Credit

Not A Ton Of Movement On Friday, With US Credit Spreads Just Slightly Tighter Into The Weekend

Weekly total US$ corporate bond issuance (IFR Markets data): IG saw 32 tranches for a total of $28.6bn (2022 YTD volume $392.2bn vs 2021 YTD $404.8bn) and HY 2 tranches for $1bn (2022 YTD volume $35.4bn vs 2021 YTD $93.8bn)

Published ET

Goodyear Tire & Avis Budget 5Y USD CDS Mid Spreads | Source: Refinitiv

QUICK SUMMARY

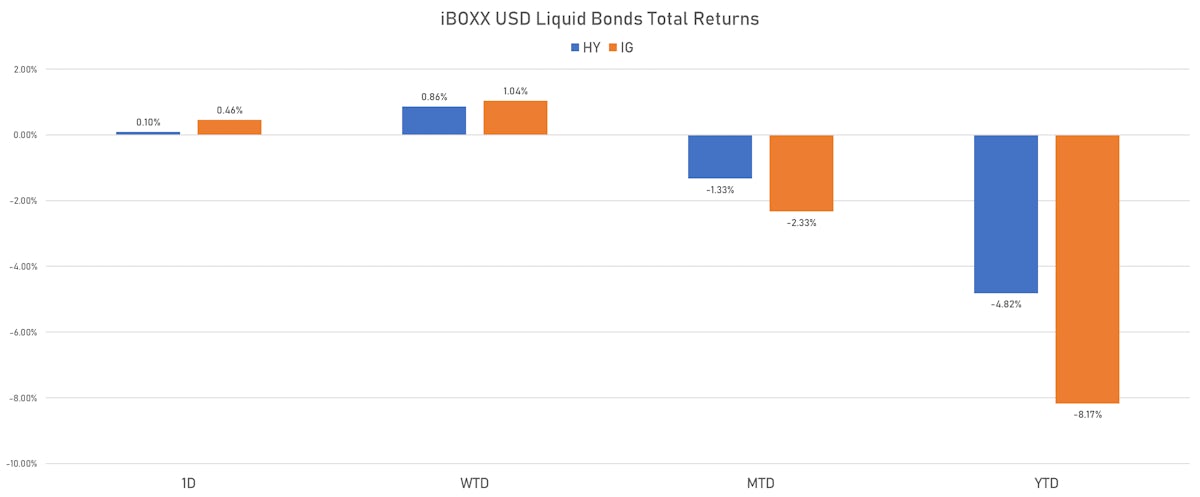

- S&P 500 Bond Index was up 0.48% today, with investment grade up 0.50% and high yield up 0.32% (YTD total return: -6.93%)

- The iBoxx USD Liquid Investment Grade Total Return Index was up 0.456% today (Month-to-date: -2.33%; Year-to-date: -8.17%)

- The iBoxx USD Liquid High Yield Total Return Index was up 0.097% today (Month-to-date: -1.33%; Year-to-date: -4.82%)

