Credit

Spreads Widen Across The Credit Complex As Macro Risks Dominate All Asset Classes

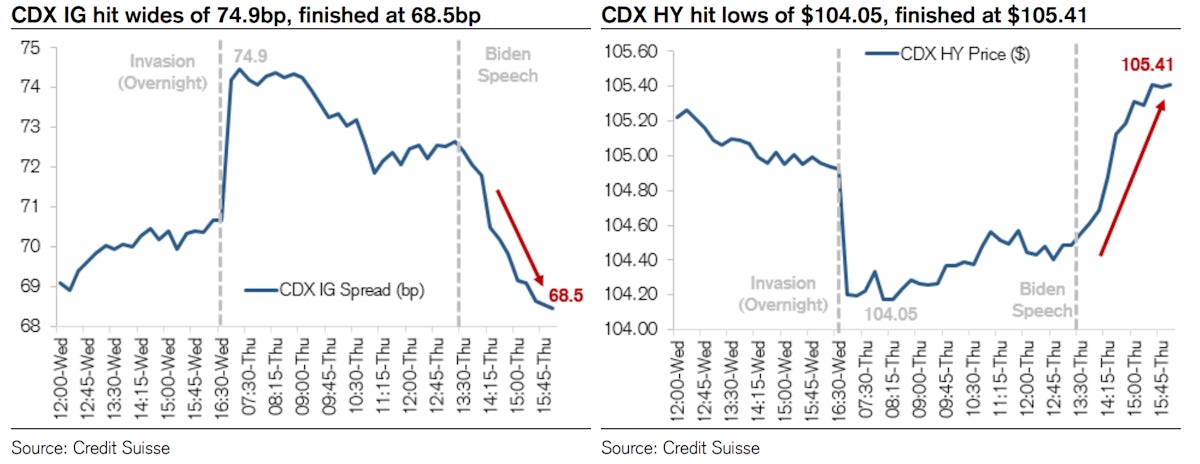

It was a roller coaster in the market today, with overnight and morning action bringing in a ton of protection buyers, followed by a reversal after Biden's speech and into the close

Published ET

CDX IG & HY Intraday Today | Source: Credit Suisse

QUICK SUMMARY

- S&P 500 Bond Index was down -0.24% today, with investment grade down -0.22% and high yield down -0.46% (YTD total return: -6.13%)

- The iBoxx USD Liquid Investment Grade Total Return Index was down -0.038% today (Month-to-date: -3.73%; Year-to-date: -7.42%)

- The iBoxx USD Liquid High Yield Total Return Index was down -0.230% today (Month-to-date: -1.71%; Year-to-date: -4.53%)

