Credit

Risk-Off Mood Brings On Sizeable Compression In HY Credit Spreads, With OAS On Cash BBs Down 7bp

US$ IG issuance was back today, with a few large deals coming to market including Bristol-Myers Squibb ($6bn in 4 tranches) and Canadian energy company Enbridge ($1.5bn in 3 tranches)

Published ET

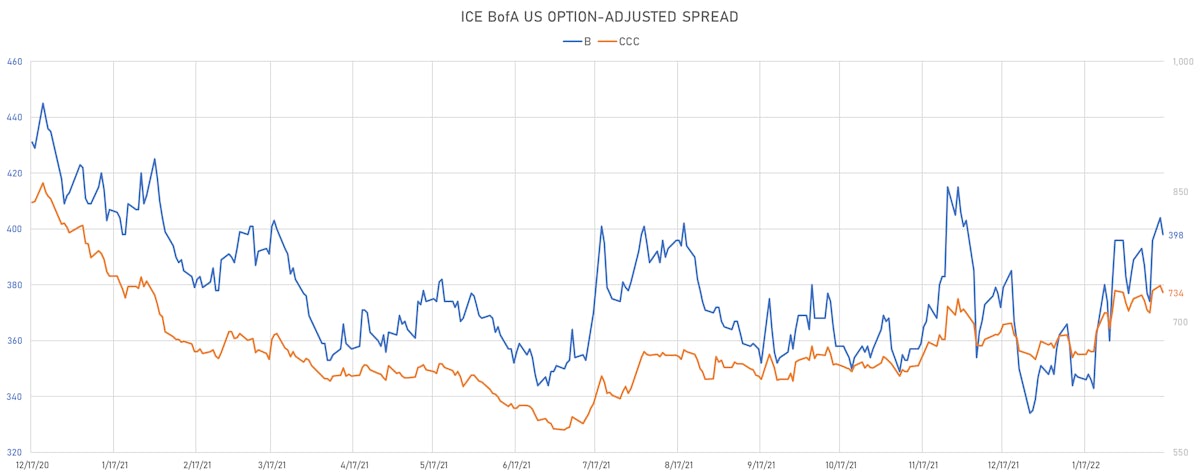

ICE BofAML US Corporate Single-Bs & CCCs OAS | Sources: ϕpost, Refinitiv data

QUICK SUMMARY

- S&P 500 Bond Index was down -0.33% today, with investment grade down -0.36% and high yield up 0.01% (YTD total return: -5.52%)

- The iBoxx USD Liquid Investment Grade Total Return Index was down -0.421% today (Month-to-date: -3.07%; Year-to-date: -6.78%)

- The iBoxx USD Liquid High Yield Total Return Index was up 0.374% today (Month-to-date: -1.57%; Year-to-date: -4.40%)

