Credit

Positive Mood Today Narrowed HY Spreads Considerably, With CDX HY 20bp Tighter, Cash Single-Bs 11 bp Tighter

Not many issuers printed new corporate bonds today, but what a print we got: Magallanes issued the 5th largest investment-grade deal ever, with an 11-tranche $30bn spin-off offering

Published ET

CDX NA HY 5Y vs iTRAXX Europe XOver 5Y | Sources: ϕpost, Refinitiv data

QUICK SUMMARY

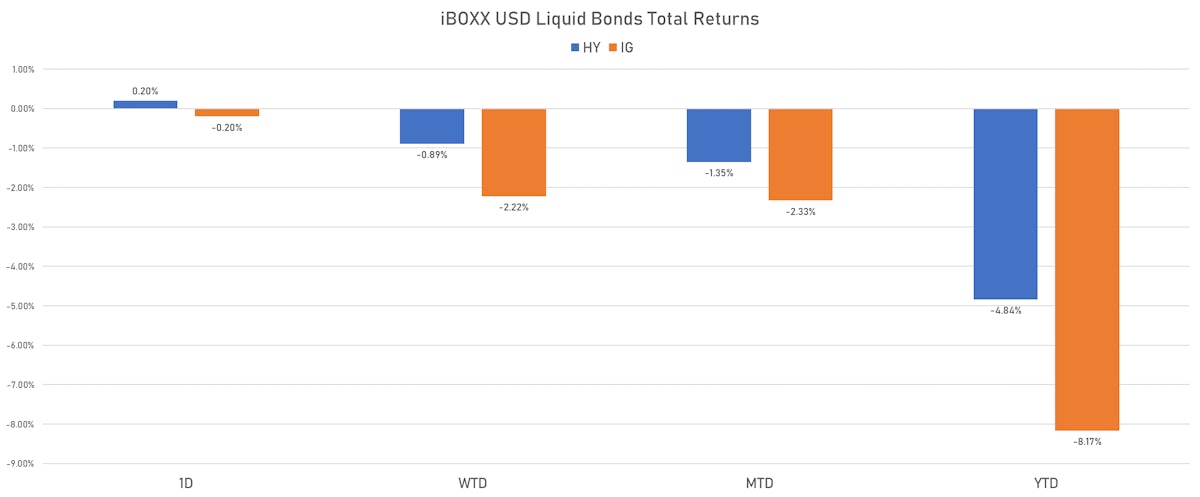

- S&P 500 Bond Index was down -0.20% today, with investment grade down -0.22% and high yield down -0.02% (YTD total return: -6.66%)

- The iBoxx USD Liquid Investment Grade Total Return Index was down -0.199% today (Month-to-date: -2.33%; Year-to-date: -8.17%)

- The iBoxx USD Liquid High Yield Total Return Index was up 0.196% today (Month-to-date: -1.35%; Year-to-date: -4.84%)

