Credit

US IG Cash Spreads Widen Slightly Despite Rebound In Rates, As Risk Sentiment Around Credit Remains Very Prudent

With the recent rates volatility, high yield issuance has slowed to a crawl, but we are seeing a resurgence of IG deals this week, with JP Morgan, Citi, Morgan Stanley, PG&E among the largest issuers today

Published ET

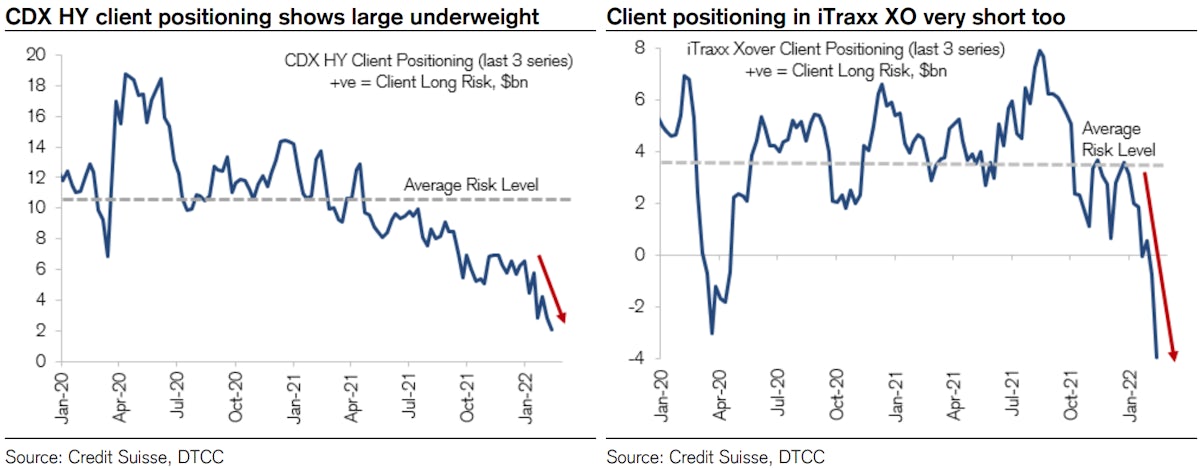

Large Net Short Positioning In CDS Indices | Source: Credit Suisse

QUICK SUMMARY

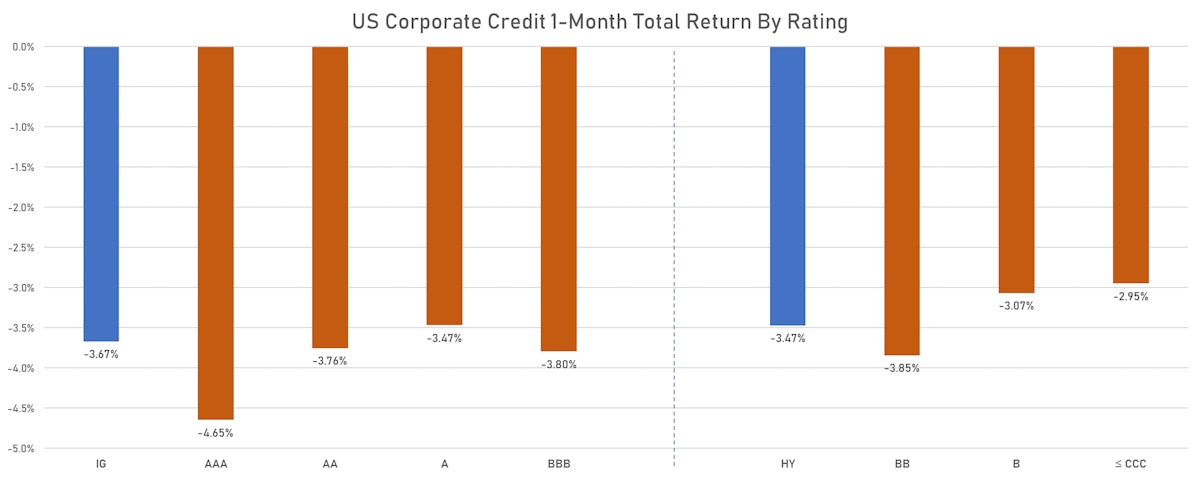

- The iBoxx USD Liquid Investment Grade Total Return Index was down -0.182% today (Month-to-date: -3.24%; Year-to-date: -6.95%)

- The iBoxx USD Liquid High Yield Total Return Index was up 0.129% today (Month-to-date: -1.45%; Year-to-date: -4.27%)