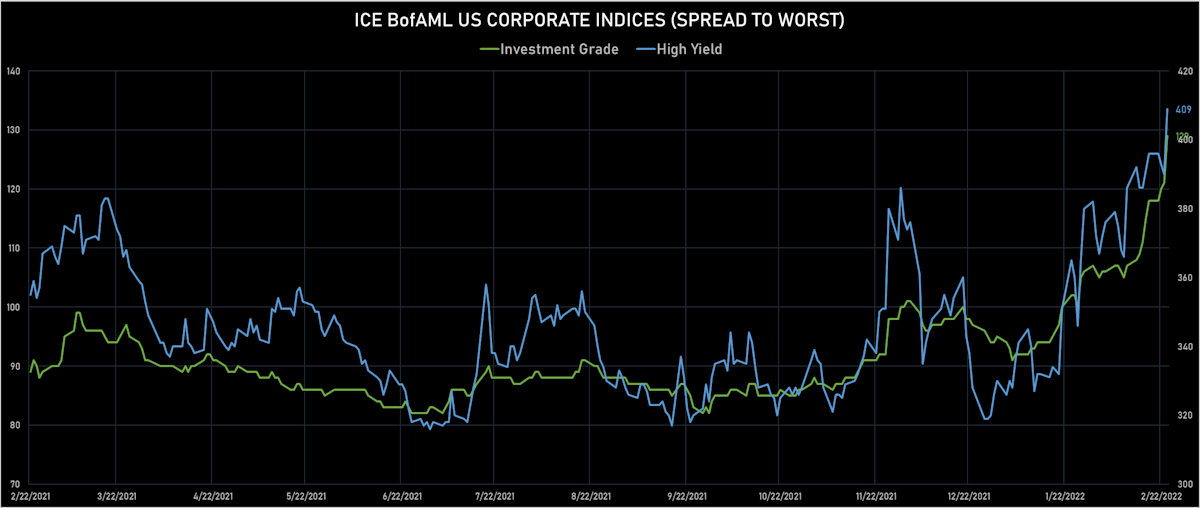

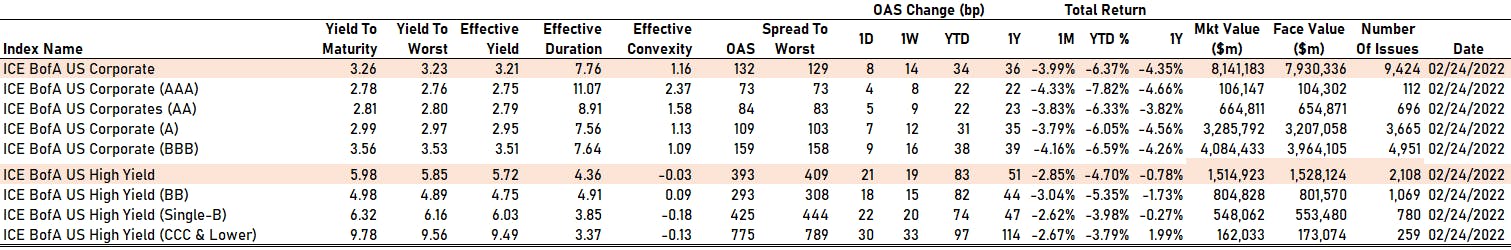

- ICE BofA US Corporate Index (Investment Grade) spread to worst up 8.0 bp, now at 129.0 bp (YTD change: +34.0 bp)

- ICE BofA US High Yield Index spread to worst up 19.0 bp, now at 409.0 bp (YTD change: +79.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index down -0.51% today (YTD total return: -0.9%)

