Credit

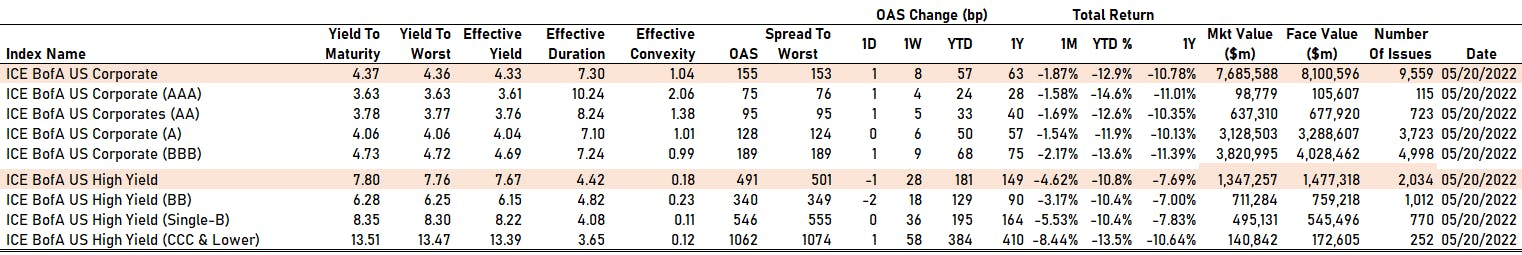

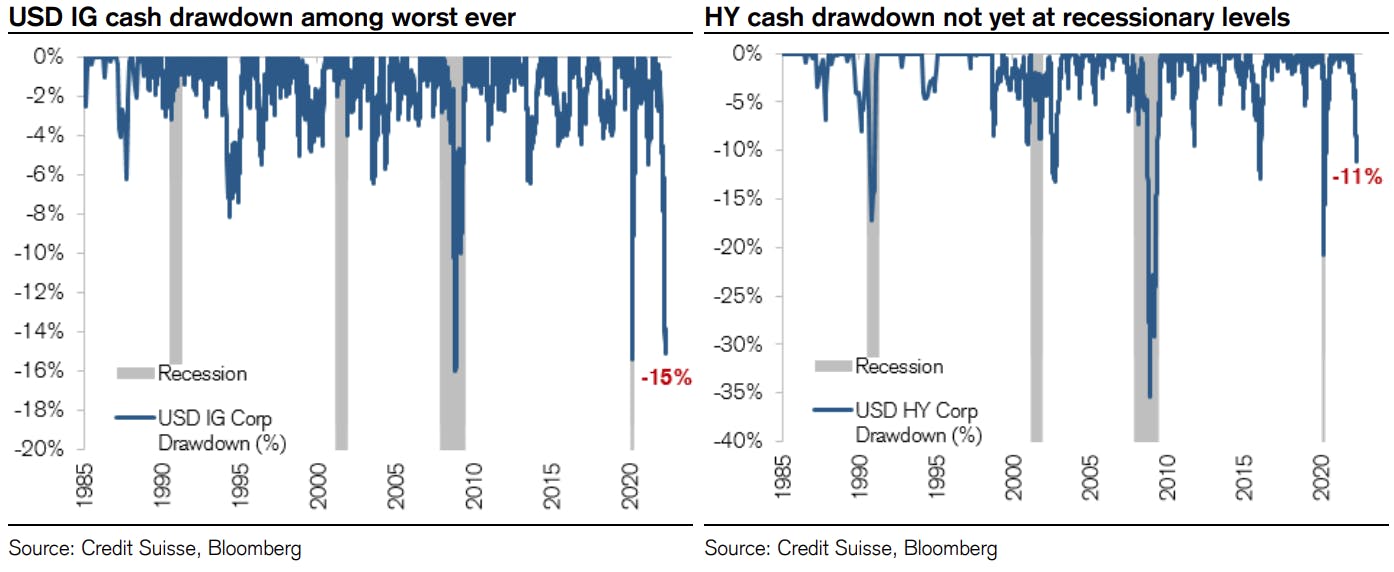

Another Volatile Week For Credit, Marked By Further Widening Of Cash OAS: +8bp In IG, +28bp In HY; CDX NA HY 5Y Implied Default At 32% (30% Recovery)

