Credit

Same Story Into The Weekend: Wider Spreads Across The Credit Complex, CDX IG Indices At New Highs For The Year

Primary market issuance volumes for the week (IFR data): $31.6bn in 37 tranches for IG (2022 YTD volume $216.0bn vs 2021 YTD $220.8bn) and $0 for HY this week (2022 YTD volume US$30.7bn vs 2021 YTD $77.4bn)

Published ET

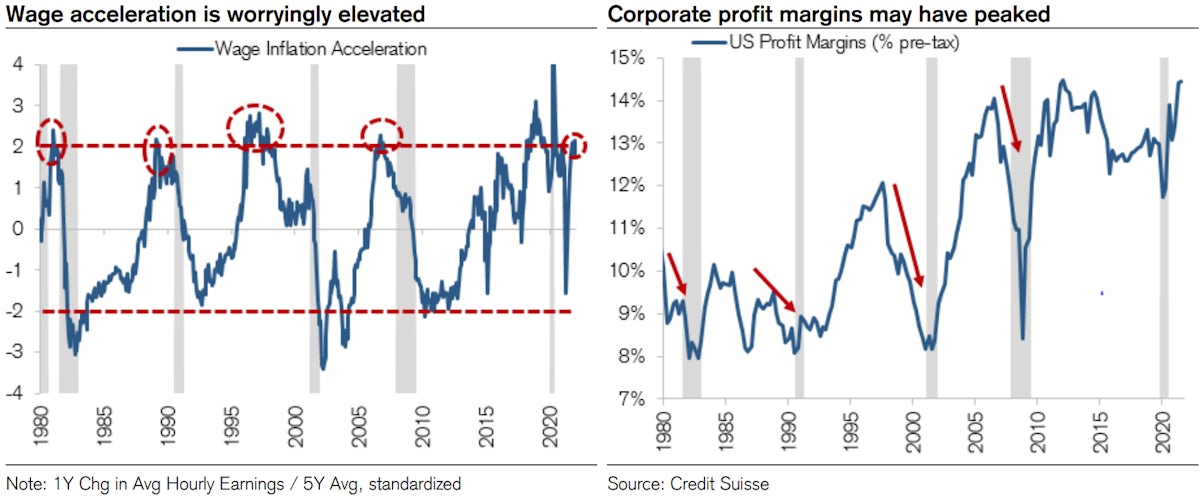

US Corporate Net Margins May Have Peaked | Source: Credit Suisse

QUICK SUMMARY

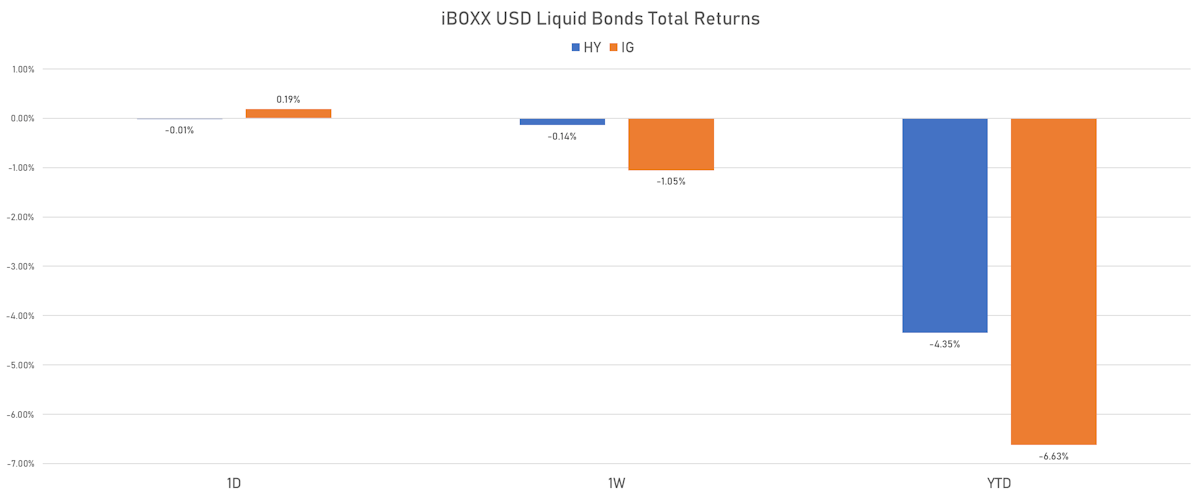

- S&P 500 Bond Index was up 0.10% today, with investment grade up 0.11% and high yield down -0.04% (YTD total return: -5.32%)

