Credit

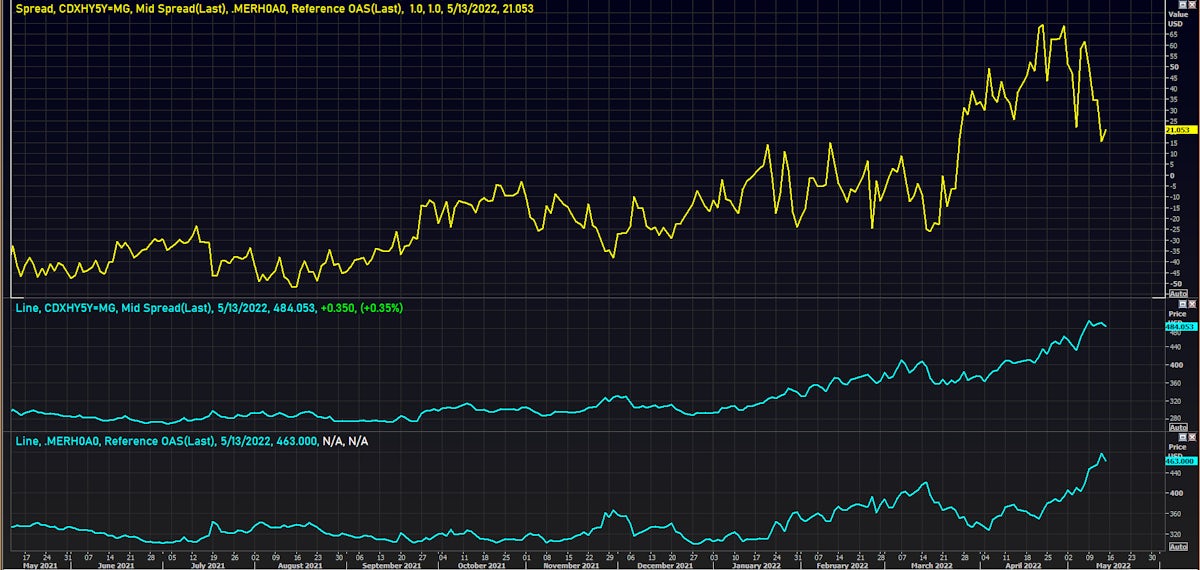

Much Wider Spreads In Cash Indices This Week, With A Sizeable Compression In The CDX.NA.HY Cash Basis

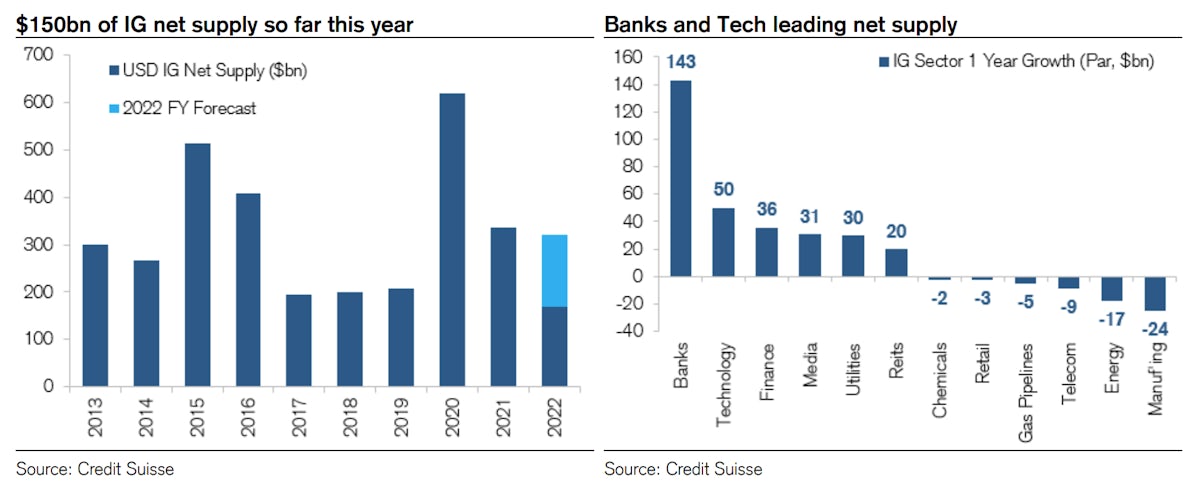

Decent volumes of issuance for USD investment grade bonds this week considering the amount of volatility in risk markets: $22.1bn in 31 tranches (IFR data), with the largest offering coming from Intercontinental Exchange ($8bn in 6 tranches); only one deal priced in the HY primary market ($1.2bn)

