Credit

Mixed Performance For US Credit, With IG Cash Helped By Lower Yields, HY Cash Hampered By Wider Spreads

Weekly total issuance of USD corporate bonds (IFR Markets data): $59.2bn in 32 tranches for IG (2022 YTD volume $293.3bn vs 2021 YTD $324.1bn), $2.2bn in 5 tranches for HY (2022 YTD volume $33.9bn vs 2021 YTD $93.8bn)

Published ET

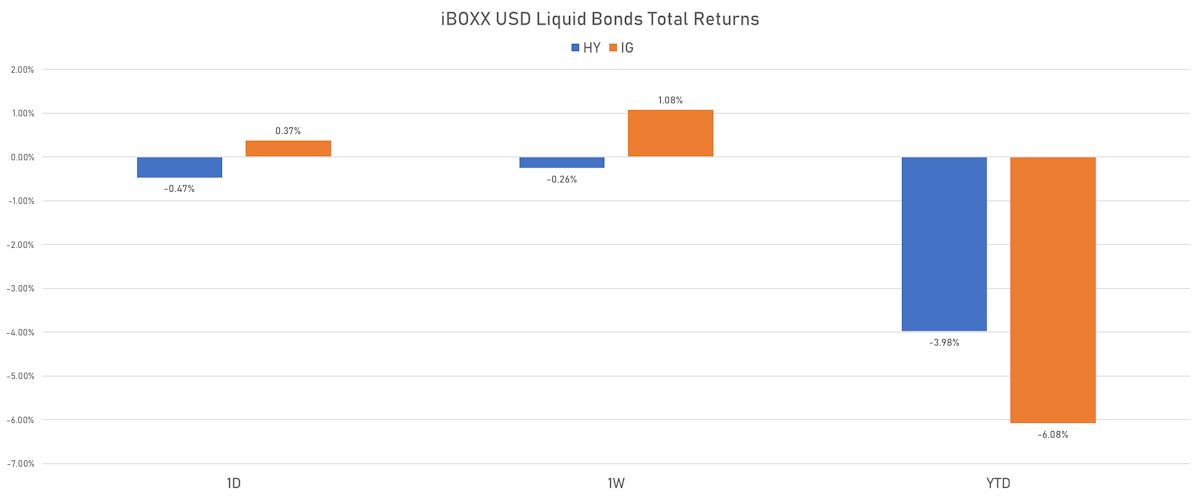

iBOXX USD Liquid Credit Total Returns | Sources: ϕpost, Refinitiv data

QUICK DAILY SUMMARY

- S&P 500 Bond Index was up 0.39% today, with investment grade up 0.47% and high yield down -0.31% (YTD total return: -4.91%)

- The iBoxx USD Liquid Investment Grade Total Return Index was up 0.374% today (Month-to-date: -0.11%; Year-to-date: -6.08%)

- The iBoxx USD Liquid High Yield Total Return Index was down -0.473% today (Month-to-date: -0.46%; Year-to-date: -3.98%)

