Credit

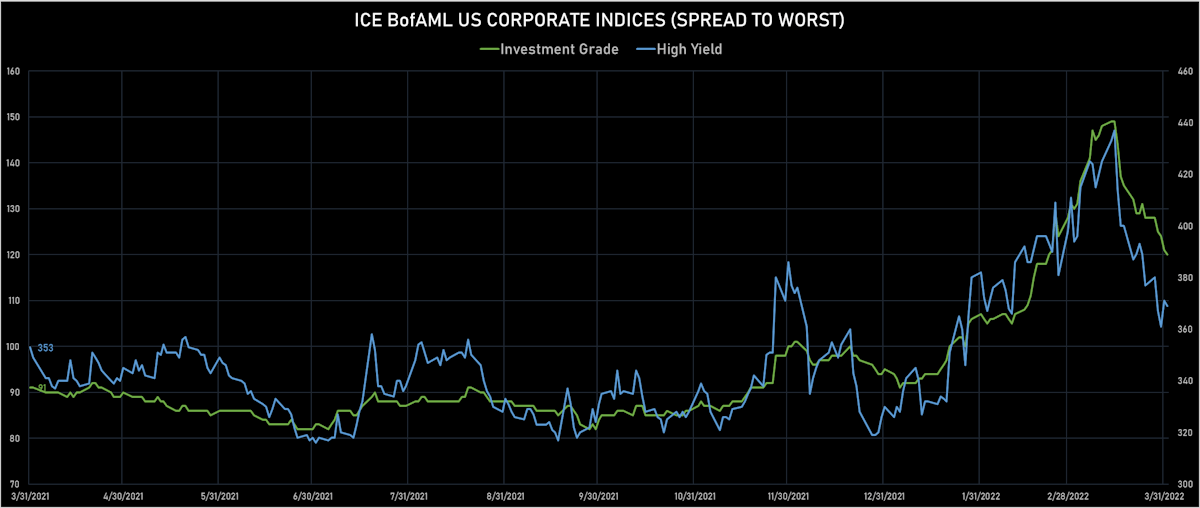

US$ Spreads Tighten Slightly On Friday, With A Decent OAS Compression For The Week Of 9bp In IG And 11bp In HY

Strong end to the quarter for investment grade corporate bond issuance, ahead of the earnings quiet period (IFR Markets data): 44 tranches for $35.8bn in IG (2022 1Q volume $466.9bn vs 2021 1Q US$459.6bn) and 5 tranches for $1.96bn in HY (2022 1Q volume $40.1bn vs 2021 1Q $152.4bn)

Published ET

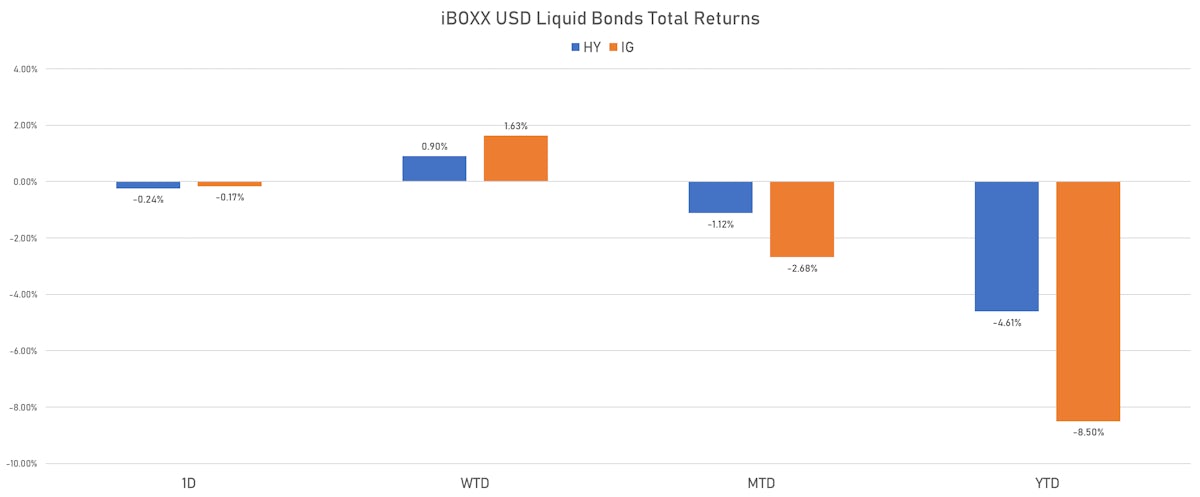

iBOXX USD Liquid Bonds Total Returns | Sources: ϕpost, Refinitiv data

QUICK SUMMARY

- S&P 500 Bond Index was down -0.16% today, with investment grade down -0.15% and high yield down -0.22% (YTD total return: -7.23%)

