Credit

Much Wider Spreads Across The Credit Complex, But Lower Yields Take Cash Prices Higher

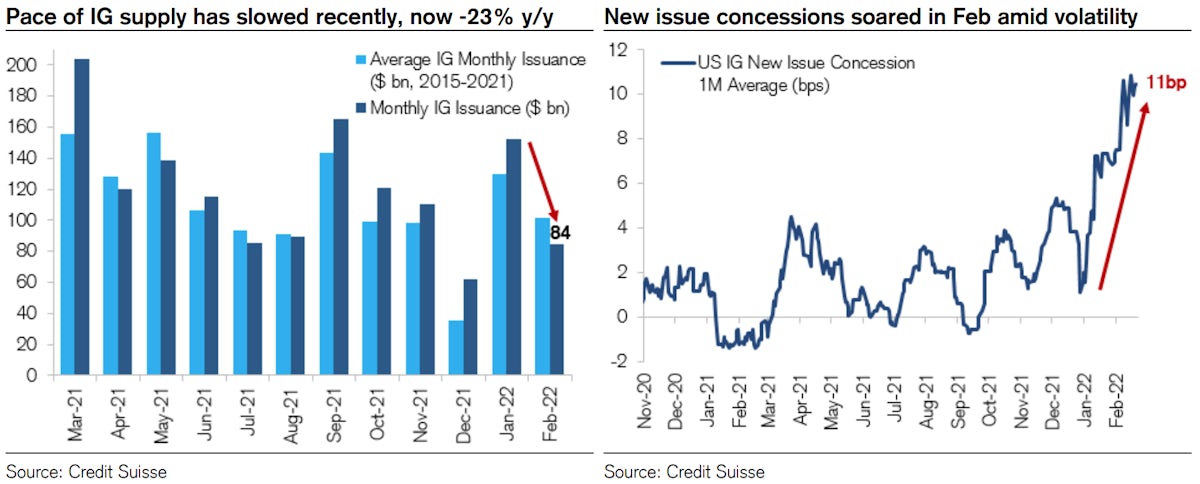

The enormous level of rates volatility kept issuers on the sidelines today, with no pricing in the primary USD corporate bonds market

Published ET

IG Supply And New Issue Concessions | Source: Credit Suisse

QUICK SUMMARY

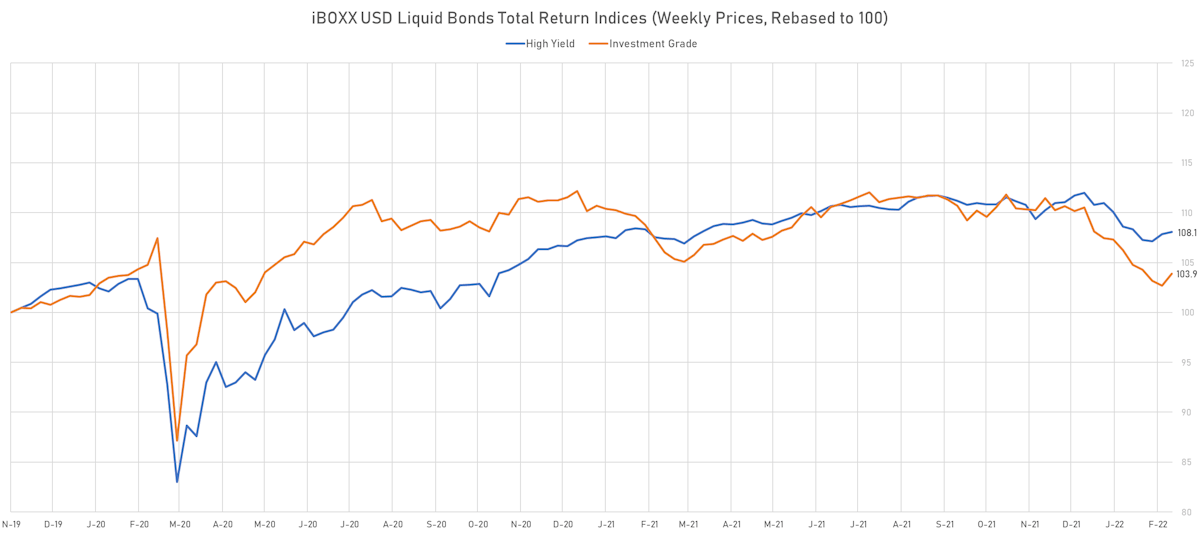

- The iBoxx USD Liquid Investment Grade Total Return Index was up 1.195% today (Month-to-date: -2.23%; Year-to-date: -5.98%)