- The iBoxx USD Liquid Investment Grade Total Return Index was up 0.186% today (Month-to-date: -2.91%; Year-to-date: -6.63%)

- The iBoxx USD Liquid High Yield Total Return Index was down -0.015% today (Month-to-date: -1.53%; Year-to-date: -4.35%)

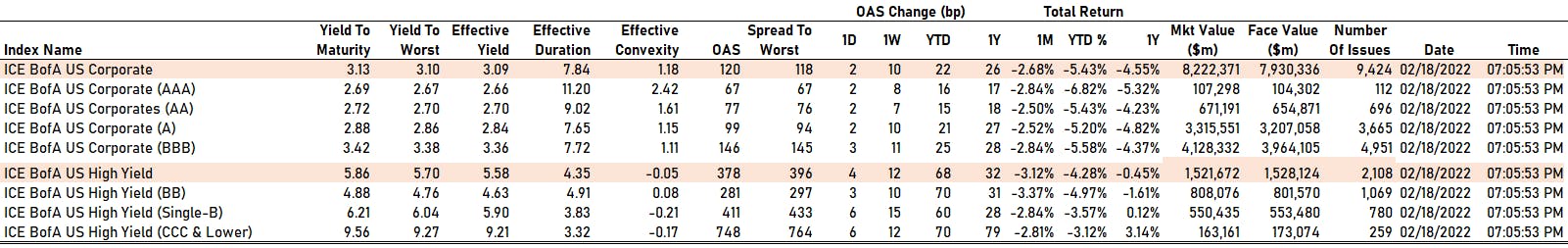

- ICE BofA US Corporate Index (Investment Grade) spread to worst up 3.0 bp, now at 118.0 bp (YTD change: +23.0 bp)

- ICE BofA US High Yield Index spread to worst up 5.0 bp, now at 396.0 bp (YTD change: +66.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index down -0.05% today (YTD total return: -0.3%)

