Credit

Duration Remains The Main Driver Of Price Action, As IG Spreads Were Close To Unchanged Today

After a hiatus of a couple of weeks, the high yield primary market saw a new offering priced today, with Twitter raising $1bn in a single tranche (8-year non-callable yielding 5%)

Published ET

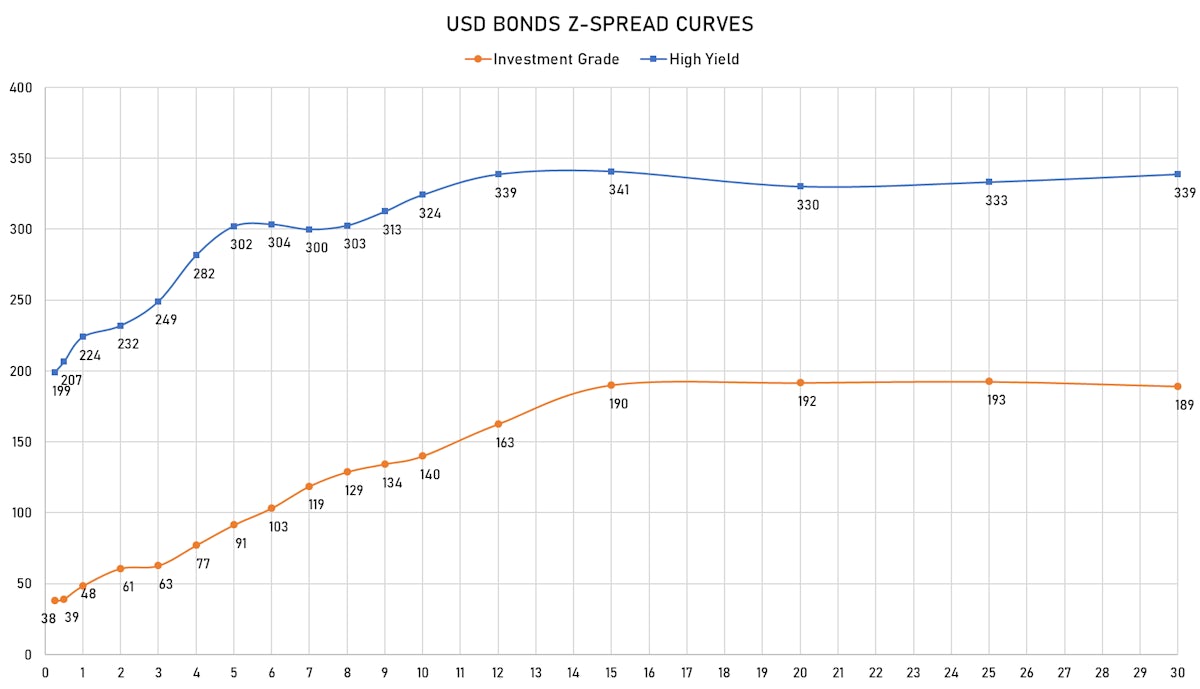

US$ Bonds Z-Spread Curves | Sources: ϕpost, Refinitiv data

QUICK SUMMARY

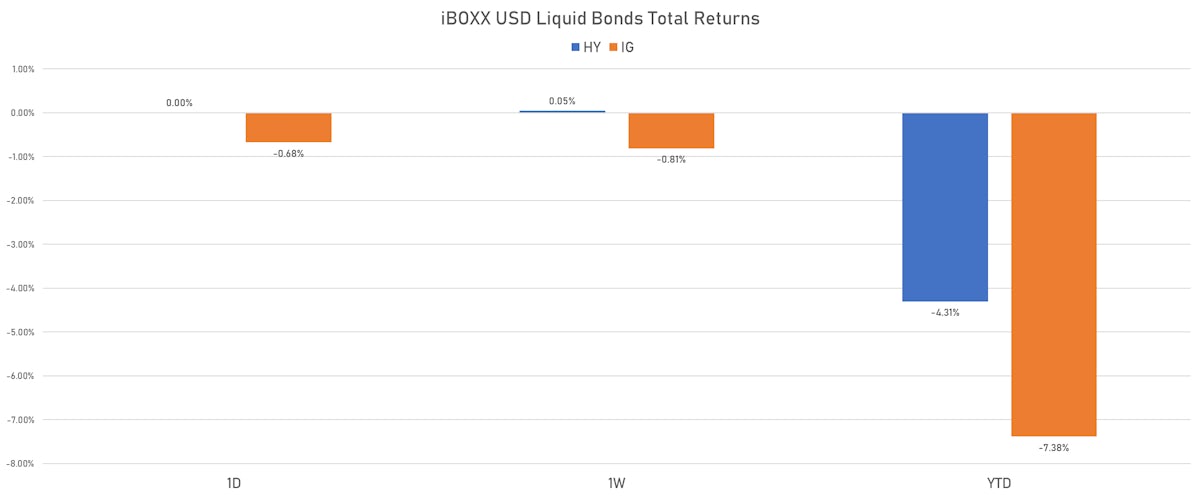

