Credit

Pretty Quiet Week In The Primary Market, With Amazon's $12.7bn Jumbo Offering Accounting For 70% Of The Weekly IG Volume

With profit margins and profits as a share of GDP at all-time highs, earnings revisions turning negative, there's a significant chance we'll see further widening of spreads, driven by energy prices, credit deterioration and funding stress for HY issuers rather than the current duration-induced drawdown

Published ET

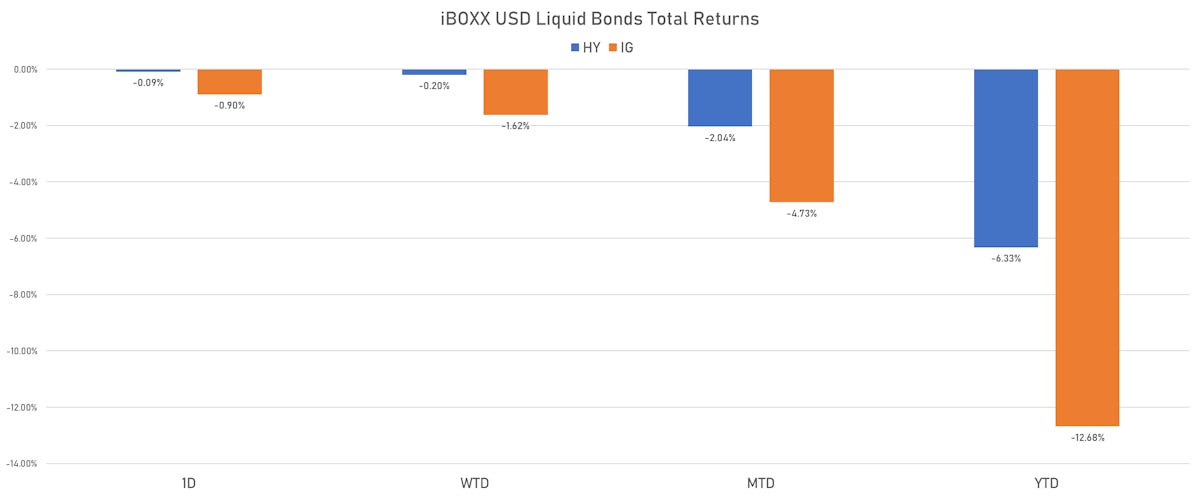

iBOXX USD Liquid Bonds Total Returns | Sources: ϕpost, Refinitiv data

DAILY US SUMMARY

- S&P 500 Bond Index was down -0.67% today, with investment grade down -0.74% and high yield down -0.09% (YTD total return: -10.46%)

- The iBoxx USD Liquid Investment Grade Total Return Index was down -0.896% today (Month-to-date: -4.73%; Year-to-date: -12.68%)

- The iBoxx USD Liquid High Yield Total Return Index was down -0.089% today (Month-to-date: -2.04%; Year-to-date: -6.33%)

