Credit

Weak Credit Performance In Line With Equities: IG Cash Spreads 1bp Wider, HY 5bp Wider

Another pretty good day for investment grade corporate bond issuance, with the largest prints coming from Goldman Sachs ($6bn in 4 tranches), Citigroup ($5.25bn in 3 tranches), and Charter Comms ($3.5bn in 3 tranches)

Published ET

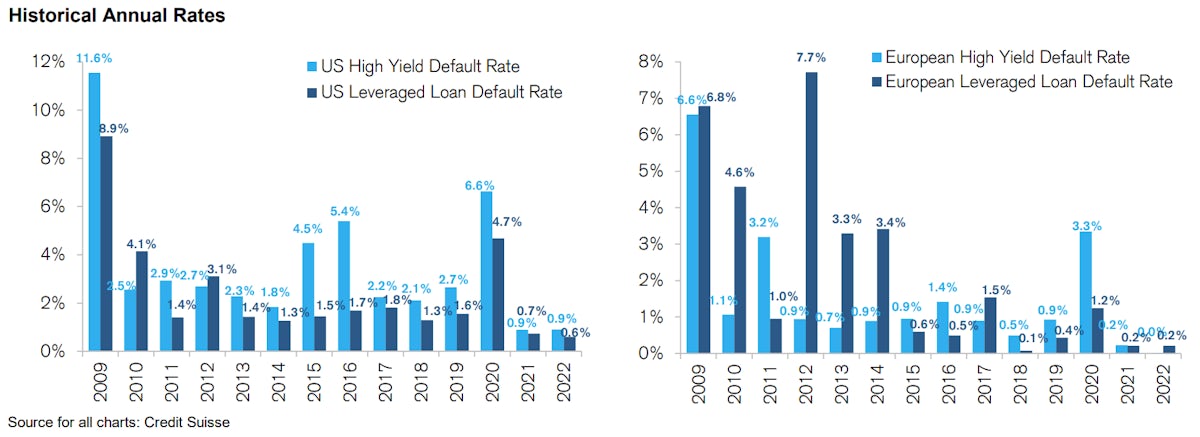

US & European High Yield Default Rates | Source: Credit Suisse

QUICK SUMMARY

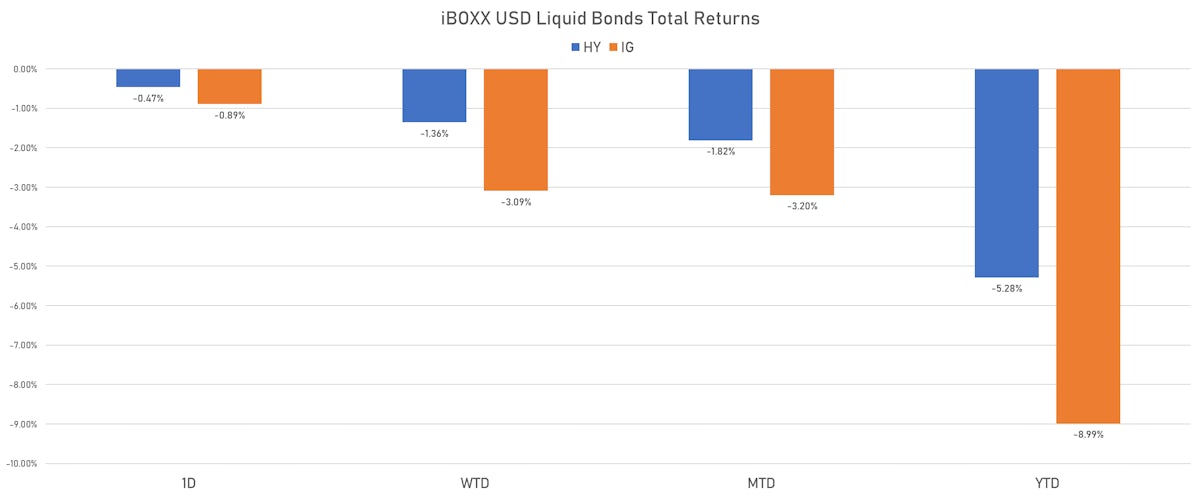

- S&P 500 Bond Index was down -0.65% today, with investment grade down -0.66% and high yield down -0.54% (YTD total return: -7.26%)

