Credit

Risk-On Mood Tightened US Corporate Cash Spreads Markedly Today, With BBs Down 17bp And Single-Bs Down 19bp

The positive sentiment pushed equities up close to 2% and brought a slew of new corporate bond issuance in the US, with large offerings from Exelon, HCA Healthcare, John Deere, Progressive Insurance

Published ET

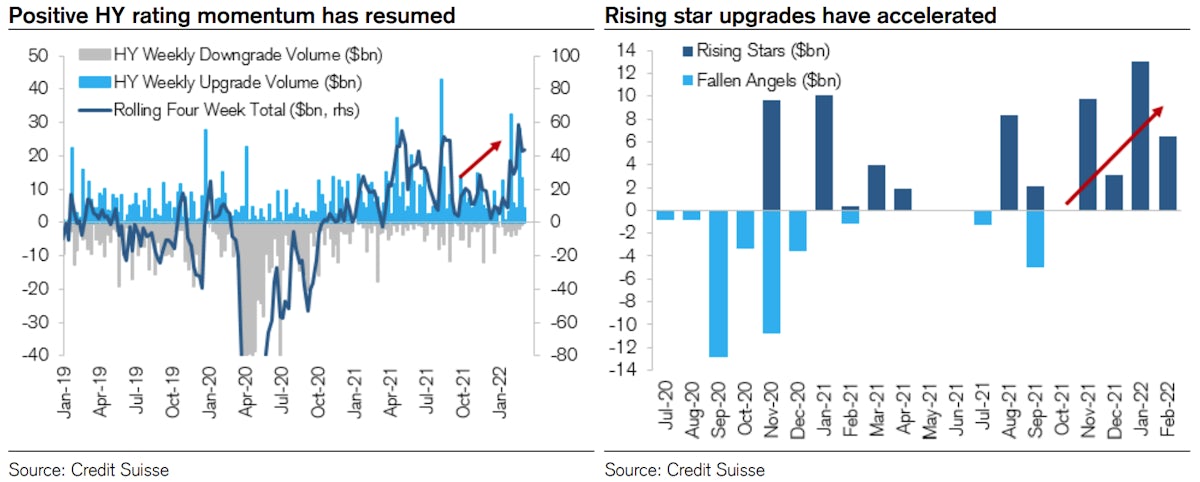

HY Upgrades & Rising Stars | Source: Credit Suisse

QUICK SUMMARY

- S&P 500 Bond Index was down -1.36% today, with investment grade down -1.46% and high yield down -0.43% (YTD total return: -5.63%)

- The iBoxx USD Liquid Investment Grade Total Return Index was down -1.516% today (Month-to-date: -0.91%; Year-to-date: -6.83%)

- The iBoxx USD Liquid High Yield Total Return Index was up 0.029% today (Month-to-date: 0.09%; Year-to-date: -3.45%)