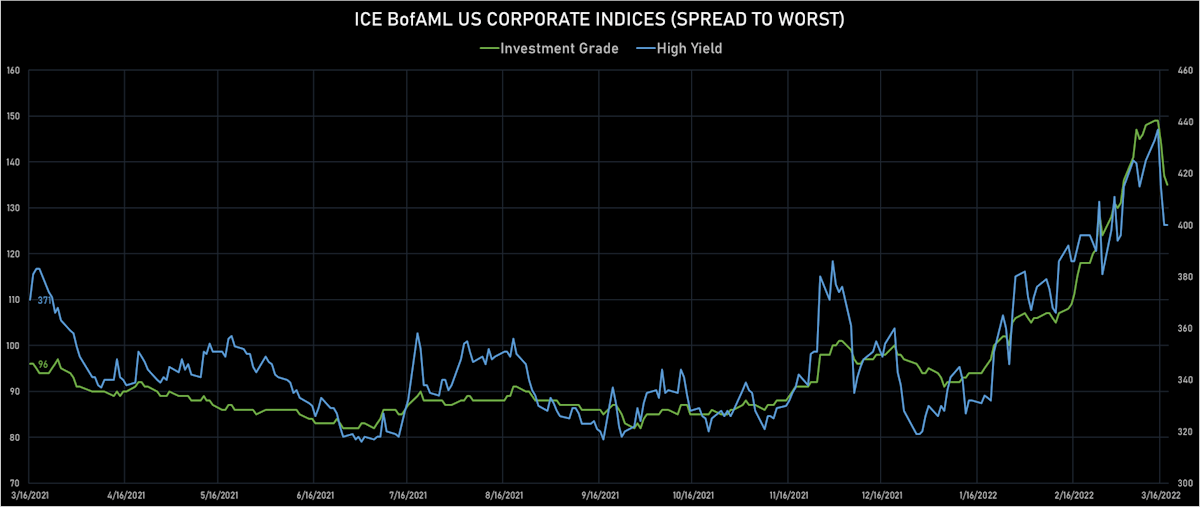

- ICE BofA US Corporate Index (Investment Grade) spread to worst down -2.0 bp, now at 135.0 bp (YTD change: +40.0 bp)

- ICE BofA US High Yield Index spread to worst unchanged at 400.0 bp (YTD change: +70.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index up 0.25% today (YTD total return: -1.3%)

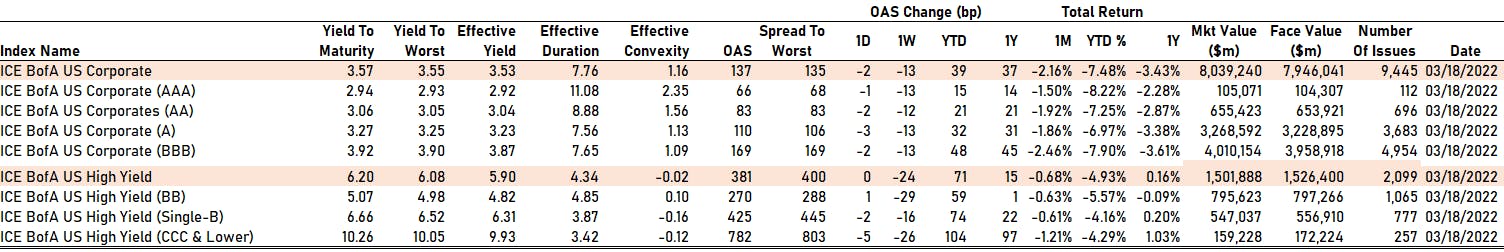

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING

- AAA down by -1 bp at 66 bp

- AA down by -2 bp at 83 bp

- A down by -3 bp at 110 bp

- BBB down by -2 bp at 169 bp

- BB up by 1 bp at 270 bp

- B down by -2 bp at 425 bp

- CCC down by -5 bp at 782 bp

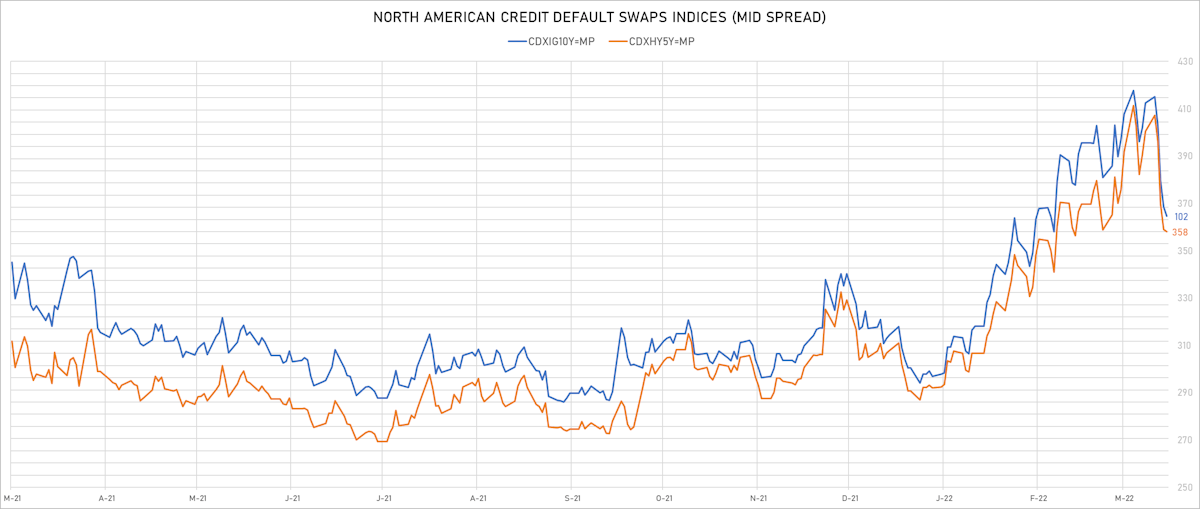

CDS INDICES (mid-spreads)

