Credit

Huge Spread Compression Across The US Credit Complex: HY Cash Spread To Worst 23bp Tighter, CDX HY 5Y 26bp Tighter

The move in credit had more to do with the relief seen in other stressed asset classes than the Fed hike, with Chinese equities up 12.8% in the last couple of days and the Russian Rouble mid spread now at 96.5 (vs a high of 150 earlier this month)

Published ET

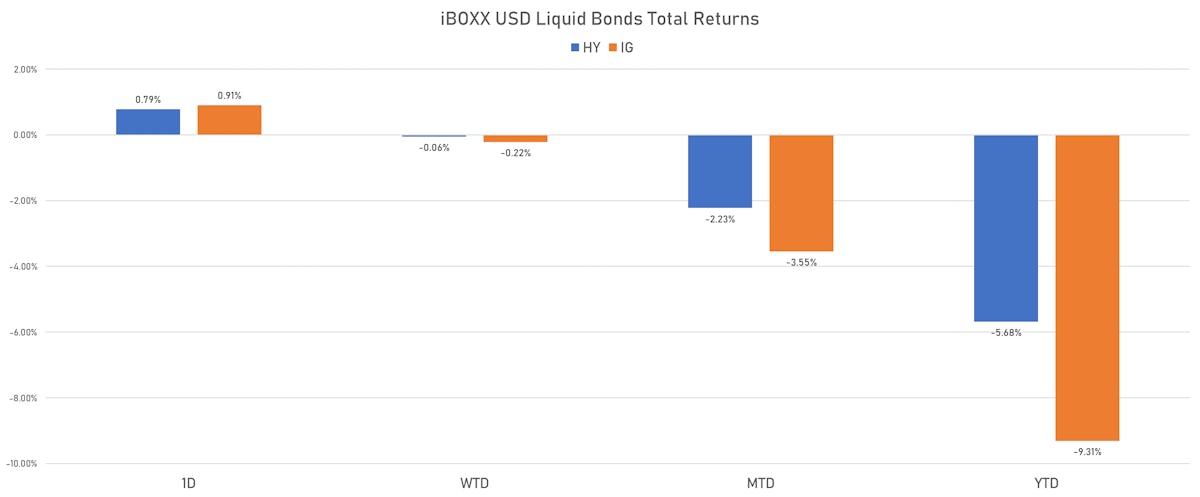

iBOXX USD Liquid Credit Total Returns | Sources: ϕpost, Refinitiv data

QUICK SUMMARY

- S&P 500 Bond Index was up 0.68% today, with investment grade up 0.67% and high yield up 0.81% (YTD total return: -7.75%)

- The iBoxx USD Liquid Investment Grade Total Return Index was up 0.908% today (Month-to-date: -3.55%; Year-to-date: -9.31%)

- The iBoxx USD Liquid High Yield Total Return Index was up 0.785% today (Month-to-date: -2.23%; Year-to-date: -5.68%)