- The iBoxx USD Liquid Investment Grade Total Return Index was down -0.167% today (Month-to-date: -2.68%; Year-to-date: -8.50%)

- The iBoxx USD Liquid High Yield Total Return Index was down -0.243% today (Month-to-date: -1.12%; Year-to-date: -4.61%)

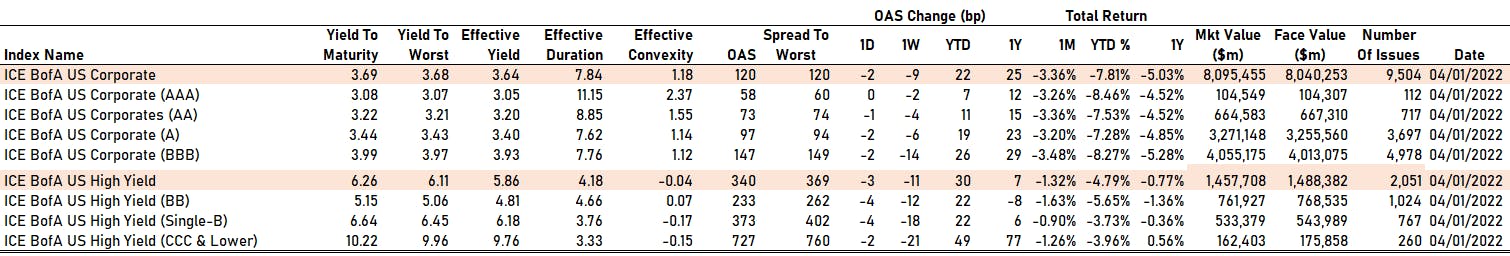

- ICE BofA US Corporate Index (Investment Grade) spread to worst down -1.0 bp, now at 120.0 bp (YTD change: +25.0 bp)

- ICE BofA US High Yield Index spread to worst down -2.0 bp, now at 369.0 bp (YTD change: +39.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index up 0.15% today (YTD total return: 0.0%)

