Credit

A Familiar Story Played Out Again Today: Wider Spreads, Lower Yields, Higher Cash Prices

Despite the tremendous volatility in rates, a bunch of issuers stepped forward with chunky new bond offerings, led by ING Bank's €9bn in 3 tranches, American Express' US$4bn in 3 tranches, and Charles Schwab's $3bn in 3 tranches

Published ET

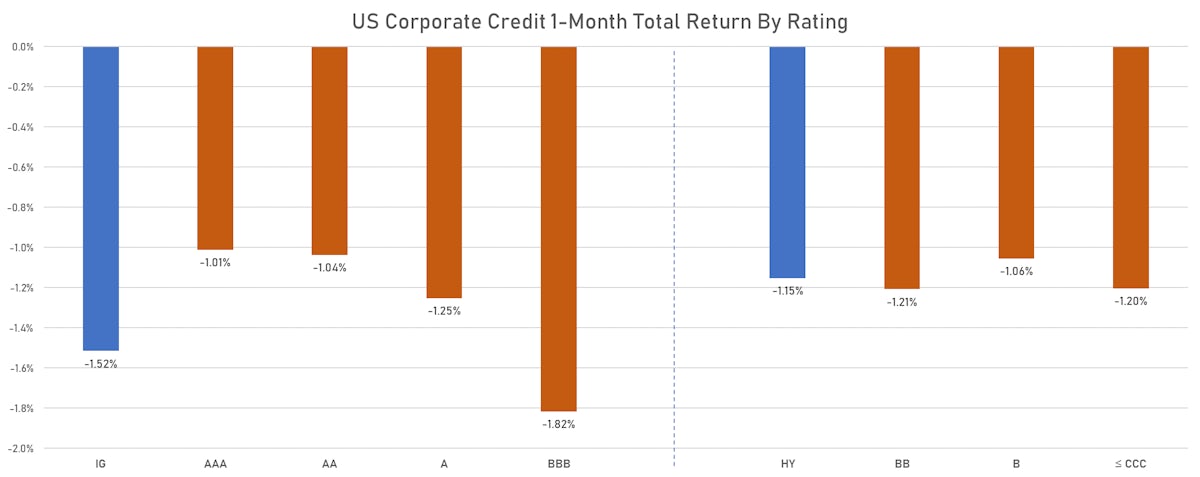

ICE BofAML US Corporate Bond Indices Total Returns By Rating | Sources: ϕpost, FactSet data

QUICK SUMMARY

- S&P 500 Bond Index was up 0.60% today, with investment grade up 0.64% and high yield up 0.27% (YTD total return: -4.33%)

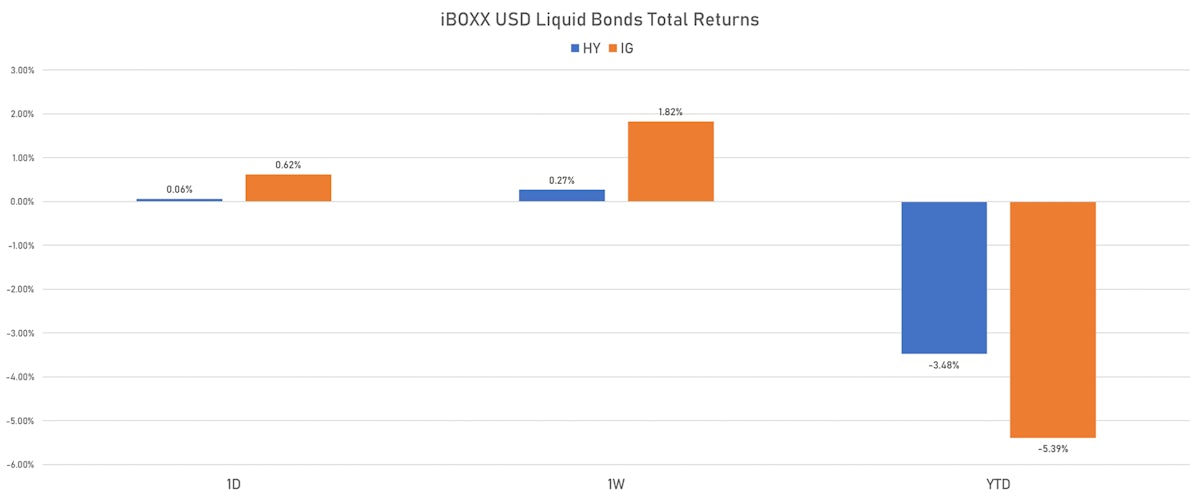

- The iBoxx USD Liquid Investment Grade Total Return Index was up 0.619% today (Month-to-date: 0.62%; Year-to-date: -5.39%)