Published ET

US$ IG Issuance YTD (Net Of Refinancing) | Source: Credit Suisse

DAILY US SUMMARY

- S&P 500 Bond Index was down -0.49% today, with investment grade down -0.55% and high yield up 0.05% (YTD total return: -12.58%)

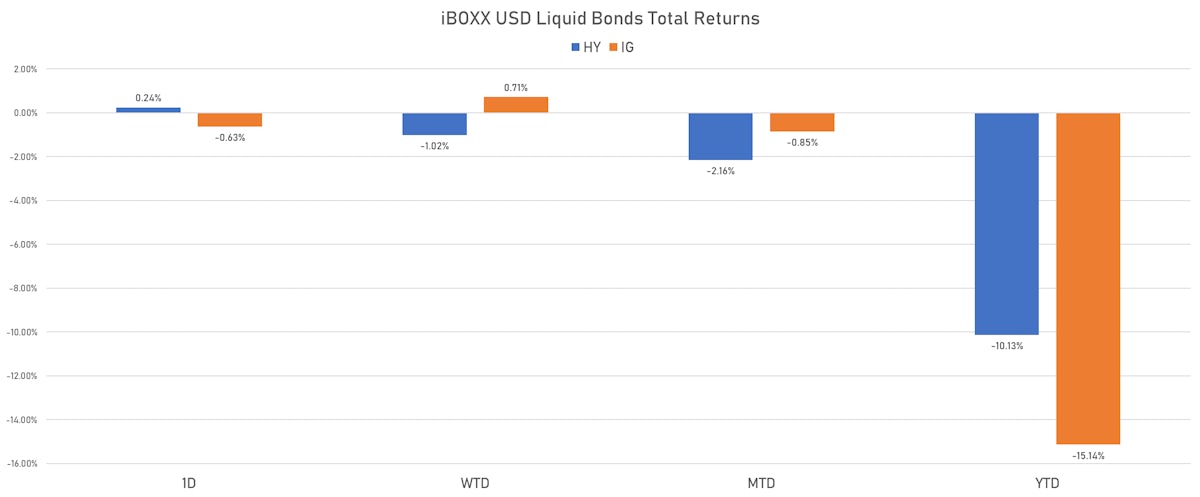

- The iBoxx USD Liquid Investment Grade Total Return Index was down -0.631% today (Month-to-date: -0.85%; Year-to-date: -15.14%)

- The iBoxx USD Liquid High Yield Total Return Index was up 0.244% today (Month-to-date: -2.16%; Year-to-date: -10.13%)

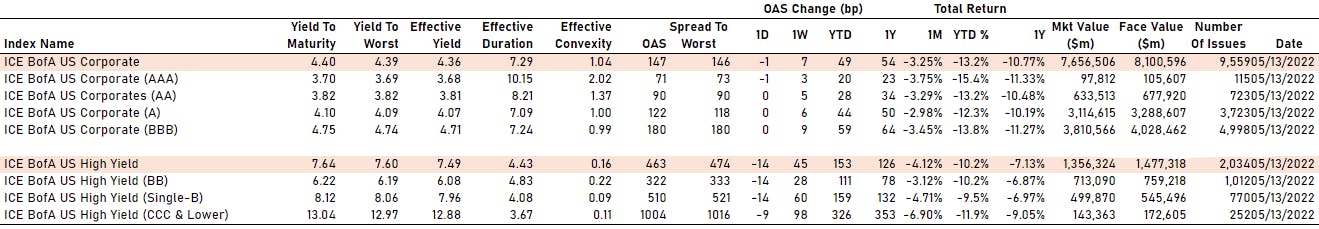

- ICE BofA US Corporate Index (Investment Grade) spread to worst unchanged at 146.0 bp (YTD change: +51.0 bp)

- ICE BofA US High Yield Index spread to worst down -14.0 bp, now at 474.0 bp (YTD change: +144.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index up 0.22% today (YTD total return: -3.2%)

