Credit

Not A Ton Of Movement In US Credit, With Cash Spreads Slightly Wider, Rates Broadly Unchanged

No investment grade bond deal priced today in the US, and February should see limited supply, with about $100bn in the US$ IG pipeline for the full month

Published ET

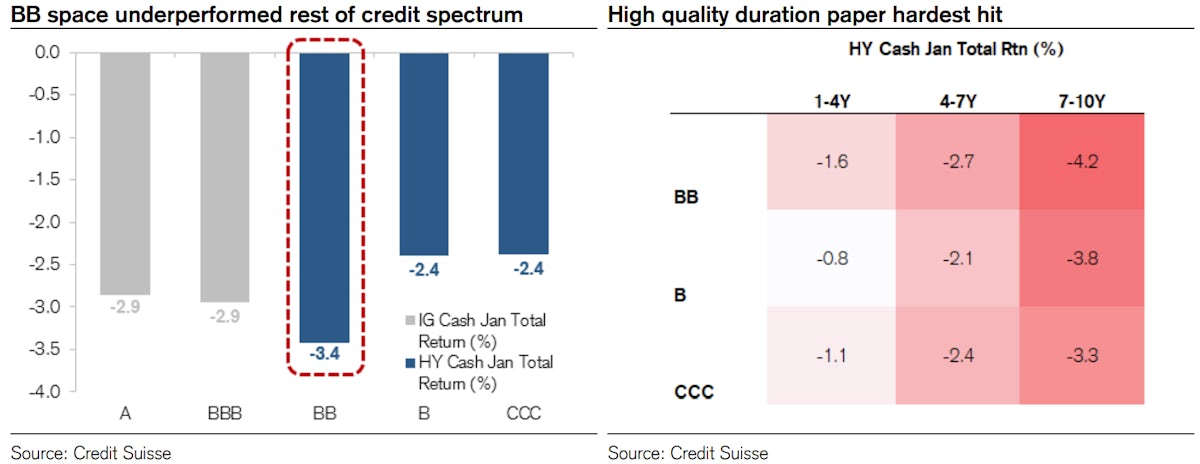

Higher Quality US$ HY Underperformed In January | Source: Credit Suisse

QUICK SUMMARY

- S&P 500 Bond Index was up 0.02% today, with investment grade up 0.03% and high yield down -0.10% (YTD total return: -4.16%)

- The iBoxx USD Liquid Investment Grade Total Return Index was up 0.085% today (Month-to-date: -1.32%; Year-to-date: -5.09%)

- The iBoxx USD Liquid High Yield Total Return Index was down -0.044% today (Month-to-date: -0.45%; Year-to-date: -3.30%)