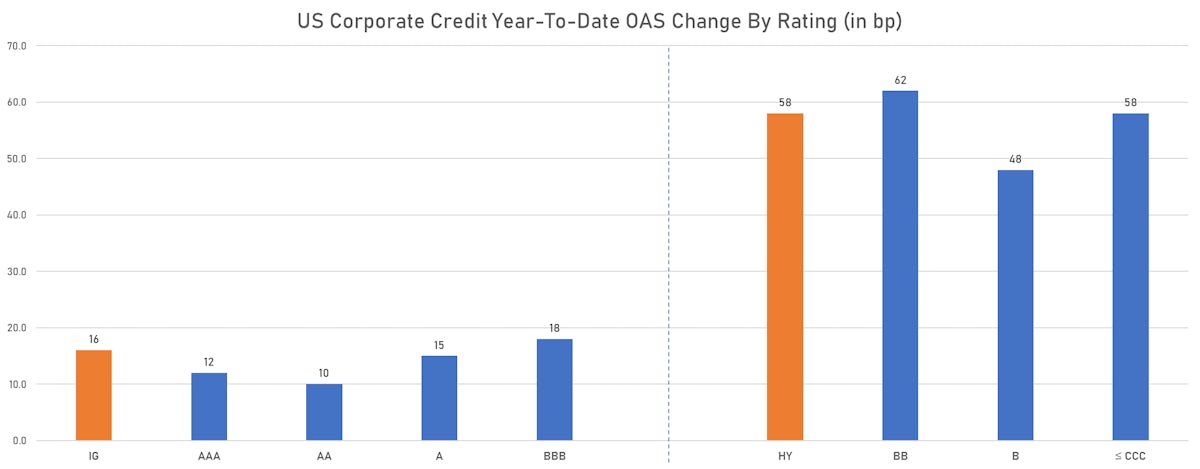

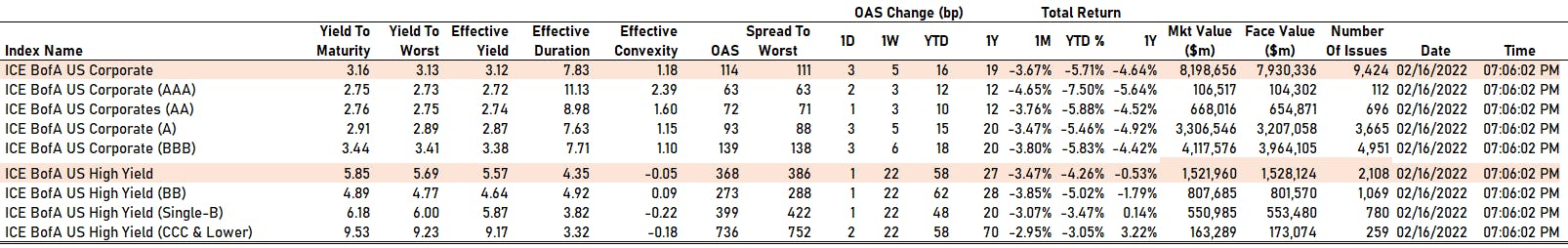

- ICE BofA US Corporate Index (Investment Grade) spread to worst up 2.0 bp, now at 111.0 bp (YTD change: +16.0 bp)

- ICE BofA US High Yield Index spread to worst unchanged, now at 386.0 bp (YTD change: +56.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index down -0.07% today (YTD total return: -0.1%)