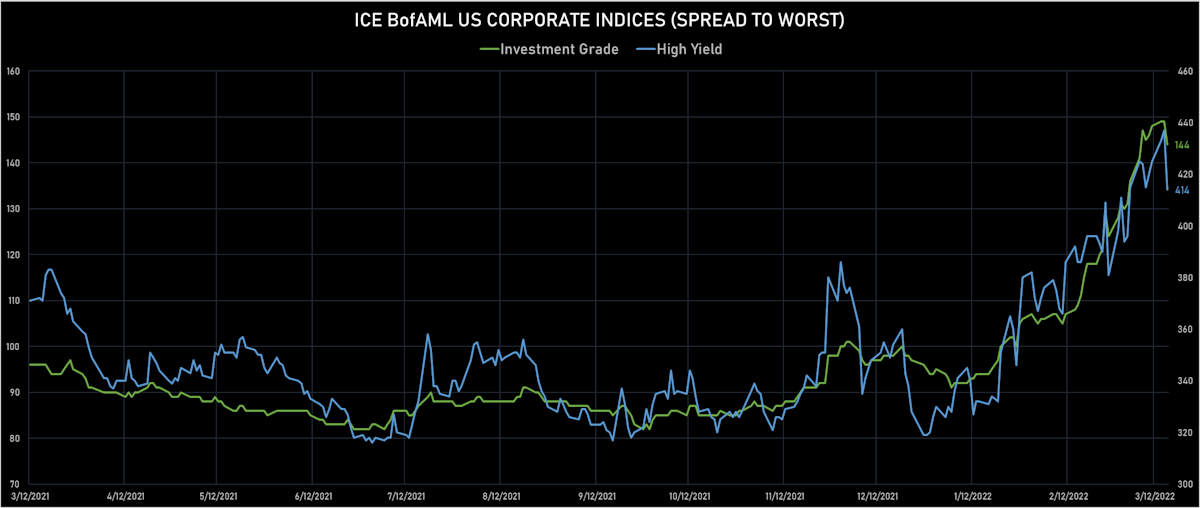

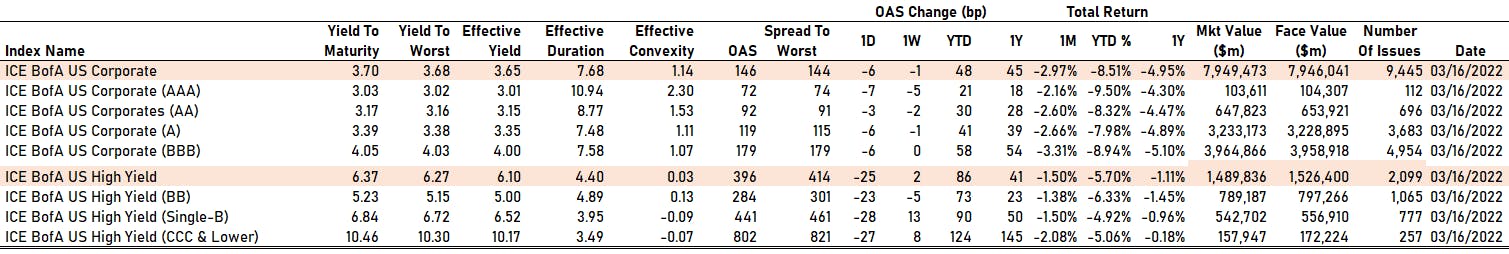

- ICE BofA US Corporate Index (Investment Grade) spread to worst down -5.0 bp, now at 144.0 bp (YTD change: +49.0 bp)

- ICE BofA US High Yield Index spread to worst down -23.0 bp, now at 414.0 bp (YTD change: +84.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index up 0.32% today (YTD total return: -1.8%)

