Credit

Tighter Spreads Across The Credit Complex As Risk Appetite Returned Today, Though IG Bonds Fall On Higher Yields

A few supranational bond deals priced today, led by the European Union (€2.2bn in a single tranche) and the Development Bank of Japan (US$1.4bn in two tranches)

Published ET

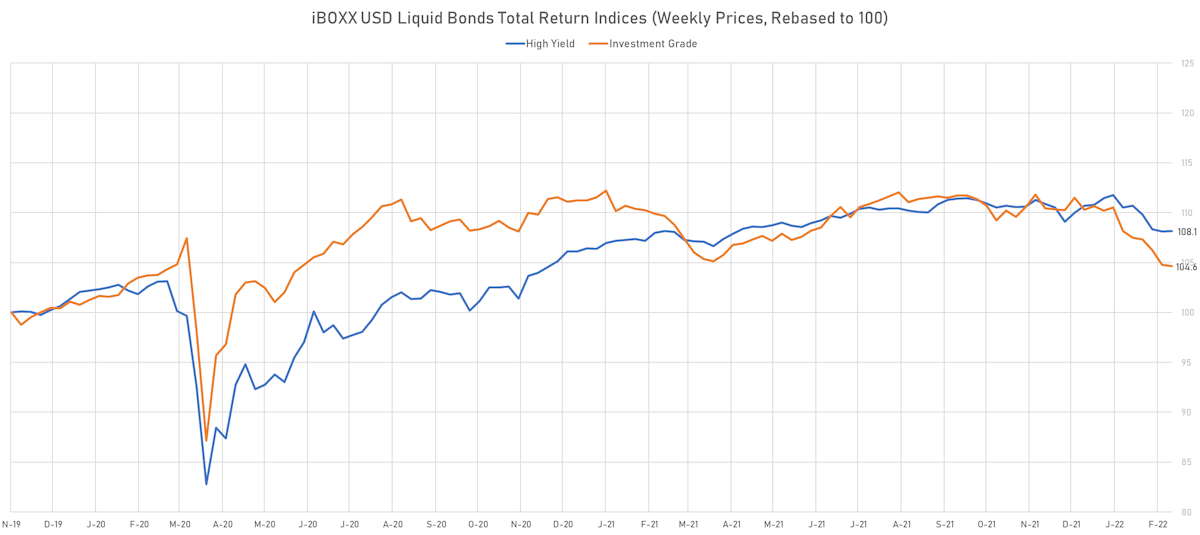

iBOXX USD Liquid IG & HY Total Return Indices | Sources: ϕpost, Refinitiv data

QUICK SUMMARY

- S&P 500 Bond Index was down -0.19% today, with investment grade down -0.22% and high yield up 0.06% (YTD total return: -4.34%)

- The iBoxx USD Liquid Investment Grade Total Return Index was down -0.247% today (Month-to-date: -1.56%; Year-to-date: -5.33%)

- The iBoxx USD Liquid High Yield Total Return Index was up 0.087% today (Month-to-date: -0.36%; Year-to-date: -3.22%)

