Credit

IG Cash Prices Rise Despite Wider Spreads, Helped By Longer Duration And Lower Yields

Not a ton of US corporate issuance today, but Amgen managed to raise $4bn in 4 tranches, while in SSA the Dominican Republic raised $3.6bn in 2 tranches

Published ET

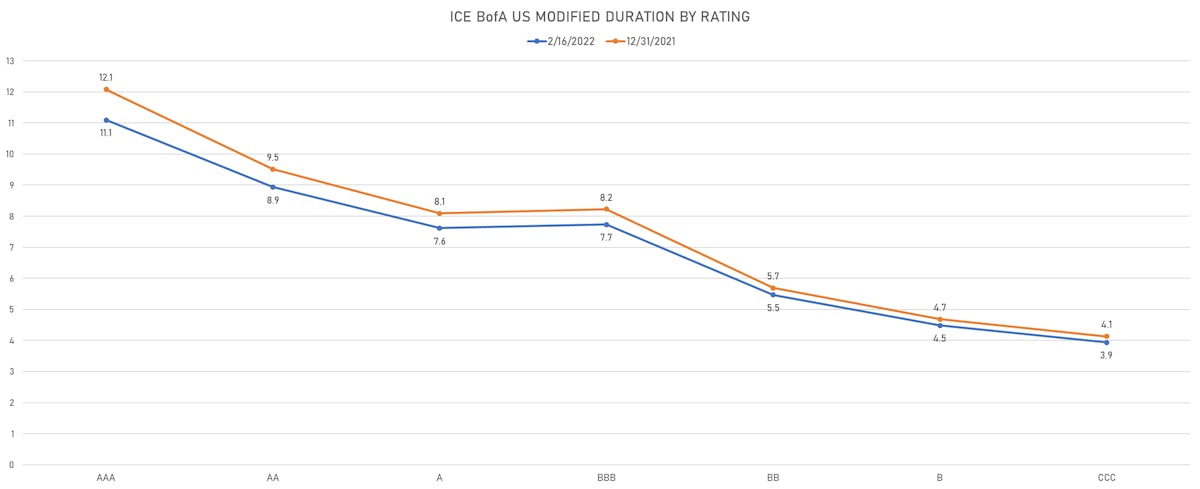

ICE BofAML US Corporate Duration By Rating | Sources: ϕpost, Refinitiv data

QUICK SUMMARY

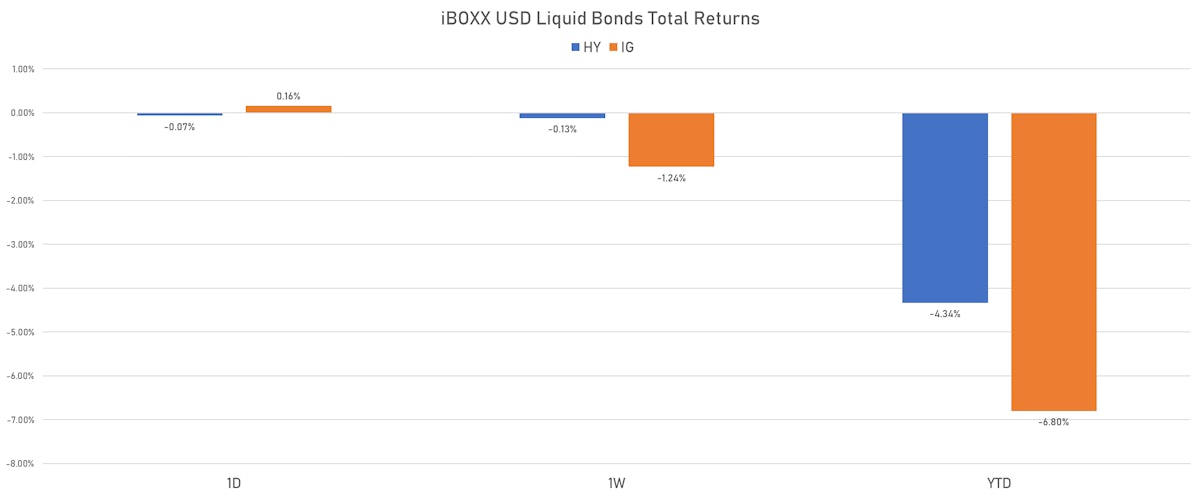

- The iBoxx USD Liquid Investment Grade Total Return Index was up 0.159% today (Month-to-date: -3.09%; Year-to-date: -6.80%)

