Credit

With The Exception Of Single-Bs, US Corporate Cash Spreads Were Modestly Wider This Week

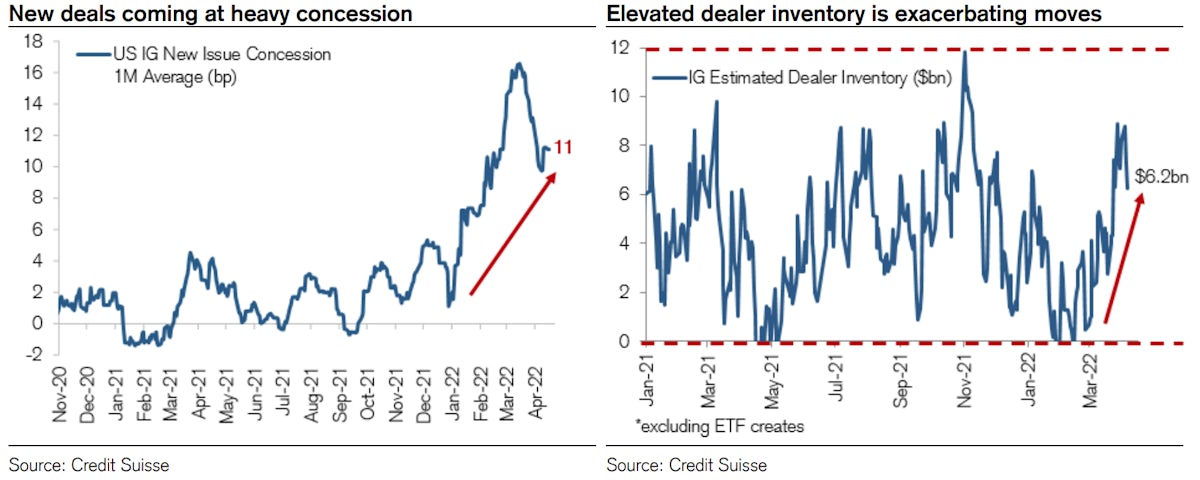

IG corporate bonds issuance remains heavy YTD, as companies look to frontload funding ahead of further monetary policy normalization; this week saw 46 tranches for $55.1bn in IG (2022 YTD volume $567.5bn vs 2021 YTD $568.6bn), 2 tranches for $900m in HY (2022 YTD volume $49.6bn vs 2021 YTD $190.2bn)

Published ET

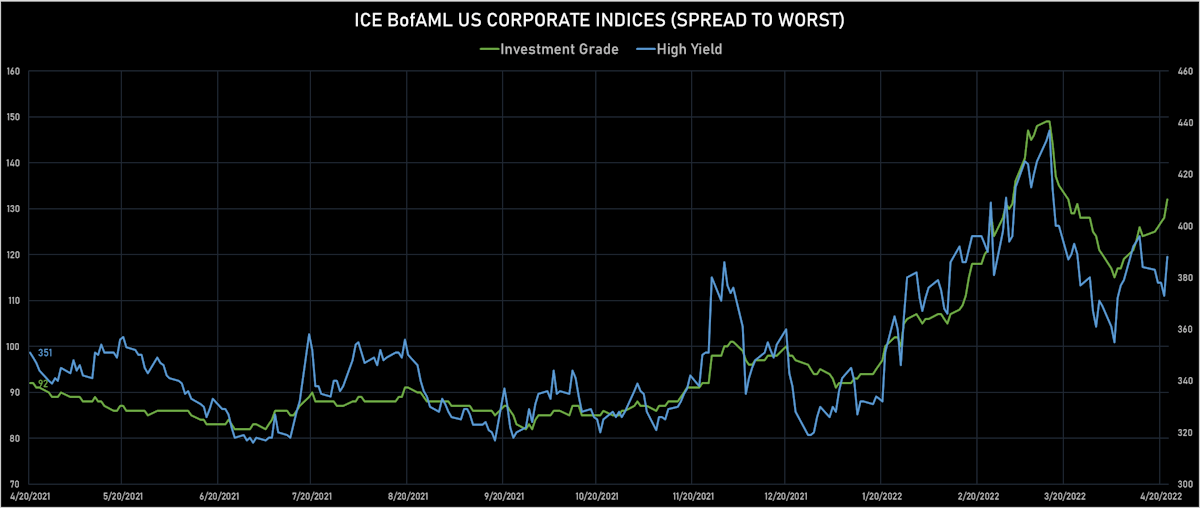

US corporate IG spreads widening with heavy issuance and limited investor appetite (high rates volatility) | Source: Credit Suisse

