Credit

Significant Widening In US High Yield Spreads This Week, In Line With Weak Equities Performance, As US Economy Clearly Slowing Down

Reasonable volumes of new USD corporate bonds this week (IFR Markets data): US$27.7bn in 35 tranches for IG (2022 YTD volume $494.6bn vs 2021 YTD $480.4bn), US$6.5bn in 11 tranches for HY (2022 YTD volume $48.2bn vs 2021 YTD $164.9bn)

Published ET

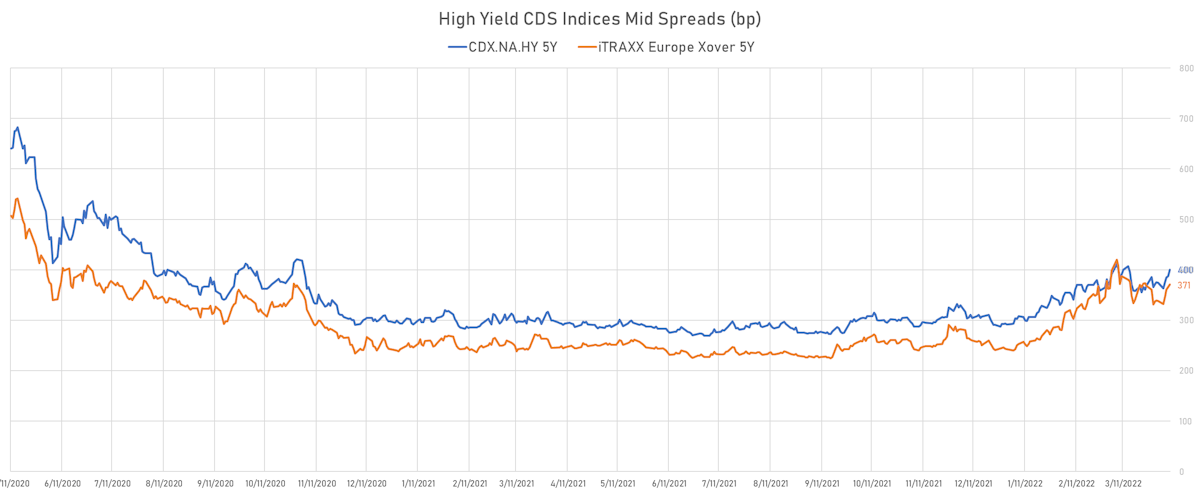

High Yield 5Y CDS Indices Europe vs North America | Sources: ϕpost, Refinitiv data

QUICK SUMMARY

- S&P 500 Bond Index was down -0.66% today, with investment grade down -0.68% and high yield down -0.50% (YTD total return: -9.22%)

