Credit

USD BBs Keep Underperforming High Yield Universe, As Spreads Widen Significantly To End Week

Tremendous rates volatility brought low volumes of bond issuance this week (IFR Markets data): $15.6bn in 25 Tranches for IG (2022 YTD volume $184.5bn vs 2021 YTD $206.8bn) and $2.75bn in 6 Tranches for HY (2022 YTD volume $30.7bn vs 2021 YTD US$73.7bn)

Published ET

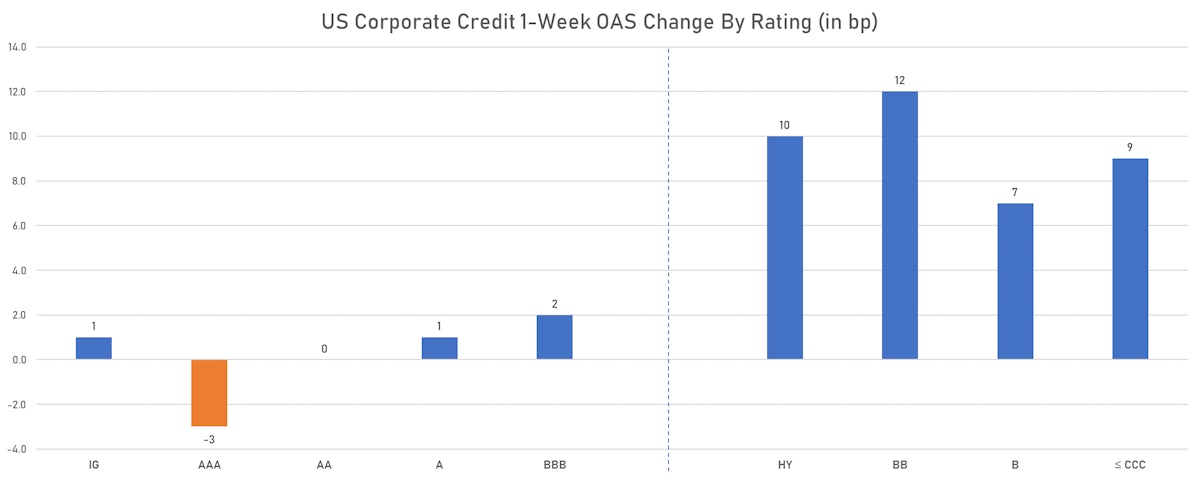

1-Week Change in US Corporate Cash OAS | Sources: ϕpost, Refinitiv data

QUICK SUMMARY

- S&P 500 Bond Index was up 0.50% today, with investment grade up 0.58% and high yield down -0.33% (YTD total return: -4.56%)

