Credit

Modest Moves In HY Cash Today, With Lower Yields Countering Wider Spreads For The Worst Credits

Very little issuance ahead of the FOMC decision tomorrow, with just a couple of notable foreign deals: $2.75bn in 4 tranches for Macquarie, and $2bn in a single tranche for the Bank of England

Published ET

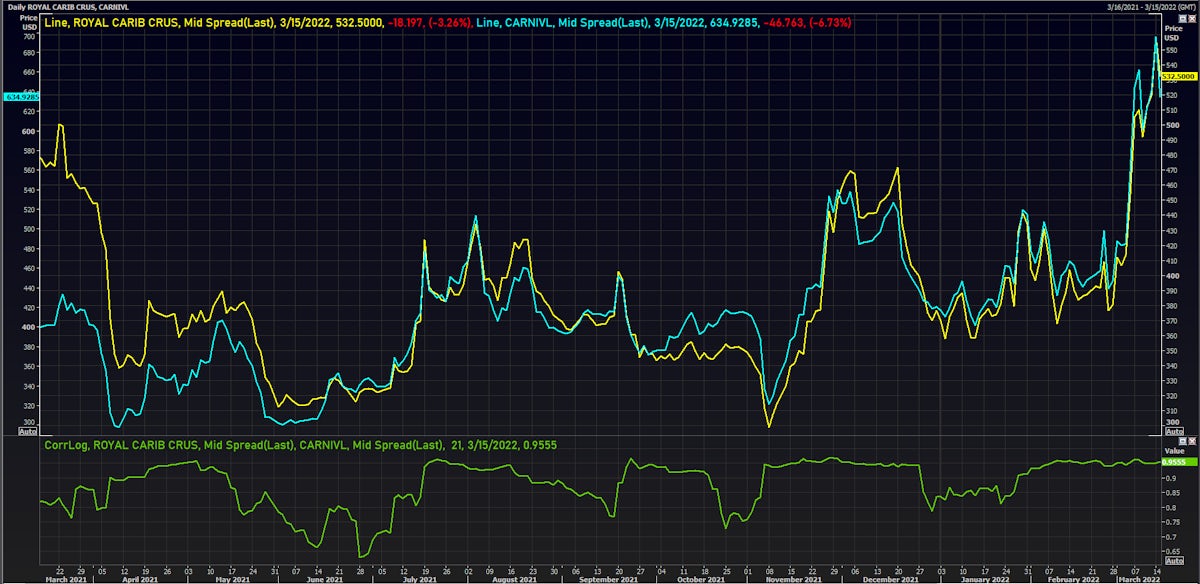

Carnival & Royal Caribbean 5Y USD CDS Mid Spreads | Source: Refinitiv

QUICK SUMMARY

- The iBoxx USD Liquid Investment Grade Total Return Index was up 0.209% today (Month-to-date: -4.42%; Year-to-date: -10.13%)

- The iBoxx USD Liquid High Yield Total Return Index was up 0.206% today (Month-to-date: -2.99%; Year-to-date: -6.41%)

