Credit

Another Good Day For US Credit, With Lower Yields, Tighter Spreads Across The Board

A decent amount of issuance in USD corporate bonds, led by FIG deals from Wells Fargo ($4bn in one tranche) and Bank Of America ($3.5bn in 2 tranches)

Published ET

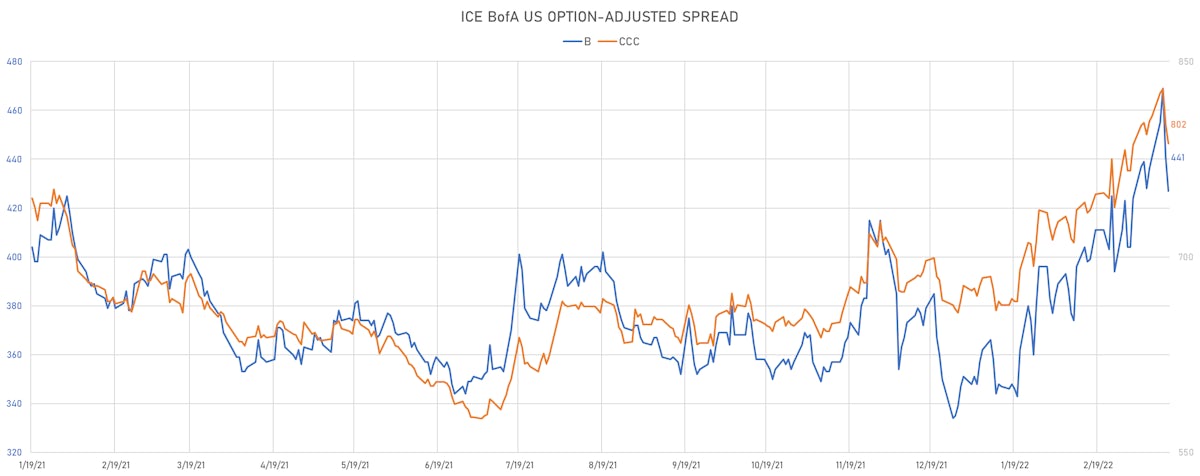

US Corporate Single-Bs & CCCs ICE BofAML Indices Option-Adjusted Spreads | Sources: ϕpost, Refinitiv data

QUICK SUMMARY

- The iBoxx USD Liquid Investment Grade Total Return Index was up 0.800% today (Month-to-date: -2.78%; Year-to-date: -8.59%)

- The iBoxx USD Liquid High Yield Total Return Index was up 0.818% today (Month-to-date: -1.43%; Year-to-date: -4.91%)