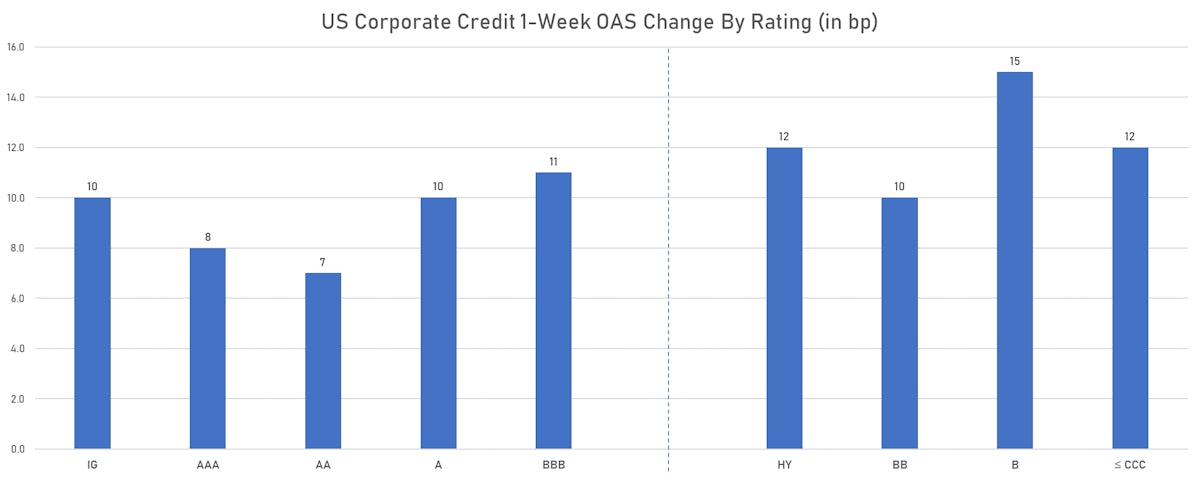

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING

- AAA up by 2 bp at 67 bp

- AA up by 2 bp at 77 bp

- A up by 2 bp at 99 bp

- BBB up by 3 bp at 146 bp

- BB up by 3 bp at 281 bp

- B up by 6 bp at 411 bp

- CCC up by 6 bp at 748 bp

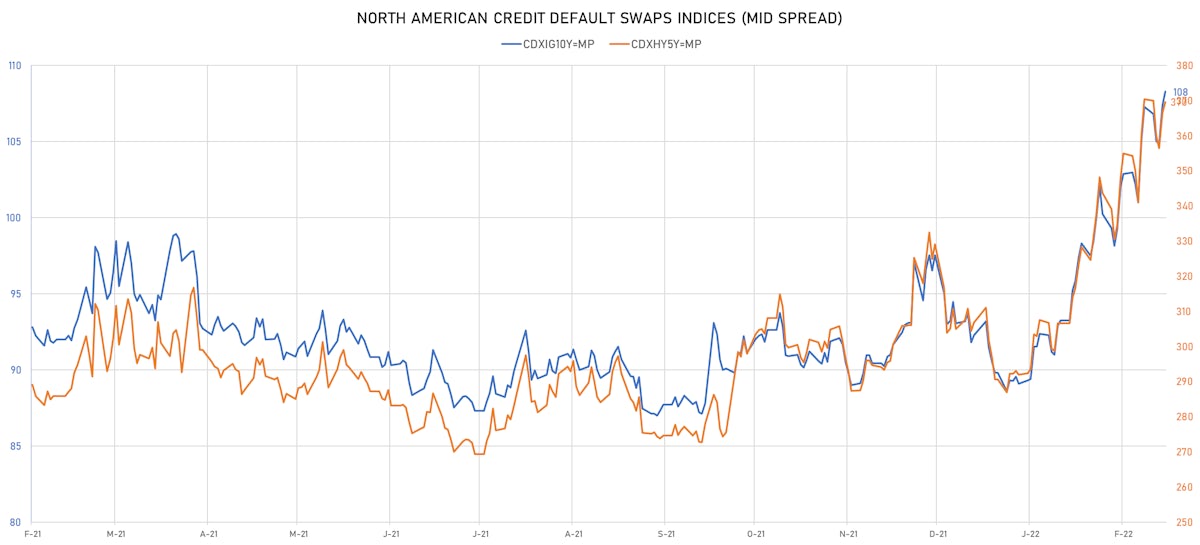

CDS INDICES (mid-spreads)

- Markit CDX.NA.IG 5Y up 0.9 bp, now at 108bp (YTD change: +19.2bp)

- Markit CDX.NA.HY 5Y up 3.1 bp, now at 370bp (YTD change: +77.7bp)

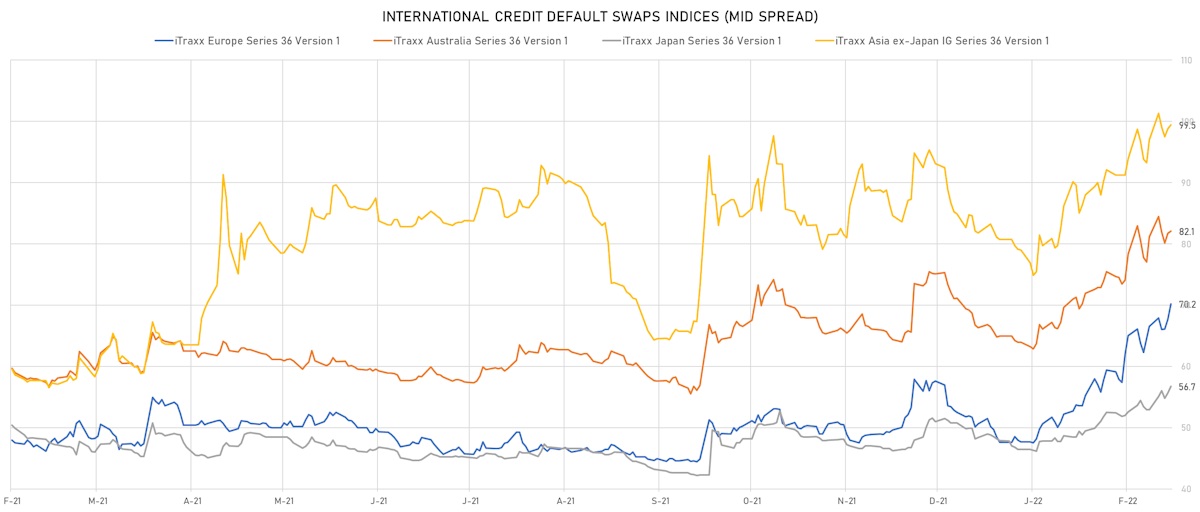

- Markit iTRAXX Europe up 2.5 bp, now at 70bp (YTD change: +22.5bp)

- Markit iTRAXX Japan up 1.1 bp, now at 57bp (YTD change: +10.3bp)

- Markit iTRAXX Asia Ex-Japan up 0.7 bp, now at 99bp (YTD change: +20.4bp)

TOP BONDS MOVES IN THE PAST WEEK - USD HY

- Issuer: WeWork Companies Inc (New York City, New York (US)) | Coupon: 7.88% | Maturity: 1/5/2025 | Rating: CCC- | ISIN: USU96217AA99 | Z-spread up by 113.4 bp to 1,092.2 bp, with the yield to worst at 11.9% and the bond now trading down to 88.5 cents on the dollar (1Y price range: 88.5-96.5).