- The iBoxx USD Liquid High Yield Total Return Index was down -0.069% today (Month-to-date: -1.51%; Year-to-date: -4.34%)

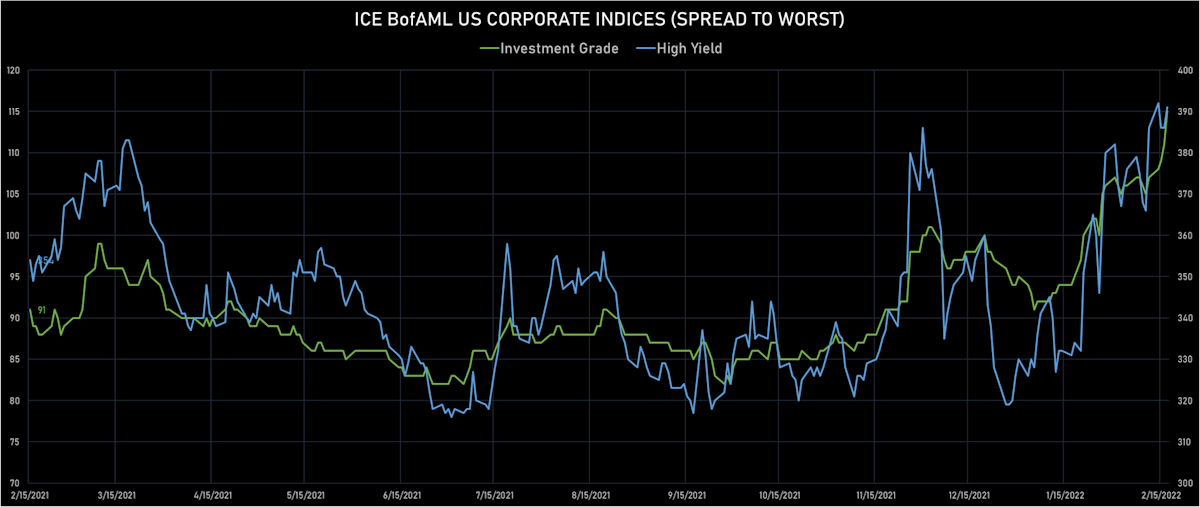

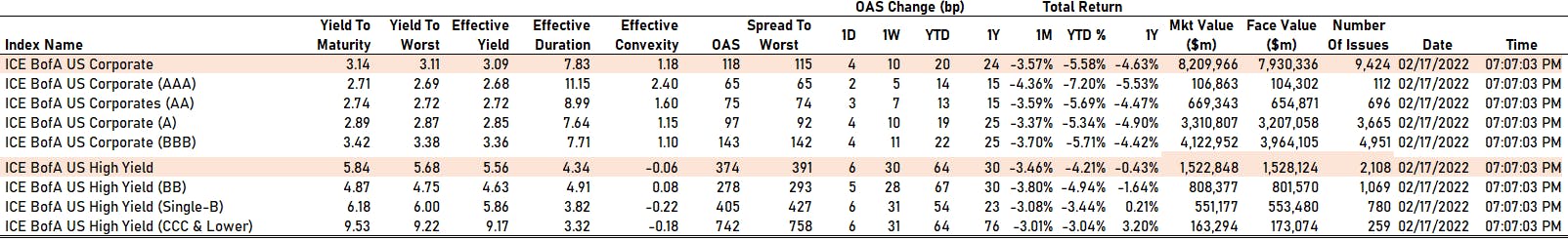

- ICE BofA US Corporate Index (Investment Grade) spread to worst up 4.0 bp, now at 115.0 bp (YTD change: +20.0 bp)

- ICE BofA US High Yield Index spread to worst up 5.0 bp, now at 391.0 bp (YTD change: +61.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index down -0.19% today (YTD total return: -0.3%)

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING

- AAA up by 2 bp at 65 bp

- AA up by 3 bp at 75 bp

- A up by 4 bp at 97 bp

- BBB up by 4 bp at 143 bp

- BB up by 5 bp at 278 bp

- B up by 6 bp at 405 bp

- CCC up by 6 bp at 742 bp

CDS INDICES (mid-spreads)