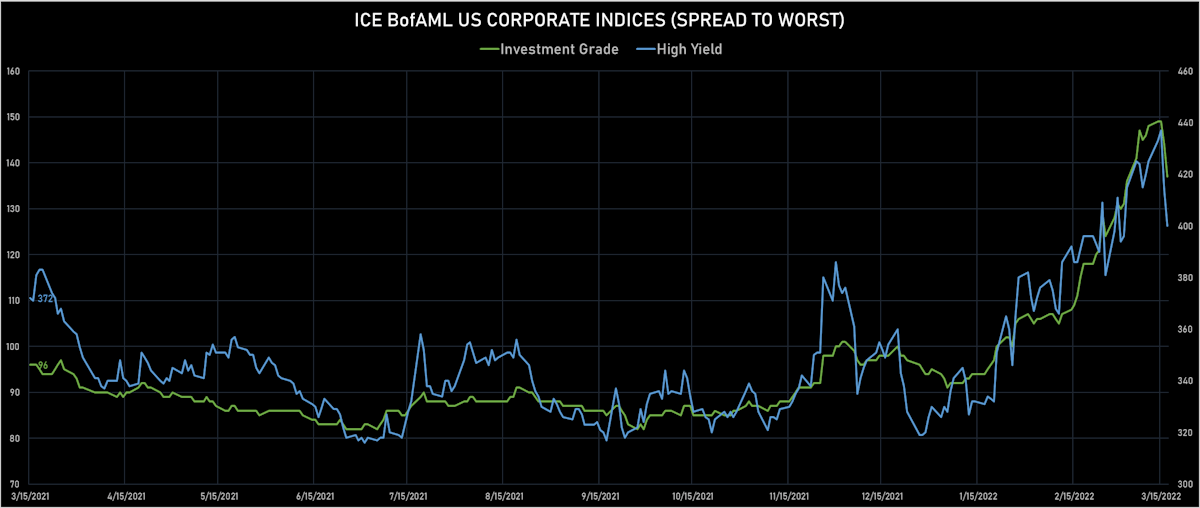

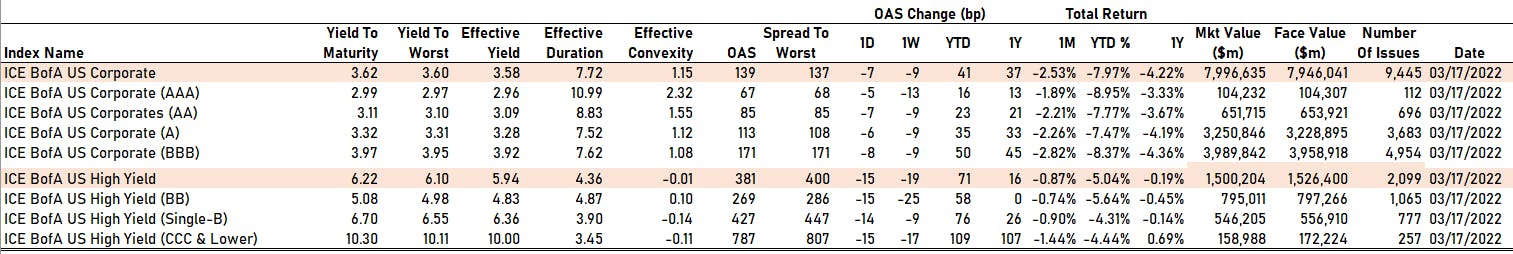

- ICE BofA US Corporate Index (Investment Grade) spread to worst down -7.0 bp, now at 137.0 bp (YTD change: +42.0 bp)

- ICE BofA US High Yield Index spread to worst down -14.0 bp, now at 400.0 bp (YTD change: +70.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index up 1.19% today (YTD total return: -1.5%)