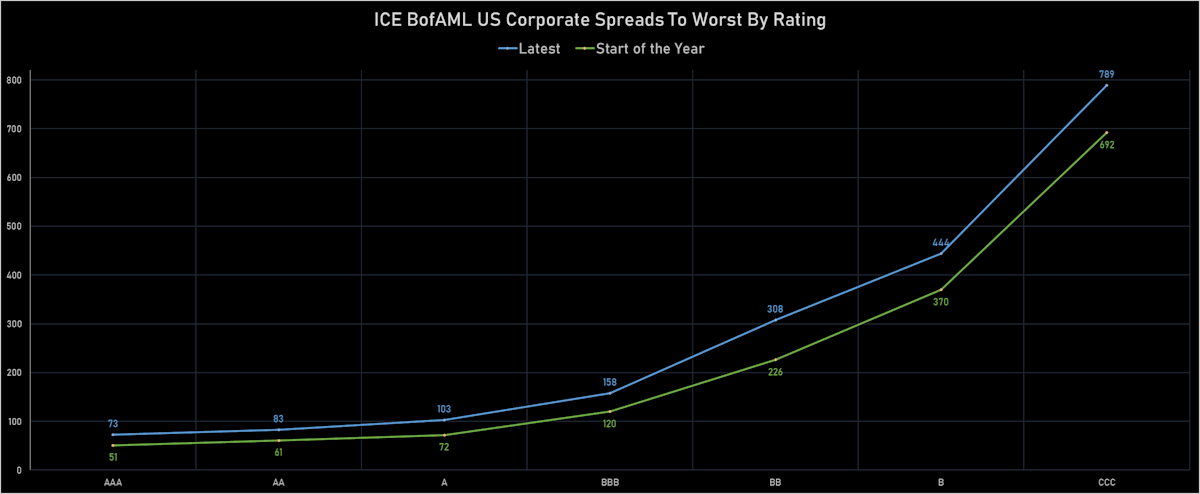

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING

- AAA up by 4 bp at 73 bp

- AA up by 5 bp at 84 bp

- A up by 7 bp at 109 bp

- BBB up by 9 bp at 159 bp

- BB up by 18 bp at 293 bp

- B up by 22 bp at 425 bp

- CCC up by 30 bp at 775 bp

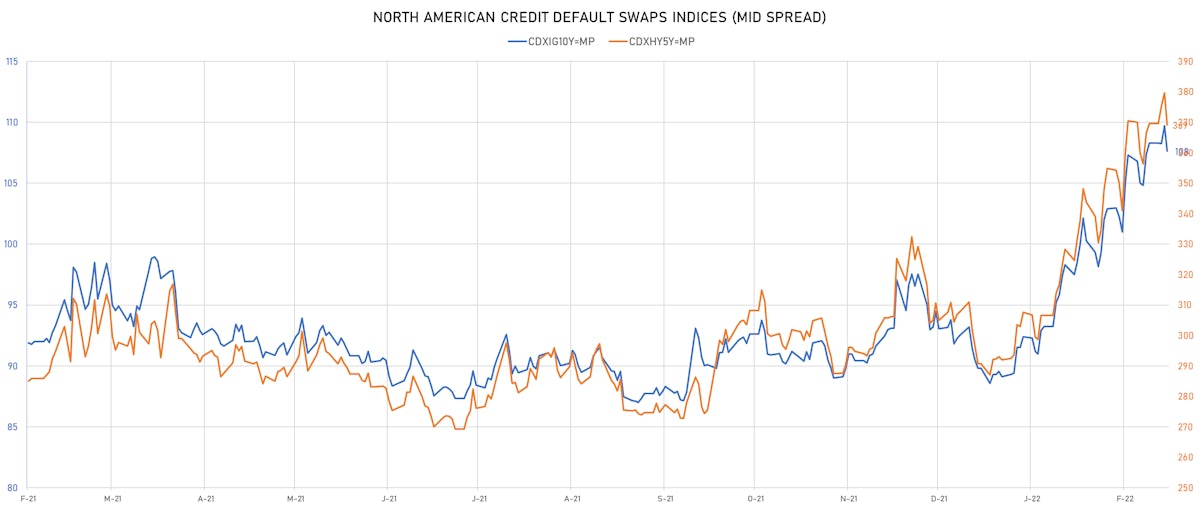

CDS INDICES (mid-spreads)

- Markit CDX.NA.IG 5Y down 2.1 bp, now at 108bp (YTD change: +18.5bp)

- Markit CDX.NA.HY 5Y down 10.5 bp, now at 369bp (YTD change: +77.2bp)