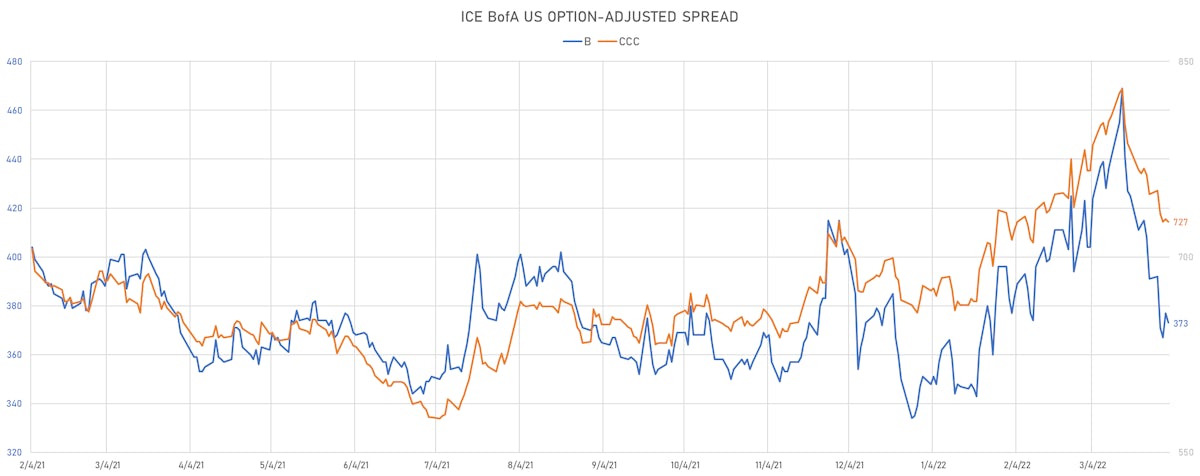

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING

- AAA unchanged at 58 bp

- AA down by -1 bp at 73 bp

- A down by -2 bp at 97 bp

- BBB down by -2 bp at 147 bp

- BB down by -4 bp at 233 bp

- B down by -4 bp at 373 bp

- CCC down by -2 bp at 727 bp

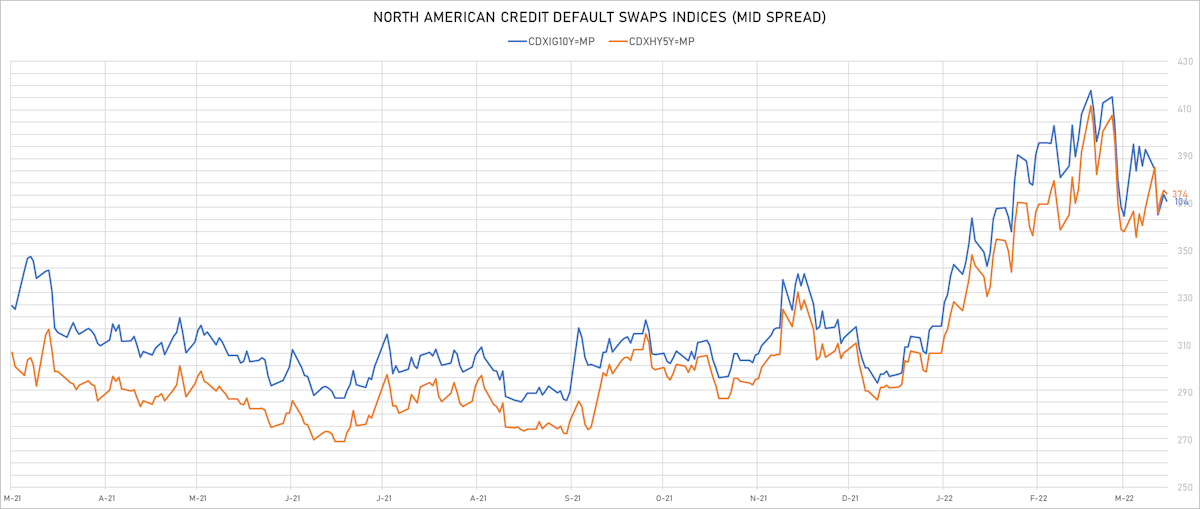

CDS INDICES (mid-spreads)

- Markit CDX.NA.IG 5Y down 0.5 bp, now at 67bp (YTD change: +17.2bp)

- Markit CDX.NA.IG 10Y down 0.6 bp, now at 104bp (YTD change: +14.4bp)

- Markit CDX.NA.HY 5Y down 1.5 bp, now at 374bp (YTD change: +82.1bp)

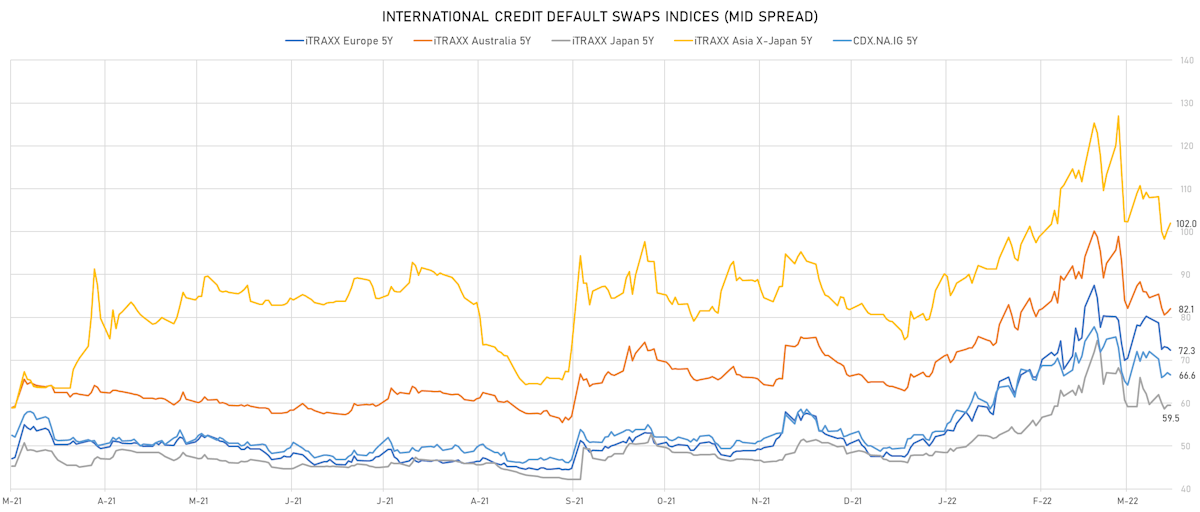

- Markit iTRAXX Europe 5Y down 0.7 bp, now at 72bp (YTD change: +24.6bp)

