Credit

Rough Day For US$ Credit, With Much Higher Yields And Wider Synthetic Spreads

With rates volatility through the roof after hot CPI print, bond issuers mostly sat on the sidelines today, with the only sizeable deal courtesy of Norwegian Cruise Line ($2bn in 3 tranches, including a $435m convertible)

Published ET

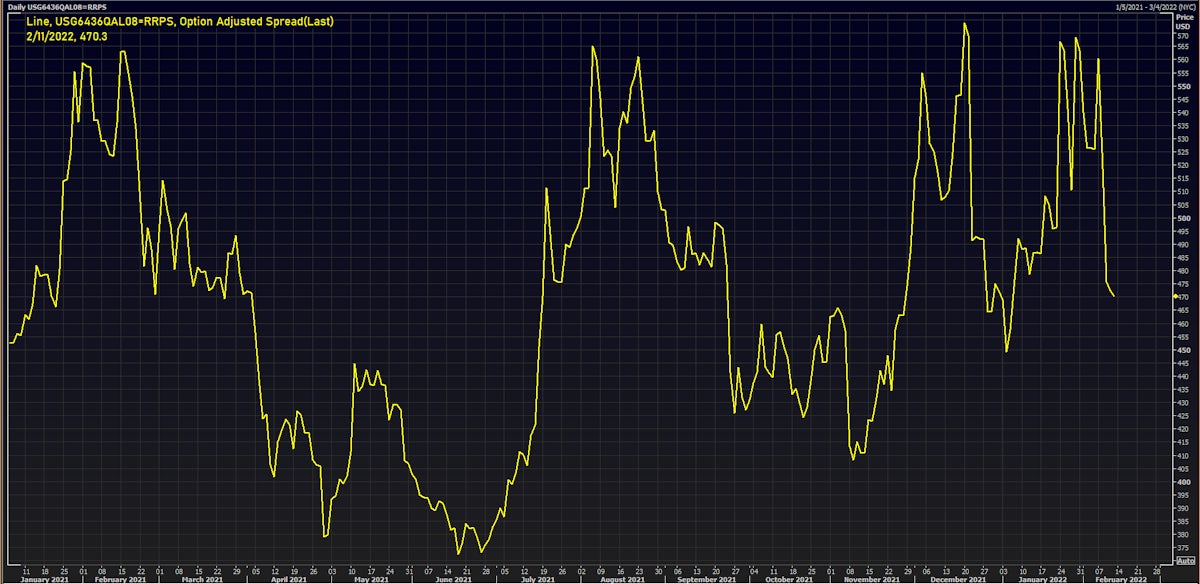

Option-Adjusted Spread On Norwegian Cruise Line 3/2026 Bond (USG6436QAL08) | Source: Refinitiv

QUICK SUMMARY

- S&P 500 Bond Index was down -0.90% today, with investment grade down -0.92% and high yield down -0.69% (YTD total return: -5.03%)

- The iBoxx USD Liquid Investment Grade Total Return Index was down -1.15% today (Month-to-date: -2.49%; Year-to-date: -6.22%)

- The iBoxx USD Liquid High Yield Total Return Index was down -0.73% today (Month-to-date: -0.75%; Year-to-date: -3.59%)