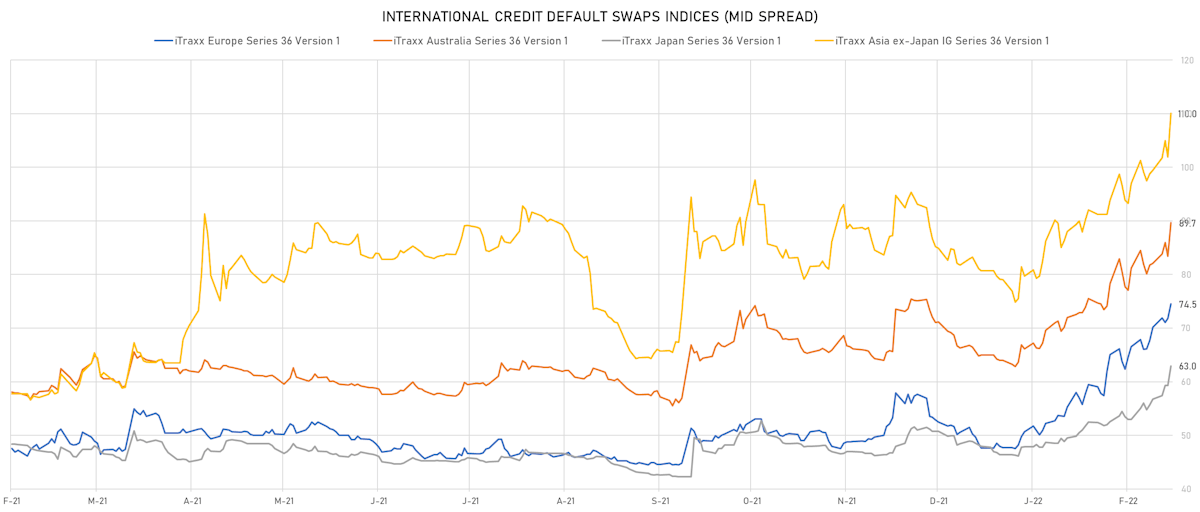

- Markit iTRAXX Europe up 2.7 bp, now at 75bp (YTD change: +26.8bp)

- Markit iTRAXX Japan up 3.6 bp, now at 63bp (YTD change: +16.5bp)

- Markit iTRAXX Asia Ex-Japan up 8.1 bp, now at 110bp (YTD change: +31.0bp)

USD CDS SINGLE NAMES - LARGEST MOVES IN THE PAST WEEK

- Meritor Inc (Country: US; rated: Ba3): down 210.7 bp to 80.2bp (1Y range: 80-315bp)

- American Axle & Manufacturing Inc (Country: US; rated: Ba1): down 41.8 bp to 455.4bp (1Y range: 355-514bp)

- American Airlines Group Inc (Country: US; rated: B2): up 28.2 bp to 868.8bp (1Y range: 596-1,074bp)

- CSC Holdings LLC (Country: US; rated: LGD3 - 30%): up 28.4 bp to 489.2bp (1Y range: -489bp)

- Beazer Homes USA Inc (Country: US; rated: B2): up 28.5 bp to 442.1bp (1Y range: 261-442bp)

- Liberty Interactive LLC (Country: US; rated: Ba3): up 31.0 bp to 609.4bp (1Y range: 287-609bp)

- Bombardier Inc (Country: CA; rated: Caa1): up 32.1 bp to 489.0bp (1Y range: 395-823bp)

- Lumen Technologies Inc (Country: US; rated: Ba3): up 33.8 bp to 547.9bp (1Y range: 195-548bp)

- RR Donnelley & Sons Co (Country: US; rated: WR): up 35.2 bp to 222.0bp (1Y range: 119-588bp)

- Tegna Inc (Country: US; rated: Ba3): up 39.8 bp to 517.5bp (1Y range: 148-517bp)

- Nabors Industries Inc (Country: US; rated: B3): up 44.1 bp to 728.3bp (1Y range: 504-1,098bp)

- Egypt, Arab Republic of (Government) (Country: EG; rated: B): up 51.3 bp to 586.3bp (1Y range: 319-598bp)

- Turkey, Republic of (Government) (Country: TR; rated: B+): up 66.8 bp to 601.6bp (1Y range: 291-620bp)

- Transocean Inc (Country: KY; rated: Caa3): up 143.1 bp to 2,173.6bp (1Y range: 941-2,174bp)

- Russia, Federation of (Government) (Country: RU; rated: P-3): up 606.8 bp to 889.3bp (1Y range: 77-889bp)

EURO CDS SINGLE NAMES - LARGEST MOVES IN THE PAST WEEK

- UPC Holding BV (Country: NL; rated: LGD6 - 93%): up 32.1 bp to 232.5bp (1Y range: 164-267bp)

- Stena AB (Country: SE; rated: B2-PD): up 35.9 bp to 549.1bp (1Y range: 401-728bp)

- Rolls-Royce PLC (Country: GB; rated: BB-): up 37.2 bp to 264.0bp (1Y range: 161-291bp)

- Altice Finco SA (Country: LU; rated: Caa1): up 38.1 bp to 552.1bp (1Y range: 333-552bp)

- Ardagh Packaging Finance PLC (Country: IE; rated: B1): up 38.1 bp to 406.8bp (1Y range: 210-407bp)

- TUI AG (Country: DE; rated: B3-PD): up 38.3 bp to 673.6bp (1Y range: 607-946bp)

- Renault SA (Country: FR; rated: Ba2): up 44.8 bp to 269.3bp (1Y range: 166-269bp)