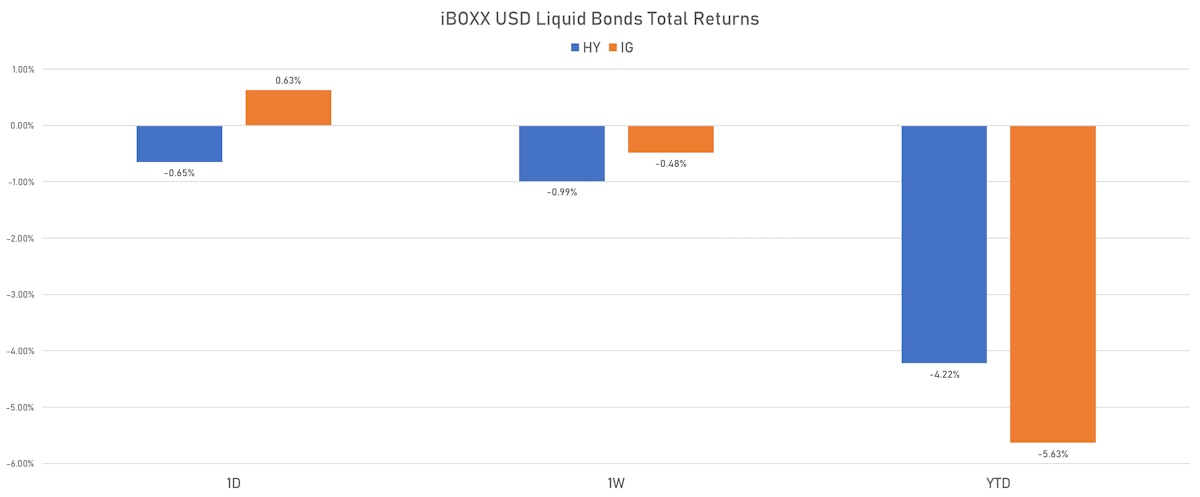

- The iBoxx USD Liquid Investment Grade Total Return Index was up 0.631% today (Month-to-date: -1.88%; Year-to-date: -5.63%)

- The iBoxx USD Liquid High Yield Total Return Index was down -0.649% today (Month-to-date: -1.39%; Year-to-date: -4.22%)

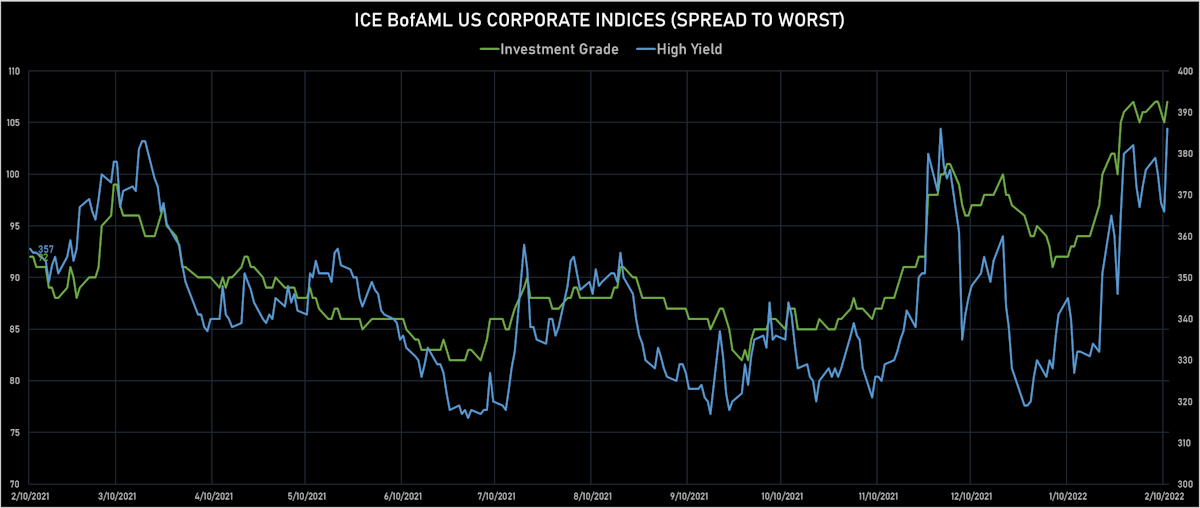

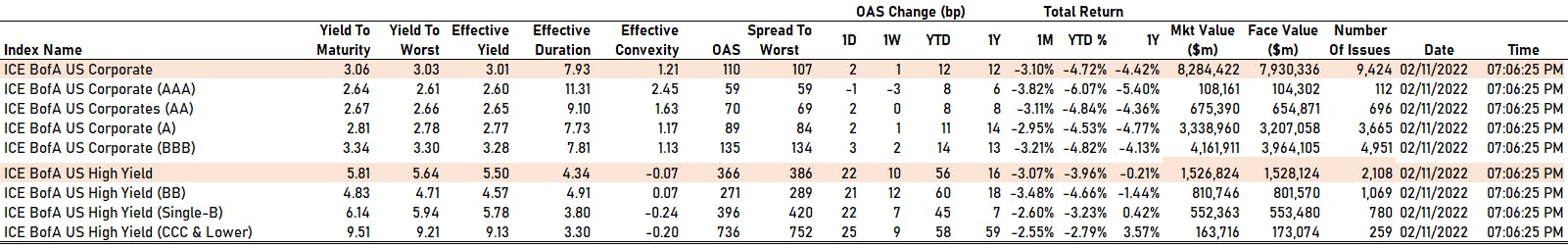

- ICE BofA US Corporate Index (Investment Grade) spread to worst up 2.0 bp, now at 107.0 bp (YTD change: +12.0 bp)

