Credit

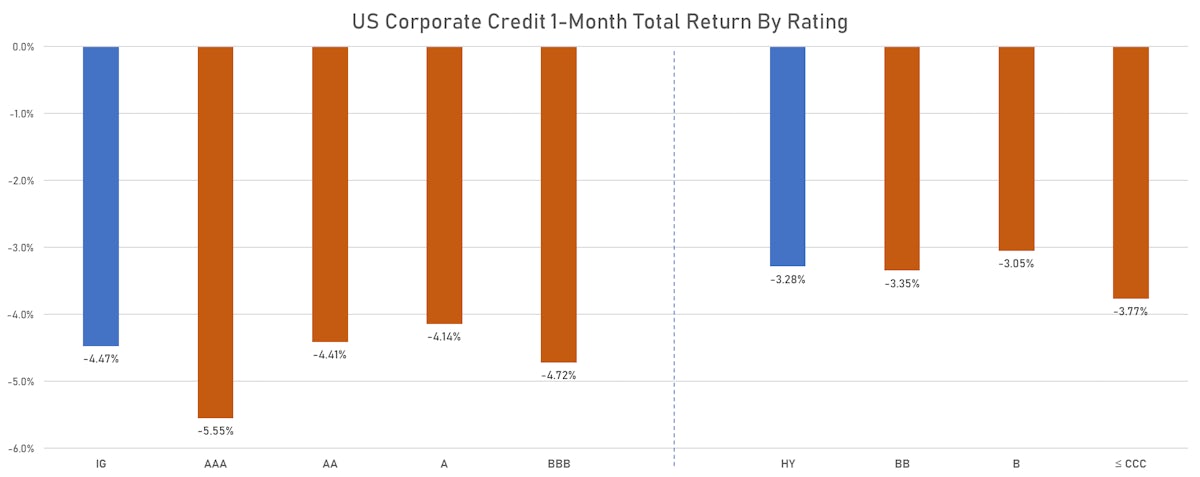

Wider Spreads Across The US Credit Complex This Week, With HY Cash +28bp And IG Cash +6bp

Pretty quiet week in terms of new USD bond issuance, as many of the large corporates are still in their quiet earnings period: 15 tranches for $10.1bn in IG (2022 YTD volume $577.6bn vs 2021 YTD $583.4bn) and 3 tranches for $4.52bn in HY (2022 YTD volume $54.2bn vs 2021 YTD $197.4bn)

Published ET

ICE BofAML US Corporate Cash Indices Total Returns | Sources: ϕpost, Refinitiv data

DAILY US SUMMARY

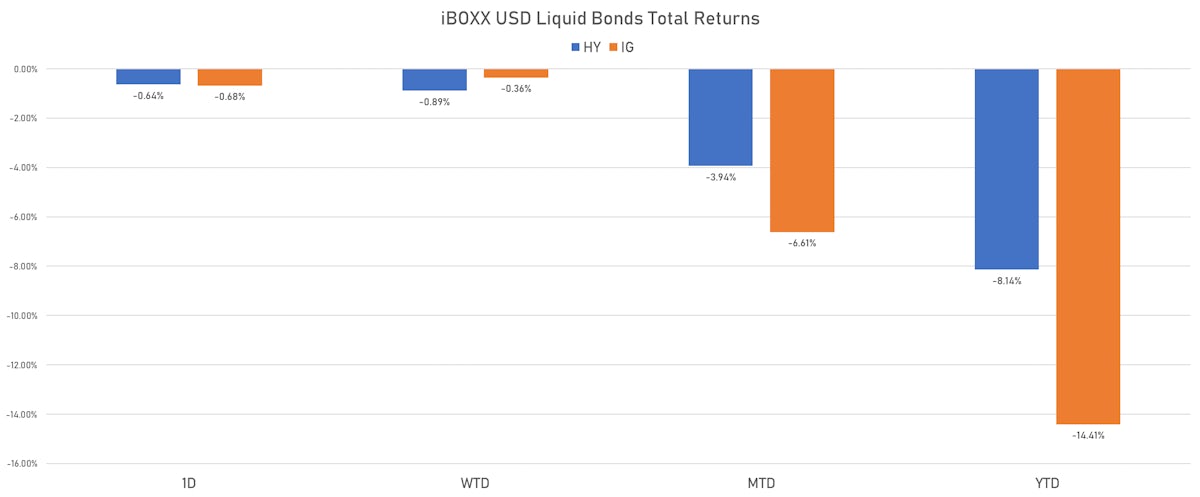

- S&P 500 Bond Index was down -0.56% today, with investment grade down -0.57% and high yield down -0.51% (YTD total return: -11.87%)