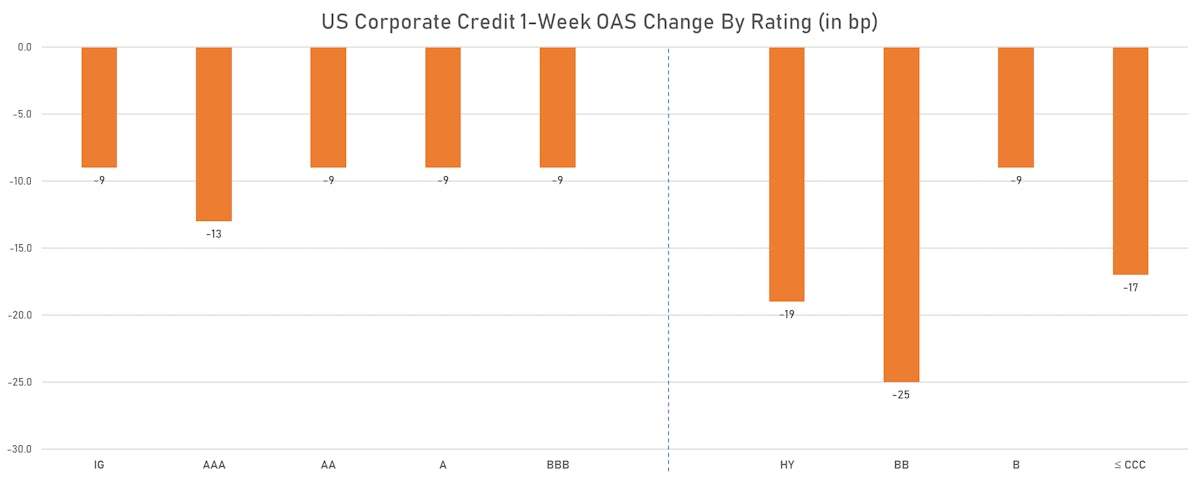

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING

- AAA down by -5 bp at 67 bp

- AA down by -7 bp at 85 bp

- A down by -6 bp at 113 bp

- BBB down by -8 bp at 171 bp

- BB down by -15 bp at 269 bp

- B down by -14 bp at 427 bp

- CCC down by -15 bp at 787 bp

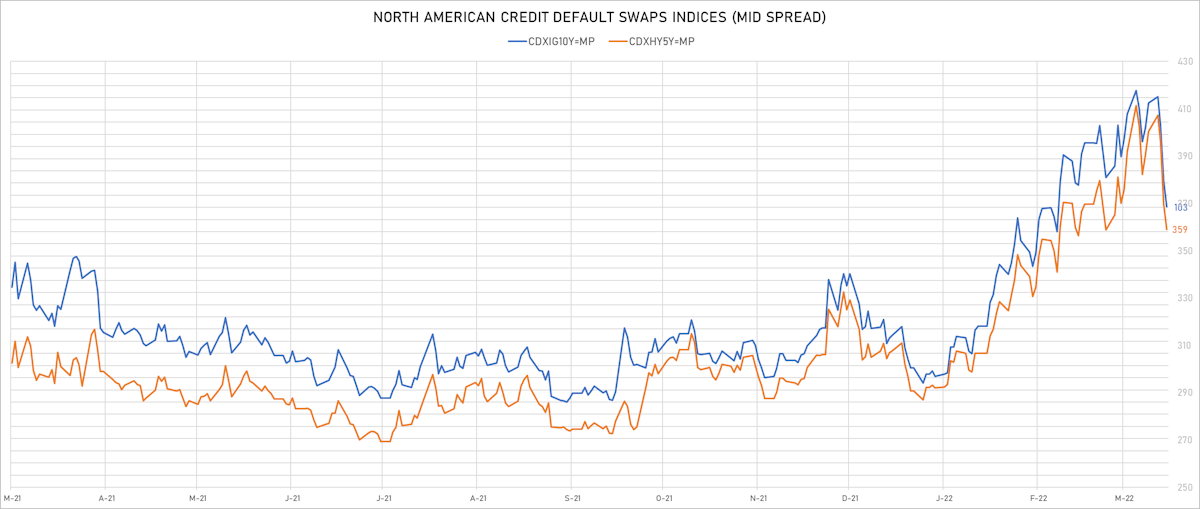

CDS INDICES (mid-spreads)

- Markit CDX.NA.IG 5Y down 2.3 bp, now at 65bp (YTD change: +15.8bp)

- Markit CDX.NA.IG 10Y down 2.1 bp, now at 103bp (YTD change: +13.9bp)

- Markit CDX.NA.HY 5Y down 10.9 bp, now at 359bp (YTD change: +67.1bp)