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING

- AAA up by 2 bp at 63 bp

- AA up by 1 bp at 72 bp

- A up by 3 bp at 93 bp

- BBB up by 3 bp at 139 bp

- BB up by 1 bp at 273 bp

- B up by 1 bp at 399 bp

- CCC up by 2 bp at 736 bp

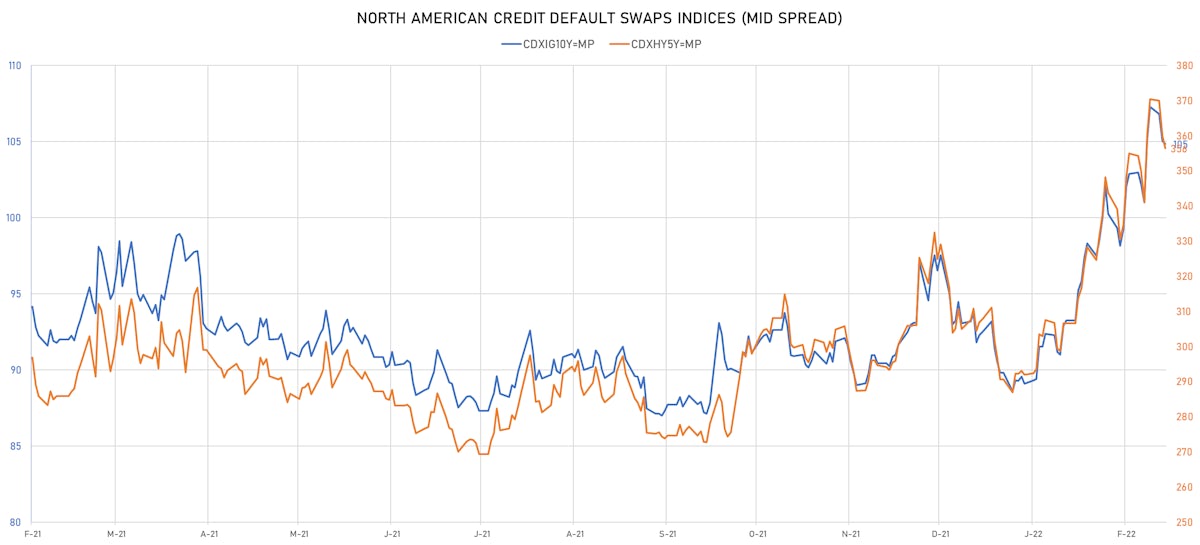

CDS INDICES (mid-spreads)

- Markit CDX.NA.IG 5Y down 0.2 bp, now at 105bp (YTD change: +15.7bp)

- Markit CDX.NA.HY 5Y down 3.6 bp, now at 356bp (YTD change: +64.4bp)

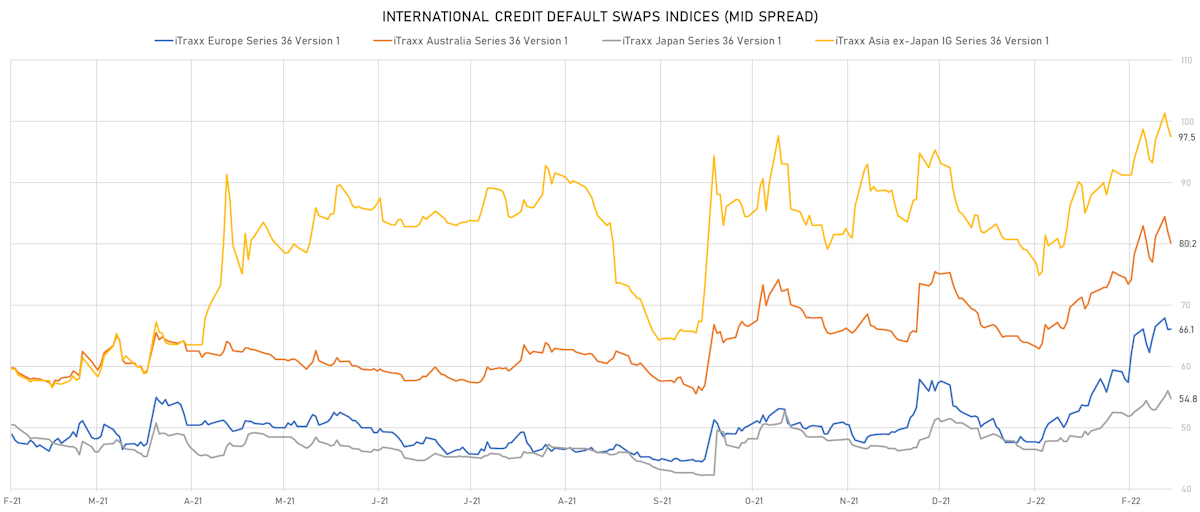

- Markit iTRAXX Europe up 0.1 bp, now at 66bp (YTD change: +18.4bp)

- Markit iTRAXX Japan down 1.2 bp, now at 55bp (YTD change: +8.4bp)

- Markit iTRAXX Asia Ex-Japan down 1.6 bp, now at 97bp (YTD change: +18.4bp)

TOP BONDS MOVES IN THE PAST WEEK - USD HY

- Issuer: Nextera Energy Operating Partners LP (Juno Beach, Florida (US)) | Coupon: 4.25% | Maturity: 15/7/2024 | Rating: BB | ISIN: USU6500TAF22 | Z-spread up by 74.3 bp to 217.5 bp, with the yield to worst at 3.9% and the bond now trading down to 100.5 cents on the dollar (1Y price range: 100.5-103.9).