- The iBoxx USD Liquid Investment Grade Total Return Index was down -0.684% today (Month-to-date: -6.61%; Year-to-date: -14.41%)

- The iBoxx USD Liquid High Yield Total Return Index was down -0.637% today (Month-to-date: -3.94%; Year-to-date: -8.14%)

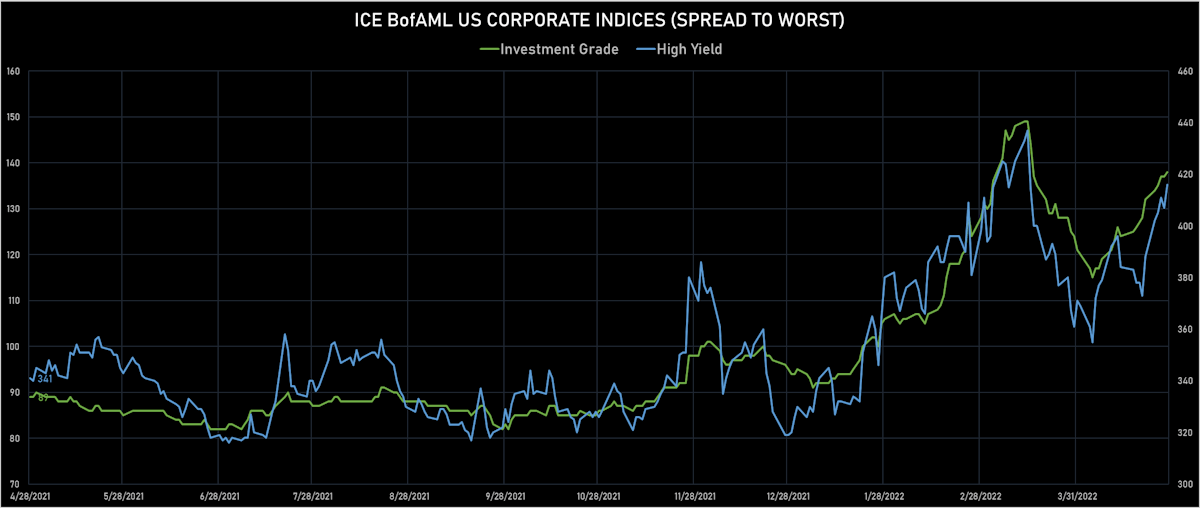

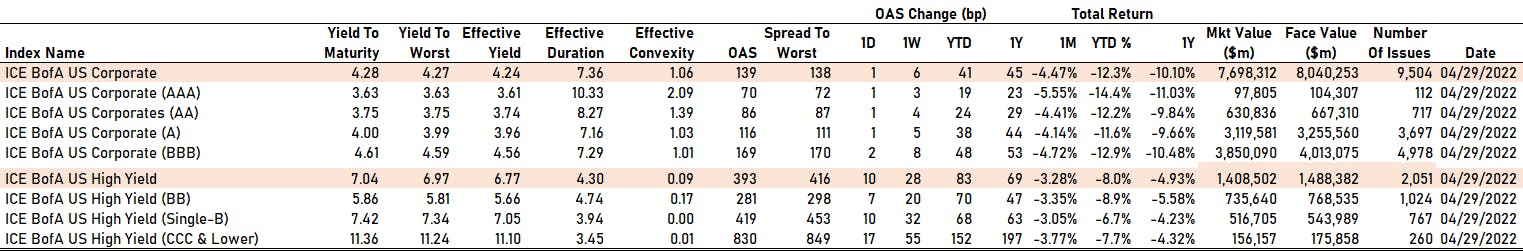

- ICE BofA US Corporate Index (Investment Grade) spread to worst up 1.0 bp, now at 138.0 bp (YTD change: +43.0 bp)