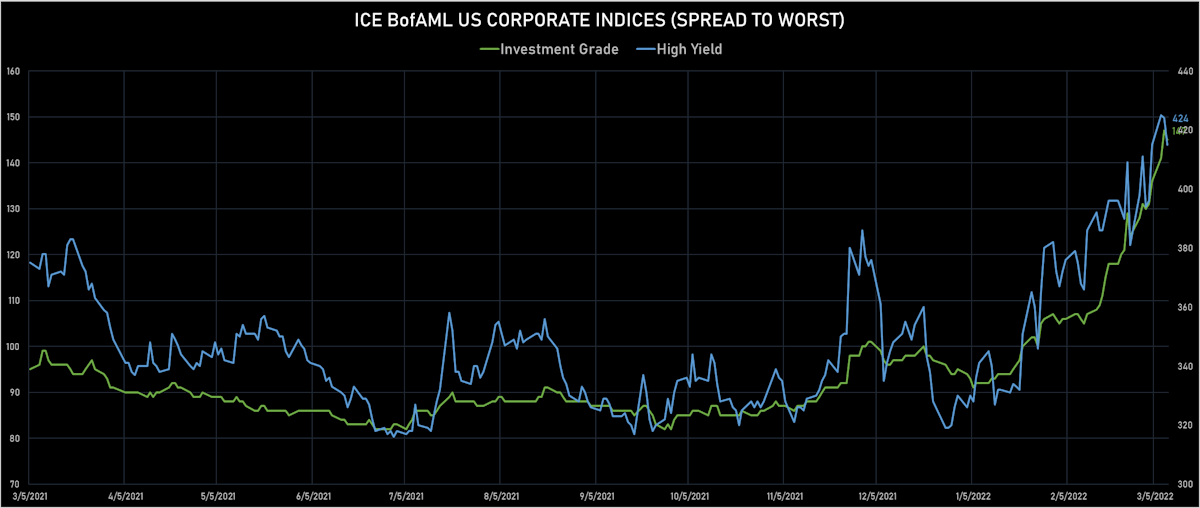

- ICE BofA US Corporate Index (Investment Grade) spread to worst down -2.0 bp, now at 145.0 bp (YTD change: +50.0 bp)

- ICE BofA US High Yield Index spread to worst down -9.0 bp, now at 415.0 bp (YTD change: +85.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index down -0.03% today (YTD total return: -1.4%)

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING

- AAA down by -5 bp at 77 bp

- AA down by -1 bp at 94 bp

- A down by -2 bp at 120 bp

- BBB down by -2 bp at 179 bp

- BB down by -8 bp at 289 bp

- B down by -11 bp at 428 bp

- CCC down by -9 bp at 794 bp

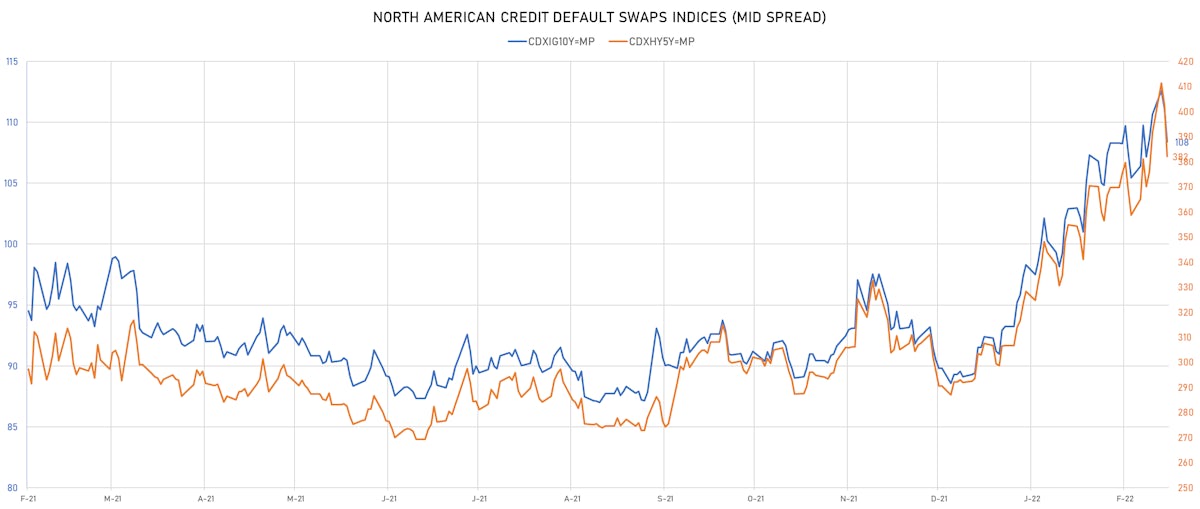

CDS INDICES (mid-spreads)

- Markit CDX.NA.IG 5Y down 4.3 bp, now at 72bp (YTD change: +22.6bp)

- Markit CDX.NA.IG 10Y down 2.7 bp, now at 108bp (YTD change: +19.3bp)

- Markit CDX.NA.HY 5Y down 20.4 bp, now at 382bp (YTD change: +90.2bp)