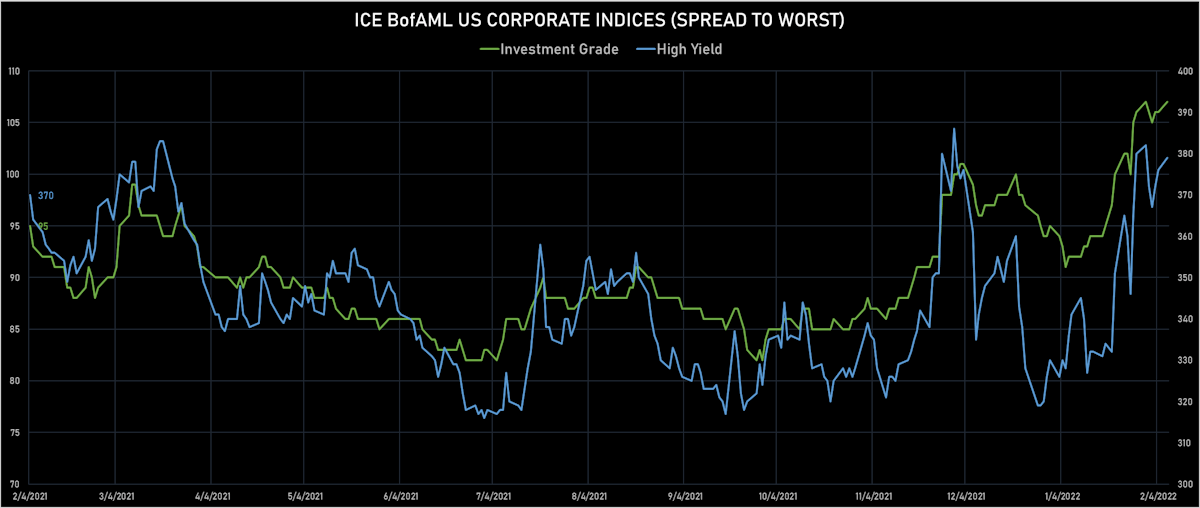

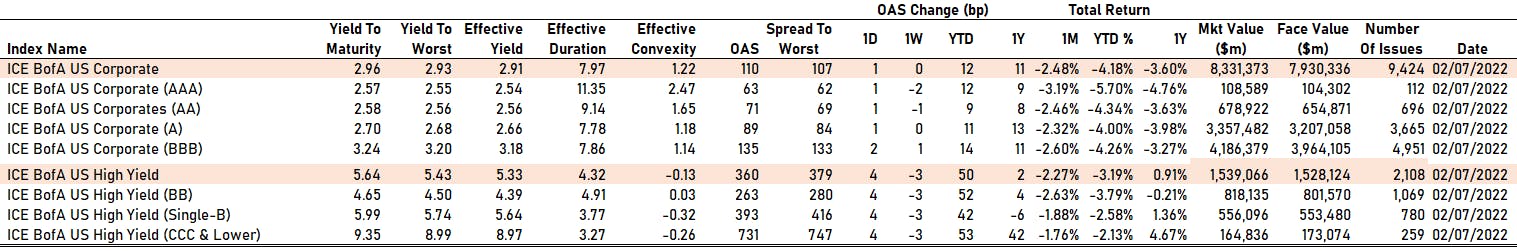

- ICE BofA US Corporate Index (Investment Grade) spread to worst up 1.0 bp, now at 107.0 bp (YTD change: +12.0 bp)

- ICE BofA US High Yield Index spread to worst up 3.0 bp, now at 379.0 bp (YTD change: +49.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index up 0.08% today (YTD total return: +0.4%)