- The iBoxx USD Liquid High Yield Total Return Index was up 0.057% today (Month-to-date: 0.06%; Year-to-date: -3.48%)

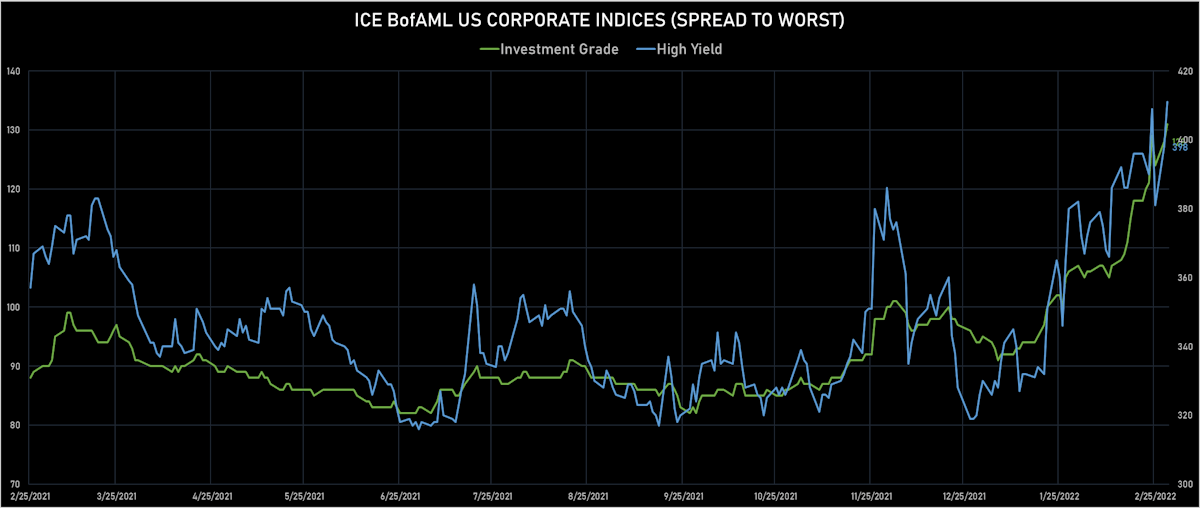

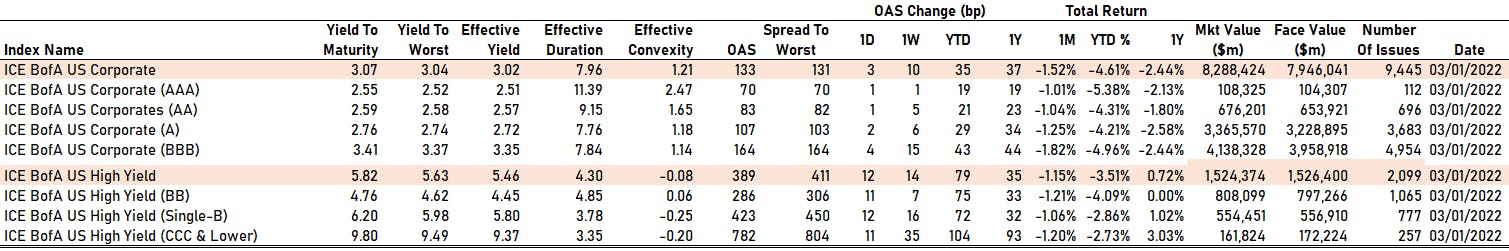

- ICE BofA US Corporate Index (Investment Grade) spread to worst up 3.0 bp, now at 131.0 bp (YTD change: +36.0 bp)