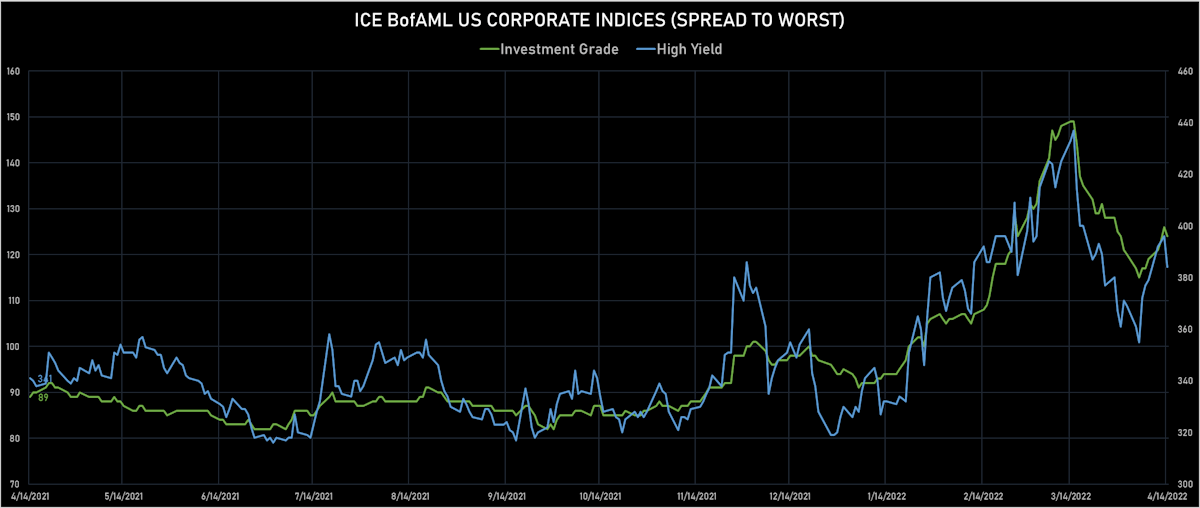

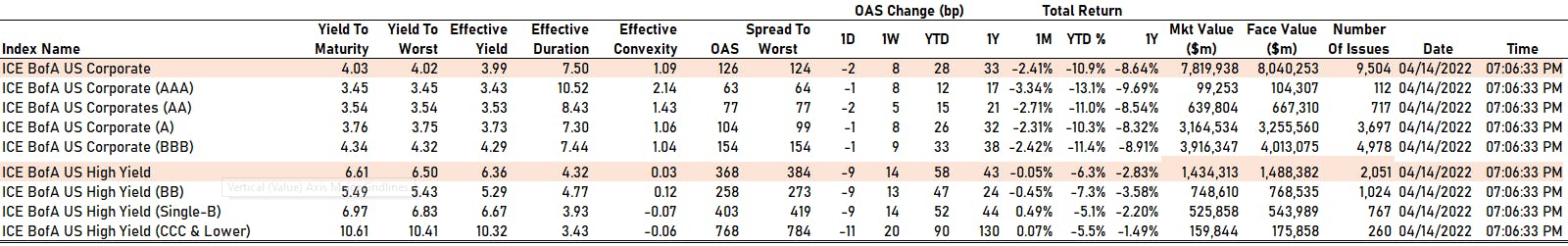

- ICE BofA US Corporate Index (Investment Grade) spread to worst down -2.0 bp, now at 124.0 bp (YTD change: +29.0 bp)

- ICE BofA US High Yield Index spread to worst down -12.0 bp, now at 384.0 bp (YTD change: +54.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index up 0.01% today (YTD total return: +0.2%)

