Credit

Higher Yields, Wider Spreads Take US$ Liquid Bonds Down 1.3% For IG, 1.0% For HY

Some US dollar bond issuance on both sides of the Atlantic to kick off the week, with the largest offering coming from BAT International Finance PLC ($2.3bn in 3 tranches)

Published ET

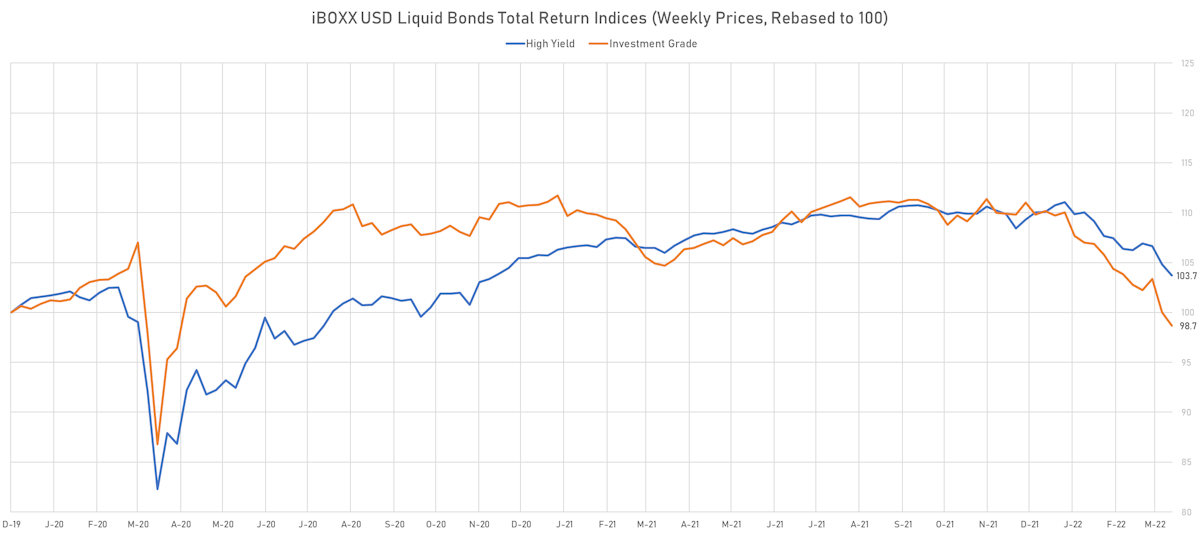

iBOXX USD Liquid Bonds Total Returns | Sources: ϕpost, Refinitiv data

QUICK SUMMARY

- S&P 500 Bond Index was down -1.13% today, with investment grade down -1.14% and high yield down -1.01% (YTD total return: -8.40%)

- The iBoxx USD Liquid Investment Grade Total Return Index was down -1.324% today (Month-to-date: -4.62%; Year-to-date: -10.32%)

- The iBoxx USD Liquid High Yield Total Return Index was down -1.037% today (Month-to-date: -3.19%; Year-to-date: -6.61%)