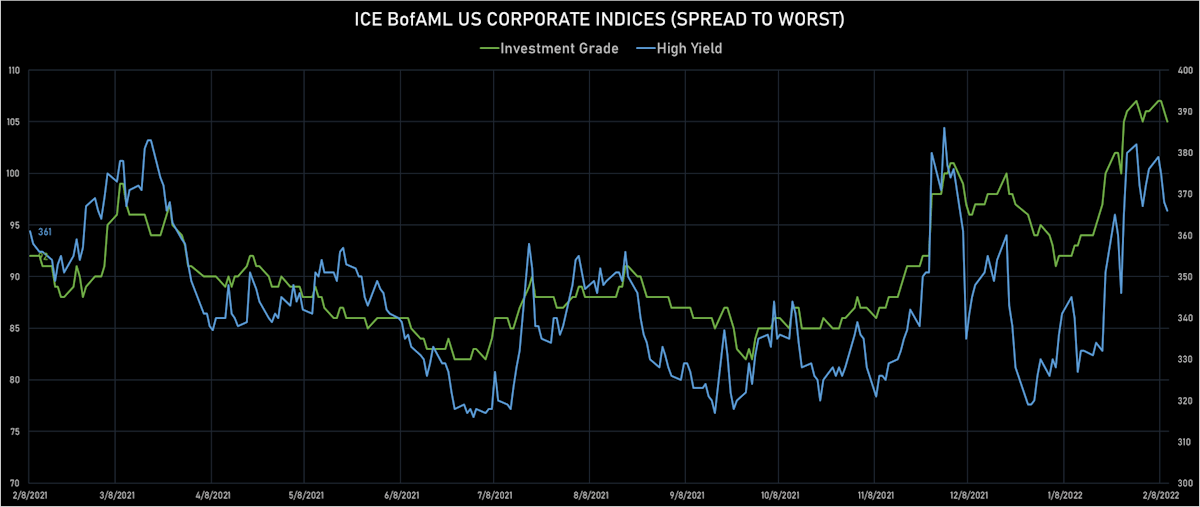

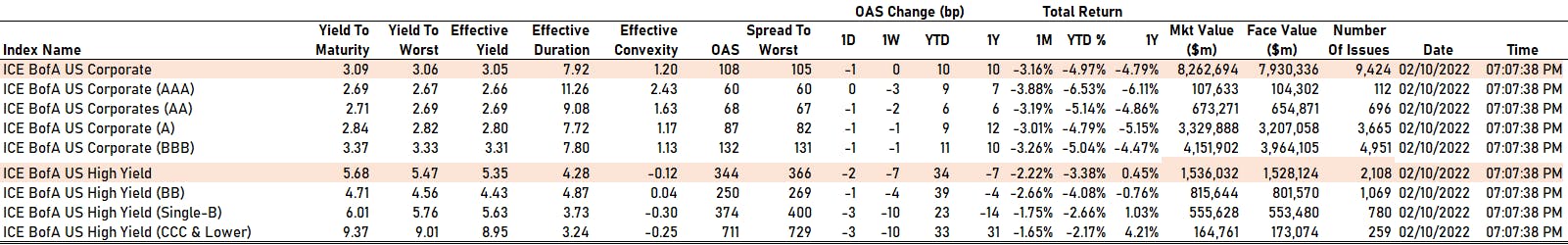

- ICE BofA US Corporate Index (Investment Grade) spread to worst down -1.0 bp, now at 105.0 bp (YTD change: +10.0 bp)

- ICE BofA US High Yield Index spread to worst down -2.0 bp, now at 366.0 bp (YTD change: +36.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index down -0.03% today (YTD total return: +0.3%)