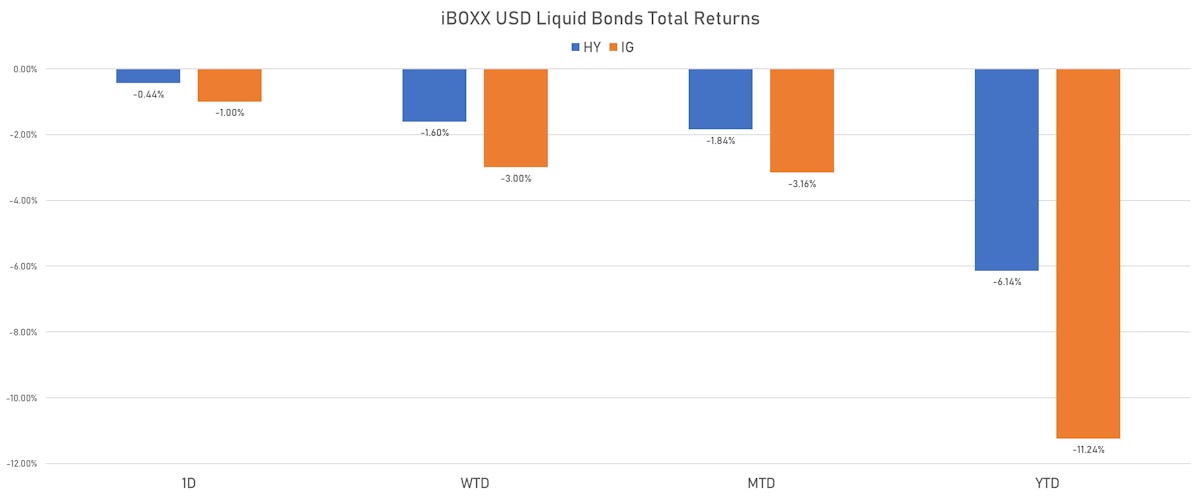

- The iBoxx USD Liquid Investment Grade Total Return Index was down -1.0% today (Month-to-date: -3.16%; Year-to-date: -11.24%)

- The iBoxx USD Liquid High Yield Total Return Index was down -0.439% today (Month-to-date: -1.84%; Year-to-date: -6.14%)

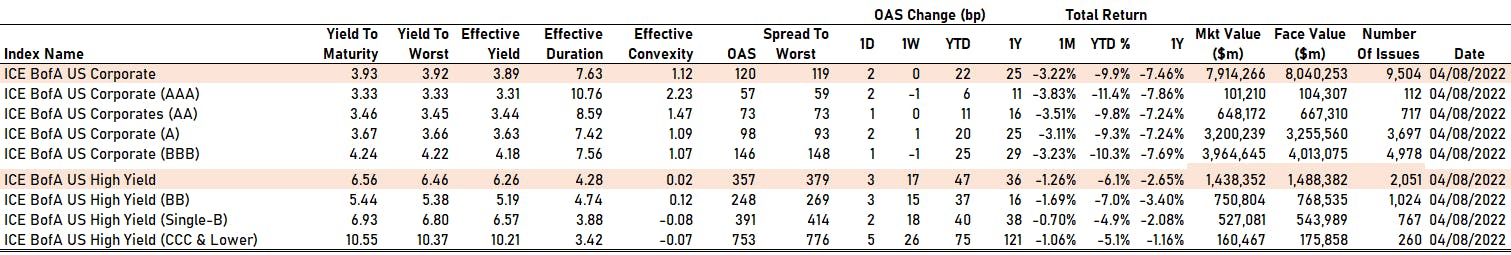

- ICE BofA US Corporate Index (Investment Grade) spread to worst up 2.0 bp, now at 119.0 bp (YTD change: +24.0 bp)

- ICE BofA US High Yield Index spread to worst up 2.0 bp, now at 379.0 bp (YTD change: +49.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index up 0.01% today (YTD total return: +0.3%)

