Credit

Significant Spread Widening Across The Credit Complex, As Tighter Financial Conditions And Slower US Earnings Growth Weigh Heavily

Weekly volumes of USD bond issuance (IFR data): $18.2bn in 25 tranches for IG issuers (2022 YTD volume: $595.9bn vs 2021 YTD: US$608.9bn), while no deal was priced in high yield (2022 YTD volume: 85 Tranches for $54.2bn vs 2021 YTD: 314 for $210.9bn)

Published ET

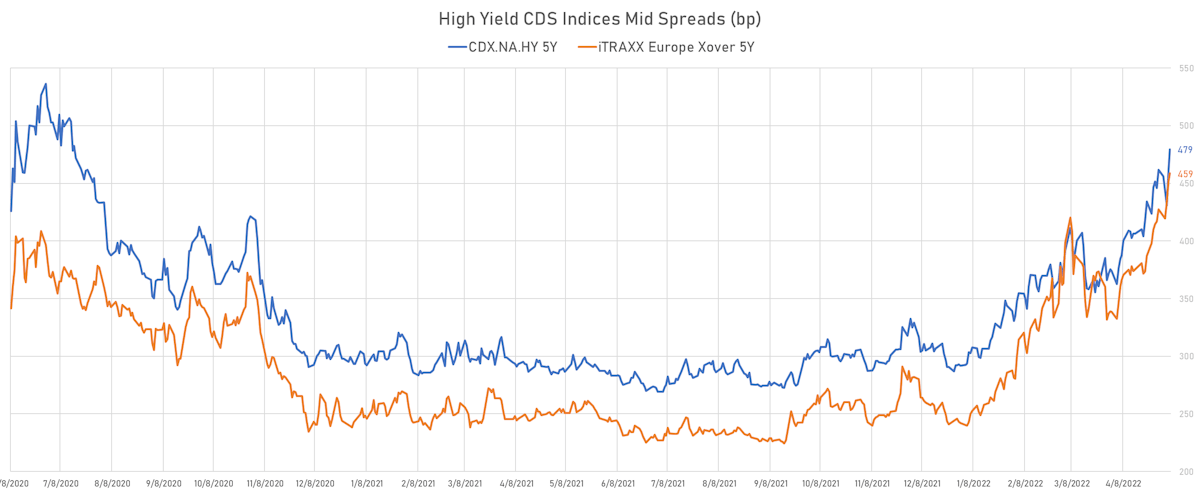

iTRAXX Europe Crossover 5Y vs CDX NA HY 5Y CDS Indices Mid Spreads | Sources: ϕpost, Refinitiv data

DAILY US SUMMARY

- S&P 500 Bond Index was down -0.73% today, with investment grade down -0.72% and high yield down -0.80% (YTD total return: -13.03%)

- The iBoxx USD Liquid Investment Grade Total Return Index was down -0.658% today (Month-to-date: -1.55%; Year-to-date: -15.74%)

- The iBoxx USD Liquid High Yield Total Return Index was down -0.632% today (Month-to-date: -1.15%; Year-to-date: -9.21%)

- ICE BofA US Corporate Index (Investment Grade) spread to worst up 1.0 bp, now at 138.0 bp (YTD change: +43.0 bp)

- ICE BofA US High Yield Index spread to worst up 13.0 bp, now at 430.0 bp (YTD change: +100.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index down -0.33% today (YTD total return: -1.1%)