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING

- AAA down by -1 bp at 71 bp

- AA unchanged at 90 bp

- A unchanged at 122 bp

- BBB unchanged at 180 bp

- BB down by -14 bp at 322 bp

- B down by -14 bp at 510 bp

- CCC down by -9 bp at 1,004 bp

CDS INDICES (mid-spreads)

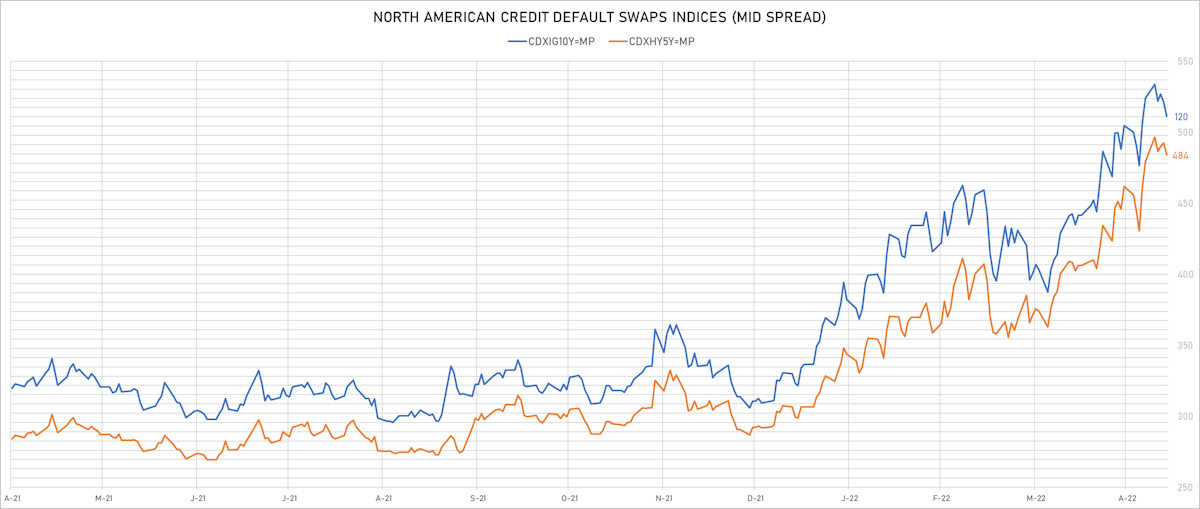

- Markit CDX.NA.IG 5Y down 1.9 bp, now at 85bp (YTD change: +36.0bp)

- Markit CDX.NA.IG 10Y down 1.5 bp, now at 120bp (YTD change: +31.0bp)

- Markit CDX.NA.HY 5Y down 8.5 bp, now at 484bp (YTD change: +192.1bp)

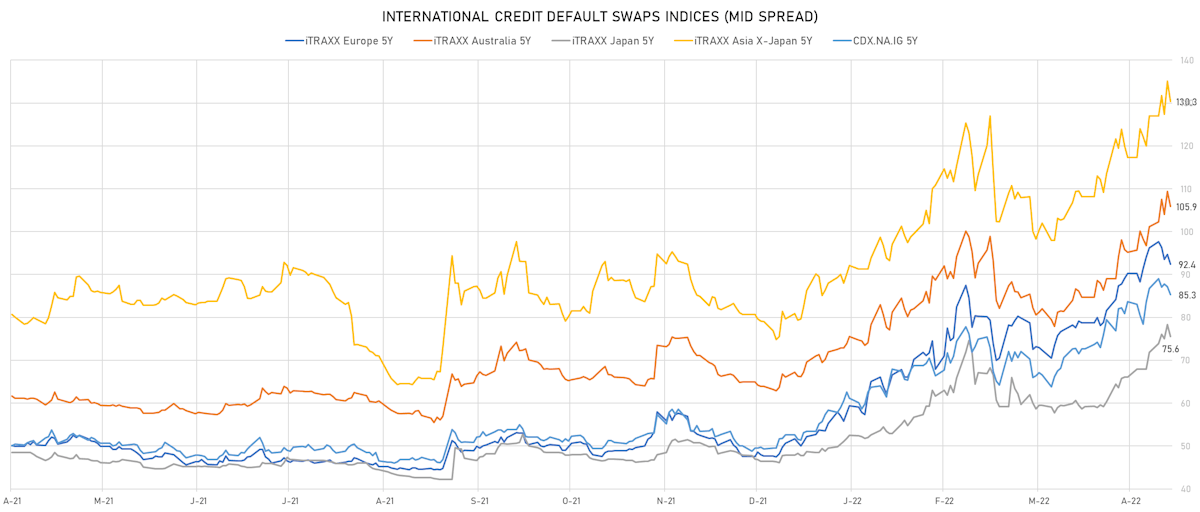

- Markit iTRAXX Europe 5Y down 2.3 bp, now at 92bp (YTD change: +44.7bp)