- The iBoxx USD Liquid Investment Grade Total Return Index was down -0.893% today (Month-to-date: -3.20%; Year-to-date: -8.99%)

- The iBoxx USD Liquid High Yield Total Return Index was down -0.467% today (Month-to-date: -1.82%; Year-to-date: -5.28%)

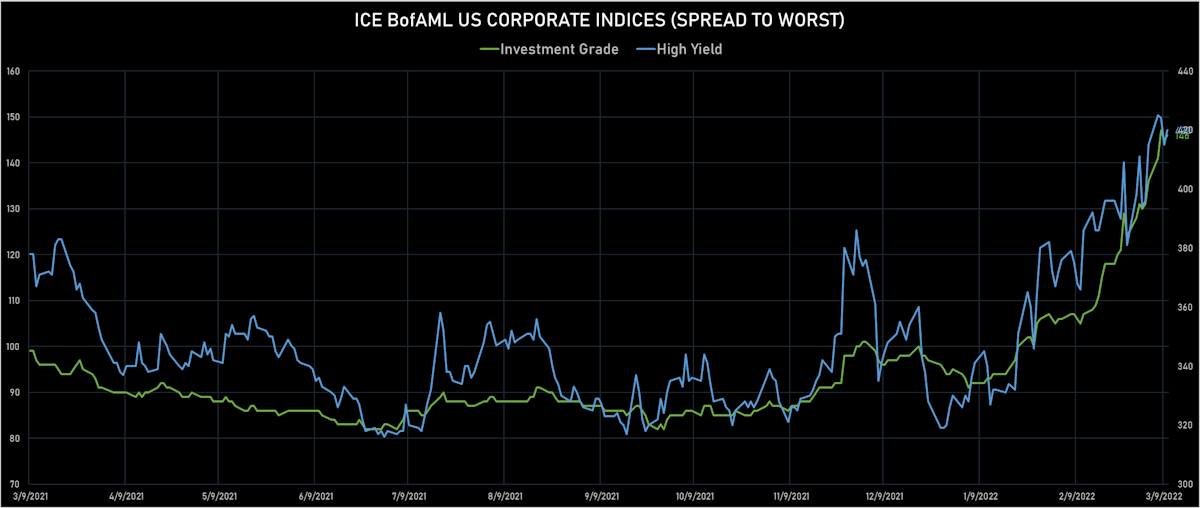

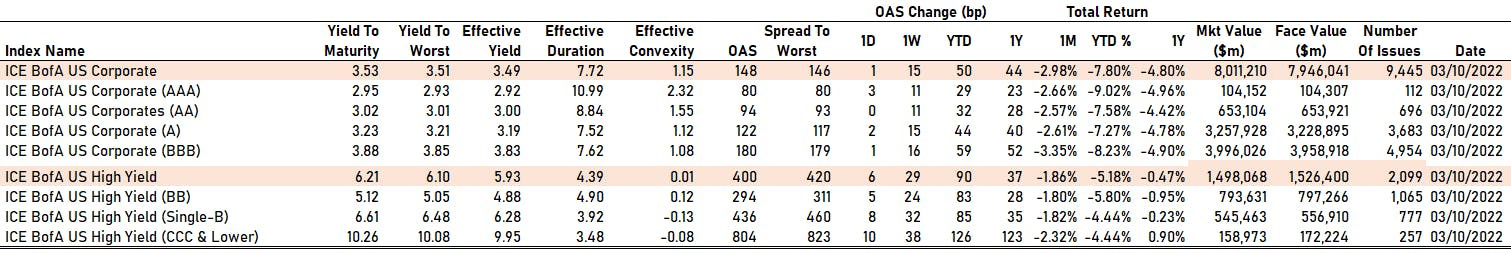

- ICE BofA US Corporate Index (Investment Grade) spread to worst up 1.0 bp, now at 146.0 bp (YTD change: +51.0 bp)

- ICE BofA US High Yield Index spread to worst up 5.0 bp, now at 420.0 bp (YTD change: +90.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index down -0.23% today (YTD total return: -1.6%)

