Credit

Credit Spreads Continued To Widen On Friday, With CDX HY 5Y 10bp Wider And ICE BofAML HY Cash 5bp Wider

Investment grade US$ corporate bond issuance had its best week of the year (7th best of all time according to IFR Markets), with a total volume of $70.2bn in 48 tranches (2022 YTD volume $363.5bn vs 2021 YTD $378.3bn)

Published ET

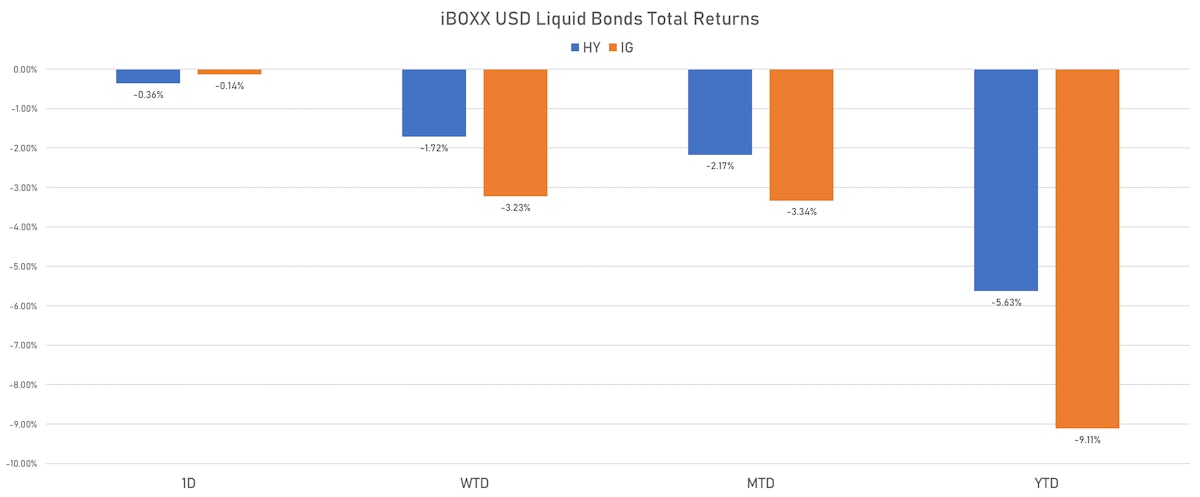

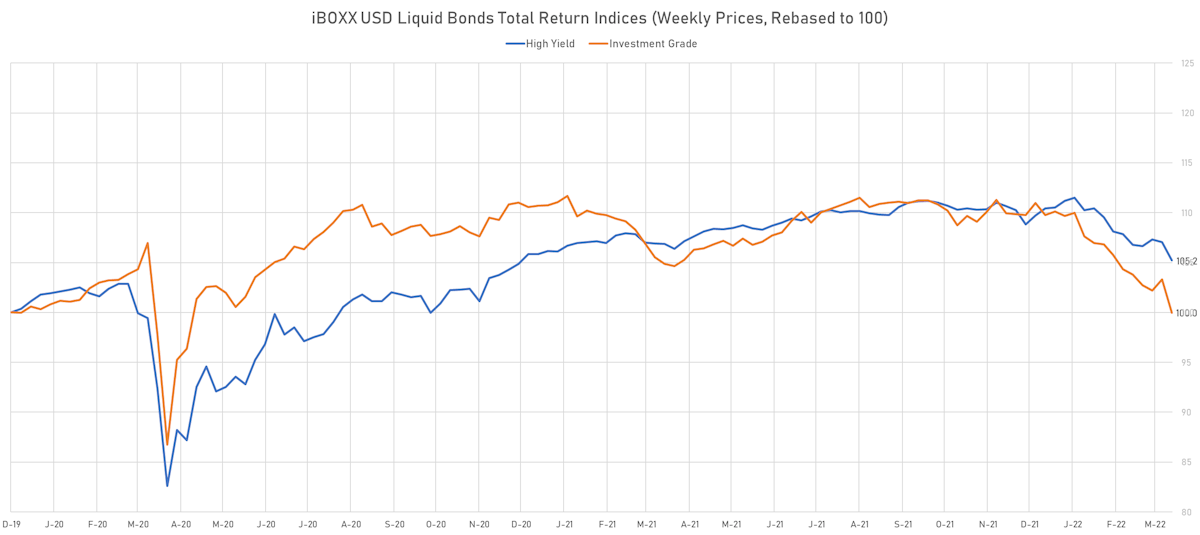

iBOXX USD Liquid Bonds Total Returns (Weekly Rebased Data) | Sources: ϕpost, Refinitiv data