- Markit iTRAXX Europe Crossover 5Y down 12.2 bp, now at 446bp (YTD change: +203.8bp)

- Markit iTRAXX Japan 5Y down 2.8 bp, now at 76bp (YTD change: +29.2bp)

- Markit iTRAXX Asia Ex-Japan 5Y down 4.7 bp, now at 130bp (YTD change: +51.3bp)

5Y USD CDS SINGLE NAMES - LARGEST MOVES OVER THE PAST WEEK

- Nordstrom Inc (Country: US; rated: Ba1): up 69.8 bp to 486.0bp (1Y range: 211-486bp)

- Ryder System Inc (Country: US; rated: Baa2): up 81.7 bp to 223.5bp (1Y range: 61-223bp)

- Avis Budget Group Inc (Country: US; rated: CCC): up 82.3 bp to 405.5bp (1Y range: 183-413bp)

- Royal Caribbean Cruises Ltd (Country: US; rated: LGD4 - 59%): up 84.7 bp to 584.8bp (1Y range: 299-594bp)

- Realogy Group LLC (Country: US; rated: WR): up 89.4 bp to 790.0bp (1Y range: 278-790bp)

- Pitney Bowes Inc (Country: US; rated: B1): up 94.8 bp to 873.6bp (1Y range: 363-874bp)

- Carnival Corp (Country: US; rated: LGD5 - 72%): up 103.6 bp to 774.2bp (1Y range: 291-779bp)

- Bombardier Inc (Country: CA; rated: Caa1): up 145.0 bp to 863.0bp (1Y range: 395-863bp)

- Nabors Industries Inc (Country: US; rated: B3): up 153.2 bp to 758.7bp (1Y range: 489-1,096bp)

- Liberty Interactive LLC (Country: US; rated: Ba3): up 192.0 bp to 1,203.9bp (1Y range: 287-1,204bp)

- American Airlines Group Inc (Country: US; rated: B2): up 212.4 bp to 1,288.0bp (1Y range: 596-1,343bp)

- DISH DBS Corp (Country: US; rated: B2): up 319.2 bp to 1,141.4bp (1Y range: 317-1,141bp)

- Staples Inc (Country: US; rated: B3): up 389.7 bp to 1,688.9bp (1Y range: 733-1,689bp)

- Transocean Inc (Country: KY; rated: Caa3): up 528.6 bp to 2,064.9bp (1Y range: 941-2,065bp)

5Y EURO CDS SINGLE NAMES - LARGEST MOVES OVER THE PAST WEEK

- Boparan Finance PLC (Country: GB; rated: Caa1): down 110.0 bp to 2,163.3bp (1Y range: 847-2,690bp)

- Casino Guichard Perrachon SA (Country: FR; rated: WR): down 74.1 bp to 1,228.9bp (1Y range: 464-1,452bp)

- Novafives SAS (Country: FR; rated: Caa1): down 64.8 bp to 1,249.8bp (1Y range: 618-1,395bp)

- UPC Holding BV (Country: NL; rated: LGD6 - 93%): down 49.3 bp to 332.0bp (1Y range: 164-393bp)

- Virgin Media Finance PLC (Country: GB; rated: WR): down 46.8 bp to 391.9bp (1Y range: 222-441bp)

- TUI AG (Country: DE; rated: B3-PD): down 36.5 bp to 743.6bp (1Y range: 607-905bp)

- Louis Dreyfus Co BV (Country: NL; rated: ): down 27.0 bp to 260.9bp (1Y range: -261bp)

- CMA CGM SA (Country: FR; rated: Ba2): down 27.0 bp to 459.9bp (1Y range: 259-496bp)

- thyssenkrupp AG (Country: DE; rated: B1): down 26.3 bp to 413.9bp (1Y range: 205-445bp)

- Unibail-Rodamco-Westfield SE (Country: FR; rated: BBB-): up 14.8 bp to 176.3bp (1Y range: 46-176bp)