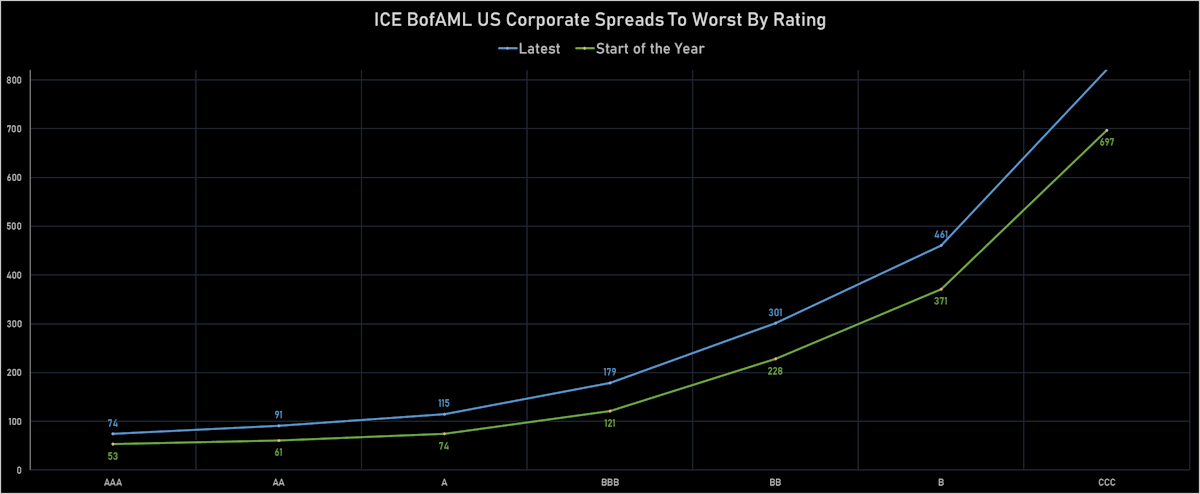

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING

- AAA down by -7 bp at 72 bp

- AA down by -3 bp at 92 bp

- A down by -6 bp at 119 bp

- BBB down by -6 bp at 179 bp

- BB down by -23 bp at 284 bp

- B down by -28 bp at 441 bp

- CCC down by -27 bp at 802 bp

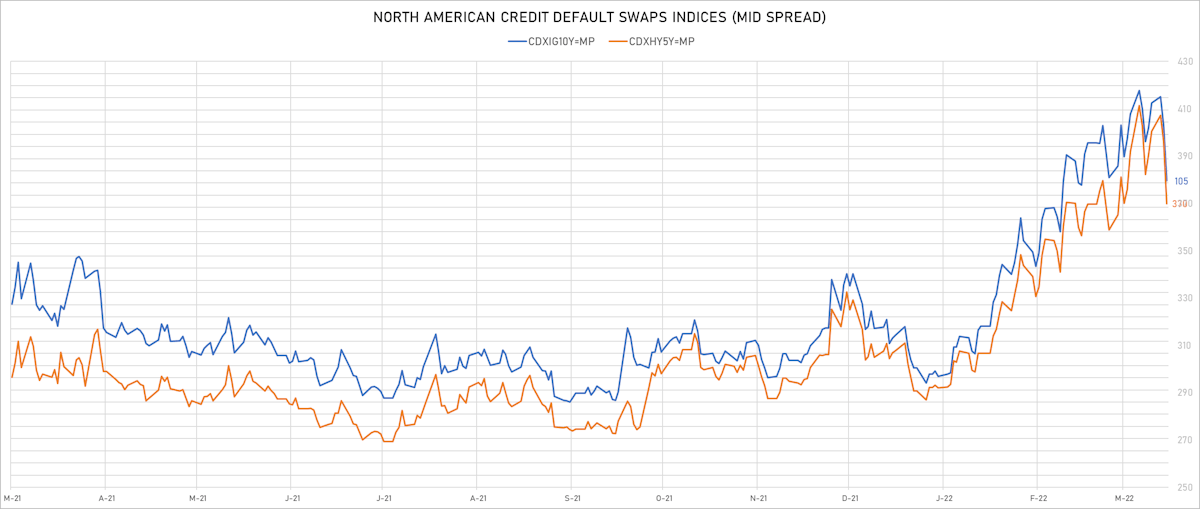

CDS INDICES (mid-spreads)

- Markit CDX.NA.IG 5Y down 5.5 bp, now at 67bp (YTD change: +18.1bp)

- Markit CDX.NA.IG 10Y down 4.5 bp, now at 105bp (YTD change: +16.1bp)

- Markit CDX.NA.HY 5Y down 26.1 bp, now at 370bp (YTD change: +78.0bp)

