Credit

US Corporate Cash Spreads Widen, Yields Rise; Rates Volatility Keeps Issuance At Minimal Levels

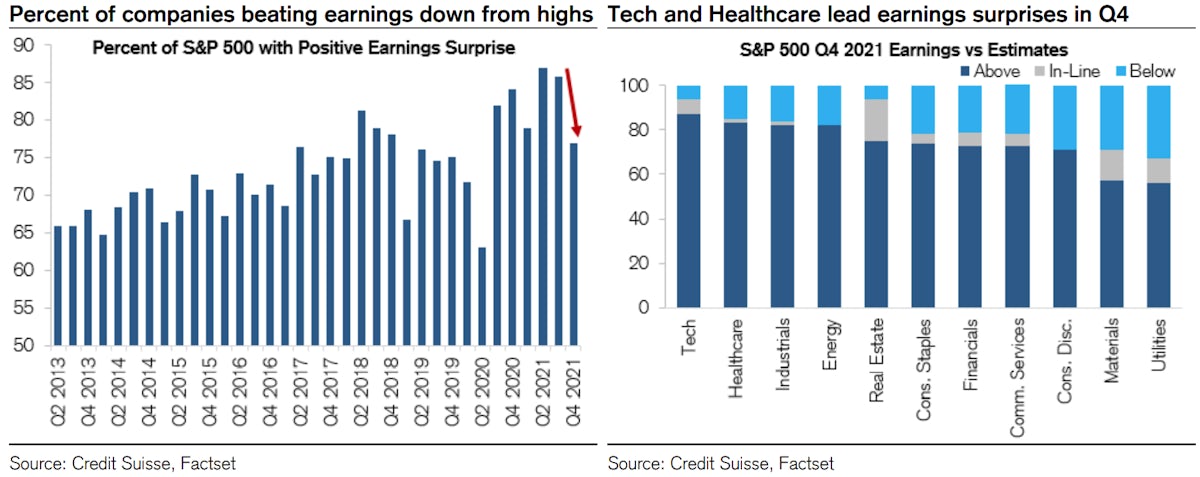

With earnings season winding down, companies are reporting strong results, but less so than in Q2/Q3 2021, with the tech and healthcare sectors having the largest numbers of positive surprises

Published ET

Share of companies beating earnings estimates | Source: Credit Suisse

QUICK SUMMARY

- S&P 500 Bond Index was down -0.68% today, with investment grade down -0.68% and high yield down -0.68% (YTD total return: -5.21%)

- The iBoxx USD Liquid Investment Grade Total Return Index was down -0.795% today (Month-to-date: -2.66%; Year-to-date: -6.38%)

- The iBoxx USD Liquid High Yield Total Return Index was down -0.558% today (Month-to-date: -1.94%; Year-to-date: -4.75%)