- Issuer: HanesBrands Inc (Winston-Salem, North Carolina (US)) | Coupon: 4.88% | Maturity: 15/5/2026 | Rating: BB- | ISIN: USU24437AE26 | Z-spread up by 63.2 bp to 263.2 bp, with the yield to worst at 4.4% and the bond now trading down to 100.9 cents on the dollar (1Y price range: 100.0-106.9).

- Issuer: Enact Holdings Inc (Raleigh, North Carolina (US)) | Coupon: 6.50% | Maturity: 15/8/2025 | Rating: BB | ISIN: USU3230LAA45 | Z-spread up by 62.9 bp to 311.9 bp (CDS basis: -56.4bp), with the yield to worst at 4.9% and the bond now trading down to 104.0 cents on the dollar (1Y price range: 104.0-109.5).

- Issuer: Goodyear Tire & Rubber Co (Akron, Ohio (US)) | Coupon: 5.00% | Maturity: 15/7/2029 | Rating: B | ISIN: USU38255AN24 | Z-spread up by 62.2 bp to 344.2 bp (CDS basis: 1.6bp), with the yield to worst at 5.4% and the bond now trading down to 96.9 cents on the dollar (1Y price range: 96.9-106.6).

- Issuer: NCL Finance Ltd (United Kingdom) | Coupon: 6.13% | Maturity: 15/3/2028 | Rating: CCC+ | ISIN: USG6437FAA78 | Z-spread up by 60.4 bp to 529.0 bp, with the yield to worst at 7.1% and the bond now trading down to 94.3 cents on the dollar (1Y price range: 94.3-99.5).

- Issuer: EQM Midstream Partners LP (Canonsburg, Pennsylvania (US)) | Coupon: 6.50% | Maturity: 1/7/2027 | Rating: BB- | ISIN: USU26886AB46 | Z-spread up by 59.3 bp to 432.7 bp, with the yield to worst at 6.1% and the bond now trading down to 100.5 cents on the dollar (1Y price range: 100.5-112.0).

- Issuer: Western Global Airlines LLC (Estero, Florida (US)) | Coupon: 10.38% | Maturity: 15/8/2025 | Rating: B- | ISIN: USU95558AA72 | Z-spread up by 57.7 bp to 572.7 bp, with the yield to worst at 7.3% and the bond now trading down to 108.3 cents on the dollar (1Y price range: 108.3-111.3).

- Issuer: NCL Corporation Ltd (Miami, Bermuda) | Coupon: 5.88% | Maturity: 15/3/2026 | Rating: CCC+ | ISIN: USG6436QAL08 | Z-spread up by 54.8 bp to 527.3 bp, with the yield to worst at 7.1% and the bond now trading down to 95.3 cents on the dollar (1Y price range: 94.5-100.0).

- Issuer: MGM Growth Properties Operating Partnership LP (Las Vegas, Nevada (US)) | Coupon: 4.63% | Maturity: 15/6/2025 | Rating: B+ | ISIN: USU5930BAD83 | Z-spread up by 51.2 bp to 165.7 bp, with the yield to worst at 3.4% and the bond now trading down to 103.0 cents on the dollar (1Y price range: 103.0-106.5).

- Issuer: Videotron Ltd (Pre-Merger) (MONTREAL, Canada) | Coupon: 5.38% | Maturity: 15/6/2024 | Rating: BB+ | ISIN: USC96225AA22 | Z-spread up by 51.0 bp to 186.2 bp, with the yield to worst at 3.5% and the bond now trading down to 103.5 cents on the dollar (1Y price range: 103.3-107.0).

- Issuer: Taylor Morrison Communities Inc (Scottsdale, Arizona (US)) | Coupon: 5.13% | Maturity: 1/8/2030 | Rating: BB- | ISIN: USU8760NAF60 | Z-spread up by 50.2 bp to 319.2 bp, with the yield to worst at 5.2% and the bond now trading down to 98.8 cents on the dollar (1Y price range: 98.8-109.9).

- Issuer: Compass Minerals International Inc (Overland Park, Kansas (US)) | Coupon: 4.88% | Maturity: 15/7/2024 | Rating: B+ | ISIN: USU2036YAC04 | Z-spread up by 44.9 bp to 304.5 bp, with the yield to worst at 4.4% and the bond now trading down to 100.0 cents on the dollar (1Y price range: 100.0-102.8).