- ICE BofA US High Yield Index spread to worst up 13.0 bp, now at 411.0 bp (YTD change: +81.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index up 0.02% today (YTD total return: -0.4%)

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING

- AAA up by 1 bp at 70 bp

- AA up by 1 bp at 83 bp

- A up by 2 bp at 107 bp

- BBB up by 4 bp at 164 bp

- BB up by 11 bp at 286 bp

- B up by 12 bp at 423 bp

- CCC up by 11 bp at 782 bp

CDS INDICES (mid-spreads)

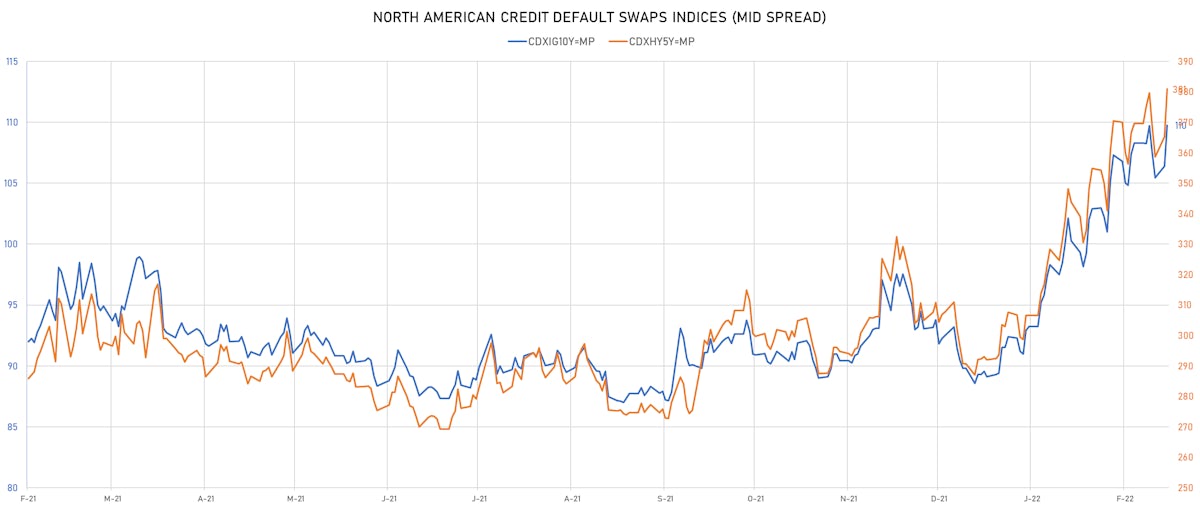

- Markit CDX.NA.IG 5Y up 3.4 bp, now at 110bp (YTD change: +20.7bp)

- Markit CDX.NA.HY 5Y up 15.9 bp, now at 381bp (YTD change: +89.1bp)