- ICE BofA US High Yield Index spread to worst up 9.0 bp, now at 416.0 bp (YTD change: +86.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index down -0.13% today (YTD total return: -0.3%)

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING

- AAA up by 1 bp at 70 bp

- AA up by 1 bp at 86 bp

- A up by 1 bp at 116 bp

- BBB up by 2 bp at 169 bp

- BB up by 7 bp at 281 bp

- B up by 10 bp at 419 bp

- CCC up by 17 bp at 830 bp

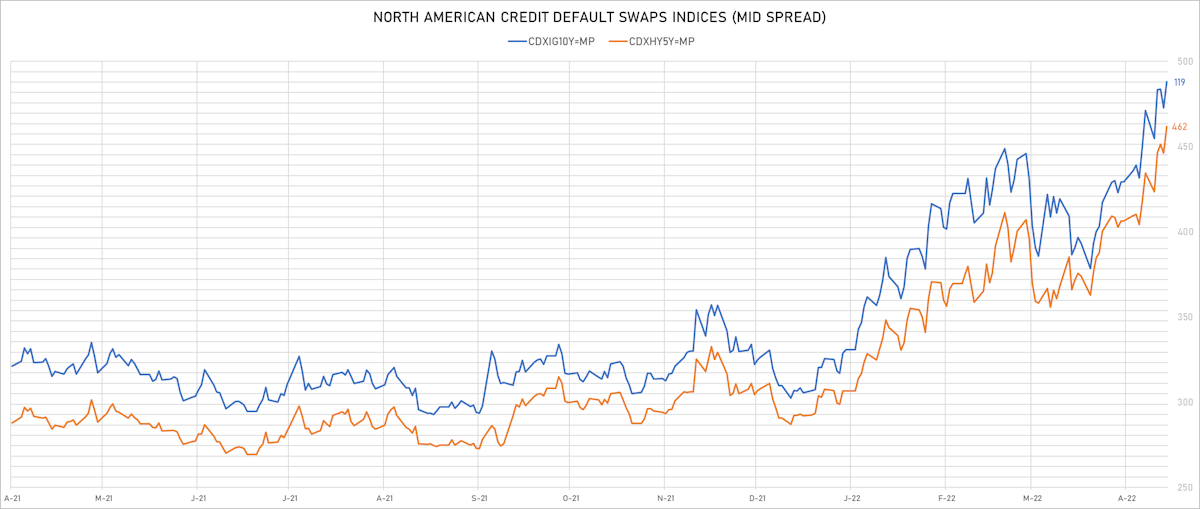

CDS INDICES (mid-spreads)

- Markit CDX.NA.IG 5Y up 2.8 bp, now at 84bp (YTD change: +34.4bp)

- Markit CDX.NA.IG 10Y up 2.5 bp, now at 119bp (YTD change: +29.9bp)

- Markit CDX.NA.HY 5Y up 15.8 bp, now at 462bp (YTD change: +169.9bp)