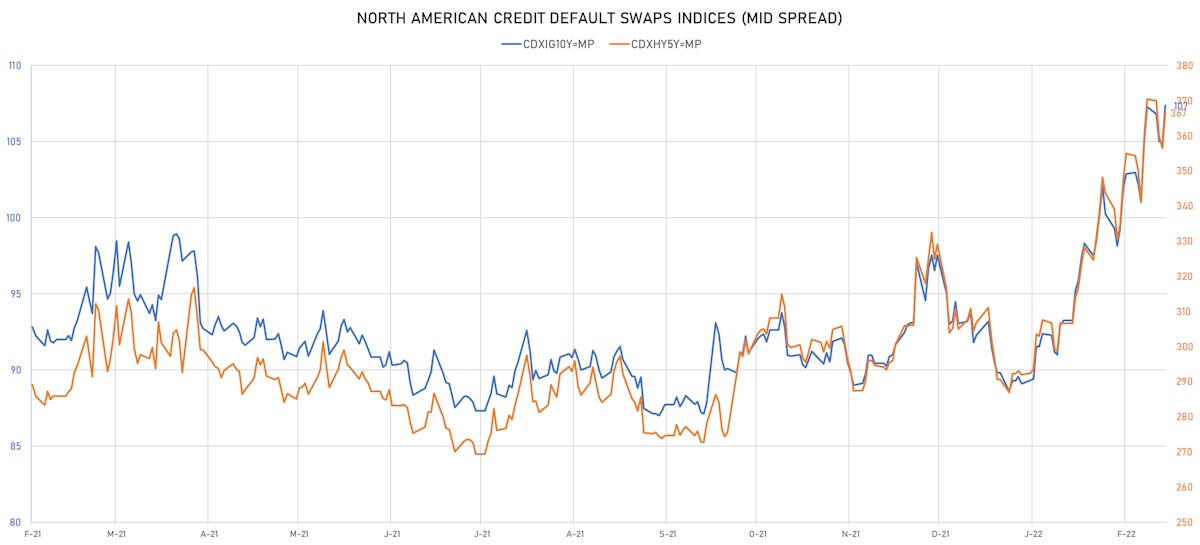

- Markit CDX.NA.IG 5Y up 2.5 bp, now at 107bp (YTD change: +18.3bp)

- Markit CDX.NA.HY 5Y up 10.2 bp, now at 367bp (YTD change: +74.6bp)

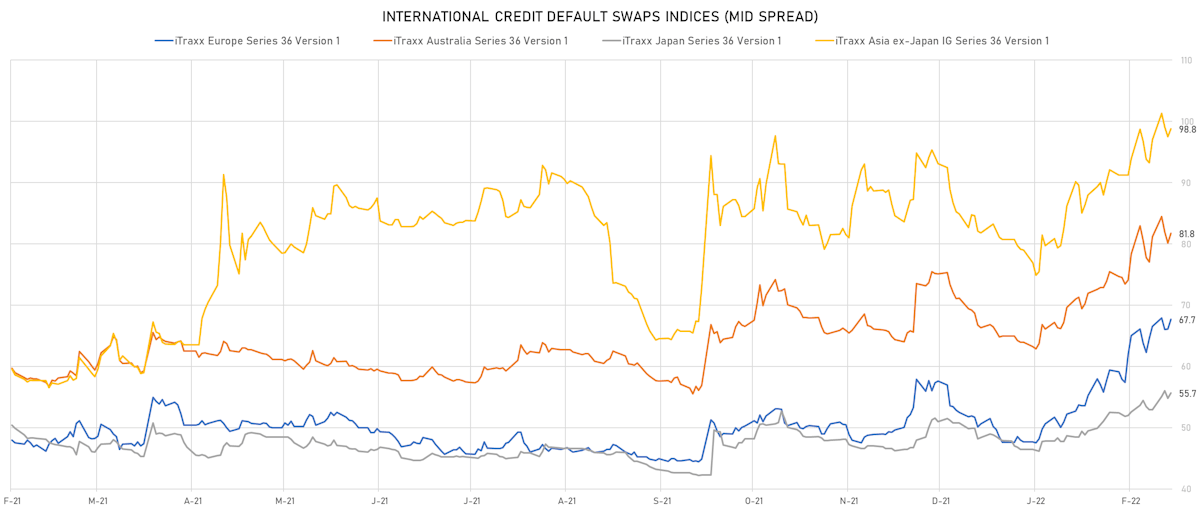

- Markit iTRAXX Europe up 1.6 bp, now at 68bp (YTD change: +20.0bp)