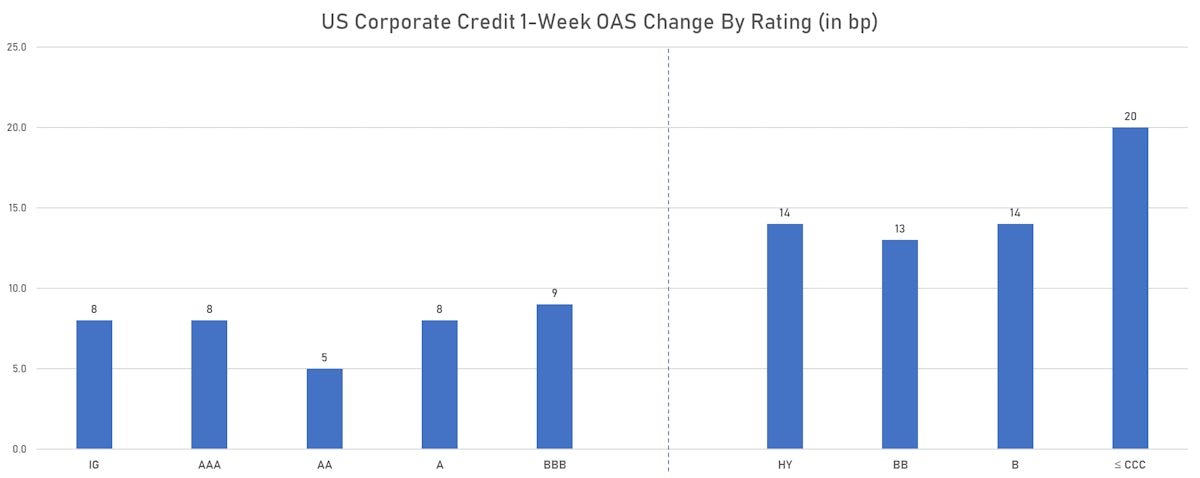

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING

- AAA down by -1 bp at 63 bp

- AA down by -2 bp at 77 bp

- A down by -1 bp at 104 bp

- BBB down by -1 bp at 154 bp

- BB down by -9 bp at 258 bp

- B down by -9 bp at 403 bp

- CCC down by -11 bp at 768 bp

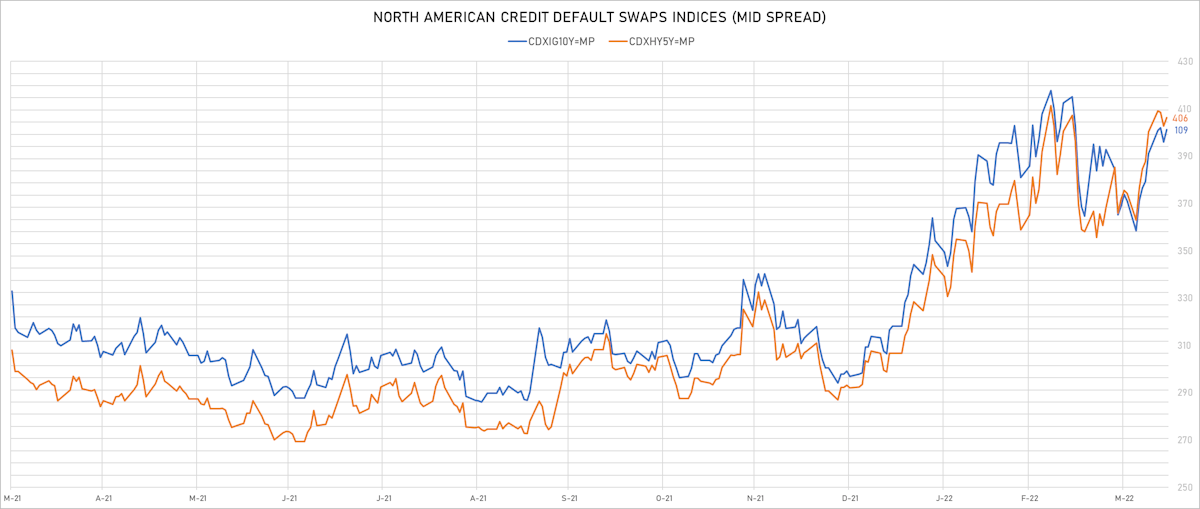

CDS INDICES (mid-spreads)

- Markit CDX.NA.IG 5Y up 1.1 bp, now at 73bp (YTD change: +23.3bp)

- Markit CDX.NA.IG 10Y up 1.0 bp, now at 109bp (YTD change: +20.3bp)

- Markit CDX.NA.HY 5Y up 3.5 bp, now at 406bp (YTD change: +114.2bp)

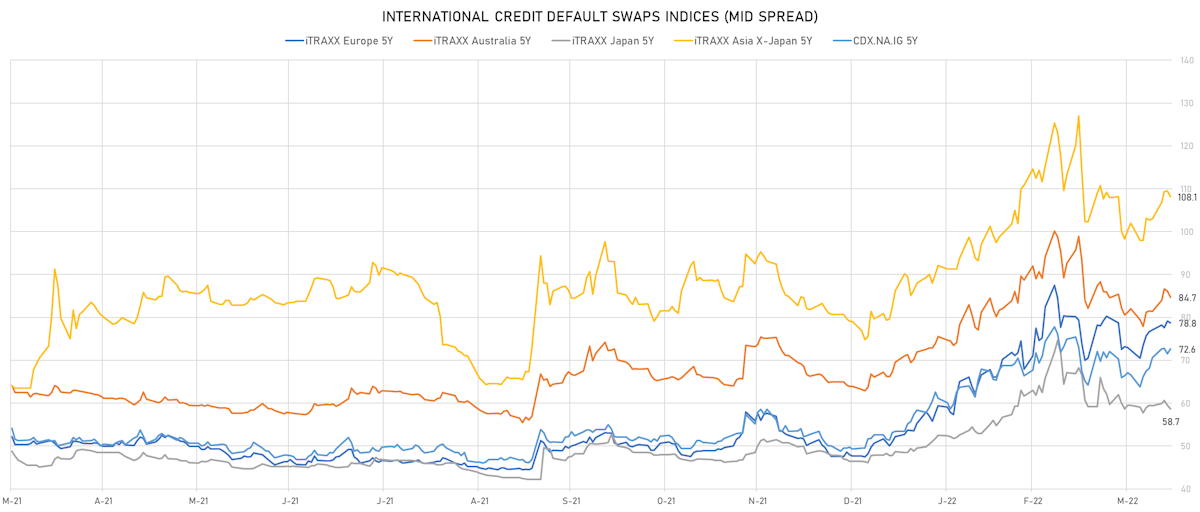

- Markit iTRAXX Europe 5Y down 0.4 bp, now at 79bp (YTD change: +31.1bp)