- Markit iTRAXX Europe Crossover 5Y down 0.2 bp, now at 339bp (YTD change: +96.4bp)

- Markit iTRAXX Japan 5Y up 0.0 bp, now at 59bp (YTD change: +13.1bp)

- Markit iTRAXX Asia Ex-Japan 5Y up 1.6 bp, now at 102bp (YTD change: +23.0bp)

5Y USD CDS SINGLE NAMES - LARGEST MOVES OVER THE PAST WEEK

- Weatherford International Ltd (Country: US; rated: B2): down 5043.4 bp to 506.6bp (1Y range: -507bp)

- Russia, Federation of (Government) (Country: RU; rated: WR): down 506.1 bp to 2,656.5bp (1Y range: 77-6,954bp)

- American Airlines Group Inc (Country: US; rated: B2): down 92.9 bp to 1,055.1bp (1Y range: 596-1,343bp)

- Egypt, Arab Republic of (Government) (Country: EG; rated: B): down 72.5 bp to 526.8bp (1Y range: 341-981bp)

- Carnival Corp (Country: US; rated: LGD5 - 72%): down 66.3 bp to 479.3bp (1Y range: 291-682bp)

- Royal Caribbean Cruises Ltd (Country: US; rated: LGD4 - 59%): down 55.0 bp to 419.7bp (1Y range: 299-554bp)

- Bombardier Inc (Country: CA; rated: Caa1): down 50.8 bp to 545.8bp (1Y range: 395-644bp)

- Pitney Bowes Inc (Country: US; rated: B1): down 45.8 bp to 696.6bp (1Y range: 363-702bp)

- Goodyear Tire & Rubber Co (Country: US; rated: WR): down 41.6 bp to 376.8bp (1Y range: 188-433bp)

- Turkey, Republic of (Government) (Country: TR; rated: WR): down 38.2 bp to 553.2bp (1Y range: 360-683bp)

- Ashland LLC (Country: US; rated: WR): down 36.9 bp to 185.8bp (1Y range: 91-250bp)

- Navient Corp (Country: US; rated: Ba3): down 35.9 bp to 436.1bp (1Y range: -436bp)

- Tegna Inc (Country: US; rated: Ba3): down 34.3 bp to 516.5bp (1Y range: 182-523bp)

- iStar Inc (Country: US; rated: BBB-): down 33.9 bp to 282.7bp (1Y range: 199-324bp)

- Amkor Technology Inc (Country: US; rated: BB): down 31.7 bp to 221.0bp (1Y range: 109-296bp)

5Y EURO CDS SINGLE NAMES - LARGEST MOVES OVER THE PAST WEEK

- Novafives SAS (Country: FR; rated: Caa1): down 186.6 bp to 900.0bp (1Y range: 618-1,342bp)

- Banca Monte dei Paschi di Siena SpA (Country: IT; rated: PNP): down 109.4 bp to 434.3bp (1Y range: 145-605bp)

- Louis Dreyfus Co BV (Country: NL; rated: ): down 80.1 bp to 201.6bp (1Y range: -202bp)

- Stonegate Pub Company Financing PLC (Country: GB; rated: WR): down 71.6 bp to 365.0bp (1Y range: 365-564bp)

- Pearson PLC (Country: GB; rated: Baa3): down 68.8 bp to 125.6bp (1Y range: 55-197bp)

- TUI AG (Country: DE; rated: B3-PD): down 64.2 bp to 688.7bp (1Y range: 607-946bp)

- Boparan Finance PLC (Country: GB; rated: B3): down 59.0 bp to 1,388.7bp (1Y range: 708-2,690bp)

- Jaguar Land Rover Automotive PLC (Country: GB; rated: WD): down 58.8 bp to 540.2bp (1Y range: 339-609bp)

- Rolls-Royce PLC (Country: GB; rated: BB-): down 43.8 bp to 241.3bp (1Y range: 161-306bp)