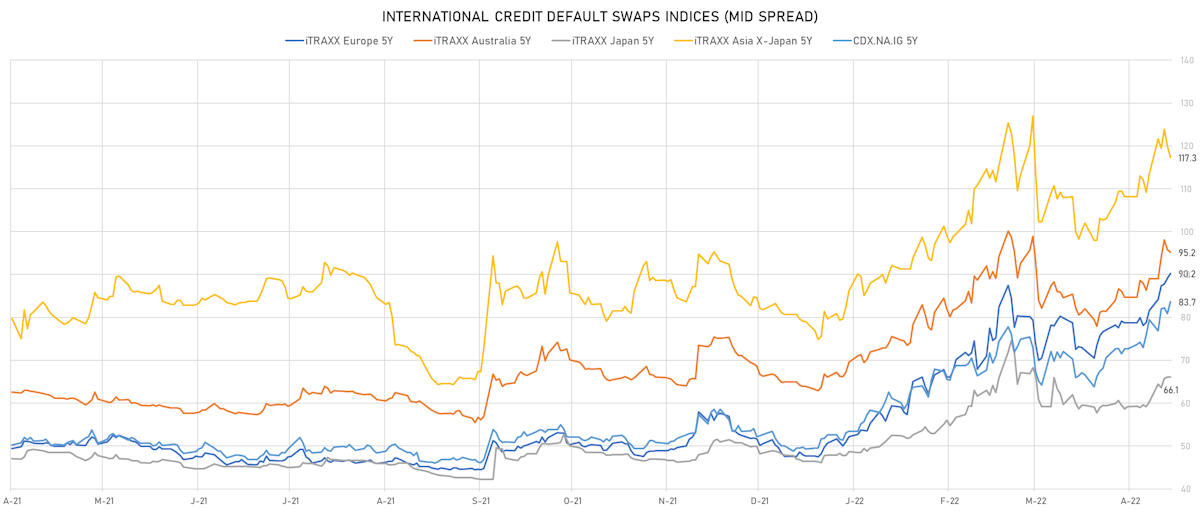

- Markit iTRAXX Europe 5Y up 1.1 bp, now at 90bp (YTD change: +42.5bp)

- Markit iTRAXX Europe Crossover 5Y up 10.5 bp, now at 428bp (YTD change: +185.3bp)

- Markit iTRAXX Japan 5Y unchanged (Japanese holiday) at 66bp (YTD change: +19.6bp)

- Markit iTRAXX Asia Ex-Japan 5Y down 2.7 bp, now at 117bp (YTD change: +38.3bp)

5Y USD CDS SINGLE NAMES - LARGEST MOVES OVER THE PAST WEEK

- Pitney Bowes Inc (Country: US; rated: B1): down 89.1 bp to 766.5bp (1Y range: 363-830bp)

- Xerox Corp (Country: US; rated: Ba2): up 54.8 bp to 473.6bp (1Y range: 185-474bp)

- American Axle & Manufacturing Inc (Country: US; rated: LGD2 - 20%): up 56.5 bp to 676.1bp (1Y range: 355-676bp)

- CCO Holdings LLC (Country: US; rated: WR): up 56.6 bp to 264.3bp (1Y range: 113-264bp)

- Carnival Corp (Country: US; rated: LGD5 - 72%): up 67.5 bp to 550.5bp (1Y range: 291-682bp)

- Liberty Interactive LLC (Country: US; rated: Ba3): up 74.3 bp to 831.7bp (1Y range: 287-832bp)

- Pactiv LLC (Country: US; rated: Caa1): up 74.6 bp to 680.0bp (1Y range: 356-680bp)

- CSC Holdings LLC (Country: US; rated: LGD3 - 30%): up 75.6 bp to 547.5bp (1Y range: -547bp)

- Office Depot Inc (Country: US; rated: WR): up 76.0 bp to 528.6bp (1Y range: -529bp)

- Bombardier Inc (Country: CA; rated: Caa1): up 102.0 bp to 670.5bp (1Y range: 395-670bp)

- American Airlines Group Inc (Country: US; rated: B2): up 106.7 bp to 990.1bp (1Y range: 596-1,343bp)

- Transocean Inc (Country: KY; rated: Caa3): up 157.9 bp to 1,605.9bp (1Y range: 941-1,784bp)

- Realogy Group LLC (Country: US; rated: WR): up 163.0 bp to 700.8bp (1Y range: 278-701bp)

5Y EURO CDS SINGLE NAMES - LARGEST MOVES OVER THE PAST WEEK

- Virgin Media Finance PLC (Country: GB; rated: WR): up 40.3 bp to 375.6bp (1Y range: 222-376bp)

- Ladbrokes Coral Group Ltd (Country: GB; rated: WR): up 40.7 bp to 334.6bp (1Y range: 107-335bp)