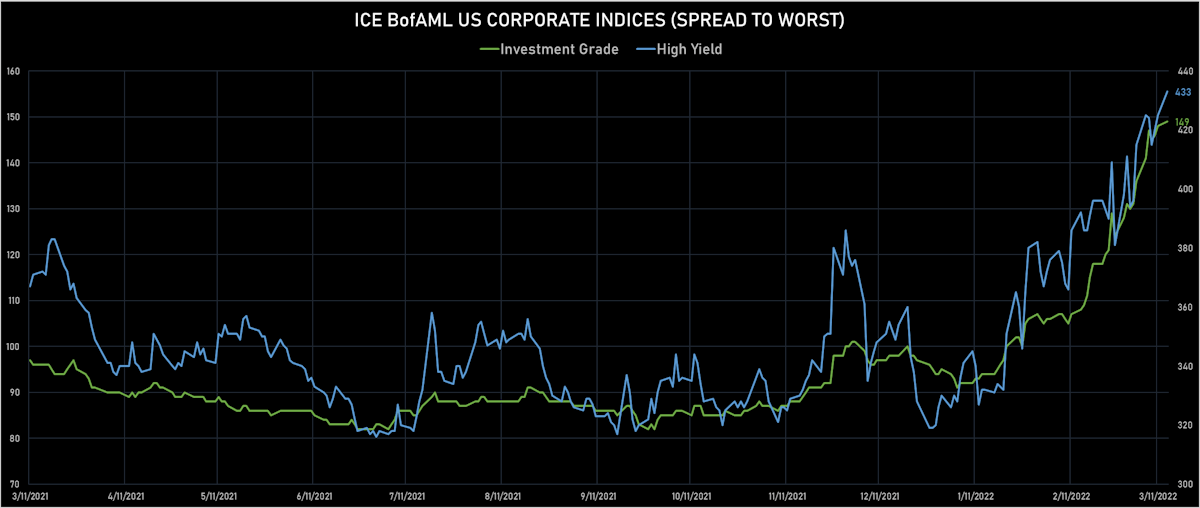

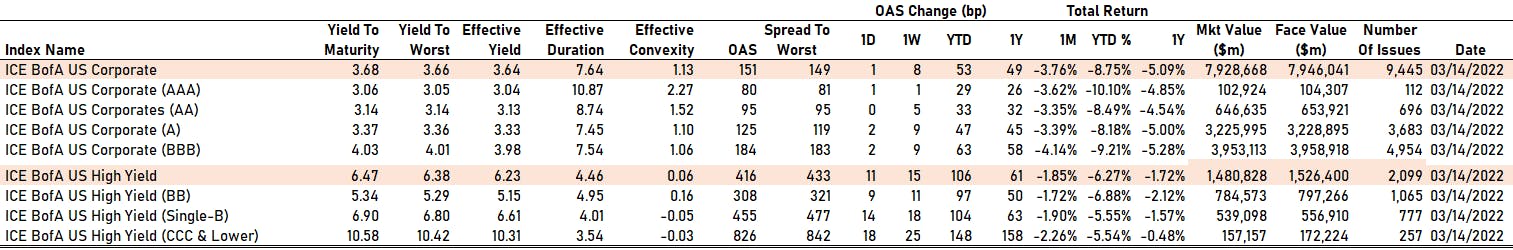

- ICE BofA US Corporate Index (Investment Grade) spread to worst up 1.0 bp, now at 149.0 bp (YTD change: +54.0 bp)

- ICE BofA US High Yield Index spread to worst up 8.0 bp, now at 433.0 bp (YTD change: +103.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index down -0.46% today (YTD total return: -2.1%)