- The iBoxx USD Liquid High Yield Total Return Index was up 0.209% today (Month-to-date: -0.68%; Year-to-date: -3.53%)

- ICE BofA US Corporate Index (Investment Grade) spread to worst up 4.0 bp, now at 128.0 bp (YTD change: +33.0 bp)

- ICE BofA US High Yield Index spread to worst up 17.0 bp, now at 398.0 bp (YTD change: +68.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index up 0.09% today (YTD total return: -0.4%)

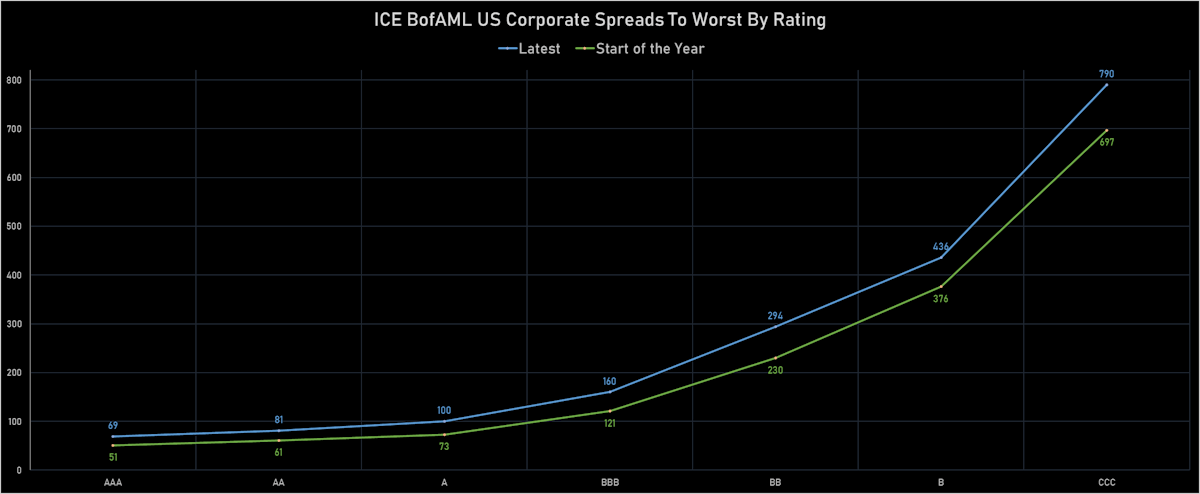

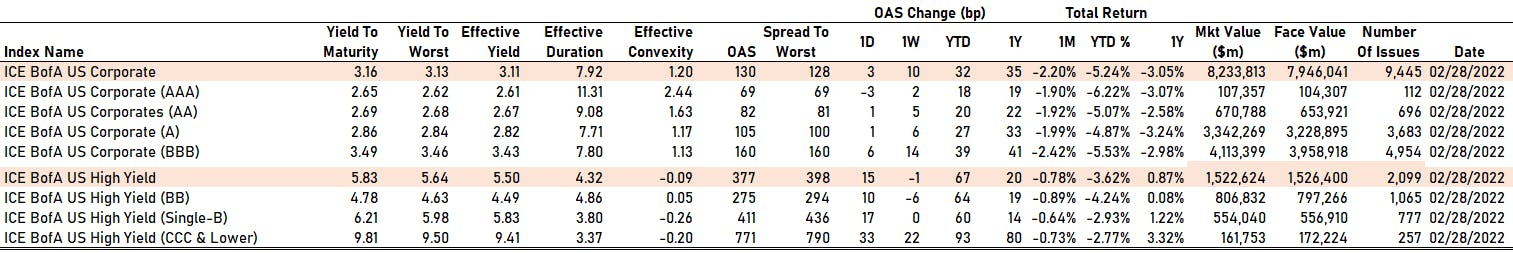

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING

- AAA down by -3 bp at 69 bp

