Credit

Cash Prices Fell In US Credit Today, With Moves In Rates Dominating The Action; In CDS Indices, Growth Concerns Continue To Weight On The Term Structure

Very little activity in the primary USD Corporate bond market, no new issue in HY so far this week and just a few new IG issues today, including Nomura ($3.25bn in 2 tranches) and Commonwealth Edison ($750m in 2 tranches)

Published ET

CDX.NA.IG 5s10s Spread | Source: Refinitiv

QUICK SUMMARY

- S&P 500 Bond Index was down -0.85% today, with investment grade down -0.88% and high yield down -0.61% (YTD total return: -6.47%)

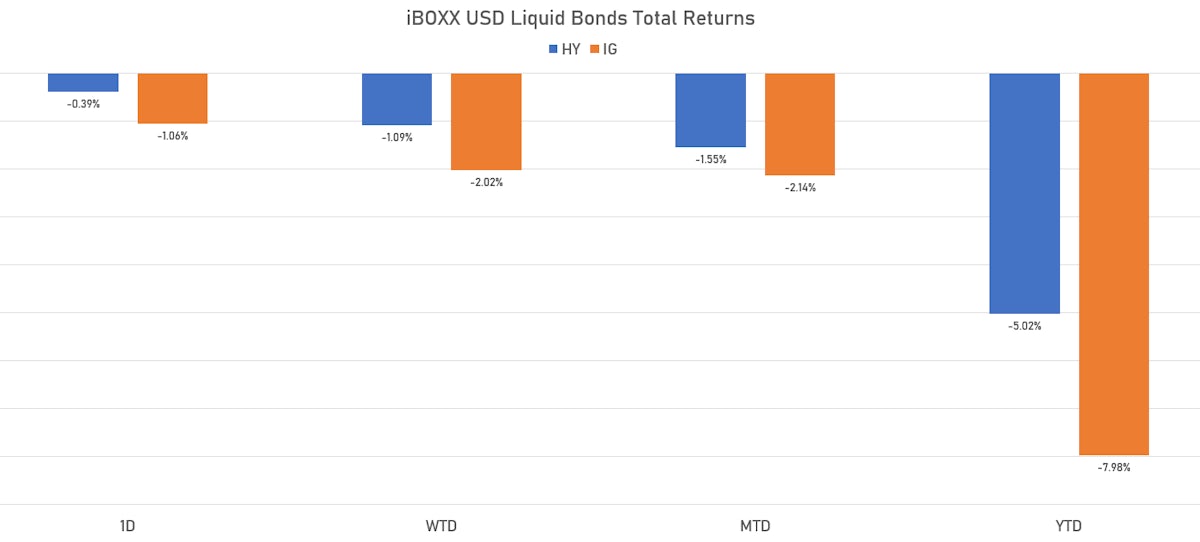

- The iBoxx USD Liquid Investment Grade Total Return Index was down -1.060% today (Month-to-date: -2.14%; Year-to-date: -7.98%)

- The iBoxx USD Liquid High Yield Total Return Index was down -0.395% today (Month-to-date: -1.55%; Year-to-date: -5.02%)

- ICE BofA US Corporate Index (Investment Grade) spread to worst up 6.0 bp, now at 147.0 bp (YTD change: +52.0 bp)

- ICE BofA US High Yield Index spread to worst down -1.0 bp, now at 424.0 bp (YTD change: +94.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index down -0.40% today (YTD total return: -1.3%)