DAILY SUMMARY

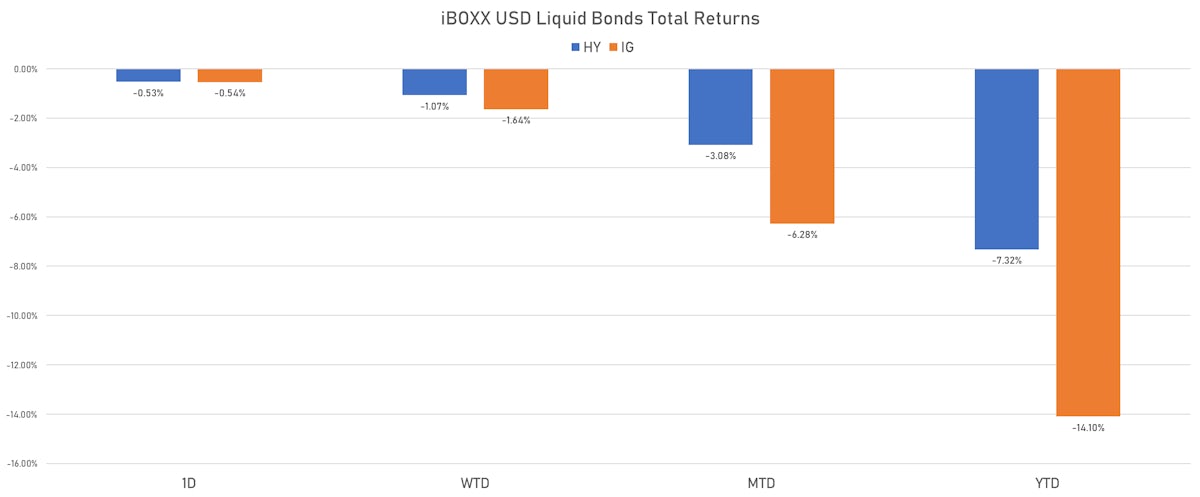

- S&P 500 Bond Index was down -0.46% to end the week, with investment grade down -0.45% and high yield down -0.58% (YTD total return: -11.49%)

- The iBoxx USD Liquid Investment Grade Total Return Index was down -0.535% today (Month-to-date: -6.28%; Year-to-date: -14.10%)

- The iBoxx USD Liquid High Yield Total Return Index was down -0.527% today (Month-to-date: -3.08%; Year-to-date: -7.32%)

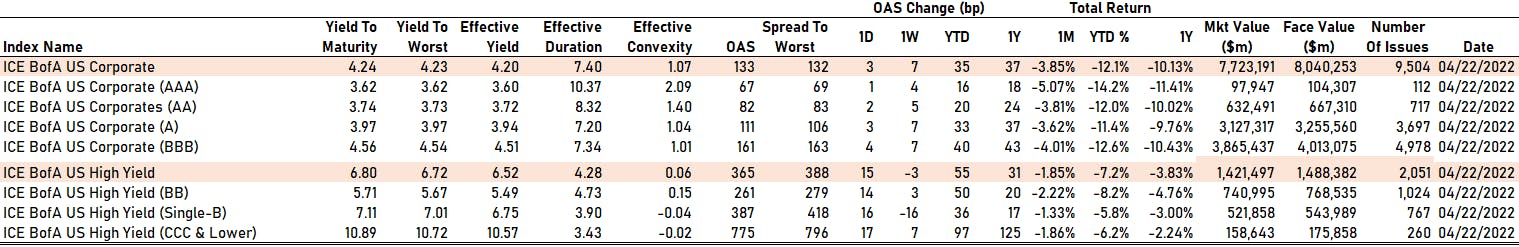

- ICE BofA US Corporate Index (Investment Grade) spread to worst up 4.0 bp, now at 132.0 bp (YTD change: +37.0 bp)