- Marks and Spencer PLC (Country: GB; rated: Ba1): up 41.5 bp to 305.6bp (1Y range: 139-306bp)

- UPC Holding BV (Country: NL; rated: LGD6 - 93%): up 42.5 bp to 328.0bp (1Y range: 164-328bp)

- Rolls-Royce PLC (Country: GB; rated: BB-): up 45.1 bp to 322.5bp (1Y range: 161-323bp)

- Monitchem Holdco 3 SA (Country: LU; rated: B2): up 45.8 bp to 344.2bp (1Y range: 186-344bp)

- Altice Finco SA (Country: LU; rated: Caa1): up 46.4 bp to 581.2bp (1Y range: 333-581bp)

- Fortum Oyj (Country: FI; rated: baa3): up 50.9 bp to 224.2bp (1Y range: 40-241bp)

- Louis Dreyfus Co BV (Country: NL; rated: ): up 54.4 bp to 276.4bp (1Y range: -276bp)

- Ardagh Packaging Finance PLC (Country: IE; rated: B1): up 59.6 bp to 484.9bp (1Y range: 213-485bp)

- Jaguar Land Rover Automotive PLC (Country: GB; rated: WD): up 72.4 bp to 677.8bp (1Y range: 339-678bp)

- Iceland Bondco PLC (Country: GB; rated: LGD3 - 46%): up 158.1 bp to 888.1bp (1Y range: 418-888bp)

- Casino Guichard Perrachon SA (Country: FR; rated: WR): up 178.2 bp to 1,257.2bp (1Y range: 464-1,257bp)

TOP BONDS MOVES IN THE PAST WEEK - USD HY

- Issuer: Enact Holdings Inc (Raleigh, North Carolina (US)) | Coupon: 6.50% | Maturity: 15/8/2025 | Rating: BB | ISIN: USU3230LAA45 | Z-spread up by 70.0 bp to 352.1 bp (CDS basis: -73.4bp), with the yield to worst at 6.6% and the bond now trading down to 99.3 cents on the dollar (1Y price range: 99.3-109.5).

- Issuer: Terraform Power Operating LLC (New York City, New York (US)) | Coupon: 5.00% | Maturity: 31/1/2028 | Rating: BB- | ISIN: USU8812LAE12 | Z-spread up by 67.6 bp to 337.8 bp, with the yield to worst at 6.3% and the bond now trading down to 93.0 cents on the dollar (1Y price range: 93.0-106.3).

- Issuer: Wynn Las Vegas LLC (Las Vegas, Nevada (US)) | Coupon: 5.25% | Maturity: 15/5/2027 | Rating: B | ISIN: USU98347AL87 | Z-spread up by 61.3 bp to 414.3 bp, with the yield to worst at 7.0% and the bond now trading down to 91.8 cents on the dollar (1Y price range: 91.8-102.8).

- Issuer: HanesBrands Inc (Winston-Salem, North Carolina (US)) | Coupon: 4.63% | Maturity: 15/5/2024 | Rating: BB- | ISIN: USU24437AD43 | Z-spread up by 60.7 bp to 192.3 bp, with the yield to worst at 4.5% and the bond now trading down to 99.3 cents on the dollar (1Y price range: 99.3-104.5).

- Issuer: Wynn Resorts Finance LLC (Las Vegas, Nevada (US)) | Coupon: 5.13% | Maturity: 1/10/2029 | Rating: B | ISIN: USU98354AA80 | Z-spread up by 56.5 bp to 433.4 bp, with the yield to worst at 7.2% and the bond now trading down to 87.3 cents on the dollar (1Y price range: 87.3-102.3).

- Issuer: Xerox Holdings Corp (Norwalk, Connecticut (US)) | Coupon: 5.50% | Maturity: 15/8/2028 | Rating: BB | ISIN: USU98401AB58 | Z-spread up by 50.6 bp to 441.1 bp, with the yield to worst at 7.3% and the bond now trading down to 90.3 cents on the dollar (1Y price range: 90.0-105.5).