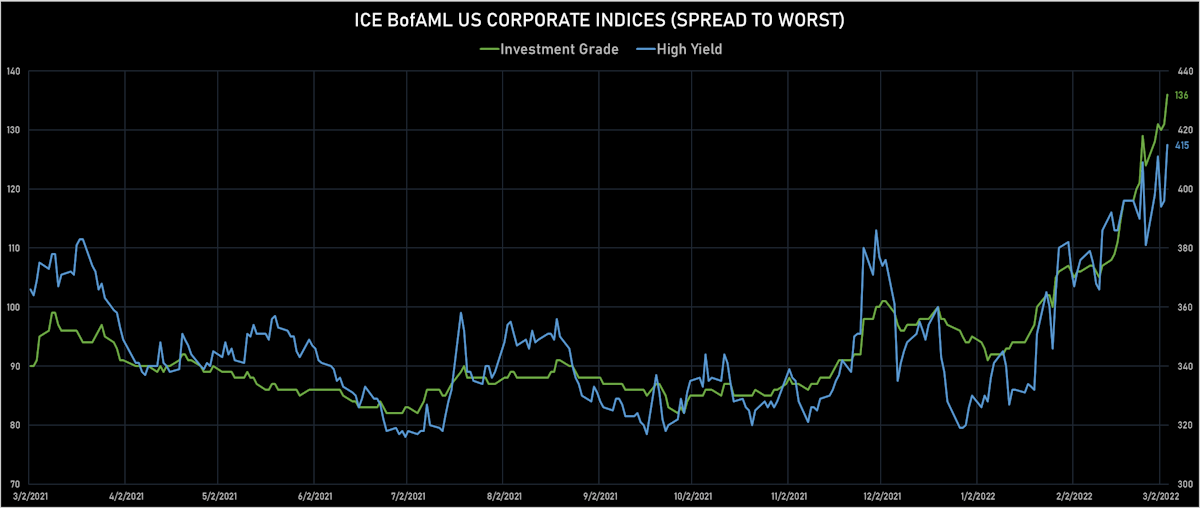

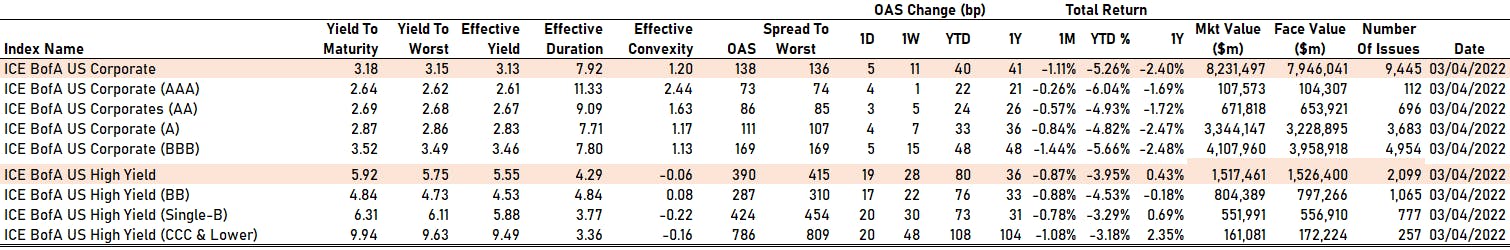

- ICE BofA US Corporate Index (Investment Grade) spread to worst up 5.0 bp, now at 136.0 bp (YTD change: +41.0 bp)

- ICE BofA US High Yield Index spread to worst up 19.0 bp, now at 415.0 bp (YTD change: +85.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index down -0.18% today (YTD total return: -0.5%)