- S&P 500 Bond Index was down -0.62% today, with investment grade down -0.68% and high yield down -0.11% (YTD total return: -5.91%)

- The iBoxx USD Liquid Investment Grade Total Return Index was down -0.678% today (Month-to-date: -3.70%; Year-to-date: -7.38%)

- The iBoxx USD Liquid High Yield Total Return Index was up 0.005% today (Month-to-date: -1.48%; Year-to-date: -4.31%)

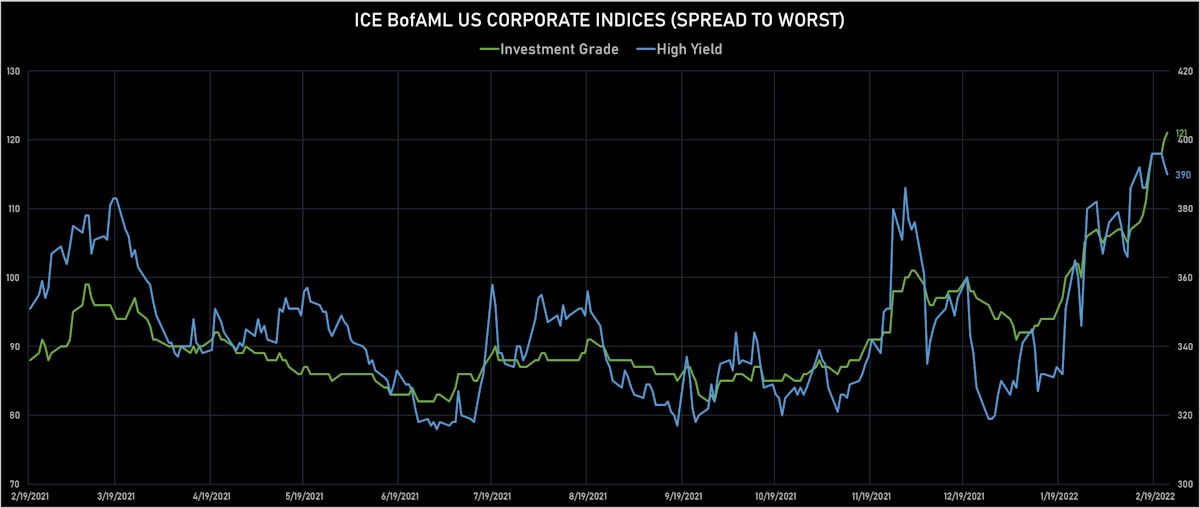

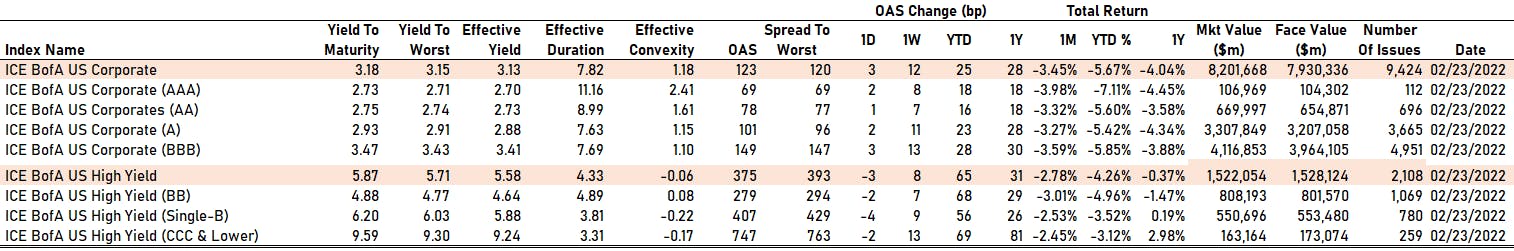

- ICE BofA US Corporate Index (Investment Grade) spread to worst up 1.0 bp, now at 121.0 bp (YTD change: +26.0 bp)

