Credit

Tough Day For US$ Corporate Bonds, With Higher Yields And Wider Cash Spreads Taking IG & HY Down In Almost Equal Measure

The Meta meltdown (FB down 26% in one day), which is taking broad stock indices along for the ride, had less of an impact on credit, as media and technology companies have much lower weights in bond indices (less leverage than many other sectors)

Published ET

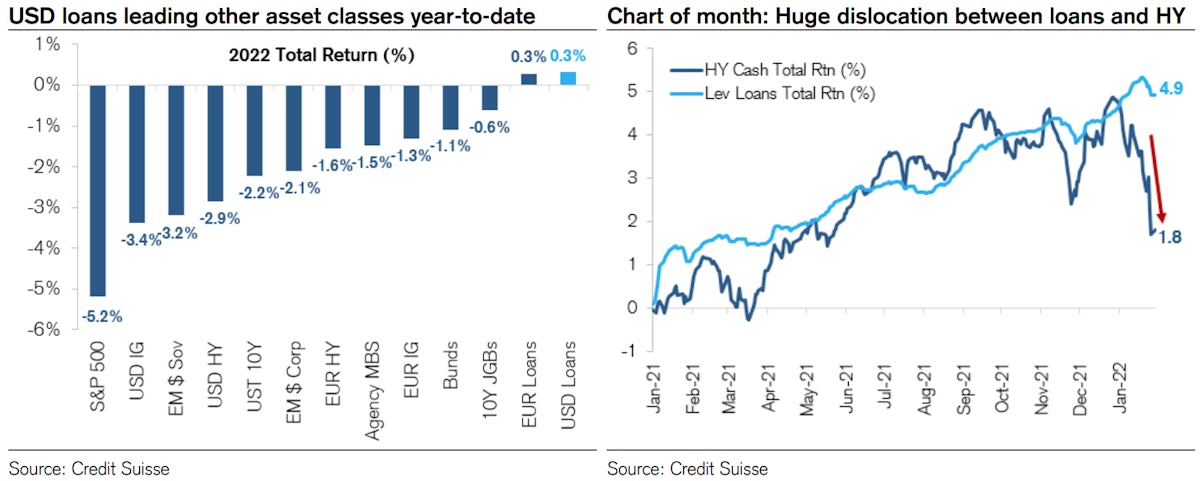

US$ Loans Widely Overperforming HY Recently | Source: Credit Suisse

QUICK SUMMARY

- S&P 500 Bond Index was down -0.53% today, with investment grade down -0.54% and high yield down -0.45% (YTD total return: -3.35%)

- The iBoxx USD Liquid Investment Grade Total Return Index was down -0.703% today (Month-to-date: -0.40%; Year-to-date: -4.21%)

- The iBoxx USD Liquid High Yield Total Return Index was down -0.503% today (Month-to-date: 0.22%; Year-to-date: -2.65%)