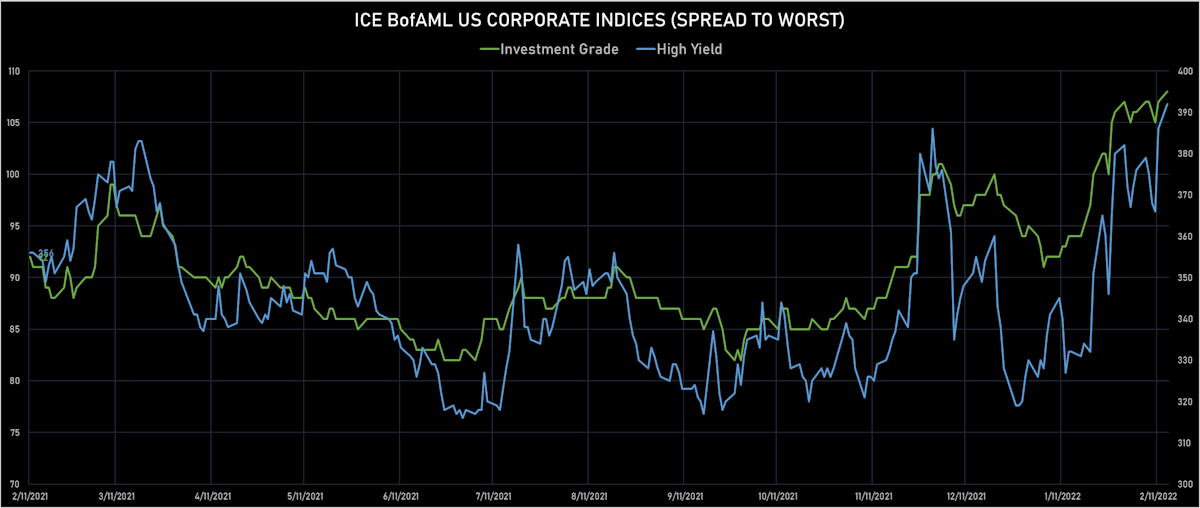

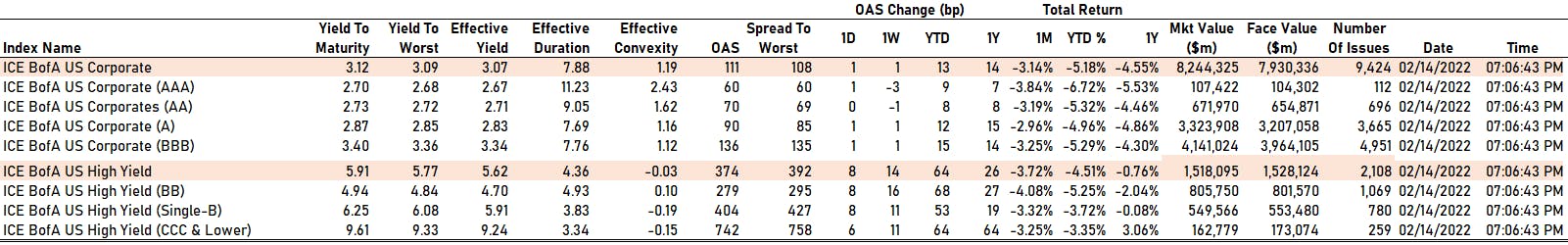

- ICE BofA US Corporate Index (Investment Grade) spread to worst up 1.0 bp, now at 108.0 bp (YTD change: +13.0 bp)

- ICE BofA US High Yield Index spread to worst up 6.0 bp, now at 392.0 bp (YTD change: +62.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index down -0.29% today (YTD total return: -0.1%)

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING

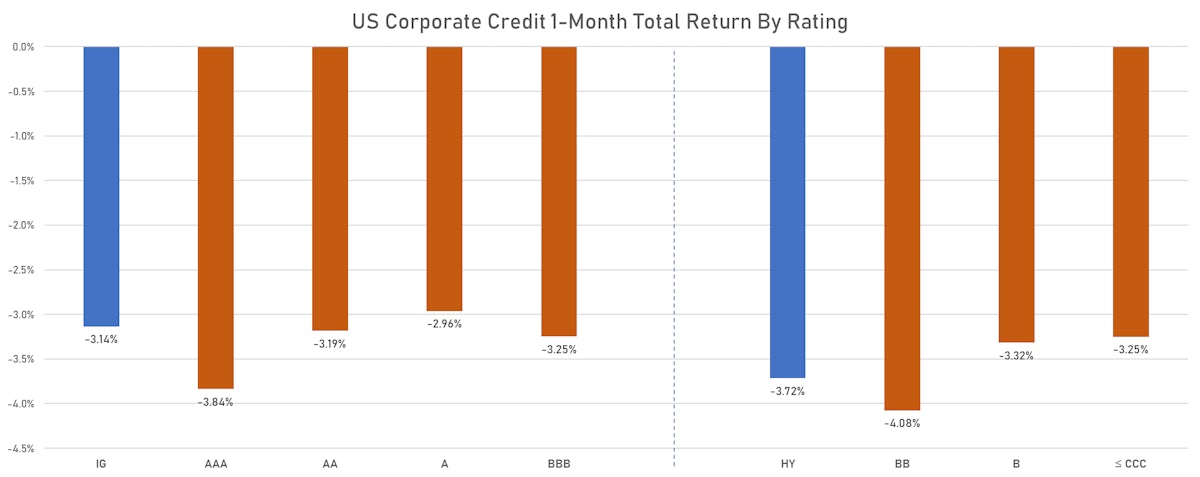

- AAA up by 1 bp at 60 bp

- AA unchanged at 70 bp

- A up by 1 bp at 90 bp

- BBB up by 1 bp at 136 bp

- BB up by 8 bp at 279 bp

- B up by 8 bp at 404 bp

- CCC up by 6 bp at 742 bp

CDS INDICES (mid-spreads)

