Credit

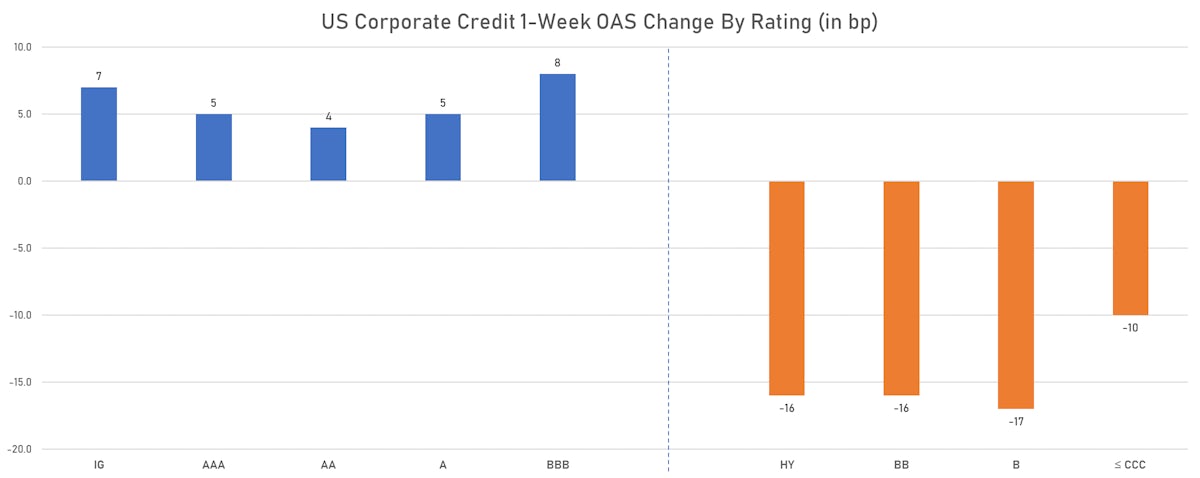

Good Rebound In High Yield Today, With Cash Spreads Down 28bp And CDX HY Down 10bp

Mediocre volumes of for the week in the primary US$ bond market, with rates volatility at extreme levels (IFR Markets data): 25 tranches for $18.0bn in IG (2022 YTD $234.1bn vs 2021 YTD $255.4bn) and 1 tranche for $1bn in HY (2022 YTD volume $31.7bn vs 2021 YTD $US$87.9bn)

Published ET

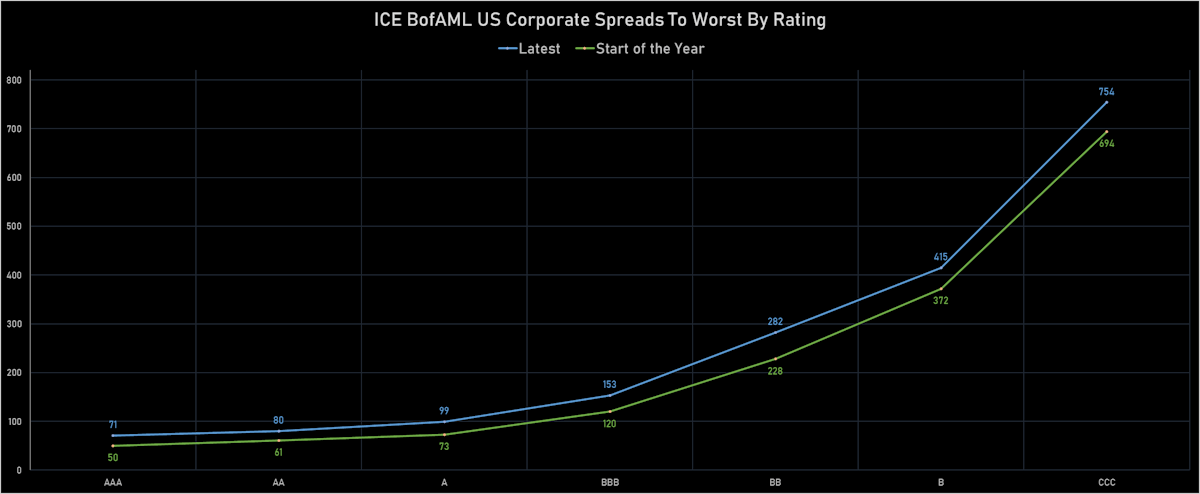

1-Week Change In US Corporate OAS By Credit Rating | Sources: ϕpost, FactSet data