- ICE BofA US High Yield Index spread to worst down -3.0 bp, now at 390.0 bp (YTD change: +60.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index down -0.07% today (YTD total return: -0.4%)

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING

- AAA unchanged at 69 bp

- AA up by 1 bp at 79 bp

- A up by 1 bp at 102 bp

- BBB up by 1 bp at 150 bp

- BB down by -4 bp at 275 bp

- B down by -4 bp at 403 bp

- CCC down by -2 bp at 745 bp

CDS INDICES (mid-spreads)

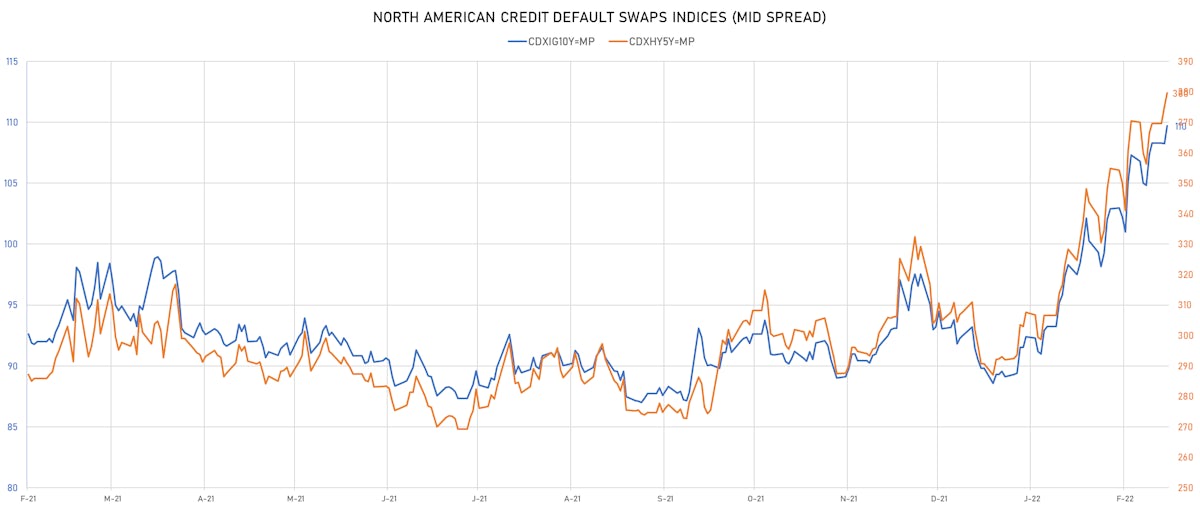

- Markit CDX.NA.IG 5Y up 1.5 bp, now at 110bp (YTD change: +20.6bp)

- Markit CDX.NA.HY 5Y up 4.3 bp, now at 380bp (YTD change: +87.7bp)