- ICE BofA US High Yield Index spread to worst up 15.0 bp, now at 388.0 bp (YTD change: +58.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index down -0.06% today (YTD total return: +0.2%)

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING

- AAA up by 1 bp at 67 bp

- AA up by 2 bp at 82 bp

- A up by 3 bp at 111 bp

- BBB up by 4 bp at 161 bp

- BB up by 14 bp at 261 bp

- B up by 16 bp at 387 bp

- CCC up by 17 bp at 775 bp

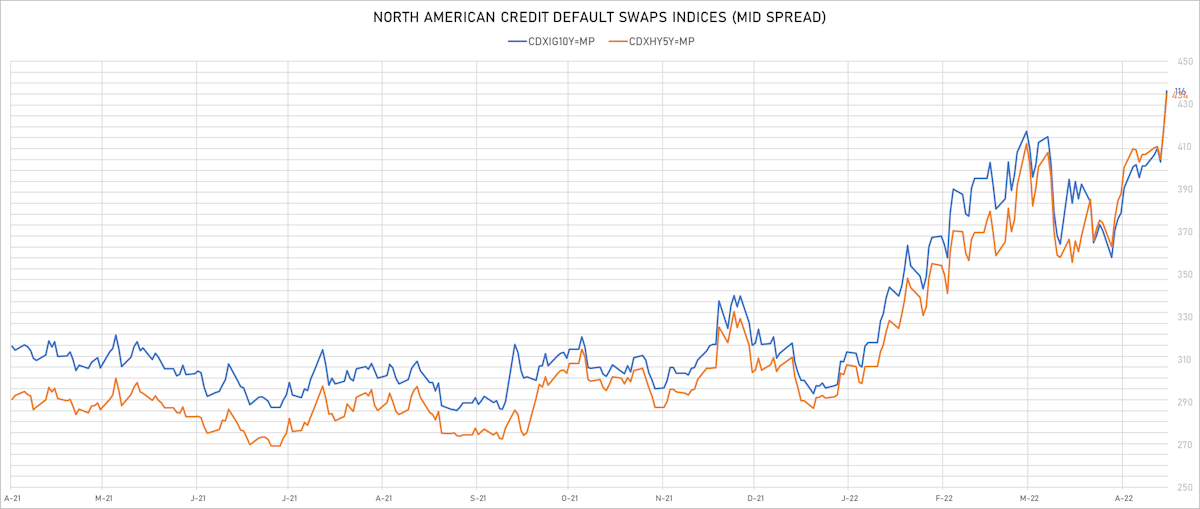

CDS INDICES (mid-spreads)

- Markit CDX.NA.IG 5Y up 3.5 bp, now at 79bp (YTD change: +30.1bp)

- Markit CDX.NA.IG 10Y up 3.5 bp, now at 116bp (YTD change: +27.2bp)

- Markit CDX.NA.HY 5Y up 16.4 bp, now at 434bp (YTD change: +142.5bp)