- Markit iTRAXX Japan up 0.9 bp, now at 56bp (YTD change: +9.3bp)

- Markit iTRAXX Asia Ex-Japan up 1.3 bp, now at 99bp (YTD change: +19.8bp)

USD CDS SINGLE NAMES - LARGEST MOVES IN THE PAST WEEK

- Staples Inc (Country: US; rated: B3): down 32.2 bp to 1,100.1bp (1Y range: 687-1,159bp)

- Sabre Holdings Corp (Country: US; rated: Ba3): down 27.2 bp to 562.0bp (1Y range: 351-585bp)

- Domtar Corp (Country: US; rated: LGD3 - 42%): down 23.5 bp to 439.5bp (1Y range: 66-460bp)

- Liberty Interactive LLC (Country: US; rated: Ba3): up 20.2 bp to 576.9bp (1Y range: 287-577bp)

- DISH DBS Corp (Country: US; rated: B2): up 20.5 bp to 589.8bp (1Y range: 317-600bp)

- Paramount Global (Country: US; rated: WR): up 21.3 bp to 108.6bp (1Y range: 57-109bp)

- Tegna Inc (Country: US; rated: Ba3): up 23.0 bp to 476.3bp (1Y range: 148-476bp)

- Avis Budget Group Inc (Country: US; rated: CCC): up 25.4 bp to 324.1bp (1Y range: 183-359bp)

- Interval Acquisition Corp (Country: US; rated: WR): up 26.6 bp to 556.4bp (1Y range: 329-556bp)

- Avon Products Inc (Country: GB; rated: WR): up 29.4 bp to 321.3bp (1Y range: 180-321bp)

- Pitney Bowes Inc (Country: US; rated: B1): up 32.1 bp to 716.5bp (1Y range: 363-716bp)

- Transocean Inc (Country: KY; rated: Caa3): up 34.0 bp to 2,013.9bp (1Y range: 941-2,014bp)

- Nabors Industries Inc (Country: US; rated: B3): up 49.9 bp to 689.2bp (1Y range: 504-1,098bp)

- CSC Holdings LLC (Country: US; rated: LGD3 - 30%): up 55.1 bp to 456.7bp (1Y range: -457bp)

EURO CDS SINGLE NAMES - LARGEST MOVES IN THE PAST WEEK

- Stonegate Pub Company Financing PLC (Country: GB; rated: WR): down 22.8 bp to 410.9bp (1Y range: 411-601bp)

- Air France KLM SA (Country: FR; rated: B-): down 12.6 bp to 416.1bp (1Y range: 386-603bp)

- ThyssenKrupp AG (Country: DE; rated: B1): down 9.1 bp to 284.3bp (1Y range: 205-300bp)

- Lagardere SA (Country: FR; rated: B): up 7.6 bp to 143.8bp (1Y range: 144-350bp)

- Premier Foods Finance PLC (Country: GB; rated: B1): up 7.7 bp to 275.0bp (1Y range: 154-278bp)

- British American Tobacco PLC (Country: GB; rated: A2): up 8.5 bp to 87.7bp (1Y range: 68-88bp)

- Alstom SA (Country: FR; rated: P-2): up 8.7 bp to 109.8bp (1Y range: 41-110bp)

- GKN Holdings Ltd (Country: GB; rated: Ba1): up 9.2 bp to 187.8bp (1Y range: 117-188bp)

- Atlantia SpA (Country: IT; rated: Ba2): up 13.6 bp to 165.9bp (1Y range: 97-181bp)

- Ineos Group Holdings SA (Country: LU; rated: WR): up 14.5 bp to 210.7bp (1Y range: 125-296bp)

- Rolls-Royce PLC (Country: GB; rated: BB-): up 23.4 bp to 224.3bp (1Y range: 161-293bp)