New issues in USD high yield are almost nonexistent (2022 YTD volume at just $56.4bn vs 2021 YTD $238.3bn), with Carnival the sole print this week, while the USD IG primary market was pretty active: 43 new tranches for $33.4bn (2022 YTD volume $651.4bn vs 2021 YTD $682.6bn)

Published ET

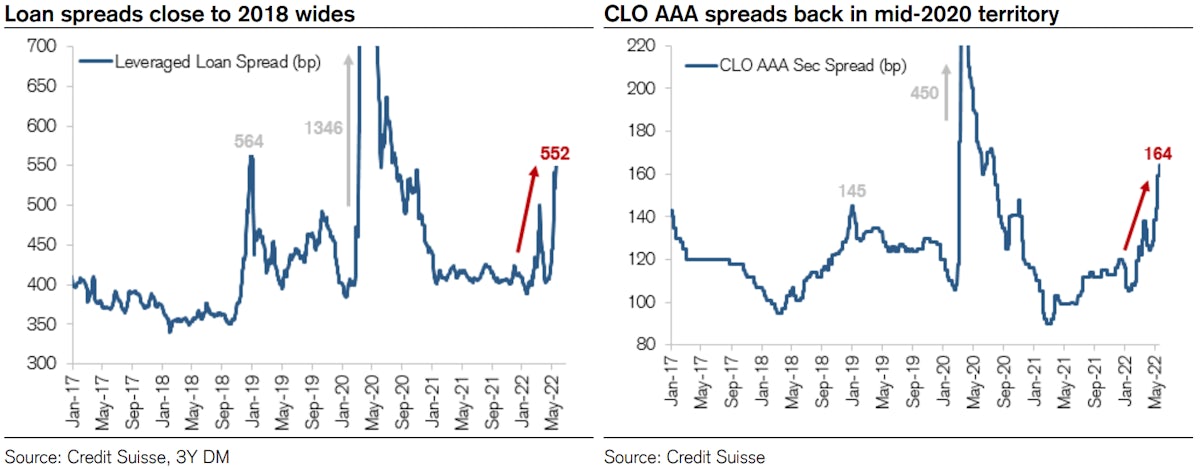

Spreads On Loans & AAA tranches of CLOs | Source: Credit Suisse

QUICK SUMMARY

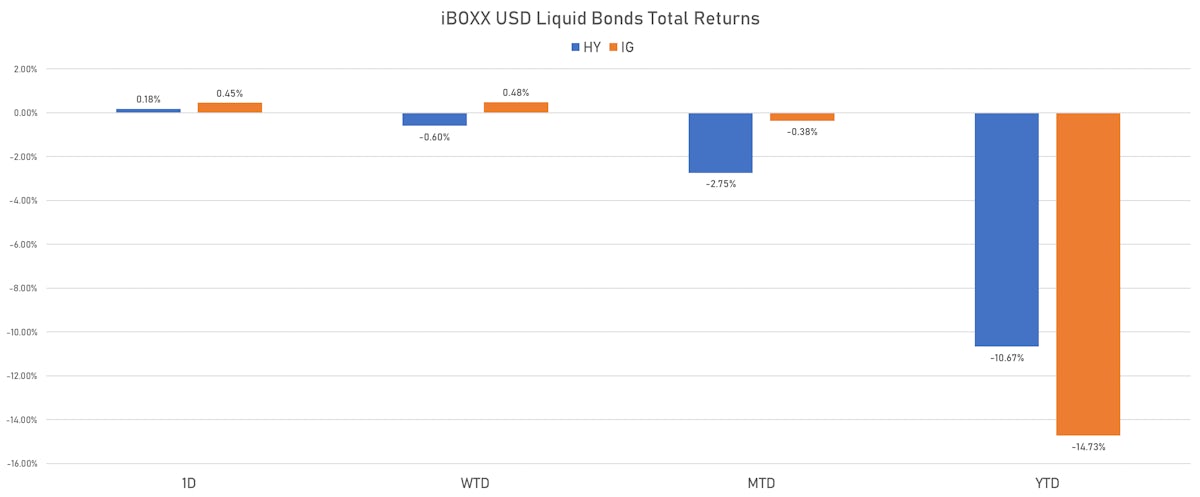

- S&P 500 Bond Index was up 0.37% today, with investment grade up 0.37% and high yield up 0.32% (YTD total return: -12.31%)