- Markit CDX.NA.IG 5Y down 0.9 bp, now at 64bp (YTD change: +14.9bp)

- Markit CDX.NA.IG 10Y down 0.8 bp, now at 102bp (YTD change: +13.2bp)

- Markit CDX.NA.HY 5Y down 1.0 bp, now at 358bp (YTD change: +66.1bp)

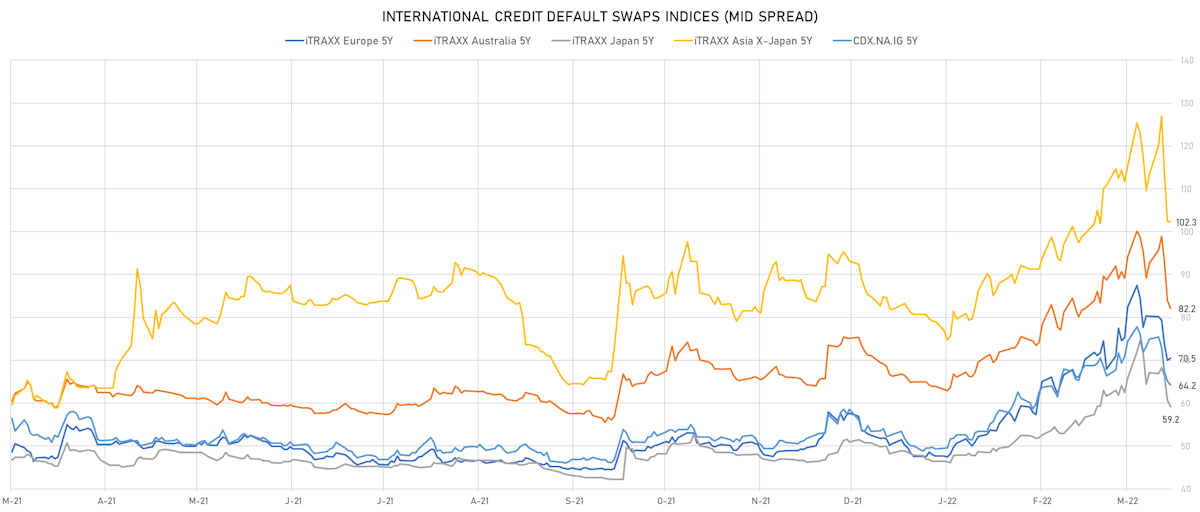

- Markit iTRAXX Europe 5Y up 0.5 bp, now at 71bp (YTD change: +22.8bp)

- Markit iTRAXX Europe Crossover 5Y up 7.1 bp, now at 341bp (YTD change: +99.0bp)

- Markit iTRAXX Japan 5Y down 1.6 bp, now at 59bp (YTD change: +12.8bp)

- Markit iTRAXX Asia Ex-Japan 5Y down 0.1 bp, now at 102bp (YTD change: +23.2bp)

5Y USD CDS SINGLE NAMES - LARGEST MOVES OVER THE PAST WEEK

- Russia, Federation of (Government) (Country: RU; rated: C): down 1,280.3 bp to 1,682.2bp (1Y range: 77-6,954bp)

- American Airlines Group Inc (Country: US; rated: B2): down 320.7 bp to 1,105.1bp (1Y range: 596-1,343bp)

- Carnival Corp (Country: US; rated: LGD5 - 72%): down 166.3 bp to 529.6bp (1Y range: 291-682bp)

- Egypt, Arab Republic of (Government) (Country: EG; rated: B): down 162.0 bp to 585.1bp (1Y range: 320-981bp)

- Transocean Inc (Country: KY; rated: Caa3): down 135.0 bp to 1,517.8bp (1Y range: 941-1,875bp)

- Staples Inc (Country: US; rated: B3): down 114.8 bp to 1,337.5bp (1Y range: 687-1,386bp)

- Royal Caribbean Cruises Ltd (Country: US; rated: LGD4 - 59%): down 107.0 bp to 451.7bp (1Y range: 299-554bp)

- DISH DBS Corp (Country: US; rated: B2): down 87.2 bp to 550.0bp (1Y range: 317-632bp)

