Credit

US Cash Spreads Slightly Wider, But The Rates Curve Flattening Helps Investment Grade Bonds Rise

Good day for IG US$ corporate bond issuance, with a number of deals priced, mostly from FIGs like BofA, CBA, BMO, Sumitomo, as well as companies like Roche and Mondelez

Published ET

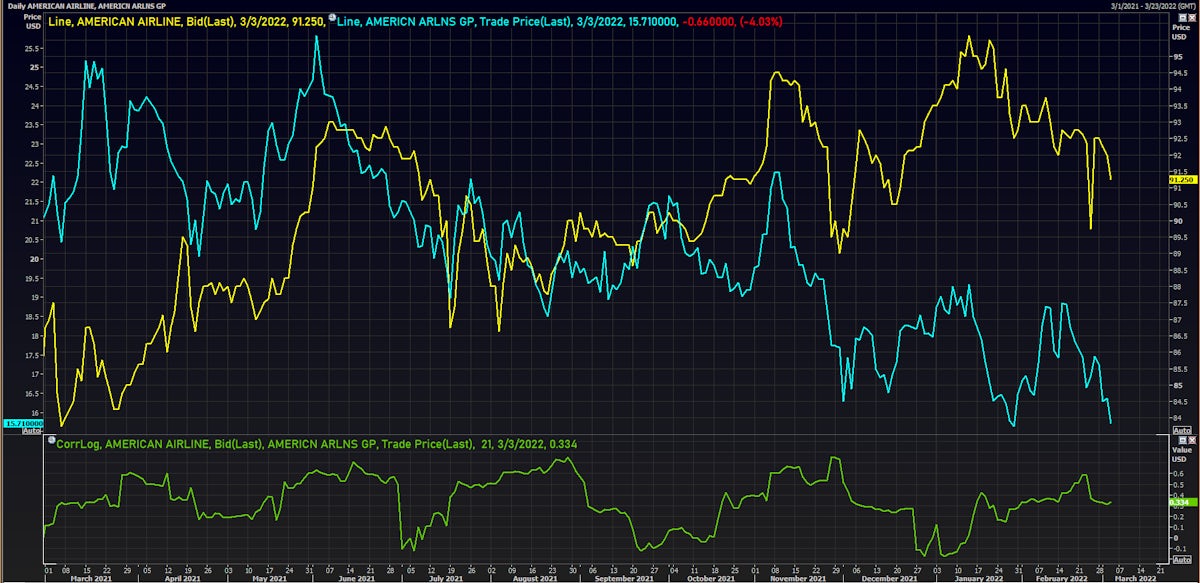

American Airlines 03/2025 Bond (USU0242AAD47) Price & Stock Price | Source: Refinitiv

QUICK SUMMARY

- S&P 500 Bond Index was up 0.38% today, with investment grade up 0.41% and high yield up 0.10% (YTD total return: -5.28%)

- The iBoxx USD Liquid Investment Grade Total Return Index was up 0.424% today (Month-to-date: -0.49%; Year-to-date: -6.43%)

- The iBoxx USD Liquid High Yield Total Return Index was down -0.078% today (Month-to-date: 0.01%; Year-to-date: -3.52%)