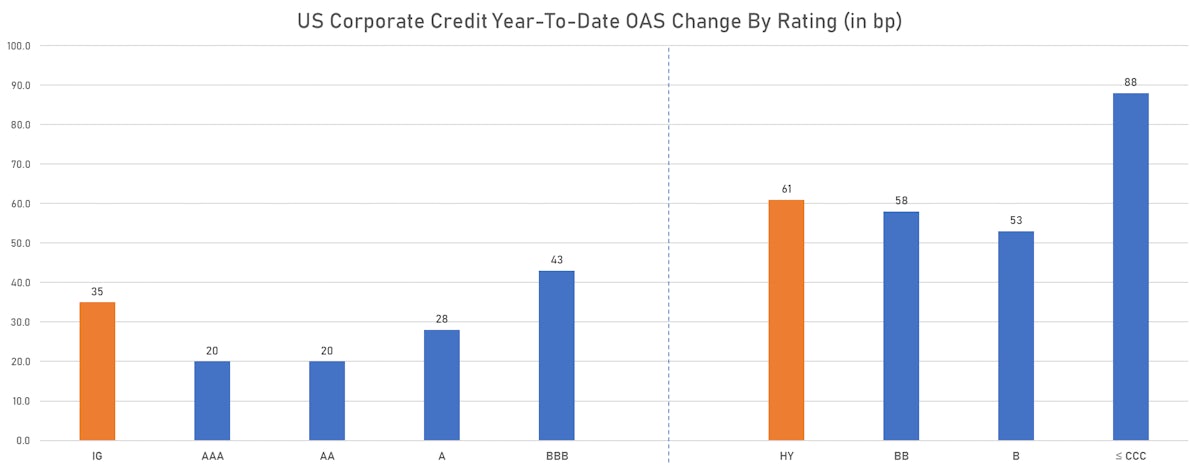

- ICE BofA US Corporate Index (Investment Grade) spread to worst down -1.0 bp, now at 130.0 bp (YTD change: +35.0 bp)

- ICE BofA US High Yield Index spread to worst down -17.0 bp, now at 394.0 bp (YTD change: +64.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index unchanged (YTD total return: -0.4%)