- AA up by 1 bp at 82 bp

- A up by 1 bp at 105 bp

- BBB up by 6 bp at 160 bp

- BB up by 10 bp at 275 bp

- B up by 17 bp at 411 bp

- CCC up by 33 bp at 771 bp

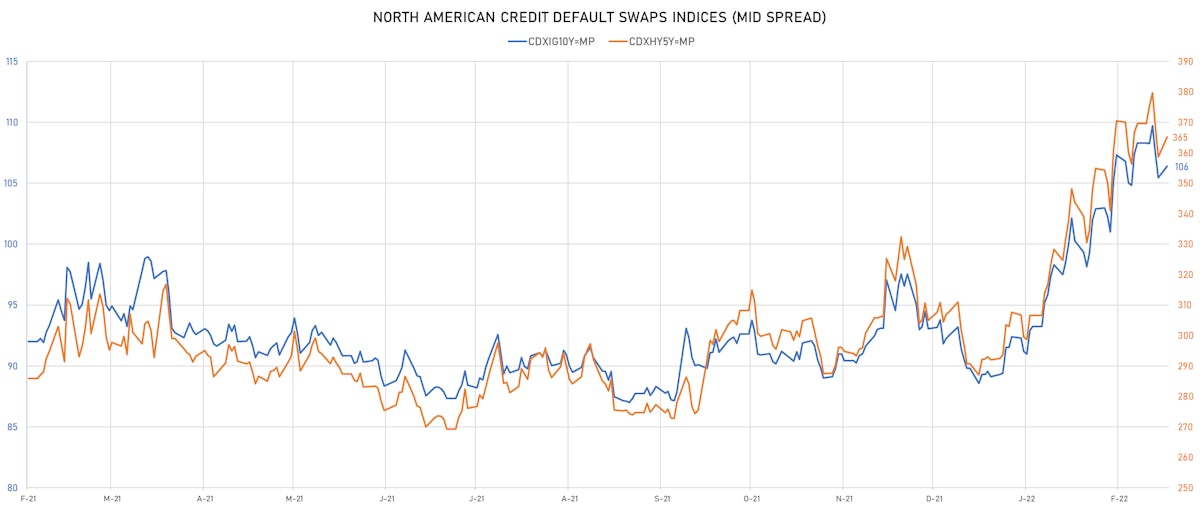

CDS INDICES (mid-spreads)

- Markit CDX.NA.IG 5Y up 0.9 bp, now at 106bp (YTD change: +17.3bp)

- Markit CDX.NA.HY 5Y up 6.5 bp, now at 365bp (YTD change: +73.2bp)

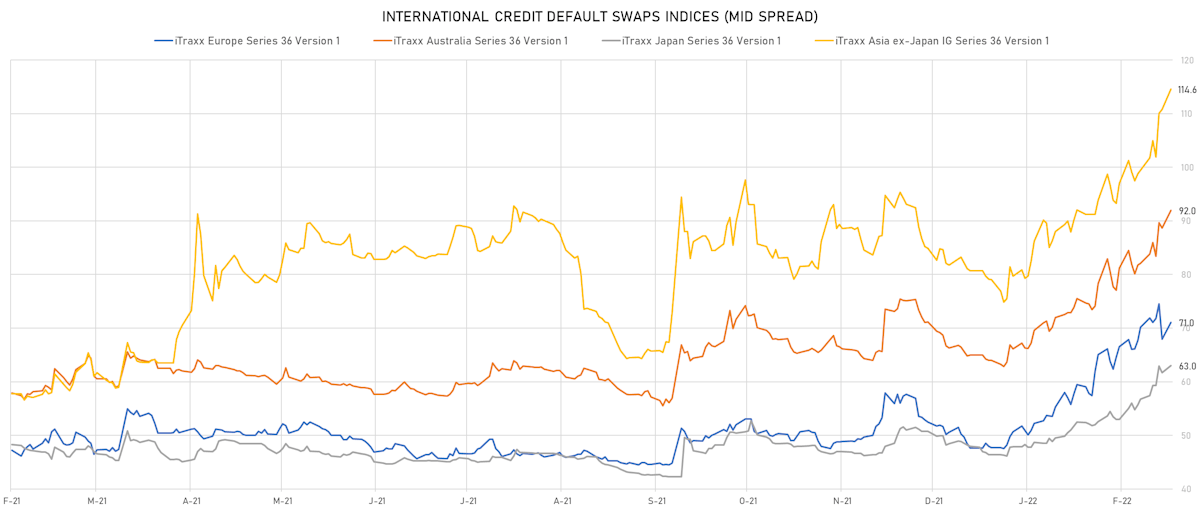

- Markit iTRAXX Europe up 3.1 bp, now at 71bp (YTD change: +23.3bp)

- Markit iTRAXX Japan up 1.4 bp, now at 63bp (YTD change: +16.6bp)

- Markit iTRAXX Asia Ex-Japan up 3.8 bp, now at 115bp (YTD change: +35.6bp)