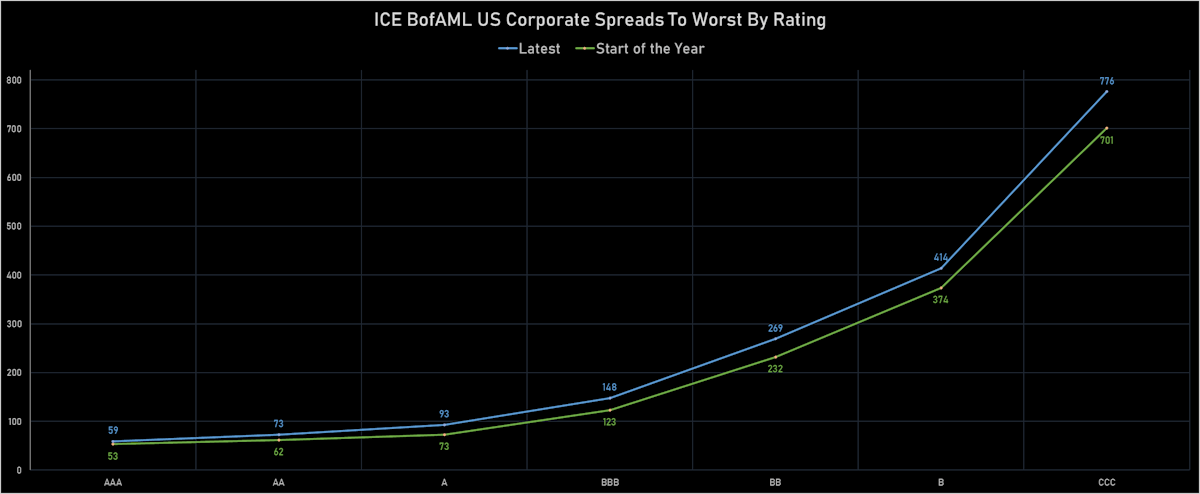

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING

- AAA up by 2 bp at 57 bp

- AA up by 1 bp at 73 bp

- A up by 2 bp at 98 bp

- BBB up by 1 bp at 146 bp

- BB up by 3 bp at 248 bp

- B up by 2 bp at 391 bp

- CCC up by 5 bp at 753 bp

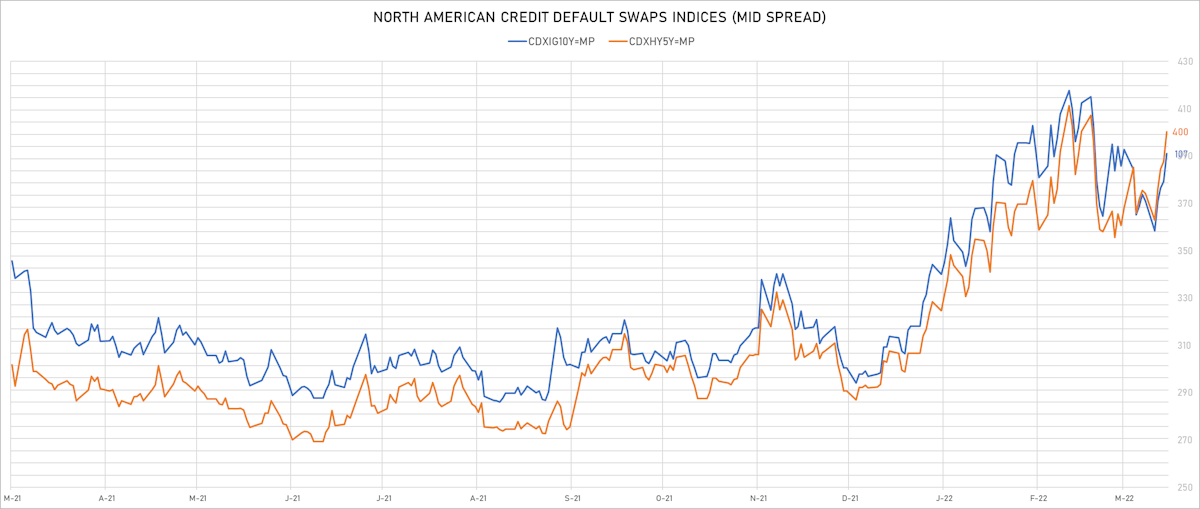

CDS INDICES TODAY (mid-spreads)

- Markit CDX.NA.IG 5Y up 2.4 bp, now at 71bp (YTD change: +21.2bp)

- Markit CDX.NA.IG 10Y up 2.3 bp, now at 107bp (YTD change: +18.3bp)

- Markit CDX.NA.HY 5Y up 12.6 bp, now at 400bp (YTD change: +108.3bp)