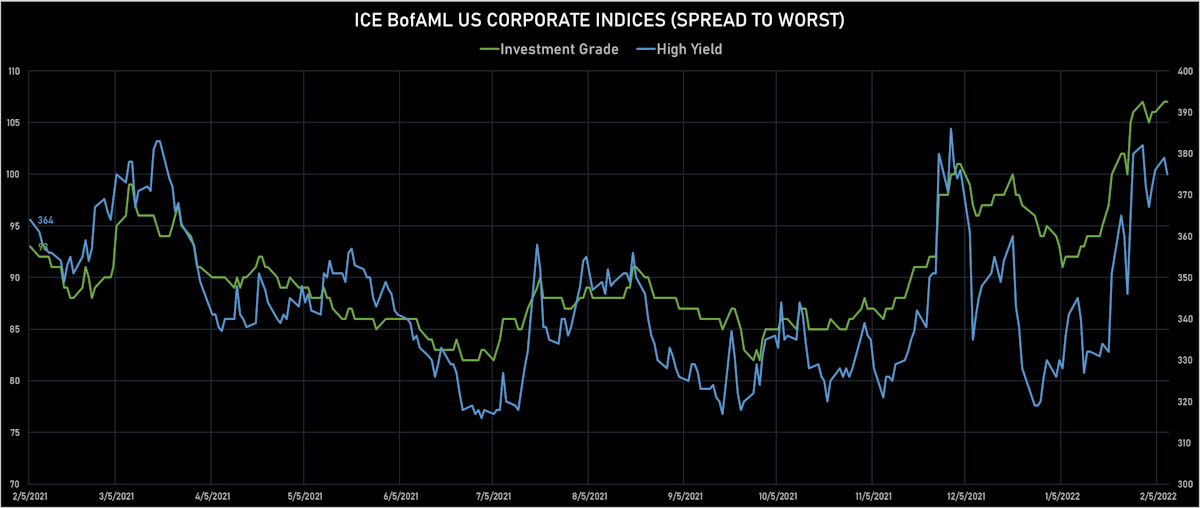

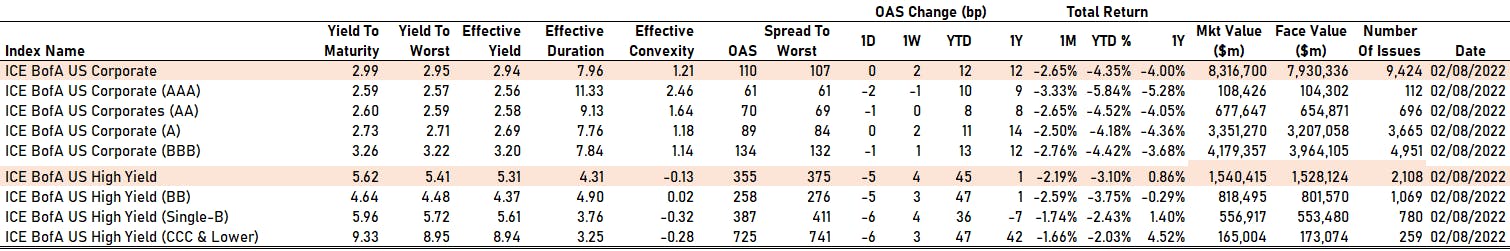

- ICE BofA US Corporate Index (Investment Grade) spread to worst unchanged at 107.0 bp (YTD change: +12.0 bp)

- ICE BofA US High Yield Index spread to worst down -4.0 bp, now at 375.0 bp (YTD change: +45.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index down -0.01% today (YTD total return: +0.4%)