- The iBoxx USD Liquid Investment Grade Total Return Index was up 0.450% today (Month-to-date: -0.38%; Year-to-date: -14.73%)

- The iBoxx USD Liquid High Yield Total Return Index was up 0.183% today (Month-to-date: -2.75%; Year-to-date: -10.67%)

- ICE BofA US Corporate Index (Investment Grade) spread to worst unchanged at 153.0 bp (YTD change: +58.0 bp)

- ICE BofA US High Yield Index spread to worst unchanged at 501.0 bp (YTD change: +171.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index up 0.21% today (YTD total return: -3.5%)

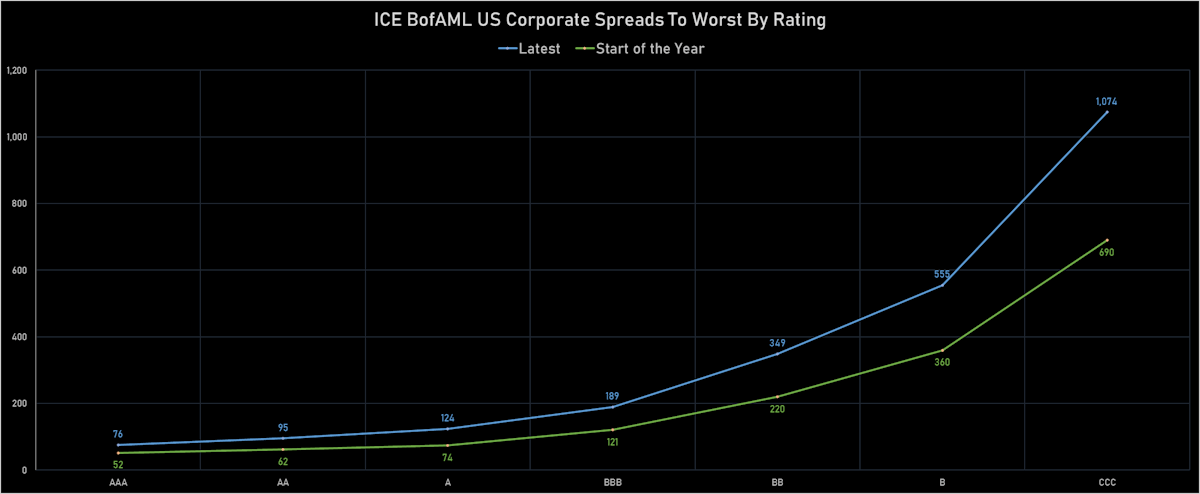

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING TODAY

- AAA up by 1 bp at 75 bp

- AA up by 1 bp at 95 bp

- A unchanged at 128 bp