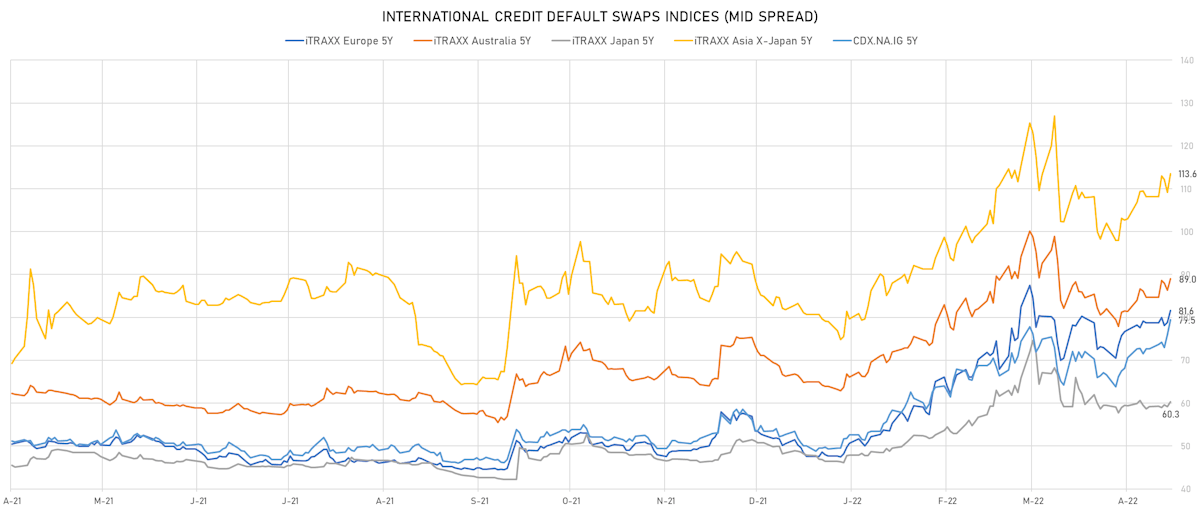

- Markit iTRAXX Europe 5Y up 2.8 bp, now at 82bp (YTD change: +33.9bp)

- Markit iTRAXX Europe Crossover 5Y up 13.5 bp, now at 387bp (YTD change: +144.8bp)

- Markit iTRAXX Japan 5Y up 1.1 bp, now at 60bp (YTD change: +13.9bp)

- Markit iTRAXX Asia Ex-Japan 5Y up 4.4 bp, now at 114bp (YTD change: +34.5bp)

5Y USD CDS SINGLE NAMES - LARGEST MOVES OVER THE PAST WEEK

- American Airlines Group Inc (Country: US; rated: B2): down 108.1 bp to 883.4bp (1Y range: 596-1,343bp)

- Staples Inc (Country: US; rated: B3): down 28.2 bp to 1,183.5bp (1Y range: 695-1,386bp)

- Bath & Body Works Inc (Country: US; rated: Ba2): down 24.2 bp to 281.7bp (1Y range: 124-401bp)

- Unisys Corp (Country: US; rated: B1): up 24.2 bp to 337.4bp (1Y range: 168-337bp)

- Calpine Corp (Country: US; rated: LGD5 - 88%): up 24.5 bp to 437.4bp (1Y range: 284-462bp)

- Onemain Finance Corp (Country: US; rated: Ba2): up 25.0 bp to 396.5bp (1Y range: 121-1,042bp)

- Tegna Inc (Country: US; rated: Ba3): up 27.2 bp to 561.8bp (1Y range: 182-562bp)

- Gap Inc (Country: US; rated: WR): up 29.7 bp to 433.7bp (1Y range: 132-434bp)

- Egypt, Arab Republic of (Government) (Country: EG; rated: Ba2): up 31.3 bp to 628.4bp (1Y range: 342-981bp)

- HCA Inc (Country: US; rated: Baa3): up 31.7 bp to 163.2bp (1Y range: 76-163bp)

- iStar Inc (Country: US; rated: WR): up 31.8 bp to 312.3bp (1Y range: 199-324bp)

- Petroleos Mexicanos (Country: MX; rated: BBB+): up 35.4 bp to 419.2bp (1Y range: 302-423bp)

- Xerox Corp (Country: US; rated: Ba2): up 39.4 bp to 418.8bp (1Y range: 185-419bp)

- Pitney Bowes Inc (Country: US; rated: B1): up 102.6 bp to 858.4bp (1Y range: 363-858bp)

5Y EURO CDS SINGLE NAMES - LARGEST MOVES OVER THE PAST WEEK

- Boparan Finance PLC (Country: GB; rated: B3): down 66.9 bp to 1,696.7bp (1Y range: 716-2,690bp)

- Casino Guichard Perrachon SA (Country: FR; rated: WR): down 65.1 bp to 1,079.0bp (1Y range: 464-1,240bp)

- Stena AB (Country: SE; rated: B2-PD): down 31.3 bp to 488.8bp (1Y range: 401-598bp)

- Atlantia SpA (Country: IT; rated: Ba1): down 20.5 bp to 201.5bp (1Y range: 97-220bp)

- Banca Monte dei Paschi di Siena SpA (Country: IT; rated: PNP): down 11.5 bp to 432.6bp (1Y range: 145-605bp)