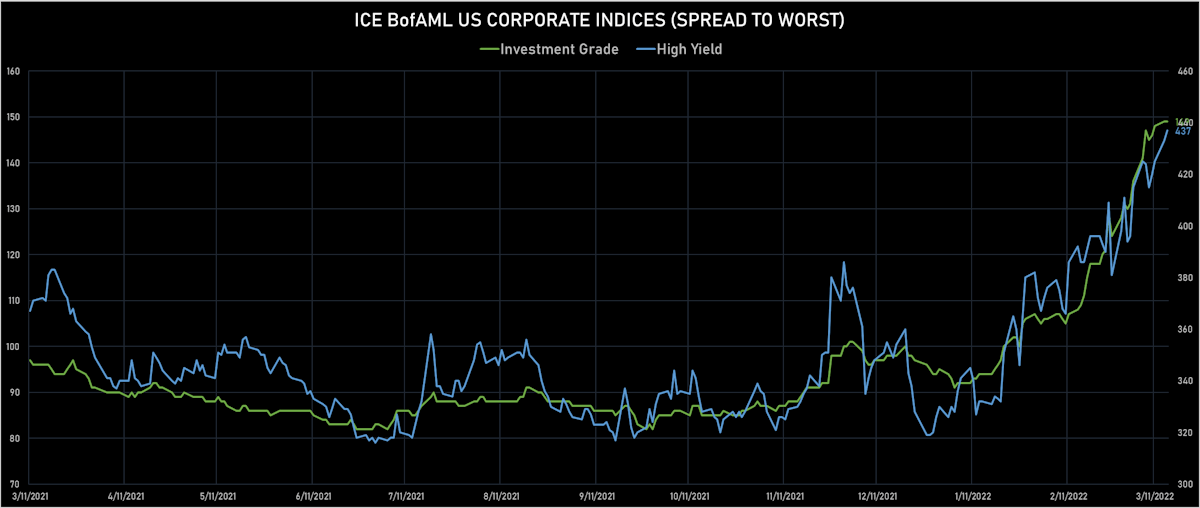

- ICE BofA US Corporate Index (Investment Grade) spread to worst unchanged at 149.0 bp (YTD change: +54.0 bp)

- ICE BofA US High Yield Index spread to worst up 4.0 bp, now at 437.0 bp (YTD change: +107.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index down -1.03% today (YTD total return: -2.7%)

