806400708 | Z-spread down by 62.8 bp to 1,047.1 bp, with the yield to worst at 11.7% and the bond now trading up to 88.5 cents on the dollar (1Y price range: 86.6-104.5).

- Issuer: Kondor Finance PLC (London, United Kingdom) | Coupon: 7.63% | Maturity: 8/11/2026 | Rating: B | ISIN: XS2077601610 | Z-spread down by 81.0 bp to 1,341.9 bp, with the yield to worst at 14.2% and the bond now trading up to 76.9 cents on the dollar (1Y price range: 73.9-87.3).

- Issuer: Mhp Se (Kiev, Cyprus) | Coupon: 7.75% | Maturity: 10/5/2024 | Rating: B | ISIN: XS1577965004 | Z-spread down by 119.7 bp to 1,031.0 bp, with the yield to worst at 11.1% and the bond now trading up to 93.0 cents on the dollar (1Y price range: 90.3-101.9).

- Issuer: YPF SA (Buenos Aires, Argentina) | Coupon: 6.95% | Maturity: 21/7/2027 | Rating: CCC | ISIN: USP989MJBL47 | Z-spread down by 251.9 bp to 1,491.2 bp, with the yield to worst at 15.8% and the bond now trading up to 68.0 cents on the dollar (1Y price range: 61.8-68.0).

TOP BONDS MOVES IN THE PAST WEEK - EUR HY

- Issuer: Heimstaden AB (Malmo, Sweden) | Coupon: 4.25% | Maturity: 9/3/2026 | Rating: BB+ | ISIN: SE0015657903 | Z-spread up by 606.5 bp to 416.4 bp, with the yield to worst at 4.2% and the bond now trading down to 99.7 cents on the dollar (1Y price range: 99.4-100.7).

- Issuer: Saipem Finance International BV (Amsterdam, Netherlands) | Coupon: 2.63% | Maturity: 7/1/2025 | Rating: B+ | ISIN: XS1711584430 | Z-spread up by 596.1 bp to 875.9 bp (CDS basis: -306.2bp), with the yield to worst at 8.5% and the bond now trading down to 84.6 cents on the dollar (1Y price range: 84.6-101.2).

- Issuer: Adler Group SA (Senningerberg, Luxembourg) | Coupon: 1.50% | Maturity: 26/7/2024 | Rating: BB- | ISIN: XS1652965085 | Z-spread up by 285.4 bp to 888.6 bp, with the yield to worst at 8.7% and the bond now trading down to 84.2 cents on the dollar (1Y price range: 84.2-91.1).

- Issuer: Adler Real Estate AG (Berlin, Germany) | Coupon: 2.13% | Maturity: 6/2/2024 | Rating: BB- | ISIN: XS1731858715 | Z-spread up by 241.4 bp to 798.0 bp, with the yield to worst at 7.7% and the bond now trading down to 89.7 cents on the dollar (1Y price range: 89.7-94.9).

- Issuer: Adler Group SA (Senningerberg, Luxembourg) | Coupon: 1.88% | Maturity: 14/1/2026 | Rating: BB- | ISIN: XS2283224231 | Z-spread up by 152.9 bp to 798.5 bp, with the yield to worst at 8.0% and the bond now trading down to 79.4 cents on the dollar (1Y price range: 79.0-86.2).

- Issuer: Webuild SpA (Milan, Italy) | Coupon: 5.88% | Maturity: 15/12/2025 | Rating: BB- | ISIN: XS2271356201 | Z-spread up by 48.7 bp to 416.8 bp, with the yield to worst at 4.1% and the bond now trading down to 104.8 cents on the dollar (1Y price range: 104.8-109.5).

- Issuer: Webuild SpA (Milan, Italy) | Coupon: 1.75% | Maturity: 26/10/2024 | Rating: BB- | ISIN: XS1707063589 | Z-spread up by 31.8 bp to 222.2 bp, with the yield to worst at 1.9% and the bond now trading down to 98.6 cents on the dollar (1Y price range: 99.0-100.8).