- Clariant AG (Country: CH; rated: LGD4 - 63%): up 33.1 bp to 125.3bp (1Y range: 65-125bp)

- Banca Monte dei Paschi di Siena SpA (Country: IT; rated: NP): up 34.6 bp to 384.7bp (1Y range: 145-385bp)

- Novafives SAS (Country: FR; rated: Caa1): up 75.1 bp to 983.1bp (1Y range: 618-995bp)

SELECTED RECENT USD BOND ISSUES

- Amgen Inc (Pharmaceuticals | Thousand Oaks, United States | Rating: BBB+): US$1,000m Senior Note (US031162DE75), fixed rate (3.35% coupon) maturing on 22 February 2032, priced at 99.76 (original spread of 140 bp), callable (10nc10)

- Amgen Inc (Pharmaceuticals | Thousand Oaks, United States | Rating: BBB+): US$1,000m Senior Note (US031162DF41), fixed rate (4.20% coupon) maturing on 22 February 2052, priced at 99.44 (original spread of 217 bp), callable (30nc30)

- Amgen Inc (Pharmaceuticals | Thousand Oaks, United States | Rating: BBB+): US$1,250m Senior Note (US031162DG24), fixed rate (4.40% coupon) maturing on 22 February 2062, priced at 99.38 (original spread of 232 bp), callable (40nc40)

- Amgen Inc (Pharmaceuticals | Thousand Oaks, United States | Rating: BBB+): US$750m Senior Note (US031162DD92), fixed rate (3.00% coupon) maturing on 22 February 2029, priced at 99.69 (original spread of 110 bp), callable (7nc7)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$112m Bond (US3133ENPU81), fixed rate (2.45% coupon) maturing on 23 February 2028, priced at 100.00, callable (6nc1)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$180m Bond (US3133ENPV64), fixed rate (3.36% coupon) maturing on 23 February 2037, priced at 100.00, callable (15nc1)

- Goldman Sachs Group Inc (Banking | New York City, New York, United States | Rating: BBB+): US$250m Unsecured Note (XS2398663521) zero coupon maturing on 25 February 2056, non callable

- KfW (Agency | Frankfurt, Germany | Rating: AAA): US$1,000m Senior Note (XS2448404009), fixed rate (1.63% coupon) maturing on 10 May 2024, priced at 99.99 (original spread of -13 bp), non callable

- Midea Investment Development Company Ltd (Financial - Other | China (Mainland) | Rating: NR): US$450m Senior Note (XS2432130453), fixed rate (2.88% coupon) maturing on 24 February 2027, priced at 99.88, callable (5nc5)

- State Of Dominican Republic (Financial - Other | Dominican Republic | Rating: BB-): US$1,782m Bond (US25714PEN42), fixed rate (6.00% coupon) maturing on 22 February 2033, priced at 100.00, non callable

- State Of Dominican Republic (Financial - Other | Dominican Republic | Rating: BB-): US$1,782m Bond (US25714PEP99), fixed rate (5.50% coupon) maturing on 22 February 2029, priced at 100.00, non callable

SELECTED RECENT EUR BOND ISSUES

- Berlin Hyp AG (Banking | Berlin, Germany | Rating: AA): €500m Hypothekenpfandbrief (Covered Bond) (DE000BHY0JD5), fixed rate (0.63% coupon) maturing on 23 February 2029, priced at 99.67 (original spread of 59 bp), non callable

- Credit Agricole SA (Banking | Montrouge, France | Rating: A+): €1,000m Bond (FR0014008MT2), fixed rate (1.13% coupon) maturing on 24 February 2029, priced at 99.20 (original spread of 120 bp), non callable

- Deutsche Bahn Finance GmbH (Financial - Other | Berlin, Germany | Rating: NR): €200m Senior Note (XS2445114734), fixed rate (0.79% coupon) maturing on 17 February 2027, priced at 100.00 (original spread of 100,000 bp), non callable

- KBC Groep NV (Banking | Brussels, Bruxelles-Capitale, Belgium | Rating: BBB+): €500m Bond (BE0002840214), floating rate (EU06MLIB + 65.0 bp) maturing on 24 February 2025, callable (3nc2)

- Landeskreditbank Baden Wuerttemberg Foerderbank (Agency | Karlsruhe, Germany | Rating: AA+): €150m Inhaberschuldverschreibung (DE000A3MQP67), floating rate (EU06MLIB + 175.0 bp) maturing on 24 February 2026, priced at 107.63, non callable