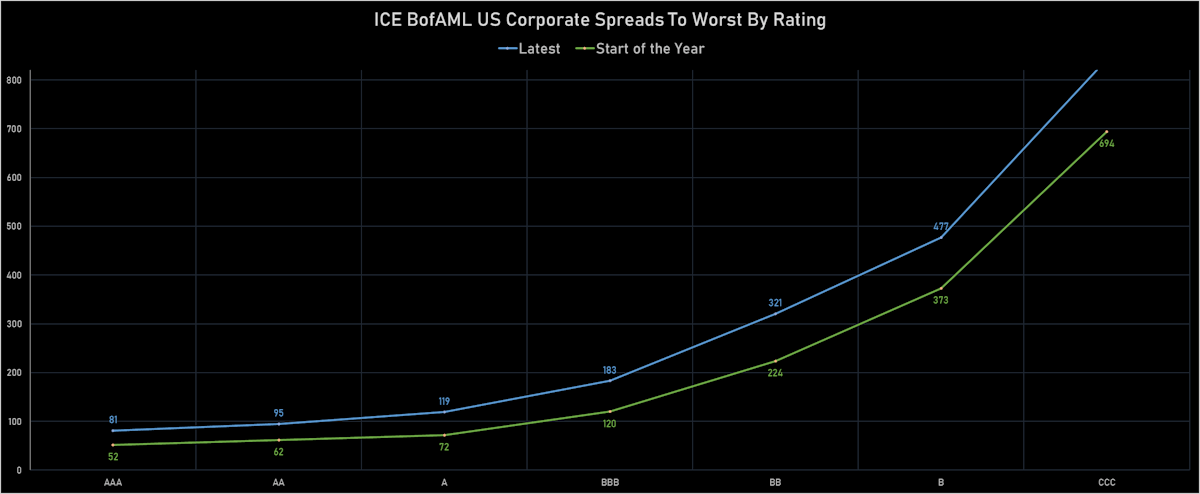

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING

- AAA up by 1 bp at 80 bp

- AA unchanged at 95 bp

- A up by 2 bp at 125 bp

- BBB up by 2 bp at 184 bp

- BB up by 9 bp at 308 bp

- B up by 14 bp at 455 bp

- CCC up by 18 bp at 826 bp

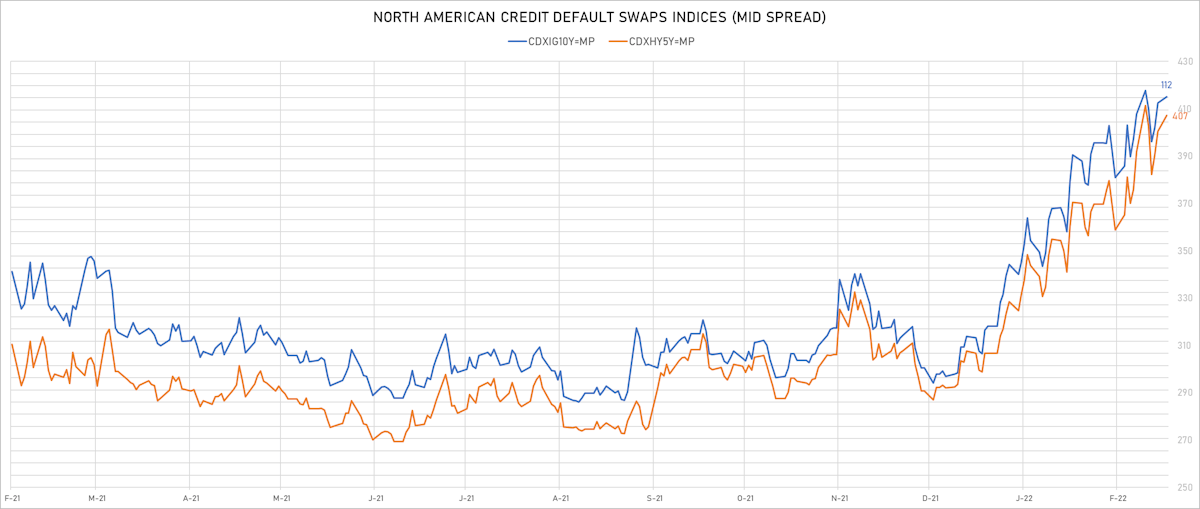

CDS INDICES (mid-spreads)

- Markit CDX.NA.IG 5Y up 0.5 bp, now at 75bp (YTD change: +26.1bp)

- Markit CDX.NA.IG 10Y up 0.5 bp, now at 112bp (YTD change: +23.0bp)

- Markit CDX.NA.HY 5Y up 6.7 bp, now at 407bp (YTD change: +115.1bp)

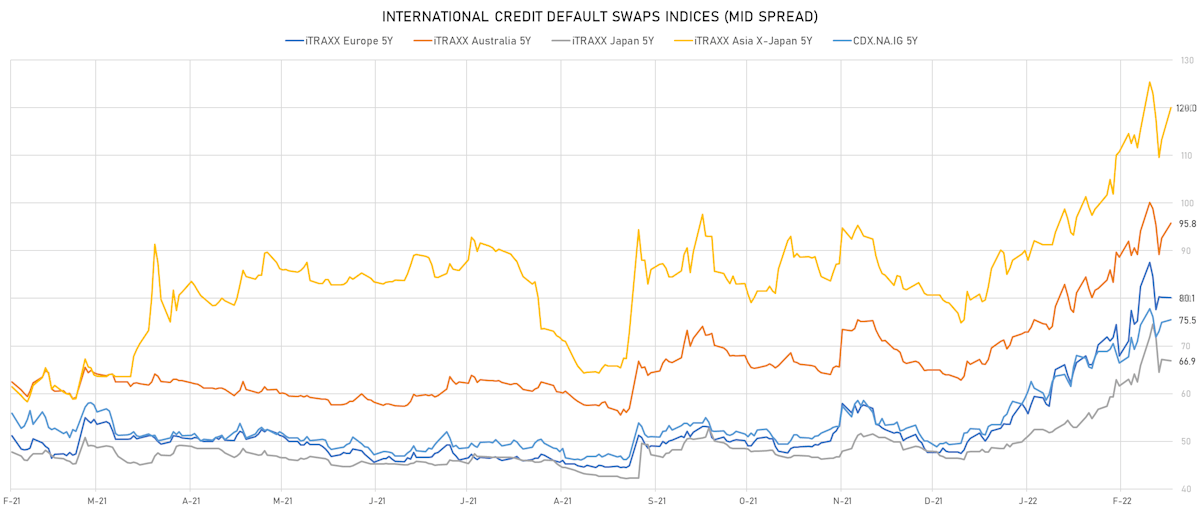

- Markit iTRAXX Europe 5Y down 0.1 bp, now at 80bp (YTD change: +32.4bp)