QUICK SUMMARY

- S&P 500 Bond Index was up 0.39% today, with investment grade up 0.33% and high yield up 0.88% (YTD total return: -5.77%)

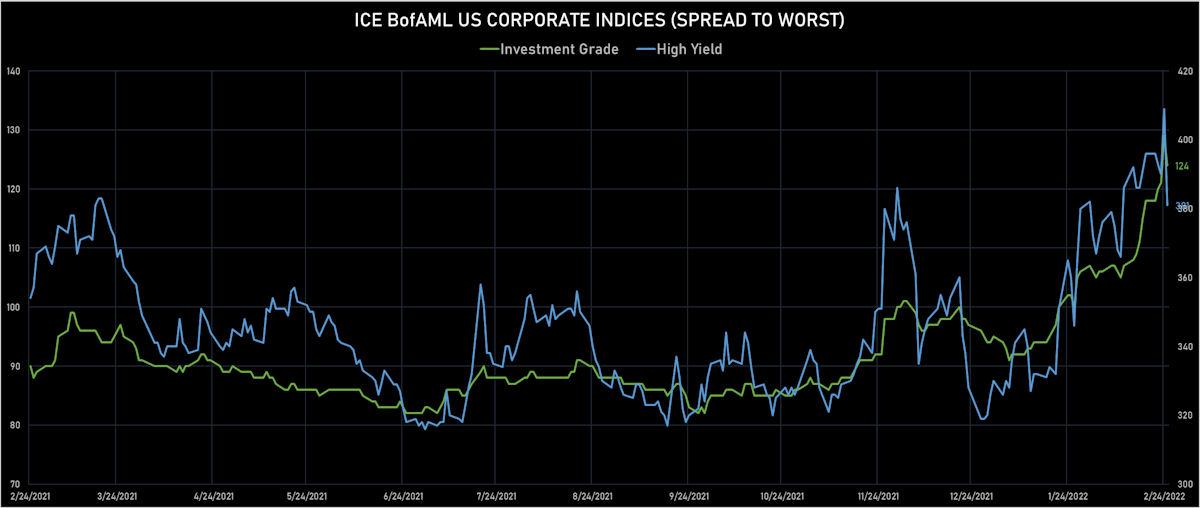

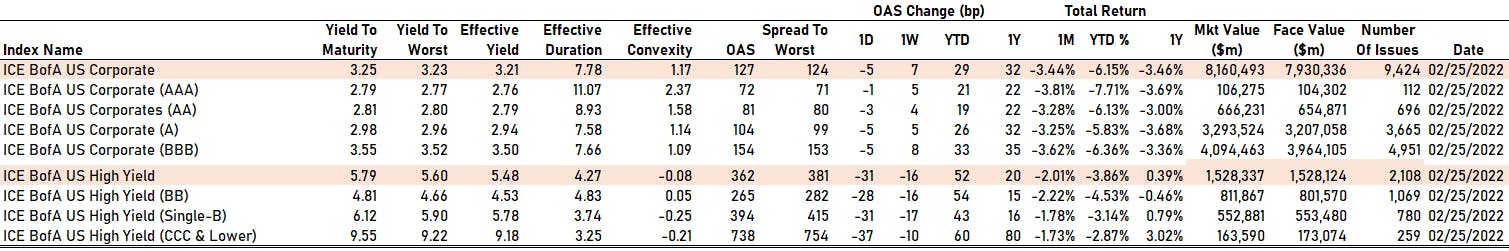

- ICE BofA US Corporate Index (Investment Grade) spread to worst down -5.0 bp, now at 124.0 bp (YTD change: +29.0 bp)