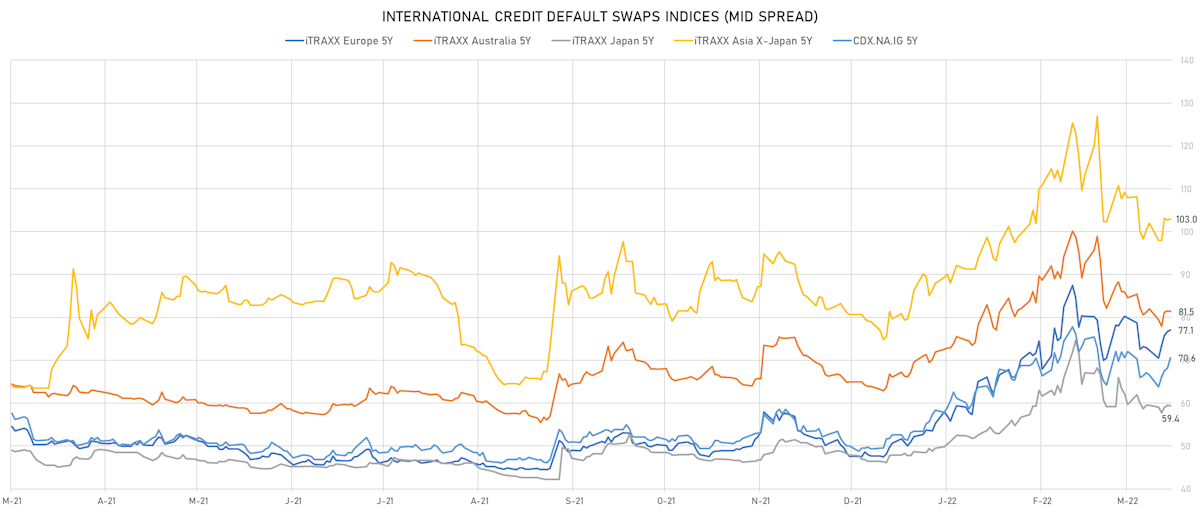

- Markit iTRAXX Europe 5Y up 0.4 bp, now at 77bp (YTD change: +29.4bp)

- Markit iTRAXX Europe Crossover 5Y up 4.7 bp, now at 371bp (YTD change: +128.5bp)

- Markit iTRAXX Japan 5Y down 0.1 bp, now at 59bp (YTD change: +13.0bp)

- Markit iTRAXX Asia Ex-Japan 5Y up 0.3 bp, now at 103bp (YTD change: +23.9bp)

5Y USD CDS SINGLE NAMES - LARGEST MOVES OVER THE PAST WEEK

- Staples Inc (Country: US; rated: B3): down 62.2 bp to 1,220.3bp (1Y range: 687-1,386bp)

- General Motors Co (Country: US; rated: Baa3): up 24.2 bp to 193.3bp (1Y range: 91-221bp)

- Ford Motor Credit Company LLC (Country: US; rated: NP): up 24.4 bp to 250.2bp (1Y range: 128-259bp)

- Ford Motor Co (Country: US; rated: LGD4 - 54%): up 26.8 bp to 259.6bp (1Y range: 143-271bp)

- MDC Holdings Inc (Country: US; rated: LGD4 - 53%): up 28.7 bp to 197.5bp (1Y range: 80-198bp)

- Ryder System Inc (Country: US; rated: Baa2): up 32.6 bp to 121.8bp (1Y range: 61-122bp)

- Turkey, Republic of (Government) (Country: TR; rated: WR): up 37.4 bp to 590.6bp (1Y range: 360-683bp)

- Pitney Bowes Inc (Country: US; rated: B1): up 38.3 bp to 734.9bp (1Y range: 363-735bp)

- KB Home (Country: US; rated: Ba2): up 48.5 bp to 313.9bp (1Y range: 138-314bp)

- American Axle & Manufacturing Inc (Country: US; rated: LGD2 - 20%): up 52.9 bp to 559.2bp (1Y range: 355-559bp)

- Beazer Homes USA Inc (Country: US; rated: B2): up 54.2 bp to 540.4bp (1Y range: 261-540bp)

- Realogy Group LLC (Country: US; rated: WR): up 69.4 bp to 480.3bp (1Y range: 278-480bp)