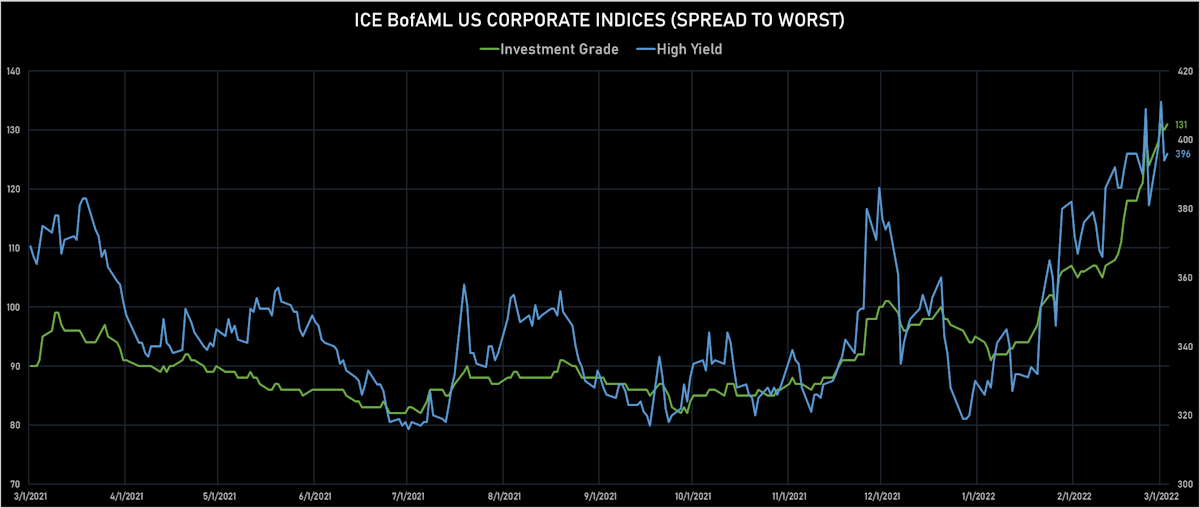

- ICE BofA US Corporate Index (Investment Grade) spread to worst up 1.0 bp, now at 131.0 bp (YTD change: +36.0 bp)

- ICE BofA US High Yield Index spread to worst up 2.0 bp, now at 396.0 bp (YTD change: +66.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index up 0.04% today (YTD total return: -0.3%)