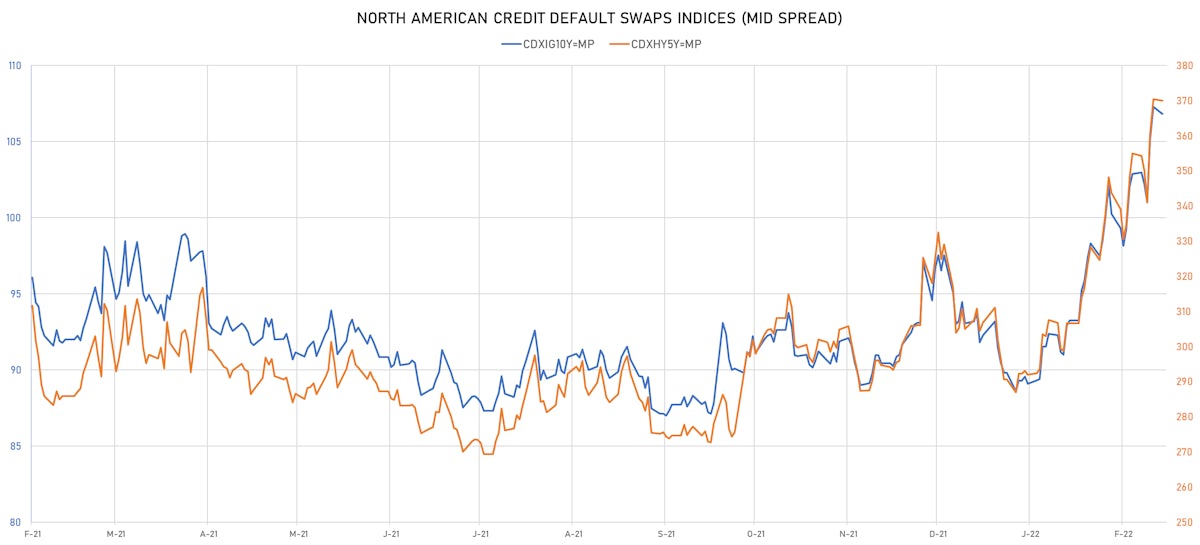

- Markit CDX.NA.IG 5Y down 0.5 bp, now at 107bp (YTD change: +17.7bp)

- Markit CDX.NA.HY 5Y down 0.4 bp, now at 370bp (YTD change: +78.1bp)

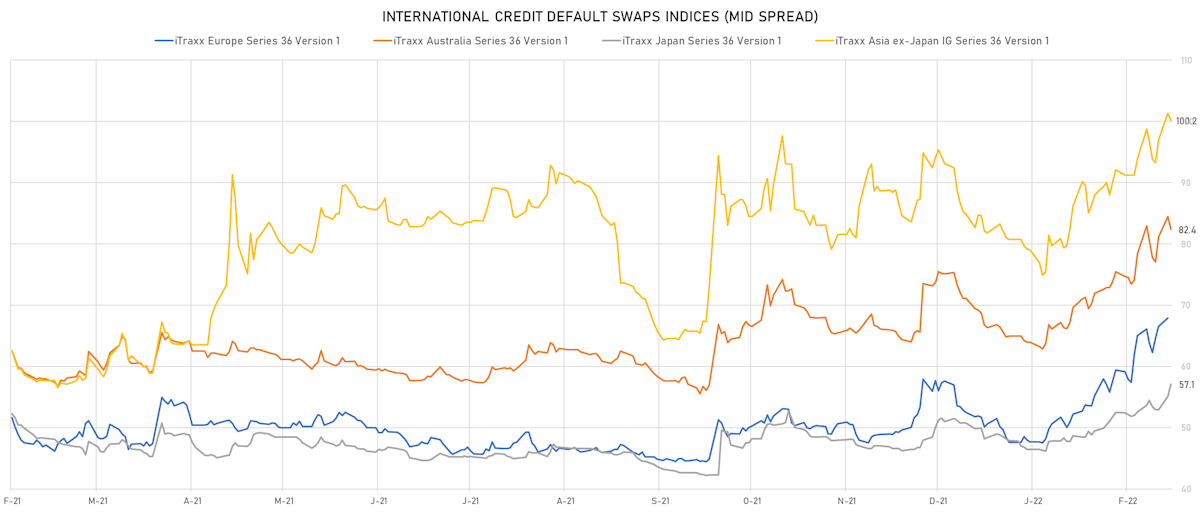

- Markit iTRAXX Europe up 1.3 bp, now at 68bp (YTD change: +20.2bp)