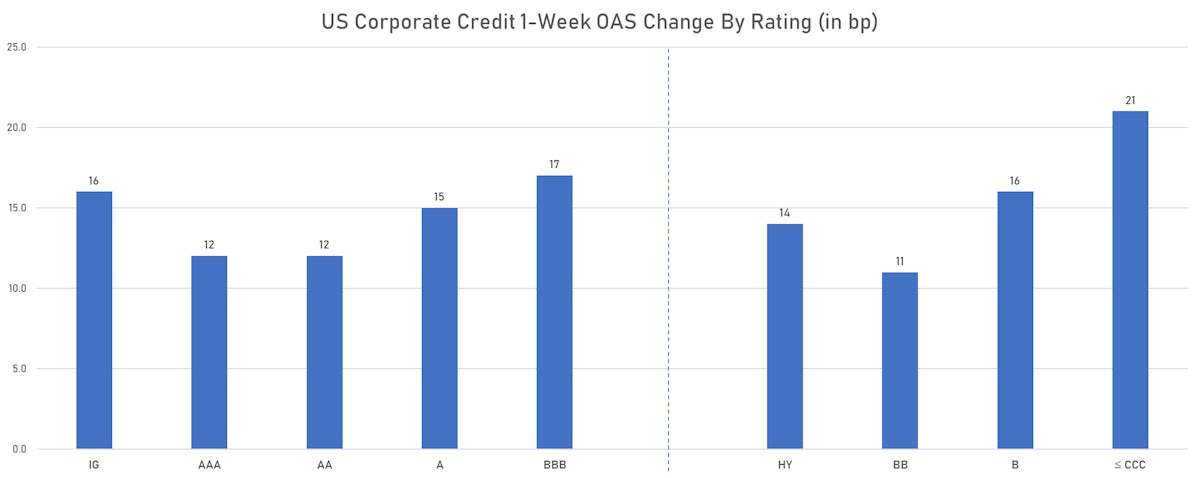

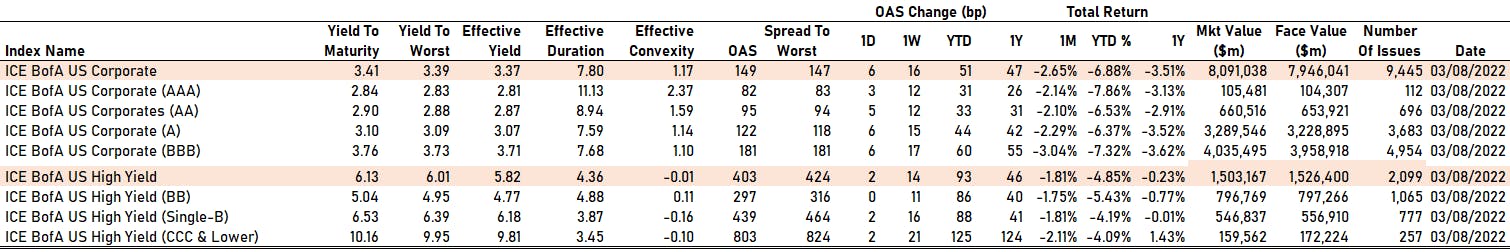

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING

- AAA up by 3 bp at 82 bp

- AA up by 5 bp at 95 bp

- A up by 6 bp at 122 bp

- BBB up by 6 bp at 181 bp

- BB unchanged at 297 bp

- B up by 2 bp at 439 bp

- CCC up by 2 bp at 803 bp

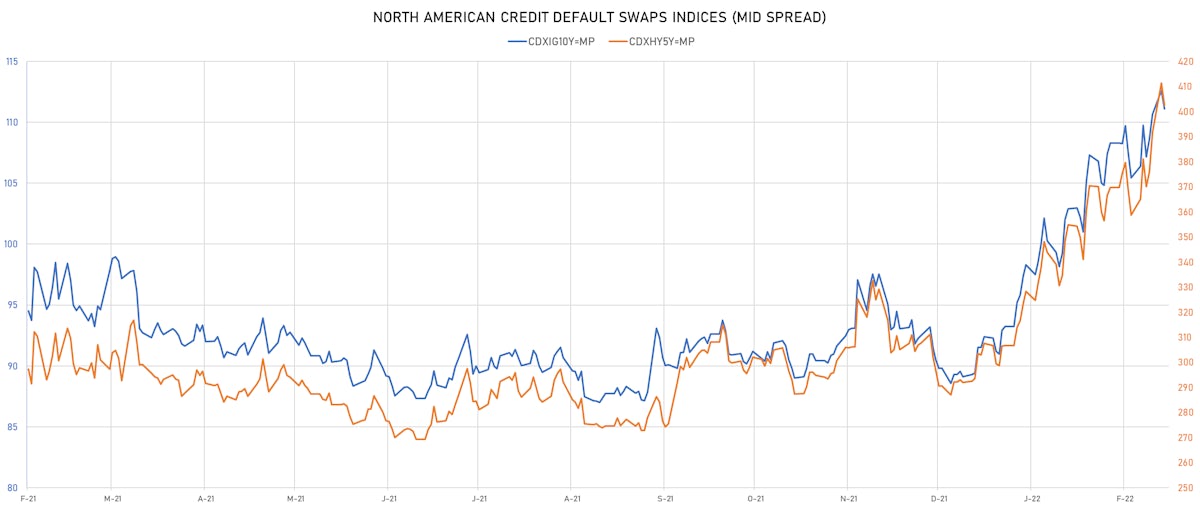

CDS INDICES (mid-spreads)

- Markit CDX.NA.IG 5Y down 1.6 bp, now at 76bp (YTD change: +26.8bp)

- Markit CDX.NA.IG 10Y down 1.5 bp, now at 111bp (YTD change: +22.0bp)

- Markit CDX.NA.HY 5Y down 8.7 bp, now at 403bp (YTD change: +110.6bp)