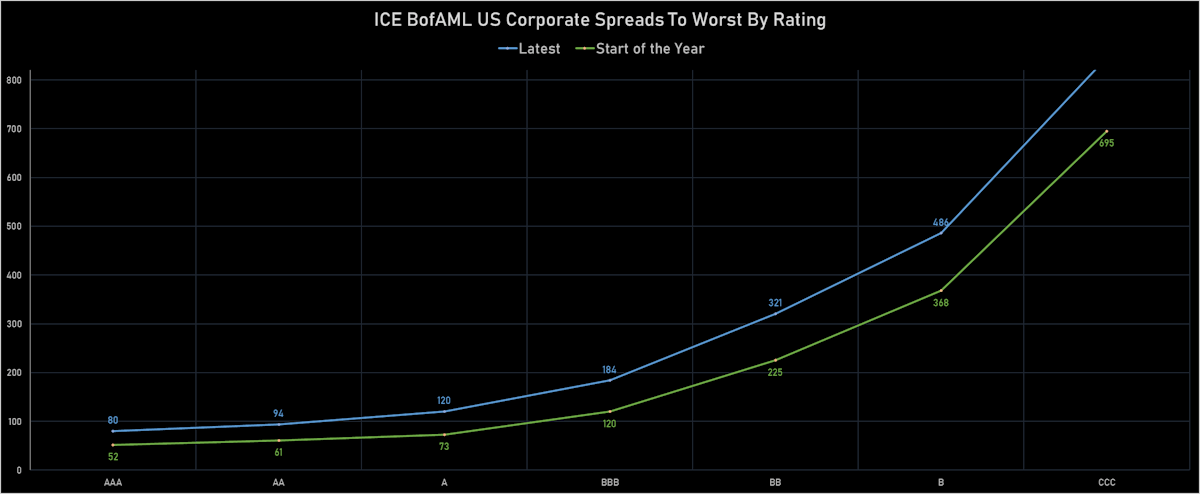

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING

- AAA down by -1 bp at 79 bp

- AA unchanged at 95 bp

- A unchanged at 125 bp

- BBB up by 1 bp at 185 bp

- BB down by -1 bp at 307 bp

- B up by 14 bp at 469 bp

- CCC up by 3 bp at 829 bp

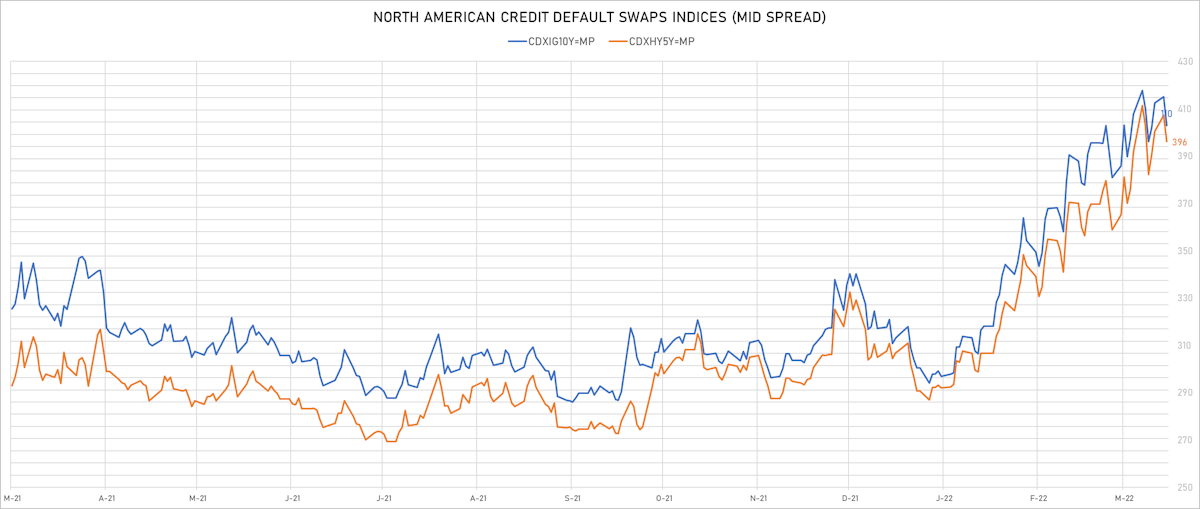

CDS INDICES (mid-spreads)

- Markit CDX.NA.IG 5Y down 2.5 bp, now at 73bp (YTD change: +23.6bp)

- Markit CDX.NA.IG 10Y down 2.4 bp, now at 110bp (YTD change: +20.6bp)

- Markit CDX.NA.HY 5Y down 11.1 bp, now at 396bp (YTD change: +104.0bp)

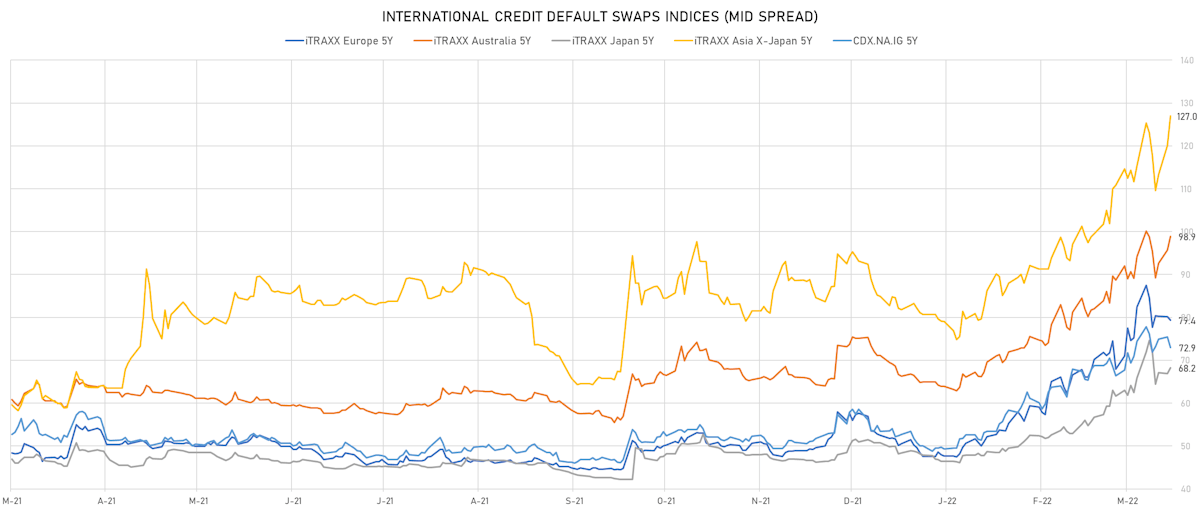

- Markit iTRAXX Europe 5Y down 0.8 bp, now at 79bp (YTD change: +31.7bp)