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING

- AAA up by 3 bp at 80 bp

- AA unchanged at 94 bp

- A up by 2 bp at 122 bp

- BBB up by 1 bp at 180 bp

- BB up by 5 bp at 294 bp

- B up by 8 bp at 436 bp

- CCC up by 10 bp at 804 bp

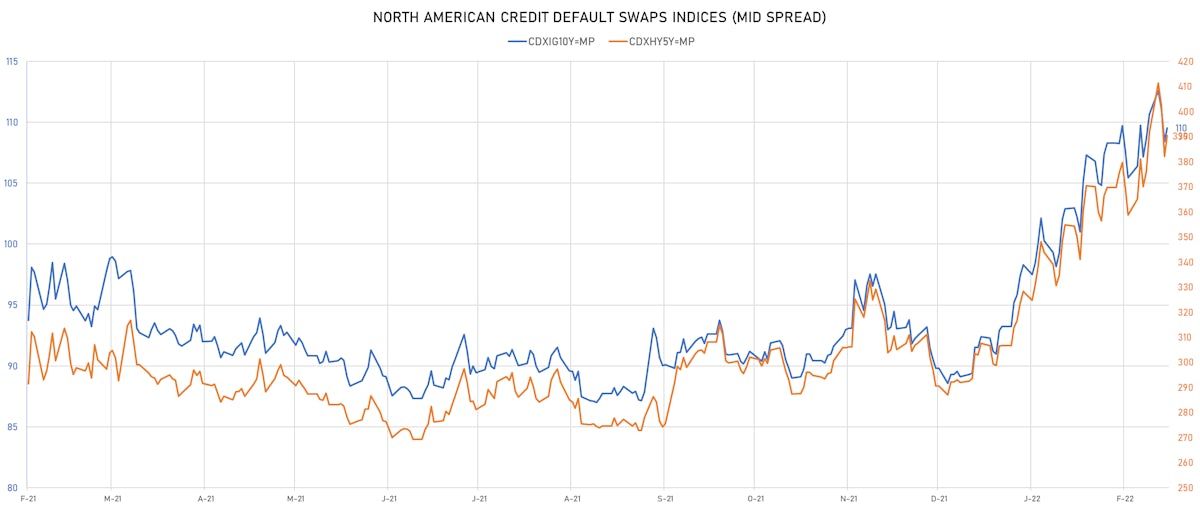

CDS INDICES (mid-spreads)

- Markit CDX.NA.IG 5Y up 1.2 bp, now at 73bp (YTD change: +23.8bp)

- Markit CDX.NA.IG 10Y up 1.2 bp, now at 110bp (YTD change: +20.4bp)

- Markit CDX.NA.HY 5Y up 8.3 bp, now at 390bp (YTD change: +98.5bp)

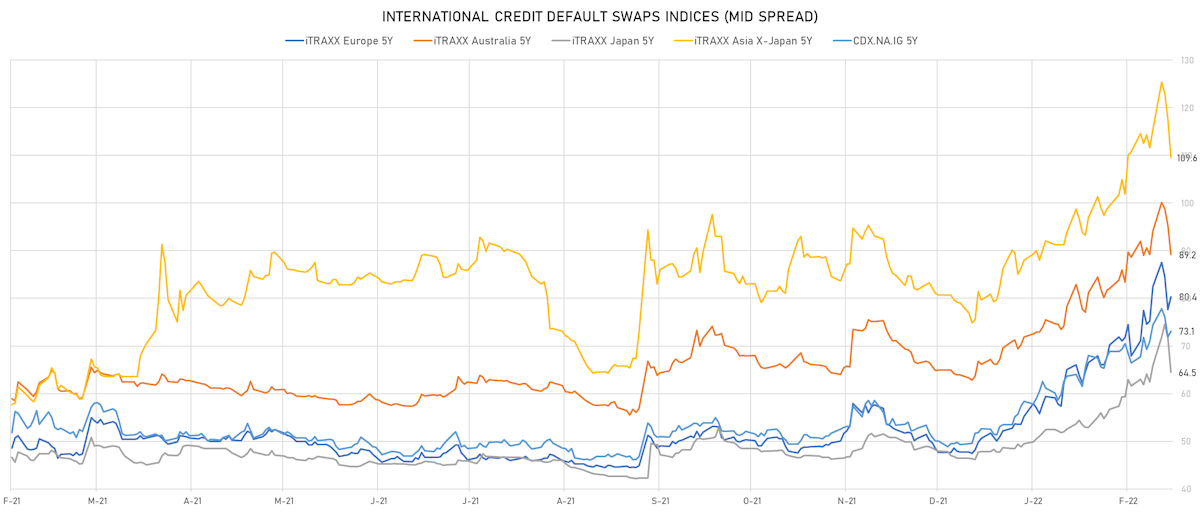

- Markit iTRAXX Europe 5Y up 2.7 bp, now at 80bp (YTD change: +32.7bp)

