Credit

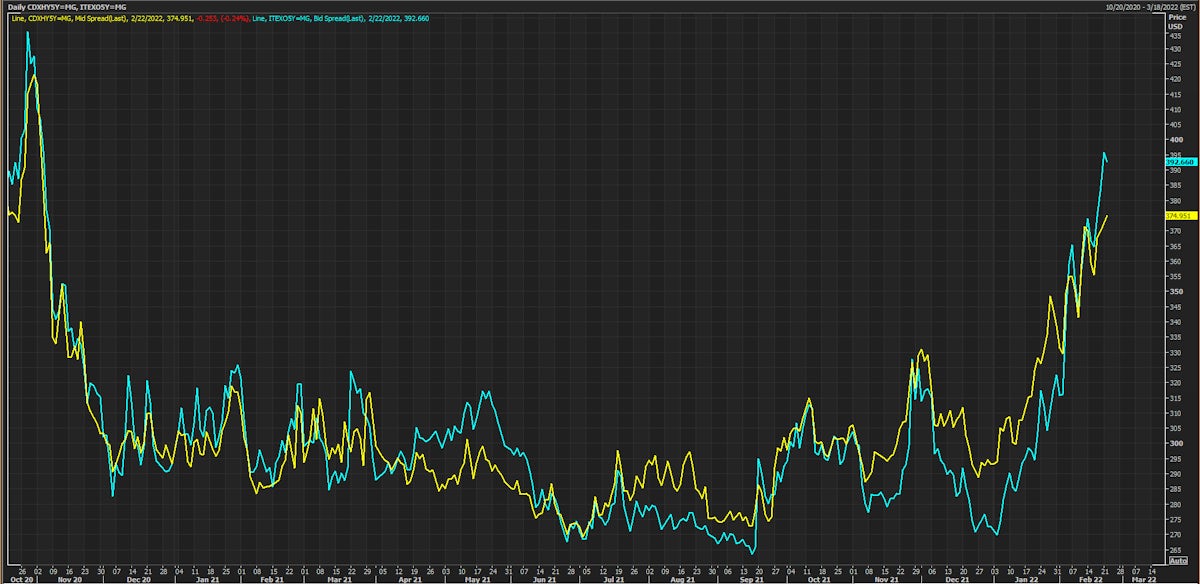

Spreads On High Yield CDS Indices At Widest Since 2020, CDX.NA.HY 5Y Now At 375bp

Despite the still considerable level of rates volatility, a handful of US$ IG deals priced today, led by ConocoPhillips' $2.9bn 3-tranche offering