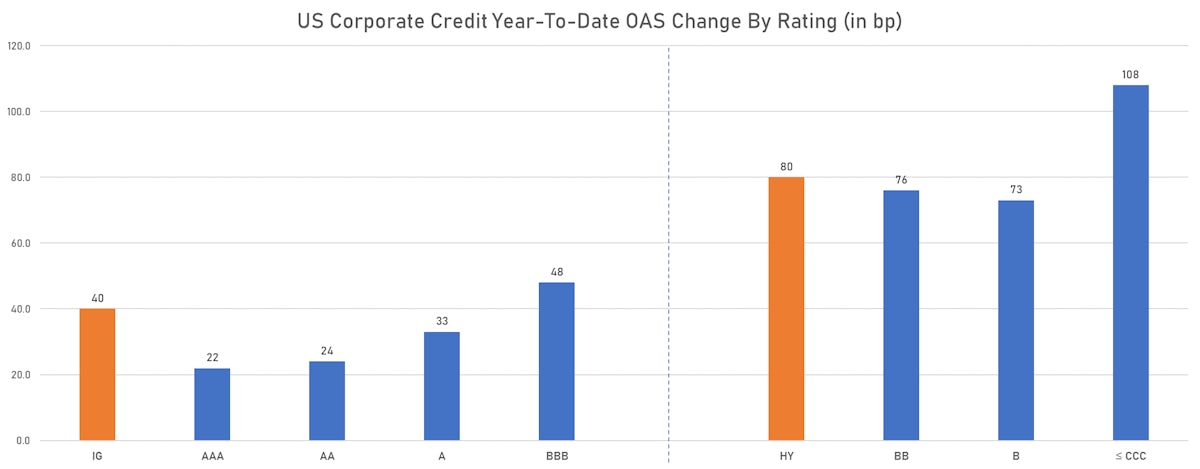

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING

- AAA up by 4 bp at 73 bp

- AA up by 3 bp at 86 bp

- A up by 4 bp at 111 bp

- BBB up by 5 bp at 169 bp

- BB up by 17 bp at 287 bp

- B up by 20 bp at 424 bp

- CCC up by 20 bp at 786 bp

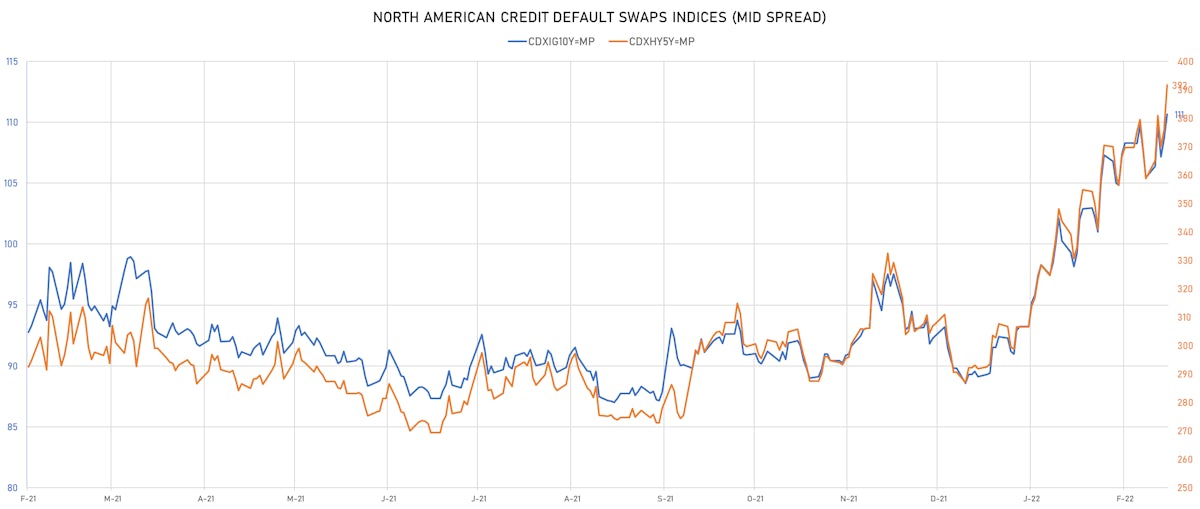

CDS INDICES (mid-spreads)

- Markit CDX.NA.IG 5Y up 3.4 bp, now at 74bp (YTD change: +25.0bp)

- Markit CDX.NA.IG 10Y up 2.0 bp, now at 111bp (YTD change: +21.6bp)

- Markit CDX.NA.HY 5Y up 15.8 bp, now at 392bp (YTD change: +99.8bp)