- Markit iTRAXX Japan up 2.1 bp, now at 55bp (YTD change: +8.6bp)

- Markit iTRAXX Asia Ex-Japan up 4.3 bp, now at 101bp (YTD change: +22.3bp)

TOP BONDS MOVES IN THE PAST WEEK - USD HY

- Issuer: WeWork Companies LLC (New York City, New York (US)) | Coupon: 5.00% | Maturity: 10/7/2025 | Rating: CCC- | ISIN: USU9621PAA94 | Z-spread up by 57.0 bp to 962.2 bp, with the yield to worst at 11.1% and the bond now trading down to 82.0 cents on the dollar (1Y price range: 82.0-84.1).

- Issuer: EQM Midstream Partners LP (Canonsburg, Pennsylvania (US)) | Coupon: 6.00% | Maturity: 1/7/2025 | Rating: BB- | ISIN: USU26886AA62 | Z-spread up by 53.1 bp to 368.4 bp, with the yield to worst at 5.3% and the bond now trading down to 101.0 cents on the dollar (1Y price range: 101.0-108.5).

- Issuer: HanesBrands Inc (Winston-Salem, North Carolina (US)) | Coupon: 4.88% | Maturity: 15/5/2026 | Rating: BB- | ISIN: USU24437AE26 | Z-spread up by 49.2 bp to 285.6 bp, with the yield to worst at 4.7% and the bond now trading down to 100.0 cents on the dollar (1Y price range: 100.0-106.9).

- Issuer: WeWork Companies Inc (New York City, New York (US)) | Coupon: 7.88% | Maturity: 1/5/2025 | Rating: CCC- | ISIN: USU96217AA99 | Z-spread up by 44.0 bp to 1,034.0 bp, with the yield to worst at 11.5% and the bond now trading down to 89.5 cents on the dollar (1Y price range: 89.5-96.5).

- Issuer: Terraform Power Operating LLC (New York City, New York (US)) | Coupon: 5.00% | Maturity: 31/1/2028 | Rating: BB- | ISIN: USU8812LAE12 | Z-spread up by 43.6 bp to 333.7 bp, with the yield to worst at 5.2% and the bond now trading down to 98.0 cents on the dollar (1Y price range: 98.0-106.3).

- Issuer: Goodyear Tire & Rubber Co (Akron, Ohio (US)) | Coupon: 5.00% | Maturity: 15/7/2029 | Rating: B | ISIN: USU38255AN24 | Z-spread up by 42.1 bp to 336.0 bp (CDS basis: -13.3bp), with the yield to worst at 5.3% and the bond now trading down to 97.5 cents on the dollar (1Y price range: 97.5-106.6).

- Issuer: Sensata Technologies BV (Almelo, Netherlands) | Coupon: 4.88% | Maturity: 15/10/2023 | Rating: BB- | ISIN: USN78840AH33 | Z-spread up by 40.0 bp to 225.4 bp, with the yield to worst at 3.5% and the bond now trading down to 101.6 cents on the dollar (1Y price range: 101.6-105.1).

- Issuer: Taylor Morrison Communities Inc (Scottsdale, Arizona (US)) | Coupon: 5.13% | Maturity: 1/8/2030 | Rating: BB- | ISIN: USU8760NAF60 | Z-spread up by 39.6 bp to 314.9 bp, with the yield to worst at 5.2% and the bond now trading down to 99.3 cents on the dollar (1Y price range: 99.3-109.9).

- Issuer: American Airlines Group Inc (Fort Worth, Texas (US)) | Coupon: 3.75% | Maturity: 1/3/2025 | Rating: CCC | ISIN: USU0242AAD47 | Z-spread up by 37.4 bp to 489.0 bp (CDS basis: 273.5bp), with the yield to worst at 6.6% and the bond now trading down to 92.0 cents on the dollar (1Y price range: 91.3-95.6).

- Issuer: Netflix Inc (Los Gatos, California (US)) | Coupon: 4.88% | Maturity: 15/6/2030 | Rating: BB+ | ISIN: USU74079AQ46 | Z-spread up by 33.2 bp to 173.2 bp, with the yield to worst at 3.8% and the bond now trading down to 107.5 cents on the dollar (1Y price range: 106.8-116.5).