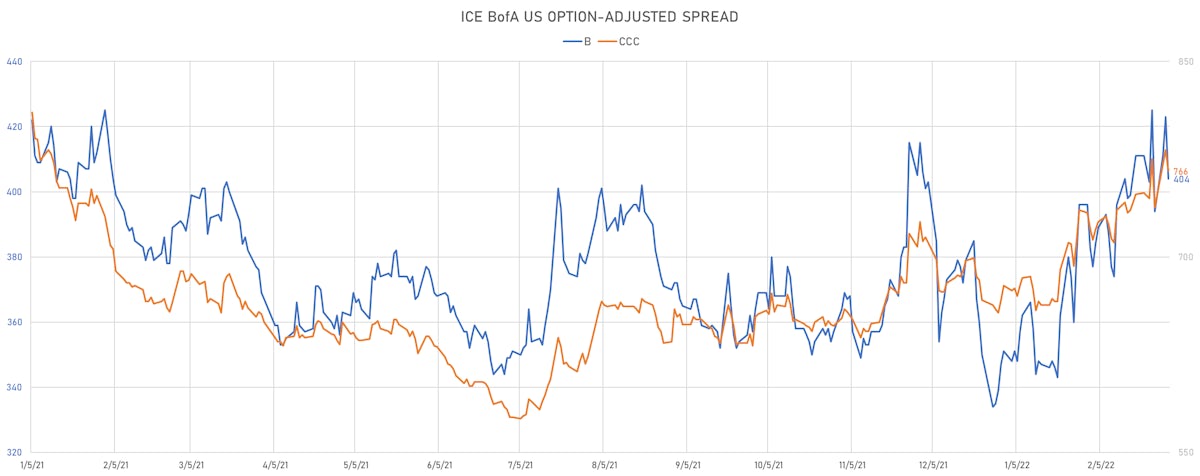

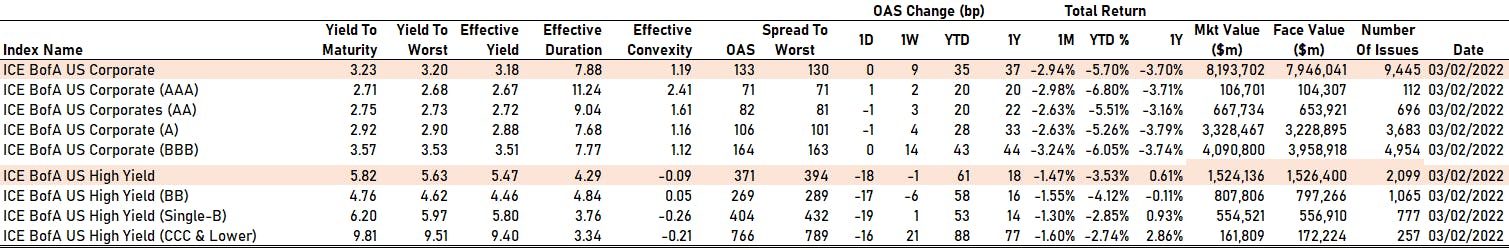

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING

- AAA up by 1 bp at 71 bp

- AA down by -1 bp at 82 bp

- A down by -1 bp at 106 bp

- BBB unchanged at 164 bp

- BB down by -17 bp at 269 bp

- B down by -19 bp at 404 bp

- CCC down by -16 bp at 766 bp

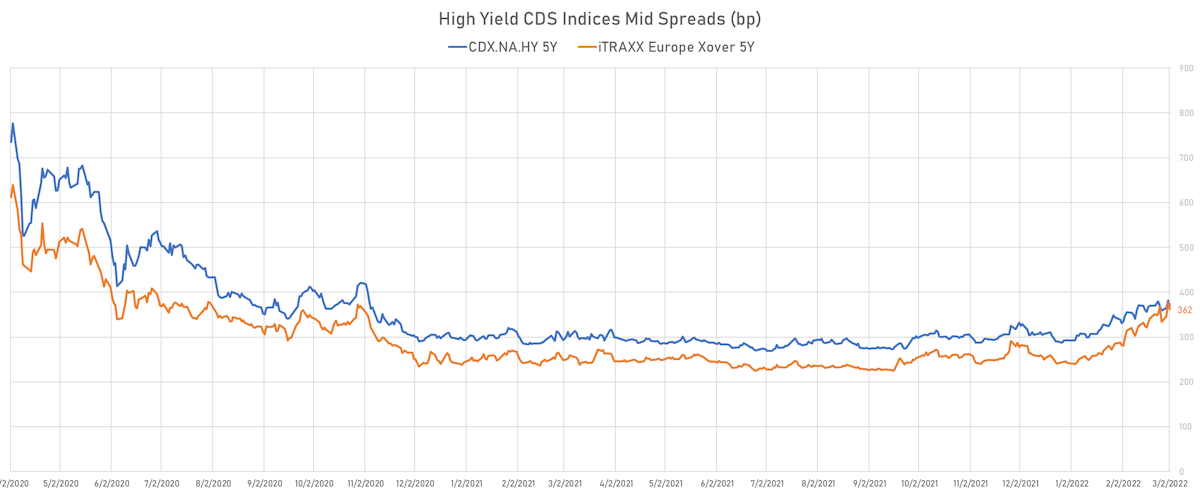

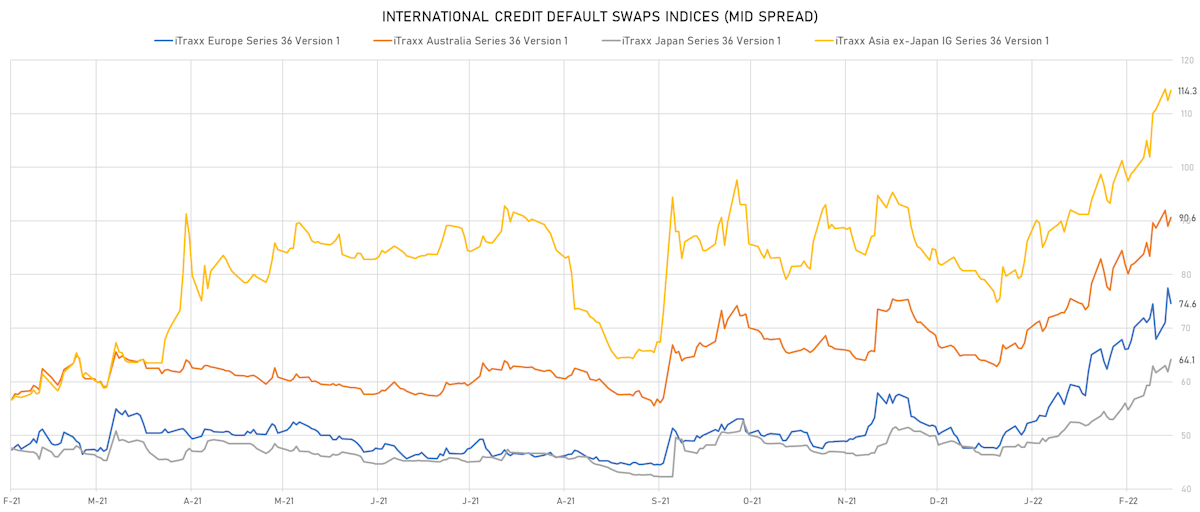

CDS INDICES (mid-spreads)