- Markit iTRAXX Europe Crossover 5Y down 5.0 bp, now at 380bp (YTD change: +138.2bp)

- Markit iTRAXX Japan 5Y down 0.3 bp, now at 67bp (YTD change: +20.4bp)

- Markit iTRAXX Asia Ex-Japan 5Y up 6.8 bp, now at 120bp (YTD change: +41.0bp)

TOP BONDS MOVES IN THE PAST WEEK - USD HY

- Issuer: WeWork Companies Inc (New York City, New York (US)) | Coupon: 7.88% | Maturity: 1/5/2025 | Rating: CCC- | ISIN: USU96217AA99 | Z-spread up by 100.7 bp to 1,236.9 bp, with the yield to worst at 13.6% and the bond now trading down to 84.8 cents on the dollar (1Y price range: 84.8-96.5).

- Issuer: WeWork Companies LLC (New York City, New York (US)) | Coupon: 5.00% | Maturity: 10/7/2025 | Rating: CCC- | ISIN: USU9621PAA94 | Z-spread up by 87.8 bp to 1,101.7 bp, with the yield to worst at 12.8% and the bond now trading down to 78.5 cents on the dollar (1Y price range: 77.4-84.5).

- Issuer: Brinker International Inc (Coppell, Texas (US)) | Coupon: 5.00% | Maturity: 1/10/2024 | Rating: B+ | ISIN: USU6223WAB01 | Z-spread up by 63.7 bp to 333.4 bp, with the yield to worst at 5.5% and the bond now trading down to 98.8 cents on the dollar (1Y price range: 98.8-106.8).

- Issuer: Taylor Morrison Communities Inc (Scottsdale, Arizona (US)) | Coupon: 5.63% | Maturity: 1/3/2024 | Rating: BB- | ISIN: USU87286AD91 | Z-spread up by 59.3 bp to 272.6 bp, with the yield to worst at 4.6% and the bond now trading down to 101.4 cents on the dollar (1Y price range: 101.4-106.5).

- Issuer: NCL Corporation Ltd (Miami, Bermuda) | Coupon: 5.88% | Maturity: 15/3/2026 | Rating: CCC+ | ISIN: USG6436QAL08 | Z-spread up by 44.4 bp to 638.8 bp, with the yield to worst at 8.4% and the bond now trading down to 91.0 cents on the dollar (1Y price range: 91.0-100.0).

- Issuer: Xerox Holdings Corp (Norwalk, Connecticut (US)) | Coupon: 5.00% | Maturity: 15/8/2025 | Rating: BB | ISIN: USU98401AA75 | Z-spread up by 44.3 bp to 353.2 bp, with the yield to worst at 5.4% and the bond now trading down to 97.8 cents on the dollar (1Y price range: 97.8-105.7).

- Issuer: HanesBrands Inc (Winston-Salem, North Carolina (US)) | Coupon: 4.63% | Maturity: 15/5/2024 | Rating: BB- | ISIN: USU24437AD43 | Z-spread up by 41.8 bp to 233.1 bp, with the yield to worst at 3.9% and the bond now trading down to 100.3 cents on the dollar (1Y price range: 100.0-104.5).

- Issuer: Wynn Las Vegas LLC (Las Vegas, Nevada (US)) | Coupon: 5.50% | Maturity: 1/3/2025 | Rating: B | ISIN: USU98347AK05 | Z-spread up by 40.9 bp to 407.7 bp, with the yield to worst at 5.9% and the bond now trading down to 97.9 cents on the dollar (1Y price range: 97.9-103.5).

- Issuer: Goodyear Tire & Rubber Co (Akron, Ohio (US)) | Coupon: 5.25% | Maturity: 15/7/2031 | Rating: B | ISIN: USU38255AP71 | Z-spread up by 35.7 bp to 471.7 bp (CDS basis: -21.3bp), with the yield to worst at 6.9% and the bond now trading down to 88.5 cents on the dollar (1Y price range: 88.5-108.0).