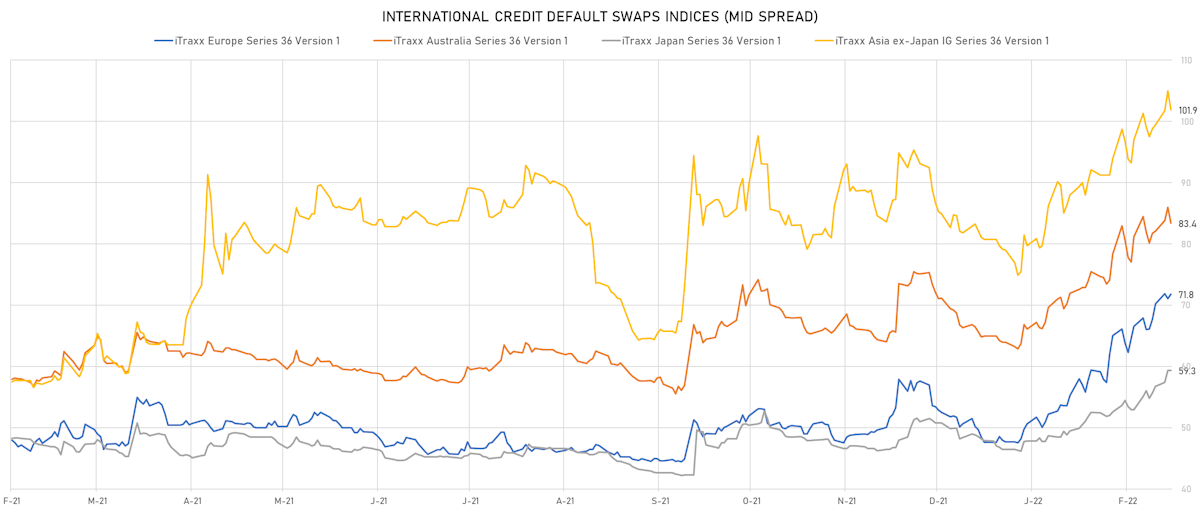

- Markit iTRAXX Europe up 0.7 bp, now at 72bp (YTD change: +24.1bp)

- Markit iTRAXX Japan unchanged at 59bp (YTD change: +12.9bp)

- Markit iTRAXX Asia Ex-Japan down 3.1 bp, now at 102bp (YTD change: +22.9bp)

TOP BONDS MOVES IN THE PAST WEEK - USD HY

- Issuer: WeWork Companies LLC (New York City, New York (US)) | Coupon: 5.00% | Maturity: 10/7/2025 | Rating: CCC- | ISIN: USU9621PAA94 | Z-spread up by 93.6 bp to 1,089.9 bp, with the yield to worst at 12.4% and the bond now trading down to 79.1 cents on the dollar (1Y price range: 78.5-84.1).

- Issuer: Sealed Air Corp (Charlotte, North Carolina (US)) | Coupon: 4.00% | Maturity: 1/12/2027 | Rating: BB | ISIN: USU81193AQ42 | Z-spread up by 32.4 bp to 212.8 bp (CDS basis: -15.2bp), with the yield to worst at 3.8% and the bond now trading down to 99.3 cents on the dollar (1Y price range: 98.5-104.3).

- Issuer: Bath & Body Works Inc (Columbus, Ohio (US)) | Coupon: 9.38% | Maturity: 1/7/2025 | Rating: BB | ISIN: USU51407AD34 | Z-spread up by 29.1 bp to 217.2 bp, with the yield to worst at 3.9% and the bond now trading down to 116.5 cents on the dollar (1Y price range: 116.5-122.3).

- Issuer: JBS USA Lux SA (Luxembourg, Luxembourg) | Coupon: 3.00% | Maturity: 2/2/2029 | Rating: BB+ | ISIN: USL56608AJ82 | Z-spread up by 25.7 bp to 188.7 bp, with the yield to worst at 3.8% and the bond now trading down to 94.5 cents on the dollar (1Y price range: 94.5-98.0).

- Issuer: Century Communities Inc (Greenwood Village (US)) | Coupon: 3.88% | Maturity: 15/8/2029 | Rating: BB- | ISIN: USU15662AF37 | Z-spread up by 23.7 bp to 322.7 bp, with the yield to worst at 5.2% and the bond now trading down to 91.5 cents on the dollar (1Y price range: 92.5-101.0).

- Issuer: Starwood Property Trust Inc (Greenwich) | Coupon: 3.75% | Maturity: 31/12/2024 | Rating: B+ | ISIN: USU85656AG86 | Z-spread up by 23.7 bp to 263.1 bp, with the yield to worst at 4.4% and the bond now trading down to 97.9 cents on the dollar (1Y price range: 96.0-101.4).

- Issuer: NCL Corporation Ltd (Miami, Bermuda) | Coupon: 5.88% | Maturity: 15/3/2026 | Rating: CCC+ | ISIN: USG6436QAL08 | Z-spread down by 21.3 bp to 510.1 bp, with the yield to worst at 6.9% and the bond now trading up to 95.9 cents on the dollar (1Y price range: 94.5-100.0).

- Issuer: Sensata Technologies BV (Almelo, Netherlands) | Coupon: 4.88% | Maturity: 15/10/2023 | Rating: BB- | ISIN: USN78840AH33 | Z-spread down by 21.6 bp to 184.1 bp, with the yield to worst at 3.1% and the bond now trading up to 102.3 cents on the dollar (1Y price range: 101.6-105.1).

- Issuer: Southeast Supply Header LLC (Houston, Texas (US)) | Coupon: 4.25% | Maturity: 15/6/2024 | Rating: BB- | ISIN: USU83854AB29 | Z-spread down by 25.3 bp to 229.5 bp, with the yield to worst at 3.7% and the bond now trading up to 100.1 cents on the dollar (1Y price range: 99.0-102.8).