- Issuer: Bombardier Inc (MONTREAL, Canada) | Coupon: 7.45% | Maturity: 1/5/2034 | Rating: CCC+ | ISIN: USC10602AJ68 | Z-spread up by 50.6 bp to 493.5 bp, with the yield to worst at 7.7% and the bond now trading down to 97.0 cents on the dollar (1Y price range: 97.0-122.9).

- Issuer: ZF North America Capital Inc (Northville, Michigan (US)) | Coupon: 4.75% | Maturity: 29/4/2025 | Rating: BB+ | ISIN: USU98737AC03 | Z-spread up by 41.6 bp to 276.3 bp, with the yield to worst at 5.4% and the bond now trading down to 97.1 cents on the dollar (1Y price range: 96.4-107.1).

- Issuer: Twitter Inc (San Francisco, California (US)) | Coupon: 3.88% | Maturity: 15/12/2027 | Rating: BB | ISIN: USU8882PAA58 | Z-spread down by 44.6 bp to 120.9 bp, with the yield to worst at 4.1% and the bond now trading up to 97.9 cents on the dollar (1Y price range: 93.8-103.9).

- Issuer: MGM Growth Properties Operating Partnership LP (Las Vegas, Nevada (US)) | Coupon: 4.63% | Maturity: 15/6/2025 | Rating: BB- | ISIN: USU5930BAD83 | Z-spread down by 47.7 bp to 161.1 bp, with the yield to worst at 4.6% and the bond now trading up to 99.5 cents on the dollar (1Y price range: 98.8-106.5).

- Issuer: OCP SA (Casablanca, Morocco) | Coupon: 5.63% | Maturity: 25/4/2024 | Rating: BB+ | ISIN: XS1061043011 | Z-spread down by 48.0 bp to 116.3 bp (CDS basis: -41.9bp), with the yield to worst at 3.9% and the bond now trading up to 102.8 cents on the dollar (1Y price range: 102.0-107.0).

- Issuer: Compass Minerals International Inc (Overland Park, Kansas (US)) | Coupon: 4.88% | Maturity: 15/7/2024 | Rating: B+ | ISIN: USU2036YAC04 | Z-spread down by 49.2 bp to 232.2 bp, with the yield to worst at 4.9% and the bond now trading up to 98.9 cents on the dollar (1Y price range: 98.1-102.8).

- Issuer: Owens-Brockway Glass Container Inc (Perrysburg, Ohio (US)) | Coupon: 5.88% | Maturity: 15/8/2023 | Rating: B- | ISIN: USU68337AK75 | Z-spread down by 90.8 bp to 201.8 bp, with the yield to worst at 4.0% and the bond now trading up to 101.4 cents on the dollar (1Y price range: 100.4-104.6).

TOP BONDS MOVES IN THE PAST WEEK - EUR HY

- Issuer: Bulgarian Energy Holding EAD (Sofia, Bulgaria) | Coupon: 3.50% | Maturity: 28/6/2025 | Rating: BB | ISIN: XS1839682116 | Z-spread up by 412.5 bp to 719.5 bp (CDS basis: -670.5bp), with the yield to worst at 8.3% and the bond now trading down to 86.9 cents on the dollar (1Y price range: 86.0-106.1).

- Issuer: Adler Group SA (Senningerberg, Luxembourg) | Coupon: 2.25% | Maturity: 27/4/2027 | Rating: B | ISIN: XS2336188029 | Z-spread up by 337.7 bp to 1,060.0 bp, with the yield to worst at 11.9% and the bond now trading down to 64.9 cents on the dollar (1Y price range: 64.7-85.9).

- Issuer: Adler Real Estate AG (Berlin, Germany) | Coupon: 3.00% | Maturity: 27/4/2026 | Rating: B | ISIN: XS1713464524 | Z-spread up by 249.6 bp to 832.5 bp, with the yield to worst at 9.5% and the bond now trading down to 78.8 cents on the dollar (1Y price range: 78.3-94.5).