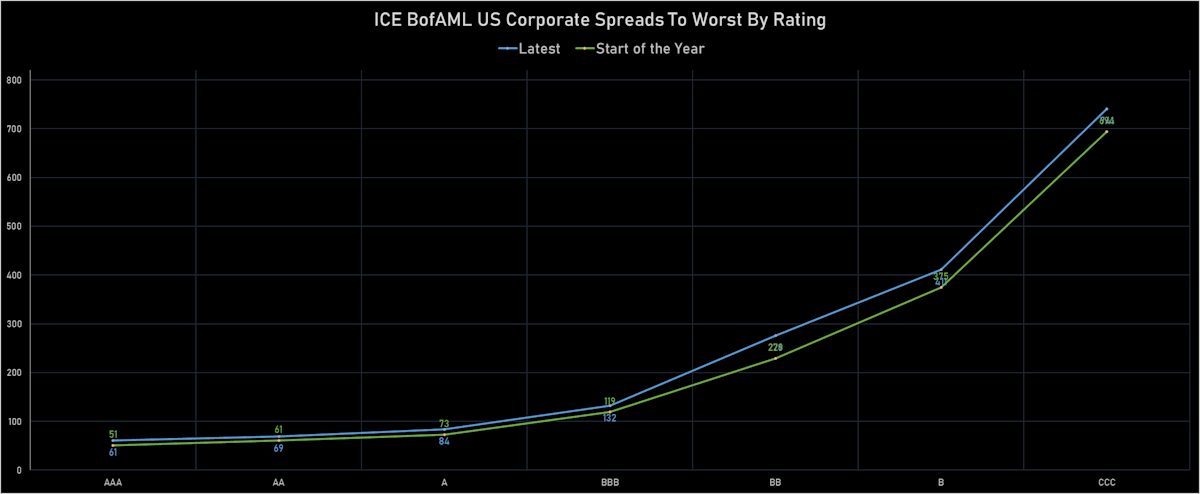

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING

- AAA down by -2 bp at 61 bp

- AA down by -1 bp at 70 bp

- A unchanged at 89 bp

- BBB down by -1 bp at 134 bp

- BB down by -5 bp at 258 bp

- B down by -6 bp at 387 bp

- CCC down by -6 bp at 725 bp

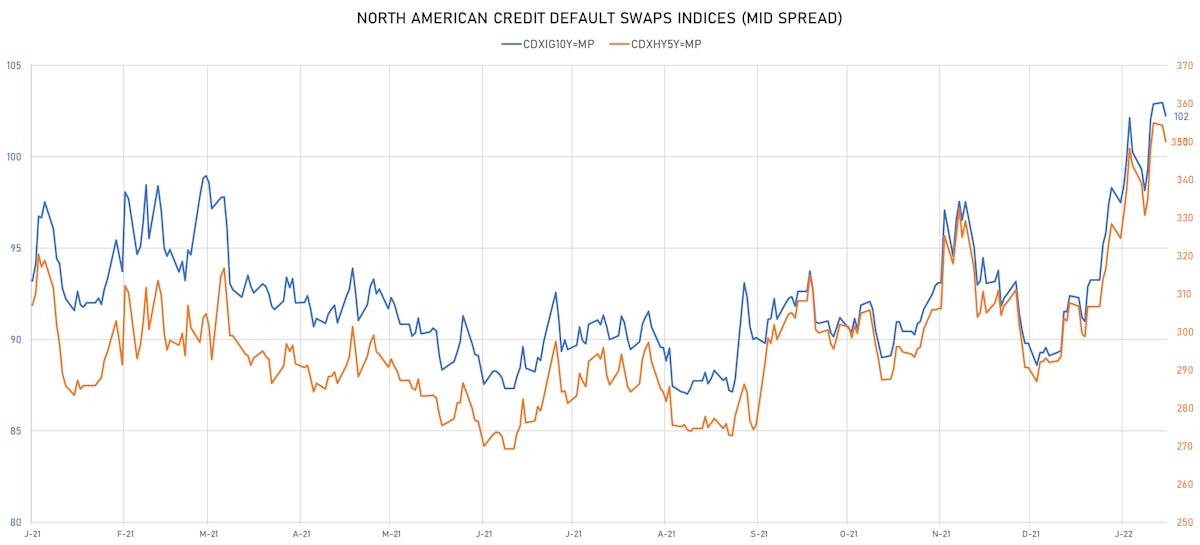

CDS INDICES (mid-spreads)

- Markit CDX.NA.IG 5Y down 0.8 bp, now at 102bp (YTD change: +13.1bp)

- Markit CDX.NA.HY 5Y down 4.2 bp, now at 350bp (YTD change: +58.1bp)