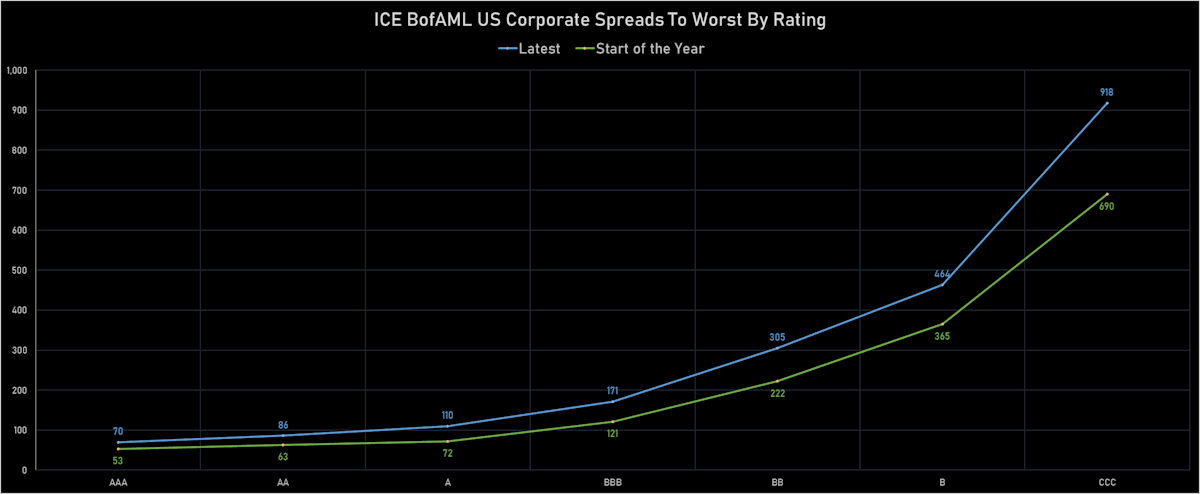

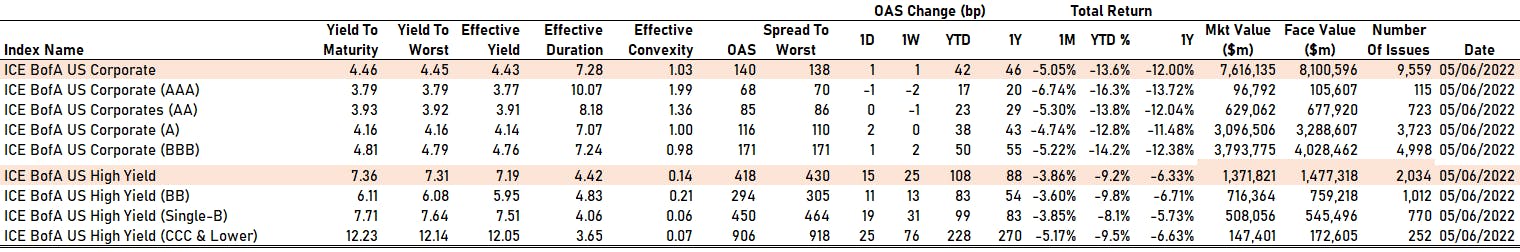

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING

- AAA down by -1 bp at 68 bp

- AA unchanged at 85 bp

- A up by 2 bp at 116 bp

- BBB up by 1 bp at 171 bp

- BB up by 11 bp at 294 bp

- B up by 19 bp at 450 bp

- CCC up by 25 bp at 906 bp

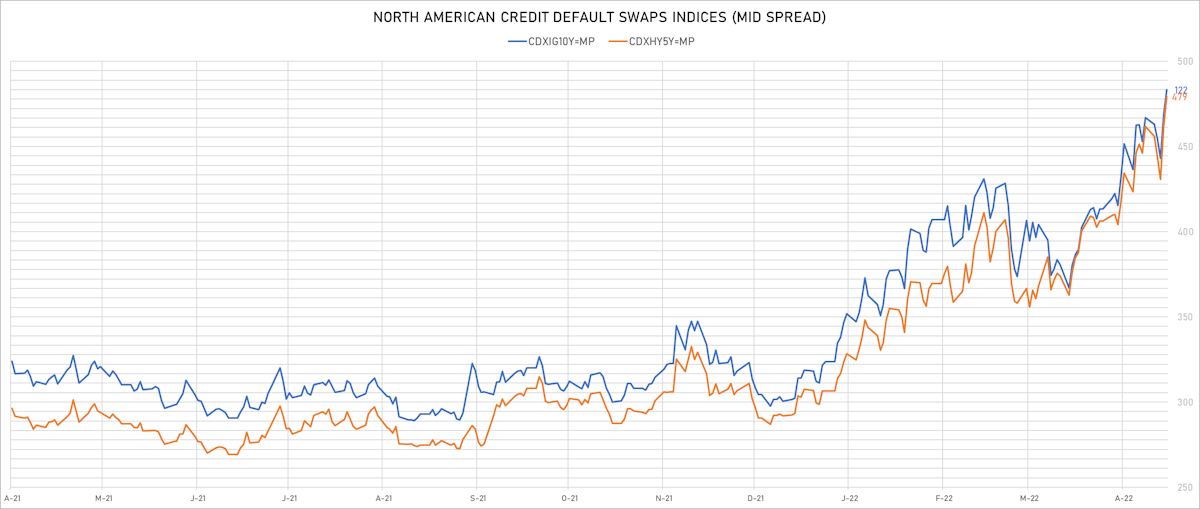

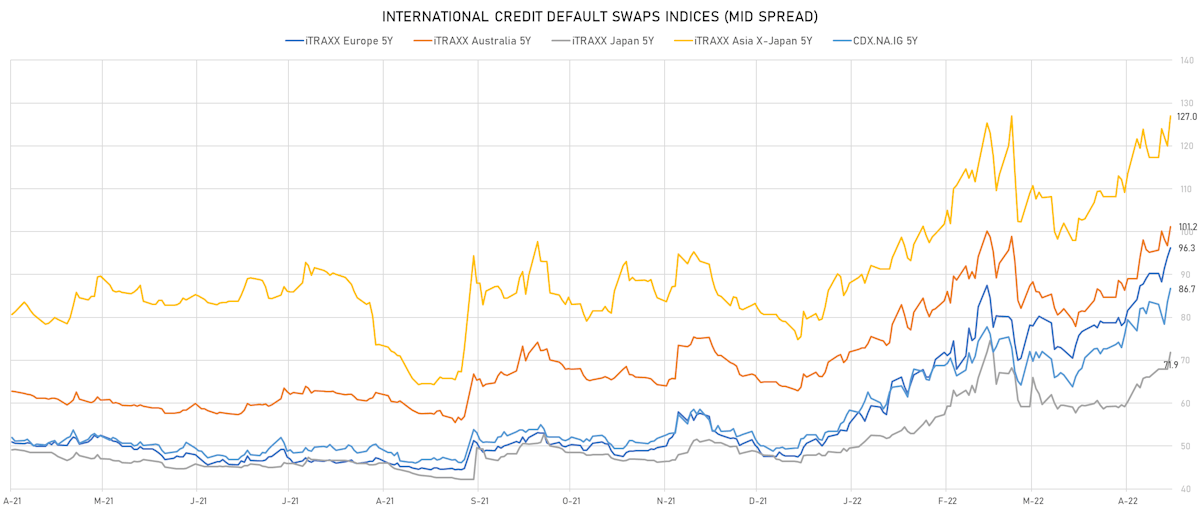

CDS INDICES (mid-spreads)

- Markit CDX.NA.IG 5Y up 3.2 bp, now at 87bp (YTD change: +37.4bp)

- Markit CDX.NA.IG 10Y up 2.7 bp, now at 122bp (YTD change: +32.9bp)

- Markit CDX.NA.HY 5Y up 18.0 bp, now at 479bp (YTD change: +187.5bp)

- Markit iTRAXX Europe 5Y up 2.2 bp, now at 96bp (YTD change: +48.6bp)

- Markit iTRAXX Europe Crossover 5Y up 6.6 bp, now at 459bp (YTD change: +216.5bp)

- Markit iTRAXX Japan 5Y up 4.0 bp, now at 72bp (YTD change: +25.5bp)

- Markit iTRAXX Asia Ex-Japan 5Y up 7.0 bp, now at 127bp (YTD change: +48.0bp)

5Y USD CDS SINGLE NAMES - LARGEST MOVES OVER THE PAST WEEK