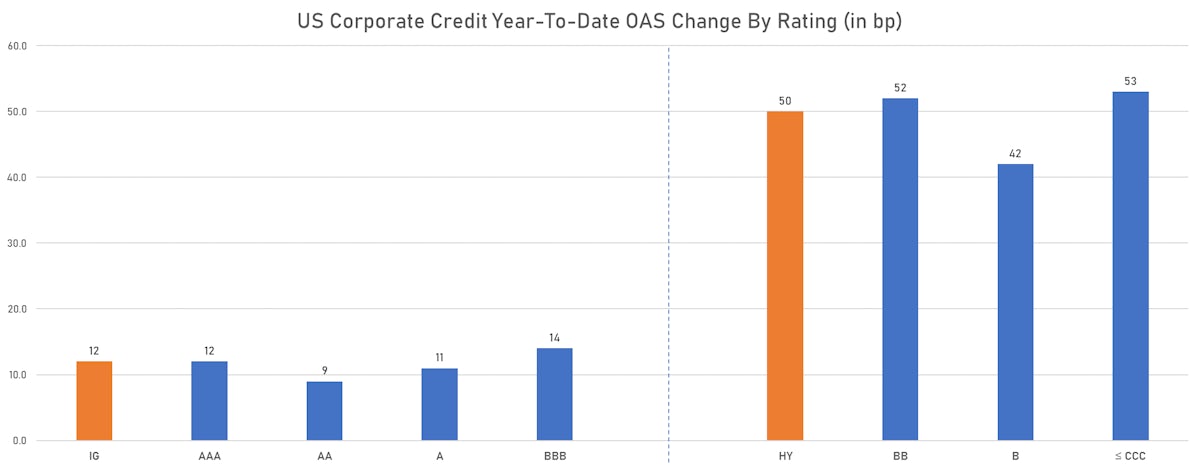

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING

- AAA up by 1 bp at 63 bp

- AA up by 1 bp at 71 bp

- A up by 1 bp at 89 bp

- BBB up by 2 bp at 135 bp

- BB up by 4 bp at 263 bp

- B up by 4 bp at 393 bp

- CCC up by 4 bp at 731 bp

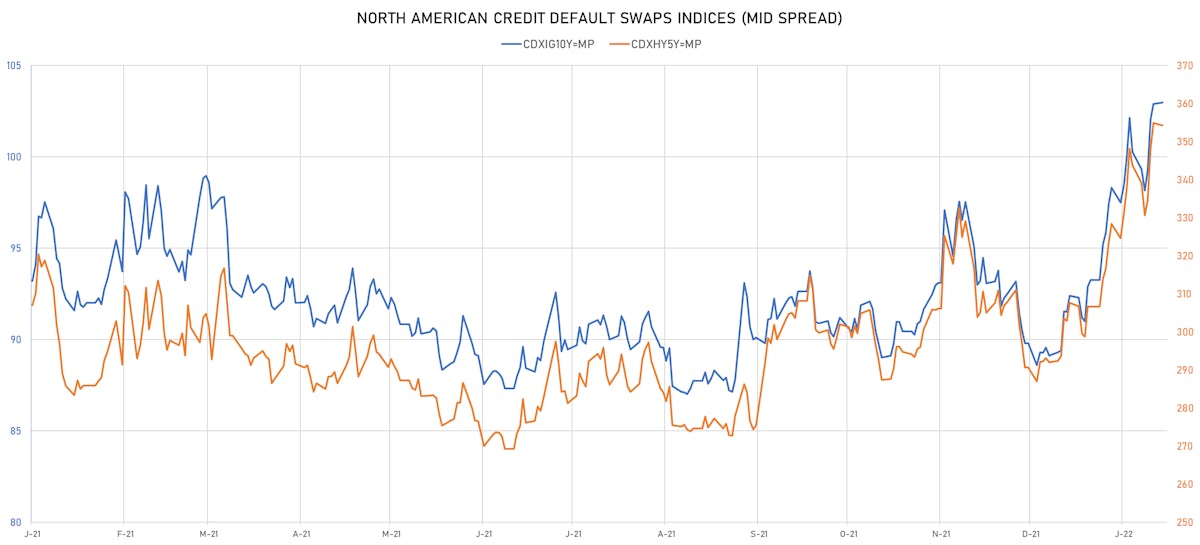

CDS INDICES (mid-spreads)

- Markit CDX.NA.IG 5Y up 0.1 bp, now at 103bp (YTD change: +13.9bp)

- Markit CDX.NA.HY 5Y down 0.7 bp, now at 354bp (YTD change: +62.3bp)

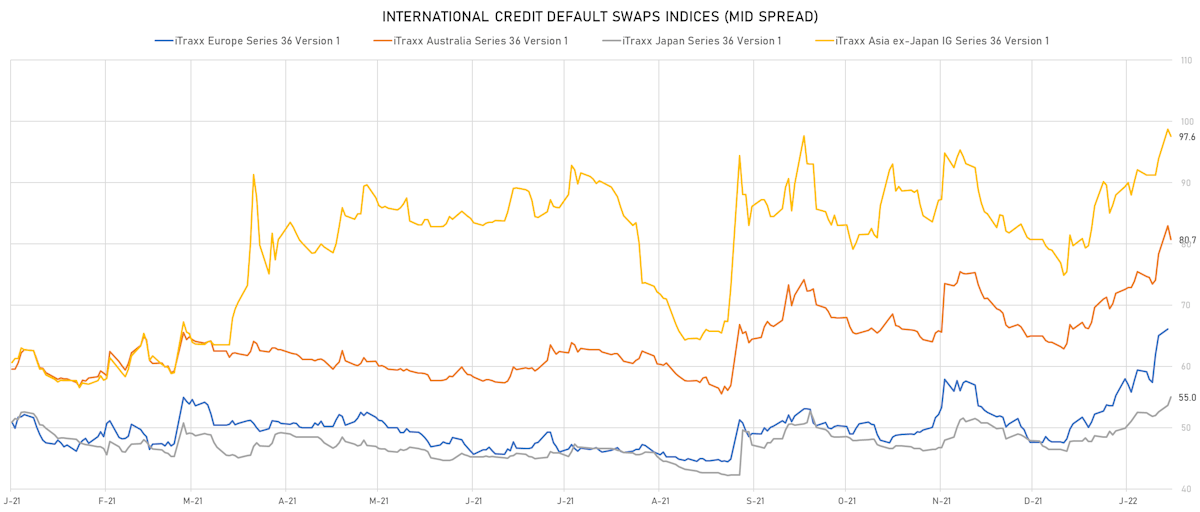

- Markit iTRAXX Europe up 0.1 bp, now at 66bp (YTD change: +18.5bp)

