Credit

US Credit Performance Still Mostly Driven By Rates: IG Cash Spreads Unchanged Today But The Sharp Rise In Yields Took Down Bond Prices

Weekly total issuance of US$ corporate bonds (IFR Markets data): $20.5bn in 25 tranches for IG (2022 YTD volume $168.9 bn vs 2021 YTD $188.4 bn) and $5.6 bn in 8 tranches for HY (2022 YTD volume $27.9 bn vs 2021 YTD $59.9 bn)

Published ET

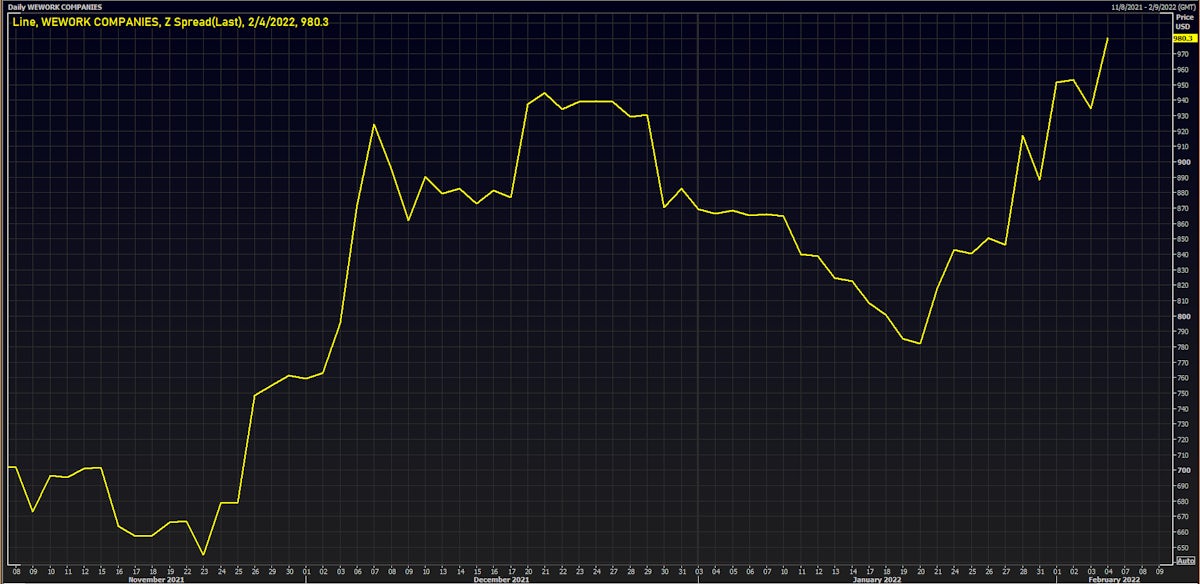

The Z-Spread On WeWork 5/2025 bond (USU96217AA99) Closed The Week Close To 1,000 bp | Source: Refinitiv