- Fortum Oyj (Country: FI; rated: baa3): up 15.3 bp to 252.2bp (1Y range: 40-252bp)

- Marks and Spencer PLC (Country: GB; rated: Ba1): up 19.4 bp to 357.8bp (1Y range: 139-358bp)

- Ceconomy AG (Country: DE; rated: Ba1): up 28.4 bp to 408.1bp (1Y range: 141-408bp)

- Iceland Bondco PLC (Country: GB; rated: LGD3 - 46%): up 32.0 bp to 958.1bp (1Y range: 418-958bp)

- Ardagh Packaging Finance PLC (Country: IE; rated: B1): up 127.4 bp to 668.5bp (1Y range: 213-669bp)

TOP BONDS MOVES IN THE PAST WEEK - USD HY

- Issuer: Southeast Supply Header LLC (Houston, Texas (US)) | Coupon: 4.25% | Maturity: 15/6/2024 | Rating: B | ISIN: USU83854AB29 | Z-spread up by 196.1 bp to 413.4 bp, with the yield to worst at 6.5% and the bond now trading down to 94.7 cents on the dollar (1Y price range: 94.6-102.8).

- Issuer: Bombardier Inc (MONTREAL, Canada) | Coupon: 7.45% | Maturity: 1/5/2034 | Rating: CCC+ | ISIN: USC10602AJ68 | Z-spread up by 174.5 bp to 678.5 bp (CDS basis: 206.1bp), with the yield to worst at 9.4% and the bond now trading down to 85.0 cents on the dollar (1Y price range: 84.5-122.9).

- Issuer: American Airlines Group Inc (Fort Worth, Texas (US)) | Coupon: 3.75% | Maturity: 1/3/2025 | Rating: CCC | ISIN: USU0242AAD47 | Z-spread up by 143.8 bp to 654.1 bp (CDS basis: 518.2bp), with the yield to worst at 9.1% and the bond now trading down to 86.8 cents on the dollar (1Y price range: 83.5-95.6).

- Issuer: ZF North America Capital Inc (Northville, Michigan (US)) | Coupon: 4.75% | Maturity: 29/4/2025 | Rating: BB+ | ISIN: USU98737AC03 | Z-spread up by 103.5 bp to 334.0 bp, with the yield to worst at 5.8% and the bond now trading down to 96.3 cents on the dollar (1Y price range: 96.3-107.1).

- Issuer: NCL Corporation Ltd (Miami, Bermuda) | Coupon: 5.88% | Maturity: 15/3/2026 | Rating: CCC+ | ISIN: USG6436QAL08 | Z-spread up by 93.3 bp to 689.1 bp, with the yield to worst at 9.5% and the bond now trading down to 87.6 cents on the dollar (1Y price range: 87.6-100.0).

- Issuer: Block Inc (San Francisco, California (US)) | Coupon: 2.75% | Maturity: 1/6/2026 | Rating: BB | ISIN: USU85223AA03 | Z-spread up by 83.9 bp to 306.2 bp, with the yield to worst at 5.7% and the bond now trading down to 88.5 cents on the dollar (1Y price range: 88.5-100.5).

- Issuer: Nextera Energy Operating Partners LP (Juno Beach, Florida (US)) | Coupon: 4.25% | Maturity: 15/7/2024 | Rating: BB | ISIN: USU6500TAF22 | Z-spread up by 80.4 bp to 236.7 bp, with the yield to worst at 4.9% and the bond now trading down to 97.9 cents on the dollar (1Y price range: 97.9-103.9).

- Issuer: Enact Holdings Inc (Raleigh, North Carolina (US)) | Coupon: 6.50% | Maturity: 15/8/2025 | Rating: BB | ISIN: USU3230LAA45 | Z-spread up by 74.6 bp to 399.5 bp (CDS basis: -82.2bp), with the yield to worst at 6.9% and the bond now trading down to 98.5 cents on the dollar (1Y price range: 98.0-109.5).

- Issuer: Twitter Inc (San Francisco, California (US)) | Coupon: 3.88% | Maturity: 15/12/2027 | Rating: BB | ISIN: USU8882PAA58 | Z-spread up by 72.4 bp to 170.4 bp, with the yield to worst at 4.5% and the bond now trading down to 96.0 cents on the dollar (1Y price range: 93.8-103.9).