- Issuer: Rockies Express Pipeline LLC (Leawood, Kansas (US)) | Coupon: 4.95% | Maturity: 15/7/2029 | Rating: BB | ISIN: USU75111AJ00 | Z-spread up by 90.9 bp to 356.9 bp, with the yield to worst at 5.4% and the bond now trading down to 96.5 cents on the dollar (1Y price range: 96.5-107.5).

- Issuer: Taylor Morrison Communities Inc (Scottsdale, Arizona (US)) | Coupon: 5.63% | Maturity: 1/3/2024 | Rating: BB- | ISIN: USU87286AD91 | Z-spread up by 85.1 bp to 227.2 bp, with the yield to worst at 3.7% and the bond now trading down to 103.0 cents on the dollar (1Y price range: 103.0-106.5).

- Issuer: Goodyear Tire & Rubber Co (Akron, Ohio (US)) | Coupon: 5.00% | Maturity: 15/7/2029 | Rating: B | ISIN: USU38255AN24 | Z-spread up by 69.9 bp to 357.8 bp (CDS basis: -6.7bp), with the yield to worst at 5.5% and the bond now trading down to 96.8 cents on the dollar (1Y price range: 96.8-106.6).

- Issuer: Braskem America Finance Co (PHILADELPHIA, Pennsylvania (US)) | Coupon: 7.13% | Maturity: 22/7/2041 | Rating: BB+ | ISIN: USU1065PAA94 | Z-spread up by 69.6 bp to 392.6 bp, with the yield to worst at 6.0% and the bond now trading down to 111.3 cents on the dollar (1Y price range: 111.0-129.0).

- Issuer: MGM Growth Properties Operating Partnership LP (Las Vegas, Nevada (US)) | Coupon: 4.63% | Maturity: 15/6/2025 | Rating: B+ | ISIN: USU5930BAD83 | Z-spread up by 62.8 bp to 182.9 bp, with the yield to worst at 3.5% and the bond now trading down to 102.8 cents on the dollar (1Y price range: 102.8-106.5).

- Issuer: JBS USA Lux SA (Luxembourg, Luxembourg) | Coupon: 3.00% | Maturity: 15/5/2032 | Rating: BB+ | ISIN: USL56608AG44 | Z-spread up by 62.1 bp to 238.7 bp, with the yield to worst at 4.3% and the bond now trading down to 88.3 cents on the dollar (1Y price range: 87.5-99.3).

- Issuer: Howard Midstream Energy Partners LLC (San Antonio, TX) | Coupon: 6.75% | Maturity: 15/1/2027 | Rating: B- | ISIN: USU4425TAA08 | Z-spread up by 61.3 bp to 509.4 bp, with the yield to worst at 6.7% and the bond now trading down to 99.5 cents on the dollar (1Y price range: 99.5-103.3).

- Issuer: Sealed Air Corp (Charlotte, North Carolina (US)) | Coupon: 5.50% | Maturity: 15/9/2025 | Rating: BB | ISIN: USU81193AP68 | Z-spread up by 54.7 bp to 211.6 bp (CDS basis: -94.0bp), with the yield to worst at 3.6% and the bond now trading down to 104.8 cents on the dollar (1Y price range: 104.8-110.5).

- Issuer: HanesBrands Inc (Winston-Salem, North Carolina (US)) | Coupon: 4.88% | Maturity: 15/5/2026 | Rating: BB- | ISIN: USU24437AE26 | Z-spread up by 54.1 bp to 276.8 bp, with the yield to worst at 4.5% and the bond now trading down to 100.8 cents on the dollar (1Y price range: 100.0-106.9).

- Issuer: Meritage Homes Corp (Scottsdale, Arizona (US)) | Coupon: 3.88% | Maturity: 15/4/2029 | Rating: BB+ | ISIN: USU58995AJ72 | Z-spread up by 52.9 bp to 238.5 bp, with the yield to worst at 4.3% and the bond now trading down to 97.0 cents on the dollar (1Y price range: 97.0-104.5).