- TUI AG (Country: DE; rated: B3-PD): down 10.3 bp to 717.3bp (1Y range: 607-942bp)

- Elo SA (Country: FR; rated: ): up 8.1 bp to 196.0bp (1Y range: 83-242bp)

- Marks and Spencer PLC (Country: GB; rated: Ba1): up 9.5 bp to 264.1bp (1Y range: 139-269bp)

- ITV PLC (Country: GB; rated: WR): up 10.4 bp to 150.9bp (1Y range: 99-189bp)

- Renault SA (Country: FR; rated: Ba2): up 10.4 bp to 351.0bp (1Y range: 166-361bp)

- Public Power Corporation Finance PLC (Country: GB; rated: ): up 10.5 bp to 158.0bp (1Y range: 158-550bp)

- Virgin Media Finance PLC (Country: GB; rated: WR): up 10.8 bp to 335.3bp (1Y range: 222-363bp)

- UPC Holding BV (Country: NL; rated: LGD6 - 93%): up 13.0 bp to 285.4bp (1Y range: 164-299bp)

- Jaguar Land Rover Automotive PLC (Country: GB; rated: WD): up 20.6 bp to 605.4bp (1Y range: 339-609bp)

- Iceland Bondco PLC (Country: GB; rated: LGD3 - 46%): up 22.7 bp to 730.0bp (1Y range: 418-730bp)

TOP BONDS MOVES IN THE PAST WEEK - USD HY

- Issuer: Terraform Power Operating LLC (New York City, New York (US)) | Coupon: 5.00% | Maturity: 31/1/2028 | Rating: BB- | ISIN: USU8812LAE12 | Z-spread up by 52.7 bp to 321.3 bp, with the yield to worst at 6.0% and the bond now trading down to 94.0 cents on the dollar (1Y price range: 94.0-106.3).

- Issuer: Wynn Las Vegas LLC (Las Vegas, Nevada (US)) | Coupon: 5.25% | Maturity: 15/5/2027 | Rating: B | ISIN: USU98347AL87 | Z-spread up by 35.6 bp to 388.0 bp, with the yield to worst at 6.7% and the bond now trading down to 93.0 cents on the dollar (1Y price range: 93.0-102.8).

- Issuer: Xerox Holdings Corp (Norwalk, Connecticut (US)) | Coupon: 5.50% | Maturity: 15/8/2028 | Rating: BB | ISIN: USU98401AD15 | Z-spread up by 30.9 bp to 419.9 bp, with the yield to worst at 7.0% and the bond now trading down to 91.5 cents on the dollar (1Y price range: 91.3-105.5).

- Issuer: Continental Resources Inc (Oklahoma City, Oklahoma (US)) | Coupon: 5.75% | Maturity: 15/1/2031 | Rating: BB+ | ISIN: USU21180AG60 | Z-spread up by 29.2 bp to 226.3 bp, with the yield to worst at 5.2% and the bond now trading down to 103.1 cents on the dollar (1Y price range: 103.1-117.6).

- Issuer: EQT Corp (Pittsburgh, Pennsylvania (US)) | Coupon: 3.63% | Maturity: 15/5/2031 | Rating: BB+ | ISIN: USU2689EAB66 | Z-spread up by 28.4 bp to 196.0 bp, with the yield to worst at 4.8% and the bond now trading down to 90.4 cents on the dollar (1Y price range: 90.4-103.9).

- Issuer: Nextera Energy Operating Partners LP (Juno Beach, Florida (US)) | Coupon: 3.88% | Maturity: 15/10/2026 | Rating: BB | ISIN: USU6500TAG05 | Z-spread down by 28.3 bp to 187.7 bp, with the yield to worst at 4.8% and the bond now trading up to 95.8 cents on the dollar (1Y price range: 95.2-106.0).

- Issuer: Compass Minerals International Inc (Overland Park, Kansas (US)) | Coupon: 4.88% | Maturity: 15/7/2024 | Rating: B+ | ISIN: USU2036YAC04 | Z-spread down by 30.4 bp to 248.9 bp, with the yield to worst at 5.1% and the bond now trading up to 98.6 cents on the dollar (1Y price range: 98.4-102.8).