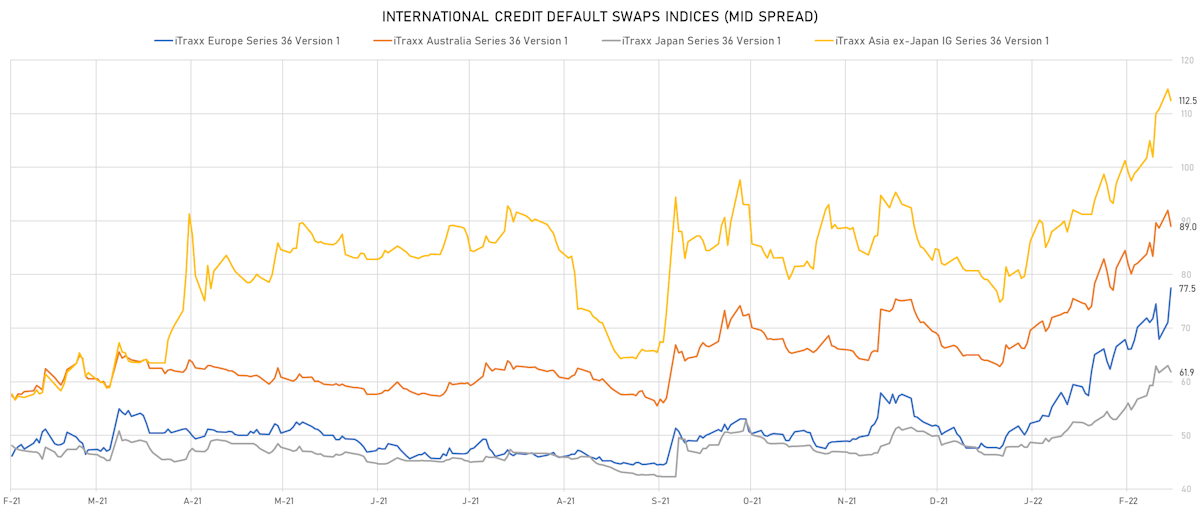

- Markit iTRAXX Europe up 6.4 bp, now at 77bp (YTD change: +29.8bp)

- Markit iTRAXX Japan down 1.1 bp, now at 62bp (YTD change: +15.4bp)

- Markit iTRAXX Asia Ex-Japan down 2.1 bp, now at 113bp (YTD change: +33.5bp)

TOP BONDS MOVES IN THE PAST WEEK - USD HY

- Issuer: OCP SA (Casablanca, Morocco) | Coupon: 5.63% | Maturity: 25/4/2024 | Rating: BB+ | ISIN: XS1061043011 | Z-spread up by 110.2 bp to 275.1 bp (CDS basis: -206.9bp), with the yield to worst at 4.0% and the bond now trading down to 102.9 cents on the dollar (1Y price range: 102.9-107.0).

- Issuer: Enact Holdings Inc (Raleigh, North Carolina (US)) | Coupon: 6.50% | Maturity: 15/8/2025 | Rating: BB | ISIN: USU3230LAA45 | Z-spread up by 87.6 bp to 394.0 bp (CDS basis: -146.3bp), with the yield to worst at 5.4% and the bond now trading down to 102.5 cents on the dollar (1Y price range: 102.5-109.5).

- Issuer: Brinker International Inc (Coppell, Texas (US)) | Coupon: 5.00% | Maturity: 1/10/2024 | Rating: B+ | ISIN: USU6223WAB01 | Z-spread up by 69.0 bp to 243.2 bp, with the yield to worst at 4.0% and the bond now trading down to 102.3 cents on the dollar (1Y price range: 102.3-106.8).

- Issuer: Bombardier Inc (MONTREAL, Canada) | Coupon: 7.45% | Maturity: 1/5/2034 | Rating: CCC+ | ISIN: USC10602AJ68 | Z-spread up by 65.9 bp to 462.5 bp (CDS basis: 100.3bp), with the yield to worst at 6.2% and the bond now trading down to 109.3 cents on the dollar (1Y price range: 109.3-122.9).

- Issuer: Southeast Supply Header LLC (Houston, Texas (US)) | Coupon: 4.25% | Maturity: 15/6/2024 | Rating: BB- | ISIN: USU83854AB29 | Z-spread up by 61.0 bp to 298.5 bp, with the yield to worst at 4.1% and the bond now trading down to 99.4 cents on the dollar (1Y price range: 99.0-102.8).

- Issuer: MGM Growth Properties Operating Partnership LP (Las Vegas, Nevada (US)) | Coupon: 4.63% | Maturity: 15/6/2025 | Rating: B+ | ISIN: USU5930BAD83 | Z-spread up by 58.8 bp to 222.0 bp, with the yield to worst at 3.6% and the bond now trading down to 102.3 cents on the dollar (1Y price range: 102.0-106.5).

- Issuer: Compass Minerals International Inc (Overland Park, Kansas (US)) | Coupon: 4.88% | Maturity: 15/7/2024 | Rating: B+ | ISIN: USU2036YAC04 | Z-spread up by 52.8 bp to 332.3 bp, with the yield to worst at 4.4% and the bond now trading down to 100.0 cents on the dollar (1Y price range: 100.0-102.8).