- Turkey, Republic of (Government) (Country: TR; rated: WR): down 70.7 bp to 583.6bp (1Y range: 303-683bp)

- NOVA Chemicals Corp (Country: CA; rated: Discontinued): down 67.8 bp to 352.5bp (1Y range: 243-433bp)

- Goodyear Tire & Rubber Co (Country: US; rated: WR): down 65.7 bp to 357.9bp (1Y range: 188-433bp)

- Lumen Technologies Inc (Country: US; rated: Ba3): down 65.7 bp to 439.3bp (1Y range: 195-533bp)

- Bombardier Inc (Country: CA; rated: Caa1): down 58.4 bp to 565.8bp (1Y range: 395-644bp)

- Avis Budget Group Inc (Country: US; rated: CCC): down 54.9 bp to 300.2bp (1Y range: 183-364bp)

- Nordstrom Inc (Country: US; rated: Ba1): down 54.5 bp to 353.0bp (1Y range: 211-442bp)

5Y EURO CDS SINGLE NAMES - LARGEST MOVES OVER THE PAST WEEK

- Boparan Finance PLC (Country: GB; rated: B3): down 129.1 bp to 2,052.3bp (1Y range: 708-2,690bp)

- Novafives SAS (Country: FR; rated: Caa1): down 100.1 bp to 1,105.5bp (1Y range: 618-1,342bp)

- Klepierre SA (Country: FR; rated: A2): down 67.6 bp to 89.0bp (1Y range: 59-105bp)

- Hammerson PLC (Country: GB; rated: Baa3): down 50.5 bp to 178.5bp (1Y range: 166-290bp)

- TUI AG (Country: DE; rated: B3-PD): down 46.6 bp to 748.6bp (1Y range: 607-946bp)

- Altice Finco SA (Country: LU; rated: Caa1): down 36.7 bp to 482.3bp (1Y range: 333-565bp)

- Elo SA (Country: FR; rated: ): down 35.1 bp to 188.8bp (1Y range: 83-242bp)

- CMA CGM SA (Country: FR; rated: Ba3): down 35.0 bp to 356.7bp (1Y range: 259-469bp)

- Telefonaktiebolaget LM Ericsson (Country: SE; rated: Ba1): down 31.4 bp to 165.7bp (1Y range: 59-244bp)

- Renault SA (Country: FR; rated: Ba2): down 30.2 bp to 317.5bp (1Y range: 166-361bp)

- Premier Foods Finance PLC (Country: GB; rated: B1): down 29.7 bp to 301.8bp (1Y range: 154-365bp)

- Marks and Spencer PLC (Country: GB; rated: Ba1): down 27.5 bp to 222.1bp (1Y range: 139-269bp)

- UPC Holding BV (Country: NL; rated: LGD6 - 93%): down 26.5 bp to 225.2bp (1Y range: 164-299bp)

- Virgin Media Finance PLC (Country: GB; rated: WR): down 26.4 bp to 300.7bp (1Y range: 222-363bp)

- Atlantia SpA (Country: IT; rated: Ba2): down 25.4 bp to 154.9bp (1Y range: 97-208bp)

SELECTED RECENT USD BOND ISSUES

- Redwood Star Merger Sub Inc (Financial - Other | United States | Rating: NR): US$500m Senior Note (US758071AA21), fixed rate (8.75% coupon) maturing on 1 April 2030, priced at 95.18 (original spread of 748 bp), callable (8nc3)

- WesBanco Inc (Banking | Wheeling, United States | Rating: NR): US$150m Subordinated Note (US950810AA95), floating rate maturing on 1 April 2032, priced at 100.00, callable (10nc5)

- Nigeria, Federal Republic of (Government) (Sovereign | Abuja, Nigeria | Rating: B-): US$1,250m Senior Note (XS2445169985), fixed rate (8.38% coupon) maturing on 24 March 2029, priced at 100.00, non callable

- Royal Bank of Canada (London branch) (Banking | London, Canada | Rating: NR): US$110m Unsecured Note (XS1192971767) zero coupon maturing on 8 April 2052, priced at 100.00, non callable

SELECTED RECENT EURO BONDS

- Madeira, Autonomous Region of (Official and Muni | Funchal, Portugal | Rating: BB-): €260m Bond (PTRAMDOM0018), fixed rate (1.58% coupon) maturing on 21 March 2035, priced at 100.00, non callable