- Issuer: American Airlines Group Inc (Fort Worth, Texas (US)) | Coupon: 3.75% | Maturity: 1/3/2025 | Rating: CCC | ISIN: USU0242AAD47 | Z-spread down by 33.0 bp to 458.9 bp (CDS basis: 257.2bp), with the yield to worst at 7.4% and the bond now trading up to 90.5 cents on the dollar (1Y price range: 83.5-95.6).

- Issuer: Owens-Brockway Glass Container Inc (Perrysburg, Ohio (US)) | Coupon: 5.38% | Maturity: 15/1/2025 | Rating: B- | ISIN: USU6S19GAC10 | Z-spread down by 34.7 bp to 290.4 bp, with the yield to worst at 5.5% and the bond now trading up to 98.8 cents on the dollar (1Y price range: 98.0-104.1).

- Issuer: Western Global Airlines LLC (Estero, Florida (US)) | Coupon: 10.38% | Maturity: 15/8/2025 | Rating: B- | ISIN: USU95558AA72 | Z-spread down by 36.8 bp to 592.8 bp, with the yield to worst at 8.5% and the bond now trading up to 103.9 cents on the dollar (1Y price range: 103.5-111.3).

- Issuer: Bath & Body Works Inc (Columbus, Ohio (US)) | Coupon: 9.38% | Maturity: 1/7/2025 | Rating: BB | ISIN: USU51407AD34 | Z-spread down by 41.4 bp to 191.4 bp, with the yield to worst at 4.8% and the bond now trading up to 113.0 cents on the dollar (1Y price range: 112.3-122.3).

- Issuer: Firstenergy Transmission LLC (Fairmont, West Virginia (US)) | Coupon: 4.35% | Maturity: 15/1/2025 | Rating: BB+ | ISIN: USU3200VAB63 | Z-spread down by 41.6 bp to 112.5 bp (CDS basis: -63.7bp), with the yield to worst at 4.2% and the bond now trading up to 100.2 cents on the dollar (1Y price range: 99.7-106.4).

- Issuer: MGM Growth Properties Operating Partnership LP (Las Vegas, Nevada (US)) | Coupon: 4.63% | Maturity: 15/6/2025 | Rating: BB- | ISIN: USU5930BAD83 | Z-spread down by 58.6 bp to 148.8 bp, with the yield to worst at 4.4% and the bond now trading up to 100.0 cents on the dollar (1Y price range: 98.8-106.5).

TOP BONDS MOVES IN THE PAST WEEK - EUR HY

- Issuer: Ceconomy AG (Dusseldorf, Germany) | Coupon: 1.75% | Maturity: 24/6/2026 | Rating: BB+ | ISIN: XS2356316872 | Z-spread up by 31.3 bp to 350.5 bp (CDS basis: -78.7bp), with the yield to worst at 4.7% and the bond now trading down to 88.6 cents on the dollar (1Y price range: 88.5-98.3).

- Issuer: Bulgarian Energy Holding EAD (Sofia, Bulgaria) | Coupon: 3.50% | Maturity: 28/6/2025 | Rating: BB | ISIN: XS1839682116 | Z-spread up by 31.0 bp to 384.2 bp (CDS basis: -335.1bp), with the yield to worst at 4.9% and the bond now trading down to 95.6 cents on the dollar (1Y price range: 95.3-106.1).

- Issuer: Petroleos Mexicanos (Miguel Hidalgo, Mexico) | Coupon: 4.75% | Maturity: 26/2/2029 | Rating: BB- | ISIN: XS1824424706 | Z-spread up by 29.8 bp to 515.7 bp (CDS basis: -96.1bp), with the yield to worst at 6.5% and the bond now trading down to 89.9 cents on the dollar (1Y price range: 89.9-98.8).

- Issuer: Maxima Grupe UAB (Vilnius, Lithuania) | Coupon: 3.25% | Maturity: 13/9/2023 | Rating: BB+ | ISIN: XS1878323499 | Z-spread up by 28.6 bp to 251.8 bp, with the yield to worst at 2.8% and the bond now trading down to 100.4 cents on the dollar (1Y price range: 100.2-101.9).