- Issuer: CTR Partnership LP (San Clemente, California (US)) | Coupon: 3.88% | Maturity: 30/6/2028 | Rating: BB | ISIN: USU1268FAB41 | Z-spread up by 51.5 bp to 295.5 bp, with the yield to worst at 4.6% and the bond now trading down to 95.8 cents on the dollar (1Y price range: 95.5-102.9).

- Issuer: NCL Finance Ltd (#N/A, United Kingdom) | Coupon: 6.13% | Maturity: 15/3/2028 | Rating: CCC+ | ISIN: USG6437FAA78 | Z-spread up by 48.1 bp to 556.1 bp, with the yield to worst at 7.0% and the bond now trading down to 94.6 cents on the dollar (1Y price range: 93.4-99.5).

- Issuer: EnerSys (Reading, Pennsylvania (US)) | Coupon: 4.38% | Maturity: 15/12/2027 | Rating: BB- | ISIN: USU2928LAB19 | Z-spread up by 47.7 bp to 303.9 bp, with the yield to worst at 4.5% and the bond now trading down to 98.3 cents on the dollar (1Y price range: 97.6-103.8).

- Issuer: Taylor Morrison Communities Inc (Scottsdale, Arizona (US)) | Coupon: 5.63% | Maturity: 1/3/2024 | Rating: BB- | ISIN: USU87286AD91 | Z-spread up by 46.9 bp to 250.0 bp, with the yield to worst at 3.8% and the bond now trading down to 102.9 cents on the dollar (1Y price range: 102.8-106.5).

- Issuer: American Airlines Group Inc (Fort Worth, Texas (US)) | Coupon: 3.75% | Maturity: 1/3/2025 | Rating: CCC | ISIN: USU0242AAD47 | Z-spread up by 45.7 bp to 516.9 bp (CDS basis: 270.3bp), with the yield to worst at 6.5% and the bond now trading down to 92.3 cents on the dollar (1Y price range: 89.8-95.6).

- Issuer: WeWork Companies Inc (New York City, New York (US)) | Coupon: 7.88% | Maturity: 1/5/2025 | Rating: CCC- | ISIN: USU96217AA99 | Z-spread down by 98.4 bp to 1,027.3 bp, with the yield to worst at 11.1% and the bond now trading up to 90.5 cents on the dollar (1Y price range: 85.0-96.5).

TOP BONDS MOVES IN THE PAST WEEK - EUR HY

- Issuer: Heimstaden AB (Malmo, Sweden) | Coupon: 4.25% | Maturity: 9/3/2026 | Rating: BB+ | ISIN: SE0015657903 | Z-spread up by 1,433.9 bp to 528.4 bp, with the yield to worst at 5.4% and the bond now trading down to 95.7 cents on the dollar (1Y price range: 95.6-100.7).

- Issuer: Akropolis Group UAB (Vilnius, Lithuania) | Coupon: 2.88% | Maturity: 2/6/2026 | Rating: BB+ | ISIN: XS2346869097 | Z-spread up by 229.7 bp to 560.3 bp, with the yield to worst at 5.6% and the bond now trading down to 89.0 cents on the dollar (1Y price range: 88.6-95.2).

- Issuer: Arcelik AS (Turkey) | Coupon: 3.00% | Maturity: 27/5/2026 | Rating: BB | ISIN: XS2346972263 | Z-spread up by 113.8 bp to 410.3 bp, with the yield to worst at 4.2% and the bond now trading down to 94.7 cents on the dollar (1Y price range: 94.1-98.4).

- Issuer: Renault SA (Boulogne-Billancourt, France) | Coupon: 1.25% | Maturity: 24/6/2025 | Rating: BB | ISIN: FR0013428414 | Z-spread up by 97.8 bp to 299.9 bp (CDS basis: -103.4bp), with the yield to worst at 3.0% and the bond now trading down to 94.0 cents on the dollar (1Y price range: 93.9-98.6).

- Issuer: Adler Real Estate AG (Berlin, Germany) | Coupon: 2.13% | Maturity: 6/2/2024 | Rating: B | ISIN: XS1731858715 | Z-spread up by 91.4 bp to 719.0 bp, with the yield to worst at 6.9% and the bond now trading down to 91.3 cents on the dollar (1Y price range: 88.8-94.9).