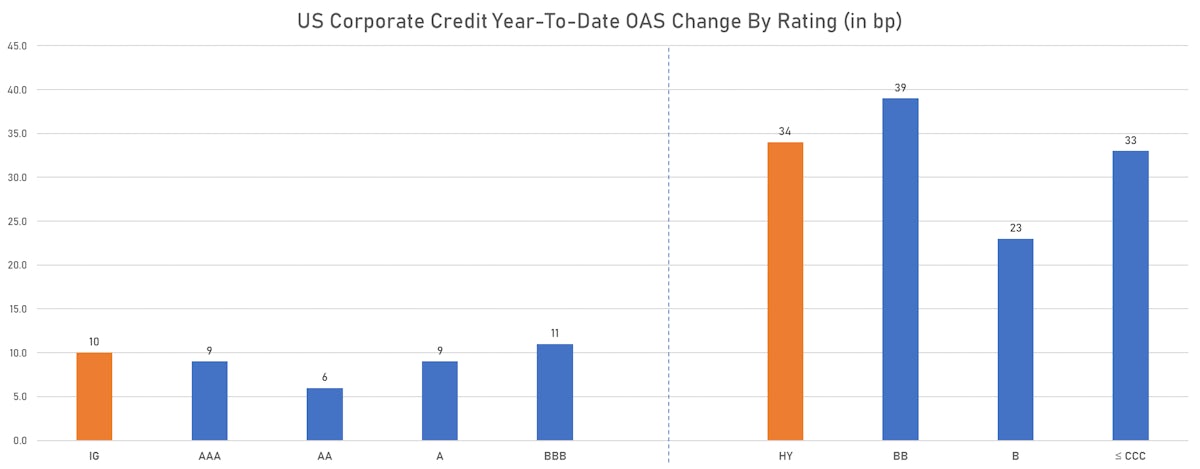

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING

- AAA unchanged at 60 bp

- AA down by -1 bp at 68 bp

- A down by -1 bp at 87 bp

- BBB down by -1 bp at 132 bp

- BB down by -1 bp at 250 bp

- B down by -3 bp at 374 bp

- CCC down by -3 bp at 711 bp

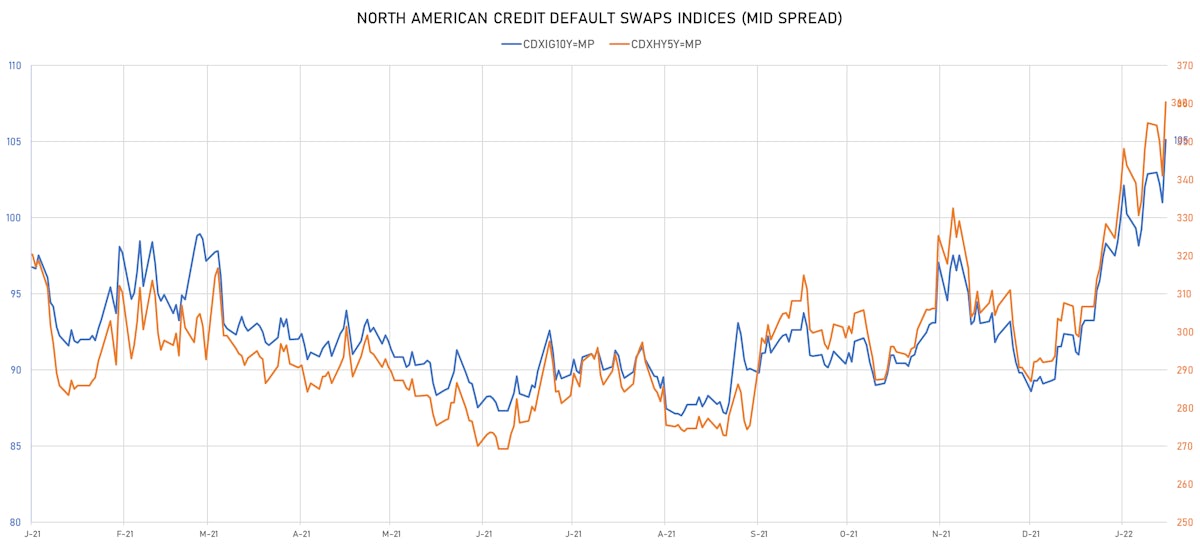

CDS INDICES (mid-spreads)

- Markit CDX.NA.IG 5Y up 4.1 bp, now at 105bp (YTD change: +16.0bp)

- Markit CDX.NA.HY 5Y up 19.3 bp, now at 360bp (YTD change: +68.4bp)