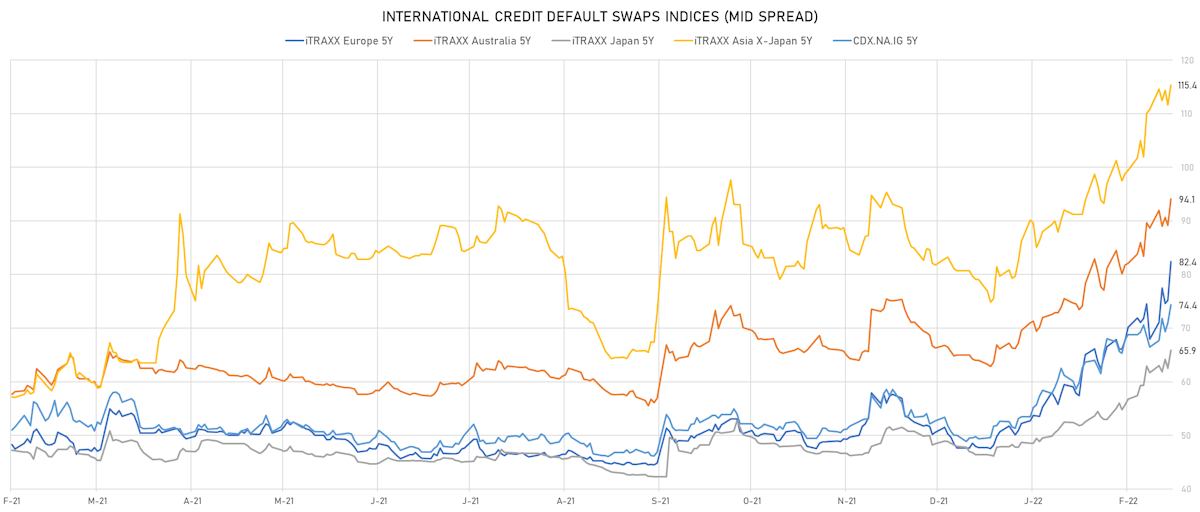

- Markit iTRAXX Europe 5Y up 7.2 bp, now at 82bp (YTD change: +34.7bp)

- Markit iTRAXX Europe Crossover 5Y up 35.0 bp, now at 398bp (YTD change: +156.3bp)

- Markit iTRAXX Japan 5Y up 3.4 bp, now at 66bp (YTD change: +19.5bp)

- Markit iTRAXX Asia Ex-Japan 5Y up 3.8 bp, now at 115bp (YTD change: +36.4bp)

USD CDS SINGLE NAMES - LARGEST MID SPREAD MOVES IN THE PAST WEEK

- Transocean Inc (Country: KY; rated: Caa3): down 310.3 bp to 1,741.2bp (1Y range: 941-1,875bp)

- Nabors Industries Inc (Country: US; rated: B3): down 128.1 bp to 601.3bp (1Y range: 504-1,098bp)

- Nordstrom Inc (Country: US; rated: Ba1): down 41.4 bp to 390.6bp (1Y range: 211-442bp)

- Supervalu Inc (Country: US; rated: WR): down 35.1 bp to 190.8bp (1Y range: 191-303bp)

- Liberty Interactive LLC (Country: US; rated: Ba3): up 32.0 bp to 645.5bp (1Y range: 287-646bp)

- NOVA Chemicals Corp (Country: CA; rated: Discontinued): up 32.2 bp to 381.2bp (1Y range: 243-381bp)

- American Axle & Manufacturing Inc (Country: US; rated: Ba1): up 39.8 bp to 460.0bp (1Y range: 355-514bp)

- Staples Inc (Country: US; rated: B3): up 40.6 bp to 1,135.9bp (1Y range: 687-1,159bp)

- Goodyear Tire & Rubber Co (Country: US; rated: WR): up 55.1 bp to 337.6bp (1Y range: 188-338bp)

- Royal Caribbean Cruises Ltd (Country: US; rated: LGD4 - 59%): up 72.2 bp to 452.3bp (1Y range: 299-502bp)

- Carnival Corp (Country: US; rated: LGD5 - 72%): up 111.9 bp to 558.6bp (1Y range: 291-559bp)

- American Airlines Group Inc (Country: US; rated: B2): up 191.8 bp to 1,034.3bp (1Y range: 596-1,034bp)

EURO CDS SINGLE NAMES - LARGEST MOVES IN THE PAST WEEK

- Iceland Bondco PLC (Country: GB; rated: LGD3 - 46%): up 32.1 bp to 651.4bp (1Y range: 398-679bp)

- Rolls-Royce PLC (Country: GB; rated: BB-): up 34.7 bp to 283.6bp (1Y range: 161-291bp)

- Stena AB (Country: SE; rated: B2-PD): up 38.1 bp to 541.3bp (1Y range: 401-676bp)

- Valeo SE (Country: FR; rated: P-3): up 38.4 bp to 256.2bp (1Y range: 110-256bp)