- Markit iTRAXX Europe Crossover 5Y up 16.1 bp, now at 387bp (YTD change: +145.3bp)

- Markit iTRAXX Japan 5Y down 7.4 bp, now at 64bp (YTD change: +18.0bp)

- Markit iTRAXX Asia Ex-Japan 5Y down 8.1 bp, now at 110bp (YTD change: +30.6bp)

TOP BONDS MOVES IN THE PAST WEEK - USD HY

- Issuer: ZF North America Capital Inc (Northville, Michigan (US)) | Coupon: 4.75% | Maturity: 29/4/2025 | Rating: BB+ | ISIN: USU98737AC03 | Z-spread up by 141.1 bp to 389.6 bp, with the yield to worst at 5.6% and the bond now trading down to 97.0 cents on the dollar (1Y price range: 97.0-107.1).

- Issuer: American Airlines Group Inc (Fort Worth, Texas (US)) | Coupon: 3.75% | Maturity: 1/3/2025 | Rating: CCC | ISIN: USU0242AAD47 | Z-spread up by 84.0 bp to 747.3 bp (CDS basis: 404.4bp), with the yield to worst at 9.1% and the bond now trading down to 86.0 cents on the dollar (1Y price range: 83.5-95.6).

- Issuer: Brinker International Inc (Coppell, Texas (US)) | Coupon: 5.00% | Maturity: 1/10/2024 | Rating: B+ | ISIN: USU6223WAB01 | Z-spread up by 64.0 bp to 330.3 bp, with the yield to worst at 5.3% and the bond now trading down to 99.3 cents on the dollar (1Y price range: 100.8-106.8).

- Issuer: Goodyear Tire & Rubber Co (Akron, Ohio (US)) | Coupon: 5.00% | Maturity: 15/7/2029 | Rating: B | ISIN: USU38255AN24 | Z-spread up by 64.0 bp to 449.2 bp (CDS basis: -22.9bp), with the yield to worst at 6.4% and the bond now trading down to 91.1 cents on the dollar (1Y price range: 91.1-106.6).

- Issuer: Wynn Las Vegas LLC (Las Vegas, Nevada (US)) | Coupon: 5.50% | Maturity: 1/3/2025 | Rating: B | ISIN: USU98347AK05 | Z-spread up by 59.4 bp to 393.2 bp, with the yield to worst at 5.6% and the bond now trading down to 98.8 cents on the dollar (1Y price range: 98.8-103.5).

- Issuer: Sensata Technologies BV (Almelo, Netherlands) | Coupon: 4.88% | Maturity: 15/10/2023 | Rating: BB- | ISIN: USN78840AH33 | Z-spread up by 39.6 bp to 214.2 bp, with the yield to worst at 3.6% and the bond now trading down to 101.5 cents on the dollar (1Y price range: 101.5-105.1).

- Issuer: Videotron Ltd (Pre-Merger) (MONTREAL, Canada) | Coupon: 5.38% | Maturity: 15/6/2024 | Rating: BB+ | ISIN: USC96225AA22 | Z-spread up by 39.0 bp to 237.9 bp, with the yield to worst at 4.2% and the bond now trading down to 102.0 cents on the dollar (1Y price range: 102.0-107.0).

- Issuer: Block Inc (San Francisco, California (US)) | Coupon: 2.75% | Maturity: 1/6/2026 | Rating: BB | ISIN: USU85223AA03 | Z-spread up by 38.8 bp to 228.0 bp, with the yield to worst at 4.0% and the bond now trading down to 94.1 cents on the dollar (1Y price range: 93.8-100.5).

- Issuer: NCL Corporation Ltd (Miami, Bermuda) | Coupon: 5.88% | Maturity: 15/3/2026 | Rating: CCC+ | ISIN: USG6436QAL08 | Z-spread up by 35.9 bp to 602.0 bp, with the yield to worst at 7.9% and the bond now trading down to 92.8 cents on the dollar (1Y price range: 92.8-100.0).