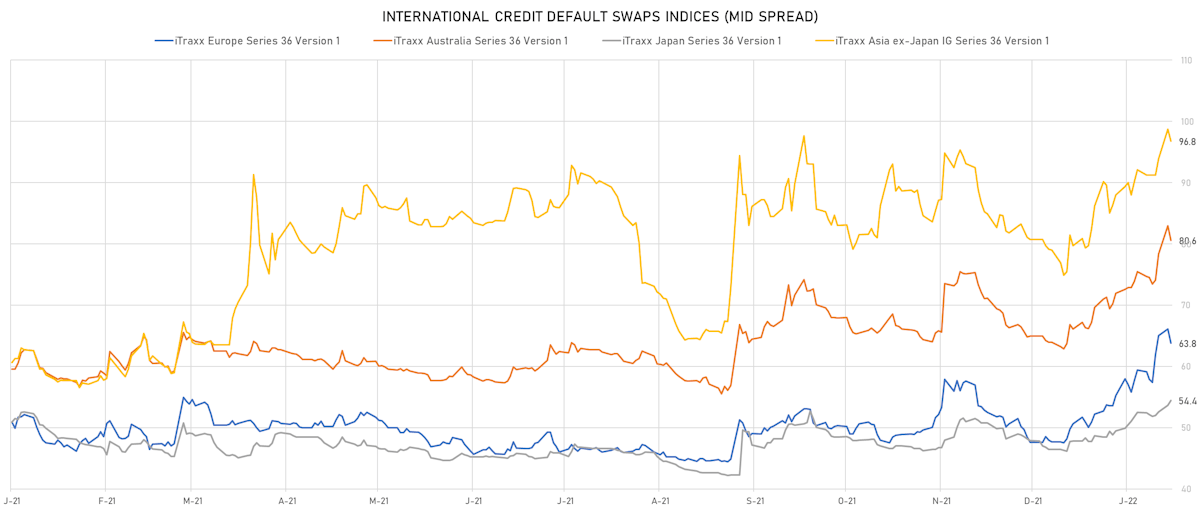

- Markit iTRAXX Europe down 2.3 bp, now at 64bp (YTD change: +16.1bp)

- Markit iTRAXX Japan up 0.7 bp, now at 54bp (YTD change: +8.0bp)

- Markit iTRAXX Asia Ex-Japan down 2.0 bp, now at 97bp (YTD change: +17.7bp)

USD CDS SINGLE NAMES - LARGEST MOVES IN THE PAST WEEK

- MGIC Investment Corp (Country: US; rated: A2): up 24.2 bp to 175.0bp (1Y range: 118-188bp)

- Ford Motor Credit Company LLC (Country: US; rated: NP): up 24.2 bp to 177.2bp (1Y range: 128-230bp)

- Bombardier Inc (Country: CA; rated: Caa1): up 24.4 bp to 454.4bp (1Y range: 395-823bp)

- Gap Inc (Country: US; rated: WR): up 25.8 bp to 293.4bp (1Y range: 132-293bp)

- Staples Inc (Country: US; rated: B2): up 27.8 bp to 1,121.4bp (1Y range: 687-1,159bp)

- Beazer Homes USA Inc (Country: US; rated: B2): up 30.3 bp to 367.6bp (1Y range: 231-388bp)

- Liberty Interactive LLC (Country: US; rated: Ba3): up 31.9 bp to 538.4bp (1Y range: 287-538bp)

- Nordstrom Inc (Country: US; rated: Ba1): up 35.1 bp to 410.0bp (1Y range: 211-410bp)

- Tegna Inc (Country: US; rated: Ba3): up 41.2 bp to 436.3bp (1Y range: 148-436bp)

- Radian Group Inc (Country: US; rated: BBB-): up 45.0 bp to 249.0bp (1Y range: 152-255bp)

- DISH DBS Corp (Country: US; rated: B2): up 49.9 bp to 550.8bp (1Y range: 317-562bp)

- Interval Acquisition Corp (Country: US; rated: WR): up 51.3 bp to 511.8bp (1Y range: 329-512bp)

- Transocean Inc (Country: KY; rated: Caa3): up 57.7 bp to 1,877.6bp (1Y range: 941-2,103bp)

- Central Bank of Tunisia (Country: TN; rated: ): up 64.0 bp to 956.6bp (1Y range: 300-957bp)

- Rite Aid Corp (Country: US; rated: B3): up 157.5 bp to 1,216.3bp (1Y range: 497-1,216bp)