- Issuer: NCL Corporation Ltd (Miami, Bermuda) | Coupon: 5.88% | Maturity: 15/3/2026 | Rating: CCC+ | ISIN: USG6436QAL08 | Z-spread up by 33.0 bp to 544.5 bp, with the yield to worst at 7.3% and the bond now trading down to 94.6 cents on the dollar (1Y price range: 94.5-100.0).

- Issuer: EQT Corp (Pittsburgh, Pennsylvania (US)) | Coupon: 3.63% | Maturity: 15/5/2031 | Rating: BB+ | ISIN: USU2689EAB66 | Z-spread up by 32.4 bp to 212.8 bp, with the yield to worst at 4.2% and the bond now trading down to 95.5 cents on the dollar (1Y price range: 95.5-103.9).

- Issuer: Wynn Las Vegas LLC (Las Vegas, Nevada (US)) | Coupon: 5.50% | Maturity: 1/3/2025 | Rating: B | ISIN: USU98347AK05 | Z-spread up by 32.4 bp to 369.3 bp, with the yield to worst at 5.3% and the bond now trading down to 99.5 cents on the dollar (1Y price range: 99.5-103.5).

- Issuer: Howard Midstream Energy Partners LLC (San Antonio, #N/A (US)) | Coupon: 6.75% | Maturity: 15/1/2027 | Rating: B- | ISIN: USU4425TAA08 | Z-spread up by 30.7 bp to 494.2 bp, with the yield to worst at 6.7% and the bond now trading down to 99.8 cents on the dollar (1Y price range: 99.8-103.3).

- Issuer: Rockies Express Pipeline LLC (Leawood, Kansas (US)) | Coupon: 4.95% | Maturity: 15/7/2029 | Rating: BB | ISIN: USU75111AJ00 | Z-spread up by 30.2 bp to 309.9 bp, with the yield to worst at 5.0% and the bond now trading down to 98.8 cents on the dollar (1Y price range: 98.8-107.5).

TOP BONDS MOVES IN THE PAST WEEK - EUR HY

- Issuer: Kondor Finance PLC (London, United Kingdom) | Coupon: 7.13% | Maturity: 19/7/2024 | Rating: B | ISIN: XS2027394233 | Z-spread up by 340.9 bp to 2,022.8 bp, with the yield to worst at 19.9% and the bond now trading down to 76.1 cents on the dollar (1Y price range: 75.2-90.2).

- Issuer: Adler Group SA (Senningerberg, Luxembourg) | Coupon: 3.25% | Maturity: 5/8/2025 | Rating: B | ISIN: XS2010029663 | Z-spread up by 84.4 bp to 900.0 bp, with the yield to worst at 9.4% and the bond now trading down to 82.2 cents on the dollar (1Y price range: 82.0-91.3).

- Issuer: Adler Group SA (Senningerberg, Luxembourg) | Coupon: 1.88% | Maturity: 14/1/2026 | Rating: B | ISIN: XS2283224231 | Z-spread up by 75.3 bp to 816.5 bp, with the yield to worst at 8.6% and the bond now trading down to 78.1 cents on the dollar (1Y price range: 77.8-86.2).

- Issuer: Metinvest BV (Amsterdam, Netherlands) | Coupon: 5.63% | Maturity: 17/6/2025 | Rating: B+ | ISIN: XS2056722734 | Z-spread up by 57.2 bp to 984.3 bp, with the yield to worst at 9.9% and the bond now trading down to 87.7 cents on the dollar (1Y price range: 86.0-99.4).

- Issuer: Renault SA (Boulogne-Billancourt, France) | Coupon: 2.50% | Maturity: 2/6/2027 | Rating: BB | ISIN: FR0014006W65 | Z-spread up by 47.6 bp to 270.3 bp (CDS basis: -47.2bp), with the yield to worst at 3.2% and the bond now trading down to 95.8 cents on the dollar (1Y price range: 95.8-101.1).

- Issuer: Jaguar Land Rover Automotive PLC (Coventry, United Kingdom) | Coupon: 2.20% | Maturity: 15/1/2024 | Rating: B+ | ISIN: XS1551347393 | Z-spread down by 32.8 bp to 390.5 bp (CDS basis: -107.8bp), with the yield to worst at 3.5% and the bond now trading up to 96.7 cents on the dollar (1Y price range: 96.2-99.3).