QUICK SUMMARY

- S&P 500 Bond Index was down -0.10% today, with investment grade down -0.08% and high yield down -0.25% (YTD total return: -7.35%)

- The iBoxx USD Liquid Investment Grade Total Return Index was down -0.138% today (Month-to-date: -3.34%; Year-to-date: -9.11%)

- The iBoxx USD Liquid High Yield Total Return Index was down -0.364% today (Month-to-date: -2.17%; Year-to-date: -5.63%)

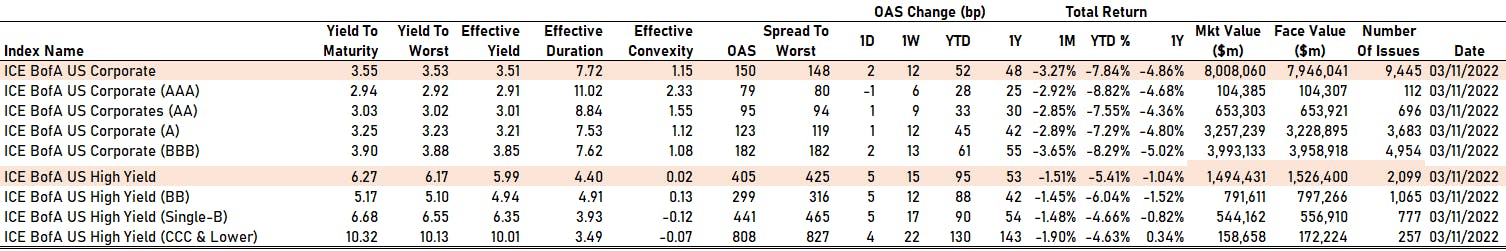

- ICE BofA US Corporate Index (Investment Grade) spread to worst up 2.0 bp, now at 148.0 bp (YTD change: +53.0 bp)

- ICE BofA US High Yield Index spread to worst up 5.0 bp, now at 425.0 bp (YTD change: +95.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index down -0.08% today (YTD total return: -1.7%)