- Markit iTRAXX Europe Crossover 5Y down 4.2 bp, now at 374bp (YTD change: +131.8bp)

- Markit iTRAXX Japan 5Y down 0.8 bp, now at 59bp (YTD change: +12.3bp)

- Markit iTRAXX Asia Ex-Japan 5Y down 1.4 bp, now at 108bp (YTD change: +29.1bp)

5Y USD CDS SINGLE NAMES - LARGEST MOVES OVER THE PAST WEEK

- American Airlines Group Inc (Country: US; rated: B2): down 167.5 bp to 991.5bp (1Y range: 596-1,343bp)

- Olin Corp (Country: US; rated: WR): down 16.3 bp to 221.8bp (1Y range: 130-276bp)

- Navient Corp (Country: US; rated: Ba3): up 14.7 bp to 449.8bp (1Y range: -450bp)

- Ford Motor Credit Company LLC (Country: US; rated: NP): up 15.6 bp to 263.0bp (1Y range: 128-270bp)

- KB Home (Country: US; rated: Ba2): up 15.8 bp to 324.8bp (1Y range: 138-346bp)

- Amkor Technology Inc (Country: US; rated: BB): up 18.9 bp to 250.4bp (1Y range: 109-296bp)

- Onemain Finance Corp (Country: US; rated: Ba2): up 21.7 bp to 371.6bp (1Y range: 121-1,042bp)

- Pitney Bowes Inc (Country: US; rated: B1): up 23.3 bp to 755.8bp (1Y range: 363-756bp)

- Gap Inc (Country: US; rated: WR): up 34.0 bp to 404.0bp (1Y range: 132-404bp)

- American Axle & Manufacturing Inc (Country: US; rated: LGD2 - 20%): up 34.1 bp to 600.7bp (1Y range: 355-601bp)

- Realogy Group LLC (Country: US; rated: WR): up 35.9 bp to 516.2bp (1Y range: 278-516bp)

- Transocean Inc (Country: KY; rated: Caa3): up 83.4 bp to 1,453.8bp (1Y range: 941-1,784bp)

5Y EURO CDS SINGLE NAMES - LARGEST MOVES OVER THE PAST WEEK

- Stonegate Pub Company Financing PLC (Country: GB; rated: WR): up 15.3 bp to 400.6bp (1Y range: 370-564bp)

- Ladbrokes Coral Group Ltd (Country: GB; rated: WR): up 15.4 bp to 296.6bp (1Y range: 107-300bp)

- Louis Dreyfus Co BV (Country: NL; rated: ): up 17.0 bp to 220.2bp (1Y range: -220bp)

- Rolls-Royce PLC (Country: GB; rated: BB-): up 19.8 bp to 276.0bp (1Y range: 161-306bp)

- Atlantia SpA (Country: IT; rated: Ba1): up 20.2 bp to 222.0bp (1Y range: 97-222bp)

- CMA CGM SA (Country: FR; rated: Ba3): up 21.9 bp to 427.9bp (1Y range: 259-469bp)

- TUI AG (Country: DE; rated: B3-PD): up 22.5 bp to 727.6bp (1Y range: 607-942bp)

- Iceland Bondco PLC (Country: GB; rated: LGD3 - 46%): up 24.7 bp to 707.3bp (1Y range: 417-707bp)

- Jaguar Land Rover Automotive PLC (Country: GB; rated: WD): up 31.9 bp to 584.8bp (1Y range: 339-609bp)

- UPC Holding BV (Country: NL; rated: LGD6 - 93%): up 32.6 bp to 272.4bp (1Y range: 164-299bp)

- Air France KLM SA (Country: FR; rated: B-): up 33.2 bp to 594.8bp (1Y range: 386-595bp)