- Issuer: Bombardier Inc (MONTREAL, Canada) | Coupon: 7.45% | Maturity: 1/5/2034 | Rating: CCC+ | ISIN: USC10602AJ68 | Z-spread up by 32.8 bp to 506.7 bp (CDS basis: 182.3bp), with the yield to worst at 7.1% and the bond now trading down to 102.0 cents on the dollar (1Y price range: 102.0-122.9).

- Issuer: Molina Healthcare Inc (Long Beach, CA (US)) | Coupon: 3.88% | Maturity: 15/5/2032 | Rating: BB- | ISIN: USU60868AE36 | Z-spread up by 28.2 bp to 245.7 bp, with the yield to worst at 4.7% and the bond now trading down to 93.0 cents on the dollar (1Y price range: 93.0-100.5).

- Issuer: Block Inc (San Francisco, California (US)) | Coupon: 2.75% | Maturity: 1/6/2026 | Rating: BB | ISIN: USU85223AA03 | Z-spread up by 27.7 bp to 226.7 bp, with the yield to worst at 4.2% and the bond now trading down to 93.5 cents on the dollar (1Y price range: 93.0-100.5).

- Issuer: Sealed Air Corp (Charlotte, North Carolina (US)) | Coupon: 4.00% | Maturity: 1/12/2027 | Rating: BB | ISIN: USU81193AQ42 | Z-spread down by 30.4 bp to 218.7 bp (CDS basis: 7.5bp), with the yield to worst at 4.1% and the bond now trading up to 98.0 cents on the dollar (1Y price range: 97.0-104.3).

- Issuer: Southeast Supply Header LLC (Houston, Texas (US)) | Coupon: 4.25% | Maturity: 15/6/2024 | Rating: BB- | ISIN: USU83854AB29 | Z-spread down by 51.0 bp to 240.7 bp, with the yield to worst at 4.1% and the bond now trading up to 99.3 cents on the dollar (1Y price range: 98.7-102.8).

- Issuer: American Airlines Group Inc (Fort Worth, Texas (US)) | Coupon: 3.75% | Maturity: 1/3/2025 | Rating: CCC | ISIN: USU0242AAD47 | Z-spread down by 73.2 bp to 797.8 bp (CDS basis: 511.2bp), with the yield to worst at 9.8% and the bond now trading up to 84.5 cents on the dollar (1Y price range: 83.5-95.6).

TOP BONDS MOVES IN THE PAST WEEK - EUR HY

- Issuer: Renault SA (Boulogne-Billancourt, France) | Coupon: 1.00% | Maturity: 28/11/2025 | Rating: BB | ISIN: FR0013299435 | Z-spread down by 79.3 bp to 280.2 bp (CDS basis: 0.4bp), with the yield to worst at 3.3% and the bond now trading up to 91.7 cents on the dollar (1Y price range: 90.6-99.4).

- Issuer: Deutsche Lufthansa AG (Cologne, Germany) | Coupon: 2.88% | Maturity: 11/2/2025 | Rating: BB- | ISIN: XS2296201424 | Z-spread down by 91.0 bp to 390.6 bp (CDS basis: -118.1bp), with the yield to worst at 4.1% and the bond now trading up to 95.9 cents on the dollar (1Y price range: 94.1-102.3).

- Issuer: ZF Europe Finance BV (Amsterdam, Netherlands) | Coupon: 1.25% | Maturity: 23/10/2023 | Rating: BB+ | ISIN: XS2010040124 | Z-spread down by 97.6 bp to 209.4 bp, with the yield to worst at 2.0% and the bond now trading up to 98.5 cents on the dollar (1Y price range: 97.8-100.9).

- Issuer: Telefonaktiebolaget LM Ericsson (Stockholm, Sweden) | Coupon: 1.00% | Maturity: 26/5/2029 | Rating: BB+ | ISIN: XS2345996743 | Z-spread down by 106.3 bp to 286.7 bp (CDS basis: -38.0bp), with the yield to worst at 3.7% and the bond now trading up to 82.8 cents on the dollar (1Y price range: 78.4-97.8).