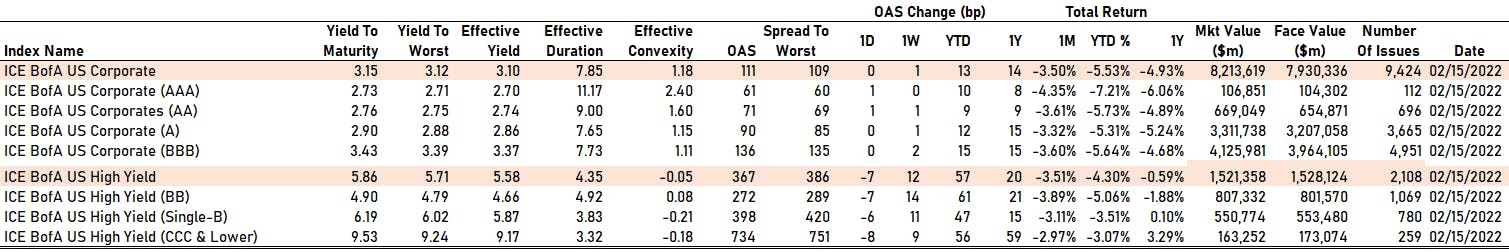

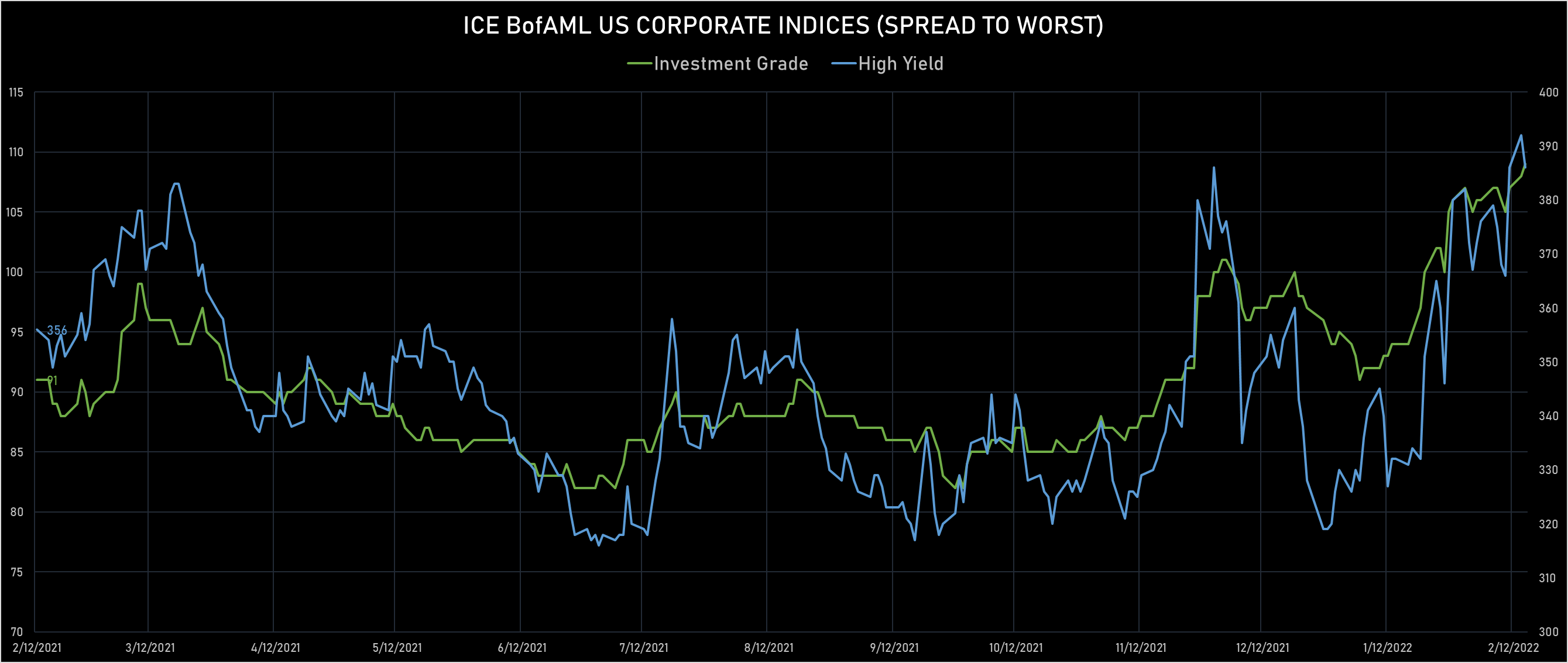

- ICE BofA US Corporate Index (Investment Grade) spread to worst up 1.0 bp, now at 109.0 bp (YTD change: +14.0 bp)

- ICE BofA US High Yield Index spread to worst down -6.0 bp, now at 386.0 bp (YTD change: +56.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index up 0.09% today (YTD total return: 0.0%)