- Transocean Inc (Country: KY; rated: Caa3): down 63.1 bp to 1,542.8bp (1Y range: 941-1,784bp)

- Genworth Holdings Inc (Country: US; rated: B2): up 34.1 bp to 422.1bp (1Y range: 335-563bp)

- Bombardier Inc (Country: CA; rated: Caa1): up 40.4 bp to 710.9bp (1Y range: 395-711bp)

- Turkey, Republic of (Government) (Country: TR; rated: WR): up 48.3 bp to 665.9bp (1Y range: 360-683bp)

- Tenet Healthcare Corp (Country: US; rated: BB+): up 50.0 bp to 371.6bp (1Y range: 242-372bp)

- Interval Acquisition Corp (Country: US; rated: WR): up 51.6 bp to 834.5bp (1Y range: 329-834bp)

- Tegna Inc (Country: US; rated: Ba3): up 55.1 bp to 686.7bp (1Y range: 182-687bp)

- Royal Caribbean Cruises Ltd (Country: US; rated: LGD4 - 59%): up 58.4 bp to 500.1bp (1Y range: 299-554bp)

- Egypt, Arab Republic of (Government) (Country: EG; rated: Ba2): up 67.1 bp to 838.1bp (1Y range: 342-981bp)

- Staples Inc (Country: US; rated: B3): up 68.0 bp to 1,299.2bp (1Y range: 706-1,386bp)