- Novafives SAS (Country: FR; rated: Caa1): up 35.8 bp to 955.7bp (1Y range: 618-1,342bp)

TOP BONDS MOVES IN THE PAST WEEK - USD HY

- Issuer: Western Global Airlines LLC (Estero, Florida (US)) | Coupon: 10.38% | Maturity: 15/8/2025 | Rating: B- | ISIN: USU95558AA72 | Z-spread up by 124.6 bp to 640.3 bp, with the yield to worst at 8.6% and the bond now trading down to 103.5 cents on the dollar (1Y price range: 103.5-111.3).

- Issuer: Taylor Morrison Communities Inc (Scottsdale, Arizona (US)) | Coupon: 5.63% | Maturity: 1/3/2024 | Rating: BB- | ISIN: USU87286AD91 | Z-spread up by 42.7 bp to 238.2 bp, with the yield to worst at 4.8% and the bond now trading down to 101.0 cents on the dollar (1Y price range: 101.0-106.5).

- Issuer: WeWork Companies Inc (New York City, New York (US)) | Coupon: 7.88% | Maturity: 1/5/2025 | Rating: CCC- | ISIN: USU96217AA99 | Z-spread up by 41.8 bp to 1,071.7 bp, with the yield to worst at 12.7% and the bond now trading down to 87.3 cents on the dollar (1Y price range: 84.5-96.5).

- Issuer: Xerox Holdings Corp (Norwalk, Connecticut (US)) | Coupon: 5.00% | Maturity: 15/8/2025 | Rating: BB | ISIN: USU98401AA75 | Z-spread up by 40.8 bp to 292.6 bp, with the yield to worst at 5.3% and the bond now trading down to 98.0 cents on the dollar (1Y price range: 97.0-105.7).

- Issuer: WeWork Companies LLC (New York City, New York (US)) | Coupon: 5.00% | Maturity: 10/7/2025 | Rating: CCC- | ISIN: USU9621PAA94 | Z-spread up by 40.6 bp to 915.3 bp, with the yield to worst at 11.5% and the bond now trading down to 82.0 cents on the dollar (1Y price range: 77.4-84.9).

- Issuer: Necessity Retail REIT Inc (New York City, New York (US)) | Coupon: 4.50% | Maturity: 30/9/2028 | Rating: BB+ | ISIN: USU0262AAA52 | Z-spread up by 40.4 bp to 426.3 bp, with the yield to worst at 6.8% and the bond now trading down to 87.1 cents on the dollar (1Y price range: 87.0-100.4).

- Issuer: Owens-Brockway Glass Container Inc (Perrysburg, Ohio (US)) | Coupon: 5.88% | Maturity: 15/8/2023 | Rating: B- | ISIN: USU68337AK75 | Z-spread up by 39.1 bp to 290.6 bp, with the yield to worst at 4.5% and the bond now trading down to 100.8 cents on the dollar (1Y price range: 100.4-104.6).

- Issuer: MGM Growth Properties Operating Partnership LP (Las Vegas, Nevada (US)) | Coupon: 4.63% | Maturity: 15/6/2025 | Rating: B+ | ISIN: USU5930BAD83 | Z-spread up by 37.2 bp to 219.4 bp, with the yield to worst at 4.8% and the bond now trading down to 99.0 cents on the dollar (1Y price range: 98.8-106.5).

- Issuer: Sensata Technologies BV (Almelo, Netherlands) | Coupon: 4.88% | Maturity: 15/10/2023 | Rating: BB- | ISIN: USN78840AH33 | Z-spread up by 36.2 bp to 186.5 bp, with the yield to worst at 4.0% and the bond now trading down to 100.8 cents on the dollar (1Y price range: 100.4-105.1).

- Issuer: Nextera Energy Operating Partners LP (Juno Beach, Florida (US)) | Coupon: 3.88% | Maturity: 15/10/2026 | Rating: BB | ISIN: USU6500TAG05 | Z-spread up by 35.2 bp to 231.8 bp, with the yield to worst at 4.9% and the bond now trading down to 95.3 cents on the dollar (1Y price range: 95.2-106.0).