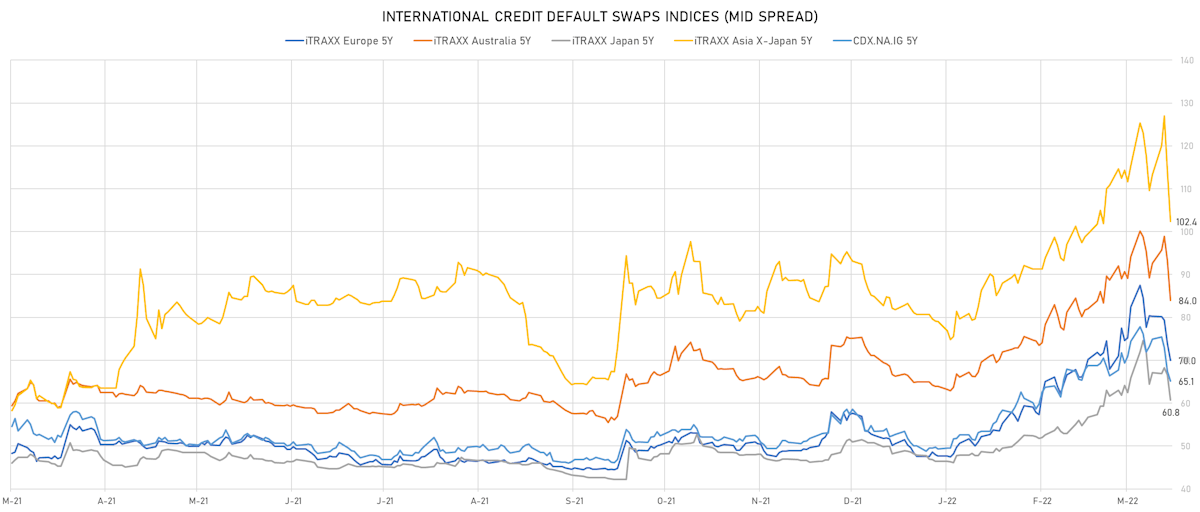

- Markit iTRAXX Europe 5Y down 3.9 bp, now at 70bp (YTD change: +22.3bp)

- Markit iTRAXX Europe Crossover 5Y down 14.2 bp, now at 334bp (YTD change: +91.9bp)

- Markit iTRAXX Japan 5Y down 5.8 bp, now at 61bp (YTD change: +14.3bp)

- Markit iTRAXX Asia Ex-Japan 5Y down 11.7 bp, now at 102bp (YTD change: +23.4bp)

TOP BONDS MOVES IN THE PAST WEEK - USD HY

- Issuer: Hat Holdings I LLC (Annapolis, Maryland (US)) | Coupon: 3.38% | Maturity: 15/6/2026 | Rating: BB+ | ISIN: USU2467RAE90 | Z-spread down by 42.3 bp to 247.1 bp, with the yield to worst at 4.6% and the bond now trading up to 94.8 cents on the dollar (1Y price range: 92.8-102.1).

- Issuer: Taylor Morrison Communities Inc (Scottsdale, Arizona (US)) | Coupon: 5.88% | Maturity: 15/6/2027 | Rating: BB- | ISIN: USU8760NAA73 | Z-spread down by 46.8 bp to 241.6 bp, with the yield to worst at 4.5% and the bond now trading up to 105.3 cents on the dollar (1Y price range: 103.4-111.9).

- Issuer: Western Global Airlines LLC (Estero, Florida (US)) | Coupon: 10.38% | Maturity: 15/8/2025 | Rating: B- | ISIN: USU95558AA72 | Z-spread down by 48.8 bp to 547.3 bp, with the yield to worst at 7.4% and the bond now trading up to 107.8 cents on the dollar (1Y price range: 107.0-111.3).

- Issuer: Brinker International Inc (Coppell, Texas (US)) | Coupon: 5.00% | Maturity: 1/10/2024 | Rating: B+ | ISIN: USU6223WAB01 | Z-spread down by 49.7 bp to 254.1 bp, with the yield to worst at 4.8% and the bond now trading up to 100.4 cents on the dollar (1Y price range: 98.8-106.8).

- Issuer: Twitter Inc (San Francisco, California (US)) | Coupon: 5.00% | Maturity: 1/3/2030 | Rating: BB | ISIN: USU8882PAB32 | Z-spread down by 51.5 bp to 279.4 bp, with the yield to worst at 4.9% and the bond now trading up to 99.5 cents on the dollar (1Y price range: 95.7-100.8).

- Issuer: Enact Holdings Inc (Raleigh, North Carolina (US)) | Coupon: 6.50% | Maturity: 15/8/2025 | Rating: BB | ISIN: USU3230LAA45 | Z-spread down by 56.3 bp to 324.2 bp (CDS basis: -53.5bp), with the yield to worst at 5.4% and the bond now trading up to 102.5 cents on the dollar (1Y price range: 101.0-109.5).