- Issuer: Sensata Technologies BV (Almelo, Netherlands) | Coupon: 4.88% | Maturity: 15/10/2023 | Rating: BB- | ISIN: USN78840AH33 | Z-spread up by 44.8 bp to 206.1 bp, with the yield to worst at 3.3% and the bond now trading down to 102.0 cents on the dollar (1Y price range: 101.6-105.1).

- Issuer: Southeast Supply Header LLC (Houston, Texas (US)) | Coupon: 4.25% | Maturity: 15/6/2024 | Rating: BB- | ISIN: USU83854AB29 | Z-spread down by 54.1 bp to 234.2 bp, with the yield to worst at 3.7% and the bond now trading up to 100.1 cents on the dollar (1Y price range: 99.0-102.8).

TOP BONDS MOVES IN THE PAST WEEK - EUR HY

- Issuer: Kondor Finance PLC (London, United Kingdom) | Coupon: 7.13% | Maturity: 19/7/2024 | Rating: B | ISIN: XS2027394233 | Z-spread up by 219.5 bp to 1,924.6 bp, with the yield to worst at 18.8% and the bond now trading down to 77.7 cents on the dollar (1Y price range: 75.2-90.2).

- Issuer: Metinvest BV (Amsterdam, Netherlands) | Coupon: 5.63% | Maturity: 17/6/2025 | Rating: B+ | ISIN: XS2056722734 | Z-spread up by 65.9 bp to 964.8 bp, with the yield to worst at 9.7% and the bond now trading down to 88.3 cents on the dollar (1Y price range: 86.0-99.4).

- Issuer: ThyssenKrupp AG (Essen, Germany) | Coupon: 2.88% | Maturity: 22/2/2024 | Rating: B+ | ISIN: DE000A2TEDB8 | Z-spread up by 60.6 bp to 218.0 bp (CDS basis: -73.9bp), with the yield to worst at 2.0% and the bond now trading down to 101.0 cents on the dollar (1Y price range: 99.9-103.1).

- Issuer: Telefonaktiebolaget LM Ericsson (Stockholm, Sweden) | Coupon: 1.00% | Maturity: 26/5/2029 | Rating: BB+ | ISIN: XS2345996743 | Z-spread up by 58.1 bp to 156.8 bp (CDS basis: -32.2bp), with the yield to worst at 2.2% and the bond now trading down to 91.5 cents on the dollar (1Y price range: 91.3-97.8).

- Issuer: Banca Monte dei Paschi di Siena SpA (Siena, Italy) | Coupon: 2.63% | Maturity: 28/4/2025 | Rating: CCC+ | ISIN: XS2110110686 | Z-spread up by 40.1 bp to 357.3 bp (CDS basis: 110.5bp), with the yield to worst at 3.7% and the bond now trading down to 96.0 cents on the dollar (1Y price range: 95.8-100.0).

- Issuer: Rolls-Royce PLC (Birmingham, United Kingdom) | Coupon: 4.63% | Maturity: 16/2/2026 | Rating: BB- | ISIN: XS2244322082 | Z-spread up by 33.0 bp to 237.8 bp (CDS basis: -64.8bp), with the yield to worst at 2.6% and the bond now trading down to 106.3 cents on the dollar (1Y price range: 105.9-110.9).

- Issuer: PPF Telecom Group BV (Amsterdam, Netherlands) | Coupon: 3.13% | Maturity: 27/3/2026 | Rating: BB+ | ISIN: XS1969645255 | Z-spread up by 32.3 bp to 197.6 bp, with the yield to worst at 2.3% and the bond now trading down to 102.3 cents on the dollar (1Y price range: 102.2-106.3).

- Issuer: Mytilineos Financial Partners SA (Luxembourg, Luxembourg) | Coupon: 2.50% | Maturity: 1/12/2024 | Rating: BB- | ISIN: XS2010038144 | Z-spread up by 32.0 bp to 237.6 bp, with the yield to worst at 2.6% and the bond now trading down to 99.3 cents on the dollar (1Y price range: 98.9-101.9).

- Issuer: CBOM Finance PLC (Dublin, Ireland) | Coupon: 3.10% | Maturity: 21/1/2026 | Rating: BB | ISIN: XS2281299763 | Z-spread up by 31.2 bp to 637.9 bp, with the yield to worst at 6.7% and the bond now trading down to 87.4 cents on the dollar (1Y price range: 86.4-96.0).