- Issuer: Rockies Express Pipeline LLC (Leawood, Kansas (US)) | Coupon: 4.95% | Maturity: 15/7/2029 | Rating: BB | ISIN: USU75111AJ00 | Z-spread up by 72.2 bp to 383.0 bp, with the yield to worst at 6.6% and the bond now trading down to 89.5 cents on the dollar (1Y price range: 89.5-107.5).

- Issuer: EQM Midstream Partners LP (Canonsburg, Pennsylvania (US)) | Coupon: 4.75% | Maturity: 15/1/2031 | Rating: BB- | ISIN: USU26886AD02 | Z-spread up by 71.1 bp to 412.0 bp, with the yield to worst at 7.0% and the bond now trading down to 84.8 cents on the dollar (1Y price range: 84.8-105.0).

- Issuer: Compass Minerals International Inc (Overland Park, Kansas (US)) | Coupon: 4.88% | Maturity: 15/7/2024 | Rating: B+ | ISIN: USU2036YAC04 | Z-spread up by 69.0 bp to 333.3 bp, with the yield to worst at 5.7% and the bond now trading down to 97.3 cents on the dollar (1Y price range: 96.6-102.8).

- Issuer: Graphic Packaging International LLC (Atlanta, Georgia (US)) | Coupon: 3.75% | Maturity: 1/2/2030 | Rating: BB | ISIN: USU41441AD58 | Z-spread up by 64.1 bp to 296.7 bp, with the yield to worst at 5.8% and the bond now trading down to 86.4 cents on the dollar (1Y price range: 86.3-101.0).

- Issuer: HanesBrands Inc (Winston-Salem, North Carolina (US)) | Coupon: 4.63% | Maturity: 15/5/2024 | Rating: BB- | ISIN: USU24437AD43 | Z-spread up by 63.8 bp to 292.6 bp, with the yield to worst at 5.3% and the bond now trading down to 97.8 cents on the dollar (1Y price range: 97.8-104.5).

TOP BONDS MOVES IN THE PAST WEEK - EUR HY

- Issuer: Ceconomy AG (Dusseldorf, Germany) | Coupon: 1.75% | Maturity: 24/6/2026 | Rating: BB+ | ISIN: XS2356316872 | Z-spread up by 256.0 bp to 553.3 bp (CDS basis: -190.9bp), with the yield to worst at 6.6% and the bond now trading down to 82.6 cents on the dollar (1Y price range: 76.6-98.3).

- Issuer: EP Infrastructure as (Praha, Czech Republic) | Coupon: 1.82% | Maturity: 2/3/2031 | Rating: BB | ISIN: XS2304675791 | Z-spread up by 113.7 bp to 475.8 bp, with the yield to worst at 6.3% and the bond now trading down to 70.0 cents on the dollar (1Y price range: 61.4-100.0).

- Issuer: SPP Infrastructure Financing BV (Schiphol, Netherlands) | Coupon: 2.63% | Maturity: 12/2/2025 | Rating: BB+ | ISIN: XS1185941850 | Z-spread up by 96.8 bp to 1,225.3 bp, with the yield to worst at 13.2% and the bond now trading down to 76.8 cents on the dollar (1Y price range: 75.7-106.8).

- Issuer: Fortune Star (BVI) Ltd (British Virgin Islands) | Coupon: 3.95% | Maturity: 2/10/2026 | Rating: BB- | ISIN: XS2357132849 | Z-spread up by 91.5 bp to 704.1 bp, with the yield to worst at 8.2% and the bond now trading down to 84.9 cents on the dollar (1Y price range: 82.0-95.0).

- Issuer: Esselunga SpA (Pioltello, Italy) | Coupon: 1.88% | Maturity: 25/10/2027 | Rating: BB+ | ISIN: XS1706922256 | Z-spread up by 78.9 bp to 110.4 bp, with the yield to worst at 2.3% and the bond now trading down to 97.0 cents on the dollar (1Y price range: 96.0-104.6).

- Issuer: Banca Monte dei Paschi di Siena SpA (Siena, Italy) | Coupon: 2.63% | Maturity: 28/4/2025 | Rating: CCC+ | ISIN: XS2110110686 | Z-spread up by 70.8 bp to 466.1 bp (CDS basis: 127.4bp), with the yield to worst at 5.4% and the bond now trading down to 91.9 cents on the dollar (1Y price range: 91.8-100.0).