Published ET

CDX.NA.HY 5Y & iTRAXX EU XOVER 5Y CDS Indices Bid Spreads | Source: Refinitiv

QUICK SUMMARY

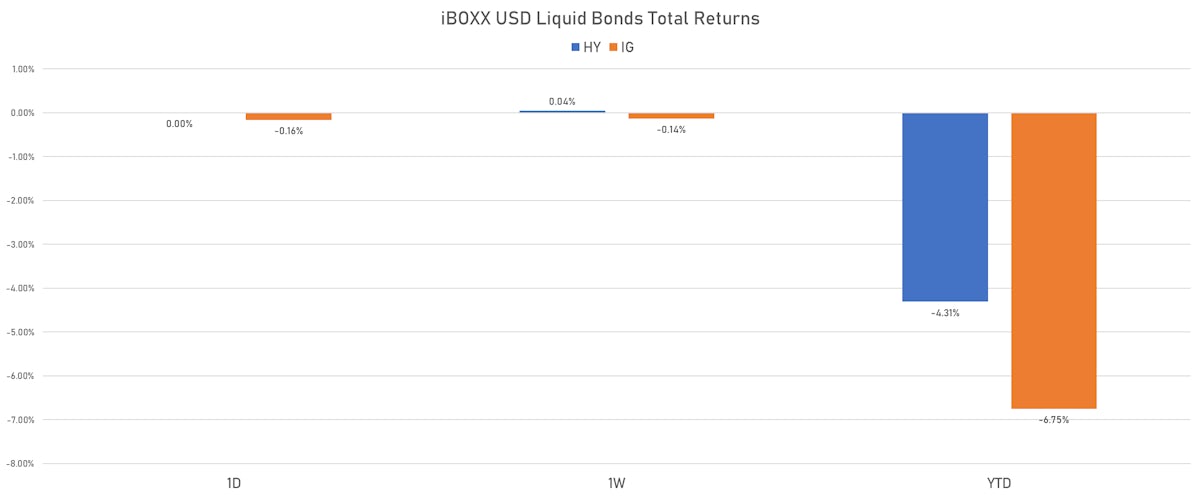

- S&P 500 Bond Index was down -0.09% today, with investment grade down -0.10% and high yield unchanged (YTD total return: -5.40%)

- The iBoxx USD Liquid Investment Grade Total Return Index was down -0.164% today (Month-to-date: -3.04%; Year-to-date: -6.75%)

- The iBoxx USD Liquid High Yield Total Return Index was down -0.003% today (Month-to-date: -1.49%; Year-to-date: -4.31%)