- Issuer: Nextera Energy Operating Partners LP (Juno Beach, Florida (US)) | Coupon: 4.25% | Maturity: 15/7/2024 | Rating: BB | ISIN: USU6500TAF22 | Z-spread down by 58.7 bp to 150.0 bp, with the yield to worst at 3.6% and the bond now trading up to 101.0 cents on the dollar (1Y price range: 99.8-103.9).

- Issuer: Wynn Las Vegas LLC (Las Vegas, Nevada (US)) | Coupon: 5.50% | Maturity: 1/3/2025 | Rating: B | ISIN: USU98347AK05 | Z-spread down by 61.8 bp to 318.3 bp, with the yield to worst at 5.1% and the bond now trading up to 100.0 cents on the dollar (1Y price range: 97.3-103.5).

- Issuer: Goodyear Tire & Rubber Co (Akron, Ohio (US)) | Coupon: 5.00% | Maturity: 15/7/2029 | Rating: B | ISIN: USU38255AN24 | Z-spread down by 70.9 bp to 378.9 bp (CDS basis: 79.1bp), with the yield to worst at 6.0% and the bond now trading up to 93.8 cents on the dollar (1Y price range: 89.5-106.6).

- Issuer: NCL Finance Ltd (#N/A, United Kingdom) | Coupon: 6.13% | Maturity: 15/3/2028 | Rating: CCC+ | ISIN: USG6437FAA78 | Z-spread down by 72.8 bp to 528.6 bp, with the yield to worst at 7.3% and the bond now trading up to 93.3 cents on the dollar (1Y price range: 89.9-99.5).

- Issuer: Block Inc (San Francisco, California (US)) | Coupon: 2.75% | Maturity: 1/6/2026 | Rating: BB | ISIN: USU85223AA03 | Z-spread down by 76.9 bp to 177.8 bp, with the yield to worst at 3.8% and the bond now trading up to 95.0 cents on the dollar (1Y price range: 92.5-100.5).

- Issuer: ZF North America Capital Inc (Northville, Michigan (US)) | Coupon: 4.75% | Maturity: 29/4/2025 | Rating: BB+ | ISIN: USU98737AC03 | Z-spread down by 77.4 bp to 307.3 bp, with the yield to worst at 5.1% and the bond now trading up to 98.5 cents on the dollar (1Y price range: 96.4-107.1).

- Issuer: NCL Corporation Ltd (Miami, Bermuda) | Coupon: 5.88% | Maturity: 15/3/2026 | Rating: CCC+ | ISIN: USG6436QAL08 | Z-spread down by 102.8 bp to 536.7 bp, with the yield to worst at 7.5% and the bond now trading up to 94.0 cents on the dollar (1Y price range: 91.0-100.0).

- Issuer: American Airlines Group Inc (Fort Worth, Texas (US)) | Coupon: 3.75% | Maturity: 1/3/2025 | Rating: CCC | ISIN: USU0242AAD47 | Z-spread down by 119.3 bp to 601.1 bp (CDS basis: 708.0bp), with the yield to worst at 8.0% and the bond now trading up to 88.8 cents on the dollar (1Y price range: 83.5-95.6).

TOP BONDS MOVES IN THE PAST WEEK - EUR HY

- Issuer: Fortune Star (BVI) Ltd (British Virgin Islands) | Coupon: 4.35% | Maturity: 6/5/2023 | Rating: BB- | ISIN: XS2066225124 | Z-spread up by 811.2 bp to 1,012.1 bp, with the yield to worst at 9.7% and the bond now trading down to 94.4 cents on the dollar (1Y price range: 90.7-99.5).

- Issuer: SoftBank Group Corp (Minato-Ku, Japan) | Coupon: 4.75% | Maturity: 30/7/2025 | Rating: BB- | ISIN: XS1266662334 | Z-spread up by 112.5 bp to 546.5 bp, with the yield to worst at 5.8% and the bond now trading down to 96.5 cents on the dollar (1Y price range: 93.8-105.1).