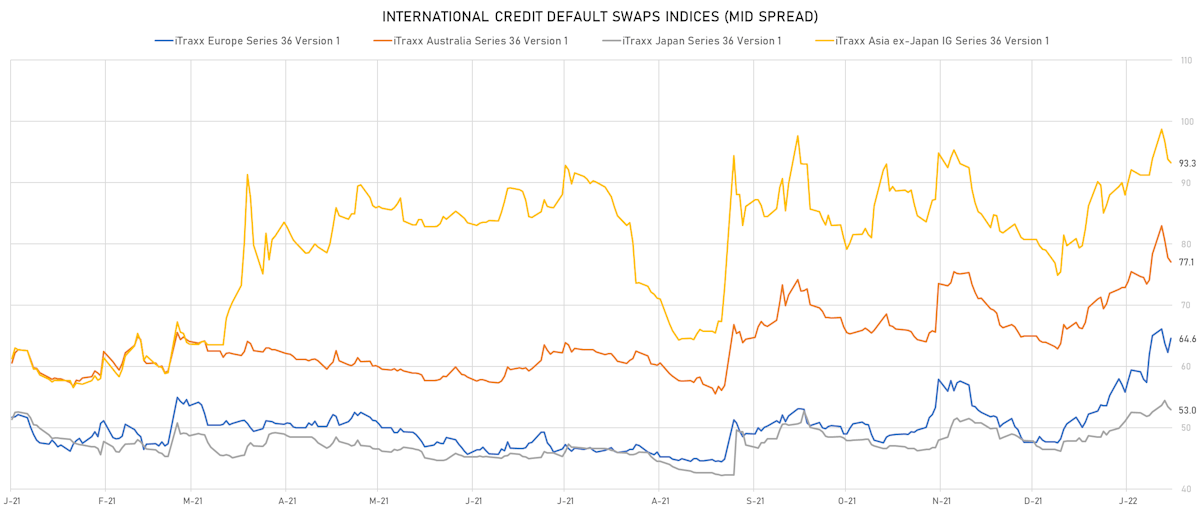

- Markit iTRAXX Europe up 2.3 bp, now at 65bp (YTD change: +16.9bp)

- Markit iTRAXX Japan down 0.5 bp, now at 53bp (YTD change: +6.5bp)

- Markit iTRAXX Asia Ex-Japan down 0.6 bp, now at 93bp (YTD change: +14.2bp)

TOP BONDS MOVES IN THE PAST WEEK - USD HY

- Issuer: ZF North America Capital Inc (Northville, Michigan (US)) | Coupon: 4.75% | Maturity: 29/4/2025 | Rating: BB+ | ISIN: USU98737AC03 | Z-spread up by 53.9 bp to 258.9 bp, with the yield to worst at 4.3% and the bond now trading down to 100.8 cents on the dollar (1Y price range: 100.8-107.1).

- Issuer: Taylor Morrison Communities Inc (Scottsdale, Arizona (US)) | Coupon: 5.63% | Maturity: 1/3/2024 | Rating: BB- | ISIN: USU87286AD91 | Z-spread up by 44.9 bp to 181.4 bp, with the yield to worst at 3.4% and the bond now trading down to 103.6 cents on the dollar (1Y price range: 104.0-106.5).

- Issuer: WeWork Companies Inc (New York City, New York (US)) | Coupon: 7.88% | Maturity: 1/5/2025 | Rating: CCC- | ISIN: USU96217AA99 | Z-spread up by 27.5 bp to 1,009.8 bp, with the yield to worst at 11.3% and the bond now trading down to 90.0 cents on the dollar (1Y price range: 90.0-96.5).

- Issuer: Lamb Weston Holdings Inc (Eagle, Idaho (US)) | Coupon: 4.88% | Maturity: 15/5/2028 | Rating: BB- | ISIN: USU5256PAC50 | Z-spread up by 25.3 bp to 237.4 bp, with the yield to worst at 4.4% and the bond now trading down to 102.0 cents on the dollar (1Y price range: 102.0-108.3).

- Issuer: OCP SA (Casablanca, Morocco) | Coupon: 5.63% | Maturity: 25/4/2024 | Rating: BB+ | ISIN: XS1061043011 | Z-spread down by 26.5 bp to 100.1 bp (CDS basis: -31.1bp), with the yield to worst at 2.6% and the bond now trading up to 106.0 cents on the dollar (1Y price range: 105.8-107.0).

- Issuer: Yum! Brands Inc (Louisville, Kentucky (US)) | Coupon: 4.75% | Maturity: 15/1/2030 | Rating: BB- | ISIN: USU9T71RAB76 | Z-spread down by 27.9 bp to 225.6 bp (CDS basis: -50.3bp), with the yield to worst at 4.2% and the bond now trading up to 102.5 cents on the dollar (1Y price range: 101.5-108.0).