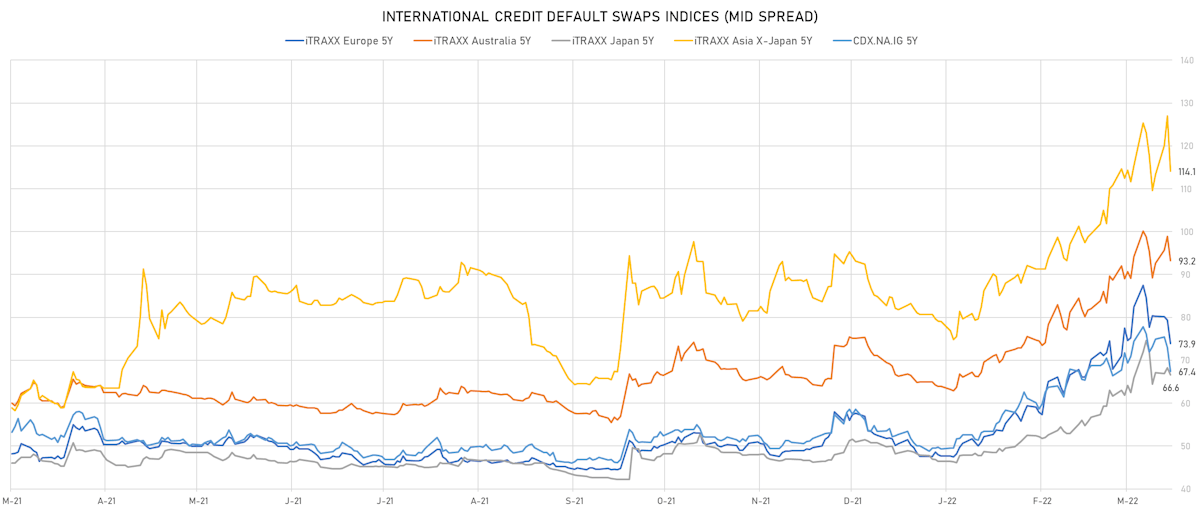

- Markit iTRAXX Europe 5Y down 5.5 bp, now at 74bp (YTD change: +26.2bp)

- Markit iTRAXX Europe Crossover 5Y down 29.0 bp, now at 348bp (YTD change: +106.1bp)

- Markit iTRAXX Japan 5Y down 1.6 bp, now at 67bp (YTD change: +20.2bp)

- Markit iTRAXX Asia Ex-Japan 5Y down 12.9 bp, now at 114bp (YTD change: +35.1bp)

TOP BONDS MOVES IN THE PAST WEEK - USD HY

- Issuer: Bath & Body Works Inc (Columbus, Ohio (US)) | Coupon: 9.38% | Maturity: 1/7/2025 | Rating: BB | ISIN: USU51407AD34 | Z-spread up by 39.7 bp to 278.9 bp, with the yield to worst at 4.9% and the bond now trading down to 113.0 cents on the dollar (1Y price range: 113.0-122.3).

- Issuer: HanesBrands Inc (Winston-Salem, North Carolina (US)) | Coupon: 4.63% | Maturity: 15/5/2024 | Rating: BB- | ISIN: USU24437AD43 | Z-spread up by 36.9 bp to 234.0 bp, with the yield to worst at 4.1% and the bond now trading down to 100.0 cents on the dollar (1Y price range: 99.5-104.5).

- Issuer: Bombardier Inc (MONTREAL, Canada) | Coupon: 7.45% | Maturity: 1/5/2034 | Rating: CCC+ | ISIN: USC10602AJ68 | Z-spread up by 30.6 bp to 514.2 bp, with the yield to worst at 7.2% and the bond now trading down to 101.0 cents on the dollar (1Y price range: 101.0-122.9).

- Issuer: GXO Logistics Inc (Greenwich, Connecticut (US)) | Coupon: 2.65% | Maturity: 15/7/2031 | Rating: BB+ | ISIN: USU4038PAB59 | Z-spread up by 24.6 bp to 190.5 bp, with the yield to worst at 4.2% and the bond now trading down to 87.9 cents on the dollar (1Y price range: 87.5-98.6).

- Issuer: Twitter Inc (San Francisco, California (US)) | Coupon: 5.00% | Maturity: 1/3/2030 | Rating: BB | ISIN: USU8882PAB32 | Z-spread down by 23.7 bp to 297.5 bp, with the yield to worst at 5.1% and the bond now trading up to 98.4 cents on the dollar (1Y price range: 95.7-100.8).

- Issuer: Taylor Morrison Communities Inc (Scottsdale, Arizona (US)) | Coupon: 5.63% | Maturity: 1/3/2024 | Rating: BB- | ISIN: USU87286AD91 | Z-spread down by 26.7 bp to 211.1 bp, with the yield to worst at 4.0% and the bond now trading up to 102.3 cents on the dollar (1Y price range: 101.4-106.5).

- Issuer: NCL Finance Ltd (United Kingdom) | Coupon: 6.13% | Maturity: 15/3/2028 | Rating: CCC+ | ISIN: USG6437FAA78 | Z-spread down by 27.1 bp to 553.3 bp, with the yield to worst at 7.6% and the bond now trading up to 92.0 cents on the dollar (1Y price range: 89.9-99.5).