- ICE BofA US High Yield Index spread to worst down -28.0 bp, now at 381.0 bp (YTD change: +51.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index up 0.41% today (YTD total return: -0.5%)

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING

- AAA down by -1 bp at 72 bp

- AA down by -3 bp at 81 bp

- A down by -5 bp at 104 bp

- BBB down by -5 bp at 154 bp

- BB down by -28 bp at 265 bp

- B down by -31 bp at 394 bp

- CCC down by -37 bp at 738 bp

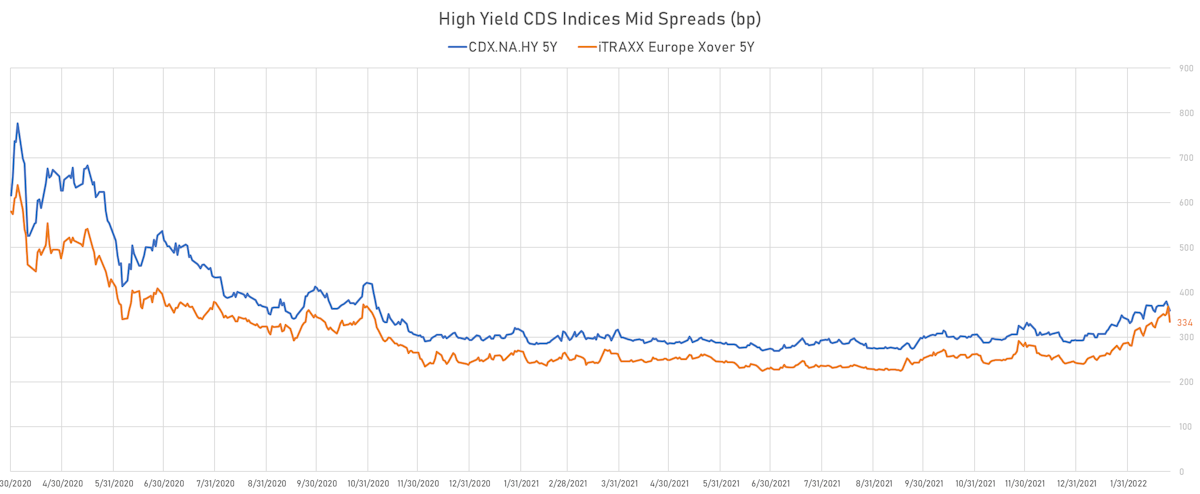

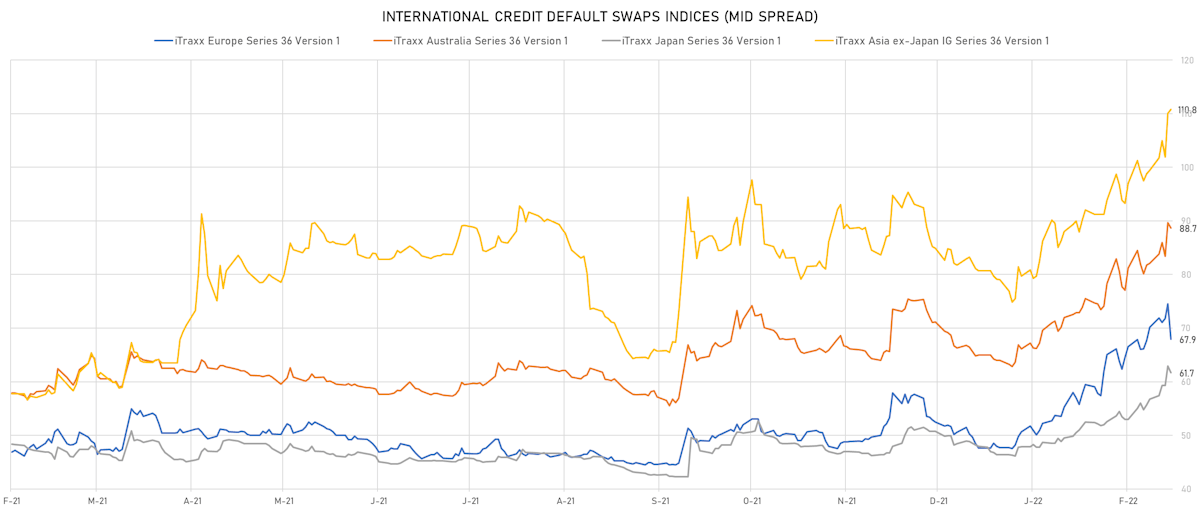

CDS INDICES (mid-spreads)

- Markit CDX.NA.IG 5Y down 2.2 bp, now at 105bp (YTD change: +16.3bp)

- Markit CDX.NA.HY 5Y down 10.4 bp, now at 359bp (YTD change: +66.8bp)

- Markit iTRAXX Europe down 6.6 bp, now at 68bp (YTD change: +20.2bp)

- Markit iTRAXX Japan down 1.3 bp, now at 62bp (YTD change: +15.2bp)

- Markit iTRAXX Asia Ex-Japan up 0.7 bp, now at 111bp (YTD change: +31.8bp)

TOP BONDS MOVES IN THE PAST WEEK - USD HY

- Issuer: OCP SA (Casablanca, Morocco) | Coupon: 5.63% | Maturity: 25/4/2024 | Rating: BB+ | ISIN: XS1061043011 | Z-spread up by 78.2 bp to 215.7 bp (CDS basis: -147.4bp), with the yield to worst at 3.7% and the bond now trading down to 103.5 cents on the dollar (1Y price range: 103.5-107.0).