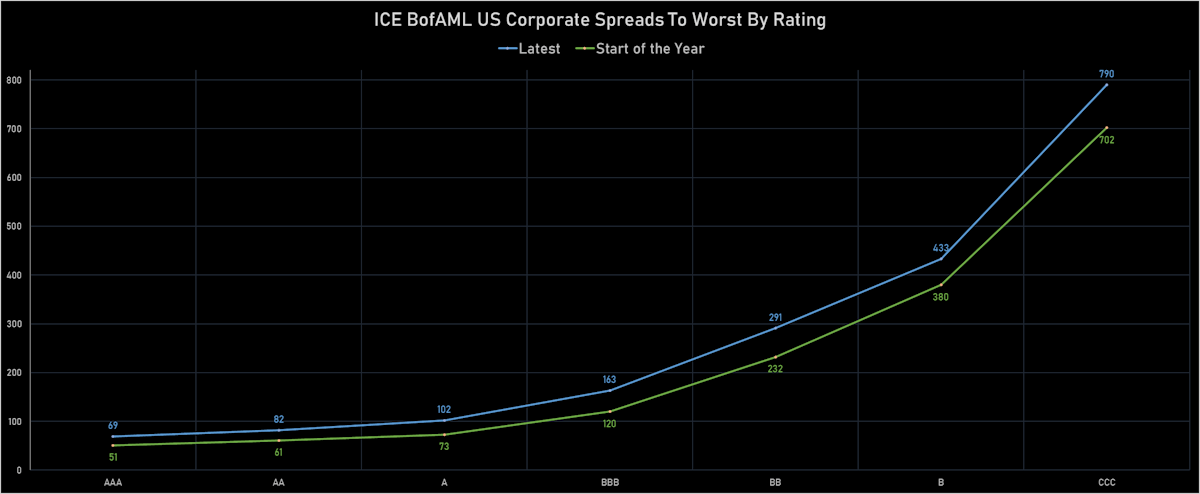

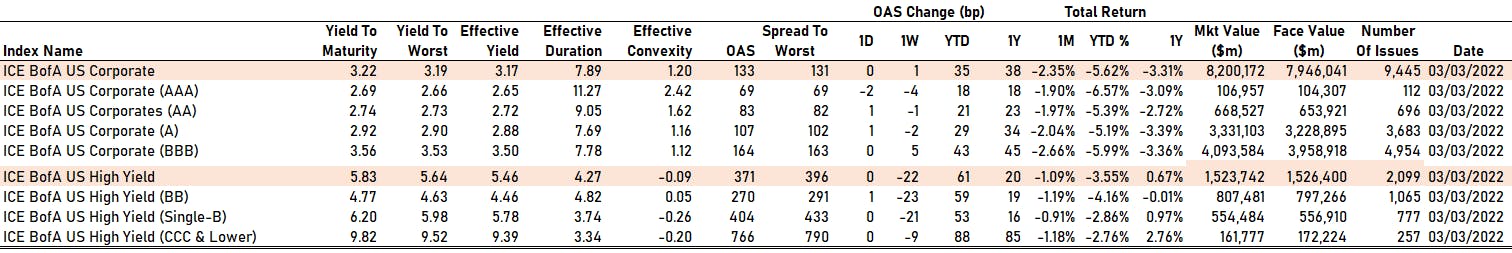

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING

- AAA down by -2 bp at 69 bp

- AA up by 1 bp at 83 bp

- A up by 1 bp at 107 bp

- BBB unchanged at 164 bp

- BB up by 1 bp at 270 bp

- B unchanged at 404 bp

- CCC unchanged at 766 bp

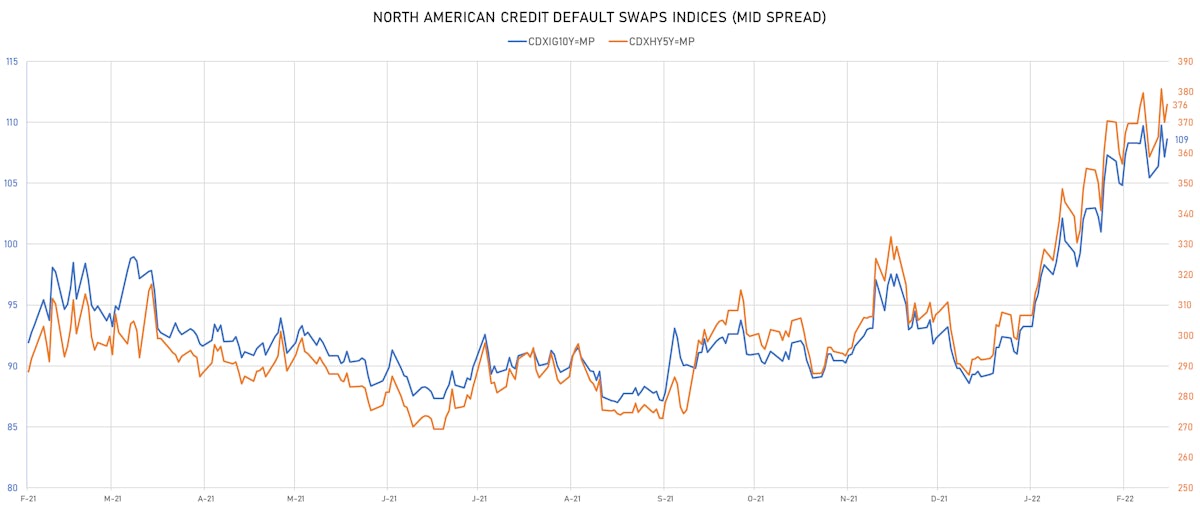

CDS INDICES (mid-spreads)

- Markit CDX.NA.IG 5Y up 1.4 bp, now at 109bp (YTD change: +19.5bp)

- Markit CDX.NA.HY 5Y up 5.8 bp, now at 376bp (YTD change: +83.9bp)