- BBB up by 1 bp at 189 bp

- BB down by -2 bp at 340 bp

- B unchanged at 546 bp

- CCC up by 1 bp at 1062 bp

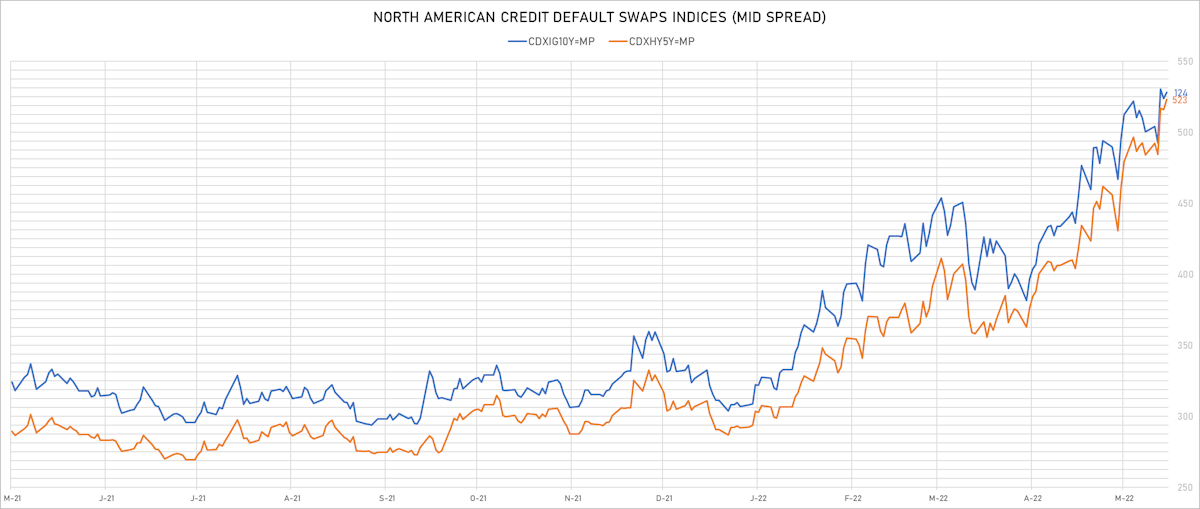

CDS INDICES TODAY (mid-spreads)

- Markit CDX.NA.IG 5Y up 0.9 bp, now at 91bp (YTD change: +41.3bp)

- Markit CDX.NA.IG 10Y up 0.7 bp, now at 124bp (YTD change: +35.4bp)

- Markit CDX.NA.HY 5Y up 7.2 bp, now at 523bp (YTD change: +231.3bp)

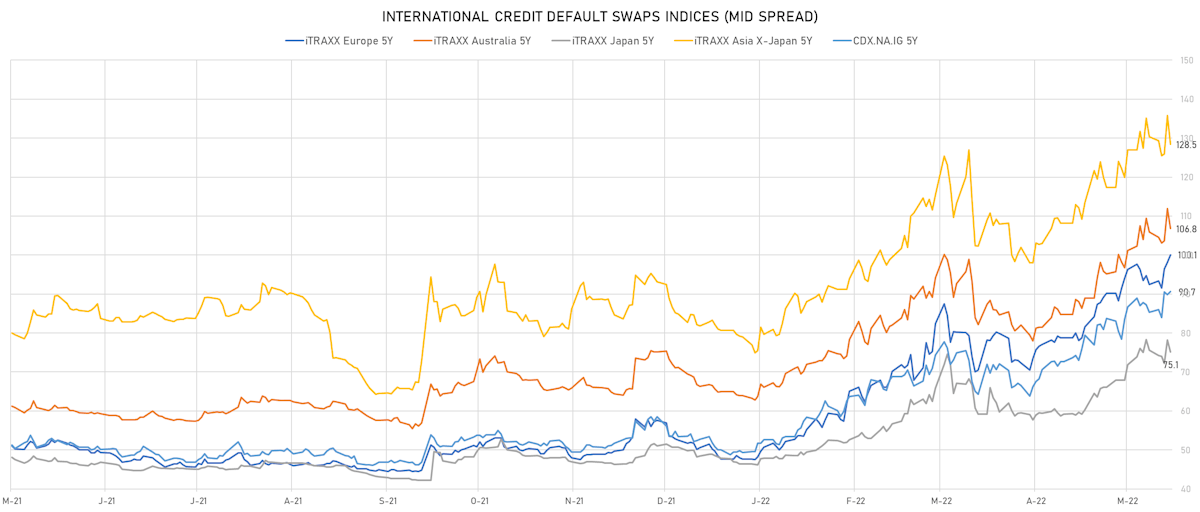

- Markit iTRAXX Europe 5Y up 1.9 bp, now at 100bp (YTD change: +52.4bp)

- Markit iTRAXX Europe Crossover 5Y up 10.9 bp, now at 488bp (YTD change: +245.7bp)

- Markit iTRAXX Japan 5Y down 3.1 bp, now at 75bp (YTD change: +28.7bp)

- Markit iTRAXX Asia Ex-Japan 5Y down 7.3 bp, now at 128bp (YTD change: +49.4bp)