- Issuer: HanesBrands Inc (Winston-Salem, North Carolina (US)) | Coupon: 4.63% | Maturity: 15/5/2024 | Rating: BB- | ISIN: USU24437AD43 | Z-spread down by 38.8 bp to 207.9 bp, with the yield to worst at 3.4% and the bond now trading up to 101.4 cents on the dollar (1Y price range: 100.1-104.5).

- Issuer: EQM Midstream Partners LP (Canonsburg, Pennsylvania (US)) | Coupon: 6.50% | Maturity: 1/7/2027 | Rating: BB- | ISIN: USU26886AB46 | Z-spread down by 40.0 bp to 388.2 bp, with the yield to worst at 5.7% and the bond now trading up to 102.5 cents on the dollar (1Y price range: 99.0-112.0).

TOP BONDS MOVES IN THE PAST WEEK - EUR HY

- Issuer: Metinvest BV (Amsterdam, Netherlands) | Coupon: 5.63% | Maturity: 17/6/2025 | Rating: B+ | ISIN: XS2056722734 | Z-spread up by 1,040.7 bp to 1,884.0 bp, with the yield to worst at 18.7% and the bond now trading down to 69.3 cents on the dollar (1Y price range: 69.3-99.4).

- Issuer: Alfa Holding Issuance PLC (Dublin, Ireland) | Coupon: 2.70% | Maturity: 11/6/2023 | Rating: BB+ | ISIN: XS2183144810 | Z-spread up by 689.8 bp to 1,196.2 bp, with the yield to worst at 11.6% and the bond now trading down to 89.6 cents on the dollar (1Y price range: 89.6-100.6).

- Issuer: CBOM Finance PLC (Dublin, Ireland) | Coupon: 3.10% | Maturity: 21/1/2026 | Rating: BB | ISIN: XS2281299763 | Z-spread up by 328.3 bp to 912.0 bp, with the yield to worst at 9.5% and the bond now trading down to 79.4 cents on the dollar (1Y price range: 79.2-96.0).

- Issuer: Akropolis Group UAB (Vilnius, Lithuania) | Coupon: 2.88% | Maturity: 2/6/2026 | Rating: BB+ | ISIN: XS2346869097 | Z-spread up by 73.3 bp to 427.9 bp, with the yield to worst at 4.7% and the bond now trading down to 92.5 cents on the dollar (1Y price range: 92.3-95.2).

- Issuer: Mytilineos Financial Partners SA (Luxembourg, Luxembourg) | Coupon: 2.50% | Maturity: 1/12/2024 | Rating: BB- | ISIN: XS2010038144 | Z-spread up by 40.4 bp to 286.7 bp, with the yield to worst at 3.1% and the bond now trading down to 98.0 cents on the dollar (1Y price range: 97.8-101.9).

- Issuer: Vivion Investments SARL (Luxembourg, Luxembourg) | Coupon: 3.50% | Maturity: 1/11/2025 | Rating: BB+ | ISIN: XS2070311431 | Z-spread up by 33.3 bp to 542.3 bp, with the yield to worst at 5.3% and the bond now trading down to 92.2 cents on the dollar (1Y price range: 92.0-99.2).

- Issuer: Telefonaktiebolaget LM Ericsson (Stockholm, Sweden) | Coupon: 1.00% | Maturity: 26/5/2029 | Rating: BB+ | ISIN: XS2345996743 | Z-spread up by 30.9 bp to 201.6 bp (CDS basis: -51.8bp), with the yield to worst at 2.7% and the bond now trading down to 88.6 cents on the dollar (1Y price range: 88.2-97.8).

- Issuer: Saipem Finance International BV (Amsterdam, Netherlands) | Coupon: 2.63% | Maturity: 7/1/2025 | Rating: B+ | ISIN: XS1711584430 | Z-spread down by 89.1 bp to 739.6 bp (CDS basis: 266.7bp), with the yield to worst at 7.6% and the bond now trading up to 87.2 cents on the dollar (1Y price range: 73.9-101.2).

- Issuer: Adler Group SA (Senningerberg, Luxembourg) | Coupon: 1.88% | Maturity: 14/1/2026 | Rating: B | ISIN: XS2283224231 | Z-spread down by 118.7 bp to 643.6 bp, with the yield to worst at 6.8% and the bond now trading up to 83.1 cents on the dollar (1Y price range: 77.7-86.2).