- Issuer: Ford Motor Credit Company LLC (Dearborn, Michigan (US)) | Coupon: 1.36% | Maturity: 7/2/2025 | Rating: BB | ISIN: XS1767930586 | Z-spread up by 30.1 bp to 179.4 bp (CDS basis: -23.2bp), with the yield to worst at 2.1% and the bond now trading down to 97.6 cents on the dollar (1Y price range: 97.4-100.9).

- Issuer: SoftBank Group Corp (Minato-Ku, Japan) | Coupon: 2.88% | Maturity: 6/1/2027 | Rating: BB+ | ISIN: XS2361254597 | Z-spread up by 30.0 bp to 473.4 bp, with the yield to worst at 5.2% and the bond now trading down to 89.9 cents on the dollar (1Y price range: 89.0-95.0).

- Issuer: Adler Group SA (Senningerberg, Luxembourg) | Coupon: 2.25% | Maturity: 27/4/2027 | Rating: B | ISIN: XS2336188029 | Z-spread up by 29.9 bp to 653.7 bp, with the yield to worst at 7.0% and the bond now trading down to 79.4 cents on the dollar (1Y price range: 77.0-85.9).

- Issuer: Banco BPM SpA (Verona, Italy) | Coupon: 1.75% | Maturity: 24/4/2023 | Rating: BB | ISIN: XS1811053641 | Z-spread down by 28.4 bp to 75.8 bp (CDS basis: -14.2bp), with the yield to worst at 0.4% and the bond now trading up to 101.4 cents on the dollar (1Y price range: 101.1-101.6).

- Issuer: Saipem Finance International BV (Amsterdam, Netherlands) | Coupon: 2.63% | Maturity: 7/1/2025 | Rating: B+ | ISIN: XS1711584430 | Z-spread down by 219.1 bp to 742.4 bp (CDS basis: 381.9bp), with the yield to worst at 7.5% and the bond now trading up to 87.1 cents on the dollar (1Y price range: 73.9-101.2).

SELECTED RECENT USD BOND ISSUES

- Axos Financial Inc (Banking | Las Vegas, United States | Rating: BBB-): US$150m Subordinated Note (US05465CAB63), floating rate maturing on 1 March 2032, priced at 100.00, callable (10nc5)

- Citigroup Inc (Banking | New York City, New York, United States | Rating: BBB+): US$500m Senior Note (US172967NH04), floating rate (SOFR + 128.0 bp) maturing on 24 February 2028, priced at 100.00, callable (6nc5)

- Citigroup Inc (Banking | New York City, New York, United States | Rating: BBB+): US$2,500m Senior Note (US172967NG21), floating rate maturing on 24 February 2028, priced at 100.00 (original spread of 113 bp), callable (6nc5)

- DTE Electric Co (Utility - Other | Detroit, Michigan, United States | Rating: AA-): US$400m Bond (US23338VAR78), fixed rate (3.65% coupon) maturing on 1 March 2052, priced at 99.39 (original spread of 147 bp), callable (30nc30)

- DTE Electric Co (Utility - Other | Detroit, Michigan, United States | Rating: AA-): US$500m Bond (US23338VAQ95), fixed rate (3.00% coupon) maturing on 1 March 2032, priced at 99.60 (original spread of 100 bp), callable (10nc10)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$110m Bond (US3133ENPL82), fixed rate (2.87% coupon) maturing on 25 February 2030, priced at 100.00, callable (8nc3m)

- JPMorgan Chase & Co (Banking | New York City, United States | Rating: A-): US$750m Senior Note (US46647PCY07), floating rate (SOFR + 118.0 bp) maturing on 24 February 2028, priced at 100.00, callable (6nc6)

- JPMorgan Chase & Co (Banking | New York City, United States | Rating: A-): US$1,650m Senior Note (US46647PCW41), floating rate maturing on 24 February 2028, priced at 100.00, callable (6nc5)

- JPMorgan Chase & Co (Banking | New York City, United States | Rating: A-): US$1,450m Senior Note (US46647PCV67), floating rate maturing on 24 February 2026, priced at 100.00, callable (4nc3)

- JPMorgan Chase & Co (Banking | New York City, United States | Rating: A-): US$750m Senior Note (), floating rate (SOFR + 92.0 bp) maturing on 24 February 2026, priced at 100.00, callable (4nc3)

- Morgan Stanley (Banking | New York City, United States | Rating: BBB+): US$750m Senior Note (US61747YEN13), floating rate (SOFR + 95.0 bp) maturing on 18 February 2026, priced at 100.00, callable (4nc3)