5Y USD CDS SINGLE NAMES - LARGEST MOVES OVER THE PAST WEEK

- Nordstrom Inc (Country: US; rated: Ba1): up 53.3 bp to 536.8bp (1Y range: 211-537bp)

- Tegna Inc (Country: US; rated: Ba3): up 57.4 bp to 796.2bp (1Y range: 182-796bp)

- Avis Budget Group Inc (Country: US; rated: CCC): up 64.0 bp to 465.8bp (1Y range: 183-466bp)

- Kohls Corp (Country: US; rated: Baa2): up 67.2 bp to 446.9bp (1Y range: 101-447bp)

- DISH DBS Corp (Country: US; rated: B2): up 70.6 bp to 1,215.9bp (1Y range: 317-1,216bp)

- Bombardier Inc (Country: CA; rated: Caa1): up 79.4 bp to 942.5bp (1Y range: 395-942bp)

- Royal Caribbean Cruises Ltd (Country: US; rated: LGD4 - 59%): up 86.2 bp to 671.5bp (1Y range: 299-673bp)

- Macy's Inc (Country: US; rated: Ba1): up 106.1 bp to 589.6bp (1Y range: 181-590bp)

- Serbia, Republic of (Government) (Country: RS; rated: Ba2): up 106.7 bp to 291.7bp (1Y range: 100-292bp)

- Gap Inc (Country: US; rated: WR): up 116.4 bp to 599.2bp (1Y range: 132-599bp)

- Bath & Body Works Inc (Country: US; rated: Ba2): up 132.0 bp to 460.1bp (1Y range: 124-460bp)

- Liberty Interactive LLC (Country: US; rated: Ba3): up 173.5 bp to 1,377.4bp (1Y range: 287-1,377bp)

- Talen Energy Supply LLC (Country: US; rated: CCC-): up 225.0 bp to 4,725.0bp (1Y range: 1,007-13,972bp)

- Staples Inc (Country: US; rated: B3): up 334.2 bp to 2,023.1bp (1Y range: 744-2,023bp)

5Y EURO CDS SINGLE NAMES - LARGEST MOVES OVER THE PAST WEEK

- Air France KLM SA (Country: FR; rated: B-): down 57.8 bp to 593.9bp (1Y range: 386-652bp)

- Fortum Oyj (Country: FI; rated: baa3): down 34.5 bp to 217.7bp (1Y range: 40-252bp)

- Ineos Group Holdings SA (Country: LU; rated: WR): up 19.8 bp to 359.8bp (1Y range: 125-360bp)

- Valeo SE (Country: FR; rated: P-3): up 21.9 bp to 324.0bp (1Y range: 110-324bp)

- Virgin Media Finance PLC (Country: GB; rated: WR): up 24.5 bp to 416.3bp (1Y range: 222-441bp)

- Stena AB (Country: SE; rated: B2-PD): up 25.1 bp to 516.3bp (1Y range: 401-567bp)

- Next PLC (Country: GB; rated: BB): up 25.9 bp to 182.6bp (1Y range: 72-183bp)

- Elo SA (Country: FR; rated: ): up 27.0 bp to 284.3bp (1Y range: 83-284bp)

- Stonegate Pub Company Financing PLC (Country: GB; rated: WR): up 42.0 bp to 535.1bp (1Y range: 370-564bp)

- Unibail-Rodamco-Westfield SE (Country: FR; rated: BBB-): up 42.2 bp to 218.4bp (1Y range: 46-218bp)

- Ceconomy AG (Country: DE; rated: Ba1): up 44.4 bp to 452.5bp (1Y range: 141-452bp)

- Marks and Spencer PLC (Country: GB; rated: Ba1): up 46.8 bp to 404.5bp (1Y range: 139-405bp)

- Novafives SAS (Country: FR; rated: Caa1): up 62.9 bp to 1,312.6bp (1Y range: 618-1,395bp)

TOP BONDS MOVES IN THE PAST WEEK - USD HY

- Issuer: Southeast Supply Header LLC (Houston, Texas (US)) | Coupon: 4.25% | Maturity: 15/6/2024 | Rating: B | ISIN: USU83854AB29 | Z-spread up by 310.9 bp to 525.1 bp, with the yield to worst at 7.6% and the bond now trading down to 92.7 cents on the dollar (1Y price range: 92.4-102.8).