EURO CDS SINGLE NAMES - LARGEST MOVES IN THE PAST WEEK

- Premier Foods Finance PLC (Country: GB; rated: B1): up 29.8 bp to 257.9bp (1Y range: 154-273bp)

- Syngenta AG (Country: CH; rated: Ba1): up 31.8 bp to 153.1bp (1Y range: 89-188bp)

- Ardagh Packaging Finance PLC (Country: IE; rated: B1): up 32.7 bp to 351.3bp (1Y range: 210-363bp)

- Jaguar Land Rover Automotive PLC (Country: GB; rated: WD): up 36.3 bp to 434.5bp (1Y range: 339-454bp)

- Stonegate Pub Company Financing PLC (Country: GB; rated: WR): up 36.5 bp to 457.7bp (1Y range: 416-601bp)

- Ladbrokes Coral Group Ltd (Country: GB; rated: WR): up 36.6 bp to 259.0bp (1Y range: 107-259bp)

- Altice Finco SA (Country: LU; rated: Caa1): up 36.6 bp to 507.5bp (1Y range: 333-516bp)

- CMA CGM SA (Country: FR; rated: Ba3): up 38.9 bp to 367.3bp (1Y range: 259-476bp)

- Iceland Bondco PLC (Country: GB; rated: LGD3 - 46%): up 45.3 bp to 679.7bp (1Y range: 358-680bp)

- thyssenkrupp AG (Country: DE; rated: B1): up 53.2 bp to 292.2bp (1Y range: 205-300bp)

- Stena AB (Country: SE; rated: B2-PD): up 58.9 bp to 496.1bp (1Y range: 401-728bp)

- Banca Monte dei Paschi di Siena SpA (Country: IT; rated: NP): up 72.8 bp to 348.8bp (1Y range: 145-349bp)

- Casino Guichard Perrachon SA (Country: FR; rated: WR): up 84.6 bp to 843.4bp (1Y range: 464-891bp)

- Novafives SAS (Country: FR; rated: Caa1): up 100.5 bp to 869.3bp (1Y range: 618-934bp)

- Boparan Finance PLC (Country: GB; rated: B3): up 133.1 bp to 1,433.3bp (1Y range: 597-1,565bp)

SELECTED RECENT USD BOND ISSUES

- El Paso Natural Gas Co LLC (Gas Utility - Pipelines | Houston, United States | Rating: BBB): US$300m Senior Note (US283695BQ68), fixed rate (3.50% coupon) maturing on 15 February 2032, priced at 99.84 (original spread of 155 bp), with a make whole call

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$220m Bond (US3133ENNM83), fixed rate (2.28% coupon) maturing on 14 February 2028, priced at 100.00 (original spread of 139 bp), callable (6nc1)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$110m Bond (US3133ENNN66), fixed rate (3.05% coupon) maturing on 17 February 2037, priced at 100.00 (original spread of 216 bp), callable (15nc1)

- Federal Home Loan Banks (Agency | Washington, United States | Rating: NR): US$140m Bond (US3130AQX401), fixed rate (1.50% coupon) maturing on 23 February 2024, priced at 100.00 (original spread of 120 bp), callable (2nc3m)

- Inter-American Development Bank (Supranational | Washington, United States | Rating: AAA): US$1,000m Senior Note (US4581X0EC87), floating rate (SOFR + 30.0 bp) maturing on 15 February 2029, priced at 100.00, non callable

- Morgan Stanley Direct Lending Fund (Financial - Other | New York City, United States | Rating: BBB-): US$425m Senior Note (US61774AAA16), fixed rate (4.50% coupon) maturing on 11 February 2027, priced at 99.75 (original spread of 275 bp), non callable

- News Corp (Leisure | New York City, United States | Rating: BB+): US$500m Senior Note (US65249BAB53), fixed rate (5.13% coupon) maturing on 15 February 2032, priced at 100.00 (original spread of 317 bp), callable (10nc5)

- Snap Inc (Information/Data Technology | Santa Monica, United States | Rating: NR): US$1,250m Bond (US83304AAG13), fixed rate (0.13% coupon) maturing on 1 March 2028, priced at 100.00, non callable, convertible