QUICK SUMMARY

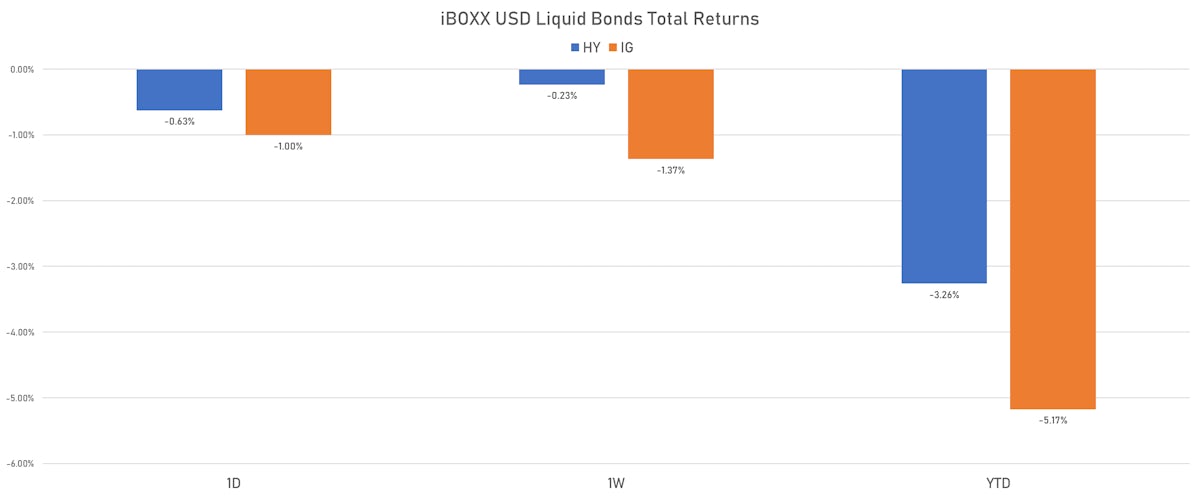

- S&P 500 Bond Index was down -0.86% today, with investment grade down -0.86% and high yield down -0.80% (YTD total return: -4.18%)

- The iBoxx USD Liquid Investment Grade Total Return Index was down -1.002% today (Month-to-date: -1.40%; Year-to-date: -5.17%)

- The iBoxx USD Liquid High Yield Total Return Index was down -0.627% today (Month-to-date: -0.41%; Year-to-date: -3.26%)

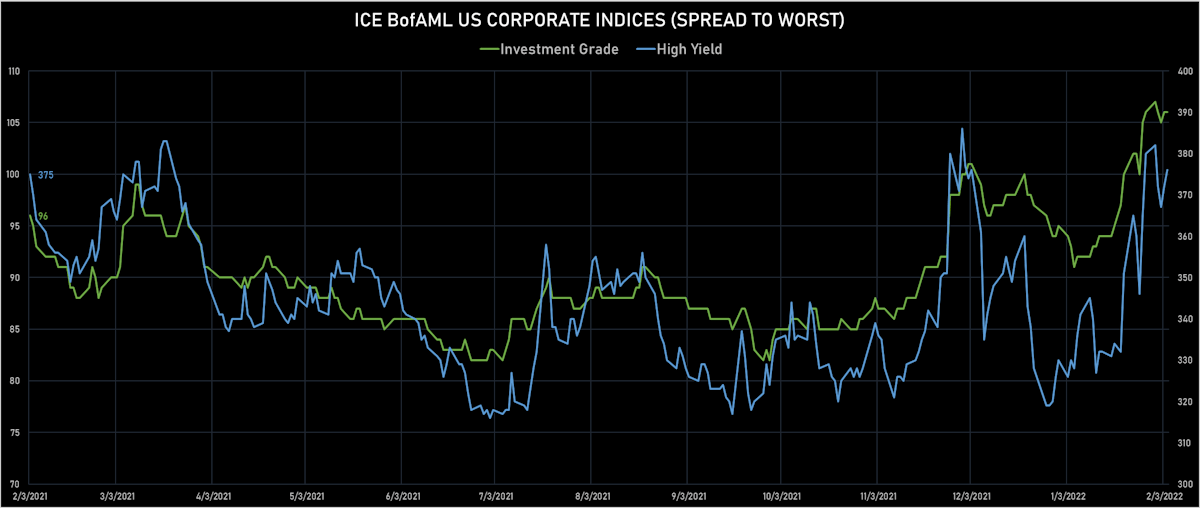

- ICE BofA US Corporate Index (Investment Grade) spread to worst unchanged at 106.0 bp (YTD change: +11.0 bp)

- ICE BofA US High Yield Index spread to worst up 4.0 bp, now at 376.0 bp (YTD change: +46.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index down -0.04% today (YTD total return: +0.3%)