- Markit iTRAXX Japan up 0.8 bp, now at 54bp (YTD change: +8.1bp)

- Markit iTRAXX Asia Ex-Japan down 0.9 bp, now at 98bp (YTD change: +18.8bp)

TOP BONDS MOVES IN THE PAST WEEK - USD HY

- Issuer: Nextera Energy Operating Partners LP (Juno Beach, Florida (US)) | Coupon: 4.25% | Maturity: 15/7/2024 | Rating: BB | ISIN: USU6500TAF22 | Z-spread up by 44.1 bp to 184.3 bp, with the yield to worst at 3.3% and the bond now trading down to 101.8 cents on the dollar (1Y price range: 101.8-103.9).

- Issuer: EQM Midstream Partners LP (Canonsburg, Pennsylvania (US)) | Coupon: 6.50% | Maturity: 1/7/2027 | Rating: BB- | ISIN: USU26886AB46 | Z-spread up by 36.4 bp to 386.3 bp, with the yield to worst at 5.5% and the bond now trading down to 103.3 cents on the dollar (1Y price range: 103.3-112.0).

- Issuer: Hat Holdings I LLC (Annapolis, Maryland (US)) | Coupon: 3.38% | Maturity: 15/6/2026 | Rating: BB+ | ISIN: USU2467RAE90 | Z-spread up by 33.9 bp to 284.7 bp, with the yield to worst at 4.5% and the bond now trading down to 95.0 cents on the dollar (1Y price range: 95.0-102.1).

- Issuer: HanesBrands Inc (Winston-Salem, North Carolina (US)) | Coupon: 4.88% | Maturity: 15/5/2026 | Rating: BB- | ISIN: USU24437AE26 | Z-spread up by 30.3 bp to 238.6 bp, with the yield to worst at 4.0% and the bond now trading down to 102.5 cents on the dollar (1Y price range: 102.5-106.9).

- Issuer: Sealed Air Corp (Charlotte, North Carolina (US)) | Coupon: 5.13% | Maturity: 1/12/2024 | Rating: BB | ISIN: USU81193AN11 | Z-spread up by 27.9 bp to 164.6 bp (CDS basis: -71.1bp), with the yield to worst at 3.0% and the bond now trading down to 104.5 cents on the dollar (1Y price range: 105.0-107.0).

- Issuer: Block Inc (San Francisco, California (US)) | Coupon: 2.75% | Maturity: 1/6/2026 | Rating: BB | ISIN: USU85223AA03 | Z-spread up by 19.1 bp to 218.4 bp, with the yield to worst at 3.7% and the bond now trading down to 95.1 cents on the dollar (1Y price range: 95.1-100.5).

- Issuer: NCL Corporation Ltd (Miami, Bermuda) | Coupon: 5.88% | Maturity: 15/3/2026 | Rating: CCC+ | ISIN: USG6436QAL08 | Z-spread up by 18.1 bp to 560.1 bp, with the yield to worst at 7.2% and the bond now trading down to 94.8 cents on the dollar (1Y price range: 94.5-100.0).

- Issuer: AAG FH LP | Coupon: 9.75% | Maturity: 15/7/2024 | Rating: B- | ISIN: USC33027AA82 | Z-spread down by 16.8 bp to 914.3 bp, with the yield to worst at 10.2% and the bond now trading up to 98.0 cents on the dollar (1Y price range: 93.0-98.0).

- Issuer: Southeast Supply Header LLC (Houston, Texas (US)) | Coupon: 4.25% | Maturity: 15/6/2024 | Rating: BB- | ISIN: USU83854AB29 | Z-spread down by 20.9 bp to 248.0 bp, with the yield to worst at 3.6% and the bond now trading up to 100.4 cents on the dollar (1Y price range: 99.2-102.8).

- Issuer: Molina Healthcare Inc (Long Beach) | Coupon: 3.88% | Maturity: 15/5/2032 | Rating: BB- | ISIN: USU60868AE36 | Z-spread down by 23.4 bp to 216.4 bp, with the yield to worst at 4.2% and the bond now trading up to 97.3 cents on the dollar (1Y price range: 96.3-100.5).

- Issuer: Sensata Technologies BV (Almelo, Netherlands) | Coupon: 4.88% | Maturity: 15/10/2023 | Rating: BB- | ISIN: USN78840AH33 | Z-spread down by 25.2 bp to 183.9 bp, with the yield to worst at 2.9% and the bond now trading up to 102.8 cents on the dollar (1Y price range: 102.3-105.1).