- Transocean Inc (Country: KY; rated: Caa3): up 90.1 bp to 1,370.4bp (1Y range: 941-1,784bp)

- American Airlines Group Inc (Country: US; rated: B2): up 106.5 bp to 1,161.6bp (1Y range: 596-1,343bp)

5Y EURO CDS SINGLE NAMES - LARGEST MOVES OVER THE PAST WEEK

- Virgin Media Finance PLC (Country: GB; rated: WR): up 15.5 bp to 313.5bp (1Y range: 222-363bp)

- Premier Foods Finance PLC (Country: GB; rated: B1): up 15.7 bp to 314.8bp (1Y range: 154-365bp)

- TUI AG (Country: DE; rated: B3-PD): up 16.4 bp to 705.1bp (1Y range: 607-946bp)

- Novafives SAS (Country: FR; rated: Caa1): up 19.9 bp to 919.9bp (1Y range: 618-1,342bp)

- UPC Holding BV (Country: NL; rated: LGD6 - 93%): up 20.2 bp to 239.9bp (1Y range: 164-299bp)

- Stonegate Pub Company Financing PLC (Country: GB; rated: WR): up 20.3 bp to 385.3bp (1Y range: 370-564bp)

- Elo SA (Country: FR; rated: ): up 21.5 bp to 182.5bp (1Y range: 83-242bp)

- Altice Finco SA (Country: LU; rated: Caa1): up 28.2 bp to 518.1bp (1Y range: 333-565bp)

- Air France KLM SA (Country: FR; rated: B-): up 31.7 bp to 561.6bp (1Y range: 386-566bp)

- CMA CGM SA (Country: FR; rated: Ba3): up 45.6 bp to 406.0bp (1Y range: 259-469bp)

- Ladbrokes Coral Group Ltd (Country: GB; rated: WR): up 49.7 bp to 281.1bp (1Y range: 107-300bp)

- thyssenkrupp AG (Country: DE; rated: B1): up 55.7 bp to 380.5bp (1Y range: 205-381bp)

- Atlantia SpA (Country: IT; rated: Ba1): up 63.5 bp to 201.8bp (1Y range: 97-208bp)

- Casino Guichard Perrachon SA (Country: FR; rated: WR): up 98.9 bp to 1,042.2bp (1Y range: 464-1,208bp)

TOP BONDS MOVES IN THE PAST WEEK - USD HY

- Issuer: Masonite International Corp (Tampa, Canada) | Coupon: 3.50% | Maturity: 15/2/2030 | Rating: BB+ | ISIN: USC5389UAM20 | Z-spread up by 50.2 bp to 266.4 bp, with the yield to worst at 5.3% and the bond now trading down to 87.5 cents on the dollar (1Y price range: 87.5-99.0).

- Issuer: Century Communities Inc (Greenwood Village, #N/A (US)) | Coupon: 3.88% | Maturity: 15/8/2029 | Rating: BB- | ISIN: USU15662AF37 | Z-spread up by 47.5 bp to 316.3 bp, with the yield to worst at 5.9% and the bond now trading down to 87.6 cents on the dollar (1Y price range: 87.6-101.0).

- Issuer: Taylor Morrison Communities Inc (Scottsdale, Arizona (US)) | Coupon: 5.13% | Maturity: 1/8/2030 | Rating: BB- | ISIN: USU8760NAF60 | Z-spread up by 47.4 bp to 310.4 bp, with the yield to worst at 5.9% and the bond now trading down to 94.8 cents on the dollar (1Y price range: 94.8-109.9).

- Issuer: Yum! Brands Inc (Louisville, Kentucky (US)) | Coupon: 4.75% | Maturity: 15/1/2030 | Rating: BB- | ISIN: USU9T71RAB76 | Z-spread up by 41.2 bp to 273.4 bp (CDS basis: -81.9bp), with the yield to worst at 5.4% and the bond now trading down to 95.0 cents on the dollar (1Y price range: 95.0-108.0).