- BNP Paribas Issuance BV (Financial - Other | Amsterdam, Noord-Holland, France | Rating: A+): US$350m Unsecured Note (XS2033215463) zero coupon maturing on 8 July 2024, priced at 100.00, non callable

- Bell Telephone Company of Canada or Bell Canada (Quebec,CA) (Financial - Other | Verdun, Canada | Rating: NR): US$750m Senior Note (US0778FPAJ86), fixed rate (3.65% coupon) maturing on 15 August 2052, priced at 99.14 (original spread of 167 bp), callable (31nc30)

- Comision Federal de Electricidad (Utility - Other | Mexico City, Mexico | Rating: BBB): US$500m Senior Note (US200447AM27), fixed rate (6.26% coupon) maturing on 15 February 2052, priced at 100.00 (original spread of 400 bp), callable (30nc30)

- Comision Federal de Electricidad (Utility - Other | Mexico City, Mexico | Rating: BBB-): US$1,250m Senior Note (USP30179BQ04), fixed rate (4.69% coupon) maturing on 15 May 2029, priced at 99.98 (original spread of 275 bp), callable (7nc7)

- DIB Sukuk Ltd (Financial - Other | George Town, United Arab Emirates | Rating: NR): US$750m Islamic Sukuk (Wakala bil-Istithmar) (XS2436922616), fixed rate (2.74% coupon) maturing on 16 February 2027, priced at 100.00 (original spread of 94 bp), non callable

- Development Bank of Japan Inc (Agency | Chiyoda-Ku, Japan | Rating: A): US$700m Senior Note (US25159MBF32), fixed rate (1.75% coupon) maturing on 18 February 2025, priced at 99.77 (original spread of 27 bp), non callable

- Development Bank of Japan Inc (Agency | Chiyoda-Ku, Japan | Rating: A+): US$700m Senior Note (XS2443529958), fixed rate (1.75% coupon) maturing on 18 February 2025, priced at 99.77 (original spread of 27 bp), non callable

- Kia Corp (Automotive Manufacturer | Seoul, South Korea | Rating: BBB+): US$300m Senior Note (USY4760JAD55), fixed rate (2.75% coupon) maturing on 14 February 2027, priced at 99.51 (original spread of 105 bp), non callable

- Kia Corp (Automotive Manufacturer | Seoul, South Korea | Rating: BBB+): US$400m Senior Note (USY4760JAC72), fixed rate (2.38% coupon) maturing on 14 February 2025, priced at 99.74 (original spread of 90 bp), non callable

SELECTED RECENT EUR BOND ISSUES

- European Union (Supranational | Brussels, Belgium | Rating: AAA): €2,200m Senior Note (EU000A3K4DA4), fixed rate (0.25% coupon) maturing on 22 October 2026, priced at 99.72 (original spread of 33 bp), non callable

- Hamburg Free and Hanseatic, City of (Official and Muni | Hamburg, Germany | Rating: AAA): €300m Landesschatzanweisung (DE000A2LQPM0), floating rate (EU06MLIB + 90.0 bp) maturing on 15 February 2027, priced at 100.00, non callable

- Palmer Square European Loan Funding 2022-1 DAC (Financial - Other | Dublin, Ireland | Rating: NR): €272m Bond (XS2439765533), floating rate maturing on 15 October 2031, priced at 100.00, non callable

NEW LOANS

- Safe Fleet Holdings LLC, signed a US$ 595m Term Loan B, to be used for general corporate purposes.

- Olaplex Inc, signed a US$ 675m Term Loan B, to be used for general corporate purposes

NEW ISSUES IN SECURITIZED CREDIT

- Sculptor European CLO IX Designated Activity Company issued a floating-rate CLO in 7 tranches, for a total of € 426 m. Highest-rated tranche offering a spread over the floating rate of 92bp, and the lowest-rated tranche a spread of 901bp. Bookrunners: BNP Paribas SA