- Markit CDX.NA.IG 5Y down 2.6 bp, now at 107bp (YTD change: +18.1bp)

- Markit CDX.NA.HY 5Y down 11.0 bp, now at 370bp (YTD change: +78.1bp)

- Markit iTRAXX Europe down 2.9 bp, now at 75bp (YTD change: +26.9bp)

- Markit iTRAXX Japan up 2.3 bp, now at 64bp (YTD change: +17.7bp)

- Markit iTRAXX Asia Ex-Japan up 1.8 bp, now at 114bp (YTD change: +35.3bp)

USD CDS SINGLE NAMES MID SPREADS - LARGEST MOVES IN THE PAST WEEK

- Transocean Inc (Country: KY; rated: Caa3): down 245.2 bp to 1,907.0bp (1Y range: 941-1,907bp)

- Nordstrom Inc (Country: US; rated: Ba1): down 109.5 bp to 351.9bp (1Y range: 211-442bp)

- Nabors Industries Inc (Country: US; rated: B3): down 61.0 bp to 670.8bp (1Y range: 504-1,098bp)

- Pitney Bowes Inc (Country: US; rated: B1): down 54.7 bp to 701.7bp (1Y range: 363-702bp)

- RR Donnelley & Sons Co (Country: US; rated: WR): down 41.2 bp to 183.8bp (1Y range: 119-588bp)

- Lumen Technologies Inc (Country: US; rated: Ba3): down 34.5 bp to 513.5bp (1Y range: 195-533bp)

- Macy's Inc (Country: US; rated: Ba1): down 33.4 bp to 272.2bp (1Y range: 181-426bp)

- Occidental Petroleum Corp (Country: US; rated: BB+): down 30.8 bp to 151.9bp (1Y range: 152-360bp)

- CSC Holdings LLC (Country: US; rated: LGD3 - 30%): down 28.3 bp to 466.9bp (1Y range: -467bp)

- DISH DBS Corp (Country: US; rated: B2): down 26.7 bp to 579.2bp (1Y range: 317-609bp)

- Staples Inc (Country: US; rated: B3): down 25.1 bp to 1,095.5bp (1Y range: 687-1,159bp)

- CCO Holdings LLC (Country: US; rated: WR): down 25.1 bp to 180.2bp (1Y range: 113-210bp)

- Kohls Corp (Country: US; rated: Baa2): down 24.0 bp to 350.3bp (1Y range: 101-364bp)

- Apache Corp (Country: US; rated: Ba1): down 23.1 bp to 157.9bp (1Y range: 154-355bp)

- Russia, Federation of (Government) (Country: RU; rated: B3): up 438.3 bp to 1,327.5bp (1Y range: 77-1,328bp)

EURO CDS SINGLE NAMES MID SPREADS - LARGEST MOVES IN THE PAST WEEK

- Leonardo SpA (Country: IT; rated: WD): down 42.3 bp to 187.1bp (1Y range: 125-239bp)

- thyssenkrupp AG (Country: DE; rated: B1): down 33.7 bp to 303.4bp (1Y range: 205-321bp)

- Stena AB (Country: SE; rated: B2-PD): down 29.7 bp to 519.4bp (1Y range: 401-679bp)

- Altice Finco SA (Country: LU; rated: Caa1): down 22.3 bp to 529.8bp (1Y range: 333-551bp)

- Monitchem Holdco 3 SA (Country: LU; rated: B2): down 14.9 bp to 288.4bp (1Y range: 186-305bp)

- Carrefour SA (Country: FR; rated: Baa1): down 13.0 bp to 98.5bp (1Y range: 45-117bp)

- Louis Dreyfus Co BV (Country: NL; rated: ): up 17.3 bp to 166.3bp (1Y range: -166bp)

- Fortum Oyj (Country: FI; rated: baa3): up 18.5 bp to 120.3bp (1Y range: 40-120bp)