- UPC Holding BV (Country: NL; rated: LGD6 - 93%): up 40.0 bp to 264.1bp (1Y range: 164-267bp)

- Ardagh Packaging Finance PLC (Country: IE; rated: B1): up 41.0 bp to 429.5bp (1Y range: 210-430bp)

- Air France KLM SA (Country: FR; rated: B-): up 54.3 bp to 508.1bp (1Y range: 386-553bp)

- Jaguar Land Rover Automotive PLC (Country: GB; rated: WD): up 63.5 bp to 511.0bp (1Y range: 339-511bp)

- Renault SA (Country: FR; rated: Ba2): up 64.5 bp to 333.9bp (1Y range: 166-334bp)

- Casino Guichard Perrachon SA (Country: FR; rated: WR): up 71.4 bp to 1,093.4bp (1Y range: 464-1,093bp)

- Telefonaktiebolaget LM Ericsson (Country: SE; rated: Ba1): up 95.5 bp to 222.5bp (1Y range: 59-223bp)

- Novafives SAS (Country: FR; rated: Caa1): up 110.6 bp to 1,234.3bp (1Y range: 618-1,234bp)

- Telecom Italia SpA (Country: IT; rated: Ba2): up 114.3 bp to 408.0bp (1Y range: 149-408bp)

- TUI AG (Country: DE; rated: B3-PD): up 180.3 bp to 842.4bp (1Y range: 607-946bp)

SELECTED RECENT USD BOND ISSUES

- Bank of America Corp (Banking | Charlotte, United States | Rating: BBB+): US$2,500m Subordinated Note (US06051GKL22), fixed rate (3.85% coupon) maturing on 8 March 2037, priced at 100.00 (original spread of 200 bp), callable (15nc10)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: NR): US$115m Bond (US3130ARAN15), fixed rate (2.63% coupon) maturing on 25 March 2027, priced at 100.00 (original spread of 228 bp), callable (5nc1m)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$210m Bond (US3133ENRD49), fixed rate (1.68% coupon) maturing on 10 March 2027, priced at 100.00 (original spread of 9 bp), non-callable

- Federal Home Loan Banks (Agency | Washington, United States | Rating: NR): US$214m Bond (US3130ARAQ46), fixed rate (2.00% coupon) maturing on 28 March 2024, priced at 100.00 (original spread of 169 bp), callable (2nc1m)

- S&P Global Inc (Publishing | New York City, United States | Rating: NR): US$500m Senior Note (US78409VBE39), fixed rate (3.90% coupon) maturing on 1 March 2062, priced at 98.21 (original spread of 180 bp), callable (40nc39)

- S&P Global Inc (Publishing | New York City, United States | Rating: NR): US$1,000m Senior Note (US78409VBD55), fixed rate (3.70% coupon) maturing on 1 March 2052, priced at 98.40 (original spread of 160 bp), callable (30nc29)

- S&P Global Inc (Publishing | New York City, United States | Rating: NR): US$1,250m Senior Note (US78409VBA17), fixed rate (2.45% coupon) maturing on 1 March 2027, priced at 99.48 (original spread of 90 bp), callable (5nc5)

- S&P Global Inc (Publishing | New York City, United States | Rating: NR): US$1,250m Senior Note (US78409VBB99), fixed rate (2.70% coupon) maturing on 1 March 2029, priced at 99.25 (original spread of 110 bp), callable (7nc7)

- S&P Global Inc (Publishing | New York City, United States | Rating: NR): US$1,500m Senior Note (US78409VBC72), fixed rate (2.90% coupon) maturing on 1 March 2032, priced at 98.76 (original spread of 130 bp), callable (10nc10)

NEW LOANS

- Circuito Seis Cuchilla Grande, signed a US$ 106m Term Loan, to be used for project finance

- ICBCIL Finance Co Ltd (A), signed a US$ 500m Revolving Credit / Term Loan, to be used for general corporate purposes. It matures on 03/04/25 and initial pricing is set at Term SOFR +100bp