- Issuer: Adler Real Estate AG (Berlin, Germany) | Coupon: 2.13% | Maturity: 6/2/2024 | Rating: B | ISIN: XS1731858715 | Z-spread down by 126.5 bp to 661.7 bp, with the yield to worst at 6.6% and the bond now trading up to 91.8 cents on the dollar (1Y price range: 88.8-94.9).

- Issuer: Adler Group SA (Senningerberg, Luxembourg) | Coupon: 1.50% | Maturity: 26/7/2024 | Rating: B | ISIN: XS1652965085 | Z-spread down by 155.2 bp to 746.4 bp, with the yield to worst at 7.5% and the bond now trading up to 86.6 cents on the dollar (1Y price range: 82.7-91.1).

- Issuer: Saipem Finance International BV (Amsterdam, Netherlands) | Coupon: 3.75% | Maturity: 8/9/2023 | Rating: B+ | ISIN: XS1487495316 | Z-spread down by 208.9 bp to 958.6 bp (CDS basis: 257.3bp), with the yield to worst at 9.3% and the bond now trading up to 92.0 cents on the dollar (1Y price range: 76.2-103.4).

SELECTED RECENT USD BOND ISSUES

- Alliant Energy Finance LLC (Utility - Other | Madison, United States | Rating: NR): US$350m Senior Note (US01882YAD85), fixed rate (3.60% coupon) maturing on 1 March 2032, priced at 99.83 (original spread of 165 bp), callable (10nc10)

- Archer-Daniels-Midland Co (Food Processors | Chicago, United States | Rating: A): US$750m Senior Note (US039482AD67), fixed rate (2.90% coupon) maturing on 1 March 2032, priced at 99.79 (original spread of 95 bp), callable (10nc10)

- AutoNation Inc (Retail Stores - Other | Fort Lauderdale, United States | Rating: BBB-): US$700m Senior Note (US05329RAA14), fixed rate (3.85% coupon) maturing on 1 March 2032, priced at 99.84 (original spread of 190 bp), callable (10nc10)

- Bio Rad Laboratories Inc (Health Care Supply | Hercules, United States | Rating: BBB): US$400m Senior Note (US090572AR99), fixed rate (3.30% coupon) maturing on 15 March 2027, priced at 99.79 (original spread of 145 bp), with a make whole call

- Bio Rad Laboratories Inc (Health Care Supply | Hercules, United States | Rating: BBB): US$800m Senior Note (US090572AQ17), fixed rate (3.70% coupon) maturing on 15 March 2032, priced at 99.73 (original spread of 175 bp), with a make whole call

- Centerpoint Energy Houston Electric LLC (Utility - Other | Houston, United States | Rating: BBB+): US$300m Bond (US15189XAX66), fixed rate (3.00% coupon) maturing on 1 March 2032, priced at 99.54 (original spread of 107 bp), callable (10nc10)

- Centerpoint Energy Houston Electric LLC (Utility - Other | Houston, United States | Rating: BBB+): US$500m Bond (US15189XAY40), fixed rate (3.60% coupon) maturing on 1 March 2052, priced at 98.70 (original spread of 159 bp), callable (30nc30)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$575m Bond (US3133ENQH61), floating rate (SOFR + 4.5 bp) maturing on 1 March 2024, priced at 100.00, non callable

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$110m Bond (US3133ENQD57), fixed rate (2.17% coupon) maturing on 1 March 2027, priced at 100.00 (original spread of 56 bp), callable (5nc2)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$150m Bond (US3133ENQC74), fixed rate (1.94% coupon) maturing on 3 September 2024, priced at 100.00 (original spread of 154 bp), callable (3nc3m)

- Goldman Sachs Finance Corp International Ltd (Financial - Other | Saint Helier, United States | Rating: NR): US$1,000m Unsecured Note (XS2061672544), floating rate maturing on 17 March 2042, priced at 100.00, non callable

- Lincoln National Corp (Life Insurance | Radnor, United States | Rating: A-): US$300m Senior Note (US534187BQ10), fixed rate (3.40% coupon) maturing on 1 March 2032, priced at 99.82 (original spread of 146 bp), callable (10nc10)

- Priority Income Fund Inc (Financial - Other | New York City, United States | Rating: NR): US$260m Preferred Stock (US74274W7561), fixed rate (6.38% coupon) maturing on 31 March 2029, priced at 100.00, callable (7nc3)