- American Airlines Group Inc (Country: US; rated: B2): up 85.5 bp to 1,075.6bp (1Y range: 596-1,343bp)

- Carnival Corp (Country: US; rated: LGD5 - 72%): up 120.1 bp to 670.6bp (1Y range: 291-682bp)

- Liberty Interactive LLC (Country: US; rated: Ba3): up 180.1 bp to 1,011.9bp (1Y range: 287-1,012bp)

- DISH DBS Corp (Country: US; rated: B2): up 191.6 bp to 822.2bp (1Y range: 317-822bp)

5Y EURO CDS SINGLE NAMES - LARGEST MOVES OVER THE PAST WEEK

- thyssenkrupp AG (Country: DE; rated: B1): up 30.4 bp to 440.2bp (1Y range: 205-440bp)

- Marks and Spencer PLC (Country: GB; rated: Ba1): up 32.8 bp to 338.4bp (1Y range: 139-338bp)

- Ineos Group Holdings SA (Country: LU; rated: WR): up 34.9 bp to 329.1bp (1Y range: 125-329bp)

- TUI AG (Country: DE; rated: B3-PD): up 36.1 bp to 780.1bp (1Y range: 607-916bp)

- Rolls-Royce PLC (Country: GB; rated: BB-): up 36.5 bp to 359.0bp (1Y range: 161-359bp)

- Iceland Bondco PLC (Country: GB; rated: LGD3 - 46%): up 38.0 bp to 926.1bp (1Y range: 418-926bp)

- Casino Guichard Perrachon SA (Country: FR; rated: WR): up 45.8 bp to 1,303.0bp (1Y range: 464-1,360bp)

- Stonegate Pub Company Financing PLC (Country: GB; rated: WR): up 46.9 bp to 480.6bp (1Y range: 370-564bp)

- UPC Holding BV (Country: NL; rated: LGD6 - 93%): up 53.3 bp to 381.3bp (1Y range: 164-381bp)

- Ardagh Packaging Finance PLC (Country: IE; rated: B1): up 56.3 bp to 541.2bp (1Y range: 213-541bp)

- Altice Finco SA (Country: LU; rated: Caa1): up 62.5 bp to 643.8bp (1Y range: 333-644bp)

- Virgin Media Finance PLC (Country: GB; rated: WR): up 63.0 bp to 438.6bp (1Y range: 222-439bp)

- Jaguar Land Rover Automotive PLC (Country: GB; rated: WD): up 84.7 bp to 762.5bp (1Y range: 339-763bp)

- Novafives SAS (Country: FR; rated: Caa1): up 164.3 bp to 1,314.6bp (1Y range: 618-1,342bp)

- Boparan Finance PLC (Country: GB; rated: Caa1): up 254.3 bp to 2,273.3bp (1Y range: 766-2,690bp)

TOP BONDS MOVES IN THE PAST WEEK - USD HY

- Issuer: NCL Corporation Ltd (Miami, Bermuda) | Coupon: 5.88% | Maturity: 15/3/2026 | Rating: CCC+ | ISIN: USG6436QAL08 | Z-spread up by 91.2 bp to 601.7 bp, with the yield to worst at 8.8% and the bond now trading down to 89.5 cents on the dollar (1Y price range: 89.5-100.0).

- Issuer: EQM Midstream Partners LP (Canonsburg, Pennsylvania (US)) | Coupon: 6.50% | Maturity: 1/7/2027 | Rating: BB- | ISIN: USU26886AB46 | Z-spread up by 83.0 bp to 379.3 bp, with the yield to worst at 6.8% and the bond now trading down to 97.8 cents on the dollar (1Y price range: 97.8-112.0).

- Issuer: HanesBrands Inc (Winston-Salem, North Carolina (US)) | Coupon: 4.63% | Maturity: 15/5/2024 | Rating: BB- | ISIN: USU24437AD43 | Z-spread up by 78.5 bp to 233.5 bp, with the yield to worst at 4.9% and the bond now trading down to 98.5 cents on the dollar (1Y price range: 98.3-104.5).

- Issuer: Rockies Express Pipeline LLC (Leawood, Kansas (US)) | Coupon: 3.60% | Maturity: 15/5/2025 | Rating: BB | ISIN: USU75111AK72 | Z-spread up by 70.5 bp to 294.1 bp, with the yield to worst at 5.7% and the bond now trading down to 93.3 cents on the dollar (1Y price range: 93.3-103.0).