- Markit iTRAXX Europe Crossover 5Y down 3.1 bp, now at 377bp (YTD change: +135.1bp)

- Markit iTRAXX Japan 5Y up 1.3 bp, now at 68bp (YTD change: +21.8bp)

- Markit iTRAXX Asia Ex-Japan 5Y up 6.9 bp, now at 127bp (YTD change: +47.9bp)

5Y USD CDS SINGLE NAMES - LARGEST MOVES OVER THE PAST WEEK

- Egypt, Arab Republic of (Government) (Country: EG; rated: B): down 289.8 bp to 716.7bp (1Y range: 320-981bp)

- Russia, Federation of (Government) (Country: RU; rated: C): down 271.3 bp to 2,622.9bp (1Y range: 77-4,812bp)

- Turkey, Republic of (Government) (Country: TR; rated: WR): down 32.3 bp to 623.3bp (1Y range: 303-683bp)

- General Motors Co (Country: US; rated: Baa3): up 33.6 bp to 201.5bp (1Y range: 91-221bp)

- Pactiv LLC (Country: US; rated: Caa1): up 35.0 bp to 570.0bp (1Y range: 356-570bp)

- Realogy Group LLC (Country: US; rated: WR): up 35.5 bp to 436.3bp (1Y range: 278-453bp)

- MGM Resorts International (Country: US; rated: WD): up 39.1 bp to 307.3bp (1Y range: 190-307bp)

- Navient Corp (Country: US; rated: Ba3): up 41.4 bp to 492.1bp (1Y range: -492bp)

- Bombardier Inc (Country: CA; rated: Caa1): up 44.4 bp to 616.0bp (1Y range: 395-644bp)

- Liberty Interactive LLC (Country: US; rated: Ba3): up 45.7 bp to 725.5bp (1Y range: 287-726bp)

- Carnival Corp (Country: US; rated: LGD5 - 72%): up 46.9 bp to 648.6bp (1Y range: 291-682bp)

- Royal Caribbean Cruises Ltd (Country: US; rated: LGD4 - 59%): up 48.1 bp to 540.4bp (1Y range: 299-540bp)

- Nabors Industries Inc (Country: US; rated: B3): up 83.2 bp to 653.7bp (1Y range: 504-1,098bp)

- Staples Inc (Country: US; rated: B3): up 144.5 bp to 1,439.2bp (1Y range: 687-1,439bp)

- Transocean Inc (Country: KY; rated: Caa3): up 211.0 bp to 1,738.2bp (1Y range: 941-1,875bp)

5Y EURO CDS SINGLE NAMES - LARGEST MOVES OVER THE PAST WEEK

- Telefonaktiebolaget LM Ericsson (Country: SE; rated: Ba1): down 33.1 bp to 196.4bp (1Y range: 59-244bp)

- Hammerson PLC (Country: GB; rated: Baa3): down 28.3 bp to 224.0bp (1Y range: 166-300bp)

- CMA CGM SA (Country: FR; rated: Ba3): down 27.6 bp to 392.9bp (1Y range: 259-469bp)

- thyssenkrupp AG (Country: DE; rated: B1): down 22.5 bp to 296.1bp (1Y range: 205-330bp)

- Unibail-Rodamco-Westfield SE (Country: FR; rated: BBB-): down 16.9 bp to 144.7bp (1Y range: 46-145bp)

- Air France KLM SA (Country: FR; rated: B-): down 16.0 bp to 545.9bp (1Y range: 386-566bp)

- Atlantia SpA (Country: IT; rated: Ba2): down 14.0 bp to 179.8bp (1Y range: 97-208bp)