- Issuer: Videotron Ltd (Pre-Merger) (MONTREAL, Canada) | Coupon: 5.38% | Maturity: 15/6/2024 | Rating: BB+ | ISIN: USC96225AA22 | Z-spread down by 39.0 bp to 132.2 bp, with the yield to worst at 3.0% and the bond now trading up to 104.5 cents on the dollar (1Y price range: 104.3-107.0).

- Issuer: Sensata Technologies BV (Almelo, Netherlands) | Coupon: 4.88% | Maturity: 15/10/2023 | Rating: BB- | ISIN: USN78840AH33 | Z-spread down by 41.0 bp to 155.8 bp, with the yield to worst at 2.9% and the bond now trading up to 102.8 cents on the dollar (1Y price range: 102.3-105.1).

- Issuer: Xerox Holdings Corp (Norwalk, Connecticut (US)) | Coupon: 5.00% | Maturity: 15/8/2025 | Rating: BB | ISIN: USU98401AA75 | Z-spread down by 45.2 bp to 236.9 bp, with the yield to worst at 4.1% and the bond now trading up to 102.0 cents on the dollar (1Y price range: 100.1-105.7).

- Issuer: Wynn Las Vegas LLC (Las Vegas, Nevada (US)) | Coupon: 5.50% | Maturity: 1/3/2025 | Rating: B | ISIN: USU98347AK05 | Z-spread down by 48.2 bp to 336.1 bp, with the yield to worst at 5.0% and the bond now trading up to 100.4 cents on the dollar (1Y price range: 99.5-103.5).

- Issuer: NCL Finance Ltd (United Kingdom) | Coupon: 6.13% | Maturity: 15/3/2028 | Rating: CCC+ | ISIN: USG6437FAA78 | Z-spread down by 67.8 bp to 466.5 bp, with the yield to worst at 6.5% and the bond now trading up to 97.0 cents on the dollar (1Y price range: 94.3-99.5).

- Issuer: NCL Corporation Ltd (Miami, Bermuda) | Coupon: 5.88% | Maturity: 15/3/2026 | Rating: CCC+ | ISIN: USG6436QAL08 | Z-spread down by 93.5 bp to 470.3 bp, with the yield to worst at 6.6% and the bond now trading up to 97.0 cents on the dollar (1Y price range: 94.5-100.0).

TOP BONDS MOVES IN THE PAST WEEK - EUR HY

- Issuer: SoftBank Group Corp (Minato-Ku, Japan) | Coupon: 2.88% | Maturity: 6/1/2027 | Rating: BB+ | ISIN: XS2361254597 | Z-spread down by 38.3 bp to 448.0 bp, with the yield to worst at 4.9% and the bond now trading up to 90.8 cents on the dollar (1Y price range: 89.0-95.0).

- Issuer: Teva Pharmaceutical Finance Netherlands II BV (Amsterdam, Netherlands) | Coupon: 6.00% | Maturity: 31/1/2025 | Rating: BB- | ISIN: XS2198213956 | Z-spread down by 48.4 bp to 346.2 bp, with the yield to worst at 3.7% and the bond now trading up to 105.6 cents on the dollar (1Y price range: 102.9-107.7).

- Issuer: Adler Group SA (Senningerberg, Luxembourg) | Coupon: 2.75% | Maturity: 13/11/2026 | Rating: BB- | ISIN: XS2248826294 | Z-spread down by 53.7 bp to 722.9 bp, with the yield to worst at 7.7% and the bond now trading up to 80.5 cents on the dollar (1Y price range: 79.0-86.4).

- Issuer: Kondor Finance PLC (London, United Kingdom) | Coupon: 7.13% | Maturity: 19/7/2024 | Rating: B | ISIN: XS2027394233 | Z-spread down by 56.0 bp to 1,731.1 bp, with the yield to worst at 17.0% and the bond now trading up to 80.5 cents on the dollar (1Y price range: 76.3-90.2).