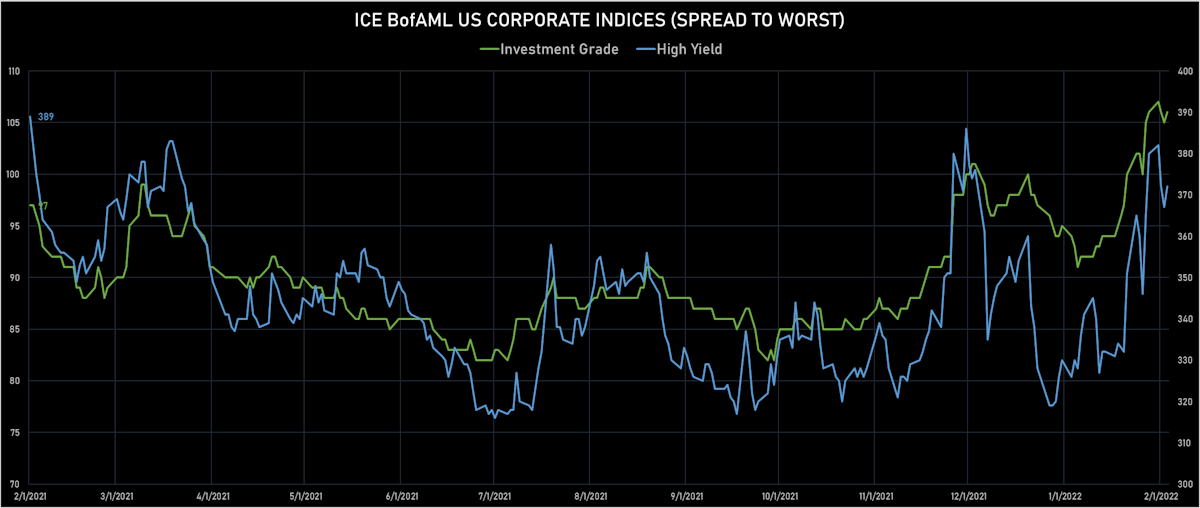

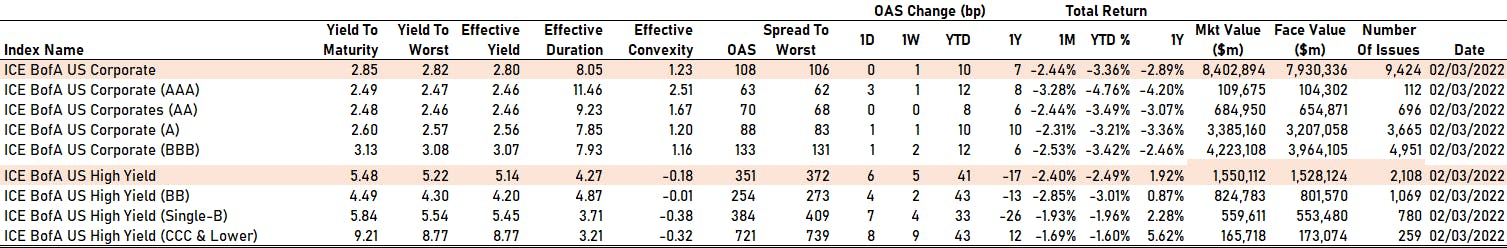

- ICE BofA US Corporate Index (Investment Grade) spread to worst up 1.0 bp, now at 106.0 bp (YTD change: +11.0 bp)

- ICE BofA US High Yield Index spread to worst up 5.0 bp, now at 372.0 bp (YTD change: +42.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index up 0.03% today (YTD total return: +0.3%)