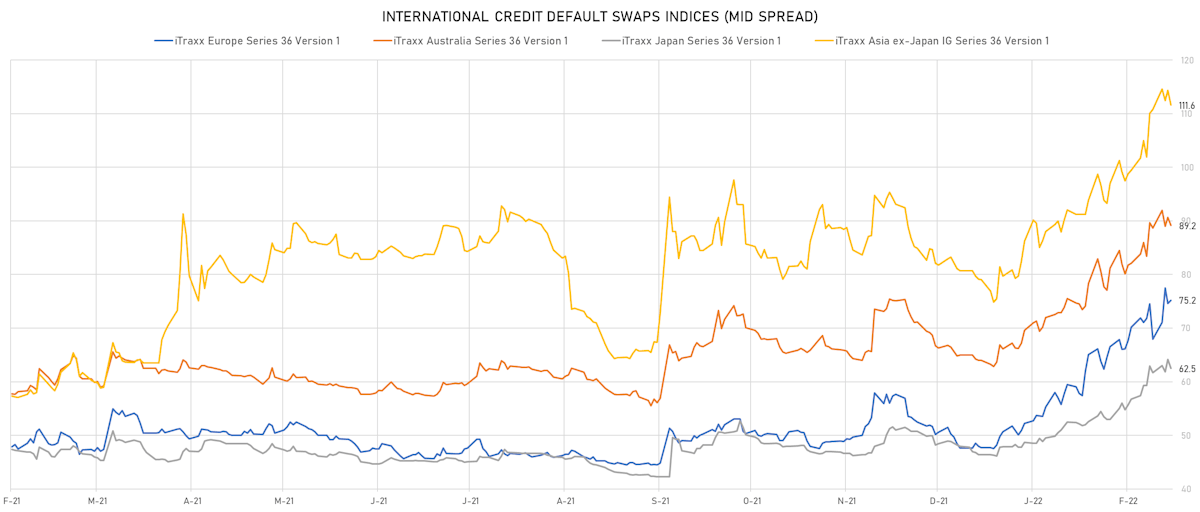

- Markit iTRAXX Europe up 0.7 bp, now at 75bp (YTD change: +27.5bp)

- Markit iTRAXX Japan down 1.6 bp, now at 63bp (YTD change: +16.1bp)

- Markit iTRAXX Asia Ex-Japan down 2.7 bp, now at 112bp (YTD change: +32.6bp)

TOP BONDS MOVES IN THE PAST WEEK - USD HY

- Issuer: Brinker International Inc (Coppell, Texas (US)) | Coupon: 5.00% | Maturity: 1/10/2024 | Rating: B+ | ISIN: USU6223WAB01 | Z-spread up by 78.3 bp to 240.8 bp, with the yield to worst at 4.2% and the bond now trading down to 101.8 cents on the dollar (1Y price range: 101.8-106.8).

- Issuer: American Airlines Group Inc (Fort Worth, Texas (US)) | Coupon: 3.75% | Maturity: 1/3/2025 | Rating: CCC | ISIN: USU0242AAD47 | Z-spread up by 66.4 bp to 537.0 bp (CDS basis: 249.7bp), with the yield to worst at 6.9% and the bond now trading down to 91.3 cents on the dollar (1Y price range: 89.8-95.6).

- Issuer: MGM Growth Properties Operating Partnership LP (Las Vegas, Nevada (US)) | Coupon: 4.63% | Maturity: 15/6/2025 | Rating: B+ | ISIN: USU5930BAD83 | Z-spread up by 46.3 bp to 174.7 bp, with the yield to worst at 3.4% and the bond now trading down to 103.0 cents on the dollar (1Y price range: 102.0-106.5).

- Issuer: Enact Holdings Inc (Raleigh, North Carolina (US)) | Coupon: 6.50% | Maturity: 15/8/2025 | Rating: BB | ISIN: USU3230LAA45 | Z-spread up by 41.9 bp to 354.3 bp (CDS basis: -100.2bp), with the yield to worst at 5.2% and the bond now trading down to 103.0 cents on the dollar (1Y price range: 102.5-109.5).

- Issuer: OCP SA (Casablanca, Morocco) | Coupon: 5.63% | Maturity: 25/4/2024 | Rating: BB+ | ISIN: XS1061043011 | Z-spread up by 33.6 bp to 244.6 bp (CDS basis: -176.6bp), with the yield to worst at 3.9% and the bond now trading down to 103.0 cents on the dollar (1Y price range: 102.9-107.0).

- Issuer: NCL Finance Ltd (United Kingdom) | Coupon: 6.13% | Maturity: 15/3/2028 | Rating: CCC+ | ISIN: USG6437FAA78 | Z-spread up by 33.0 bp to 543.0 bp, with the yield to worst at 7.1% and the bond now trading down to 94.5 cents on the dollar (1Y price range: 93.4-99.5).