- Leonardo SpA (Country: IT; rated: WD): down 14.0 bp to 159.5bp (1Y range: 125-239bp)

- Casino Guichard Perrachon SA (Country: FR; rated: WR): down 13.3 bp to 1,022.3bp (1Y range: 464-1,208bp)

- Novafives SAS (Country: FR; rated: Caa1): up 16.7 bp to 1,219.0bp (1Y range: 618-1,342bp)

- Jaguar Land Rover Automotive PLC (Country: GB; rated: WD): up 17.4 bp to 605.3bp (1Y range: 339-605bp)

- Louis Dreyfus Co BV (Country: NL; rated: ): up 33.1 bp to 261.7bp (1Y range: -262bp)

- Fortum Oyj (Country: FI; rated: baa3): up 75.5 bp to 242.6bp (1Y range: 40-243bp)

- Pearson PLC (Country: GB; rated: Baa3): up 97.4 bp to 198.2bp (1Y range: 55-198bp)

- Boparan Finance PLC (Country: GB; rated: B3): up 113.8 bp to 2,211.2bp (1Y range: 708-2,690bp)

SELECTED RECENT USD BOND ISSUES

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$220m Bond (US3133ENSF87), fixed rate (2.87% coupon) maturing on 21 March 2029, priced at 100.00 (original spread of 166 bp), callable (7nc1)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$110m Bond (US3133ENSK72), fixed rate (2.19% coupon) maturing on 21 March 2025, priced at 100.00 (original spread of 98 bp), callable (3nc1)

- Bank of England (Agency | London, United Kingdom | Rating: AA-): US$2,000m Senior Note (US38376HAH12), fixed rate (2.00% coupon) maturing on 21 March 2025, priced at 99.73 (original spread of 10 bp), non callable

- Macquarie Bank Ltd (Banking | Sydney, Australia | Rating: A): US$500m Senior Note (US55608PBK93), floating rate (SOFR + 131.0 bp) maturing on 21 March 2025, priced at 100.00, non callable

- Macquarie Bank Ltd (Banking | Sydney, Australia | Rating: A): US$1,000m Senior Note (US55608PBJ21), fixed rate (3.23% coupon) maturing on 21 March 2025, priced at 100.00 (original spread of 120 bp), non callable

- Macquarie Group Ltd (Financial - Other | Sydney, Australia | Rating: BBB+): US$650m Senior Note (US55608JBC18), floating rate maturing on 21 June 2028, priced at 100.00, callable (6nc5)

- Macquarie Group Ltd (Financial - Other | Sydney, Australia | Rating: BBB+): US$600m Senior Note (US55608JBE73), floating rate maturing on 21 June 2033, priced at 100.00 (original spread of 222 bp), callable (11nc10)

- Swedish Export Credit Corp (Agency | Stockholm, Sweden | Rating: AA+): US$1,000m Senior Note (US87031CAE30), fixed rate (2.25% coupon) maturing on 22 March 2027, priced at 99.87 (original spread of 23 bp), non callable

SELECTED RECENT EUR BOND ISSUES

- African Development Bank (Supranational | Abidjan, Ivory Coast | Rating: AAA): €1,250m Senior Note (XS2459747791), fixed rate (0.50% coupon) maturing on 22 March 2027, priced at 99.41 (original spread of 63 bp), non callable

- Banque Federative du Credit Mutuel SA (Banking | Strasbourg, France | Rating: A+): €1,500m Bond (FR0014009A50), fixed rate (1.00% coupon) maturing on 23 May 2025, priced at 99.93 (original spread of 124 bp), non callable

- Credit Agricole SA (Banking | Montrouge, France | Rating: A+): €1,250m Bond (FR00140098S7), fixed rate (1.00% coupon) maturing on 18 September 2025, priced at 99.88 (original spread of 117 bp), non callable

- HSBC SFH (France) SA (Financial - Other | Courbevoie, United Kingdom | Rating: NR): €1,250m Obligation de Financement de l'Habitat (Covered Bond) (FR00140099G0), fixed rate (0.75% coupon) maturing on 22 March 2027, priced at 99.60 (original spread of 80 bp), non callable