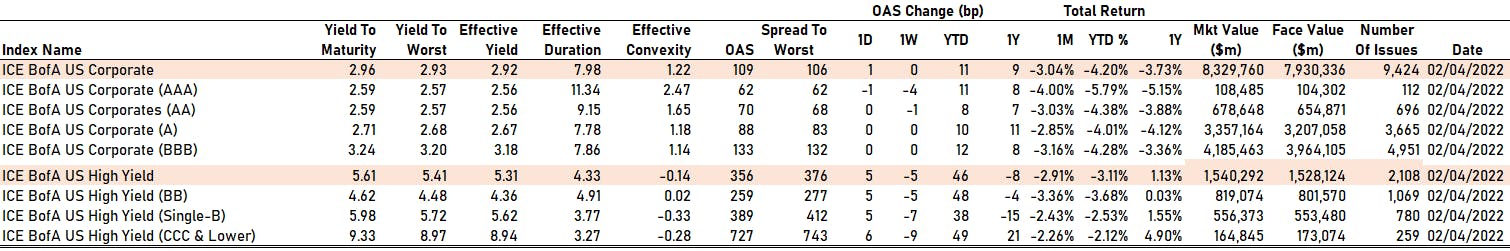

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING

- AAA down by -1 bp at 62 bp

- AA unchanged at 70 bp

- A unchanged at 88 bp

- BBB unchanged at 133 bp

- BB up by 5 bp at 259 bp

- B up by 5 bp at 389 bp

- CCC up by 6 bp at 727 bp

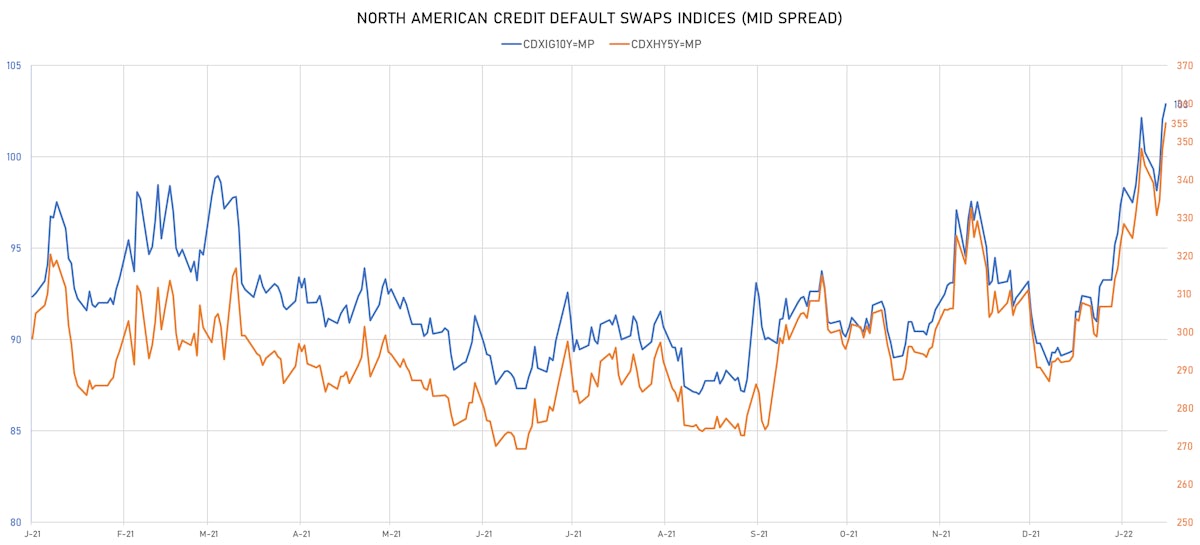

CDS INDICES (mid-spreads)

- Markit CDX.NA.IG 5Y up 0.9 bp, now at 103bp (YTD change: +13.8bp)

- Markit CDX.NA.HY 5Y up 6.9 bp, now at 355bp (YTD change: +63.0bp)