- Issuer: DCP Midstream Operating LP (Denver, Colorado (US)) | Coupon: 6.45% | Maturity: 3/11/2036 | Rating: BB+ | ISIN: USU2647UAA35 | Z-spread up by 31.6 bp to 271.1 bp, with the yield to worst at 4.6% and the bond now trading down to 119.0 cents on the dollar (1Y price range: 121.0-131.0).

- Issuer: Southeast Supply Header LLC (Houston, Texas (US)) | Coupon: 4.25% | Maturity: 15/6/2024 | Rating: BB- | ISIN: USU83854AB29 | Z-spread up by 30.2 bp to 282.8 bp, with the yield to worst at 4.1% and the bond now trading down to 99.2 cents on the dollar (1Y price range: 98.7-102.8).

- Issuer: Wynn Resorts (Las Vegas, Nevada (US)) | Coupon: 5.13% | Maturity: 1/10/2029 | Rating: B | ISIN: USU98354AA80 | Z-spread up by 28.9 bp to 390.3 bp, with the yield to worst at 5.6% and the bond now trading down to 96.0 cents on the dollar (1Y price range: 95.3-102.3).

- Issuer: Xerox Holdings Corp (Norwalk, Connecticut (US)) | Coupon: 5.50% | Maturity: 15/8/2028 | Rating: BB | ISIN: USU98401AB58 | Z-spread up by 27.3 bp to 384.1 bp, with the yield to worst at 5.5% and the bond now trading down to 99.0 cents on the dollar (1Y price range: 98.4-105.5).

- Issuer: Nextera Energy Operating Partners LP (Juno Beach, Florida (US)) | Coupon: 4.50% | Maturity: 15/9/2027 | Rating: BB | ISIN: USU6500TAB18 | Z-spread down by 26.8 bp to 236.0 bp, with the yield to worst at 4.0% and the bond now trading up to 101.4 cents on the dollar (1Y price range: 99.5-107.8).

- Issuer: Sealed Air Corp (Charlotte, North Carolina (US)) | Coupon: 4.00% | Maturity: 1/12/2027 | Rating: BB | ISIN: USU81193AQ42 | Z-spread down by 26.9 bp to 232.0 bp (CDS basis: -30.2bp), with the yield to worst at 3.9% and the bond now trading up to 99.1 cents on the dollar (1Y price range: 97.0-104.3).

- Issuer: Hat Holdings I LLC (Annapolis, Maryland (US)) | Coupon: 3.38% | Maturity: 15/6/2026 | Rating: BB+ | ISIN: USU2467RAE90 | Z-spread down by 32.0 bp to 267.8 bp, with the yield to worst at 4.4% and the bond now trading up to 95.6 cents on the dollar (1Y price range: 93.3-102.1).

- Issuer: ZF North America Capital Inc (Northville, Michigan (US)) | Coupon: 4.75% | Maturity: 29/4/2025 | Rating: BB+ | ISIN: USU98737AC03 | Z-spread down by 43.2 bp to 212.4 bp, with the yield to worst at 3.7% and the bond now trading up to 102.5 cents on the dollar (1Y price range: 100.1-107.1).

TOP BONDS MOVES IN THE PAST WEEK - EUR HY

- Issuer: Alfa Holding Issuance PLC (Dublin, Ireland) | Coupon: 2.70% | Maturity: 11/6/2023 | Rating: BB- | ISIN: XS2183144810 | Z-spread up by 4,852.7 bp to 7,106.6 bp, with the yield to worst at 70.6% and the bond now trading down to 52.6 cents on the dollar (1Y price range: 50.0-100.6).

- Issuer: Akropolis Group UAB (Vilnius, Lithuania) | Coupon: 2.88% | Maturity: 2/6/2026 | Rating: BB+ | ISIN: XS2346869097 | Z-spread up by 220.0 bp to 556.1 bp, with the yield to worst at 5.7% and the bond now trading down to 89.0 cents on the dollar (1Y price range: 88.5-95.2).