- Lower Saxony, State of (Official and Muni | Hannover, Germany | Rating: AAA): €500m Landesschatzanweisung (DE000A3MQY17), fixed rate (0.75% coupon) maturing on 21 March 2031, priced at 98.97 (original spread of 60 bp), non callable

- Royal Bank of Canada (Banking | Toronto, Canada | Rating: A+): €2,000m Covered Bond (Other) (XS2460043743), fixed rate (0.63% coupon) maturing on 23 March 2026, priced at 99.60 (original spread of 82 bp), non callable

NEW LOANS

- LATAM Airlines Group SA, signed a US$ 2,050m Term Loan, to be used for debtors in possesion. It matures on 08/08/22 and initial pricing is set at Term SOFR +750bp

- LATAM Airlines Group SA, signed a US$ 1,650m Term Loan, to be used for debtors in possesion. It matures on 08/08/22 and initial pricing is set at Term SOFR +1,300bp

- FEDEX Corp (BBB), signed a US$ 1,500m Revolving Credit Facility, to be used for general corporate purposes. It matures on 03/15/25 and initial pricing is set at Term SOFR +125bp

- Select Energy Services LLC, signed a US$ 250m Revolving Credit Facility, to be used for general corporate purposes. It matures on 11/01/22 and initial pricing is set at Term SOFR +175bp

- Duke Energy Corp (BBB), signed a US$ 9,000m Revolving Credit Facility, to be used for general corporate purposes. It matures on 03/18/27 and initial pricing is set at Term SOFR +127.5bp

- American Trailer World Corp (B), signed a US$ 225m Revolving Credit Facility, to be used for general corporate purposes

- Scientific Games Corp (B), signed a US$ 1,670m Term Loan B, to be used for acquisition financing. It matures on 03/23/29 and initial pricing is set at Term SOFR +350bp

- Scientific Games Corp (B), signed a US$ 440m Revolving Credit Facility, to be used for acquisition financing. It matures on 03/23/27 and initial pricing is set at Term SOFR +325bp

- Savage Cos, signed a US$ 650m Revolving Credit Facility, to be used for general corporate purposes. Initial pricing is set at Term SOFR +150bp

- Premier Trailers LLC, signed a US$ 400m Revolving Credit Facility, to be used for general corporate purposes. Initial pricing is set at Term SOFR +160bp

- DCP Midstream Operating LP (BB+), signed a US$ 1,400m Revolving Credit Facility, to be used for general corporate purposes. It matures on 03/18/27 and initial pricing is set at Term SOFR +135bp

- CVR Energy Inc (B+), signed a US$ 300m Revolving Credit Facility, to be used for general corporate purposes. It matures on 01/00/00 and initial pricing is set at Term SOFR +186.5bp

- Tenet Healthcare Corp (CCC+), signed a US$ 1,500m Revolving Credit Facility, to be used for general corporate purposes. It matures on 03/16/27 and initial pricing is set at Term SOFR +125bp

- Wesco Iv Llc, signed a US$ 298m Term Loan A, to be used for general corporate purposes. It matures on 01/00/00 and initial pricing is set at Term SOFR +120bp

- KaMin LLC, signed a US$ 325m Term Loan, to be used for acquisition financing

- ECHO Realty LP, signed a US$ 650m Term Loan, to be used for general corporate purposes

NEW ISSUES IN SECURITIZED CREDIT

- Bayview Opportunity Master Fund Vi Trust 2022-Inv4 issued a fixed-rate RMBS in 5 tranches, for a total of US$ 359 m. Bookrunners: Wells Fargo Securities LLC

- Laq 2022-Laq Mortgage Trust issued a floating-rate CMBS in 8 tranches, for a total of US$ 1,039 m. Highest-rated tranche offering a spread over the floating rate of 172bp, and the lowest-rated tranche a spread of 597bp. Bookrunners: Deutsche Bank Securities Inc, BMO Capital Markets