- Issuer: NCL Corporation Ltd (Miami, Bermuda) | Coupon: 5.88% | Maturity: 15/3/2026 | Rating: CCC+ | ISIN: USG6436QAL08 | Z-spread up by 33.6 bp to 517.6 bp, with the yield to worst at 7.6% and the bond now trading down to 93.3 cents on the dollar (1Y price range: 91.0-100.0).

- Issuer: Enact Holdings Inc (Raleigh, North Carolina (US)) | Coupon: 6.50% | Maturity: 15/8/2025 | Rating: BB | ISIN: USU3230LAA45 | Z-spread up by 32.2 bp to 301.8 bp (CDS basis: -34.3bp), with the yield to worst at 5.7% and the bond now trading down to 101.8 cents on the dollar (1Y price range: 100.5-109.5).

- Issuer: Brinker International Inc (Coppell, Texas (US)) | Coupon: 5.00% | Maturity: 1/10/2024 | Rating: B+ | ISIN: USU6223WAB01 | Z-spread up by 31.6 bp to 224.6 bp, with the yield to worst at 5.0% and the bond now trading down to 100.0 cents on the dollar (1Y price range: 98.8-106.8).

- Issuer: Twitter Inc (San Francisco, California (US)) | Coupon: 3.88% | Maturity: 15/12/2027 | Rating: BB | ISIN: USU8882PAA58 | Z-spread down by 33.8 bp to 177.0 bp, with the yield to worst at 4.3% and the bond now trading up to 96.8 cents on the dollar (1Y price range: 93.8-103.9).

- Issuer: American Airlines Group Inc (Fort Worth, Texas (US)) | Coupon: 3.75% | Maturity: 1/3/2025 | Rating: CCC | ISIN: USU0242AAD47 | Z-spread down by 42.9 bp to 491.8 bp (CDS basis: 418.5bp), with the yield to worst at 7.5% and the bond now trading up to 90.3 cents on the dollar (1Y price range: 83.5-95.6).

TOP BONDS MOVES IN THE PAST WEEK - EUR HY

- Issuer: Adler Group SA (Senningerberg, Luxembourg) | Coupon: 1.88% | Maturity: 14/1/2026 | Rating: B | ISIN: XS2283224231 | Z-spread up by 121.3 bp to 836.9 bp, with the yield to worst at 9.3% and the bond now trading down to 77.0 cents on the dollar (1Y price range: 76.8-86.2).

- Issuer: Adler Group SA (Senningerberg, Luxembourg) | Coupon: 3.25% | Maturity: 5/8/2025 | Rating: B | ISIN: XS2010029663 | Z-spread up by 109.0 bp to 871.6 bp, with the yield to worst at 9.6% and the bond now trading down to 82.4 cents on the dollar (1Y price range: 82.0-91.3).

- Issuer: Vivion Investments SARL (Luxembourg, Luxembourg) | Coupon: 3.50% | Maturity: 1/11/2025 | Rating: BB+ | ISIN: XS2070311431 | Z-spread up by 97.9 bp to 541.9 bp, with the yield to worst at 5.8% and the bond now trading down to 90.7 cents on the dollar (1Y price range: 89.3-99.2).

- Issuer: Adler Real Estate AG (Berlin, Germany) | Coupon: 3.00% | Maturity: 27/4/2026 | Rating: B | ISIN: XS1713464524 | Z-spread up by 66.0 bp to 586.4 bp, with the yield to worst at 6.8% and the bond now trading down to 86.4 cents on the dollar (1Y price range: 85.3-94.5).

- Issuer: Adient Global Holdings Ltd (Saint Helier, Jersey) | Coupon: 3.50% | Maturity: 15/8/2024 | Rating: B- | ISIN: XS1468662801 | Z-spread up by 63.1 bp to 441.6 bp, with the yield to worst at 5.1% and the bond now trading down to 96.4 cents on the dollar (1Y price range: 95.4-101.5).

- Issuer: Rolls-Royce PLC (Birmingham, United Kingdom) | Coupon: 0.88% | Maturity: 9/5/2024 | Rating: BB- | ISIN: XS1819575066 | Z-spread up by 61.9 bp to 186.6 bp (CDS basis: -53.1bp), with the yield to worst at 2.4% and the bond now trading down to 96.6 cents on the dollar (1Y price range: 95.2-99.1).