- ICE BofA US High Yield Index spread to worst up 20.0 bp, now at 386.0 bp (YTD change: +56.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index down -0.15% today (YTD total return: +0.2%)

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING

- AAA down by -1 bp at 59 bp

- AA up by 2 bp at 70 bp

- A up by 2 bp at 89 bp

- BBB up by 3 bp at 135 bp

- BB up by 21 bp at 271 bp

- B up by 22 bp at 396 bp

- CCC up by 25 bp at 736 bp

CDS INDICES (mid-spreads)

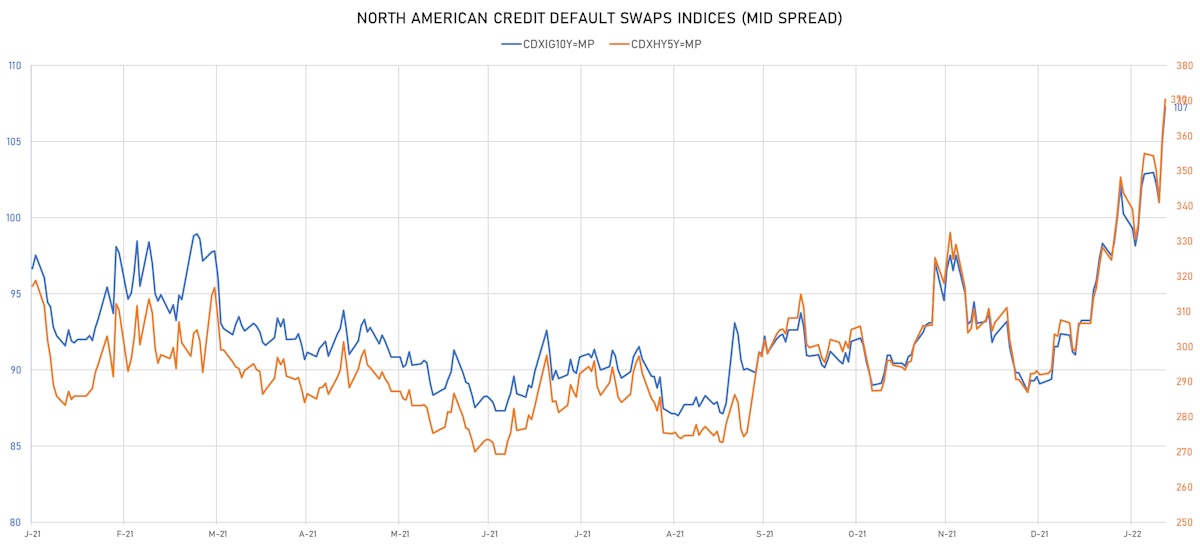

- Markit CDX.NA.IG 5Y up 2.2 bp, now at 107bp (YTD change: +18.2bp)

- Markit CDX.NA.HY 5Y up 10.1 bp, now at 370bp (YTD change: +78.5bp)