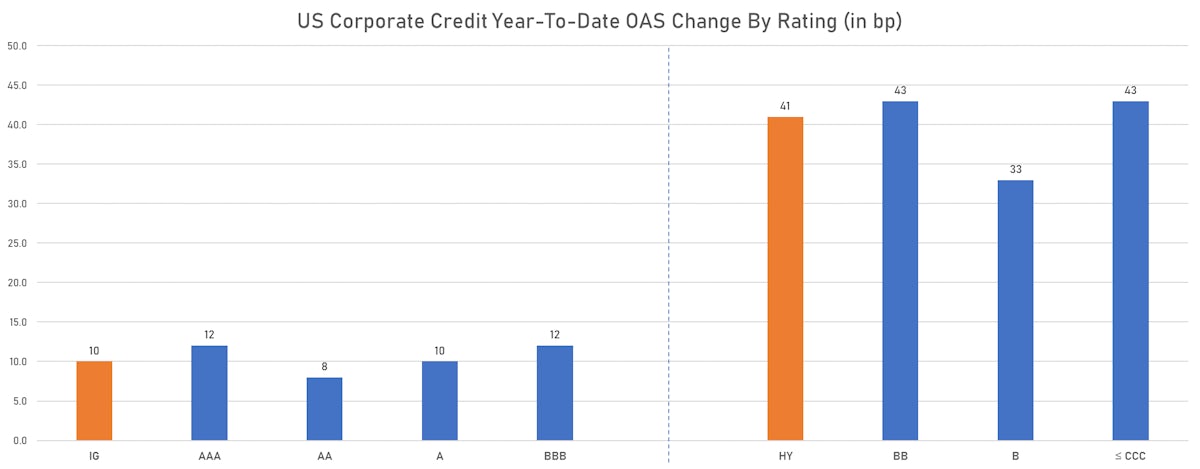

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING

- AAA up by 3 bp at 63 bp

- AA unchanged at 70 bp

- A up by 1 bp at 88 bp

- BBB up by 1 bp at 133 bp

- BB up by 4 bp at 254 bp

- B up by 7 bp at 384 bp

- CCC up by 8 bp at 721 bp

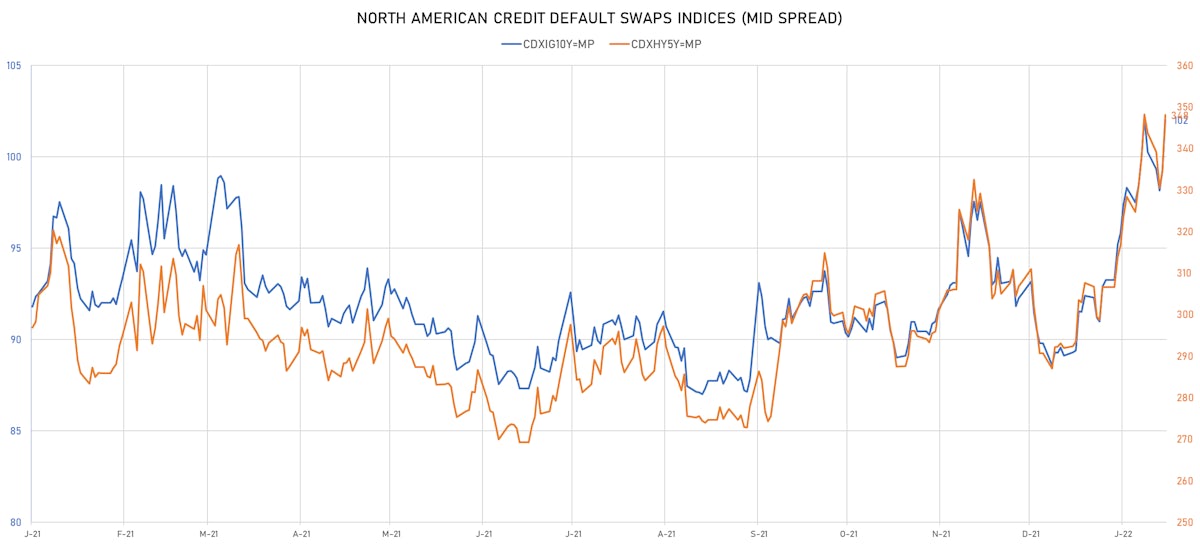

CDS INDICES (mid-spreads)

- Markit CDX.NA.IG 5Y up 2.8 bp, now at 102bp (YTD change: +12.9bp)

- Markit CDX.NA.HY 5Y up 13.4 bp, now at 348bp (YTD change: +56.1bp)