- Issuer: OCP SA (Casablanca, Morocco) | Coupon: 5.63% | Maturity: 25/4/2024 | Rating: BB+ | ISIN: XS1061043011 | Z-spread down by 29.9 bp to 115.6 bp (CDS basis: -46.3bp), with the yield to worst at 2.5% and the bond now trading up to 106.3 cents on the dollar (1Y price range: 105.9-107.0).

- Issuer: Graphic Packaging International LLC (Atlanta) | Coupon: 3.75% | Maturity: 1/2/2030 | Rating: BB | ISIN: USU41441AD58 | Z-spread down by 31.0 bp to 219.7 bp, with the yield to worst at 4.0% and the bond now trading up to 97.1 cents on the dollar (1Y price range: 95.6-101.0).

TOP BONDS MOVES IN THE PAST WEEK - EUR HY

- Issuer: Saipem Finance International BV (Amsterdam, Netherlands) | Coupon: 3.75% | Maturity: 8/9/2023 | Rating: B+ | ISIN: XS1487495316 | Z-spread up by 1,518.0 bp to 2,207.2 bp (CDS basis: -326.3bp), with the yield to worst at 21.8% and the bond now trading down to 77.6 cents on the dollar (1Y price range: 76.2-103.4).

- Issuer: Saipem Finance International BV (Amsterdam, Netherlands) | Coupon: 2.63% | Maturity: 7/1/2025 | Rating: B+ | ISIN: XS1711584430 | Z-spread up by 709.9 bp to 1,377.0 bp (CDS basis: -66.3bp), with the yield to worst at 13.9% and the bond now trading down to 74.1 cents on the dollar (1Y price range: 76.4-101.2).

- Issuer: Webuild SpA (Milan, Italy) | Coupon: 1.75% | Maturity: 26/10/2024 | Rating: BB- | ISIN: XS1707063589 | Z-spread up by 177.4 bp to 391.8 bp, with the yield to worst at 3.8% and the bond now trading down to 93.8 cents on the dollar (1Y price range: 95.8-100.8).

- Issuer: Webuild SpA (Milan, Italy) | Coupon: 5.88% | Maturity: 15/12/2025 | Rating: BB- | ISIN: XS2271356201 | Z-spread up by 158.5 bp to 554.3 bp, with the yield to worst at 5.9% and the bond now trading down to 99.5 cents on the dollar (1Y price range: 99.5-109.5).

- Issuer: Jaguar Land Rover Automotive PLC (Coventry, United Kingdom) | Coupon: 2.20% | Maturity: 15/1/2024 | Rating: B+ | ISIN: XS1551347393 | Z-spread up by 89.3 bp to 425.0 bp (CDS basis: -150.6bp), with the yield to worst at 3.8% and the bond now trading down to 96.2 cents on the dollar (1Y price range: 96.2-99.3).

- Issuer: Telecom Italia SpA (Rome, Italy) | Coupon: 4.00% | Maturity: 11/4/2024 | Rating: BB | ISIN: XS1935256369 | Z-spread up by 82.4 bp to 272.5 bp (CDS basis: -151.4bp), with the yield to worst at 2.7% and the bond now trading down to 102.1 cents on the dollar (1Y price range: 102.2-105.2).

- Issuer: Telecom Italia Finance SA (Luxembourg, Luxembourg) | Coupon: 7.75% | Maturity: 24/1/2033 | Rating: BB | ISIN: XS0161100515 | Z-spread up by 70.3 bp to 457.1 bp (CDS basis: -84.5bp), with the yield to worst at 5.1% and the bond now trading down to 120.5 cents on the dollar (1Y price range: 119.2-133.2).

- Issuer: thyssenkrupp AG (Essen, Germany) | Coupon: 2.88% | Maturity: 22/2/2024 | Rating: B+ | ISIN: DE000A2TEDB8 | Z-spread up by 58.9 bp to 272.6 bp (CDS basis: -107.0bp), with the yield to worst at 2.5% and the bond now trading down to 100.0 cents on the dollar (1Y price range: 100.0-103.1).