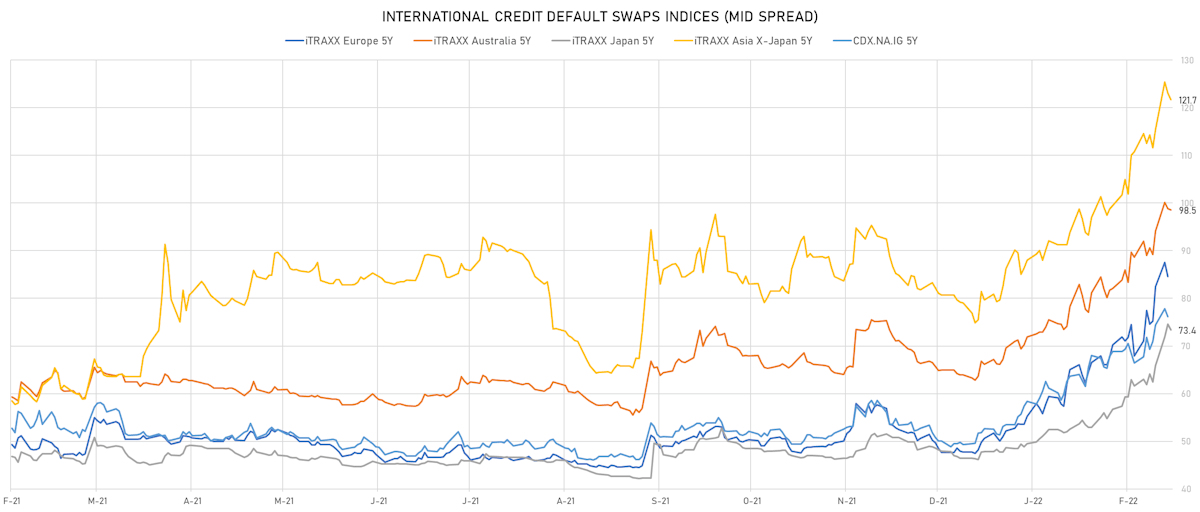

- Markit iTRAXX Europe 5Y down 3.0 bp, now at 85bp (YTD change: +36.9bp)

- Markit iTRAXX Europe Crossover 5Y down 16.9 bp, now at 392bp (YTD change: +149.4bp)

- Markit iTRAXX Japan 5Y down 1.2 bp, now at 73bp (YTD change: +27.0bp)

- Markit iTRAXX Asia Ex-Japan 5Y down 1.4 bp, now at 122bp (YTD change: +42.6bp)

SELECTED RECENT USD BOND ISSUES

- Avista Corp (Utility - Other | Spokane, Washington, United States | Rating: BBB): US$400m First Mortgage Bond (US05379BAR87), fixed rate (4.00% coupon) maturing on 1 April 2052, priced at 99.96 (original spread of 205 bp), callable (30nc30)