- Issuer: Telecom Italia SpA (Rome, Italy) | Coupon: 2.75% | Maturity: 15/4/2025 | Rating: BB- | ISIN: XS1982819994 | Z-spread up by 70.4 bp to 451.6 bp (CDS basis: -132.2bp), with the yield to worst at 5.4% and the bond now trading down to 92.7 cents on the dollar (1Y price range: 92.1-102.4).

- Issuer: Maxima Grupe UAB (Vilnius, Lithuania) | Coupon: 3.25% | Maturity: 13/9/2023 | Rating: BB+ | ISIN: XS1878323499 | Z-spread up by 70.4 bp to 317.3 bp, with the yield to worst at 3.4% and the bond now trading down to 99.6 cents on the dollar (1Y price range: 99.6-101.9).

- Issuer: Mytilineos Financial Partners SA (Luxembourg, Luxembourg) | Coupon: 2.50% | Maturity: 1/12/2024 | Rating: BB- | ISIN: XS2010038144 | Z-spread up by 67.6 bp to 359.7 bp, with the yield to worst at 4.4% and the bond now trading down to 95.3 cents on the dollar (1Y price range: 95.1-101.9).

- Issuer: PPF Telecom Group BV (Amsterdam, Netherlands) | Coupon: 3.13% | Maturity: 27/3/2026 | Rating: BB+ | ISIN: XS1969645255 | Z-spread up by 61.3 bp to 392.1 bp, with the yield to worst at 4.9% and the bond now trading down to 93.3 cents on the dollar (1Y price range: 92.7-106.3).

- Issuer: Atlantia SpA (Rome, Italy) | Coupon: 1.63% | Maturity: 3/2/2025 | Rating: BB | ISIN: XS1558491855 | Z-spread up by 60.9 bp to 257.7 bp (CDS basis: -110.0bp), with the yield to worst at 3.1% and the bond now trading down to 95.1 cents on the dollar (1Y price range: 95.0-101.6).

- Issuer: Teollisuuden Voima Oyj (Eurajoki, Finland) | Coupon: 1.13% | Maturity: 9/3/2026 | Rating: BB+ | ISIN: XS2049419398 | Z-spread down by 67.7 bp to 169.0 bp, with the yield to worst at 2.7% and the bond now trading up to 93.8 cents on the dollar (1Y price range: 93.0-100.7).

- Issuer: Adient Global Holdings Ltd (Saint Helier, Jersey) | Coupon: 3.50% | Maturity: 15/8/2024 | Rating: B- | ISIN: XS1468662801 | Z-spread down by 84.7 bp to 624.0 bp, with the yield to worst at 6.9% and the bond now trading up to 92.9 cents on the dollar (1Y price range: 89.5-101.5).

- Issuer: Vivion Investments SARL (Luxembourg, Luxembourg) | Coupon: 3.50% | Maturity: 1/11/2025 | Rating: BB+ | ISIN: XS2070311431 | Z-spread down by 96.2 bp to 538.7 bp, with the yield to worst at 5.8% and the bond now trading up to 91.0 cents on the dollar (1Y price range: 86.7-99.2).

- Issuer: Adler Group SA (Senningerberg, Luxembourg) | Coupon: 2.25% | Maturity: 27/4/2027 | Rating: CCC | ISIN: XS2336188029 | Z-spread down by 125.1 bp to 1,253.0 bp, with the yield to worst at 13.4% and the bond now trading up to 60.5 cents on the dollar (1Y price range: 54.7-85.9).

SELECTED RECENT USD BOND ISSUES

- Avnet Inc (Electronics | Phoenix, Arizona, United States | Rating: BBB-): US$300m Senior Note (US053807AV56), fixed rate (5.50% coupon) maturing on 1 June 2032, priced at 99.99 (original spread of 265 bp), callable (10nc10)

- Intercontinental Exchange Inc (Financial - Other | Atlanta, Georgia, United States | Rating: A-): US$1,500m Senior Note (US45866FAW41), fixed rate (4.60% coupon) maturing on 15 March 2033, priced at 99.95 (original spread of 175 bp), callable (11nc11)

- Intercontinental Exchange Inc (Financial - Other | Atlanta, Georgia, United States | Rating: A-): US$1,500m Senior Note (US45866FAX24), fixed rate (4.95% coupon) maturing on 15 June 2052, priced at 98.61 (original spread of 200 bp), callable (30nc30)