- Valeo SE (Country: FR; rated: P-3): up 19.9 bp to 231.3bp (1Y range: 110-231bp)

- Telefonaktiebolaget LM Ericsson (Country: SE; rated: Ba1): up 24.4 bp to 154.1bp (1Y range: 59-154bp)

- Renault SA (Country: FR; rated: Ba2): up 30.1 bp to 299.4bp (1Y range: 166-299bp)

- Casino Guichard Perrachon SA (Country: FR; rated: WR): up 63.8 bp to 1,048.4bp (1Y range: 464-1,080bp)

- TUI AG (Country: DE; rated: B3-PD): up 78.1 bp to 758.1bp (1Y range: 607-946bp)

- Raiffeisen Bank International AG (Country: AT; rated: baa2): up 131.2 bp to 201.1bp (1Y range: 41-204bp)

SELECTED RECENT USD BOND ISSUES

- Alabama Power Co (Utility - Other | Birmingham, Alabama, United States | Rating: A-): US$700m Senior Note (US010392FX19), fixed rate (3.05% coupon) maturing on 15 March 2032, priced at 99.93 (original spread of 120 bp), callable (10nc10)

- Aptargroup Inc (Industrials - Other | Crystal Lake, United States | Rating: BBB-): US$400m Senior Note (US038336AA11), fixed rate (3.60% coupon) maturing on 15 March 2032, priced at 99.74 (original spread of 177 bp), callable (10nc10)

- Athene Global Funding (Financial - Other | Wilmington, Delaware, United States | Rating: NR): US$500m Note (US04685A3L31), fixed rate (3.21% coupon) maturing on 8 March 2027, priced at 100.00 (original spread of 145 bp), non callable

- Athene Global Funding (Financial - Other | Wilmington, Delaware, United States | Rating: NR): US$550m Note (US04685A3J84), fixed rate (2.51% coupon) maturing on 8 March 2024, priced at 100.00 (original spread of 100 bp), non callable

- CBOE Global Markets Inc (Securities | Chicago, Illinois, United States | Rating: A-): US$300m Senior Note (US12503MAD02), fixed rate (3.00% coupon) maturing on 16 March 2032, priced at 99.55 (original spread of 120 bp), callable (10nc10)

- Crown Castle International Corp (Real Estate Investment Trust | Houston, United States | Rating: BBB-): US$750m Senior Note (US22822VAZ40), fixed rate (2.90% coupon) maturing on 15 March 2027, priced at 99.76 (original spread of 120 bp), callable (5nc5)

- Exelon Corp (Utility - Other | Chicago, United States | Rating: BBB): US$700m Senior Note (US30161NBF78), fixed rate (4.10% coupon) maturing on 15 March 2052, priced at 99.93 (original spread of 180 bp), callable (30nc30)

- Exelon Corp (Utility - Other | Chicago, United States | Rating: BBB): US$650m Senior Note (US30161NBC48), fixed rate (3.35% coupon) maturing on 15 March 2032, priced at 99.93 (original spread of 145 bp), callable (10nc10)

- Exelon Corp (Utility - Other | Chicago, United States | Rating: BBB): US$650m Senior Note (US30161NAZ42), fixed rate (2.75% coupon) maturing on 15 March 2027, priced at 99.87 (original spread of 100 bp), callable (5nc5)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$235m Bond (US3133ENQV55), fixed rate (1.87% coupon) maturing on 10 March 2025, priced at 100.00 (original spread of 82 bp), callable (3nc1)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$250m Bond (US3133ENQX12), fixed rate (1.67% coupon) maturing on 8 March 2024, priced at 100.00, callable (2nc1)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$1,150m Bond (US3133ENQU72), floating rate (SOFR + 4.5 bp) maturing on 8 March 2024, priced at 100.00, non callable

- GATX Corp (Railroads | Chicago, Illinois, United States | Rating: BBB): US$400m Senior Note (US361448BJ12), fixed rate (3.50% coupon) maturing on 1 June 2032, priced at 99.75 (original spread of 167 bp), callable (10nc10)