- Issuer: Owens-Brockway Glass Container Inc (Perrysburg, Ohio (US)) | Coupon: 5.38% | Maturity: 15/1/2025 | Rating: B- | ISIN: USU6S19GAC10 | Z-spread up by 65.9 bp to 356.4 bp, with the yield to worst at 6.2% and the bond now trading down to 97.0 cents on the dollar (1Y price range: 97.0-104.1).

- Issuer: Wynn Resorts Finance LLC (Las Vegas, Nevada (US)) | Coupon: 5.13% | Maturity: 1/10/2029 | Rating: B | ISIN: USU98354AA80 | Z-spread up by 63.8 bp to 463.5 bp, with the yield to worst at 7.6% and the bond now trading down to 85.0 cents on the dollar (1Y price range: 86.0-102.3).

- Issuer: Station Casinos LLC (Las Vegas, Nevada (US)) | Coupon: 4.63% | Maturity: 1/12/2031 | Rating: B- | ISIN: USU85731AE46 | Z-spread up by 62.8 bp to 416.7 bp, with the yield to worst at 7.2% and the bond now trading down to 81.3 cents on the dollar (1Y price range: 81.3-100.4).

- Issuer: Xerox Holdings Corp (Norwalk, Connecticut (US)) | Coupon: 5.00% | Maturity: 15/8/2025 | Rating: BB | ISIN: USU98401AA75 | Z-spread up by 58.4 bp to 349.0 bp, with the yield to worst at 6.3% and the bond now trading down to 95.3 cents on the dollar (1Y price range: 93.8-105.7).

- Issuer: Nextera Energy Operating Partners LP (Juno Beach, Florida (US)) | Coupon: 3.88% | Maturity: 15/10/2026 | Rating: BB | ISIN: USU6500TAG05 | Z-spread up by 56.6 bp to 246.9 bp, with the yield to worst at 5.5% and the bond now trading down to 93.1 cents on the dollar (1Y price range: 93.1-106.0).

- Issuer: Taylor Morrison Communities Inc (Scottsdale, Arizona (US)) | Coupon: 5.63% | Maturity: 1/3/2024 | Rating: BB- | ISIN: USU87286AD91 | Z-spread up by 55.6 bp to 256.4 bp, with the yield to worst at 5.4% and the bond now trading down to 100.0 cents on the dollar (1Y price range: 100.0-106.5).

- Issuer: Wynn Las Vegas LLC (Las Vegas, Nevada (US)) | Coupon: 5.50% | Maturity: 1/3/2025 | Rating: B | ISIN: USU98347AK05 | Z-spread up by 55.1 bp to 414.0 bp, with the yield to worst at 6.9% and the bond now trading down to 95.5 cents on the dollar (1Y price range: 96.3-103.5).

- Issuer: Twitter Inc (San Francisco, California (US)) | Coupon: 3.88% | Maturity: 15/12/2027 | Rating: BB | ISIN: USU8882PAA58 | Z-spread down by 64.6 bp to 101.5 bp, with the yield to worst at 4.0% and the bond now trading up to 98.3 cents on the dollar (1Y price range: 93.8-103.9).

TOP BONDS MOVES IN THE PAST WEEK - EUR HY

- Issuer: Bulgarian Energy Holding EAD (Sofia, Bulgaria) | Coupon: 3.50% | Maturity: 28/6/2025 | Rating: BB | ISIN: XS1839682116 | Z-spread up by 277.2 bp to 699.7 bp, with the yield to worst at 8.2% and the bond now trading down to 87.1 cents on the dollar (1Y price range: 86.0-106.1).

- Issuer: Adler Real Estate AG (Berlin, Germany) | Coupon: 3.00% | Maturity: 27/4/2026 | Rating: CCC | ISIN: XS1713464524 | Z-spread up by 260.6 bp to 787.0 bp, with the yield to worst at 7.6% and the bond now trading down to 79.7 cents on the dollar (1Y price range: 74.8-94.5).

- Issuer: Adient Global Holdings Ltd (Saint Helier, Jersey) | Coupon: 3.50% | Maturity: 15/8/2024 | Rating: B- | ISIN: XS1468662801 | Z-spread up by 230.5 bp to 700.4 bp, with the yield to worst at 8.0% and the bond now trading down to 90.9 cents on the dollar (1Y price range: 92.4-101.5).

- Issuer: Jaguar Land Rover Automotive PLC (Coventry, United Kingdom) | Coupon: 5.88% | Maturity: 15/11/2024 | Rating: B+ | ISIN: XS2010037849 | Z-spread up by 181.9 bp to 674.7 bp (CDS basis: -90.6bp), with the yield to worst at 7.5% and the bond now trading down to 95.6 cents on the dollar (1Y price range: 95.6-108.0).