NEW LOANS

- Iron Mountain Inc (BB-), signed a US$ 2,250m Revolving Credit Facility, to be used for general corporate purposes

- Ovintiv Inc (BBB-), signed a US$ 2,200m Revolving Credit Facility, to be used for general corporate purposes. It matures on 07/15/26 and initial pricing is set at LIBOR +150.0bp

- Cintas Corp No 2 (BBB+), signed a US$ 2,000m Revolving Credit Facility, to be used for general corporate purposes and working capital

- Flint Hills Resources LLC, signed a US$ 1,250m Revolving Credit Facility, to be used for general corporate purposes. It matures on 03/28/27 and initial pricing is set at Term SOFR +75.0bp

- United Therapeutics Corp, signed a US$ 1,200m Revolving Credit Facility, to be used for general corporate purposes. It matures on 03/31/27 and initial pricing is set at Term SOFR +150.0bp

- Vulcan Materials Co (BBB+), signed a US$ 1,000m Revolving Credit Facility, to be used for general corporate purposes. It matures on 09/18/26 and initial pricing is set at Term SOFR +112.5bp

- Gildan Activewear Inc, signed a US$ 1,000m Revolving Credit Facility, to be used for general corporate purposes

- Sealed Air Corp (BB+), signed a US$ 900m Revolving Credit Facility, to be used for general corporate purposes. It matures on 03/22/27 and initial pricing is set at Term SOFR +125.0bp

- United Therapeutics Corp, signed a US$ 800m Revolving Credit Facility, to be used for general corporate purposes. It matures on 03/31/27 and initial pricing is set at Term SOFR +130.0bp

- Pilot Travel Centers LLC, signed a US$ 750m Revolving Credit Facility, to be used for general corporate purposes. Initial pricing is set at Term SOFR +150.0bp

- Consolidated Edison Inc (BBB+), signed a US$ 750m 364d Revolver, to be used for general corporate purposes. It matures on 03/30/23 and initial pricing is set at Term SOFR +112.5bp

- National Health Investors Inc (BBB-), signed a US$ 700m Revolving Credit Facility, to be used for general corporate purposes. Initial pricing is set at Term SOFR +105.0bp

- Baytex Energy Corp, signed a US$ 650m Revolving Credit Facility, to be used for general corporate purposes. It matures on 03/31/26.

- Milestone Equipment Holdings, signed a US$ 600m Revolving Credit Facility, to be used for general corporate purposes. It matures on 11/19/26 and initial pricing is set at Term SOFR +200.0bp

- Border States Inds, signed a US$ 600m Revolving Credit Facility, to be used for general corporate purposes. It matures on 03/31/27 and initial pricing is set at Term SOFR +150.0bp

- Arakelian Enterprises Inc, signed a US$ 500m Revolving Credit Facility, to be used for general corporate purposes. It matures on 03/31/27 and initial pricing is set at Term SOFR +120.0bp

- Designer Brands Inc, signed a US$ 500m Revolving Credit Facility, to be used for general corporate purposes and working capital. It matures on 03/31/27 and initial pricing is set at Term SOFR +150.0bp

NEW ISSUES IN SECURITIZED CREDIT

- Colt 2022-3 Mortgage Loan Trust issued a fixed-rate RMBS in 6 tranches, for a total of US$ 464 m. Bookrunners: Credit Suisse, Goldman Sachs & Co, Morgan Stanley International Ltd, Barclays Capital Group

- Palmer Square European Loan Funding 2022-2 Dac issued a floating-rate CLO in 5 tranches, for a total of € 412 m. Highest-rated tranche offering a spread over the floating rate of 105bp, and the lowest-rated tranche a spread of 737bp. Bookrunners: JP Morgan & Co Inc

- Hayfin Emerald CLO IX Dac issued a floating-rate CLO in 8 tranches, for a total of € 405 m. Highest-rated tranche offering a spread over the floating rate of 107bp, and the lowest-rated tranche a spread of 925bp. Bookrunners: Bank of America Merrill Lynch

- Harvest CLO XXVIII Dac issued a floating-rate CLO in 9 tranches, for a total of € 499 m. Highest-rated tranche offering a spread over the floating rate of 50bp, and the lowest-rated tranche a spread of 960bp. Bookrunners: Jefferies & Co Inc