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING

- AAA up by 1 bp at 61 bp

- AA up by 1 bp at 71 bp

- A unchanged at 90 bp

- BBB unchanged at 136 bp

- BB down by -7 bp at 272 bp

- B down by -6 bp at 398 bp

- CCC down by -8 bp at 734 bp

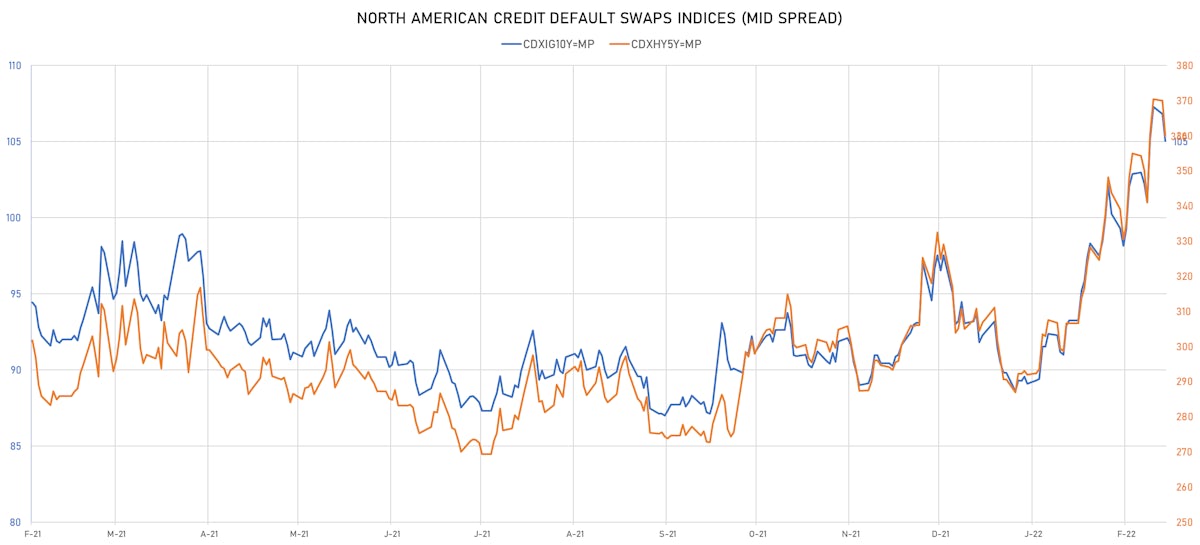

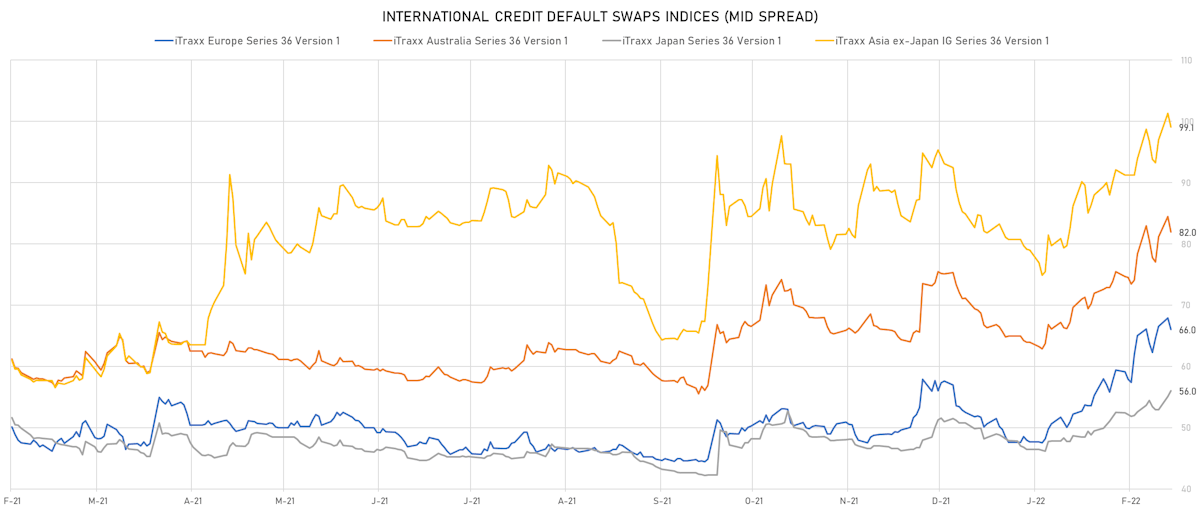

CDS INDICES (mid-spreads)