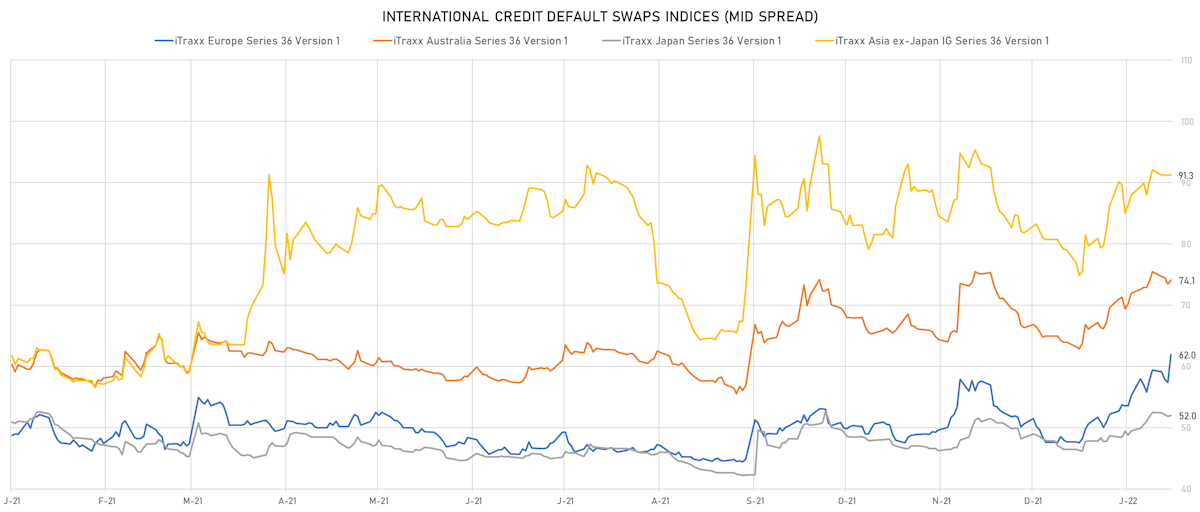

- Markit iTRAXX Europe up 4.6 bp, now at 62bp (YTD change: +14.3bp)

- Markit iTRAXX Japan up 0.2 bp, now at 52bp (YTD change: +5.6bp)

- Markit iTRAXX Asia Ex-Japan unchanged at 91bp (YTD change: +12.2bp)

USD CDS SINGLE NAMES - LARGEST MOVES IN THE PAST WEEK

- Transocean Inc (Country: KY; rated: Caa3): down 106.1 bp to 1,882.0bp (1Y range: 941-2,267bp)

- RR Donnelley & Sons Co (Country: US; rated: B2): down 77.2 bp to 140.0bp (1Y range: 119-610bp)

- Staples Inc (Country: US; rated: B2): down 64.0 bp to 1,110.3bp (1Y range: 687-1,159bp)

- Carnival Corp (Country: US; rated: LGD5 - 72%): down 39.4 bp to 480.1bp (1Y range: 291-544bp)

- iStar Inc (Country: US; rated: BBB-): down 39.3 bp to 298.9bp (1Y range: 199-324bp)

- American Airlines Group Inc (Country: US; rated: B2): down 32.6 bp to 825.7bp (1Y range: 596-1,090bp)

- Russia, Federation of (Government) (Country: RU; rated: P-3): down 32.1 bp to 197.4bp (1Y range: 77-247bp)

- Royal Caribbean Cruises Ltd (Country: US; rated: LGD4 - 59%): down 31.4 bp to 410.2bp (1Y range: 299-655bp)

- K Hovnanian Enterprises Inc (Country: US; rated: Caa3): down 23.3 bp to 702.4bp (1Y range: 606-1,183bp)

- Petroleo Brasileiro SA Petrobras (Country: BR; rated: Ba1): down 21.2 bp to 254.1bp (1Y range: 175-303bp)

- Egypt, Arab Republic of (Government) (Country: EG; rated: Ba2): down 19.3 bp to 534.0bp (1Y range: 319-598bp)

- Rite Aid Corp (Country: US; rated: B3): down 19.1 bp to 1,113.6bp (1Y range: 497-1,114bp)

- Murphy Oil Corp (Country: US; rated: Ba3): down 18.3 bp to 359.1bp (1Y range: 280-480bp)

- Liberty Interactive LLC (Country: US; rated: Ba3): up 27.6 bp to 524.9bp (1Y range: 287-525bp)

- Pitney Bowes Inc (Country: US; rated: LGD2 - 16%): up 94.0 bp to 694.8bp (1Y range: 363-695bp)