- Issuer: Adler Real Estate AG (Berlin, Germany) | Coupon: 2.13% | Maturity: 6/2/2024 | Rating: BB- | ISIN: XS1731858715 | Z-spread down by 60.9 bp to 761.8 bp, with the yield to worst at 7.6% and the bond now trading up to 90.0 cents on the dollar (1Y price range: 88.8-94.9).

- Issuer: Metinvest BV (Amsterdam, Netherlands) | Coupon: 5.63% | Maturity: 17/6/2025 | Rating: B+ | ISIN: XS2056722734 | Z-spread down by 66.3 bp to 900.3 bp, with the yield to worst at 9.1% and the bond now trading up to 89.8 cents on the dollar (1Y price range: 86.0-99.4).

- Issuer: Adler Group SA (Senningerberg, Luxembourg) | Coupon: 1.50% | Maturity: 26/7/2024 | Rating: BB- | ISIN: XS1652965085 | Z-spread down by 69.0 bp to 846.2 bp, with the yield to worst at 8.5% and the bond now trading up to 84.6 cents on the dollar (1Y price range: 83.2-91.1).

- Issuer: Saipem Finance International BV (Amsterdam, Netherlands) | Coupon: 2.63% | Maturity: 7/1/2025 | Rating: B+ | ISIN: XS1711584430 | Z-spread down by 246.1 bp to 1,031.0 bp (CDS basis: 236.9bp), with the yield to worst at 10.6% and the bond now trading up to 80.7 cents on the dollar (1Y price range: 73.9-101.2).

SELECTED RECENT USD BOND ISSUES

- Blue Owl Finance LLC (Financial - Other | United States | Rating: BBB): US$400m Senior Note (US09581JAG13), fixed rate (4.38% coupon) maturing on 15 February 2032, priced at 98.77 (original spread of 250 bp), callable (10nc10)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$165m Bond (US3133ENPB01), fixed rate (2.18% coupon) maturing on 16 February 2027, priced at 100.00, callable (5nc2)

- Federal Home Loan Banks (Agency | Washington, United States | Rating: NR): US$176m Bond (US3130AQY490), fixed rate (2.00% coupon) maturing on 27 February 2025, priced at 100.00 (original spread of 155 bp), callable (3nc3m)

- JPMorgan Chase & Co (Banking | New York City, New York, United States | Rating: A-): US$285m Unsecured Note (XS1450779233) zero coupon maturing on 16 February 2037, priced at 100.00, non callable

- NCL Corporation Ltd (Leisure | Miami, United States | Rating: B): US$435m Bond (US62886HBJ95), fixed rate (2.50% coupon) maturing on 15 February 2027, priced at 100.00, non callable, convertible

- NCL Corporation Ltd (Leisure | Miami, United States | Rating: B+): US$1,000m Note (US62886HBE09), fixed rate (5.88% coupon) maturing on 15 February 2027, priced at 100.00 (original spread of 392 bp), callable (5nc2)

- NCL Corporation Ltd (Leisure | Miami, United States | Rating: B-): US$600m Senior Note (US62886HBG56), fixed rate (7.75% coupon) maturing on 15 February 2029, priced at 100.00 (original spread of 572 bp), callable (7nc7)

SELECTED RECENT EUR BOND ISSUES

- Arval Service Lease SA (Financial - Other | Paris, France | Rating: A-): €750m Bond (FR0014008FH1), fixed rate (0.88% coupon) maturing on 17 February 2025, priced at 99.87 (original spread of 117 bp), callable (3nc3)

- Caja Rural de Navarra S Coop de Credito (Banking | Pamplona, Spain | Rating: NR): €500m Cedula Hipotecaria (Covered Bond) (ES0415306093), fixed rate (0.75% coupon) maturing on 16 February 2029, priced at 99.73, non callable

- Castor SpA (Financial - Other | Milan, Luxembourg | Rating: B): €1,050m Senior Note (XS2445841104), floating rate (EU03MLIB + 5.3 bp) maturing on 15 February 2029, priced at 99.50, with a make whole call