- Prudential Financial Inc (Life Insurance | Newark, United States | Rating: BBB+): US$1,000m Junior Subordinated Note (US744320BJ04), fixed rate (5.13% coupon) maturing on 1 March 2052, priced at 100.00 (original spread of 309 bp), callable (30nc10)

- Twitter Inc (Service - Other | San Francisco, United States | Rating: BB+): US$1,000m Senior Note (US90184LAP76), fixed rate (5.00% coupon) maturing on 1 March 2030, priced at 100.00 (original spread of 306 bp)

- Wells Fargo & Co (Banking | San Francisco, United States | Rating: BBB+): US$3,500m Senior Note (US95000U2U64), floating rate maturing on 2 March 2033, priced at 100.00, callable (11nc10)

- Weyerhaeuser Co (Real Estate Investment Trust | Seattle, United States | Rating: BBB): US$450m Senior Note (US962166CA07), fixed rate (3.38% coupon) maturing on 9 March 2033, priced at 99.46 (original spread of 145 bp), callable (11nc11)

- Weyerhaeuser Co (Real Estate Investment Trust | Seattle, United States | Rating: BBB): US$450m Senior Note (US962166CB89), fixed rate (4.00% coupon) maturing on 9 March 2052, priced at 98.27 (original spread of 180 bp), callable (30nc30)

SELECTED RECENT EUR BOND ISSUES

- Argenta Spaarbank NV (Banking | Antwerp, Belgium | Rating: A-): €500m Senior Note (BE6333477568), fixed rate (0.75% coupon) maturing on 3 March 2029, priced at 99.61 (original spread of 73 bp), non callable

- Credit Mutuel Home Loan SFH SA (Financial - Other | Paris, France | Rating: NR): €1,500m Obligation de Financement de l'Habitat (Covered Bond) (FR0014008RP9), fixed rate (0.63% coupon) maturing on 4 March 2027, priced at 99.91 (original spread of 65 bp), non callable

- Credit Mutuel Home Loan SFH SA (Financial - Other | Paris, France | Rating: NR): €500m Obligation de Financement de l'Habitat (Covered Bond) (FR0014008RV7), fixed rate (0.88% coupon) maturing on 4 March 2032, priced at 99.43 (original spread of 68 bp), non callable

- Deutsche Bahn Finance GmbH (Financial - Other | Berlin, Germany | Rating: NR): €750m Senior Note (XS2451376219), fixed rate (1.38% coupon) maturing on 3 March 2034, priced at 99.85 (original spread of 114 bp), non callable

- Kommunalkredit Austria AG (Banking | Wien | Rating: BBB-): €250m Pfandbrief Anleihe (Covered Bond) (AT0000A2VL52), fixed rate (0.75% coupon) maturing on 2 March 2027, priced at 99.69 (original spread of 83 bp), non callable

- NATWEST MARKETS PLC (Banking | Edinburgh, United Kingdom | Rating: A-): €1,000m Senior Note (XS2449911143), fixed rate (1.38% coupon) maturing on 2 March 2027, priced at 99.79 (original spread of 138 bp), non callable

- Thuringia, State of (Official and Muni | Erfurt, Germany | Rating: AAA): €500m Landesschatzanweisung (DE000A3MQQT9), fixed rate (0.50% coupon) maturing on 2 March 2029, priced at 99.24 (original spread of 53 bp), non callable

- Unilever Finance Netherlands BV (Financial - Other | Rotterdam, United Kingdom | Rating: A+): €650m Senior Note (XS2450200741), fixed rate (1.25% coupon) maturing on 28 February 2031, priced at 99.77 (original spread of 113 bp), callable (9nc9)

- Unilever Finance Netherlands BV (Financial - Other | Rotterdam, Zuid-Holland, United Kingdom | Rating: A+): €500m Senior Note (XS2450200824), fixed rate (0.75% coupon) maturing on 28 February 2026, priced at 99.86 (original spread of 89 bp), callable (4nc4)

NEW LOANS

- Entegris Inc (BB-), signed a US$ 575m Revolving Credit Facility, to be used for general corporate purposes. It matures on 03/02/27 and initial pricing is set at LIBOR +125bp

- Right Lane International Ltd, signed a US$ 400m Revolving Credit / Term Loan, to be used for refinancing and returning bank debt. It matures on 02/23/25 and initial pricing is set at Term SOFR +136bp