- Issuer: Arcelik AS (Turkey) | Coupon: 3.00% | Maturity: 27/5/2026 | Rating: BB | ISIN: XS2346972263 | Z-spread down by 60.9 bp to 461.6 bp, with the yield to worst at 5.1% and the bond now trading up to 91.7 cents on the dollar (1Y price range: 89.6-98.4).

- Issuer: Deutsche Lufthansa AG (Cologne, Germany) | Coupon: 2.00% | Maturity: 14/7/2024 | Rating: BB- | ISIN: XS2363244513 | Z-spread down by 63.0 bp to 298.6 bp (CDS basis: -77.4bp), with the yield to worst at 2.9% and the bond now trading up to 97.0 cents on the dollar (1Y price range: 94.9-101.1).

- Issuer: ZF Europe Finance BV (Amsterdam, Netherlands) | Coupon: 1.25% | Maturity: 23/10/2023 | Rating: BB+ | ISIN: XS2010040124 | Z-spread down by 63.8 bp to 148.0 bp, with the yield to worst at 1.3% and the bond now trading up to 99.6 cents on the dollar (1Y price range: 97.8-100.9).

- Issuer: Renault SA (Boulogne-Billancourt, France) | Coupon: 2.50% | Maturity: 1/4/2028 | Rating: BB | ISIN: FR0014002OL8 | Z-spread down by 66.1 bp to 429.4 bp (CDS basis: -87.9bp), with the yield to worst at 4.9% and the bond now trading up to 86.8 cents on the dollar (1Y price range: 84.1-100.1).

- Issuer: Telefonaktiebolaget LM Ericsson (Stockholm, Sweden) | Coupon: 1.00% | Maturity: 26/5/2029 | Rating: BB+ | ISIN: XS2345996743 | Z-spread down by 69.7 bp to 263.9 bp (CDS basis: -40.4bp), with the yield to worst at 3.5% and the bond now trading up to 84.3 cents on the dollar (1Y price range: 78.4-97.8).

- Issuer: Standard Industries Inc (Parsippany, New Jersey (US)) | Coupon: 2.25% | Maturity: 21/11/2026 | Rating: B+ | ISIN: XS2080766475 | Z-spread down by 76.7 bp to 299.0 bp, with the yield to worst at 3.6% and the bond now trading up to 93.9 cents on the dollar (1Y price range: 90.0-98.3).

- Issuer: BPER Banca SpA (Modena, Italy) | Coupon: 1.88% | Maturity: 7/7/2025 | Rating: BB- | ISIN: XS2190502323 | Z-spread down by 92.0 bp to 185.6 bp, with the yield to worst at 2.2% and the bond now trading up to 98.5 cents on the dollar (1Y price range: 97.8-101.9).

- Issuer: Saipem Finance International BV (Amsterdam, Netherlands) | Coupon: 2.63% | Maturity: 7/1/2025 | Rating: B+ | ISIN: XS1711584430 | Z-spread down by 98.6 bp to 601.2 bp (CDS basis: 327.1bp), with the yield to worst at 6.3% and the bond now trading up to 90.5 cents on the dollar (1Y price range: 73.9-101.2).

- Issuer: Saipem Finance International BV (Amsterdam, Netherlands) | Coupon: 3.75% | Maturity: 8/9/2023 | Rating: B+ | ISIN: XS1487495316 | Z-spread down by 174.0 bp to 730.2 bp (CDS basis: 369.0bp), with the yield to worst at 7.1% and the bond now trading up to 95.2 cents on the dollar (1Y price range: 76.2-103.4).

SELECTED RECENT USD BOND ISSUES

- Bank of America Corp (Banking | Charlotte, United States | Rating: A-): US$500m Senior Note (US06051GKN87), floating rate (SOFR + 133.0 bp) maturing on 2 April 2026, priced at 100.00, callable (4nc3)

- Bank of America Corp (Banking | Charlotte, United States | Rating: A-): US$3,000m Senior Note (US06051GKM05), floating rate maturing on 2 April 2026, priced at 100.00 (original spread of 123 bp), callable (4nc3)