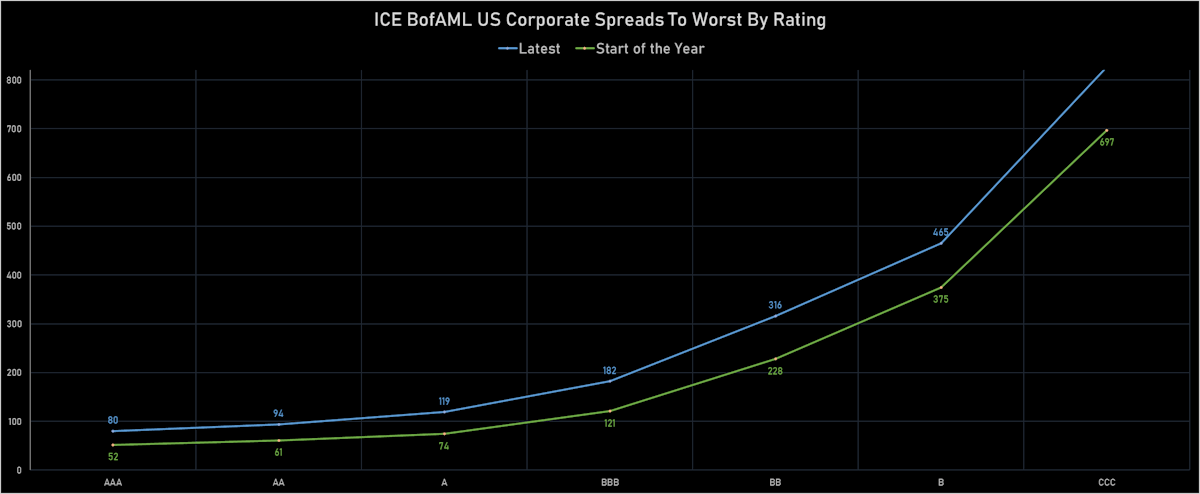

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING

- AAA down by -1 bp at 79 bp

- AA up by 1 bp at 95 bp

- A up by 1 bp at 123 bp

- BBB up by 2 bp at 182 bp

- BB up by 5 bp at 299 bp

- B up by 5 bp at 441 bp

- CCC up by 4 bp at 808 bp

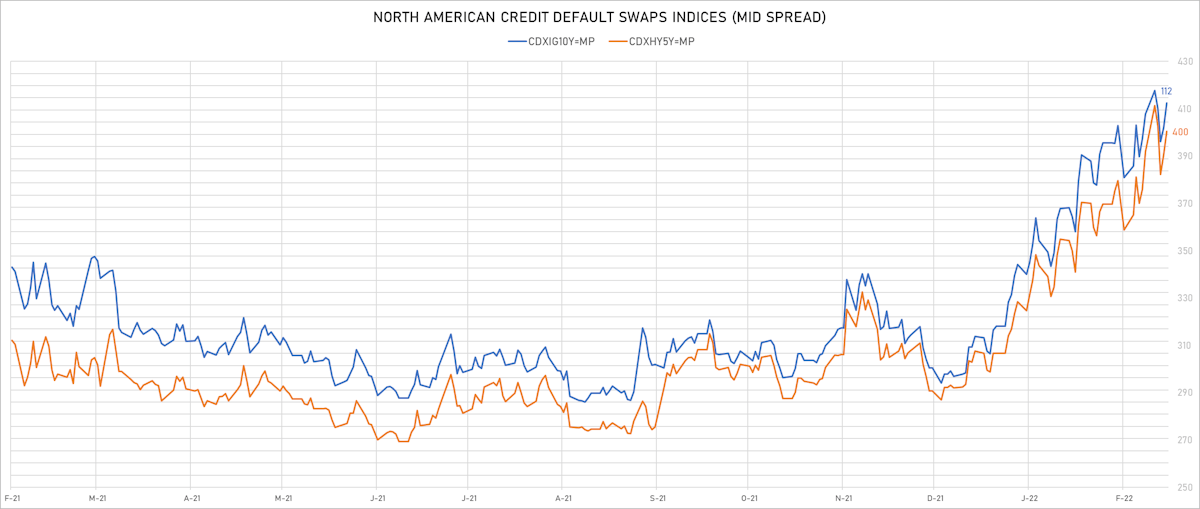

CDS INDICES (mid-spreads)

- Markit CDX.NA.IG 5Y up 1.8 bp, now at 75bp (YTD change: +25.6bp)

- Markit CDX.NA.IG 10Y up 2.0 bp, now at 112bp (YTD change: +22.5bp)

- Markit CDX.NA.HY 5Y up 9.9 bp, now at 400bp (YTD change: +108.5bp)