- Issuer: Bombardier Inc (MONTREAL, Canada) | Coupon: 7.45% | Maturity: 1/5/2034 | Rating: CCC+ | ISIN: USC10602AJ68 | Z-spread up by 239.9 bp to 743.9 bp (CDS basis: 169.6bp), with the yield to worst at 9.9% and the bond now trading down to 82.0 cents on the dollar (1Y price range: 81.0-122.9).

- Issuer: NCL Finance Ltd (#N/A, United Kingdom) | Coupon: 6.13% | Maturity: 15/3/2028 | Rating: CCC+ | ISIN: USG6437FAA78 | Z-spread up by 199.0 bp to 740.2 bp, with the yield to worst at 10.0% and the bond now trading down to 82.3 cents on the dollar (1Y price range: 82.0-99.5).

- Issuer: American Airlines Group Inc (Fort Worth, Texas (US)) | Coupon: 3.75% | Maturity: 1/3/2025 | Rating: CCC | ISIN: USU0242AAD47 | Z-spread up by 185.8 bp to 696.1 bp (CDS basis: 450.3bp), with the yield to worst at 9.5% and the bond now trading down to 86.0 cents on the dollar (1Y price range: 83.5-95.6).

- Issuer: NCL Corporation Ltd (Miami, Bermuda) | Coupon: 7.75% | Maturity: 15/2/2029 | Rating: CCC+ | ISIN: USG6436QAP12 | Z-spread up by 185.1 bp to 763.0 bp, with the yield to worst at 10.4% and the bond now trading down to 87.0 cents on the dollar (1Y price range: 86.8-103.0).

- Issuer: Bath & Body Works Inc (Columbus, Ohio (US)) | Coupon: 9.38% | Maturity: 1/7/2025 | Rating: BB | ISIN: USU51407AD34 | Z-spread up by 166.6 bp to 388.7 bp, with the yield to worst at 6.5% and the bond now trading down to 107.5 cents on the dollar (1Y price range: 104.5-122.3).

- Issuer: ZF North America Capital Inc (Northville, Michigan (US)) | Coupon: 4.75% | Maturity: 29/4/2025 | Rating: BB+ | ISIN: USU98737AC03 | Z-spread up by 162.4 bp to 392.9 bp, with the yield to worst at 6.3% and the bond now trading down to 94.9 cents on the dollar (1Y price range: 94.8-107.1).

- Issuer: Compass Minerals International Inc (Overland Park, Kansas (US)) | Coupon: 4.88% | Maturity: 15/7/2024 | Rating: B+ | ISIN: USU2036YAC04 | Z-spread up by 132.2 bp to 396.7 bp, with the yield to worst at 6.3% and the bond now trading down to 96.1 cents on the dollar (1Y price range: 96.0-102.8).

- Issuer: Twitter Inc (San Francisco, California (US)) | Coupon: 3.88% | Maturity: 15/12/2027 | Rating: BB | ISIN: USU8882PAA58 | Z-spread up by 125.9 bp to 226.1 bp, with the yield to worst at 4.9% and the bond now trading down to 94.0 cents on the dollar (1Y price range: 93.8-103.9).

- Issuer: FMG Resources (August 2006) Pty Ltd (#N/A, Australia) | Coupon: 5.88% | Maturity: 15/4/2030 | Rating: BB+ | ISIN: USQ3919KAP68 | Z-spread up by 122.6 bp to 405.0 bp, with the yield to worst at 6.7% and the bond now trading down to 93.8 cents on the dollar (1Y price range: 93.8-99.9).

- Issuer: Rockies Express Pipeline LLC (Leawood, Kansas (US)) | Coupon: 6.88% | Maturity: 15/4/2040 | Rating: BB | ISIN: USU75111AG60 | Z-spread up by 101.8 bp to 564.2 bp, with the yield to worst at 8.2% and the bond now trading down to 86.0 cents on the dollar (1Y price range: 86.0-112.8).