- Issuer: Adler Real Estate AG (Berlin, Germany) | Coupon: 2.13% | Maturity: 6/2/2024 | Rating: BB- | ISIN: XS1731858715 | Z-spread up by 57.1 bp to 830.2 bp, with the yield to worst at 8.2% and the bond now trading down to 88.9 cents on the dollar (1Y price range: 88.8-94.9).

- Issuer: SIG Combibloc PurchaseCo SARL (Munsbach, Luxembourg) | Coupon: 2.13% | Maturity: 18/6/2025 | Rating: BB+ | ISIN: XS2189594315 | Z-spread up by 56.3 bp to 147.6 bp, with the yield to worst at 1.8% and the bond now trading down to 100.8 cents on the dollar (1Y price range: 100.8-105.1).

- Issuer: Standard Industries Inc (Parsippany, New Jersey (US)) | Coupon: 2.25% | Maturity: 21/11/2026 | Rating: B+ | ISIN: XS2080766475 | Z-spread up by 54.0 bp to 382.1 bp, with the yield to worst at 4.2% and the bond now trading down to 91.1 cents on the dollar (1Y price range: 91.1-98.3).

- Issuer: Kondor Finance PLC (London, United Kingdom) | Coupon: 7.13% | Maturity: 19/7/2024 | Rating: B | ISIN: XS2027394233 | Z-spread down by 267.0 bp to 1,772.0 bp, with the yield to worst at 17.3% and the bond now trading up to 79.9 cents on the dollar (1Y price range: 76.3-90.2).

SELECTED RECENT USD BOND ISSUES

- Crescent Energy Finance LLC (Financial - Other | New York City, United States | Rating: NR): US$200m Senior Note (USU4526LAB37), fixed rate (7.25% coupon) maturing on 1 May 2026, priced at 101.00 (original spread of 525 bp), callable (4nc1)

- BNP Paribas Issuance BV (Financial - Other | Amsterdam, France | Rating: A+): US$350m Unsecured Note (XS2033215463) zero coupon maturing on 8 July 2024, priced at 100.00, non callable

- Coruripe Netherlands BV (Financial - Other | Rating: B): US$300m Note (US22088DAA81), fixed rate (10.00% coupon) maturing on 10 February 2027, priced at 100.00, callable (5nc3)

SELECTED RECENT EUR BOND ISSUES

- Haitong Bank SA (Banking | Lisbon, China (Mainland) | Rating: BBB): €230m Bond (PTESS2OM0011), floating rate (EU03MLIB + 145.0 bp) maturing on 8 February 2025, priced at 100.00, with a regulatory call

- Ile-de-France Mobilites (Transportation - Other | Paris, France | Rating: AA-): €700m Bond (FR0014008CQ9), fixed rate (0.95% coupon) maturing on 16 February 2032, priced at 99.95 (original spread of 27 bp), non callable

- Ile-de-France Mobilites (Transportation - Other | Paris, France | Rating: AA-): €600m Bond (FR0014008CP1), fixed rate (1.28% coupon) maturing on 14 February 2042, priced at 99.84 (original spread of 52 bp), non callable

- Mexico (United Mexican States) (Government) (Sovereign | Miguel Hidalgo, Mexico | Rating: BBB-): €800m Senior Note (XS2444273168), fixed rate (2.38% coupon) maturing on 11 February 2030, priced at 99.17 (original spread of 237 bp), callable (8nc8)

- Volvo Treasury AB (Financial - Other | Goeteborg, Sweden | Rating: NR): €500m Senior Note (XS2440678915), fixed rate (0.63% coupon) maturing on 14 February 2025, priced at 99.64 (original spread of 97 bp), callable (3nc3)

NEW LOANS

- Culligan Holding Inc (B), signed a US$ 250m Delayed Draw Term Loan, to be used for general corporate purposes, acquisition financing.

- Culligan Holding Inc (B), signed a US$ 1,100m Term Loan B, to be used for general corporate purposes, acquisition financing. It matures on 07/30/28 and initial pricing is set at Term SOFR +425bp

- Latham Pool Products Inc (BB-), signed a US$ 350m Term Loan B maturing on 02/22/29, to be used for general corporate purposes.

- Banco BTG Pactual SA (BB-), signed a US$ 200m Term Loan, to be used for general corporate purposes

- WeddingWire Inc (B), signed a US$ 437m Term Loan B, to be used for general corporate purposes. It matures on 12/21/25 and initial pricing is set at Term SOFR +450bp