- HCA Inc (Health Care Facilities | Nashville, Tennessee, United States | Rating: BBB-): US$2,000m Note (US404119CG28), fixed rate (4.63% coupon) maturing on 15 March 2052, priced at 99.90 (original spread of 254 bp), callable (30nc30)

- HCA Inc (Health Care Facilities | Nashville, Tennessee, United States | Rating: BBB-): US$500m Note (US404119CM95), fixed rate (4.38% coupon) maturing on 15 March 2042, priced at 98.43 (original spread of 235 bp), callable (20nc20)

- HCA Inc (Health Care Facilities | Nashville, Tennessee, United States | Rating: BBB-): US$500m Note (US404119CE79), fixed rate (3.38% coupon) maturing on 15 March 2029, priced at 99.46 (original spread of 160 bp), callable (7nc7)

- HCA Inc (Health Care Facilities | Nashville, Tennessee, United States | Rating: BBB-): US$1,000m Note (US404119CD96), fixed rate (3.13% coupon) maturing on 15 March 2027, priced at 99.80 (original spread of 140 bp), callable (5nc5)

- HCA Inc (Health Care Facilities | Nashville, Tennessee, United States | Rating: BBB-): US$2,000m Note (US404119CF45), fixed rate (3.63% coupon) maturing on 15 March 2032, priced at 99.01 (original spread of 185 bp), callable (10nc10)

- Innoviva Inc (Pharmaceuticals | Burlingame, California, United States | Rating: NR): US$200m Bond (US45781MAC55), fixed rate (2.13% coupon) maturing on 15 March 2028, priced at 100.00, non callable, convertible

- John Deere Capital Corp (Financial - Other | Reno, United States | Rating: A): US$450m Senior Note (US24422EWB19), fixed rate (2.13% coupon) maturing on 7 March 2025, priced at 99.96 (original spread of 45 bp), non callable

- John Deere Capital Corp (Financial - Other | Reno, United States | Rating: A): US$300m Senior Note (US24422EWC91), floating rate (SOFR + 56.0 bp) maturing on 7 March 2025, priced at 100.00, non callable

- John Deere Capital Corp (Financial - Other | Reno, United States | Rating: A): US$500m Senior Note (US24422EWD74), fixed rate (2.35% coupon) maturing on 8 March 2027, priced at 99.95 (original spread of 60 bp), non callable

- Macy's Retail Holdings LLC (Financial - Other | Springdale, United States | Rating: BBB-): US$425m Senior Note (US55617LAR33), fixed rate (6.13% coupon) maturing on 15 March 2032, priced at 100.00 (original spread of 428 bp), callable (10nc5)

- Nasdaq Inc (Securities | New York City, New York, United States | Rating: BBB+): US$550m Senior Note (US631103AM02), fixed rate (3.95% coupon) maturing on 7 March 2052, priced at 99.39 (original spread of 175 bp), callable (30nc30)

- Nucor Corp (Machinery | Charlotte, North Carolina, United States | Rating: A-): US$550m Senior Note (US670346AV71), fixed rate (3.13% coupon) maturing on 1 April 2032, priced at 99.67 (original spread of 130 bp), callable (10nc10)

- Nucor Corp (Machinery | Charlotte, North Carolina, United States | Rating: A-): US$550m Senior Note (US670346AW54), fixed rate (3.85% coupon) maturing on 1 April 2052, priced at 99.07 (original spread of 183 bp), callable (30nc30)

- Progressive Corp (Property and Casualty Insurance | Village Of Mayfield, Ohio, United States | Rating: A): US$500m Senior Note (US743315BA02), fixed rate (3.70% coupon) maturing on 15 March 2052, priced at 99.75 (original spread of 145 bp), callable (30nc30)

- Progressive Corp (Property and Casualty Insurance | Village Of Mayfield, Ohio, United States | Rating: A): US$500m Senior Note (US743315AY96), fixed rate (2.50% coupon) maturing on 15 March 2027, priced at 99.96 (original spread of 75 bp), callable (5nc5)