- Issuer: Block Inc (San Francisco, California (US)) | Coupon: 2.75% | Maturity: 1/6/2026 | Rating: BB | ISIN: USU85223AA03 | Z-spread up by 39.4 bp to 204.7 bp, with the yield to worst at 4.6% and the bond now trading down to 92.0 cents on the dollar (1Y price range: 92.0-100.5).

- Issuer: LGI Homes Inc (The Woodlands, Texas (US)) | Coupon: 4.00% | Maturity: 15/7/2029 | Rating: BB- | ISIN: USU5286JAB53 | Z-spread up by 38.9 bp to 372.4 bp, with the yield to worst at 6.4% and the bond now trading down to 85.5 cents on the dollar (1Y price range: 85.5-99.6).

- Issuer: JBS USA Lux SA (Luxembourg, Luxembourg) | Coupon: 4.38% | Maturity: 2/2/2052 | Rating: BB+ | ISIN: USL56608AH27 | Z-spread down by 34.3 bp to 269.9 bp, with the yield to worst at 5.1% and the bond now trading up to 87.0 cents on the dollar (1Y price range: 82.5-100.0).

- Issuer: Enact Holdings Inc (Raleigh, North Carolina (US)) | Coupon: 6.50% | Maturity: 15/8/2025 | Rating: BB | ISIN: USU3230LAA45 | Z-spread down by 40.7 bp to 261.1 bp (CDS basis: 6.9bp), with the yield to worst at 5.4% and the bond now trading up to 102.5 cents on the dollar (1Y price range: 101.0-109.5).

- Issuer: Goodyear Tire & Rubber Co (Akron, Ohio (US)) | Coupon: 5.00% | Maturity: 15/7/2029 | Rating: B | ISIN: USU38255AN24 | Z-spread down by 45.8 bp to 360.1 bp (CDS basis: 106.3bp), with the yield to worst at 6.3% and the bond now trading up to 91.9 cents on the dollar (1Y price range: 89.5-106.6).

- Issuer: EQM Midstream Partners LP (Canonsburg, Pennsylvania (US)) | Coupon: 6.00% | Maturity: 1/7/2025 | Rating: BB- | ISIN: USU26886AA62 | Z-spread down by 48.9 bp to 289.8 bp, with the yield to worst at 5.4% and the bond now trading up to 100.5 cents on the dollar (1Y price range: 99.0-108.5).

- Issuer: NCL Corporation Ltd (Miami, Bermuda) | Coupon: 5.88% | Maturity: 15/3/2026 | Rating: CCC+ | ISIN: USG6436QAL08 | Z-spread down by 50.0 bp to 472.0 bp, with the yield to worst at 7.3% and the bond now trading up to 94.3 cents on the dollar (1Y price range: 91.0-100.0).

- Issuer: OCP SA (Casablanca, Morocco) | Coupon: 6.88% | Maturity: 25/4/2044 | Rating: BB+ | ISIN: XS1061043367 | Z-spread down by 61.3 bp to 394.1 bp (CDS basis: -247.8bp), with the yield to worst at 6.5% and the bond now trading up to 103.8 cents on the dollar (1Y price range: 98.0-116.3).

TOP BONDS MOVES IN THE PAST WEEK - EUR HY

- Issuer: Adler Group SA (Senningerberg, Luxembourg) | Coupon: 3.25% | Maturity: 5/8/2025 | Rating: B | ISIN: XS2010029663 | Z-spread up by 135.0 bp to 749.0 bp, with the yield to worst at 8.4% and the bond now trading down to 85.3 cents on the dollar (1Y price range: 82.0-91.3).

- Issuer: Adler Group SA (Senningerberg, Luxembourg) | Coupon: 1.88% | Maturity: 14/1/2026 | Rating: B | ISIN: XS2283224231 | Z-spread up by 129.0 bp to 702.7 bp, with the yield to worst at 8.0% and the bond now trading down to 80.5 cents on the dollar (1Y price range: 77.7-86.2).