- Morgan Stanley (Banking | New York City, United States | Rating: BBB+): US$1,750m Senior Note (US61747YEM30), floating rate maturing on 18 February 2026, priced at 100.00 (original spread of 86 bp), callable (4nc3)

- Pacific Gas and Electric Co (Utility - Other | San Francisco, United States | Rating: BB-): US$1,000m First Mortgage Bond (US694308KA47), fixed rate (3.25% coupon) maturing on 16 February 2024, priced at 99.96 (original spread of 175 bp), callable (2nc1)

- Pacific Gas and Electric Co (Utility - Other | San Francisco, United States | Rating: BB-): US$400m First Mortgage Bond (US694308KB20), fixed rate (4.20% coupon) maturing on 1 March 2029, priced at 99.93 (original spread of 220 bp), callable (7nc7)

- Pacific Gas and Electric Co (Utility - Other | San Francisco, United States | Rating: BB-): US$450m First Mortgage Bond (US694308KC03), fixed rate (4.40% coupon) maturing on 1 March 2032, priced at 99.69 (original spread of 240 bp), callable (10nc10)

- Pacific Gas and Electric Co (Utility - Other | San Francisco, United States | Rating: BB-): US$550m First Mortgage Bond (US694308KD85), fixed rate (5.25% coupon) maturing on 1 March 2052, priced at 99.64 (original spread of 290 bp), callable (30nc30)

- Verizon Communications Inc (Telecommunications | New York City, New York, United States | Rating: BBB+): US$1,000m Senior Note (US92343VGP31), fixed rate (3.88% coupon) maturing on 1 March 2052, priced at 98.95 (original spread of 174 bp), callable (30nc30)

- Chinalco Capital Holdings Ltd (Financial - Other | Road Town, China (Mainland) | Rating: NR): US$600m Bond (XS2435557959), fixed rate (2.95% coupon) maturing on 24 February 2027, priced at 98.52 (original spread of 135 bp), callable (5nc5)

- Korea Development Bank (Agency | Seoul, Seoul, South Korea | Rating: AA-): US$1,000m Senior Note (US500630DQ87), fixed rate (2.00% coupon) maturing on 24 February 2025, priced at 99.63 (original spread of 35 bp), non callable

- Korea Development Bank (Agency | Seoul, Seoul, South Korea | Rating: AA-): US$500m Senior Note (US500630DR60), fixed rate (2.25% coupon) maturing on 24 February 2027, priced at 99.49 (original spread of 43 bp), non callable

- Landesbank Baden Wuerttemberg (Banking | Stuttgart, Germany | Rating: A-): US$750m Hypothekenpfandbrief (Covered Bond) (DE000LB2ZTL3), fixed rate (2.00% coupon) maturing on 24 February 2025, priced at 99.76 (original spread of 29 bp), non callable

- Midea Investment Development Company Ltd (Financial - Other | China (Mainland) | Rating: NR): US$450m Senior Note (XS2432130453), fixed rate (2.88% coupon) maturing on 24 February 2027, priced at 99.88 (original spread of 98 bp), callable (5nc5)

- Mizuho Financial Group Inc (Banking | Chiyoda-Ku, Japan | Rating: A-): US$600m Senior Note (US60687YCA55), fixed rate (2.65% coupon) maturing on 22 May 2026, priced at 100.00 (original spread of 90 bp), callable (4nc3)

- Mizuho Financial Group Inc (Banking | Chiyoda-Ku, Japan | Rating: A-): US$500m Senior Note (US60687YBX67), fixed rate (3.26% coupon) maturing on 22 May 2030, priced at 100.00 (original spread of 125 bp), callable (8nc7)

- Mizuho Financial Group Inc (Banking | Chiyoda-Ku, Japan | Rating: A-): US$750m Senior Note (US60687YBY41), floating rate (SOFR + 96.0 bp) maturing on 22 May 2026, priced at 100.00, callable (4nc3)

- Nomura International Funding Pte Ltd (Financial - Other | Singapore | Rating: NR): US$200m Unsecured Note (XS2217959464), floating rate maturing on 25 February 2027, priced at 100.00, non callable

SELECTED RECENT EUR BOND ISSUES

- Beijing State-owned Capital Operation and Management Center Investment Hldg Ltd (Financial - Other | Road Town, British Virgin Islands | Rating: NR): €1,000m Bond (XS2445374213), fixed rate (1.21% coupon) maturing on 23 February 2025, priced at 100.00 (original spread of 140 bp), callable (3nc3)