- Issuer: Saipem Finance International BV (Amsterdam, Netherlands) | Coupon: 2.63% | Maturity: 7/1/2025 | Rating: B+ | ISIN: XS1711584430 | Z-spread down by 150.6 bp to 756.4 bp (CDS basis: 171.4bp), with the yield to worst at 7.9% and the bond now trading up to 86.8 cents on the dollar (1Y price range: 73.9-101.2).

- Issuer: Adler Group SA (Senningerberg, Luxembourg) | Coupon: 1.88% | Maturity: 14/1/2026 | Rating: B | ISIN: XS2283224231 | Z-spread down by 161.5 bp to 582.0 bp, with the yield to worst at 6.3% and the bond now trading up to 84.9 cents on the dollar (1Y price range: 77.7-86.2).

- Issuer: Adler Real Estate AG (Berlin, Germany) | Coupon: 2.13% | Maturity: 6/2/2024 | Rating: B | ISIN: XS1731858715 | Z-spread down by 177.0 bp to 653.8 bp, with the yield to worst at 6.6% and the bond now trading up to 92.0 cents on the dollar (1Y price range: 88.8-94.9).

- Issuer: Adler Group SA (Senningerberg, Luxembourg) | Coupon: 1.50% | Maturity: 26/7/2024 | Rating: B | ISIN: XS1652965085 | Z-spread down by 222.3 bp to 609.2 bp, with the yield to worst at 6.2% and the bond now trading up to 89.4 cents on the dollar (1Y price range: 82.7-91.1).

- Issuer: Fortune Star (BVI) Ltd (British Virgin Islands) | Coupon: 4.35% | Maturity: 6/5/2023 | Rating: BB- | ISIN: XS2066225124 | Z-spread down by 222.7 bp to 1,034.9 bp, with the yield to worst at 10.0% and the bond now trading up to 94.1 cents on the dollar (1Y price range: 94.1-99.5).

- Issuer: Saipem Finance International BV (Amsterdam, Netherlands) | Coupon: 3.75% | Maturity: 8/9/2023 | Rating: B+ | ISIN: XS1487495316 | Z-spread down by 413.3 bp to 949.9 bp (CDS basis: 145.5bp), with the yield to worst at 9.3% and the bond now trading up to 92.3 cents on the dollar (1Y price range: 76.2-103.4).

SELECTED RECENT USD BOND ISSUES

- Brown & Brown Inc (Property and Casualty Insurance | Daytona Beach, United States | Rating: BBB-): US$600m Senior Note (US115236AF88), fixed rate (4.95% coupon) maturing on 16 March 2052, priced at 98.63 (original spread of 285 bp), callable (30nc30)

- Brown & Brown Inc (Property and Casualty Insurance | Daytona Beach, Florida, United States | Rating: BBB-): US$600m Senior Note (US115236AE14), fixed rate (4.20% coupon) maturing on 16 March 2032, priced at 99.64 (original spread of 210 bp), callable (10nc10)

- Crown Americas LLC (Containers | Philadelphia, United States | Rating: NR): US$500m Senior Note (US228180AA31), fixed rate (5.25% coupon) maturing on 1 April 2030, priced at 100.00, callable (8nc8)

- Duke Energy Progress LLC (Utility - Other | Raleigh, United States | Rating: BBB+): US$400m First Mortgage Bond (US26442UAP93), fixed rate (4.00% coupon) maturing on 1 April 2052, priced at 99.13 (original spread of 182 bp), callable (30nc30)

- Duke Energy Progress LLC (Utility - Other | Raleigh, United States | Rating: BBB+): US$500m First Mortgage Bond (US26442UAN46), fixed rate (3.40% coupon) maturing on 1 April 2032, priced at 99.74 (original spread of 130 bp), callable (10nc10)

- Puget Energy Inc (Utility - Other | Bellevue, Washington, United States | Rating: BBB-): US$450m Note (US745310AN24), fixed rate (4.22% coupon) maturing on 15 March 2032, priced at 100.00 (original spread of 210 bp), callable (10nc10)

- Anglo American Capital PLC (Financial - Other | London, United Kingdom | Rating: NR): US$500m Senior Note (US034863BB50), fixed rate (3.88% coupon) maturing on 16 March 2029, priced at 99.35 (original spread of 183 bp), callable (7nc7)