- Issuer: Hat Holdings I LLC (Annapolis, Maryland (US)) | Coupon: 3.38% | Maturity: 15/6/2026 | Rating: BB+ | ISIN: USU2467RAE90 | Z-spread down by 29.1 bp to 264.2 bp, with the yield to worst at 4.8% and the bond now trading up to 94.0 cents on the dollar (1Y price range: 92.8-102.1).

- Issuer: Sealed Air Corp (Charlotte, North Carolina (US)) | Coupon: 5.50% | Maturity: 15/9/2025 | Rating: BB | ISIN: USU81193AP68 | Z-spread down by 30.0 bp to 199.9 bp (CDS basis: -48.9bp), with the yield to worst at 4.0% and the bond now trading up to 103.5 cents on the dollar (1Y price range: 103.0-110.5).

- Issuer: JBS USA Lux SA (Luxembourg, Luxembourg) | Coupon: 3.00% | Maturity: 15/5/2032 | Rating: BB+ | ISIN: USL56608AG44 | Z-spread down by 31.8 bp to 221.9 bp, with the yield to worst at 4.5% and the bond now trading up to 87.3 cents on the dollar (1Y price range: 86.0-99.3).

- Issuer: Goodyear Tire & Rubber Co (Akron, Ohio (US)) | Coupon: 5.00% | Maturity: 15/7/2029 | Rating: B | ISIN: USU38255AN24 | Z-spread down by 34.0 bp to 412.9 bp (CDS basis: 69.8bp), with the yield to worst at 6.3% and the bond now trading up to 91.8 cents on the dollar (1Y price range: 89.5-106.6).

- Issuer: ZF North America Capital Inc (Northville, Michigan (US)) | Coupon: 4.75% | Maturity: 29/4/2025 | Rating: BB+ | ISIN: USU98737AC03 | Z-spread down by 38.1 bp to 349.0 bp, with the yield to worst at 5.5% and the bond now trading up to 97.3 cents on the dollar (1Y price range: 96.4-107.1).

- Issuer: Rockies Express Pipeline LLC (Leawood, Kansas (US)) | Coupon: 3.60% | Maturity: 15/5/2025 | Rating: BB | ISIN: USU75111AK72 | Z-spread down by 39.0 bp to 248.3 bp, with the yield to worst at 4.5% and the bond now trading up to 96.5 cents on the dollar (1Y price range: 95.8-103.0).

- Issuer: NCL Corporation Ltd (Miami, Bermuda) | Coupon: 5.88% | Maturity: 15/3/2026 | Rating: CCC+ | ISIN: USG6436QAL08 | Z-spread down by 50.2 bp to 548.7 bp, with the yield to worst at 7.6% and the bond now trading up to 93.5 cents on the dollar (1Y price range: 91.0-100.0).

- Issuer: Brinker International Inc (Coppell, Texas (US)) | Coupon: 5.00% | Maturity: 1/10/2024 | Rating: B+ | ISIN: USU6223WAB01 | Z-spread down by 69.7 bp to 265.6 bp, with the yield to worst at 5.0% and the bond now trading up to 100.0 cents on the dollar (1Y price range: 98.8-106.8).

TOP BONDS MOVES IN THE PAST WEEK - EUR HY

- Issuer: SoftBank Group Corp (Minato-Ku, Japan) | Coupon: 4.75% | Maturity: 30/7/2025 | Rating: BB- | ISIN: XS1266662334 | Z-spread up by 140.8 bp to 571.0 bp, with the yield to worst at 6.1% and the bond now trading down to 95.7 cents on the dollar (1Y price range: 93.8-105.1).

- Issuer: Saipem Finance International BV (Amsterdam, Netherlands) | Coupon: 2.63% | Maturity: 7/1/2025 | Rating: B+ | ISIN: XS1711584430 | Z-spread down by 60.5 bp to 700.8 bp (CDS basis: 220.7bp), with the yield to worst at 7.3% and the bond now trading up to 88.0 cents on the dollar (1Y price range: 73.9-101.2).