- Commonwealth Bank of Australia (Banking | Sydney, New South Wales, Australia | Rating: A+): €1,250m Covered Bond (Other) (XS2446284783), fixed rate (0.75% coupon) maturing on 28 February 2028, priced at 99.94 (original spread of 68 bp), non callable

- Deutsche Bank AG (Banking | Frankfurt, Germany | Rating: A-): €1,250m Note (DE000DL19WL7), floating rate maturing on 23 February 2028, priced at 99.54 (original spread of 199 bp), callable (6nc5)

- Deutsche Boerse AG (Securities | Eschborn, Hessen, Germany | Rating: AA): €500m Inhaberschuldverschreibung (DE000A3MQQV5), fixed rate (2.00% coupon) maturing on 23 June 2048, priced at 99.27 (original spread of 207 bp), callable (26nc6)

- General Motors Financial Company Inc (Financial - Other | Fort Worth, Texas, United States | Rating: BBB): €600m Senior Note (XS2444424639), fixed rate (1.00% coupon) maturing on 24 February 2025, priced at 99.93 (original spread of 128 bp), with a make whole call

- Mastercard Inc (Financial - Other | Purchase, New York, United States | Rating: A+): €750m Senior Note (XS2448014808), fixed rate (1.00% coupon) maturing on 22 February 2029, priced at 99.73 (original spread of 95 bp), callable (7nc7)

- NRW Bank (Agency | Dusseldorf, Germany | Rating: AA): €150m Inhaberschuldverschreibung (DE000NWB2R08), fixed rate (0.49% coupon) maturing on 23 February 2026, priced at 100.00, callable (4nc1)

- Raiffeisen Landesbank Steiermark AG (Banking | Graz, Austria | Rating: A-): €500m Fundierte Schuldverschreibungen (Covered Bond) (AT000B093638), floating rate (EU03MLIB + 0.0 bp) maturing on 24 February 2028, priced at 100.00, non callable

- Siemens Financieringsmaatschappij NV (Financial - Other | S-Gravenhage, Zuid-Holland, Germany | Rating: NR): €750m Senior Note (XS2446846888), fixed rate (1.25% coupon) maturing on 25 February 2035, priced at 98.66 (original spread of 112 bp), callable (13nc13)

- Siemens Financieringsmaatschappij NV (Financial - Other | S-Gravenhage, Zuid-Holland, Germany | Rating: NR): €750m Senior Note (XS2446844594), fixed rate (1.00% coupon) maturing on 25 February 2030, priced at 99.65 (original spread of 89 bp), callable (8nc8)

- Siemens Financieringsmaatschappij NV (Financial - Other | S-Gravenhage, Zuid-Holland, Germany | Rating: NR): €500m Senior Note (XS2446843430), fixed rate (0.63% coupon) maturing on 25 February 2027, priced at 99.49 (original spread of 74 bp), callable (5nc5)

- Svenska Handelsbanken AB (Banking | Stockholm, Stockholm, Sweden | Rating: AA-): €1,000m Note (XS2447983813), fixed rate (1.38% coupon) maturing on 23 February 2029, priced at 99.87 (original spread of 129 bp), non callable

- UniCredit Bank AG (Banking | Muenchen, Italy | Rating: BBB+): €1,000m Oeffentlicher Pfandbrief Jumbo (Covered Bond) (DE000HV2AYU9), fixed rate (0.50% coupon) maturing on 23 February 2027, priced at 99.53 (original spread of 58 bp), non callable

NEW LOANS

- Bluegreen Vacations Corp, signed a US$ 200m Revolving Credit Facility, to be used for general corporate purposes. It matures on 02/16/27 and initial pricing is set at Term SOFR +250bp

- State Bank Of India (BBB-), signed a US$ 500m Revolving Credit / Term Loan, to be used for general corporate purposes

- SKYCITY Entertainment Group (BBB-), signed a US$ 115m Revolving Credit / Term Loan, to be used for refinancing and returning bank debt

- Republic Of Indonesia (BBB), signed a US$ 150m Revolving Credit / Term Loan, to be used for capital expenditures

- Marubeni Corp (BBB), signed a US$ 555m 364d Revolver, to be used for general corporate purposes. It matures on 02/15/23 and initial pricing is set at SOFR +50bp

NEW ISSUES IN SECURITIZED CREDIT

- FCT Credit Agricole Habitat 2022-1 issued a floating-rate RMBS in 1 tranche offering a spread over the floating rate of 75bp, for a total of € 1,163 m. Bookrunners: Credit Agricole Corporate & Investment Bank