EURO CDS SINGLE NAMES - LARGEST MOVES IN THE PAST WEEK

- Boparan Finance PLC (Country: GB; rated: B3): down 177.9 bp to 1,324.7bp (1Y range: 597-1,565bp)

- TDC Holding A/S (Country: DK; rated: ): down 34.4 bp to 143.1bp (1Y range: 142-178bp)

- TUI AG (Country: DE; rated: B3-PD): down 20.6 bp to 645.0bp (1Y range: 607-946bp)

- Carrefour SA (Country: FR; rated: Baa1): down 10.5 bp to 106.8bp (1Y range: 45-117bp)

- Iceland Bondco PLC (Country: GB; rated: LGD3 - 46%): down 8.6 bp to 641.2bp (1Y range: 358-661bp)

- UPC Holding BV (Country: NL; rated: LGD6 - 93%): down 6.8 bp to 173.9bp (1Y range: 164-267bp)

- J Sainsbury PLC (Country: GB; rated: WR): down 5.5 bp to 108.8bp (1Y range: 61-157bp)

- Syngenta AG (Country: CH; rated: Ba1): down 5.4 bp to 130.1bp (1Y range: 89-189bp)

- Ladbrokes Coral Group Ltd (Country: GB; rated: WR): down 5.2 bp to 232.7bp (1Y range: 107-237bp)

- Accor SA (Country: FR; rated: B): down 4.5 bp to 144.8bp (1Y range: 136-182bp)

- Hammerson PLC (Country: GB; rated: Baa3): up 5.4 bp to 233.4bp (1Y range: 166-346bp)

- Telecom Italia SpA (Country: IT; rated: Ba2): up 13.0 bp to 265.1bp (1Y range: 149-270bp)

- Novafives SAS (Country: FR; rated: Caa1): up 16.6 bp to 784.2bp (1Y range: 618-956bp)

- Banca Monte dei Paschi di Siena SpA (Country: IT; rated: NP): up 24.4 bp to 302.6bp (1Y range: 145-303bp)

- Casino Guichard Perrachon SA (Country: FR; rated: WR): up 30.7 bp to 763.9bp (1Y range: 464-782bp)

SELECTED RECENT USD BOND ISSUES

- Valero Energy Corp (Oil and Gas | San Antonio, United States | Rating: BBB): US$650m Senior Note (US91913YBE95), fixed rate (4.00% coupon) maturing on 1 June 2052, priced at 98.26 (original spread of 222 bp), callable (30nc30)

- Deutsche Bank AG (Banking | Frankfurt, Germany | Rating: BBB+): US$500m Note (XS0459874698), fixed rate (1.75% coupon) maturing on 24 February 2026, priced at 100.00, non callable

SELECTED RECENT EUR BOND ISSUES

- Allwyn Entertainment Financing (UK) PLC (Financial - Other | United Kingdom | Rating: NR): €400m Senior Note (XS2440790835), floating rate (EU03MLIB + 412.5 bp) maturing on 15 February 2028, priced at 99.50, with a make whole call

NEW LOANS

- Perdaman Chemicals &, signed a US$ 2,280m Revolving Credit / Term Loan, to be used for capital expenditures.

- Indian Oil Corp Ltd, signed a US$ 300m Revolving Credit / Term Loan maturing on 09/30/24, to be used for refinancing and returning bank debt

NEW ISSUES IN SECURITIZED CREDIT

- BBCMS 2022-C14 issued a fixed-rate CMBS in 5 tranches, for a total of US$ 618 m. Highest-rated tranche offering a yield to maturity of 1.73%, and the lowest-rated tranche a yield to maturity of 2.82%. Bookrunners: UBS Securities Inc, Barclays Capital Group, SG Americas Securities LLC

- Kapitus Asset Securitization LLC 2022-1 issued a fixed-rate ABS backed by small business loan in 3 tranches, for a total of US$ 200 m. Highest-rated tranche offering a yield to maturity of 3.38%, and the lowest-rated tranche a yield to maturity of 4.46%. Bookrunners: Guggenheim Securities LLC