- Issuer: Teollisuuden Voima Oyj (Eurajoki, Finland) | Coupon: 2.13% | Maturity: 4/2/2025 | Rating: BB | ISIN: XS1183235644 | Z-spread up by 25.1 bp to 88.9 bp, with the yield to worst at 0.8% and the bond now trading down to 103.1 cents on the dollar (1Y price range: 103.0-104.4).

- Issuer: Deutsche Lufthansa AG (Cologne, Germany) | Coupon: 2.00% | Maturity: 14/7/2024 | Rating: BB- | ISIN: XS2363244513 | Z-spread down by 19.5 bp to 176.0 bp (CDS basis: -25.1bp), with the yield to worst at 1.6% and the bond now trading up to 100.5 cents on the dollar (1Y price range: 99.2-101.1).

- Issuer: Metinvest BV (Amsterdam, Netherlands) | Coupon: 5.63% | Maturity: 17/6/2025 | Rating: B+ | ISIN: XS2056722734 | Z-spread down by 44.8 bp to 976.1 bp, with the yield to worst at 9.5% and the bond now trading up to 88.6 cents on the dollar (1Y price range: 86.0-99.4).

SELECTED RECENT USD BOND ISSUES

- Alexandria Real Estate Equities Inc (Real Estate Investment Trust | Pasadena, United States | Rating: BBB+): US$800m Senior Note (US015271AY59), fixed rate (2.95% coupon) maturing on 15 March 2034, priced at 99.70 (original spread of 120 bp), callable (12nc12)

- Alexandria Real Estate Equities Inc (Real Estate Investment Trust | Pasadena, United States | Rating: BBB+): US$1,000m Senior Note (US015271AZ25), fixed rate (3.55% coupon) maturing on 15 March 2052, priced at 99.58 (original spread of 162 bp), callable (30nc30)

- AMC Entertainment Holdings Inc (Leisure | Leawood, United States | Rating: B-): US$950m Note (US00165CBA18), fixed rate (7.50% coupon) maturing on 15 February 2029, priced at 100.00 (original spread of 577 bp), callable (7nc3)

- Boyne USA Inc (Lodging | Petoskey, United States | Rating: B): US$150m Senior Note (USU1022TAE56), fixed rate (4.75% coupon) maturing on 15 May 2029, priced at 100.00 (original spread of 302 bp), callable (7nc2)

- Citigroup Inc (Banking | New York City, United States | Rating: BBB+): US$270m Unsecured Note (XS2110106064) zero coupon maturing on 15 February 2062, priced at 100.00, non callable

- International Business Machines Corp (Information/Data Technology | Armonk, United States | Rating: A-): US$650m Senior Note (US459200KM24), fixed rate (2.20% coupon) maturing on 9 February 2027, priced at 99.99 (original spread of 60 bp), callable (5nc5)

- International Business Machines Corp (Information/Data Technology | Armonk, United States | Rating: A-): US$500m Senior Note (US459200KN07), fixed rate (2.72% coupon) maturing on 9 February 2032, priced at 99.98 (original spread of 95 bp), callable (10nc10)

- International Business Machines Corp (Information/Data Technology | Armonk, United States | Rating: A-): US$650m Senior Note (US459200KP54), fixed rate (3.43% coupon) maturing on 9 February 2052, priced at 99.98 (original spread of 132 bp), callable (30nc30)

- MEDNAX Inc (Health Care Facilities | Sunrise, United States | Rating: B+): US$400m Senior Note (US58502BAE65), fixed rate (5.38% coupon) maturing on 15 February 2030, priced at 100.00 (original spread of 368 bp), callable (8nc3)

- State Street Corp (Financial - Other | Boston, United States | Rating: A): US$300m Senior Note (US857477BR39), floating rate maturing on 6 February 2026, priced at 100.00, callable (4nc3)