- Issuer: Immobiliare Grande Distribuzione SIIQ SpA (Bologna, Italy) | Coupon: 2.13% | Maturity: 28/11/2024 | Rating: BB+ | ISIN: XS2084425466 | Z-spread down by 29.0 bp to 178.9 bp, with the yield to worst at 2.3% and the bond now trading up to 98.1 cents on the dollar (1Y price range: 98.1-101.4).

- Issuer: Hanesbrands Finance Luxembourg SCA (Bertrange, Luxembourg) | Coupon: 3.50% | Maturity: 15/6/2024 | Rating: BB | ISIN: XS1419661118 | Z-spread down by 29.6 bp to 169.2 bp, with the yield to worst at 2.0% and the bond now trading up to 101.7 cents on the dollar (1Y price range: 101.3-105.0).

- Issuer: Titan Global Finance PLC (Hull, United Kingdom) | Coupon: 2.38% | Maturity: 16/11/2024 | Rating: BB | ISIN: XS1716212243 | Z-spread down by 31.5 bp to 163.9 bp, with the yield to worst at 2.4% and the bond now trading up to 99.1 cents on the dollar (1Y price range: 98.6-101.8).

- Issuer: EP Infrastructure as (Praha, Czech Republic) | Coupon: 1.82% | Maturity: 2/3/2031 | Rating: BB | ISIN: XS2304675791 | Z-spread down by 33.7 bp to 311.4 bp, with the yield to worst at 4.5% and the bond now trading up to 79.4 cents on the dollar (1Y price range: 61.4-100.0).

- Issuer: Transportes Aereos Portugueses SA (Lisbon, Portugal) | Coupon: 5.63% | Maturity: 2/12/2024 | Rating: B- | ISIN: PTTAPDOM0005 | Z-spread down by 41.4 bp to 864.1 bp, with the yield to worst at 8.9% and the bond now trading up to 91.3 cents on the dollar (1Y price range: 89.5-95.5).

- Issuer: International Consolidated Airlines Group SA (Harmondsworth, Spain) | Coupon: 2.75% | Maturity: 25/3/2025 | Rating: B+ | ISIN: XS2322423455 | Z-spread down by 42.7 bp to 370.2 bp, with the yield to worst at 4.7% and the bond now trading up to 94.4 cents on the dollar (1Y price range: 92.2-99.8).

- Issuer: Vivion Investments SARL (Luxembourg, Luxembourg) | Coupon: 3.50% | Maturity: 1/11/2025 | Rating: BB+ | ISIN: XS2070311431 | Z-spread down by 44.0 bp to 564.1 bp, with the yield to worst at 6.2% and the bond now trading up to 89.7 cents on the dollar (1Y price range: 89.3-99.2).

- Issuer: Atlantia SpA (Rome, Italy) | Coupon: 1.88% | Maturity: 12/2/2028 | Rating: BB | ISIN: XS2301390089 | Z-spread down by 53.9 bp to 240.6 bp (CDS basis: -33.1bp), with the yield to worst at 3.6% and the bond now trading up to 89.8 cents on the dollar (1Y price range: 87.6-102.6).

- Issuer: Adler Real Estate AG (Berlin, Germany) | Coupon: 3.00% | Maturity: 27/4/2026 | Rating: B | ISIN: XS1713464524 | Z-spread down by 68.6 bp to 518.0 bp, with the yield to worst at 6.3% and the bond now trading up to 88.0 cents on the dollar (1Y price range: 85.3-94.5).

- Issuer: Adler Group SA (Senningerberg, Luxembourg) | Coupon: 1.88% | Maturity: 14/1/2026 | Rating: B | ISIN: XS2283224231 | Z-spread down by 89.3 bp to 724.3 bp, with the yield to worst at 8.4% and the bond now trading up to 79.5 cents on the dollar (1Y price range: 76.4-86.2).

- Issuer: Adler Group SA (Senningerberg, Luxembourg) | Coupon: 3.25% | Maturity: 5/8/2025 | Rating: B | ISIN: XS2010029663 | Z-spread down by 119.4 bp to 734.5 bp, with the yield to worst at 8.4% and the bond now trading up to 85.3 cents on the dollar (1Y price range: 82.0-91.3).