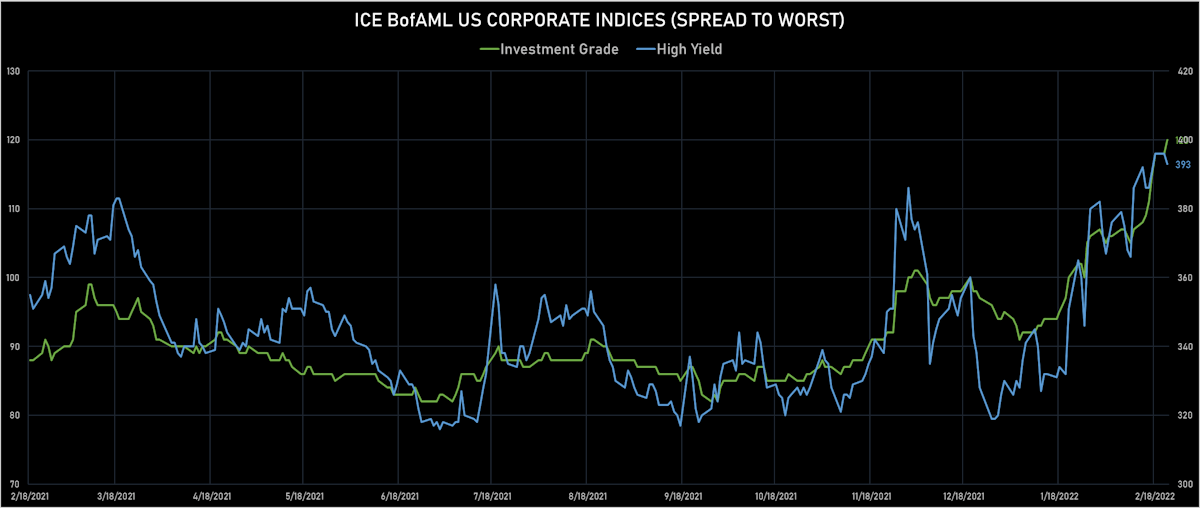

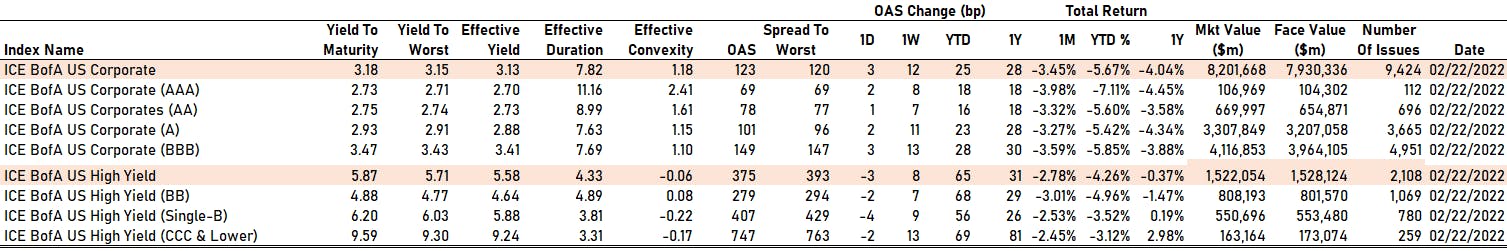

- ICE BofA US Corporate Index (Investment Grade) spread to worst up 2.0 bp, now at 120.0 bp (YTD change: +25.0 bp)

- ICE BofA US High Yield Index spread to worst down -3.0 bp, now at 393.0 bp (YTD change: +63.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index down -0.07% today (YTD total return: -0.4%)

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING

- AAA up by 2 bp at 69 bp

- AA up by 1 bp at 78 bp

- A up by 2 bp at 101 bp

- BBB up by 3 bp at 149 bp

- BB down by -2 bp at 279 bp

- B down by -4 bp at 407 bp

- CCC down by -2 bp at 747 bp

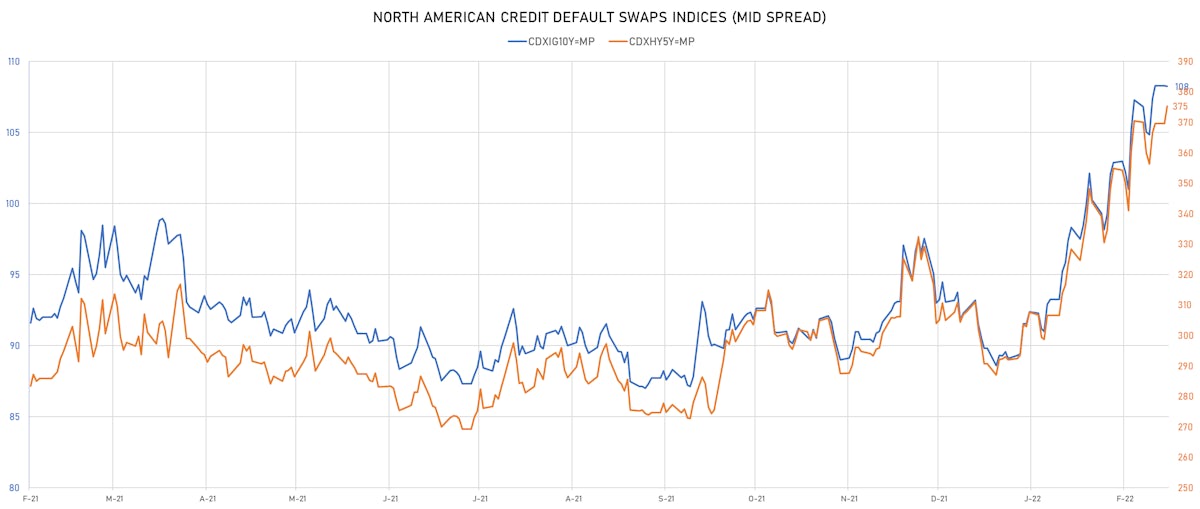

CDS INDICES (mid-spreads)

- Markit CDX.NA.IG 5Y unchanged at 108bp (YTD change: +19.2bp)

- Markit CDX.NA.HY 5Y up 5.7 bp, now at 375bp (YTD change: +83.4bp)