- Issuer: Telefonaktiebolaget LM Ericsson (Stockholm, Sweden) | Coupon: 1.88% | Maturity: 1/3/2024 | Rating: BB+ | ISIN: XS1571293684 | Z-spread up by 100.2 bp to 182.1 bp (CDS basis: -116.3bp), with the yield to worst at 1.8% and the bond now trading down to 100.1 cents on the dollar (1Y price range: 99.8-103.5).

- Issuer: Telecom Italia SpA (Rome, Italy) | Coupon: 4.00% | Maturity: 11/4/2024 | Rating: BB | ISIN: XS1935256369 | Z-spread up by 95.9 bp to 348.6 bp (CDS basis: -220.2bp), with the yield to worst at 3.3% and the bond now trading down to 100.9 cents on the dollar (1Y price range: 100.9-105.2).

- Issuer: Renault SA (Boulogne-Billancourt, France) | Coupon: 2.50% | Maturity: 1/4/2028 | Rating: BB | ISIN: FR0014002OL8 | Z-spread up by 71.4 bp to 405.3 bp (CDS basis: -93.9bp), with the yield to worst at 4.3% and the bond now trading down to 89.5 cents on the dollar (1Y price range: 89.6-100.1).

- Issuer: International Consolidated Airlines Group SA (Harmondsworth, Spain) | Coupon: 2.75% | Maturity: 25/3/2025 | Rating: B+ | ISIN: XS2322423455 | Z-spread up by 70.5 bp to 408.7 bp, with the yield to worst at 4.1% and the bond now trading down to 95.7 cents on the dollar (1Y price range: 95.1-99.8).

- Issuer: Adler Real Estate AG (Berlin, Germany) | Coupon: 2.13% | Maturity: 6/2/2024 | Rating: B | ISIN: XS1731858715 | Z-spread up by 70.2 bp to 740.5 bp, with the yield to worst at 7.2% and the bond now trading down to 90.9 cents on the dollar (1Y price range: 88.8-94.9).

- Issuer: Arcelik AS (Turkey) | Coupon: 3.00% | Maturity: 27/5/2026 | Rating: BB | ISIN: XS2346972263 | Z-spread up by 70.0 bp to 459.5 bp, with the yield to worst at 4.8% and the bond now trading down to 92.8 cents on the dollar (1Y price range: 92.7-98.4).

- Issuer: Deutsche Lufthansa AG (Cologne, Germany) | Coupon: 2.00% | Maturity: 14/7/2024 | Rating: BB- | ISIN: XS2363244513 | Z-spread up by 68.0 bp to 301.9 bp (CDS basis: -104.1bp), with the yield to worst at 3.0% and the bond now trading down to 97.5 cents on the dollar (1Y price range: 97.4-101.1).

SELECTED RECENT USD BOND ISSUES

- Bank of America Corp (Banking | Charlotte, North Carolina, United States | Rating: A-): US$2,500m Subordinated Note (US06051GKL22), fixed rate (3.85% coupon) maturing on 8 March 2037, priced at 100.00 (original spread of 210 bp), callable (15nc5)

- Diamondback Energy Inc (Oil and Gas | Midland, Texas, United States | Rating: BBB-): US$750m Senior Note (US25278XAT63), fixed rate (4.25% coupon) maturing on 15 March 2052, priced at 99.71 (original spread of 227 bp), callable (30nc30)

- Energizer Holdings Inc (Electronics | St. Louis, Missouri, United States | Rating: B): US$300m Senior Note (US29272WAF68), fixed rate (6.50% coupon) maturing on 31 December 2027, priced at 100.00 (original spread of 470 bp), callable (6nc2)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, New Jersey, United States | Rating: AA+): US$500m Bond (US3133ENRB82), floating rate (SOFR + 5.0 bp) maturing on 11 March 2024, priced at 100.00, non callable

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$250m Bond (US3133ENQZ69), floating rate (PRQ + -313.0 bp) maturing on 11 March 2024, priced at 100.00, non callable