- Issuer: Ceconomy AG (Dusseldorf, Germany) | Coupon: 1.75% | Maturity: 24/6/2026 | Rating: BB+ | ISIN: XS2356316872 | Z-spread up by 157.9 bp to 469.1 bp (CDS basis: -172.8bp), with the yield to worst at 5.9% and the bond now trading down to 84.7 cents on the dollar (1Y price range: 84.4-98.3).

- Issuer: EP Infrastructure as (Praha, Czech Republic) | Coupon: 2.05% | Maturity: 9/10/2028 | Rating: BB | ISIN: XS2062490649 | Z-spread up by 120.9 bp to 550.5 bp, with the yield to worst at 6.7% and the bond now trading down to 74.9 cents on the dollar (1Y price range: 72.6-104.4).

- Issuer: Adient Global Holdings Ltd (Saint Helier, Jersey) | Coupon: 3.50% | Maturity: 15/8/2024 | Rating: B- | ISIN: XS1468662801 | Z-spread up by 96.0 bp to 545.6 bp, with the yield to worst at 6.3% and the bond now trading down to 94.0 cents on the dollar (1Y price range: 93.9-101.5).

- Issuer: Eustream as (Bratislava, Slovakia) | Coupon: 1.63% | Maturity: 25/6/2027 | Rating: BB+ | ISIN: XS2190979489 | Z-spread up by 95.9 bp to 761.8 bp, with the yield to worst at 8.4% and the bond now trading down to 70.5 cents on the dollar (1Y price range: 69.9-103.5).

- Issuer: Mytilineos SA (Athina, Greece) | Coupon: 2.25% | Maturity: 30/10/2026 | Rating: BB- | ISIN: XS2337604479 | Z-spread up by 91.8 bp to 354.5 bp, with the yield to worst at 4.8% and the bond now trading down to 89.6 cents on the dollar (1Y price range: 89.4-100.1).

- Issuer: Jaguar Land Rover Automotive PLC (Coventry, United Kingdom) | Coupon: 4.50% | Maturity: 15/1/2026 | Rating: B+ | ISIN: XS1881005976 | Z-spread up by 88.4 bp to 624.4 bp (CDS basis: -31.0bp), with the yield to worst at 7.2% and the bond now trading down to 90.8 cents on the dollar (1Y price range: 90.7-104.5).

- Issuer: Standard Industries Inc (Parsippany, New Jersey (US)) | Coupon: 2.25% | Maturity: 21/11/2026 | Rating: B+ | ISIN: XS2080766475 | Z-spread up by 88.0 bp to 374.1 bp, with the yield to worst at 5.0% and the bond now trading down to 88.5 cents on the dollar (1Y price range: 88.5-98.3).

- Issuer: Mahle GmbH (Stuttgart, Germany) | Coupon: 2.38% | Maturity: 14/5/2028 | Rating: BB+ | ISIN: XS2341724172 | Z-spread up by 79.7 bp to 517.7 bp, with the yield to worst at 6.5% and the bond now trading down to 79.2 cents on the dollar (1Y price range: 79.0-97.6).

- Issuer: Telecom Italia SpA (Rome, Italy) | Coupon: 3.00% | Maturity: 30/9/2025 | Rating: BB- | ISIN: XS1497606365 | Z-spread up by 77.1 bp to 325.7 bp (CDS basis: -29.5bp), with the yield to worst at 4.5% and the bond now trading down to 95.3 cents on the dollar (1Y price range: 93.0-103.1).

- Issuer: Saipem Finance International BV (Amsterdam, Netherlands) | Coupon: 2.63% | Maturity: 7/1/2025 | Rating: B+ | ISIN: XS1711584430 | Z-spread up by 76.7 bp to 553.8 bp (CDS basis: 55.0bp), with the yield to worst at 6.5% and the bond now trading down to 90.3 cents on the dollar (1Y price range: 73.9-101.2).

- Issuer: SoftBank Group Corp (Minato-Ku, Japan) | Coupon: 2.88% | Maturity: 6/1/2027 | Rating: BB+ | ISIN: XS2361254597 | Z-spread up by 74.9 bp to 544.4 bp, with the yield to worst at 6.7% and the bond now trading down to 84.8 cents on the dollar (1Y price range: 81.8-95.0).