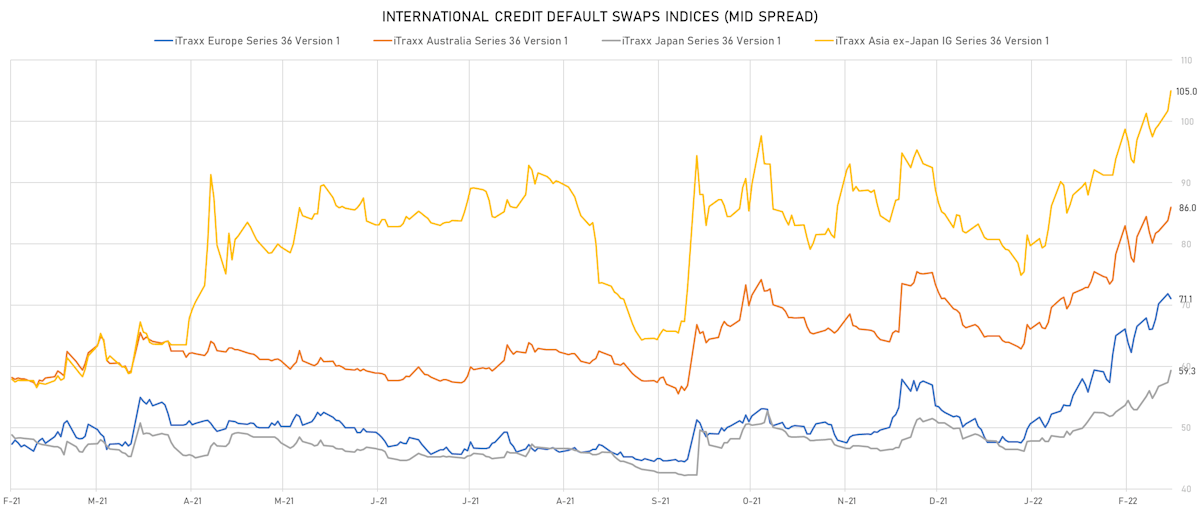

- Markit iTRAXX Europe down 0.8 bp, now at 71bp (YTD change: +23.4bp)

- Markit iTRAXX Japan up 2.0 bp, now at 59bp (YTD change: +12.9bp)

- Markit iTRAXX Asia Ex-Japan up 3.2 bp, now at 105bp (YTD change: +25.9bp)

USD CDS SINGLE NAMES - LARGEST MOVES IN THE PAST WEEK

- Meritor Inc (Country: US; rated: Ba3): down 212.2 bp to 79.5bp (1Y range: 80-315bp)

- Macy's Inc (Country: US; rated: Ba2): down 27.1 bp to 289.4bp (1Y range: 181-470bp)

- Staples Inc (Country: US; rated: B3): down 16.5 bp to 1,092.0bp (1Y range: 687-1,159bp)

- Liberty Interactive LLC (Country: US; rated: Ba3): up 16.2 bp to 586.9bp (1Y range: 287-587bp)

- Toll Brothers Inc (Country: US; rated: WR): up 16.3 bp to 158.9bp (1Y range: 82-159bp)

- Xerox Corp (Country: US; rated: Ba2): up 17.0 bp to 295.5bp (1Y range: 158-297bp)

- Interval Acquisition Corp (Country: US; rated: WR): up 17.3 bp to 570.8bp (1Y range: 329-571bp)

- Turkey, Republic of (Government) (Country: TR; rated: B+): up 22.4 bp to 545.3bp (1Y range: 288-620bp)

- Beazer Homes USA Inc (Country: US; rated: B2): up 25.9 bp to 424.6bp (1Y range: 261-425bp)

- Lumen Technologies Inc (Country: US; rated: Ba3): up 30.9 bp to 525.6bp (1Y range: 195-533bp)

- Tegna Inc (Country: US; rated: Ba3): up 37.0 bp to 508.3bp (1Y range: 148-508bp)

- American Airlines Group Inc (Country: US; rated: B2): up 52.7 bp to 844.7bp (1Y range: 596-1,074bp)

- CSC Holdings LLC (Country: US; rated: LGD3 - 30%): up 55.8 bp to 462.3bp (1Y range: -462bp)