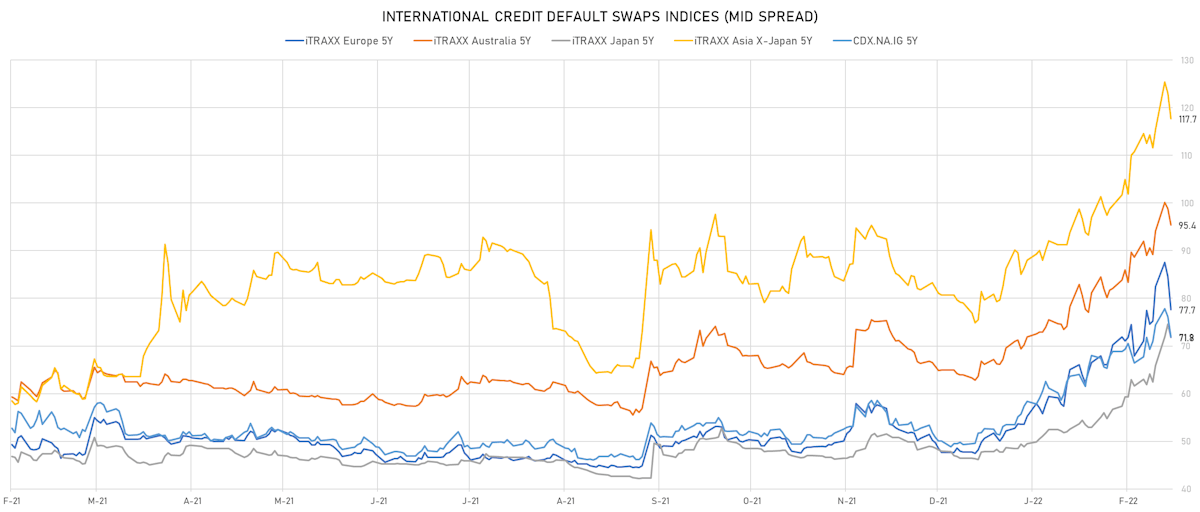

- Markit iTRAXX Europe 5Y down 6.9 bp, now at 78bp (YTD change: +30.0bp)

- Markit iTRAXX Europe Crossover 5Y down 37.0 bp, now at 371bp (YTD change: +129.2bp)

- Markit iTRAXX Japan 5Y down 2.8 bp, now at 72bp (YTD change: +25.4bp)

- Markit iTRAXX Asia Ex-Japan 5Y down 5.4 bp, now at 118bp (YTD change: +38.7bp)

5Y USD CDS SINGLE NAMES - LARGEST MOVES OVER THE PAST WEEK

- Transocean Inc (Country: KY; rated: Caa3): down 403.9 bp to 1,503.0bp (1Y range: 941-1,875bp)

- Nabors Industries Inc (Country: US; rated: B3): down 101.6 bp to 569.1bp (1Y range: 504-1,098bp)

- NOVA Chemicals Corp (Country: CA; rated: Discontinued): up 43.8 bp to 398.8bp (1Y range: 243-418bp)

- Southwest Airlines Co (Country: US; rated: Baa1): up 47.1 bp to 141.2bp (1Y range: 73-149bp)

- American Axle & Manufacturing Inc (Country: US; rated: Ba1): up 53.2 bp to 488.1bp (1Y range: 355-514bp)

- Liberty Interactive LLC (Country: US; rated: Ba3): up 53.4 bp to 678.5bp (1Y range: 287-678bp)

- Turkey, Republic of (Government) (Country: TR; rated: WR): up 55.2 bp to 655.6bp (1Y range: 303-683bp)

- Royal Caribbean Cruises Ltd (Country: US; rated: LGD4 - 59%): up 85.8 bp to 492.3bp (1Y range: 299-510bp)

- Bombardier Inc (Country: CA; rated: Caa1): up 87.0 bp to 573.5bp (1Y range: 395-644bp)

- Goodyear Tire & Rubber Co (Country: US; rated: WR): up 97.6 bp to 396.1bp (1Y range: 188-418bp)

- Carnival Corp (Country: US; rated: LGD5 - 72%): up 120.3 bp to 603.4bp (1Y range: 291-642bp)