- Commonwealth Edison Co (Utility - Other | Chicago, Illinois, United States | Rating: A): US$450m First Mortgage Bond (US202795JV39), fixed rate (3.85% coupon) maturing on 15 March 2052, priced at 99.82 (original spread of 187 bp), callable (30nc30)

- Commonwealth Edison Co (Utility - Other | Chicago, Illinois, United States | Rating: A): US$300m First Mortgage Bond (US202795JW12), fixed rate (3.15% coupon) maturing on 15 March 2032, priced at 99.87 (original spread of 131 bp), callable (10nc10)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, New Jersey, United States | Rating: AA+): US$225m Bond (US3133ENRN21), fixed rate (3.54% coupon) maturing on 16 March 2037, priced at 100.00 (original spread of 246 bp), callable (15nc1)

- Federal Home Loan Banks (Agency | Washington, Washington Dc, United States | Rating: NR): US$250m Bond (US3130ARBW05), fixed rate (2.75% coupon) maturing on 25 March 2027, priced at 100.00 (original spread of 232 bp), callable (5nc1m)

- Federal Home Loan Mortgage Corp (Agency | Mc Lean, United States | Rating: NR): US$125m Unsecured Note (US3134GXNG52), fixed rate (2.35% coupon) maturing on 25 March 2025, priced at 100.00, callable (3nc6m)

- Southern California Gas Co (Gas Utility - Local Distrib | Los Angeles, United States | Rating: A): US$700m Senior Note (US842434CW01), fixed rate (2.95% coupon) maturing on 15 April 2027, priced at 99.53 (original spread of 125 bp), callable (5nc5)

- The Howard University (Service - Other | Washington, United States | Rating: NR): US$300m Bond (US442851BH38), fixed rate (5.21% coupon) maturing on 1 October 2052, priced at 100.00 (original spread of 295 bp), callable (31nc11)

- Travere Therapeutics Inc (Pharmaceuticals | San Diego, California, United States | Rating: NR): US$250m Bond (US89422GAA58), fixed rate (1.75% coupon) maturing on 1 March 2029, priced at 100.00, non callable, convertible

- Asian Development Bank (Supranational | Mandaluyong, Philippines | Rating: AAA): US$1,500m Senior Note (US045167FL20), fixed rate (1.88% coupon) maturing on 15 March 2029, priced at 99.44 (original spread of 14 bp), non callable

- Asian Development Bank (Supranational | Mandaluyong, Philippines | Rating: AAA): US$2,250m Senior Note (US045167FK47), fixed rate (1.63% coupon) maturing on 15 March 2024, priced at 99.87 (original spread of 11 bp), non callable

- Nomura International Funding Pte Ltd (Financial - Other | Japan | Rating: NR): US$250m Unsecured Note (XS2217933824), floating rate maturing on 20 December 2026, priced at 100.00, non callable

- Nomura International Funding Pte Ltd (Financial - Other | Japan | Rating: NR): US$3,000m Unsecured Note (XS2217934806), floating rate maturing on 20 June 2027, priced at 100.00, non callable

NEW LOANS

- Sumitomo Corp (BBB+) signed a US$ 1,060m Revolving Credit Facility, to be used for general corporate purposes. It matures on 03/23/24 and initial pricing is set at Term SOFR +50bp

- SPX FLOW Inc (CCC+), signed a US$ 1,540m Term Loan B, to be used for a leveraged buyout. It matures on 03/17/29 and initial pricing is set at Term SOFR +450bp

- Cornerstone Bldg Brands Inc (B-), signed a US$ 1,675m Bridge Loan, to be used for a leveraged buyout.

- Ardagh Metal Beverage USA Inc, signed a US$ 500m Revolving Credit Facility, to be used for general corporate purposes and working capital. It matures on 03/31/27 and initial pricing is set at Term SOFR +125bp

- Comunidad Autonoma de Madrid (A-), signed a € 300m Term Loan, to be used for general corporate purposes.