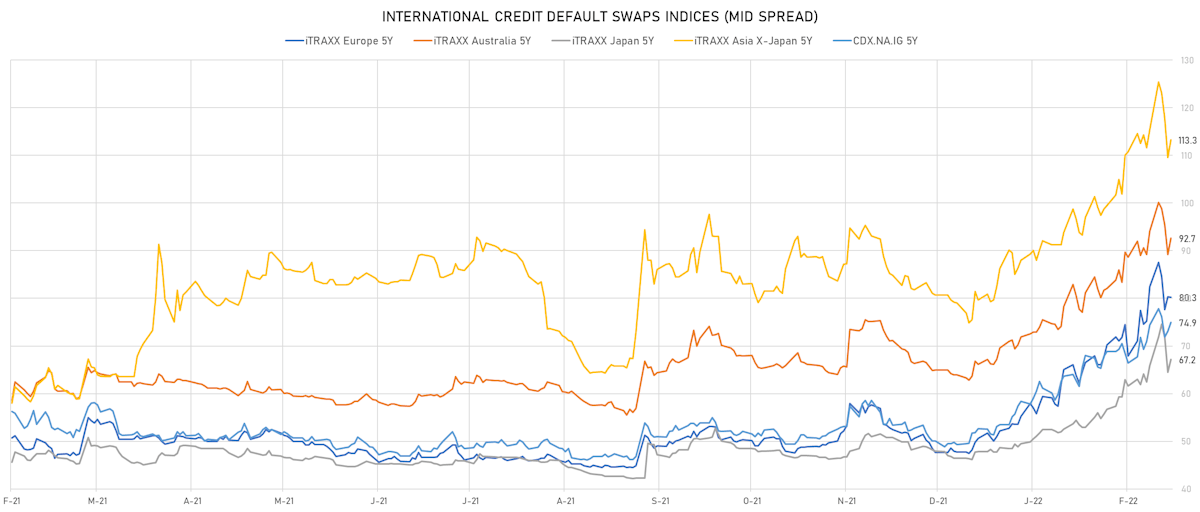

- Markit iTRAXX Europe 5Y down 0.1 bp, now at 80bp (YTD change: +32.6bp)

- Markit iTRAXX Europe Crossover 5Y down 2.0 bp, now at 385bp (YTD change: +143.3bp)

- Markit iTRAXX Japan 5Y up 2.7 bp, now at 67bp (YTD change: +20.7bp)

- Markit iTRAXX Asia Ex-Japan 5Y up 3.7 bp, now at 113bp (YTD change: +34.2bp)

5Y USD CDS SINGLE NAMES - LARGEST MOVES OVER THE PAST WEEK

- Transocean Inc (Country: KY; rated: Caa3): down 150.5 bp to 1,522.4bp (1Y range: 941-1,875bp)

- Lumen Technologies Inc (Country: US; rated: Ba3): down 32.0 bp to 495.3bp (1Y range: 195-533bp)

- Nordstrom Inc (Country: US; rated: Ba1): down 23.8 bp to 388.1bp (1Y range: 211-442bp)

- Olin Corp (Country: US; rated: WR): up 25.7 bp to 270.5bp (1Y range: 130-270bp)

- Realogy Group LLC (Country: US; rated: WR): up 26.1 bp to 416.1bp (1Y range: 278-453bp)

- Ashland LLC (Country: US; rated: WR): up 26.8 bp to 239.5bp (1Y range: 82-239bp)

- Pactiv LLC (Country: US; rated: Caa1): up 27.3 bp to 550.0bp (1Y range: 354-550bp)

- Liberty Interactive LLC (Country: US; rated: Ba3): up 29.9 bp to 694.2bp (1Y range: 287-694bp)

- Bombardier Inc (Country: CA; rated: Caa1): up 30.6 bp to 599.0bp (1Y range: 395-644bp)

- General Motors Co (Country: US; rated: Baa3): up 38.6 bp to 203.2bp (1Y range: 91-203bp)

- Goodyear Tire & Rubber Co (Country: US; rated: WR): up 39.0 bp to 424.0bp (1Y range: 188-424bp)

- American Airlines Group Inc (Country: US; rated: B2): up 90.6 bp to 1,350.8bp (1Y range: 596-1,351bp)

- Staples Inc (Country: US; rated: B3): up 91.5 bp to 1,336.3bp (1Y range: 687-1,336bp)

5Y EURO CDS SINGLE NAMES - LARGEST MOVES OVER THE PAST WEEK

- Boparan Finance PLC (Country: GB; rated: B3): down 251.0 bp to 2,210.7bp (1Y range: 708-2,690bp)

- TUI AG (Country: DE; rated: B3-PD): down 129.3 bp to 791.3bp (1Y range: 607-946bp)

- Casino Guichard Perrachon SA (Country: FR; rated: WR): down 116.1 bp to 1,053.9bp (1Y range: 464-1,208bp)