- Markit CDX.NA.IG 5Y down 1.8 bp, now at 105bp (YTD change: +15.9bp)

- Markit CDX.NA.HY 5Y down 10.1 bp, now at 360bp (YTD change: +68.0bp)

- Markit iTRAXX Europe down 1.8 bp, now at 66bp (YTD change: +18.3bp)

- Markit iTRAXX Japan up 0.9 bp, now at 56bp (YTD change: +9.6bp)

- Markit iTRAXX Asia Ex-Japan down 2.2 bp, now at 99bp (YTD change: +20.1bp)

USD CDS SINGLE NAMES - LARGEST MOVES IN THE PAST WEEK

- Nordstrom Inc (Country: US; rated: Ba1): up 28.5 bp to 430.6bp (1Y range: 211-431bp)

- Carnival Corp (Country: US; rated: LGD5 - 72%): up 34.2 bp to 466.5bp (1Y range: 291-544bp)

- Beazer Homes USA Inc (Country: US; rated: B2): up 34.8 bp to 398.9bp (1Y range: 256-413bp)

- Pitney Bowes Inc (Country: US; rated: LGD2 - 16%): up 36.6 bp to 716.4bp (1Y range: 363-716bp)

- DISH DBS Corp (Country: US; rated: B2): up 36.7 bp to 583.1bp (1Y range: 317-600bp)

- Liberty Interactive LLC (Country: US; rated: Ba3): up 37.9 bp to 572.0bp (1Y range: 287-572bp)

- Tegna Inc (Country: US; rated: Ba3): up 42.3 bp to 479.0bp (1Y range: 148-479bp)

- Staples Inc (Country: US; rated: B3): up 46.0 bp to 1,145.1bp (1Y range: 687-1,159bp)

- American Axle & Manufacturing Inc (Country: US; rated: Ba1): up 55.9 bp to 504.4bp (1Y range: 355-514bp)

- American Airlines Group Inc (Country: US; rated: B2): up 71.6 bp to 802.7bp (1Y range: 596-1,074bp)

- Goodyear Tire & Rubber Co (Country: US; rated: WR): up 87.0 bp to 312.7bp (1Y range: 188-319bp)

- Lumen Technologies Inc (Country: US; rated: Ba3): up 139.6 bp to 491.2bp (1Y range: 195-533bp)

- Transocean Inc (Country: KY; rated: Caa3): up 212.8 bp to 2,006.7bp (1Y range: 941-2,017bp)

EURO CDS SINGLE NAMES - LARGEST MOVES IN THE PAST WEEK

- Iceland Bondco PLC (Country: GB; rated: LGD3 - 46%): down 25.9 bp to 607.6bp (1Y range: 376-679bp)

- Altice Finco SA (Country: LU; rated: Caa1): up 20.7 bp to 511.1bp (1Y range: 333-535bp)

- Air France KLM SA (Country: FR; rated: B-): up 21.1 bp to 439.3bp (1Y range: 386-603bp)

- Atlantia SpA (Country: IT; rated: Ba2): up 21.1 bp to 164.0bp (1Y range: 97-181bp)

- Syngenta AG (Country: CH; rated: Ba1): up 23.0 bp to 163.2bp (1Y range: 89-188bp)

- Premier Foods Finance PLC (Country: GB; rated: B1): up 24.1 bp to 272.9bp (1Y range: 154-277bp)

- Stena AB (Country: SE; rated: B2-PD): up 25.0 bp to 507.9bp (1Y range: 401-728bp)

- Ineos Group Holdings SA (Country: LU; rated: WR): up 25.5 bp to 214.7bp (1Y range: 125-296bp)

- Clariant AG (Country: CH; rated: LGD4 - 63%): up 28.3 bp to 118.3bp (1Y range: 65-118bp)