- Issuer: Owens-Brockway Glass Container Inc (Perrysburg, Ohio (US)) | Coupon: 5.88% | Maturity: 15/8/2023 | Rating: B- | ISIN: USU68337AK75 | Z-spread up by 30.1 bp to 309.9 bp, with the yield to worst at 4.0% and the bond now trading down to 101.5 cents on the dollar (1Y price range: 102.0-104.6).

- Issuer: EQM Midstream Partners LP (Canonsburg, Pennsylvania (US)) | Coupon: 6.00% | Maturity: 1/7/2025 | Rating: BB- | ISIN: USU26886AA62 | Z-spread up by 26.2 bp to 386.5 bp, with the yield to worst at 5.5% and the bond now trading down to 100.3 cents on the dollar (1Y price range: 100.1-108.5).

- Issuer: CTR Partnership LP (San Clemente, California (US)) | Coupon: 3.88% | Maturity: 30/6/2028 | Rating: BB | ISIN: USU1268FAB41 | Z-spread down by 25.1 bp to 262.1 bp, with the yield to worst at 4.6% and the bond now trading up to 95.8 cents on the dollar (1Y price range: 95.5-102.9).

- Issuer: Aag FH LP | Coupon: 9.75% | Maturity: 15/7/2024 | Rating: B- | ISIN: USC33027AA82 | Z-spread down by 27.0 bp to 876.5 bp, with the yield to worst at 10.2% and the bond now trading up to 98.0 cents on the dollar (1Y price range: 93.0-98.5).

- Issuer: EnLink Midstream LLC (Dallas, Texas (US)) | Coupon: 5.63% | Maturity: 15/1/2028 | Rating: BB | ISIN: USU26790AB82 | Z-spread down by 32.3 bp to 315.4 bp, with the yield to worst at 5.0% and the bond now trading up to 101.9 cents on the dollar (1Y price range: 100.0-104.8).

TOP BONDS MOVES IN THE PAST WEEK - EUR HY

- Issuer: Heimstaden AB (Malmo, Sweden) | Coupon: 4.25% | Maturity: 9/3/2026 | Rating: BB+ | ISIN: SE0015657903 | Z-spread up by 790.6 bp to 504.0 bp, with the yield to worst at 5.4% and the bond now trading down to 95.5 cents on the dollar (1Y price range: 95.1-100.7).

- Issuer: Renault SA (Boulogne-Billancourt, France) | Coupon: 1.00% | Maturity: 18/4/2024 | Rating: BB | ISIN: FR0013329315 | Z-spread up by 77.1 bp to 341.5 bp (CDS basis: -160.9bp), with the yield to worst at 3.5% and the bond now trading down to 94.7 cents on the dollar (1Y price range: 94.5-100.1).

- Issuer: Adient Global Holdings Ltd (Saint Helier, Jersey) | Coupon: 3.50% | Maturity: 15/8/2024 | Rating: B- | ISIN: XS1468662801 | Z-spread up by 74.7 bp to 509.7 bp, with the yield to worst at 5.3% and the bond now trading down to 95.8 cents on the dollar (1Y price range: 95.5-101.5).

- Issuer: Jaguar Land Rover Automotive PLC (Coventry, United Kingdom) | Coupon: 6.88% | Maturity: 15/11/2026 | Rating: B+ | ISIN: XS2010037682 | Z-spread up by 54.7 bp to 609.1 bp (CDS basis: -55.1bp), with the yield to worst at 6.4% and the bond now trading down to 101.1 cents on the dollar (1Y price range: 100.3-113.4).

- Issuer: Mahle GmbH (Stuttgart, Germany) | Coupon: 2.38% | Maturity: 14/5/2028 | Rating: BB+ | ISIN: XS2341724172 | Z-spread up by 53.1 bp to 468.2 bp, with the yield to worst at 5.3% and the bond now trading down to 84.5 cents on the dollar (1Y price range: 84.2-97.6).

- Issuer: Webuild SpA (Milan, Italy) | Coupon: 3.63% | Maturity: 28/1/2027 | Rating: BB- | ISIN: XS2102392276 | Z-spread up by 45.6 bp to 537.8 bp, with the yield to worst at 5.7% and the bond now trading down to 90.2 cents on the dollar (1Y price range: 90.2-104.2).