- Issuer: Sealed Air Corp (Charlotte, North Carolina (US)) | Coupon: 4.00% | Maturity: 1/12/2027 | Rating: BB | ISIN: USU81193AQ42 | Z-spread up by 72.4 bp to 261.6 bp (CDS basis: -61.2bp), with the yield to worst at 4.3% and the bond now trading down to 97.0 cents on the dollar (1Y price range: 97.0-104.3).

- Issuer: Enact Holdings Inc (Raleigh, North Carolina (US)) | Coupon: 6.50% | Maturity: 15/8/2025 | Rating: BB | ISIN: USU3230LAA45 | Z-spread up by 67.4 bp to 328.4 bp (CDS basis: -73.6bp), with the yield to worst at 5.1% and the bond now trading down to 103.5 cents on the dollar (1Y price range: 103.3-109.5).

- Issuer: Necessity Retail REIT Inc (New York City) | Coupon: 4.50% | Maturity: 30/9/2028 | Rating: BB+ | ISIN: USU0262AAA52 | Z-spread up by 65.2 bp to 377.3 bp, with the yield to worst at 5.6% and the bond now trading down to 93.1 cents on the dollar (1Y price range: 93.0-100.4).

- Issuer: Rockies Express Pipeline LLC (Leawood, Kansas) | Coupon: 4.95% | Maturity: 15/7/2029 | Rating: BB | ISIN: USU75111AJ00 | Z-spread up by 64.2 bp to 364.8 bp, with the yield to worst at 5.5% and the bond now trading down to 95.8 cents on the dollar (1Y price range: 95.8-107.5).

- Issuer: Bath & Body Works Inc (Columbus, Ohio) | Coupon: 9.38% | Maturity: 1/7/2025 | Rating: BB | ISIN: USU51407AD34 | Z-spread up by 62.3 bp to 215.9 bp, with the yield to worst at 3.9% and the bond now trading down to 116.5 cents on the dollar (1Y price range: 115.3-122.3).