- Progressive Corp (Property and Casualty Insurance | Village Of Mayfield, Ohio, United States | Rating: A): US$500m Senior Note (US743315AZ61), fixed rate (3.00% coupon) maturing on 15 March 2032, priced at 99.76 (original spread of 115 bp), callable (10nc10)

- Bank of Nova Scotia (Banking | Toronto, Ontario, Canada | Rating: A): US$2,250m Covered Bond (Other) (US06418BAB45), fixed rate (2.17% coupon) maturing on 9 March 2027, priced at 100.00 (original spread of 42 bp), non callable

- Chile, Government of (Sovereign | Chile | Rating: A-): US$2,000m Senior Note (US168863DY16), fixed rate (4.34% coupon) maturing on 7 March 2042, priced at 99.92 (original spread of 200 bp), callable (20nc20)

- Deutsche Bank AG (Banking | Frankfurt, Hessen, Germany | Rating: BBB+): US$500m Note (XS0459877790), fixed rate (1.75% coupon) maturing on 24 March 2026, priced at 100.00, non callable

- Single Platform Investment Repackaging Entity SA (Financial - Other | Luxembourg, Netherlands | Rating: NR): US$208m Unsecured Note (XS2450197269) zero coupon maturing on 20 December 2051, priced at 48.09, non callable

- TransCanada Trust (Financial - Other | Calgary, Alberta, Canada | Rating: BBB-): US$800m Junior Subordinated Note (US89356BAG32), fixed rate (5.60% coupon) maturing on 7 March 2082, priced at 100.00 (original spread of 374 bp), callable (60nc10)

- Waste Connections Inc (Service - Other | Woodbridge, Ontario, Canada | Rating: BBB+): US$500m Senior Note (US94106BAE11), fixed rate (3.20% coupon) maturing on 1 June 2032, priced at 99.93 (original spread of 135 bp), callable (10nc10)

- YanAn Tourism Group Co Ltd (Leisure | Yan'An, Shaanxi, China (Mainland) | Rating: NR): US$150m Bond (XS2360160563) maturing on 30 June 2024, priced at 100.00, non callable

SELECTED RECENT EUR BOND ISSUES

- DZ BANK AG Deutsche Zentral Genossenschaftsbank Frankfurt am Main (Banking | Frankfurt, Hessen, Germany | Rating: A+): €180m Fundierte Schuldverschreibungen (Covered Bond) (DE000DFK0QC8), fixed rate (0.01% coupon) maturing on 21 March 2024, priced at 100.29, non callable

- Nordic Investment Bank (Supranational | Helsinki, Etela-Suomen, Finland | Rating: AAA): €500m Bond (XS2454249652), fixed rate (0.25% coupon) maturing on 9 March 2029, priced at 99.61 (original spread of 55 bp), non callable

- Vestas Wind Systems Finance BV (Financial - Other | Arnhem, Netherlands | Rating: NR): €500m Unsecured Note (XS2449929517) maturing on 2 June 2034, priced at 100.00, non callable

NEW LOANS

- BLADEX (BBB), signed a US$ 150m Term Loan, to be used for general corporate purposes. It matures on 03/16/25 and initial pricing is set at Term SOFR +125bp

- Pembina Pipeline Corp (BBB), signed a US$ 250m Revolving Credit Facility, to be used for acquisition financing

- Pembina Pipeline Corp (BBB), signed a US$ 550m Revolving Credit Facility, to be used for acquisition financing

- Pembina Pipeline Corp (BBB), signed a US$ 3,900m Term Loan, to be used for acquisition financing

NEW ISSUES IN SECURITIZED CREDIT

- Wingstop Funding LLC Series 2022-1 issued a fixed-rate ABS backed by business cashflow in 1 tranche offering a yield to maturity of 3.73%, for a total of US$ 250 m. Bookrunner: Morgan Stanley International Ltd

- SG Residential Mortgage Trust 2022-1 issued a fixed-rate RMBS in 6 tranches, for a total of US$ 296 m. Highest-rated tranche offering a coupon of 3.58%, and the lowest-rated tranche a yield to maturity of 4.12%. Bookrunners: Credit Suisse, Morgan Stanley International Ltd