- Altice Finco SA (Country: LU; rated: Caa1): down 41.9 bp to 489.9bp (1Y range: 333-565bp)

- Renault SA (Country: FR; rated: Ba2): down 41.2 bp to 314.5bp (1Y range: 166-361bp)

- Elo SA (Country: FR; rated: ): down 38.6 bp to 161.0bp (1Y range: 83-242bp)

- Telecom Italia SpA (Country: IT; rated: BB): down 37.4 bp to 361.0bp (1Y range: 149-440bp)

- Casino Guichard Perrachon SA (Country: FR; rated: WR): down 35.2 bp to 943.3bp (1Y range: 464-1,208bp)

- Fortum Oyj (Country: FI; rated: baa3): down 33.3 bp to 168.8bp (1Y range: 40-241bp)

SELECTED RECENT USD BOND ISSUES

- American Homes 4 Rent LP (Financial - Other | Calabasas, California, United States | Rating: BBB-): US$300m Senior Note (US02666TAF49), fixed rate (4.30% coupon) maturing on 15 April 2052, priced at 97.24 (original spread of 200 bp), callable (30nc30)

- American Homes 4 Rent LP (Financial - Other | Calabasas, California, United States | Rating: BBB-): US$600m Senior Note (US02666TAE73), fixed rate (3.63% coupon) maturing on 15 April 2032, priced at 97.52 (original spread of 160 bp), callable (10nc10)

- Broadcom Inc (Electronics | San Jose, California, United States | Rating: BBB-): US$750m Senior Note (US11135FBR10), fixed rate (4.00% coupon) maturing on 15 April 2029, priced at 99.95 (original spread of 160 bp), callable (7nc7)

- Broadcom Inc (Electronics | San Jose, United States | Rating: BBB-): US$1,200m Senior Note (USU1109MAZ96), fixed rate (4.15% coupon) maturing on 15 April 2032, priced at 99.78 (original spread of 185 bp), callable (10nc10)

- Corebridge Financial Inc (Property and Casualty Insurance | Los Angeles, United States | Rating: BBB): US$500m Senior Note (US21871XAJ81), fixed rate (4.35% coupon) maturing on 5 April 2042, priced at 99.97 (original spread of 175 bp), callable (20nc20)

- Corebridge Financial Inc (Property and Casualty Insurance | Los Angeles, United States | Rating: BBB): US$1,250m Senior Note (USU20256AF70), fixed rate (4.40% coupon) maturing on 5 April 2052, priced at 99.98 (original spread of 195 bp), callable (30nc30)

- Corebridge Financial Inc (Property and Casualty Insurance | Los Angeles, United States | Rating: BBB): US$1,000m Senior Note (US21871XAA72), fixed rate (3.50% coupon) maturing on 4 April 2025, priced at 99.92 (original spread of 105 bp), callable (3nc3)

- Corebridge Financial Inc (Property and Casualty Insurance | Los Angeles, United States | Rating: BBB): US$1,000m Senior Note (US21871XAE94), fixed rate (3.85% coupon) maturing on 5 April 2029, priced at 99.91 (original spread of 145 bp), callable (7nc7)

- Corebridge Financial Inc (Property and Casualty Insurance | Los Angeles, United States | Rating: BBB): US$1,500m Senior Note (US21871XAG43), fixed rate (3.90% coupon) maturing on 5 April 2032, priced at 99.85 (original spread of 160 bp), callable (10nc10)

- Corebridge Financial Inc (Property and Casualty Insurance | Los Angeles, United States | Rating: BBB): US$1,250m Senior Note (USU20256AB66), fixed rate (3.65% coupon) maturing on 5 April 2027, priced at 99.86 (original spread of 125 bp), callable (5nc5)

- Equinix Inc (Real Estate Investment Trust | Redwood City, California, United States | Rating: BBB-): US$1,200m Senior Note (US29444UBU97), fixed rate (3.90% coupon) maturing on 15 April 2032, priced at 99.47 (original spread of 165 bp), callable (10nc10)

- PACCAR Financial Corp (Financial - Other | Bellevue, Washington, United States | Rating: A+): US$400m Senior Note (US69371RR738), fixed rate (2.85% coupon) maturing on 7 April 2025, priced at 99.97 (original spread of 40 bp), non callable