USD CDS SINGLE NAMES - LARGEST MOVES IN THE PAST WEEK

- American Axle & Manufacturing Inc (Country: US; rated: Ba1): down 69.8 bp to 420.2bp (1Y range: 355-514bp)

- Transocean Inc (Country: KY; rated: Caa3): down 68.8 bp to 2,051.5bp (1Y range: 941-2,051bp)

- Goodyear Tire & Rubber Co (Country: US; rated: WR): down 24.7 bp to 282.5bp (1Y range: 188-327bp)

- DISH DBS Corp (Country: US; rated: B2): down 20.9 bp to 572.6bp (1Y range: 317-609bp)

- Gap Inc (Country: US; rated: WR): down 19.2 bp to 321.5bp (1Y range: 132-347bp)

- Pitney Bowes Inc (Country: US; rated: B1): down 18.5 bp to 714.4bp (1Y range: 363-714bp)

- Radian Group Inc (Country: US; rated: BBB-): down 18.0 bp to 243.3bp (1Y range: 152-285bp)

- Croatia, Republic of (Government) (Country: HR; rated: BBB): up 16.9 bp to 93.3bp (1Y range: 71-100bp)

- Hungary (Government) (Country: HU; rated: F2): up 18.9 bp to 75.6bp (1Y range: 47-76bp)

- Bombardier Inc (Country: CA; rated: Caa1): up 23.7 bp to 484.3bp (1Y range: 395-765bp)

- Nabors Industries Inc (Country: US; rated: B3): up 29.1 bp to 729.4bp (1Y range: 504-1,098bp)

- Liberty Interactive LLC (Country: US; rated: Ba3): up 29.4 bp to 614.4bp (1Y range: 287-614bp)

- Poland, Republic of (Government) (Country: PL; rated: AAA): up 32.1 bp to 77.4bp (1Y range: 37-77bp)

- Turkey, Republic of (Government) (Country: TR; rated: B+): up 41.7 bp to 587.0bp (1Y range: 301-620bp)