- Staples Inc (Country: US; rated: B3): up 198.9 bp to 1,299.6bp (1Y range: 687-1,300bp)

- American Airlines Group Inc (Country: US; rated: B2): up 317.8 bp to 1,205.0bp (1Y range: 596-1,279bp)

- Egypt, Arab Republic of (Government) (Country: EG; rated: B): up 439.4 bp to 1,006.4bp (1Y range: 320-1,006bp)

- Russia, Federation of (Government) (Country: RU; rated: C): up 1566.7 bp to 2,894.2bp (1Y range: 77-2,894bp)

5Y EURO CDS SINGLE NAMES - LARGEST MOVES OVER THE PAST WEEK

- Unilabs SubHolding AB (publ) (Country: SE; rated: B2): down 82.8 bp to 111.2bp (1Y range: -111bp)

- CMA CGM SA (Country: FR; rated: Ba3): down 42.6 bp to 420.5bp (1Y range: 259-469bp)

- Rolls-Royce PLC (Country: GB; rated: BB-): up 35.9 bp to 296.5bp (1Y range: 161-306bp)

- Iceland Bondco PLC (Country: GB; rated: LGD3 - 46%): up 41.2 bp to 670.6bp (1Y range: 398-682bp)

- Elo SA (Country: FR; rated: ): up 46.1 bp to 228.1bp (1Y range: 83-242bp)

- Fortum Oyj (Country: FI; rated: baa3): up 46.8 bp to 167.1bp (1Y range: 40-167bp)

- TUI AG (Country: DE; rated: B3-PD): up 54.0 bp to 812.1bp (1Y range: 607-946bp)

- Renault SA (Country: FR; rated: Ba2): up 57.6 bp to 357.0bp (1Y range: 166-361bp)

- Banca Monte dei Paschi di Siena SpA (Country: IT; rated: NP): up 59.6 bp to 480.6bp (1Y range: 145-481bp)

- Louis Dreyfus Co BV (Country: NL; rated: ): up 62.3 bp to 228.6bp (1Y range: -229bp)

- Telefonaktiebolaget LM Ericsson (Country: SE; rated: Ba1): up 75.4 bp to 229.5bp (1Y range: 59-244bp)

- Air France KLM SA (Country: FR; rated: B-): up 93.4 bp to 561.9bp (1Y range: 386-566bp)

- Jaguar Land Rover Automotive PLC (Country: GB; rated: WD): up 120.5 bp to 587.9bp (1Y range: 339-603bp)

- Telecom Italia SpA (Country: IT; rated: Ba3): up 123.0 bp to 420.8bp (1Y range: 149-440bp)

- Boparan Finance PLC (Country: GB; rated: B3): up 274.4 bp to 2,097.5bp (1Y range: 708-2,690bp)

SELECTED RECENT USD BOND ISSUES

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$600m Bond (US3133ENRT90), floating rate (SOFR + 4.5 bp) maturing on 15 March 2024, priced at 100.00, non callable

- Federal Home Loan Banks (Agency | Washington, Washington Dc, United States | Rating: AA+): US$250m Bond (US3134GXNM21), fixed rate (2.67% coupon) maturing on 25 March 2027, priced at 100.00, callable (5nc1m)

- Magallanes Inc (Financial - Other | Dallas, United States | Rating: NR): US$3,000m Senior Note (US55903VAS25), fixed rate (5.39% coupon) maturing on 15 March 2062, priced at 100.00 (original spread of 305 bp), callable (40nc40)

- Magallanes Inc (Financial - Other | Dallas, United States | Rating: NR): US$7,000m Senior Note (US55903VAQ68), fixed rate (5.14% coupon) maturing on 15 March 2052, priced at 100.00 (original spread of 280 bp), callable (30nc30)

- Magallanes Inc (Financial - Other | Dallas, United States | Rating: NR): US$500m Senior Note (USU55632AA84), floating rate (SOFR + 178.0 bp) maturing on 15 March 2024, priced at 100.00, non callable

- Magallanes Inc (Financial - Other | Dallas, United States | Rating: NR): US$4,500m Senior Note (USU55632AG54), fixed rate (5.05% coupon) maturing on 15 March 2042, priced at 100.00 (original spread of 265 bp), callable (20nc20)