- Blackstone Private Credit Fund (Financial - Other | New York City, United States | Rating: BBB-): US$900m Senior Note (US09261HAS67), fixed rate (4.70% coupon) maturing on 24 March 2025, priced at 99.86 (original spread of 260 bp), with a make whole call

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$125m Bond (US3133ENSR26), fixed rate (3.70% coupon) maturing on 24 March 2042, priced at 100.00 (original spread of 136 bp), callable (20nc5)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$350m Bond (US3133ENSP69), fixed rate (3.30% coupon) maturing on 23 March 2032, priced at 100.00, callable (10nc1)

- JPMorgan Chase & Co (Banking | New York City, United States | Rating: A-): US$110m Unsecured Note (XS1450778185) zero coupon maturing on 20 March 2056, priced at 100.00, non callable

- NextEra Energy Capital Holdings Inc (Financial - Other | Juno Beach, United States | Rating: A-): US$1,100m Senior Debenture (US65339KCD00), fixed rate (2.94% coupon) maturing on 21 March 2024, priced at 99.99 (original spread of 100 bp), callable (2nc6m)

- NextEra Energy Capital Holdings Inc (Financial - Other | Juno Beach, United States | Rating: A-): US$400m Senior Debenture (US65339KCE82), floating rate (SOFR + 102.0 bp) maturing on 21 March 2024, priced at 100.00, callable (2nc6m)

- Southwest Gas Corp (Gas Utility - Local Distrib | Las Vegas, United States | Rating: A): US$600m Senior Note (US845011AE58), fixed rate (4.05% coupon) maturing on 15 March 2032, priced at 99.63 (original spread of 190 bp), callable (10nc10)

- Wells Fargo & Co (Banking | San Francisco, United States | Rating: BBB+): US$4,000m Senior Note (US95000U2V48), floating rate maturing on 24 March 2028, priced at 100.00 (original spread of 115 bp), callable (6nc5)

- NATWEST MARKETS PLC (Banking | Edinburgh, United Kingdom | Rating: A-): US$500m Senior Note (US63906YAF51), floating rate (SOFR + 145.0 bp) maturing on 22 March 2025, priced at 100.00, non callable

- NATWEST MARKETS PLC (Banking | Edinburgh, United Kingdom | Rating: A-): US$1,000m Senior Note (US63906YAG35), fixed rate (3.48% coupon) maturing on 22 March 2025, priced at 100.00 (original spread of 135 bp), non callable

- Royal Bank of Canada (Banking | Toronto, Canada | Rating: A+): US$1,500m Covered Bond (Other) (USC7976PAD80), fixed rate (2.60% coupon) maturing on 24 March 2027, priced at 99.94 (original spread of 48 bp), non callable

- Toyota Motor Credit Corp (Financial - Other | Plano, Japan | Rating: A+): US$1,200m Senior Note (US89236TJX46), fixed rate (2.50% coupon) maturing on 22 March 2024, priced at 99.94 (original spread of 60 bp), with a make whole call

- Toyota Motor Credit Corp (Financial - Other | Plano, Japan | Rating: A+): US$1,400m Senior Note (US89236TJZ93), fixed rate (3.05% coupon) maturing on 22 March 2027, priced at 99.91 (original spread of 90 bp), with a make whole call

- Toyota Motor Credit Corp (Financial - Other | Plano, Japan | Rating: A+): US$400m Senior Note (US89236TJY29), floating rate (SOFR + 62.0 bp) maturing on 22 March 2024, priced at 100.00, non callable

SELECTED RECENT EUR BOND ISSUES

- Castellum Helsinki Finance Holding Abp (Financial - Other | Helsinki, Sweden | Rating: NR): €500m Senior Note (XS2461785185), fixed rate (2.00% coupon) maturing on 24 March 2025, priced at 99.84 (original spread of 222 bp), callable (3nc3)

- Credit Suisse Group AG (Banking | Zurich, Switzerland | Rating: BBB+): €2,000m Bond (CH1174335732), fixed rate (2.13% coupon) maturing on 13 October 2026, priced at 99.83 (original spread of 227 bp), callable (5nc3)