- State Street Corp (Financial - Other | Boston, United States | Rating: A): US$650m Senior Note (US857477BS12), floating rate maturing on 7 February 2028, priced at 100.00, callable (6nc5)

- State Street Corp (Financial - Other | Boston, United States | Rating: A): US$550m Senior Note (US857477BT94), floating rate maturing on 7 February 2033, priced at 100.00, callable (11nc10)

- Brookfield Finance Inc (Financial - Other | Toronto, Canada | Rating: A-): US$400m Senior Note (US11271LAJ17), fixed rate (3.63% coupon) maturing on 15 February 2052, priced at 99.91 (original spread of 175 bp), callable (30nc30)

- Fells Point Funding Trust (Financial - Other | Rating: NR): US$1,000m Trust (US314382AA01), fixed rate (3.05% coupon) maturing on 31 January 2027, priced at 100.00 (original spread of 145 bp), callable (5nc5)

SELECTED RECENT EUR BOND ISSUES

- Allwyn Entertainment Financing (UK) PLC (Financial - Other | Rating: NR): €400m Senior Note (XS2440790835), floating rate (EU03MLIB + 412.5 bp) maturing on 15 February 2028, priced at 99.50, with a make whole call

NEW LOANS

- BCP Renaissance Parent Llc (B+), signed a US$ 1,026m Term Loan B, to be used for general corporate purposes, project finance. It matures on 10/31/26 and initial pricing is set at Term SOFR +350bp

NEW ISSUES IN SECURITIZED CREDIT

- Acc Trust 2022-1 issued a fixed-rate ABS backed by auto receivables in 4 tranches, for a total of US$ 207 m. Highest-rated tranche offering a yield to maturity of 1.22%, and the lowest-rated tranche a yield to maturity of 6.74%. Bookrunners: Credit Suisse

- Imperial Fund Mortgage Trust 2022-Nqm1 issued a fixed-rate RMBS in 6 tranches, for a total of US$ 403 m. Highest-rated tranche offering a coupon of 2.49%, and the lowest-rated tranche a yield to maturity of 4.08%. Bookrunners: Barclays Capital Group, Bank of America Merrill Lynch, Performance Trust Capital

- Connecticut Avenue Securities Trust 2022-R02 issued a floating-rate Agency RMBS in 4 tranches, for a total of US$ 1,241 m. Highest-rated tranche offering a spread over the floating rate of 120bp, and the lowest-rated tranche a spread of 765bp. Bookrunners: Nomura Securities New York Inc, Morgan Stanley International Ltd

- Benchmark Commercial Mortgage Securities Trust 2022-B32 issued a fixed-rate CMBS in 12 tranches, for a total of US$ 1,599 m. Highest-rated tranche offering a yield to maturity of 1.81%, and the lowest-rated tranche a yield to maturity of 3.46%. Bookrunners: Goldman Sachs & Co, JP Morgan & Co Inc, Deutsche Bank Securities Inc, Citigroup Global Markets Inc

- Gbx Leasing 2022-1 LLC Series 2022-1 issued a fixed-rate ABS backed by certificates in 2 tranches, for a total of US$ 323 m. Highest-rated tranche offering a yield to maturity of 2.87%, and the lowest-rated tranche a yield to maturity of 3.45%. Bookrunners: Wells Fargo Securities LLC, Bank of America Merrill Lynch

- Navient Private Education Refi Loan Trust 2022-A issued a fixed-rate ABS backed by student loans in 2 tranches, for a total of US$ 952 m. Highest-rated tranche offering a yield to maturity of 2.23%, and the lowest-rated tranche a yield to maturity of 3.03%. Bookrunners: Credit Suisse, JP Morgan & Co Inc, Barclays Capital Group, RBC Capital Markets, Bank of America Merrill Lynch