- Castor SpA (Financial - Other | Milan, Luxembourg | Rating: B): €350m Senior Note (XS2445837177), fixed rate (6.00% coupon) maturing on 15 February 2029, priced at 100.00 (original spread of 586 bp), callable (7nc3)

- Danske Bank A/S (Banking | Koebenhavn K, Denmark | Rating: A-): €750m Note (XS2443438051), fixed rate (1.38% coupon) maturing on 17 February 2027, priced at 99.92 (original spread of 146 bp), non callable

- Deutsche Bank AG (Banking | Frankfurt, Hessen, Germany | Rating: BBB+): €500m Inhaberschuldverschreibung (DE000DB9U6G7), fixed rate (0.40% coupon) maturing on 3 March 2025, priced at 100.00 (original spread of -4 bp), non callable

- Experian Europe DAC (Financial - Other | Ireland | Rating: BBB+): €500m Senior Note (XS2444263102), fixed rate (1.56% coupon) maturing on 16 May 2031, priced at 99.94 (original spread of 135 bp), callable (9nc9)

- Infineon Technologies AG (Electronics | Neubiberg, Germany | Rating: BBB): €500m Senior Note (XS2443921056), fixed rate (0.63% coupon) maturing on 17 February 2025, priced at 99.70 (original spread of 99 bp), callable (3nc3)

- ING Bank NV (Banking | Amsterdam Zuidoost, Netherlands | Rating: A+): €1,500m Covered Bond (Other) (XS2445188423), fixed rate (0.50% coupon) maturing on 17 February 2027, priced at 99.62 (original spread of 60 bp), non callable

- Swedbank AB (Banking | Sundbyberg, Sweden | Rating: A+): €750m Note (XS2443485565), fixed rate (1.30% coupon) maturing on 17 February 2027, priced at 99.78 (original spread of 132 bp), non callable

NEW LOANS

- Hexion Inc (B), signed a US$ 1,400m Term Loan B, to be used for leveraged buyout

NEW ISSUES IN SECURITIZED CREDIT

- Monroe Capital Mml Clo XIII LLC issued a floating-rate CLO in 9 tranches, for a total of US$ 457 m. Bookrunners: Deutsche Bank Securities Inc

- Freddie Mac Spc Series K-F130 issued a floating-rate Agency CMBS in 1 tranche offering a spread over the floating rate of 29bp, for a total of US$ 781 m. Bookrunners: Goldman Sachs & Co, Morgan Stanley International Ltd

- Global Container Assets 2016 Ltd 2022-1 issued a fixed-rate ABS backed by certificates in 2 tranches, for a total of US$ 230 m. Highest-rated tranche offering a yield to maturity of 3.21%, and the lowest-rated tranche a yield to maturity of 3.75%. Bookrunners: Mizuho Securities USA Inc

- Fresb 2022-Sb95 Mortgage Trust issued a floating-rate Agency CMBS in 3 tranches, for a total of US$ 371 m. Bookrunners: Credit Suisse, Wells Fargo Securities LLC

- GCAT 2022-HX1 issued a fixed-rate RMBS in 6 tranches, for a total of US$ 279 m. Highest-rated tranche offering a yield to maturity of 0.06%, and the lowest-rated tranche a yield to maturity of 3.73%. Bookrunners: Barclays Capital Group

- Spgn 2022-Tflm Mortgage Trust issued a floating-rate CMBS in 4 tranches, for a total of US$ 570 m. Highest-rated tranche offering a spread over the floating rate of 155bp, and the lowest-rated tranche a spread of 350bp. Bookrunners: Barclays Capital Group, Wells Fargo Securities LLC, BMO Capital Markets

- Marlette Funding Trust 2022-1 issued a fixed-rate ABS backed by consumer loan in 4 tranches, for a total of US$ 300 m. Highest-rated tranche offering a yield to maturity of 1.37%, and the lowest-rated tranche a yield to maturity of 3.58%. Bookrunners: Robert W Baird & Co Inc, Goldman Sachs & Co, JP Morgan & Co Inc