- thyssenkrupp AG (Country: DE; rated: B1): up 45.8 bp to 337.1bp (1Y range: 205-337bp)

- Premier Foods Finance PLC (Country: GB; rated: B1): up 46.8 bp to 324.0bp (1Y range: 154-324bp)

- CMA CGM SA (Country: FR; rated: Ba3): up 47.6 bp to 463.1bp (1Y range: 259-476bp)

- Air France KLM SA (Country: FR; rated: B-): up 52.9 bp to 471.8bp (1Y range: 386-560bp)

- Monitchem Holdco 3 SA (Country: LU; rated: B2): up 56.4 bp to 303.3bp (1Y range: 186-309bp)

- Casino Guichard Perrachon SA (Country: FR; rated: WR): up 122.4 bp to 984.5bp (1Y range: 464-985bp)

- Boparan Finance PLC (Country: GB; rated: B3): up 142.3 bp to 1,572.6bp (1Y range: 648-1,573bp)

- Novafives SAS (Country: FR; rated: Caa1): up 177.1 bp to 1,204.4bp (1Y range: 618-1,204bp)

SELECTED RECENT USD BOND ISSUES

- JP Morgan Structured Products BV (Financial - Other | Amsterdam, United States | Rating: NR): US$150m Unsecured Note (XS1450778342) zero coupon maturing on 3 March 2027, priced at 100.00, non callable

SELECTED RECENT EUR BOND ISSUES

- BAWAG PSK Bank fuer Arbeit und Wirtschaft und Oesterreichische Postsparkasse AG (Banking | Wien, Austria | Rating: AAA): €150m Fundierte Schuldverschreibungen (Covered Bond) (AT0000A2VJJ4) zero coupon maturing on 25 February 2027, priced at 97.30, non callable

- Deutsche Bank AG (Banking | Frankfurt, Hessen, Germany | Rating: BBB+): €500m Inhaberschuldverschreibung (DE000DB9U6N3), fixed rate (0.40% coupon) maturing on 17 March 2025, priced at 100.00 (original spread of 3 bp), non callable

NEW LOANS

- Mondelez International Inc (BBB), signed a US$ 4,500m Revolving Credit Facility, to be used for general corporate purposes. It matures on 02/23/27 and initial pricing is set at Term SOFR +81.5bp

- Mondelez International Inc (BBB), signed a US$ 2,500m 364d Revolver, to be used for general corporate purposes. It matures on 02/22/23 and initial pricing is set at Term SOFR +84bp

- We Soda Ltd, signed a US$ 1,200m Term Loan, to be used for general corporate purposes

- Entegris Inc (BB-), signed a US$ 575m Revolving Credit Facility, to be used for general corporate purposes. It matures on 03/02/27 and initial pricing is set at LIBOR +125bp

- Right Lane International Ltd, signed a US$ 400m Revolving Credit / Term Loan, to be used for refinancing and returning bank debt. It matures on 02/23/25 and initial pricing is set at Term SOFR +136bp

NEW ISSUES IN SECURITIZED CREDIT

- Toyota Lease Owner Trust 2022-A issued a fixed-rate ABS backed by auto receivables in 4 tranches, for a total of US$ 1,045 m. Highest-rated tranche offering a coupon of 1.73%, and the lowest-rated tranche a yield to maturity of 2.10%. Bookrunners: SG Americas Securities LLC, Bank of America Merrill Lynch, Credit Agricole Corporate & Investment Bank, TD Securities (USA) LLC

- Thirax 2 Llc issued a fixed-rate ABS backed by aircraft leases in 1 tranche, for a total of US$ 137 m. Highest-rated tranche offering a coupon of 0.00%, and the lowest-rated tranche a coupon of 0.00%. Bookrunners: JP Morgan & Co Inc, Citigroup Global Markets Inc

- Dt Auto Owner Trust 2022-1 issued a fixed-rate ABS backed by auto receivables in 5 tranches, for a total of US$ 396 m. Highest-rated tranche offering a yield to maturity of 1.58%, and the lowest-rated tranche a yield to maturity of 5.54%. Bookrunners: Deutsche Bank Securities Inc, Citigroup Global Markets Inc, Wells Fargo Securities LLC