- Issuer: Vivion Investments SARL (Luxembourg, Luxembourg) | Coupon: 3.50% | Maturity: 1/11/2025 | Rating: BB+ | ISIN: XS2070311431 | Z-spread down by 38.1 bp to 550.8 bp, with the yield to worst at 5.4% and the bond now trading up to 92.0 cents on the dollar (1Y price range: 90.3-99.2).

- Issuer: Nexi SpA (Milan, Italy) | Coupon: 1.75% | Maturity: 31/10/2024 | Rating: BB- | ISIN: XS2066703989 | Z-spread down by 43.8 bp to 185.1 bp, with the yield to worst at 1.9% and the bond now trading up to 98.8 cents on the dollar (1Y price range: 97.7-101.9).

- Issuer: Telefonaktiebolaget LM Ericsson (Stockholm, Sweden) | Coupon: 1.88% | Maturity: 1/3/2024 | Rating: BB+ | ISIN: XS1571293684 | Z-spread down by 46.2 bp to 220.8 bp (CDS basis: -118.2bp), with the yield to worst at 2.4% and the bond now trading up to 98.9 cents on the dollar (1Y price range: 98.3-103.5).

- Issuer: Adler Group SA (Senningerberg, Luxembourg) | Coupon: 3.25% | Maturity: 5/8/2025 | Rating: B | ISIN: XS2010029663 | Z-spread down by 47.8 bp to 739.9 bp, with the yield to worst at 7.7% and the bond now trading up to 86.7 cents on the dollar (1Y price range: 82.0-91.3).

- Issuer: Fortune Star (BVI) Ltd (British Virgin Islands) | Coupon: 3.95% | Maturity: 2/10/2026 | Rating: BB- | ISIN: XS2357132849 | Z-spread down by 66.7 bp to 602.6 bp, with the yield to worst at 6.6% and the bond now trading up to 90.0 cents on the dollar (1Y price range: 89.5-95.0).

- Issuer: Akropolis Group UAB (Vilnius, Lithuania) | Coupon: 2.88% | Maturity: 2/6/2026 | Rating: BB+ | ISIN: XS2346869097 | Z-spread down by 79.1 bp to 620.8 bp, with the yield to worst at 6.8% and the bond now trading up to 86.1 cents on the dollar (1Y price range: 86.0-95.2).

SELECTED RECENT USD BOND ISSUES

- Charter Communications Operating LLC (Cable/Media | St. Louis, United States | Rating: BBB-): US$1,500m Note (US161175CK86), fixed rate (5.25% coupon) maturing on 1 April 2053, priced at 99.30 (original spread of 290 bp), callable (31nc31)

- Charter Communications Operating LLC (Cable/Media | St. Louis, United States | Rating: BBB-): US$1,000m Note (US161175CL69), fixed rate (5.50% coupon) maturing on 1 April 2063, priced at 99.26 (original spread of 365 bp), callable (41nc41)

- Charter Communications Operating LLC (Cable/Media | St. Louis, United States | Rating: BBB-): US$1,000m Note (US161175CJ14), fixed rate (4.40% coupon) maturing on 1 April 2033, priced at 99.63 (original spread of 246 bp), callable (11nc11)

- Citigroup Inc (Banking | New York City, United States | Rating: BBB+): US$3,000m Senior Note (US172967NN71), floating rate maturing on 17 March 2033, priced at 100.00 (original spread of 170 bp), callable (11nc10)

- Citigroup Inc (Banking | New York City, United States | Rating: BBB+): US$1,750m Senior Note (US172967NL16), floating rate maturing on 17 March 2026, priced at 100.00, callable (4nc3)

- Citigroup Inc (Banking | New York City, United States | Rating: BBB+): US$500m Senior Note (US172967NM98), floating rate (SOFR + 152.8 bp) maturing on 17 March 2026, priced at 100.00, callable (4nc3)

- Evergy Missouri West Inc (Utility - Other | Kansas City, United States | Rating: A-): US$250m First Mortgage Bond (US30037EAA10), fixed rate (3.75% coupon) maturing on 15 March 2032, priced at 99.91 (original spread of 175 bp), callable (10nc10)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$105m Bond (US3133ENRV47), fixed rate (3.75% coupon) maturing on 17 March 2042, priced at 100.00 (original spread of 162 bp), callable (20nc1)