- Magallanes Inc (Financial - Other | Dallas, United States | Rating: NR): US$500m Senior Note (US55903VAU70), fixed rate (3.79% coupon) maturing on 15 March 2025, priced at 100.00 (original spread of 195 bp), callable (3nc1)

- Magallanes Inc (Financial - Other | Dallas, United States | Rating: NR): US$500m Senior Note (US55903VAB99), fixed rate (3.53% coupon) maturing on 15 March 2024, priced at 100.00 (original spread of 185 bp), callable (2nc1)

- Magallanes Inc (Financial - Other | Dallas, United States | Rating: NR): US$1,750m Senior Note (US55903VAE39), fixed rate (3.64% coupon) maturing on 15 March 2025, priced at 100.00 (original spread of 180 bp), with a make whole call

- Magallanes Inc (Financial - Other | Dallas, United States | Rating: NR): US$1,750m Senior Note (US55903VAC72), fixed rate (3.43% coupon) maturing on 15 March 2024, priced at 100.00 (original spread of 175 bp), with a make whole call

- Magallanes Inc (Financial - Other | Dallas, United States | Rating: NR): US$4,000m Senior Note (US55903VAG86), fixed rate (3.76% coupon) maturing on 15 March 2027, priced at 100.00 (original spread of 190 bp), callable (5nc5)

- Magallanes Inc (Financial - Other | Dallas, United States | Rating: NR): US$5,000m Senior Note (US55903VAL71), fixed rate (4.28% coupon) maturing on 15 March 2032, priced at 100.00 (original spread of 235 bp), callable (10nc10)

- Magallanes Inc (Financial - Other | Dallas, United States | Rating: NR): US$1,500m Senior Note (US55903VAJ26), fixed rate (4.05% coupon) maturing on 15 March 2029, priced at 100.00 (original spread of 215 bp), callable (7nc7)

- Public Service Electric And Gas Co (Utility - Other | Newark, United States | Rating: A-): US$500m Note (US74456QCJ31), fixed rate (3.10% coupon) maturing on 15 March 2032, priced at 99.81 (original spread of 120 bp), callable (10nc10)

- Keqiao Hk International Investment Co Ltd (Financial - Other | Rating: NR): US$300m Senior Note (XS2450979484), fixed rate (3.00% coupon) maturing on 16 March 2025, priced at 100.00, non callable

- Ninghai State-Owned Assets Investment Holding Group Co Ltd (Service - Other | Ningbo, China (Mainland) | Rating: NR): US$120m Senior Note (XS2453995701), fixed rate (3.65% coupon) maturing on 16 March 2025, priced at 100.00, non callable

NEW LOANS

- Renaissance Learning Inc, signed a US$ 475m Term Loan B, to be used for acquisition financing

- REINTEL, signed a € 255m Term Loan, to be used for a leveraged buyout.

- Solaria Solar PV Plant, signed a € 375m Term Loan, to be used for project finance

NEW ISSUES IN SECURITIZED CREDIT

- GLS Auto Receivables Issuer Trust 2022-1 issued a fixed-rate ABS backed by auto receivables in 5 tranches, for a total of US$ 484 m. Highest-rated tranche offering a yield to maturity of 1.98%, and the lowest-rated tranche a yield to maturity of 5.64%. Bookrunners: Deutsche Bank Securities Inc, Wells Fargo Securities LLC

- SMB Private Education Loan Trust 2022-A issued a fixed-rate ABS backed by student loans in 4 tranches, for a total of US$ 1,059 m. Highest-rated tranche offering a yield to maturity of 2.88%, and the lowest-rated tranche a yield to maturity of 4.77%. Bookrunners: Goldman Sachs & Co

- Shamrock Residential 2022-1 Dac issued a floating-rate RMBS in 4 tranches, for a total of € 516 m. Highest-rated tranche offering a spread over the floating rate of 150bp, and the lowest-rated tranche a spread of 340bp. Bookrunners: Morgan Stanley International Ltd