- CMA CGM SA (Country: FR; rated: Ba3): up 29.7 bp to 381.9bp (1Y range: 259-476bp)

- Casino Guichard Perrachon SA (Country: FR; rated: WR): up 34.1 bp to 831.7bp (1Y range: 464-891bp)

- Boparan Finance PLC (Country: GB; rated: B3): up 84.9 bp to 1,483.5bp (1Y range: 610-1,565bp)

- Novafives SAS (Country: FR; rated: Caa1): up 118.1 bp to 971.0bp (1Y range: 618-995bp)

SELECTED RECENT USD BOND ISSUES

- Bristol-Myers Squibb Co (Pharmaceuticals | New York City, United States | Rating: A+): US$1,000m Senior Note (US110122DX32), fixed rate (3.90% coupon) maturing on 15 March 2062, priced at 99.52 (original spread of 185 bp), callable (40nc40)

- Bristol-Myers Squibb Co (Pharmaceuticals | New York City, New York, United States | Rating: A+): US$1,250m Senior Note (US110122DV75), fixed rate (3.55% coupon) maturing on 15 March 2042, priced at 99.66 (original spread of 136 bp), callable (20nc20)

- Bristol-Myers Squibb Co (Pharmaceuticals | New York City, United States | Rating: A+): US$2,000m Senior Note (US110122DW58), fixed rate (3.70% coupon) maturing on 15 March 2052, priced at 99.57 (original spread of 157 bp), callable (30nc30)

- Bristol-Myers Squibb Co (Pharmaceuticals | New York City, United States | Rating: A+): US$1,750m Senior Note (US110122DU92), fixed rate (2.95% coupon) maturing on 15 March 2032, priced at 99.64 (original spread of 95 bp), callable (10nc10)

- FactSet Research Systems Inc (Information/Data Technology | Norwalk, United States | Rating: NR): US$500m Senior Note (US303075AA30), fixed rate (2.90% coupon) maturing on 1 March 2027, priced at 99.83 (original spread of 100 bp), callable (5nc5)

- FactSet Research Systems Inc (Information/Data Technology | Norwalk, United States | Rating: NR): US$500m Senior Note (US303075AB13), fixed rate (3.45% coupon) maturing on 1 March 2032, priced at 99.61 (original spread of 145 bp), callable (10nc10)

- Federal Home Loan Banks (Agency | Washington, United States | Rating: NR): US$300m Bond (US3130AR2C48), fixed rate (2.20% coupon) maturing on 28 February 2025, priced at 100.00 (original spread of 193 bp), callable (3nc1m)

- Kemper Corp (Life Insurance | Chicago, Illinois, United States | Rating: BBB-): US$400m Senior Note (US488401AD23), fixed rate (3.80% coupon) maturing on 23 February 2032, priced at 99.73 (original spread of 180 bp), callable (10nc10)

- Kimco Realty Corp (Real Estate Investment Trust | Jericho, United States | Rating: BBB+): US$600m Senior Note (US49446RAZ29), fixed rate (3.20% coupon) maturing on 1 April 2032, priced at 99.17 (original spread of 125 bp), callable (10nc10)

- Mount Nittany Medical Center (Health Care Facilities | State College, United States | Rating: NR): US$300m Bond (US62213LAA44), fixed rate (3.80% coupon) maturing on 15 November 2052, priced at 100.00 (original spread of 166 bp), with a make whole call

- Norfolk Southern Corp (Railroads | Atlanta, Georgia, United States | Rating: BBB+): US$600m Senior Note (US655844CM86), fixed rate (3.00% coupon) maturing on 15 March 2032, priced at 100.00 (original spread of 95 bp), callable (10nc10)

- Norfolk Southern Corp (Railroads | Atlanta, Georgia, United States | Rating: BBB+): US$400m Senior Note (US655844CN69), fixed rate (3.70% coupon) maturing on 15 March 2053, priced at 99.41 (original spread of 161 bp), callable (31nc31)

- Enbridge Inc (Gas Utility - Pipelines | Calgary, Canada | Rating: BBB+): US$500m Senior Note (US29250NBL82), fixed rate (2.50% coupon) maturing on 14 February 2025, priced at 99.93 (original spread of 73 bp), with a make whole call