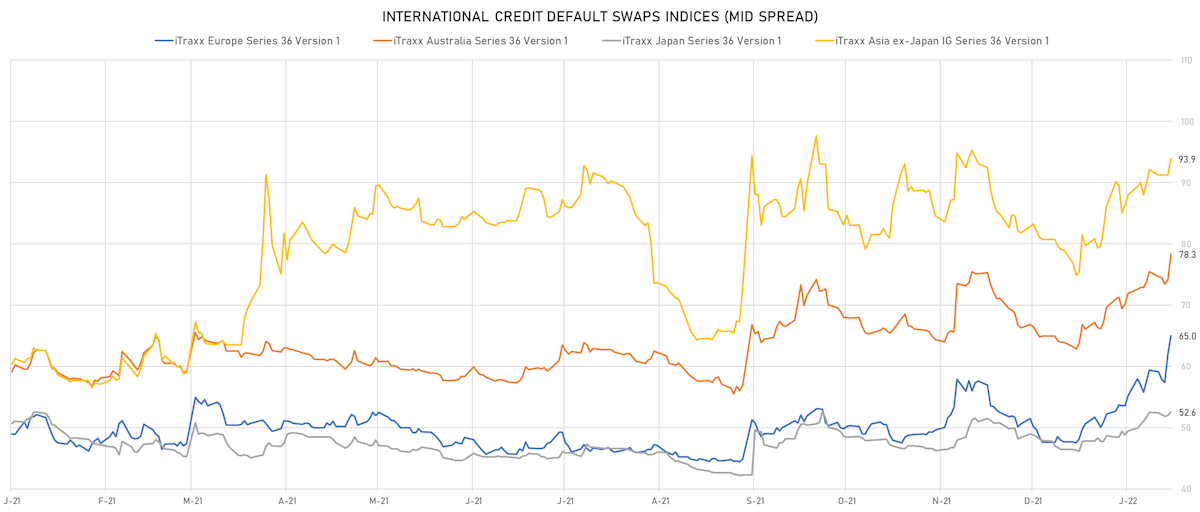

- Markit iTRAXX Europe up 3.1 bp, now at 65bp (YTD change: +17.4bp)

- Markit iTRAXX Japan up 0.6 bp, now at 53bp (YTD change: +6.2bp)

- Markit iTRAXX Asia Ex-Japan up 2.6 bp, now at 94bp (YTD change: +14.9bp)

TOP BONDS MOVES IN THE PAST WEEK - USD HY

- Issuer: Hopson Development Holdings Ltd (Bermuda) | Coupon: 6.80% | Maturity: 28/12/2023 | Rating: B+ | ISIN: XS2353028298 | Z-spread up by 464.9 bp to 1,459.8 bp, with the yield to worst at 15.3% and the bond now trading down to 85.5 cents on the dollar (1Y price range: 83.5-96.4).

- Issuer: WeWork Companies Inc (New York City, New York (US)) | Coupon: 7.88% | Maturity: 1/5/2025 | Rating: CCC- | ISIN: USU96217AA99 | Z-spread up by 150.3 bp to 980.3 bp, with the yield to worst at 10.8% and the bond now trading down to 91.3 cents on the dollar (1Y price range: 91.3-96.5).

- Issuer: Gtlk Europe Capital DAC (Ireland) | Coupon: 5.95% | Maturity: 17/4/2025 | Rating: BB | ISIN: XS1713473608 | Z-spread up by 122.6 bp to 533.6 bp, with the yield to worst at 6.5% and the bond now trading down to 97.3 cents on the dollar (1Y price range: 96.4-106.0).

- Issuer: CBOM Finance PLC (DUBLIN, Ireland) | Coupon: 3.88% | Maturity: 21/9/2026 | Rating: BB | ISIN: XS2384475930 | Z-spread up by 111.5 bp to 657.6 bp, with the yield to worst at 8.1% and the bond now trading down to 83.0 cents on the dollar (1Y price range: 82.3-95.0).

- Issuer: Karlou BV (Amsterdam, Netherlands) | Coupon: 7.75% | Maturity: 18/6/2024 | Rating: B+ | ISIN: XS2008618501 | Z-spread up by 110.8 bp to 854.6 bp, with the yield to worst at 9.2% and the bond now trading down to 96.0 cents on the dollar (1Y price range: 96.0-98.3).

- Issuer: EQM Midstream Partners LP (Canonsburg, Pennsylvania (US)) | Coupon: 6.50% | Maturity: 1/7/2027 | Rating: BB- | ISIN: USU26886AB46 | Z-spread up by 102.6 bp to 386.4 bp, with the yield to worst at 5.5% and the bond now trading down to 103.3 cents on the dollar (1Y price range: 103.3-112.0).

- Issuer: Yapi ve Kredi Bankasi AS (Turkey) | Coupon: 6.10% | Maturity: 16/3/2023 | Rating: B | ISIN: XS1788516679 | Z-spread down by 108.6 bp to 362.4 bp, with the yield to worst at 4.0% and the bond now trading up to 101.6 cents on the dollar (1Y price range: 99.2-101.9).

- Issuer: Ronesans Gayrimenkul Yatirim AS (Ankara, Turkey) | Coupon: 7.25% | Maturity: 26/4/2023 | Rating: CCC | ISIN: XS1807502668 | Z-spread down by 190.5 bp to 924.7 bp, with the yield to worst at 9.4% and the bond now trading up to 96.8 cents on the dollar (1Y price range: 89.0-97.6).