- Issuer: Spie SA (Cergy-Pontoise, France) | Coupon: 3.13% | Maturity: 22/3/2024 | Rating: BB | ISIN: FR0013245263 | Z-spread down by 34.2 bp to 219.9 bp, with the yield to worst at 1.7% and the bond now trading up to 101.2 cents on the dollar (1Y price range: 100.9-104.1).

- Issuer: Webuild SpA (Milan, Italy) | Coupon: 5.88% | Maturity: 15/12/2025 | Rating: BB- | ISIN: XS2271356201 | Z-spread down by 34.8 bp to 519.1 bp, with the yield to worst at 5.6% and the bond now trading up to 100.3 cents on the dollar (1Y price range: 99.5-109.5).

- Issuer: Teva Pharmaceutical Finance Netherlands II BV (Amsterdam, Netherlands) | Coupon: 6.00% | Maturity: 31/1/2025 | Rating: BB- | ISIN: XS2198213956 | Z-spread down by 37.3 bp to 379.1 bp, with the yield to worst at 4.0% and the bond now trading up to 104.7 cents on the dollar (1Y price range: 102.9-107.7).

- Issuer: Syngenta Finance NV (Enkhuizen, Netherlands) | Coupon: 3.38% | Maturity: 16/4/2026 | Rating: BB+ | ISIN: XS2154325489 | Z-spread down by 46.1 bp to 152.7 bp, with the yield to worst at 2.0% and the bond now trading up to 104.7 cents on the dollar (1Y price range: 104.5-109.3).

- Issuer: Webuild SpA (Milan, Italy) | Coupon: 1.75% | Maturity: 26/10/2024 | Rating: BB- | ISIN: XS1707063589 | Z-spread down by 65.8 bp to 302.0 bp, with the yield to worst at 3.0% and the bond now trading up to 95.8 cents on the dollar (1Y price range: 94.4-100.8).

- Issuer: Saipem Finance International BV (Amsterdam, Netherlands) | Coupon: 2.63% | Maturity: 7/1/2025 | Rating: B+ | ISIN: XS1711584430 | Z-spread down by 123.1 bp to 1,032.8 bp (CDS basis: 221.8bp), with the yield to worst at 10.6% and the bond now trading up to 80.6 cents on the dollar (1Y price range: 73.9-101.2).

- Issuer: Saipem Finance International BV (Amsterdam, Netherlands) | Coupon: 3.75% | Maturity: 8/9/2023 | Rating: B+ | ISIN: XS1487495316 | Z-spread down by 340.7 bp to 1,381.4 bp (CDS basis: 210.6bp), with the yield to worst at 13.6% and the bond now trading up to 86.6 cents on the dollar (1Y price range: 76.2-103.4).

SELECTED RECENT USD BOND ISSUES

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$235m Bond (US3133ENPE40), fixed rate (2.94% coupon) maturing on 23 February 2032, priced at 100.00, callable (10nc1)

- Goldman Sachs Group Inc (Banking | New York City, United States | Rating: BBB+): US$566m Unsecured Note (XS1970494487) zero coupon maturing on 15 February 2062, non callable

- Deutsche Bank Ag (London Branch) (Banking | London, Germany | Rating: BBB+): US$1,500m Senior Note (XS1628429356), floating rate maturing on 22 February 2027, priced at 100.00, non callable

SELECTED RECENT EUR BOND ISSUES

- Bank VTB PAO (Banking | Moscow, Moscow, Russia | Rating: BBB-): €1,000m Bond (RU000A1042E4), zero coupon maturing on 30 January 2025, priced at 100.00, non callable

NEW LOANS

- Team Health Holdings Inc (CCC), signed a US$ 2,750m Term Loan B, to be used for general corporate purposes. It matures on 02/15/27 and initial pricing is set at Term SOFR +450bp

- PointClick Care Techno Inc (B), signed a US$ 400m Delayed Draw Term Loan, to be used for general corporate purposes and acquisition financing. It matures on 12/29/27 and initial pricing is set at Term SOFR +350bp

- ViaSat Inc (B-), signed a US$ 700m Term Loan B, to be used for general corporate purposes. It matures on 02/17/29 and initial pricing is set at Term SOFR +375bp