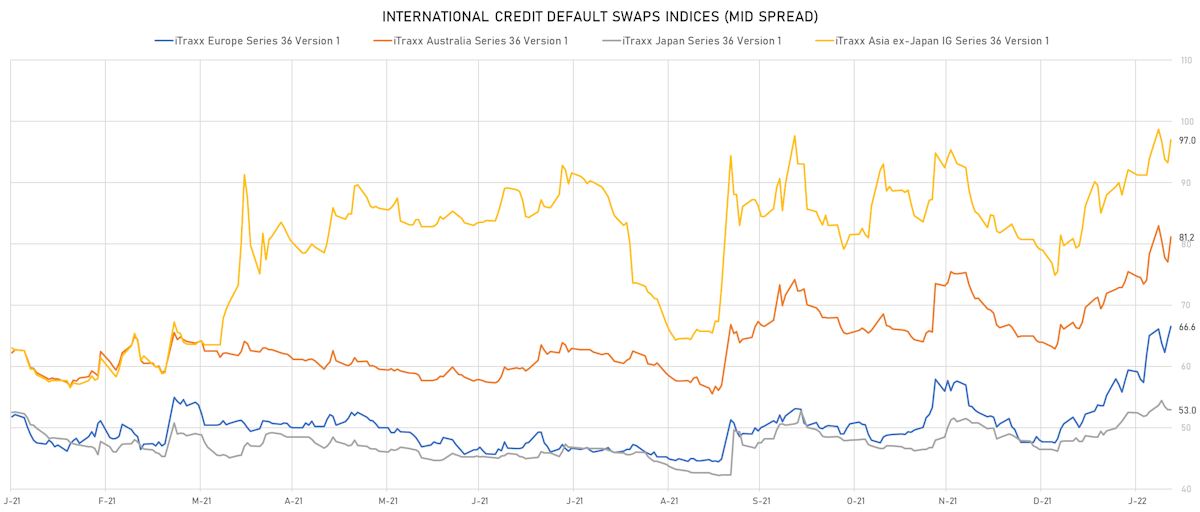

- Markit iTRAXX Europe up 2.0 bp, now at 67bp (YTD change: +18.9bp)

- Markit iTRAXX Japan unchanged 0.0 bp, now at 53bp (YTD change: +6.5bp)

- Markit iTRAXX Asia Ex-Japan up 3.8 bp, now at 97bp (YTD change: +18.0bp)

USD CDS SINGLE NAMES - LARGEST MOVES IN THE PAST WEEK

- Carnival Corp (Country: US; rated: LGD5 - 72%): down 46.1 bp to 461.0bp (1Y range: 291-544bp)

- Royal Caribbean Cruises Ltd (Country: US; rated: LGD4 - 59%): down 42.0 bp to 388.9bp (1Y range: 299-651bp)

- American Airlines Group Inc (Country: US; rated: B2): down 41.3 bp to 824.2bp (1Y range: 596-1,074bp)

- Turkey, Republic of (Government) (Country: TR; rated: BB): down 32.3 bp to 511.6bp (1Y range: 283-620bp)

- Turkiye Is Bankasi AS (Country: TR; rated: B+): down 29.9 bp to 627.1bp (1Y range: 482-824bp)

- Liberty Interactive LLC (Country: US; rated: Ba3): up 29.0 bp to 556.8bp (1Y range: 287-557bp)

- American Axle & Manufacturing Inc (Country: US; rated: Ba1): up 31.1 bp to 493.9bp (1Y range: 355-494bp)

- Gap Inc (Country: US; rated: WR): up 31.3 bp to 320.9bp (1Y range: 132-321bp)

- Beazer Homes USA Inc (Country: US; rated: B2): up 32.1 bp to 393.1bp (1Y range: 244-393bp)

- Interval Acquisition Corp (Country: US; rated: WR): up 39.2 bp to 529.8bp (1Y range: 329-530bp)

- Radian Group Inc (Country: US; rated: BBB-): up 49.1 bp to 265.0bp (1Y range: 152-265bp)

- Tegna Inc (Country: US; rated: Ba3): up 51.4 bp to 453.3bp (1Y range: 148-453bp)

- Rite Aid Corp (Country: US; rated: B3): up 94.4 bp to 1,223.1bp (1Y range: 497-1,223bp)

- Transocean Inc (Country: KY; rated: Caa3): up 99.5 bp to 1,980.0bp (1Y range: 941-2,017bp)

- Lumen Technologies Inc (Country: US; rated: Ba3): up 137.0 bp to 499.3bp (1Y range: 195-533bp)