- Issuer: Banca Monte dei Paschi di Siena SpA (Siena, Italy) | Coupon: 2.63% | Maturity: 28/4/2025 | Rating: CCC+ | ISIN: XS2110110686 | Z-spread up by 86.6 bp to 463.2 bp (CDS basis: 37.7bp), with the yield to worst at 4.5% and the bond now trading down to 93.9 cents on the dollar (1Y price range: 93.9-100.0).

- Issuer: Ford Motor Credit Company LLC (Dearborn, Michigan (US)) | Coupon: 1.36% | Maturity: 7/2/2025 | Rating: BB | ISIN: XS1767930586 | Z-spread up by 80.0 bp to 268.9 bp (CDS basis: -106.3bp), with the yield to worst at 2.6% and the bond now trading down to 96.1 cents on the dollar (1Y price range: 95.7-100.9).

- Issuer: K&S AG (Kassel, Germany) | Coupon: 3.25% | Maturity: 18/7/2024 | Rating: B+ | ISIN: XS1854830889 | Z-spread up by 79.8 bp to 251.4 bp, with the yield to worst at 2.1% and the bond now trading down to 101.5 cents on the dollar (1Y price range: 101.3-104.0).

- Issuer: Mytilineos Financial Partners SA (Luxembourg, Luxembourg) | Coupon: 2.50% | Maturity: 1/12/2024 | Rating: BB- | ISIN: XS2010038144 | Z-spread up by 77.4 bp to 340.6 bp, with the yield to worst at 3.4% and the bond now trading down to 97.4 cents on the dollar (1Y price range: 96.9-101.9).

- Issuer: PPF Telecom Group BV (Amsterdam, Netherlands) | Coupon: 3.13% | Maturity: 27/3/2026 | Rating: BB+ | ISIN: XS1969645255 | Z-spread up by 74.6 bp to 278.2 bp, with the yield to worst at 2.9% and the bond now trading down to 100.2 cents on the dollar (1Y price range: 100.1-106.3).

- Issuer: Deutsche Lufthansa AG (Cologne, Germany) | Coupon: 2.88% | Maturity: 11/2/2025 | Rating: BB- | ISIN: XS2296201424 | Z-spread up by 72.3 bp to 330.0 bp (CDS basis: -124.1bp), with the yield to worst at 3.2% and the bond now trading down to 98.5 cents on the dollar (1Y price range: 98.2-102.3).

SELECTED RECENT USD BOND ISSUES

- Advance Auto Parts Inc (Vehicle Parts | Raleigh, United States | Rating: BBB-): US$350m Senior Note (US00751YAG17), fixed rate (3.50% coupon) maturing on 15 March 2032, priced at 99.61 (original spread of 183 bp), callable (10nc10)

- American Express Co (Banking | New York City, United States | Rating: BBB+): US$1,750m Senior Note (US025816CS64), fixed rate (2.55% coupon) maturing on 4 March 2027, priced at 99.91 (original spread of 100 bp), callable (5nc5)

- American Express Co (Banking | New York City, United States | Rating: BBB+): US$1,750m Senior Note (US025816CQ09), fixed rate (2.25% coupon) maturing on 4 March 2025, priced at 99.90 (original spread of 80 bp), callable (3nc3)

- American Express Co (Banking | New York City, United States | Rating: BBB+): US$500m Senior Note (US025816CR81), floating rate (SOFR + 93.0 bp) maturing on 4 March 2025, priced at 100.00, callable (3nc3)

- BellRing Distribution LLC (Financial - Other | St. Louis, United States | Rating: B): US$840m Senior Note (US07831CAA18), fixed rate (7.00% coupon) maturing on 15 March 2030, priced at 100.00 (original spread of 535 bp), callable (8nc5)

- Capital One Financial Corp (Financial - Other | Mc Lean, United States | Rating: BBB): US$1,250m Senior Note (US14040HCN35), floating rate maturing on 1 March 2030, priced at 100.00 (original spread of 155 bp), callable (8nc7)

- Capital One Financial Corp (Financial - Other | Mc Lean, United States | Rating: BBB): US$1,250m Senior Note (US14040HCM51), floating rate maturing on 3 March 2026, priced at 100.00 (original spread of 116 bp), callable (4nc3)