- Issuer: Southeast Supply Header LLC (Houston, Texas (US)) | Coupon: 4.25% | Maturity: 15/6/2024 | Rating: BB- | ISIN: USU83854AB29 | Z-spread down by 51.3 bp to 247.8 bp, with the yield to worst at 3.7% and the bond now trading up to 100.0 cents on the dollar (1Y price range: 99.0-102.8).

TOP BONDS MOVES IN THE PAST WEEK - EUR HY

- Issuer: Metinvest BV (Amsterdam, Netherlands) | Coupon: 5.63% | Maturity: 17/6/2025 | Rating: B+ | ISIN: XS2056722734 | Z-spread up by 187.4 bp to 1,034.5 bp, with the yield to worst at 10.3% and the bond now trading down to 86.8 cents on the dollar (1Y price range: 86.0-99.4).

- Issuer: Alfa Holding Issuance PLC (Dublin, Ireland) | Coupon: 2.70% | Maturity: 11/6/2023 | Rating: BB+ | ISIN: XS2183144810 | Z-spread up by 78.5 bp to 515.5 bp, with the yield to worst at 4.8% and the bond now trading down to 97.2 cents on the dollar (1Y price range: 96.9-100.6).

- Issuer: Telefonaktiebolaget LM Ericsson (Stockholm, Sweden) | Coupon: 1.00% | Maturity: 26/5/2029 | Rating: BB+ | ISIN: XS2345996743 | Z-spread up by 71.0 bp to 181.8 bp (CDS basis: -44.0bp), with the yield to worst at 2.5% and the bond now trading down to 90.2 cents on the dollar (1Y price range: 90.0-97.8).

- Issuer: Rolls-Royce PLC (Birmingham, United Kingdom) | Coupon: 4.63% | Maturity: 16/2/2026 | Rating: BB- | ISIN: XS2244322082 | Z-spread up by 64.6 bp to 272.6 bp (CDS basis: -92.3bp), with the yield to worst at 2.9% and the bond now trading down to 105.2 cents on the dollar (1Y price range: 105.1-110.9).

- Issuer: Schaeffler AG (Herzogenaurach, Germany) | Coupon: 2.75% | Maturity: 12/10/2025 | Rating: BB+ | ISIN: DE000A289Q91 | Z-spread up by 57.4 bp to 181.4 bp, with the yield to worst at 2.1% and the bond now trading down to 101.6 cents on the dollar (1Y price range: 101.4-106.3).

- Issuer: ZF Europe Finance BV (Amsterdam, Netherlands) | Coupon: 2.00% | Maturity: 23/2/2026 | Rating: BB+ | ISIN: XS2010039381 | Z-spread up by 55.6 bp to 279.4 bp, with the yield to worst at 3.1% and the bond now trading down to 95.3 cents on the dollar (1Y price range: 95.0-100.9).

- Issuer: Mytilineos Financial Partners SA (Luxembourg, Luxembourg) | Coupon: 2.50% | Maturity: 1/12/2024 | Rating: BB- | ISIN: XS2010038144 | Z-spread up by 52.4 bp to 241.2 bp, with the yield to worst at 2.6% and the bond now trading down to 99.4 cents on the dollar (1Y price range: 98.9-101.9).

- Issuer: Banca Monte dei Paschi di Siena SpA (Siena, Italy) | Coupon: 2.63% | Maturity: 28/4/2025 | Rating: CCC+ | ISIN: XS2110110686 | Z-spread up by 51.0 bp to 363.8 bp (CDS basis: 104.9bp), with the yield to worst at 3.7% and the bond now trading down to 96.0 cents on the dollar (1Y price range: 95.6-100.0).

- Issuer: Volvo Car AB (Goeteborg, Sweden) | Coupon: 2.00% | Maturity: 24/1/2025 | Rating: BB+ | ISIN: XS1724626699 | Z-spread up by 50.3 bp to 152.2 bp, with the yield to worst at 1.7% and the bond now trading down to 100.3 cents on the dollar (1Y price range: 100.0-104.1).

- Issuer: Atlantia SpA (Rome, Italy) | Coupon: 1.63% | Maturity: 3/2/2025 | Rating: BB- | ISIN: XS1558491855 | Z-spread up by 48.1 bp to 191.4 bp (CDS basis: -65.9bp), with the yield to worst at 2.0% and the bond now trading down to 98.2 cents on the dollar (1Y price range: 98.0-101.6).