- Issuer: CALC Bond 3 Ltd (British Virgin Islands) | Coupon: 5.50% | Maturity: 8/3/2024 | Rating: BB | ISIN: XS1574821143 | Z-spread down by 197.5 bp to 743.2 bp, with the yield to worst at 8.2% and the bond now trading up to 94.0 cents on the dollar (1Y price range: 87.1-94.0).

- Issuer: YPF SA (Buenos Aires, Argentina) | Coupon: 6.95% | Maturity: 21/7/2027 | Rating: CCC | ISIN: USP989MJBL47 | Z-spread down by 227.4 bp to 1,457.2 bp, with the yield to worst at 15.6% and the bond now trading up to 68.5 cents on the dollar (1Y price range: 61.8-68.5).

- Issuer: Wanda Properties International Co Ltd (British Virgin Islands) | Coupon: 7.25% | Maturity: 29/1/2024 | Rating: BB- | ISIN: XS1023280271 | Z-spread down by 295.9 bp to 1,042.5 bp, with the yield to worst at 10.9% and the bond now trading up to 92.6 cents on the dollar (1Y price range: 85.1-94.9).

- Issuer: Wanda Properties Overseas Ltd (Road Town, British Virgin Islands) | Coupon: 6.88% | Maturity: 23/7/2023 | Rating: BB- | ISIN: XS2100658066 | Z-spread down by 324.2 bp to 1,066.7 bp, with the yield to worst at 10.8% and the bond now trading up to 93.9 cents on the dollar (1Y price range: 88.8-95.5).

TOP BONDS MOVES IN THE PAST WEEK - EUR HY

- Issuer: Saipem Finance International BV (Amsterdam, Netherlands) | Coupon: 3.75% | Maturity: 8/9/2023 | Rating: B+ | ISIN: XS1487495316 | Z-spread up by 1,759.8 bp to 1,966.3 bp (CDS basis: -558.7bp), with the yield to worst at 19.4% and the bond now trading down to 80.0 cents on the dollar (1Y price range: 80.0-103.4).

- Issuer: Saipem Finance International BV (Amsterdam, Netherlands) | Coupon: 2.63% | Maturity: 7/1/2025 | Rating: B+ | ISIN: XS1711584430 | Z-spread up by 984.1 bp to 1,247.3 bp (CDS basis: -233.1bp), with the yield to worst at 12.7% and the bond now trading down to 76.5 cents on the dollar (1Y price range: 76.4-101.2).

- Issuer: Adler Group SA (Senningerberg, Luxembourg) | Coupon: 1.50% | Maturity: 26/7/2024 | Rating: BB- | ISIN: XS1652965085 | Z-spread up by 344.3 bp to 909.6 bp, with the yield to worst at 9.1% and the bond now trading down to 83.4 cents on the dollar (1Y price range: 83.4-91.1).

- Issuer: Adler Real Estate AG (Berlin, Germany) | Coupon: 2.13% | Maturity: 6/2/2024 | Rating: BB- | ISIN: XS1731858715 | Z-spread up by 290.6 bp to 812.7 bp, with the yield to worst at 8.1% and the bond now trading down to 89.2 cents on the dollar (1Y price range: 89.1-94.9).

- Issuer: Adler Group SA (Senningerberg, Luxembourg) | Coupon: 1.88% | Maturity: 14/1/2026 | Rating: BB- | ISIN: XS2283224231 | Z-spread up by 162.7 bp to 788.3 bp, with the yield to worst at 8.2% and the bond now trading down to 79.1 cents on the dollar (1Y price range: 79.0-86.2).

- Issuer: Webuild SpA (Milan, Italy) | Coupon: 1.75% | Maturity: 26/10/2024 | Rating: BB- | ISIN: XS1707063589 | Z-spread up by 118.8 bp to 310.8 bp, with the yield to worst at 3.0% and the bond now trading down to 95.8 cents on the dollar (1Y price range: 95.8-100.8).

- Issuer: Webuild SpA (Milan, Italy) | Coupon: 5.88% | Maturity: 15/12/2025 | Rating: BB- | ISIN: XS2271356201 | Z-spread up by 110.4 bp to 489.5 bp, with the yield to worst at 5.2% and the bond now trading down to 101.6 cents on the dollar (1Y price range: 103.1-109.5).