- Transocean Inc (Country: KY; rated: Caa3): up 127.4 bp to 2,110.4bp (1Y range: 941-2,110bp)

- Russia, Federation of (Government) (Country: RU; rated: P-3): up 127.6 bp to 344.9bp (1Y range: 77-345bp)

EURO CDS SINGLE NAMES - LARGEST MOVES IN THE PAST WEEK

- Ceconomy AG (Country: DE; rated: Ba1): up 19.6 bp to 283.7bp (1Y range: 126-284bp)

- Telefonaktiebolaget LM Ericsson (Country: SE; rated: Ba1): up 20.1 bp to 119.0bp (1Y range: 59-119bp)

- Atlantia SpA (Country: IT; rated: Ba2): up 20.3 bp to 185.2bp (1Y range: 97-185bp)

- Ardagh Packaging Finance PLC (Country: IE; rated: B1): up 22.0 bp to 376.8bp (1Y range: 210-377bp)

- UPC Holding BV (Country: NL; rated: LGD6 - 93%): up 22.5 bp to 208.3bp (1Y range: 164-267bp)

- Altice Finco SA (Country: LU; rated: Caa1): up 23.4 bp to 522.9bp (1Y range: 333-535bp)

- TDC Holding A/S (Country: DK; rated: ): up 27.6 bp to 182.1bp (1Y range: 142-182bp)

- Ladbrokes Coral Group Ltd (Country: GB; rated: WR): up 27.8 bp to 278.6bp (1Y range: 107-279bp)

- Stena AB (Country: SE; rated: B2-PD): up 28.5 bp to 524.6bp (1Y range: 401-728bp)

- TUI AG (Country: DE; rated: B3-PD): up 28.7 bp to 654.3bp (1Y range: 607-946bp)

- Monitchem Holdco 3 SA (Country: LU; rated: B2): up 30.1 bp to 271.4bp (1Y range: 186-309bp)

- CMA CGM SA (Country: FR; rated: Ba3): up 68.4 bp to 440.3bp (1Y range: 259-476bp)

- Boparan Finance PLC (Country: GB; rated: B3): up 93.3 bp to 1,460.6bp (1Y range: 648-1,565bp)

- Casino Guichard Perrachon SA (Country: FR; rated: WR): up 131.3 bp to 916.9bp (1Y range: 464-917bp)

- Novafives SAS (Country: FR; rated: Caa1): up 136.0 bp to 1,088.5bp (1Y range: 618-1,088bp)

SELECTED RECENT USD BOND ISSUES

- ConocoPhillips Co (Oil and Gas | Houston, Texas, United States | Rating: A-): US$900m Senior Note (US20826FAU03), fixed rate (2.40% coupon) maturing on 7 March 2025, priced at 99.88 (original spread of 70 bp), callable (3nc1)

- ConocoPhillips Co (Oil and Gas | Houston, Texas, United States | Rating: A-): US$900m Senior Note (US20826FAT30), fixed rate (2.13% coupon) maturing on 8 March 2024, priced at 99.97 (original spread of 60 bp), callable (2nc6m)

- ConocoPhillips Co (Oil and Gas | Houston, Texas, United States | Rating: A-): US$1,100m Senior Note (US20826FAV85), fixed rate (3.80% coupon) maturing on 15 March 2052, priced at 99.84 (original spread of 177 bp), callable (30nc30)

- Eversource Energy (Utility - Other | Springfield, Massachusetts, United States | Rating: BBB+): US$650m Senior Note (US30040WAP32), fixed rate (3.38% coupon) maturing on 1 March 2032, priced at 99.80 (original spread of 145 bp), callable (10nc10)

- Eversource Energy (Utility - Other | Springfield, Massachusetts, United States | Rating: BBB+): US$650m Senior Note (US30040WAQ15), fixed rate (2.90% coupon) maturing on 1 March 2027, priced at 99.90 (original spread of 105 bp), callable (5nc5)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$300m Bond (US3133ENPY04), fixed rate (1.75% coupon) maturing on 25 February 2025, priced at 100.00, non callable