- Issuer: Telecom Italia SpA (Rome, Italy) | Coupon: 4.00% | Maturity: 11/4/2024 | Rating: BB- | ISIN: XS1935256369 | Z-spread up by 60.9 bp to 248.6 bp (CDS basis: -108.3bp), with the yield to worst at 2.9% and the bond now trading down to 101.5 cents on the dollar (1Y price range: 98.8-105.2).

- Issuer: Saipem Finance International BV (Amsterdam, Netherlands) | Coupon: 3.38% | Maturity: 15/7/2026 | Rating: B+ | ISIN: XS2202907510 | Z-spread up by 53.0 bp to 545.8 bp (CDS basis: 23.8bp), with the yield to worst at 6.2% and the bond now trading down to 88.4 cents on the dollar (1Y price range: 71.8-100.7).

- Issuer: Jaguar Land Rover Automotive PLC (Coventry, United Kingdom) | Coupon: 2.20% | Maturity: 15/1/2024 | Rating: B+ | ISIN: XS1551347393 | Z-spread up by 44.3 bp to 453.8 bp (CDS basis: -19.2bp), with the yield to worst at 4.4% and the bond now trading down to 95.4 cents on the dollar (1Y price range: 94.8-99.3).

- Issuer: Fortune Star (BVI) Ltd (British Virgin Islands) | Coupon: 3.95% | Maturity: 2/10/2026 | Rating: BB- | ISIN: XS2357132849 | Z-spread up by 41.7 bp to 672.6 bp, with the yield to worst at 7.9% and the bond now trading down to 85.8 cents on the dollar (1Y price range: 82.0-95.0).

- Issuer: BPER Banca SpA (Modena, Italy) | Coupon: 1.88% | Maturity: 7/7/2025 | Rating: BB- | ISIN: XS2190502323 | Z-spread down by 46.0 bp to 163.8 bp, with the yield to worst at 2.5% and the bond now trading up to 97.5 cents on the dollar (1Y price range: 97.0-101.9).

SELECTED RECENT USD BOND ISSUES

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$160m Bond (US3133ENUZ14), fixed rate (3.09% coupon) maturing on 20 October 2025, priced at 100.00 (original spread of 227 bp), callable (4nc3m)

- Oscar Acquisition co LLC (Financial - Other | Rating: B): US$585m Senior Note (US687785AB10), fixed rate (9.50% coupon) maturing on 15 April 2030, priced at 92.19 (original spread of 825 bp), callable (8nc3)

- SELECTED RECENT EUR BOND ISSUES

- Muhu Capital SA (Financial - Other | Strassen, Netherlands | Rating: NR): €398m Bond (XS2352522440), fixed rate (5.01% coupon) maturing on 31 December 2200, priced at 100.00, non callable

NEW LOANS

- Boliden Mineral AB, signed a € 450m Revolving Credit Facility maturing 04/14/27, to be used for general corporate purposes

- Boliden Mineral AB, signed a € 400m Revolving Credit Facility maturing 04/14/25, to be used for general corporate purposes

NEW ISSUES IN SECURITIZED CREDIT

- Goodleap Sustainable Home Solutions Trust 2022-2 issued a fixed-rate ABS backed by certificates in 3 tranches, for a total of US$ 356 m. Highest-rated tranche offering a yield to maturity of 4.00%, and the lowest-rated tranche a yield to maturity of 5.50%. Bookrunners: Credit Suisse, Goldman Sachs & Co

- Barclays Dryrock Issuance Trust 2022-1 issued a fixed-rate ABS backed by receivables in 1 tranche offering a yield to maturity of 3.07%, for a total of US$ 725 m. Bookrunners: Barclays Capital Group

- Freddie Mac Spc Series K-J39 issued a fixed-rate Agency CMBS in 2 tranches, for a total of US$ 245 m. Highest-rated tranche offering a yield to maturity of 2.75%, and the lowest-rated tranche a yield to maturity of 3.16%. Bookrunners: Morgan Stanley International Ltd, Bank of America Merrill Lynch

- Mulcair Securities No.3 Dac issued a floating-rate RMBS in 5 tranches, for a total of € 352 m. Highest-rated tranche offering a spread over the floating rate of 95bp, and the lowest-rated tranche a spread of 200bp. Bookrunners: Standard Chartered Bank AG, BNP Paribas SA, Citigroup Global Markets Inc