- Issuer: Saipem Finance International BV (Amsterdam, Netherlands) | Coupon: 3.75% | Maturity: 8/9/2023 | Rating: B+ | ISIN: XS1487495316 | Z-spread down by 85.3 bp to 860.7 bp (CDS basis: 217.3bp), with the yield to worst at 8.4% and the bond now trading up to 93.4 cents on the dollar (1Y price range: 76.2-103.4).

- Issuer: Adler Group SA (Senningerberg, Luxembourg) | Coupon: 2.25% | Maturity: 27/4/2027 | Rating: B | ISIN: XS2336188029 | Z-spread down by 95.9 bp to 492.3 bp, with the yield to worst at 5.5% and the bond now trading up to 85.2 cents on the dollar (1Y price range: 76.7-85.9).

- Issuer: Adler Real Estate AG (Berlin, Germany) | Coupon: 2.13% | Maturity: 6/2/2024 | Rating: B | ISIN: XS1731858715 | Z-spread down by 110.9 bp to 636.8 bp, with the yield to worst at 6.4% and the bond now trading up to 92.3 cents on the dollar (1Y price range: 88.8-94.9).

- Issuer: Bper Banca SpA (Modena, Italy) | Coupon: 1.88% | Maturity: 7/7/2025 | Rating: BB- | ISIN: XS2190502323 | Z-spread down by 113.8 bp to 194.0 bp, with the yield to worst at 2.4% and the bond now trading up to 98.0 cents on the dollar (1Y price range: 97.8-101.9).

- Issuer: Transportes Aereos Portugueses SA (Lisbon, Portugal) | Coupon: 5.63% | Maturity: 2/12/2024 | Rating: CCC | ISIN: PTTAPDOM0005 | Z-spread down by 115.5 bp to 940.3 bp, with the yield to worst at 9.0% and the bond now trading up to 90.6 cents on the dollar (1Y price range: 89.5-95.5).

- Issuer: Adler Group SA (Senningerberg, Luxembourg) | Coupon: 1.50% | Maturity: 26/7/2024 | Rating: B | ISIN: XS1652965085 | Z-spread down by 159.6 bp to 577.1 bp, with the yield to worst at 5.9% and the bond now trading up to 90.0 cents on the dollar (1Y price range: 82.7-91.1).

SELECTED RECENT USD BOND ISSUES

- Goldman Sachs Finance Corp International Ltd (Financial - Other | Saint Helier, United States | Rating: NR): US$1,000m Unsecured Note (XS2061672544), floating rate maturing on 17 March 2042, priced at 100.00, non callable

- Deutsche Bank AG (Banking | Frankfurt, Germany | Rating: BBB+): US$500m Note (XS0459878251), fixed rate (2.30% coupon) maturing on 7 April 2025, priced at 100.00, non callable

- SecurAsset SA (Financial - Other | Luxembourg, Netherlands | Rating: NR): US$500m Unsecured Note (XS2368695800), fixed rate (2.00% coupon) maturing on 16 March 2027, priced at 100.00 (original spread of 100,000 bp), non callable

SELECTED RECENT EUR BOND ISSUES

- FMS Wertmanagement AoeR (Agency | Muenchen, Germany | Rating: AAA): €2,000m Inhaberschuldverschreibung (DE000A2YPEF3), floating rate (EU03MLIB + 0.0 bp) maturing on 25 March 2024, priced at 100.00, non callable

- JPMorgan Chase & Co (Banking | New York City, United States | Rating: A-): €2,500m Senior Note (XS2461234622), floating rate maturing on 23 March 2030, priced at 100.00 (original spread of 181 bp), callable (8nc7)

- Natixis Pfandbriefbank AG (Mortgage Banking | Frankfurt, France | Rating: NR): €250m Hypothekenpfandbrief (Covered Bond) (DE000A14J0N7), fixed rate (0.50% coupon) maturing on 23 May 2025, priced at 99.82 (original spread of 75 bp), non callable

- SEGRO PLC (Financial - Other | London, United Kingdom | Rating: NR): €650m Senior Note (XS2455401328), fixed rate (1.25% coupon) maturing on 23 March 2026, priced at 99.61 (original spread of 141 bp), callable (4nc4)