- Intercontinental Exchange Inc (Financial - Other | Atlanta, Georgia, United States | Rating: A-): US$1,000m Senior Note (US45866FAY07), fixed rate (5.20% coupon) maturing on 15 June 2062, priced at 99.33 (original spread of 220 bp), callable (40nc40)

- Intercontinental Exchange Inc (Financial - Other | Atlanta, Georgia, United States | Rating: A-): US$1,250m Senior Note (US45866FAV67), fixed rate (4.35% coupon) maturing on 15 June 2029, priced at 99.89 (original spread of 150 bp), callable (7nc7)

- Intercontinental Exchange Inc (Financial - Other | Atlanta, Georgia, United States | Rating: A-): US$1,500m Senior Note (US45866FAU84), fixed rate (4.00% coupon) maturing on 15 September 2027, priced at 99.74 (original spread of 125 bp), callable (5nc5)

- Intercontinental Exchange Inc (Financial - Other | Atlanta, Georgia, United States | Rating: A-): US$1,250m Senior Note (US45866FAT12), fixed rate (3.65% coupon) maturing on 23 May 2025, priced at 99.89 (original spread of 95 bp), with a special call

- NSTAR Electric Co (Utility - Other | Boston, Massachusetts, United States | Rating: A): US$450m Senior Debenture (US67021CAS61), fixed rate (4.55% coupon) maturing on 1 June 2052, priced at 99.37 (original spread of 157 bp), callable (30nc30)

- BOC Aviation Ltd (Leasing | China (Mainland) | Rating: A-): US$300m Senior Note (XS2482621419), fixed rate (4.33% coupon) maturing on 24 May 2027, priced at 100.00, non callable

- NXP BV (Electronics | Eindhoven, Noord-Brabant, Netherlands | Rating: BBB): US$1,000m Senior Note (US62954HBB33), fixed rate (5.00% coupon) maturing on 15 January 2033, priced at 99.70 (original spread of 220 bp), callable (11nc10)

- NXP BV (Electronics | Eindhoven, Noord-Brabant, Netherlands | Rating: BBB): US$500m Senior Note (US62954HBE71), fixed rate (4.40% coupon) maturing on 1 June 2027, priced at 99.85 (original spread of 165 bp), callable (5nc5)

- Ontario, Province of (Official and Muni | Toronto, Ontario, Canada | Rating: A+): US$2,250m Bond (US683234DB13), fixed rate (3.10% coupon) maturing on 19 May 2027, priced at 99.91 (original spread of 30 bp), non callable

- United Bank for Africa PLC (Banking | Lagos, Lagos, Nigeria | Rating: B-): US$300m Unsecured Note (XS2432565260), fixed rate (9.88% coupon) maturing on 3 May 2027, priced at 100.00, non callable

- Var Energi ASA (Oil and Gas | Sandnes, Rogaland, Italy | Rating: BBB): US$500m Senior Note (USR9576ZAA68), fixed rate (5.00% coupon) maturing on 18 May 2027, priced at 99.96 (original spread of 220 bp), callable (5nc5)

- Willis North America Inc (Financial - Other | Nashville, United Kingdom | Rating: BBB-): US$750m Senior Note (US970648AL56), fixed rate (4.65% coupon) maturing on 15 June 2027, priced at 99.96 (original spread of 185 bp), callable (5nc5)

SELECTED RECENT EUR BOND ISSUES

- Loarre Investments SARL (Financial - Other | Luxembourg | Rating: NR): €500m Senior Note (XS2483510637), fixed rate (6.50% coupon) maturing on 15 May 2029, priced at 96.61 (original spread of 645 bp), callable (7nc3)

- Loarre Investments SARL (Financial - Other | Luxembourg | Rating: NR): €350m Note (XS2483511957), floating rate (EU03MLIB + 500.0 bp) maturing on 15 May 2029, priced at 97.00, callable (7nc1)

NEW ISSUES IN SECURITIZED CREDIT

- RESIMAC Bastille Trust-RESIMAC Series 2022-1NC issued a floating-rate RMBS in a single tranche offering a spread over the floating rate of 120bp, for a total of US$ 215 m. Bookrunners: Commonwealth Bank of Australia, National Australia Bank Ltd, Deutsche Bank, Citigroup Global Markets Inc, Barrenjoey Markets Pty Ltd