- Issuer: Telecom Italia Finance SA (Luxembourg, Luxembourg) | Coupon: 7.75% | Maturity: 24/1/2033 | Rating: BB- | ISIN: XS0161100515 | Z-spread down by 62.3 bp to 429.1 bp (CDS basis: 6.1bp), with the yield to worst at 5.5% and the bond now trading up to 116.5 cents on the dollar (1Y price range: 107.7-133.2).

- Issuer: Telecom Italia SpA (Rome, Italy) | Coupon: 2.38% | Maturity: 12/10/2027 | Rating: BB- | ISIN: XS1698218523 | Z-spread down by 78.0 bp to 283.1 bp (CDS basis: 73.5bp), with the yield to worst at 4.0% and the bond now trading up to 92.0 cents on the dollar (1Y price range: 86.4-98.5).

- Issuer: MPT Operating Partnership LP (Birmingham, Alabama (US)) | Coupon: 0.99% | Maturity: 15/10/2026 | Rating: BB+ | ISIN: XS2390849318 | Z-spread down by 78.5 bp to 165.5 bp, with the yield to worst at 2.7% and the bond now trading up to 92.4 cents on the dollar (1Y price range: 92.4-99.4).

- Issuer: Mytilineos Financial Partners SA (Luxembourg, Luxembourg) | Coupon: 2.50% | Maturity: 1/12/2024 | Rating: BB- | ISIN: XS2010038144 | Z-spread down by 92.5 bp to 198.2 bp, with the yield to worst at 2.8% and the bond now trading up to 98.9 cents on the dollar (1Y price range: 95.8-101.9).

- Issuer: Fortune Star (BVI) Ltd (British Virgin Islands) | Coupon: 3.95% | Maturity: 2/10/2026 | Rating: BB- | ISIN: XS2357132849 | Z-spread down by 96.1 bp to 643.5 bp, with the yield to worst at 7.5% and the bond now trading up to 86.9 cents on the dollar (1Y price range: 82.0-95.0).

- Issuer: SoftBank Group Corp (Minato-Ku, Japan) | Coupon: 3.13% | Maturity: 19/9/2025 | Rating: BB- | ISIN: XS1684385161 | Z-spread down by 96.8 bp to 392.0 bp, with the yield to worst at 4.6% and the bond now trading up to 94.4 cents on the dollar (1Y price range: 88.1-100.4).

- Issuer: Saipem Finance International BV (Amsterdam, Netherlands) | Coupon: 3.38% | Maturity: 15/7/2026 | Rating: B+ | ISIN: XS2202907510 | Z-spread down by 98.7 bp to 510.1 bp (CDS basis: 28.1bp), with the yield to worst at 5.8% and the bond now trading up to 89.6 cents on the dollar (1Y price range: 71.8-100.7).

- Issuer: Akropolis Group UAB (Vilnius, Lithuania) | Coupon: 2.88% | Maturity: 2/6/2026 | Rating: BB+ | ISIN: XS2346869097 | Z-spread down by 116.9 bp to 469.3 bp, with the yield to worst at 5.7% and the bond now trading up to 89.5 cents on the dollar (1Y price range: 85.6-95.2).

SELECTED RECENT USD BOND ISSUES

- Ready Capital Corp (Real Estate Investment Trust | New York City, New York, United States | Rating: NR): US$120m Senior Note (US75574UAC53), fixed rate (6.13% coupon) maturing on 30 April 2025, priced at 100.00, callable (3nc3)

- Haitong UT Brilliant Ltd (Financial - Other | China (Mainland) | Rating: NR): US$200m Unsecured Note (XS2461426459), fixed rate (3.00% coupon) maturing on 11 April 2025, priced at 100.00, non callable

- National Australia Bank Ltd (Banking | Melbourne, Victoria, Australia | Rating: A+): US$200m Unsecured Note (XS2469408434) zero coupon maturing on 15 April 2052, priced at 100.00, non callable