- Issuer: Bombardier Inc (MONTREAL, Canada) | Coupon: 7.45% | Maturity: 1/5/2034 | Rating: CCC+ | ISIN: USC10602AJ68 | Z-spread up by 55.3 bp to 431.6 bp, with the yield to worst at 6.2% and the bond now trading down to 109.8 cents on the dollar (1Y price range: 109.8-122.9).

- Issuer: Goodyear Tire & Rubber Co (Akron, Ohio) | Coupon: 5.00% | Maturity: 15/7/2029 | Rating: B | ISIN: USU38255AN24 | Z-spread up by 54.6 bp to 350.3 bp (CDS basis: 0.4bp), with the yield to worst at 5.5% and the bond now trading down to 96.8 cents on the dollar (1Y price range: 96.3-106.6).

- Issuer: JBS USA Lux SA (Luxembourg, Luxembourg) | Coupon: 3.00% | Maturity: 15/5/2032 | Rating: BB+ | ISIN: USL56608AG44 | Z-spread up by 53.6 bp to 247.9 bp, with the yield to worst at 4.4% and the bond now trading down to 87.3 cents on the dollar (1Y price range: 87.0-99.3).

- Issuer: Starwood Property Trust Inc (Greenwich) | Coupon: 3.63% | Maturity: 15/7/2026 | Rating: B+ | ISIN: USU85656AF04 | Z-spread up by 47.6 bp to 300.8 bp, with the yield to worst at 4.7% and the bond now trading down to 94.8 cents on the dollar (1Y price range: 94.8-100.1).

- Issuer: Block Inc (San Francisco, California) | Coupon: 2.75% | Maturity: 1/6/2026 | Rating: BB | ISIN: USU85223AA03 | Z-spread down by 46.4 bp to 176.0 bp, with the yield to worst at 3.5% and the bond now trading up to 96.3 cents on the dollar (1Y price range: 93.8-100.5).

- Issuer: Wynn Las Vegas LLC (Las Vegas, Nevada) | Coupon: 5.25% | Maturity: 15/5/2027 | Rating: B | ISIN: USU98347AL87 | Z-spread down by 49.9 bp to 337.4 bp, with the yield to worst at 5.1% and the bond now trading up to 99.5 cents on the dollar (1Y price range: 97.8-102.8).

- Issuer: WeWork Companies LLC (New York City, New York) | Coupon: 5.00% | Maturity: 10/7/2025 | Rating: CCC- | ISIN: USU9621PAA94 | Z-spread down by 60.1 bp to 909.7 bp, with the yield to worst at 10.6% and the bond now trading up to 83.5 cents on the dollar (1Y price range: 77.4-84.1).

TOP BONDS MOVES IN THE PAST WEEK - EUR HY

- Issuer: Telefonaktiebolaget LM Ericsson (Stockholm, Sweden) | Coupon: 1.00% | Maturity: 26/5/2029 | Rating: BB+ | ISIN: XS2345996743 | Z-spread up by 99.0 bp to 209.9 bp (CDS basis: -48.6bp), with the yield to worst at 2.8% and the bond now trading down to 88.2 cents on the dollar (1Y price range: 87.9-97.8).

- Issuer: Rolls-Royce PLC (Birmingham, United Kingdom) | Coupon: 4.63% | Maturity: 16/2/2026 | Rating: BB- | ISIN: XS2244322082 | Z-spread up by 93.8 bp to 306.4 bp (CDS basis: -86.2bp), with the yield to worst at 3.3% and the bond now trading down to 103.8 cents on the dollar (1Y price range: 102.6-110.9).

- Issuer: Banca Monte dei Paschi di Siena SpA (Siena, Italy) | Coupon: 2.63% | Maturity: 28/4/2025 | Rating: CCC+ | ISIN: XS2110110686 | Z-spread up by 91.1 bp to 410.8 bp (CDS basis: 89.5bp), with the yield to worst at 4.3% and the bond now trading down to 94.5 cents on the dollar (1Y price range: 94.1-100.0).