- Anglo American Capital PLC (Financial - Other | London, United Kingdom | Rating: NR): US$750m Senior Note (US034863BC34), fixed rate (4.75% coupon) maturing on 16 March 2052, priced at 98.27 (original spread of 264 bp), callable (30nc30)

- BAT International Finance PLC (Financial - Other | London, United Kingdom | Rating: NR): US$600m Senior Note (US05526DBV64), fixed rate (5.65% coupon) maturing on 16 March 2052, priced at 96.50 (original spread of 340 bp), callable (30nc30)

- BAT International Finance PLC (Financial - Other | London, United Kingdom | Rating: BBB): US$1,000m Senior Note (US05530QAP54), fixed rate (4.45% coupon) maturing on 16 March 2028, priced at 100.00 (original spread of 235 bp), callable (6nc6)

- BAT International Finance PLC (Financial - Other | London, United Kingdom | Rating: NR): US$700m Senior Note (US05526DBW48), fixed rate (4.74% coupon) maturing on 16 March 2032, priced at 100.00 (original spread of 260 bp), callable (10nc10)

- Bank of Communications Co Ltd (Hong Kong Branch) (Banking | China (Mainland) | Rating: A): US$400m Senior Note (XS2455213590), fixed rate (2.38% coupon) maturing on 21 March 2025, priced at 99.77 (original spread of 45 bp), non callable

SELECTED RECENT EUR BOND ISSUES

- ANZ New Zealand Intl Ltd (London Branch) (Securities | London, Australia | Rating: NR): €750m Covered Bond (Other) (XS2459053943), fixed rate (0.90% coupon) maturing on 23 March 2027, priced at 100.00 (original spread of 87 bp), non callable

- AXA Home Loan SFH (Service - Other | Fontenay-Sous-Bois, France | Rating: NR): €500m Obligation de Financement de l'Habitat (Covered Bond) (FR00140098T5), fixed rate (0.75% coupon) maturing on 22 October 2026, priced at 99.99, non callable

- EDP Finance BV (Financial - Other | Amsterdam, Portugal | Rating: BBB): €1,250m Senior Note (XS2459544339), fixed rate (1.88% coupon) maturing on 21 September 2029, priced at 99.85 (original spread of 172 bp), callable (8nc7)

- Korea Housing Finance Corp (Agency | Busan, Busan, South Korea | Rating: AA-): €600m Covered Bond (Other) (XS2442748385), fixed rate (0.72% coupon) maturing on 22 March 2025, priced at 100.00 (original spread of 90 bp), non callable

- Lanxess AG (Chemicals | Cologne, Nordrhein-Westfalen, Germany | Rating: BBB): €600m Senior Note (XS2459163619), fixed rate (1.75% coupon) maturing on 22 March 2028, priced at 99.65 (original spread of 170 bp), callable (6nc6)

- Luminis Investments PLC (Financial - Other | Dublin, Ireland | Rating: NR): €125m Unsecured Note (XS2360496041) zero coupon maturing on 21 January 2026, non callable

- UniCredit Bank AG (Banking | Muenchen, Bayern, Italy | Rating: BBB+): €1,000m Hypothekenpfandbrief (Covered Bond) (DE000HV2AYV7), fixed rate (0.70% coupon) maturing on 30 September 2027, priced at 100.00, non callable

- Vseobecna Uverova Banka as (Banking | Bratislava, Bratislavsky Kraj | Rating: NR): €500m Covered Bond (Other) (SK4000020491), fixed rate (0.88% coupon) maturing on 22 March 2027, priced at 99.69, non callable

NEW LOANS

- Century Casinos Inc (B), signed a US$ 350m Term Loan B, to be used for acquisition financing

- Everstream Solutions LLC, signed a US$ 225m Delayed Draw Term Loan maturing on 04/04/29, to be used for general corporate purposes, capital expenditures and acquisition financing

- Everstream Solutions LLC, signed a US$ 495m Term Loan B, to be used for general corporate purposes, capital expenditures and acquisition financing. It matures on 04/04/29 and initial pricing is set at Term SOFR +350bp

- SkillSoft Corp (B-), signed a US$ 160m Term Loan B, to be used for acquisition financing. It matures on 07/16/28 and initial pricing is set at LIBOR +475bp

- PT Pertamina (Persero) (BBB), signed a US$ 3,000m Revolving Credit / Term Loan, to be used for general corporate purposes and capital expenditures