- Credit Suisse Group AG (Banking | Zurich, Switzerland | Rating: BBB+): €1,500m Bond (CH1174335740), fixed rate (2.88% coupon) maturing on 2 April 2032, priced at 99.68, non callable

- Deutsche Bank AG (Banking | Frankfurt, Germany | Rating: A-): €1,500m Subordinated Note (DE000DL19WN3), fixed rate (4.00% coupon) maturing on 24 June 2032, priced at 99.63, non callable

- Toronto-Dominion Bank (Banking | Toronto, Canada | Rating: A+): €2,500m Covered Bond (Other) (XS2461741212), fixed rate (0.86% coupon) maturing on 24 March 2027, priced at 100.00 (original spread of 80 bp), non callable

NEW LOANS

- Oshkosh Corp (BBB), signed a US$ 1,100m Revolving Credit Facility, to be used for general corporate purposes. It matures on 03/23/27 and initial pricing is set at Term SOFR +112.5bp

- Black Creek Industrial Fund, signed a US$ 400m Revolving Credit Facility, to be used for real estate acquisitions

- Trimble Navigation LTD, signed a US$ 1,250m Revolving Credit Facility, to be used for general corporate purposes. It matures on 03/18/27 and initial pricing is set at Term SOFR +102.5bp

- IMAX Corp, signed a US$ 300m Revolving Credit Facility, to be used for general corporate purposes. It matures on 03/31/27 and initial pricing is set at Term SOFR +250.0bp

- Seminole Tribe of Florida Inc (BBB), signed a US$ 450m Term Loan B maturing on 03/28/29, to be used for general corporate purposes

- Seminole Tribe of Florida Inc (BBB), signed a US$ 500m Revolving Credit Facility maturing on 03/28/27, to be used for general corporate purposes

- Seminole Tribe of Florida Inc (BBB), signed a US$ 1,750m Term Loan A maturing on 03/28/27, to be used for general corporate purposes

- Celanese US Holdings LLC (BBB), signed a US$ 1,000m Delayed Draw Term Loan, to be used for acquisition financing. It matures on 03/18/27 and initial pricing is set at Term SOFR +137.5bp

- Celanese US Holdings LLC (BBB), signed a US$ 1,750m Revolving Credit Facility, to be used for acquisition financing. It matures on 03/18/27 and initial pricing is set at Term SOFR +137.5bp

- JM Family Enterprises Inc, signed a US$ 530m 364d Revolver, to be used for general corporate purposes. It matures on 03/16/23 and initial pricing is set at Term SOFR +93.000bp

- Duke Energy Corp (BBB), signed a US$ 9,000m Revolving Credit Facility, to be used for general corporate purposes. It matures on 03/18/27 and initial pricing is set at Term SOFR +127.5bp

- Ovintiv Canada ULC (BBB-), signed a US$ 1,300m Revolving Credit Facility, to be used for general corporate purposes and working capital. It matures on 07/15/26 and initial pricing is set at LIBOR +145.0bp

- Copa Casino of Mississippi LLC, signed a US$ 225m Term Loan A, to be used for proceed to sharehlds. It matures on 05/03/22 and initial pricing is set at LIBOR +225.0bp

- AQR Capital Management LLC, signed a US$ 350m 364d Revolver, to be used for general corporate purposes. It matures on 03/17/23 and initial pricing is set at Term SOFR +100.0bp

- Altus Midstream Lp, signed a US$ 1,000m Revolving Credit Facility maturing on 03/31/27, to be used for general corporate purposes

- Camelot Finance LP, signed a US$ 750m Revolving Credit Facility, to be used for general corporate purposes. It matures on 03/31/27 and initial pricing is set at Term SOFR +275.0bp

NEW ISSUES IN SECURITIZED CREDIT

- Brignole CQ 2022 S.R.L issued a floating-rate ABS backed by receivables in 2 tranches, for a total of € 177 m. Highest-rated tranche offering a spread over the floating rate of 70bp, and the lowest-rated tranche a spread of 150bp. Bookrunners: Citigroup Global Markets Inc, Bank of America Merrill Lynch