- Mercialys SA (Service - Other | Paris, France | Rating: BBB): €500m Bond (FR0014008JQ4), fixed rate (2.50% coupon) maturing on 28 February 2029, priced at 99.40 (original spread of 252 bp), callable (7nc7)

- Sagax EURO MTN NL BV (Financial - Other | Rotterdam, Sweden | Rating: NR): €300m Senior Note (XS2447539060), fixed rate (1.63% coupon) maturing on 24 February 2026, priced at 99.74 (original spread of 193 bp), callable (4nc4)

- Societe Generale Scf SA (Financial - Other | Puteaux, France | Rating: AAA): €1,250m Bond (FR0014008GR8), floating rate (EU03MLIB + 60.0 bp) maturing on 18 February 2035, priced at 103.20 (original spread of 100,000 bp), non callable

- Societe Generale Scf SA (Financial - Other | Puteaux, France | Rating: AAA): €750m Covered Bond (Other) (FR0014008GS6), floating rate (EU03MLIB + 60.0 bp) maturing on 18 May 2024, priced at 101.26, non callable

- UniCredit SpA (Banking | Milan, Italy | Rating: BBB): €1,000m Bond (IT0005483638) maturing on 30 April 2026, priced at 100.00, non callable

- UniCredit SpA (Banking | Milan, Italy | Rating: BBB): €1,000m Bond (IT0005483646) maturing on 30 April 2025, priced at 100.00, non callable

- Westpac Securities NZ Ltd (London Branch) (Financial - Other | London, Australia | Rating: NR): €750m Senior Note (XS2448001813), fixed rate (1.10% coupon) maturing on 24 March 2026, priced at 100.00 (original spread of 131 bp), non callable

NEW LOANS

- Callaway Golf Co (B), signed a US$ 950m Term Loan B, to be used for general corporate purposes. It matures on 03/03/29 and initial pricing is set at Term SOFR +325bp

- Callaway Golf Co (B), signed a US$ 500m Revolving Credit Facility maturing on 03/03/27, to be used for general corporate purposes

NEW ISSUES IN SECURITIZED CREDIT

- GS Mortgage-Backed Securities Trust 2022-Ltv1 issued a fixed-rate RMBS in 2 tranches, for a total of US$ 233 m. Bookrunners: Goldman Sachs & Co

- Sunnova Helios VII Issuer LLC 2022-A issued a fixed-rate ABS backed by certificates in 3 tranches, for a total of US$ 292 m. Highest-rated tranche offering a yield to maturity of 2.87%, and the lowest-rated tranche a yield to maturity of 3.68%. Bookrunners: Credit Suisse

- Fort Cre 2022-Fl3 Issuer LLC issued a floating-rate CLO in 5 tranches, for a total of US$ 853 m. Highest-rated tranche offering a spread over the floating rate of 185bp, and the lowest-rated tranche a spread of 385bp. Bookrunners: Goldman Sachs & Co, UBS Securities Inc

- Regional Management Issuance Trust 2022-1 issued a fixed-rate ABS backed by consumer loan in 4 tranches, for a total of US$ 250 m. Highest-rated tranche offering a yield to maturity of 3.07%, and the lowest-rated tranche a yield to maturity of 6.72%. Bookrunners: Credit Suisse, JP Morgan & Co Inc, Wells Fargo Securities LLC

- Nissan Auto Receivables 2022-A Owner Trust issued a fixed-rate ABS backed by auto receivables in 4 tranches, for a total of US$ 1,000 m. Highest-rated tranche offering a yield to maturity of 0.50%, and the lowest-rated tranche a yield to maturity of 2.07%. Bookrunners: Citigroup Global Markets Inc, Mizuho Securities USA Inc, Lloyds Securities Inc, TD Securities (USA) LLC

- Exeter Automobile Receivables Trust 2022-1 issued a fixed-rate ABS backed by auto receivables in 7 tranches, for a total of US$ 806 m. Highest-rated tranche offering a coupon of 1.15%, and the lowest-rated tranche a yield to maturity of 5.18%. Bookrunners: Barclays Capital Group, Citigroup Global Markets Inc