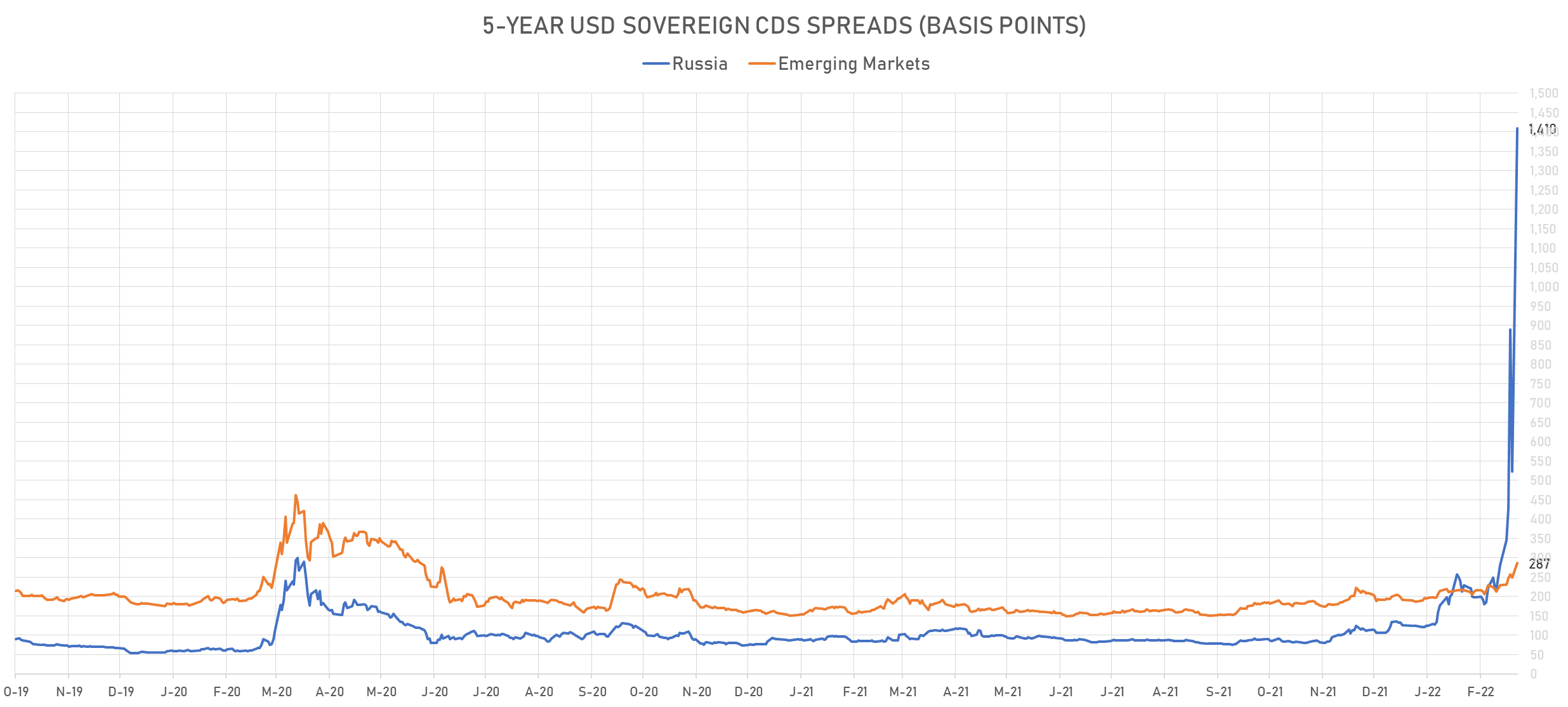

- Russia, Federation of (Government) (Country: RU; rated: P-3): up 1064.7 bp to 1,409.6bp (1Y range: 77-1,410bp)

EURO CDS SINGLE NAMES - LARGEST MOVES IN THE PAST WEEK

- Stena AB (Country: SE; rated: B2-PD): down 21.4 bp to 503.1bp (1Y range: 401-696bp)

- Leonardo SpA (Country: IT; rated: WD): down 16.9 bp to 198.2bp (1Y range: 125-239bp)

- Ineos Group Holdings SA (Country: LU; rated: WR): up 14.2 bp to 242.4bp (1Y range: 125-292bp)

- Rolls-Royce PLC (Country: GB; rated: BB-): up 15.2 bp to 248.9bp (1Y range: 161-291bp)

- UPC Holding BV (Country: NL; rated: LGD6 - 93%): up 15.9 bp to 224.1bp (1Y range: 164-267bp)

- Louis Dreyfus Co BV (Country: NL; rated: ): up 18.0 bp to 150.8bp (1Y range: -151bp)

- Unilabs SubHolding AB (publ) (Country: SE; rated: B2): up 18.2 bp to 189.2bp (1Y range: -189bp)

- thyssenkrupp AG (Country: DE; rated: B1): up 19.7 bp to 316.3bp (1Y range: 205-321bp)

- Banca Monte dei Paschi di Siena SpA (Country: IT; rated: NP): up 24.7 bp to 421.7bp (1Y range: 145-422bp)

- Valeo SE (Country: FR; rated: P-3): up 26.0 bp to 217.8bp (1Y range: 110-218bp)

- Fortum Oyj (Country: FI; rated: Baa2): up 34.6 bp to 112.2bp (1Y range: 40-112bp)

- Novafives SAS (Country: FR; rated: Caa1): up 35.2 bp to 1,123.7bp (1Y range: 618-1,234bp)

- Renault SA (Country: FR; rated: Ba2): up 39.9 bp to 269.4bp (1Y range: 166-269bp)

- Casino Guichard Perrachon SA (Country: FR; rated: WR): up 105.0 bp to 1,022.0bp (1Y range: 464-1,022bp)

- Boparan Finance PLC (Country: GB; rated: B3): up 174.2 bp to 1,634.8bp (1Y range: 674-1,635bp)

SELECTED RECENT USD BOND ISSUES

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$210m Bond (US3133ENQQ60), fixed rate (3.00% coupon) maturing on 8 March 2032, priced at 100.00, callable (10nc1)

SELECTED RECENT EUR BOND ISSUES

- Vestas Wind Systems Finance BV (Financial - Other | Arnhem, Netherlands | Rating: NR): €500m Unsecured Note (XS2449928543) maturing on 2 June 2029, priced at 100.00, non callable

NEW LOANS

- Restaurant Technologies Inc (B), signed a US$ 810m Term Loan B

- Syngenta Grp (HK) Hldg Co Ltd, signed a US$ 1,500m Term Loan, to be used for refinancing and returning bank debt. It matures on 02/28/25 and initial pricing is set at Term SOFR +92bp

- SHB, signed a US$ 150m Revolving Credit / Term Loan, to be used for general corporate purposes, with initial pricing set at SOFR +205bp