- Issuer: Arcelik AS (Turkey) | Coupon: 3.00% | Maturity: 27/5/2026 | Rating: BB | ISIN: XS2346972263 | Z-spread up by 89.2 bp to 390.6 bp, with the yield to worst at 4.3% and the bond now trading down to 94.5 cents on the dollar (1Y price range: 94.2-98.4).

- Issuer: Adler Group SA (Senningerberg, Luxembourg) | Coupon: 1.88% | Maturity: 14/1/2026 | Rating: B | ISIN: XS2283224231 | Z-spread down by 128.1 bp to 646.6 bp, with the yield to worst at 6.8% and the bond now trading up to 83.2 cents on the dollar (1Y price range: 77.7-86.2).

- Issuer: Volvo Car AB (Goeteborg, Sweden) | Coupon: 2.13% | Maturity: 2/4/2024 | Rating: BB+ | ISIN: XS1971935223 | Z-spread down by 159.9 bp to 145.9 bp, with the yield to worst at 1.5% and the bond now trading up to 100.9 cents on the dollar (1Y price range: 100.5-103.6).

SELECTED RECENT USD BOND ISSUES

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, New Jersey, United States | Rating: AA+): US$650m Bond (US3133ENQJ28), floating rate (SOFR + 4.0 bp) maturing on 4 March 2024, priced at 100.00, non callable

- JP Morgan Structured Products BV (Financial - Other | Amsterdam, Noord-Holland, United States | Rating: NR): US$150m Unsecured Note (XS1450778342) zero coupon maturing on 3 March 2027, priced at 100.00, non callable

- JPMorgan Chase & Co (Banking | New York City, New York, United States | Rating: A-): US$110m Unsecured Note (XS1450778185) zero coupon maturing on 18 March 2056, priced at 100.00, non callable

- Franshion Brilliant Ltd (Financial - Other | China (Mainland) | Rating: NR): US$200m Senior Note (XS2451285253), fixed rate (4.40% coupon) maturing on 4 March 2025, priced at 100.00, non callable

- Nomura International Funding Pte Ltd (Financial - Other | Singapore | Rating: NR): US$200m Unsecured Note (XS2217938468), floating rate maturing on 20 December 2026, priced at 100.00, non callable

SELECTED RECENT EUR BOND ISSUES

- Deutsche Apotheker und Aerztebank eG (Banking | Dusseldorf, Nordrhein-Westfalen, Germany | Rating: A+): €400m Hypothekenpfandbrief (Covered Bond) (XS2449907620), floating rate (EU03MLIB + 60.0 bp) maturing on 1 September 2026, priced at 102.40, non callable

NEW LOANS

- Intl Co For Water & Power, signed a US$ 1,302m Term Loan, to be used for general corporate purposes

- Sopra Steria Group SA, signed a € 1,100m Revolving Credit Facility, to be used for general corporate purposes

NEW ISSUES IN SECURITIZED CREDIT

- Ready Capital Mortgage Financing 2022-Fl8 issued a floating-rate CLO in 6 tranches, for a total of US$ 914 m. Highest-rated tranche offering a spread over the floating rate of 165bp, and the lowest-rated tranche a spread of 425bp. Bookrunners: Credit Suisse, JP Morgan & Co Inc, Deutsche Bank Securities Inc

- Freddie Mac Spc Series K-748 issued a fixed-rate Agency CMBS in 3 tranches, for a total of US$ 1,020 m. Highest-rated tranche offering a yield to maturity of 1.75%, and the lowest-rated tranche a yield to maturity of 2.33%. Bookrunners: Goldman Sachs & Co, Barclays Capital Group

- Benchmark 2022-B33 Mortgage Trust issued a fixed-rate CMBS in 11 tranches, for a total of US$ 990 m. Highest-rated tranche offering a coupon of 2.31%, and the lowest-rated tranche a yield to maturity of 3.67%. Bookrunners: Goldman Sachs & Co, JP Morgan & Co Inc, Deutsche Bank Securities Inc, Citigroup Global Markets Inc