- Issuer: Saipem Finance International BV (Amsterdam, Netherlands) | Coupon: 2.63% | Maturity: 7/1/2025 | Rating: B+ | ISIN: XS1711584430 | Z-spread up by 162.3 bp to 665.3 bp (CDS basis: 12.1bp), with the yield to worst at 7.8% and the bond now trading down to 87.7 cents on the dollar (1Y price range: 73.9-101.2).

- Issuer: Mytilineos SA (Athina, Greece) | Coupon: 2.25% | Maturity: 30/10/2026 | Rating: BB- | ISIN: XS2337604479 | Z-spread up by 149.1 bp to 402.0 bp, with the yield to worst at 5.4% and the bond now trading down to 87.2 cents on the dollar (1Y price range: 87.0-100.1).

- Issuer: SoftBank Group Corp (Minato-Ku, Japan) | Coupon: 2.88% | Maturity: 6/1/2027 | Rating: BB+ | ISIN: XS2361254597 | Z-spread up by 145.8 bp to 607.9 bp, with the yield to worst at 7.5% and the bond now trading down to 82.0 cents on the dollar (1Y price range: 81.8-95.0).

- Issuer: ZF Europe Finance BV (Amsterdam, Netherlands) | Coupon: 2.00% | Maturity: 23/2/2026 | Rating: BB+ | ISIN: XS2010039381 | Z-spread up by 145.7 bp to 467.1 bp, with the yield to worst at 5.9% and the bond now trading down to 86.3 cents on the dollar (1Y price range: 86.3-100.9).

- Issuer: Teva Pharmaceutical Finance Netherlands II BV (Amsterdam, Netherlands) | Coupon: 1.13% | Maturity: 15/10/2024 | Rating: BB- | ISIN: XS1439749281 | Z-spread up by 141.9 bp to 399.9 bp, with the yield to worst at 5.0% and the bond now trading down to 90.9 cents on the dollar (1Y price range: 90.8-96.7).

- Issuer: Ford Motor Credit Company LLC (Dearborn, Michigan (US)) | Coupon: 3.02% | Maturity: 6/3/2024 | Rating: BB | ISIN: XS1959498160 | Z-spread up by 141.5 bp to 345.0 bp (CDS basis: -134.4bp), with the yield to worst at 4.0% and the bond now trading down to 97.6 cents on the dollar (1Y price range: 97.6-104.5).

- Issuer: MPT Operating Partnership LP (Birmingham, Alabama (US)) | Coupon: 0.99% | Maturity: 15/10/2026 | Rating: BB+ | ISIN: XS2390849318 | Z-spread up by 139.8 bp to 299.4 bp, with the yield to worst at 4.5% and the bond now trading down to 86.0 cents on the dollar (1Y price range: 85.9-99.4).

- Issuer: ZF Finance GmbH (Friedrichshafen, Germany) | Coupon: 2.75% | Maturity: 25/5/2027 | Rating: BB+ | ISIN: XS2262961076 | Z-spread up by 128.8 bp to 495.2 bp, with the yield to worst at 6.4% and the bond now trading down to 84.1 cents on the dollar (1Y price range: 84.0-103.0).

- Issuer: Renault SA (Boulogne-Billancourt, France) | Coupon: 1.13% | Maturity: 4/10/2027 | Rating: BB | ISIN: FR0013451416 | Z-spread up by 128.6 bp to 436.9 bp (CDS basis: -57.7bp), with the yield to worst at 5.9% and the bond now trading down to 78.0 cents on the dollar (1Y price range: 77.7-93.7).

- Issuer: Mytilineos Financial Partners SA (Luxembourg, Luxembourg) | Coupon: 2.50% | Maturity: 1/12/2024 | Rating: BB- | ISIN: XS2010038144 | Z-spread up by 127.9 bp to 298.3 bp, with the yield to worst at 4.1% and the bond now trading down to 95.9 cents on the dollar (1Y price range: 95.8-101.9).

- Issuer: Citycon Treasury BV (Amsterdam, Netherlands) | Coupon: 1.25% | Maturity: 8/9/2026 | Rating: BBB- | ISIN: XS1485608118 | Z-spread down by 241.0 bp to 389.1 bp, with the yield to worst at 5.2% and the bond now trading up to 84.2 cents on the dollar (1Y price range: 84.0-100.9).