NEW LOANS

- Gates Grp, signed a US$ 650m Term Loan B, to be used for general corporate purposes. It matures on 03/30/29 and initial pricing is set at Term SOFR +250bp

- 21st Century Fox Inc (BBB+), signed a US$ 500m Term Loan, to be used for general corporate purposes. It matures on 03/31/27 and initial pricing is set at Term SOFR +150bp

- 21st Century Fox Inc (BBB+), signed a US$ 750m Revolving Credit Facility, to be used for general corporate purposes. It matures on 03/31/27 and initial pricing is set at Term SOFR +127.5bp

- Trane Tech Holdco Inc (BBB), signed a US$ 1,000m Revolving Credit Facility, to be used for general corporate purposes. It matures on 03/31/27 and initial pricing is set at Term SOFR +125bp

- Formula One World, signed a US$ 500m Revolving Credit Facility, to be used for general corporate purposes. It matures on 03/22/27 and initial pricing is set at Term SOFR +175bp

- Formula One World, signed a US$ 2,300m Term Loan B, to be used for general corporate purposes. It matures on 03/22/29 and initial pricing is set at Term SOFR +275bp

- Formula One World, signed a US$ 300m Term Loan A, to be used for general corporate purposes. It matures on 03/22/27 and initial pricing is set at Term SOFR +175bp

- American Axle & Mnfg Inc (B+), signed a US$ 1,000m Term Loan B, to be used for general corporate purposes

- II-VI Inc (B+), signed a US$ 650m Term Loan A, to be used for acquisition financing. It matures on 03/31/27 and initial pricing is set at Term SOFR +225bp

- II-VI Inc (B+), signed a US$ 350m Revolving Credit Facility, to be used for acquisition financing. It matures on 03/31/27 and initial pricing is set at Term SOFR +225bp

- Celanese US Holdings LLC (BBB), signed a US$ 1,750m Revolving Credit Facility, to be used for general corporate purposes. It matures on 03/17/27 and initial pricing is set at Term SOFR +137.5bp

- SPX FLOW Inc (CCC+), signed a US$ 200m Revolving Credit Facility, to be used for general corporate purposes. It matures on 03/31/27 and initial pricing is set at Term SOFR +375bp

- MKS Instruments Inc (BB), signed a US$ 4,710m Term Loan B, to be used for general corporate purposes, working capital. It matures on 03/31/29 and initial pricing is set at Term SOFR +200bp

- MKS Instruments Inc (BB), signed a US$ 500m Revolving Credit Facility, to be used for general corporate purposes and working capital. It matures on 03/31/27 and initial pricing is set at Term SOFR +200bp

- BlackRock Inc (AA-), signed a US$ 4,400m Revolving Credit Facility, to be used for general corporate purposes and working capital. It matures on 03/31/27 and initial pricing is set at Term SOFR +62.5bp

- PT Bk Rakyat Indonesia (BBB-), signed a US$ 333m Revolving Credit / Term Loan maturing on 03/16/26, to be used for general corporate purposes

NEW ISSUES IN SECURITIZED CREDIT

- Bravo Residential Funding Trust 2022-Nqm1 issued a fixed-rate RMBS in 5 tranches, for a total of US$ 347 m. Highest-rated tranche offering a yield to maturity of 3.63%, and the lowest-rated tranche a yield to maturity of 4.90%. Bookrunners: Credit Suisse, Barclays Capital Group

- Progress Residential 2022-Sfr2 Trust issued a fixed-rate ABS backed by rental income in 6 tranches, for a total of US$ 383 m. Highest-rated tranche offering a yield to maturity of 3.09%, and the lowest-rated tranche a yield to maturity of 5.02%. Bookrunners: Goldman Sachs & Co

- Freddie Mac Stacr Remic Trust 2022-Hqa1 issued a floating-rate Agency RMBS in 5 tranches, for a total of US$ 1,816 m. Highest-rated tranche offering a spread over the floating rate of 210bp, and the lowest-rated tranche a spread of 1,100bp. Bookrunners: Nomura Securities New York Inc, Bank of America Merrill Lynch