- Kemper Corp (Life Insurance | Chicago, Illinois, United States | Rating: BB+): US$150m Junior Subordinated Debenture (US4884013081), fixed rate (5.88% coupon) maturing on 15 March 2062, priced at 100.00, callable (40nc5)

- LSB Industries Inc (Industrials - Other | Oklahoma City, United States | Rating: B): US$200m Note (USU5464JAE39), fixed rate (6.25% coupon) maturing on 15 October 2028, priced at 100.00, callable (7nc3)

- Lumentum Holdings Inc (Electronics | San Jose, California, United States | Rating: BB-): US$750m Bond (US55024UAE91), fixed rate (0.38% coupon) maturing on 15 June 2028, priced at 100.00, non callable, convertible

- Mondelez International Inc (Food Processors | Chicago, Illinois, United States | Rating: BBB): US$750m Senior Note (US609207BB05), fixed rate (3.00% coupon) maturing on 17 March 2032, priced at 99.27 (original spread of 123 bp), callable (10nc10)

- Mondelez International Inc (Food Processors | Chicago, Illinois, United States | Rating: BBB): US$500m Senior Note (US609207AZ81), fixed rate (2.13% coupon) maturing on 17 March 2024, priced at 99.76 (original spread of 70 bp), with a make whole call

- Mondelez International Inc (Food Processors | Chicago, Illinois, United States | Rating: BBB): US$750m Senior Note (US609207BA22), fixed rate (2.63% coupon) maturing on 17 March 2027, priced at 99.74 (original spread of 93 bp), callable (5nc5)

- Bank of Montreal (Banking | Montreal, Canada | Rating: A+): US$500m Senior Note (US06368FAH29), floating rate (SOFR + 71.0 bp) maturing on 8 March 2024, priced at 100.00, non callable

- Bank of Montreal (Banking | Montreal, Canada | Rating: A+): US$1,250m Senior Note (US06368FAG46), fixed rate (2.15% coupon) maturing on 8 March 2024, priced at 99.93 (original spread of 65 bp), with a make whole call

- Bank of Montreal (Banking | Montreal, Canada | Rating: A+): US$1,250m Senior Note (US06368FAJ84), fixed rate (2.65% coupon) maturing on 8 March 2027, priced at 99.79 (original spread of 95 bp), with a make whole call

- Commonwealth Bank of Australia (Banking | London, Australia | Rating: NR): US$350m Senior Note (US2027A0KL25), floating rate (SOFR + 97.0 bp) maturing on 14 March 2027, priced at 100.00, non callable

- Commonwealth Bank of Australia (Banking | London, Australia | Rating: NR): US$1,250m Subordinated Note (USQ2704MAH18), fixed rate (3.78% coupon) maturing on 14 March 2032, priced at 100.00 (original spread of 195 bp), non callable

- Commonwealth Bank of Australia (Banking | London, Australia | Rating: NR): US$650m Senior Note (US2027A1KJ51), floating rate (SOFR + 74.0 bp) maturing on 14 March 2025, priced at 100.00, non callable

- Commonwealth Bank of Australia (Banking | London, Australia | Rating: NR): US$1,000m Senior Note (US2027A1KK25), fixed rate (2.55% coupon) maturing on 14 March 2027, priced at 100.00 (original spread of 83 bp), non callable

- Commonwealth Bank of Australia (Banking | London, Australia | Rating: NR): US$1,250m Senior Note (US2027A1KH95), fixed rate (2.30% coupon) maturing on 14 March 2025, priced at 100.00 (original spread of 63 bp), non callable

- HSBC Holdings PLC (Banking | London, United Kingdom | Rating: A-): US$500m Senior Note (US404280DB25), floating rate (SOFR + 143.0 bp) maturing on 10 March 2026, priced at 100.00, callable (4nc3)

- HSBC Holdings PLC (Banking | London, United Kingdom | Rating: A-): US$1,750m Senior Note (US404280DA42), floating rate maturing on 10 March 2026, priced at 100.00, callable (4nc3)