- Charles Schwab Corp (Securities | Westlake, United States | Rating: A): US$1,500m Senior Note (US808513BY05), fixed rate (2.45% coupon) maturing on 3 March 2027, priced at 99.89 (original spread of 90 bp), callable (5nc5)

- Charles Schwab Corp (Securities | Westlake, United States | Rating: A): US$500m Senior Note (US808513BZ79), floating rate (SOFR + 105.0 bp) maturing on 3 March 2027, priced at 100.00, callable (5nc5)

- Charles Schwab Corp (Securities | Westlake, United States | Rating: A): US$1,000m Senior Note (US808513CA10), fixed rate (2.90% coupon) maturing on 3 March 2032, priced at 99.78 (original spread of 120 bp), callable (10nc10)

- CME Group Inc (Securities | Chicago, United States | Rating: AA-): US$750m Senior Note (US12572QAK13), fixed rate (2.65% coupon) maturing on 15 March 2032, priced at 99.68 (original spread of 98 bp), callable (10nc10)

- Duke Energy Carolinas LLC (Utility - Other | Charlotte, United States | Rating: AA-): US$650m First & Refunding Mortgage Bond (US26442CBH60), fixed rate (3.55% coupon) maturing on 15 March 2052, priced at 99.69 (original spread of 165 bp), callable (30nc30)

- Duke Energy Carolinas LLC (Utility - Other | Charlotte, United States | Rating: AA-): US$500m First & Refunding Mortgage Bond (US26442CBG87), fixed rate (2.85% coupon) maturing on 15 March 2032, priced at 99.94 (original spread of 115 bp), callable (10nc10)

- Massachusetts Institute of Technology (Service - Other | Cambridge, United States | Rating: AAA): US$500m Bond (US575718AJ03), fixed rate (3.07% coupon) maturing on 1 April 2052, priced at 100.00 (original spread of 95 bp), callable (30nc30)

- European Investment Bank (Supranational | Luxembourg, Luxembourg | Rating: AAA): US$3,000m Senior Note (US298785JR84), fixed rate (1.75% coupon) maturing on 15 March 2029, priced at 99.34 (original spread of 12 bp), non callable

SELECTED RECENT EUR BOND ISSUES

- ING Bank NV (Banking | Amsterdam Zuidoost, Netherlands | Rating: A+): €3,000m Unsecured Note (XS2449932651) zero coupon maturing on 3 March 2028, priced at 100.00, non callable

- ING Bank NV (Banking | Amsterdam Zuidoost, Netherlands | Rating: A+): €3,000m Unsecured Note (XS2449931844) zero coupon maturing on 3 March 2031, priced at 100.00, non callable

- ING Bank NV (Banking | Amsterdam Zuidoost, Netherlands | Rating: A+): €3,000m Unsecured Note (XS2449932149) zero coupon maturing on 3 March 2026, priced at 100.00, non callable

- Landeskreditbank Baden Wuerttemberg Foerderbank (Agency | Karlsruhe, Germany | Rating: AA+): €150m Inhaberschuldverschreibung (DE000A3MQP83), floating rate (EU03MLIB + 175.0 bp) maturing on 9 March 2026, priced at 107.45, non callable

- Landwirtschaftliche Rentenbank (Agency | Frankfurt, Hessen, Germany | Rating: AAA): €2,000m Senior Note (XS2453958766), fixed rate (0.10% coupon) maturing on 8 March 2027, priced at 99.95 (original spread of 48 bp), non callable

- Vestas Wind Systems Finance BV (Financial - Other | Arnhem, Netherlands | Rating: NR): €500m Unsecured Note (XS2449929517) maturing on 2 June 2034, priced at 100.00, non callable

- Vestas Wind Systems Finance BV (Financial - Other | Arnhem, Netherlands | Rating: NR): €500m Unsecured Note (XS2449928543) maturing on 2 June 2029, priced at 100.00, non callable

NEW LOANS

- Compass Power Generation Llc, signed a US$ 650m Term Loan B, to be used for general corporate purposes. It matures on 03/10/29 and initial pricing is set at Term SOFR +425bp