- Federal Home Loan Banks (Agency | Washington, United States | Rating: NR): US$120m Bond (US3130AR4D03), fixed rate (2.00% coupon) maturing on 10 March 2025, priced at 100.00 (original spread of 159 bp), callable (3nc3m)

- Goldman Sachs Finance Corp International Ltd (Financial - Other | Saint Helier, United States | Rating: NR): US$1,000m Unsecured Note (XS2061672544), floating rate maturing on 17 March 2042, priced at 100.00, non callable

- Moody's Corp (Service - Other | New York City, New York, United States | Rating: BBB+): US$500m Senior Note (US615369AY18), fixed rate (3.75% coupon) maturing on 25 February 2052, priced at 98.28 (original spread of 184 bp), callable (30nc30)

- Ryder System Inc (Service - Other | Medley, United States | Rating: BBB): US$450m Senior Note (US78355HKT58), fixed rate (2.85% coupon) maturing on 1 March 2027, priced at 99.85 (original spread of 105 bp), with a make whole call

- Stanley Black & Decker Inc (Building Products | New Britain, Connecticut, United States | Rating: A-): US$500m Senior Note (US854502AP61), fixed rate (2.30% coupon) maturing on 24 February 2025, priced at 99.87 (original spread of 63 bp), callable (3nc1)

- Stanley Black & Decker Inc (Building Products | New Britain, Connecticut, United States | Rating: A-): US$500m Senior Note (US854502AQ45), fixed rate (3.00% coupon) maturing on 15 May 2032, priced at 99.81 (original spread of 111 bp), callable (10nc10)

- Agricultural Bank of China Ltd (Hong Kong Branch) (Banking | China (Mainland) | Rating: A): US$300m Senior Note (XS2436799584), fixed rate (2.25% coupon) maturing on 1 March 2027, priced at 99.48 (original spread of 50 bp), non callable

- Agricultural Bank of China Ltd (Hong Kong Branch) (Banking | China (Mainland) | Rating: A): US$600m Senior Note (XS2436799238), fixed rate (2.00% coupon) maturing on 1 March 2025, priced at 99.75 (original spread of 35 bp), non callable

- Sunny Express Enterprises Corp (Financial - Other | China (Mainland) | Rating: A-): US$700m Senior Note (XS2434699968), fixed rate (2.95% coupon) maturing on 1 March 2027, priced at 99.77, with a make whole call

SELECTED RECENT EUR BOND ISSUES

- Credit Agricole SA (Banking | Montrouge, Ile-De-France, France | Rating: AA-): €700m Bond (FR0014008MH7), fixed rate (1.10% coupon) maturing on 23 August 2028, priced at 100.00, non callable

- Ile-de-France Mobilites (Transportation - Other | Paris, Ile-De-France, France | Rating: AA-): €140m Bond (FR0014008NY0), fixed rate (1.59% coupon) maturing on 23 February 2052, priced at 100.00, non callable

- KfW (Agency | Frankfurt, Hessen, Germany | Rating: AAA): €5,000m Inhaberschuldverschreibung (DE000A3MP7J5), fixed rate (0.13% coupon) maturing on 30 June 2025, priced at 99.91 (original spread of 35 bp), non callable

- Landeskreditbank Baden Wuerttemberg Foerderbank (Agency | Karlsruhe, Baden-Wuerttemberg, Germany | Rating: AA+): €1,000m Inhaberschuldverschreibung (DE000A3MQPJ2), fixed rate (0.38% coupon) maturing on 25 February 2027, priced at 99.63, non callable

NEW LOANS

- Storable Inc (B), signed a US$ 130m Term Loan B, maturing on 04/16/28, with initial pricing set at Term SOFR +350bp