EURO CDS SINGLE NAMES - LARGEST MOVES IN THE PAST WEEK

- Iceland Bondco PLC (Country: GB; rated: LGD3 - 46%): down 61.3 bp to 608.3bp (1Y range: 358-679bp)

- TUI AG (Country: DE; rated: B3-PD): down 49.3 bp to 621.1bp (1Y range: 607-946bp)

- Casino Guichard Perrachon SA (Country: FR; rated: WR): down 37.8 bp to 815.8bp (1Y range: 464-891bp)

- Stonegate Pub Company Financing PLC (Country: GB; rated: WR): down 11.1 bp to 433.6bp (1Y range: 416-601bp)

- Air France KLM SA (Country: FR; rated: B-): down 10.6 bp to 428.7bp (1Y range: 386-636bp)

- Premier Foods Finance PLC (Country: GB; rated: B1): up 9.5 bp to 267.3bp (1Y range: 154-277bp)

- ThyssenKrupp AG (Country: DE; rated: B1): up 9.7 bp to 293.3bp (1Y range: 205-300bp)

- Leonardo SpA (Country: IT; rated: WD): up 9.8 bp to 196.4bp (1Y range: 125-207bp)

- Monitchem Holdco 3 SA (Country: LU; rated: B2): up 10.7 bp to 242.5bp (1Y range: 186-309bp)

- Atlantia SpA (Country: IT; rated: Ba2): up 12.6 bp to 152.2bp (1Y range: 97-183bp)

- Cable & Wireless Ltd (Country: GB; rated: WR): up 14.1 bp to 82.3bp (1Y range: 61-143bp)

- Alstom SA (Country: FR; rated: P-2): up 14.5 bp to 101.1bp (1Y range: 41-101bp)

- Marks and Spencer PLC (Country: GB; rated: Ba1): up 18.4 bp to 216.9bp (1Y range: 139-233bp)

- Boparan Finance PLC (Country: GB; rated: B3): up 50.7 bp to 1,439.1bp (1Y range: 610-1,565bp)

- Novafives SAS (Country: FR; rated: Caa1): up 70.2 bp to 908.0bp (1Y range: 618-926bp)

SELECTED RECENT USD BOND ISSUES

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$110m Bond (US3133ENPA28), fixed rate (2.13% coupon) maturing on 22 February 2029, priced at 100.00, non callable

- Goldman Sachs Group Inc (Banking | New York City, United States | Rating: BBB+): US$566m Unsecured Note (XS1970494487) zero coupon maturing on 15 February 2062, non callable

- JPMorgan Chase & Co (Banking | New York City, United States | Rating: A-): US$285m Unsecured Note (XS1450779233) zero coupon maturing on 14 February 2057, priced at 100.00, non callable

NEW LOANS

- Oil & Gas Holding Co BSCC, signed a US$ 1,600m Term Loan, to be used for general corporate purposes. It matures on 09/10/26 and initial pricing is set at Term SOFR +210bp

NEW ISSUES IN SECURITIZED CREDIT

- United Auto Credit Securitization Trust 2022-1 issued a fixed-rate ABS backed by auto receivables in 5 tranches, for a total of US$ 280 m. Highest-rated tranche offering a yield to maturity of 1.11%, and the lowest-rated tranche a yield to maturity of 5.23%. Bookrunners: Capital One Financial Corp, Wells Fargo Securities LLC

- Oscar US Funding Xiv LLC issued a fixed-rate ABS backed by auto receivables in 4 tranches, for a total of US$ 435 m. Highest-rated tranche offering a yield to maturity of 0.45%, and the lowest-rated tranche a yield to maturity of 2.82%. Bookrunners: Mizuho Securities USA Inc, BNP Paribas Securities Corp

- BMO 2022-C1 Mortgage Trust issued a fixed-rate CMBS in 11 tranches, for a total of US$ 994 m. Highest-rated tranche offering a yield to maturity of 3.18%, and the lowest-rated tranche a yield to maturity of 3.51%. Bookrunners: Deutsche Bank Securities Inc, BMO Capital Markets, KeyBanc Capital Markets Inc