- Issuer: SoftBank Group Corp (Minato-Ku, Japan) | Coupon: 4.00% | Maturity: 19/9/2029 | Rating: BB- | ISIN: XS1684385591 | Z-spread up by 90.1 bp to 551.9 bp, with the yield to worst at 5.7% and the bond now trading down to 88.0 cents on the dollar (1Y price range: 87.9-97.1).

- Issuer: Atrium Finance Issuer BV (Amsterdam, Netherlands) | Coupon: 2.63% | Maturity: 5/9/2027 | Rating: BB | ISIN: XS2294495838 | Z-spread up by 87.1 bp to 454.1 bp, with the yield to worst at 4.8% and the bond now trading down to 88.4 cents on the dollar (1Y price range: 88.2-97.7).

- Issuer: Kondor Finance PLC (London, United Kingdom) | Coupon: 7.13% | Maturity: 19/7/2024 | Rating: B | ISIN: XS2027394233 | Z-spread down by 125.6 bp to 1,799.0 bp, with the yield to worst at 17.6% and the bond now trading up to 79.4 cents on the dollar (1Y price range: 76.3-90.2).

SELECTED RECENT USD BOND ISSUES

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$125m Bond (US3133ENNL01), fixed rate (1.96% coupon) maturing on 14 February 2029, priced at 100.00 (original spread of 9 bp), non callable

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$550m Bond (US3133ENNK28), floating rate (SOFR + 4.0 bp) maturing on 9 February 2024, priced at 100.00, non callable

- Federal Home Loan Banks (Agency | Washington, United States | Rating: NR): US$150m Bond (US3130AQVK63), fixed rate (2.60% coupon) maturing on 18 February 2032, priced at 100.00, callable (10nc3m)

- Deutsche Bank Ag (London Branch) (Banking | London, Germany | Rating: BBB+): US$3,000m Senior Note (XS1628429273), floating rate maturing on 9 February 2027, priced at 100.00, non callable

SELECTED RECENT EUR BOND ISSUES

- Findomestic Banca SpA (Banking | Florence, France | Rating: NR): €200m Bond (IT0005482960), floating rate (EU03MLIB + 0.0 bp) maturing on 8 February 2028, priced at 100.00, non callable

- KfW (Agency | Frankfurt, Germany | Rating: AAA): €300m Senior Note (XS2441573271), fixed rate (0.89% coupon) maturing on 9 February 2034, priced at 100.00, callable (12nc1)

NEW LOANS

- Solera Holdings Inc, signed a US$ 300m Term Loan B, to be used for acquisition financing. It matures on 06/04/28 and initial pricing is set at LIBOR +400bp

- Garda World Security Corp (CCC+), signed a US$ 700m Term Loan B, to be used for acquisition financing. It matures on 02/10/29 and initial pricing is set at Term SOFR +400bp

- NAPA Management Services Corp (CCC+), signed a US$ 610m Term Loan B maturing on 02/21/29, to be used for general corporate purposes.

- CitiusTech Inc, signed a US$ 386m Term Loan, to be used for refinancing / returning bank debt, and a leveraged buyout. It matures on 02/04/27 and initial pricing is set at SOFR +400bp

NEW ISSUES IN SECURITIZED CREDIT

- Kref 2022-Fl3 Ltd issued a floating-rate CLO in 6 tranches, for a total of US$ 848 m. Highest-rated tranche offering a spread over the floating rate of 145bp, and the lowest-rated tranche a spread of 315bp. Bookrunners: Goldman Sachs & Co, Morgan Stanley International Ltd, Wells Fargo Securities LLC, KKR Capital Markets LLC, MUFG Securities Americas Inc

- GS Mortgage-Backed Securities Trust 2022-Mm1 issued a fixed-rate RMBS in 5 tranches, for a total of US$ 345 m. Bookrunners: Goldman Sachs & Co

- Neuberger Berman Loan Advisers Euro Clo 3 Designated Activity Company issued a floating-rate CLO in 6 tranches, for a total of € 319 m. Highest-rated tranche offering a spread over the floating rate of 92bp, and the lowest-rated tranche a spread of 887bp. Bookrunners: JP Morgan & Co Inc