- Honda Motor Co Ltd (Automotive Manufacturer | Minato-Ku, Tokyo-To, Japan | Rating: A-): US$1,000m Senior Note (US438127AB80), fixed rate (2.53% coupon) maturing on 10 March 2027, priced at 100.00 (original spread of 80 bp), with a make whole call

- Honda Motor Co Ltd (Automotive Manufacturer | Minato-Ku, Tokyo-To, Japan | Rating: A-): US$750m Senior Note (US438127AC63), fixed rate (2.97% coupon) maturing on 10 March 2032, priced at 100.00 (original spread of 112 bp), with a make whole call

- Roche Holdings Inc (Pharmaceuticals | Wilmington, Switzerland | Rating: NR): US$1,250m Senior Note (US771196BV36), fixed rate (2.31% coupon) maturing on 10 March 2027, priced at 100.00 (original spread of 58 bp), callable (5nc5)

- Roche Holdings Inc (Pharmaceuticals | Wilmington, Switzerland | Rating: NR): US$1,250m Senior Note (US771196BU52), fixed rate (1.88% coupon) maturing on 8 March 2024, priced at 100.00 (original spread of 35 bp), with a make whole call

- Roche Holdings Inc (Pharmaceuticals | Wilmington, Switzerland | Rating: NR): US$1,000m Senior Note (USU75000BT27), fixed rate (2.13% coupon) maturing on 10 March 2025, priced at 100.00 (original spread of 45 bp), callable (3nc3)

- Roche Holdings Inc (Pharmaceuticals | Wilmington, Switzerland | Rating: NR): US$750m Senior Note (USU75000CA27), floating rate (SOFR + 56.0 bp) maturing on 10 March 2025, priced at 100.00, with a make whole call

- Sumitomo Mitsui Trust Bank Ltd (Banking | Chiyoda-Ku, Tokyo-To, Japan | Rating: A-): US$500m Senior Note (US86563VAZ22), fixed rate (2.55% coupon) maturing on 10 March 2025, priced at 99.91 (original spread of 90 bp), non callable

- Sumitomo Mitsui Trust Bank Ltd (Banking | Chiyoda-Ku, Tokyo-To, Japan | Rating: A-): US$500m Senior Note (US86563VBA61), fixed rate (2.80% coupon) maturing on 10 March 2027, priced at 99.91 (original spread of 108 bp), non callable

SELECTED RECENT EUR BOND ISSUES

- Council of Europe Development Bank (Supranational | Paris, Ile-De-France, France | Rating: AA+): €1,000m Senior Note (XS2454764429), fixed rate (0.13% coupon) maturing on 10 March 2027, priced at 99.42 (original spread of 51 bp), non callable

NEW LOANS

- SpeedCast International Ltd, signed a US$ 300m Term Loan B

- MSX International Inc, signed a € 498m Term Loan B, to be used for general corporate purposes. It matures on 01/06/26 and initial pricing is set at EURIBOR +475bp

- BLADEX (BBB), signed a US$ 150m Term Loan, to be used for general corporate purposes. It matures on 03/16/25 and initial pricing is set at Term SOFR +125bp

- Pembina Pipeline Corp (BBB), signed a US$ 250m Revolving Credit Facility, to be used for acquisition financing

- Pembina Pipeline Corp (BBB), signed a US$ 3,900m Term Loan, to be used for acquisition financing

- Enapter AG, signed a € 90m Term Loan, to be used for real estate acquisitions

NEW ISSUES IN SECURITIZED CREDIT

- New Residential Mortgage Loan Trust 2022-Nqm2 issued a fixed-rate RMBS in 6 tranches, for a total of US$ 322 m. Highest-rated tranche offering a coupon of 3.70%, and the lowest-rated tranche a yield to maturity of 3.90%. Bookrunners: Credit Suisse, Nomura Securities New York Inc, Amherst Securities Corp, Goldman Sachs & Co, Morgan Stanley International Ltd

- MFA 2022-Chm1 Trust issued a fixed-rate RMBS in 2 tranches, for a total of US$ 204 m. Highest-rated tranche offering a coupon of 4.57%, and the lowest-rated tranche a yield to maturity of 4.62%. Bookrunners: Credit Suisse