- Enbridge Inc (Gas Utility - Pipelines | Calgary, Canada | Rating: BBB+): US$600m Senior Note (US29250NBM65), floating rate (SOFR + 63.0 bp) maturing on 16 February 2024, priced at 100.00, non callable

- Enbridge Inc (Gas Utility - Pipelines | Calgary, Canada | Rating: BBB+): US$400m Senior Note (US29250NBK00), fixed rate (2.15% coupon) maturing on 16 February 2024, priced at 99.92 (original spread of 63 bp), with a make whole call

- Israel Electric Corp Ltd (Utility - Other | Haifa, Israel | Rating: BBB): US$500m Senior Note (IL0060004004), fixed rate (3.75% coupon) maturing on 22 February 2032, priced at 99.69 (original spread of 175 bp), with a make whole call

- Nomura International Funding Pte Ltd (Financial - Other | Singapore | Rating: NR): US$200m Unsecured Note (XS2217959464), floating rate maturing on 25 February 2027, priced at 100.00, non callable

- Tucson Electric Power Co (Utility - Other | Tucson, Canada | Rating: A-): US$325m Senior Note (US898813AU40), fixed rate (3.25% coupon) maturing on 15 May 2032, priced at 99.63 (original spread of 125 bp), callable (10nc10)

SELECTED RECENT EUR BOND ISSUES

- Belgium, Kingdom of (Government) (Sovereign | Brussels, Belgium | Rating: AA-): €5,000m Obligation Lineaire (BE0000355645), fixed rate (1.40% coupon) maturing on 22 June 2053, priced at 99.40 (original spread of 59 bp), non callable

- BMW Finance NV (Financial - Other | Rijswijk, Zuid-Holland, Germany | Rating: AAA): €1,250m Senior Note (XS2447561403), fixed rate (0.50% coupon) maturing on 22 February 2025, priced at 99.71, non callable

- BMW Finance NV (Financial - Other | Rijswijk, Zuid-Holland, Germany | Rating: AAA): €750m Senior Note (XS2447564332), fixed rate (1.00% coupon) maturing on 22 May 2028, priced at 99.69 (original spread of 95 bp), non callable

- BPCE SFH SA (Financial - Other | Paris, France | Rating: NR): €1,750m Obligation de Financement de l'Habitat (Covered Bond) (FR0014008JP6), fixed rate (0.75% coupon) maturing on 23 February 2029, priced at 99.63 (original spread of 67 bp), non callable

- Cooperatieve Rabobank UA (Banking | Utrecht, Netherlands | Rating: AAA): €5,000m Bond (NL0015000R54), fixed rate (0.63% coupon) maturing on 16 February 2030, priced at 99.72 (original spread of 100,000 bp), non callable

- DZ Hyp AG (Mortgage Banking | Hamburg, Germany | Rating: A+): €1,000m Hypothekenpfandbrief Jumbo (Covered Bond) (DE000A3MP619), fixed rate (0.75% coupon) maturing on 21 November 2029, priced at 99.81 (original spread of 61 bp), non callable

- European Investment Bank (Supranational | Luxembourg, Luxembourg | Rating: AAA): €3,000m Senior Note (XS2446841657), fixed rate (0.38% coupon) maturing on 15 September 2027, priced at 99.54 (original spread of 41 bp), non callable

- State of Rhineland Palatinate (Official and Muni | Mainz, Germany | Rating: AAA): €500m Jumbo Landesschatzanweisung (DE000RLP1353), fixed rate (0.75% coupon) maturing on 23 February 2032, priced at 99.79 (original spread of 48 bp), non callable

NEW LOANS

- Entegris Inc (BB-), signed a US$ 2,495m Term Loan B, to be used for acquisition financing

- UDG Healthcare plc, signed a US$ 200m Term Loan B, to be used for general corporate purposes and acquisition financing. It matures on 08/19/28 and initial pricing is set at LIBOR +425bp