- Federal Home Loan Banks (Agency | Washington, United States | Rating: NR): US$300m Bond (US3130ARDA66), fixed rate (2.23% coupon) maturing on 28 March 2025, priced at 100.00 (original spread of 178 bp), callable (3nc3m)

- Goldman Sachs Group Inc (Banking | New York City, United States | Rating: BBB+): US$350m Senior Note (US38141GZQ09), floating rate (SOFR + 139.0 bp) maturing on 15 March 2024, priced at 100.00, callable (2nc1)

- Guitar Center Inc (Retail Stores - Other | Westlake Village, United States | Rating: B): US$200m Note (USU40245AL33), fixed rate (8.50% coupon) maturing on 15 January 2026, priced at 100.50, callable (4nc10m)

- MPLX LP (Gas Utility - Pipelines | Findlay, United States | Rating: BBB): US$1,500m Senior Note (US55336VBT61), fixed rate (4.95% coupon) maturing on 14 March 2052, priced at 98.98 (original spread of 293 bp), callable (30nc30)

- NextEra Energy Capital Holdings Inc (Financial - Other | Juno Beach, United States | Rating: A-): US$275m Senior Debenture (XS2456252860), fixed rate (4.30% coupon) maturing on 24 March 2062, priced at 100.00, callable (40nc5)

- DBS Bank Ltd (Banking | Singapore | Rating: AA-): US$1,500m Covered Bond (Other) (US23304RAC97), fixed rate (2.38% coupon) maturing on 17 March 2027, priced at 100.00, non callable

SELECTED RECENT EUR BOND ISSUES

- Deutsche Bank AG (Banking | Frankfurt, Hessen, Germany | Rating: BBB+): €500m Inhaberschuldverschreibung (DE000DB9U6T0), fixed rate (0.90% coupon) maturing on 1 April 2027, priced at 100.00 (original spread of 31 bp), non callable

- Raiffeisen Bank International AG (Banking | Wien, Austria | Rating: A-): €1,000m Fundierte Schuldverschreibungen (Covered Bond) (AT000B015276), floating rate (EU03MLIB + 20.0 bp) maturing on 17 March 2032, priced at 100.00, non callable

NEW LOANS

- Smyrna Ready Mix Concrete Inc (B+), signed a US$ 650m Term Loan B maturing on 03/28/29, to be used for general corporate purposes and acquisition financing

NEW ISSUES IN SECURITIZED CREDIT

- Westlake Automobile Receivables Trust 2022-1 issued a floating-rate ABS backed by auto receivables in 7 tranches, for a total of US$ 1,342 m. Highest-rated tranche offering a spread over the floating rate of 25bp, and the lowest-rated tranche a spread of 160bp. Bookrunners: JP Morgan & Co Inc, Deutsche Bank Securities Inc, Wells Fargo Securities LLC, BMO Capital Markets

- Hyundai Auto Receivables Trust 2022-A issued a fixed-rate ABS backed by auto receivables in 5 tranches, for a total of US$ 1,324 m. Highest-rated tranche offering a coupon of 1.81%, and the lowest-rated tranche a yield to maturity of 2.36%. Bookrunners: Santander Investment Securities Inc, Bank of America Merrill Lynch, Mizuho Securities USA Inc, SMBC Nikko Securities America Inc, BNP Paribas Securities Corp

- Gcat 2022-Nqm1 Trust issued a fixed-rate RMBS in 7 tranches, for a total of US$ 365 m. Highest-rated tranche offering a coupon of 3.89%, and the lowest-rated tranche a yield to maturity of 4.17%. Bookrunners: Credit Suisse, Performance Trust Capital

- Jimmy Johns Funding LLC 2022-1 issued a fixed-rate ABS backed by business cashflow in 3 tranches, for a total of US$ 775 m. Highest-rated tranche offering a yield to maturity of 4.08%, and the lowest-rated tranche a yield to maturity of 4.35%. Bookrunners: Credit Suisse, Blackstone Group LP, Goldman Sachs & Co, Morgan Stanley International Ltd, JP Morgan & Co Inc, Barclays Capital Group, Wells Fargo Securities LLC, Bank of America Merrill Lynch