- Novafives SAS (Country: FR; rated: Caa1): down 104.5 bp to 1,211.3bp (1Y range: 618-1,342bp)

- CMA CGM SA (Country: FR; rated: Ba3): down 71.1 bp to 401.1bp (1Y range: 259-469bp)

- Altice Finco SA (Country: LU; rated: Caa1): down 49.2 bp to 522.8bp (1Y range: 333-565bp)

- Unilabs SubHolding AB (publ) (Country: SE; rated: B2): down 49.2 bp to 99.7bp (1Y range: -100bp)

- thyssenkrupp AG (Country: DE; rated: B1): down 38.3 bp to 311.1bp (1Y range: 205-330bp)

- Ladbrokes Coral Group Ltd (Country: GB; rated: WR): down 37.5 bp to 266.9bp (1Y range: 107-300bp)

- Telefonaktiebolaget LM Ericsson (Country: SE; rated: Ba1): down 33.2 bp to 204.8bp (1Y range: 59-244bp)

- UPC Holding BV (Country: NL; rated: LGD6 - 93%): down 32.7 bp to 256.2bp (1Y range: 164-299bp)

- Stena AB (Country: SE; rated: B2-PD): down 31.8 bp to 534.3bp (1Y range: 401-644bp)

- Leonardo SpA (Country: IT; rated: WD): down 31.3 bp to 166.6bp (1Y range: 125-239bp)

- Fortum Oyj (Country: FI; rated: baa3): up 45.3 bp to 204.3bp (1Y range: 40-204bp)

- Pearson PLC (Country: GB; rated: Baa3): up 82.4 bp to 193.6bp (1Y range: 55-194bp)

SELECTED RECENT USD BOND ISSUES

- Carpenter Technology Corp (Metals/Mining | Philadelphia, Pennsylvania, United States | Rating: BB+): US$300m Senior Note (US144285AM55), fixed rate (7.63% coupon) maturing on 15 March 2030, priced at 100.00 (original spread of 566 bp), callable (8nc3)

- Boston Gas Co (Gas Utility - Local Distrib | Boston | Rating: BBB+): US$400m Senior Note (US100743AM53), fixed rate (3.76% coupon) maturing on 16 March 2032, priced at 100.00 (original spread of 175 bp)

- DBS Bank Ltd (Banking | Singapore | Rating: AA-): US$1,500m Covered Bond (Other) (US23304RAC97), fixed rate (2.38% coupon) maturing on 17 March 2027, priced at 100.00, non callable

- Lloyds Banking Group PLC (Banking | London, United Kingdom | Rating: BBB+): US$1,000m Senior Note (US53944YAR45), fixed rate (3.51% coupon) maturing on 18 March 2026, priced at 100.00 (original spread of 160 bp), callable (4nc3)

- Lloyds Banking Group PLC (Banking | London, United Kingdom | Rating: BBB+): US$1,000m Senior Note (US53944YAS28), fixed rate (3.75% coupon) maturing on 18 March 2028, priced at 100.00 (original spread of 180 bp), callable (6nc5)

NEW LOANS

- Bracell Ltd, signed a US$ 1,800m Term Loan maturing on 03/23/29, to be used for general corporate purposes

- VPBank, signed a US$ 600m Revolving Credit / Term Loan maturing on 03/11/25, to be used for general corporate purposes

NEW ISSUES IN SECURITIZED CREDIT

- Wheels Fleet Lease Funding 1 LLC issued a fixed-rate ABS backed by certificates in 3 tranches, for a total of US$ 488 m. Highest-rated tranche offering a yield to maturity of 2.47%, and the lowest-rated tranche a yield to maturity of 3.20%. Bookrunners: RBC Capital Markets, BNP Paribas Securities Corp, Apollo Global Securities LLC

- Dte Electric Securitization Funding I LLC issued a fixed-rate ABS backed by certificates in 2 tranches, for a total of US$ 236 m. Highest-rated tranche offering a yield to maturity of 2.64%, and the lowest-rated tranche a yield to maturity of 3.12%. Bookrunners: Citigroup Global Markets Inc