SELECTED RECENT EUR BOND ISSUES

- Banco Santander SA (Banking | Boadilla Del Monte, Madrid, Spain | Rating: A): €195m Senior Note (XS2469031400), fixed rate (1.28% coupon) maturing on 30 June 2025, priced at 100.00, non callable

- KfW (Agency | Frankfurt, Germany | Rating: AAA): €235m Unsecured Note (XS2469023134), fixed rate (0.18% coupon) maturing on 19 April 2024, priced at 100.00, non callable

NEW LOANS

- VXI Global Solutions LLC, signed a US$ 615m Term Loan B, maturing on 04/22/29

- SIS, signed a US$ 350m Revolving Credit / Term Loan, to be used for general corporate purposes

- E2open LLC (B), signed a US$ 190m Term Loan, to be used for acquisition financing. It matures on 02/04/28 and initial pricing is set at LIBOR +350.0bp

NEW ISSUES IN SECURITIZED CREDIT

- Freddie Mac Seasoned Credit Risk Transfer Trust Series 2022-1 issued a fixed-rate Agency RMBS in 6 tranches, for a total of US$ 963 m. Highest-rated tranche offering a yield to maturity of 3.06%, and the lowest-rated tranche a yield to maturity of 5.74%. Bookrunners: Citigroup Global Markets Inc, Bank of America Merrill Lynch

- Avis Budget Rental Car Funding LLC Series 2022-1 issued a fixed-rate ABS backed by receivables in 3 tranches, for a total of US$ 660 m. Highest-rated tranche offering a yield to maturity of 3.83%, and the lowest-rated tranche a yield to maturity of 4.84%. Bookrunners: JP Morgan & Co Inc, Barclays Capital Group, SG Americas Securities LLC, Credit Agricole Corporate & Investment Bank, MUFG Securities Americas Inc

- Toyota Auto Receivables 2022-B Owner Trust issued a floating-rate ABS backed by auto receivables in 4 tranches, for a total of US$ 1,239 m. Highest-rated tranche offering a spread over the floating rate of 49bp, and the lowest-rated tranche a spread of 49bp. Bookrunners: Santander Investment Securities Inc, Barclays Capital Group, RBC Capital Markets, MUFG Securities Americas Inc

- PRPM 2022-2 LLC issued a fixed-rate RMBS in 2 tranches, for a total of US$ 267 m. Highest-rated tranche offering a yield to maturity of 5.01%, and the lowest-rated tranche a yield to maturity of 6.90%. Bookrunners: Nomura Securities New York Inc, Goldman Sachs & Co

- BPR 2022-Oana Mortgage Trust issued a floating-rate CMBS in 4 tranches, for a total of US$ 2,274 m. Highest-rated tranche offering a spread over the floating rate of 195bp, and the lowest-rated tranche a spread of 375bp. Bookrunners: Goldman Sachs & Co, Morgan Stanley International Ltd, , JP Morgan & Co Inc, Barclays Capital Group, Deutsche Bank Securities Inc, Citigroup Global Markets Inc, Wells Fargo Securities LLC, Bank of America Merrill Lynch

- Santander Retail Auto Loan Trust 2022-B issued a fixed-rate ABS backed by auto receivables in 4 tranches, for a total of US$ 1,127 m. Highest-rated tranche offering a yield to maturity of 2.84%, and the lowest-rated tranche a yield to maturity of 3.85%. Bookrunners: Santander Investment Securities Inc, RBC Capital Markets, SG Americas Securities LLC

- Ari Fleet Lease Trust Series 2022-A issued a floating-rate ABS backed by auto receivables in 5 tranches, for a total of US$ 601 m. Highest-rated tranche offering a spread over the floating rate of 28bp, and the lowest-rated tranche a spread of 145bp. Bookrunners: JP Morgan & Co Inc, Bank of America Merrill Lynch, Mizuho Securities USA Inc, MUFG Securities Americas Inc