- University of Miami (Service - Other | Coral Gables, Florida, United States | Rating: A): US$500m Bond (US914453AA36), fixed rate (4.06% coupon) maturing on 1 April 2052, priced at 100.00 (original spread of 173 bp), with a make whole call

- Washington University (Service - Other | St. Louis, Missouri, United States | Rating: AA+): US$500m Bond (US940663AD91), fixed rate (4.35% coupon) maturing on 15 April 2122, priced at 100.00 (original spread of 188 bp), callable (100nc100)

- Washington University (Service - Other | St. Louis, Missouri, United States | Rating: AA+): US$500m Bond (US940663AC19), fixed rate (3.52% coupon) maturing on 15 April 2054, priced at 100.00 (original spread of 105 bp), callable (32nc32)

- Daimler Trucks Finance North America LLC (Financial - Other | Portland, Oregon, Germany | Rating: BBB+): US$650m Senior Note (US233853AM25), fixed rate (3.65% coupon) maturing on 7 April 2027, priced at 99.80 (original spread of 128 bp), with a make whole call

- Daimler Trucks Finance North America LLC (Financial - Other | Portland, Germany | Rating: BBB+): US$650m Senior Note (USU2340BAL19), fixed rate (3.50% coupon) maturing on 7 April 2025, priced at 99.89 (original spread of 108 bp), with a make whole call

- Daimler Trucks Finance North America LLC (Financial - Other | Portland, Oregon, Germany | Rating: BBB+): US$500m Senior Note (USU2340BAK36), floating rate (SOFR + 100.0 bp) maturing on 5 April 2024, priced at 100.00, non callable

- State Grid Europe Development (2014) PLC (Service - Other | London, China (Mainland) | Rating: A+): US$350m Senior Note (XS2435161539), fixed rate (3.25% coupon) maturing on 7 April 2027, priced at 99.53 (original spread of 90 bp), callable (5nc5)

- State Grid Europe Development (2014) PLC (Service - Other | London, China (Mainland) | Rating: A+): US$650m Senior Note (XS2460254282), fixed rate (3.13% coupon) maturing on 7 April 2025, priced at 99.66 (original spread of 75 bp), with a make whole call

- United Overseas Bank Ltd (Banking | Singapore | Rating: AA-): US$1,000m Subordinated Note (US91127LAH33), fixed rate (3.86% coupon) maturing on 7 October 2032, priced at 100.00 (original spread of 145 bp), callable (11nc6)

- United Overseas Bank Ltd (Banking | Singapore | Rating: AA-): US$750m Senior Note (US91127LAF76), fixed rate (3.06% coupon) maturing on 7 April 2025, priced at 100.00 (original spread of 60 bp), non callable

- United Overseas Bank Ltd (Banking | Singapore | Rating: AA-): US$350m Senior Note (US91127KAG76), floating rate (SOFR + 70.0 bp) maturing on 7 April 2025, priced at 100.00, non callable

- United Overseas Bank Ltd (Banking | Singapore | Rating: AA-): US$350m Senior Note (US91127LAG59), floating rate (SOFR + 70.0 bp) maturing on 7 April 2025, priced at 100.00, non callable

SELECTED RECENT EUR BOND ISSUES

- Action Logement Services SAS (Service - Other | Paris, Ile-De-France, France | Rating: AA): €1,250m Bond (FR0014009N55), fixed rate (1.38% coupon) maturing on 13 April 2032, priced at 99.39, non callable

NEW LOANS

- Glencore PLC (BBB+), signed a US$ 6,535m Revolving Credit Facility, to be used for general corporate purposes. It matures on 05/31/23.

- Uniper SE (BBB), signed a € 2,000m Revolving Credit Facility, to be used for general corporate purposes. It matures on 04/30/23.

- Brunswick Corp (BBB-), signed a US$ 750m Revolving Credit Facility, to be used for general corporate purposes. It matures on 03/31/27 and initial pricing is set at Term SOFR +100.0bp

- Seche Environnement SA (BB), signed a € 200m Revolving Credit Facility, to be used for general corporate purposes. It matures on 03/31/27 and initial pricing is set at

NEW ISSUES IN SECURITIZED CREDIT

- Bain Capital Euro Clo 2022-1 Dac issued a floating-rate CLO in 6 tranches, for a total of € 421 m. Highest-rated tranche offering a spread over the floating rate of 124bp, and the lowest-rated tranche a spread of 951bp. Bookrunners: Credit Suisse