- Issuer: Wynn Resorts Finance LLC (Las Vegas, Nevada (US)) | Coupon: 5.13% | Maturity: 1/10/2029 | Rating: B | ISIN: USU98354AA80 | Z-spread up by 100.8 bp to 560.8 bp, with the yield to worst at 8.3% and the bond now trading down to 82.0 cents on the dollar (1Y price range: 81.5-102.3).

- Issuer: Brinker International Inc (Coppell, Texas (US)) | Coupon: 5.00% | Maturity: 1/10/2024 | Rating: B+ | ISIN: USU6223WAB01 | Z-spread up by 98.5 bp to 336.7 bp, with the yield to worst at 6.2% and the bond now trading down to 97.3 cents on the dollar (1Y price range: 97.0-106.8).

- TOP BONDS MOVES IN THE PAST WEEK - EUR HY

- Issuer: Adler Group SA (Senningerberg, Luxembourg) | Coupon: 2.25% | Maturity: 27/4/2027 | Rating: CCC | ISIN: XS2336188029 | Z-spread up by 168.1 bp to 1,565.4 bp, with the yield to worst at 16.6% and the bond now trading down to 53.2 cents on the dollar (1Y price range: 52.9-85.9).

- Issuer: Ceconomy AG (Dusseldorf, Germany) | Coupon: 1.75% | Maturity: 24/6/2026 | Rating: BB+ | ISIN: XS2356316872 | Z-spread up by 153.7 bp to 510.9 bp (CDS basis: -109.9bp), with the yield to worst at 6.2% and the bond now trading down to 83.8 cents on the dollar (1Y price range: 76.6-98.3).

- Issuer: EP Infrastructure as (Praha, Czech Republic) | Coupon: 1.82% | Maturity: 2/3/2031 | Rating: BB | ISIN: XS2304675791 | Z-spread up by 153.5 bp to 496.0 bp, with the yield to worst at 6.6% and the bond now trading down to 69.0 cents on the dollar (1Y price range: 61.4-100.0).

- Issuer: Nemak SAB de CV (San Pedro Garza Garcia, Mexico) | Coupon: 2.25% | Maturity: 20/7/2028 | Rating: BB+ | ISIN: XS2362994068 | Z-spread up by 112.7 bp to 514.3 bp, with the yield to worst at 6.4% and the bond now trading down to 78.6 cents on the dollar (1Y price range: 78.2-97.0).

- Issuer: Arcelik AS (Turkey) | Coupon: 3.00% | Maturity: 27/5/2026 | Rating: BB | ISIN: XS2346972263 | Z-spread up by 96.3 bp to 469.0 bp, with the yield to worst at 5.8% and the bond now trading down to 89.7 cents on the dollar (1Y price range: 89.5-98.4).

- Issuer: Maxima Grupe UAB (Vilnius, Lithuania) | Coupon: 3.25% | Maturity: 13/9/2023 | Rating: BB+ | ISIN: XS1878323499 | Z-spread up by 91.0 bp to 359.5 bp, with the yield to worst at 3.9% and the bond now trading down to 98.9 cents on the dollar (1Y price range: 98.8-101.9).

- Issuer: Dometic Group AB (publ) (Solna, Sweden) | Coupon: 3.00% | Maturity: 8/5/2026 | Rating: BB- | ISIN: XS1991114858 | Z-spread up by 91.0 bp to 336.1 bp, with the yield to worst at 4.3% and the bond now trading down to 94.3 cents on the dollar (1Y price range: 94.2-105.2).

- Issuer: DIC Asset AG (Frankfurt, Germany) | Coupon: 2.25% | Maturity: 22/9/2026 | Rating: BB+ | ISIN: XS2388910270 | Z-spread up by 86.9 bp to 588.6 bp, with the yield to worst at 7.0% and the bond now trading down to 82.2 cents on the dollar (1Y price range: 82.0-95.9).

- Issuer: Carnival PLC (Southampton, United Kingdom) | Coupon: 1.00% | Maturity: 28/10/2029 | Rating: B- | ISIN: XS2066744231 | Z-spread up by 85.5 bp to 570.5 bp, with the yield to worst at 7.1% and the bond now trading down to 65.1 cents on the dollar (1Y price range: 64.7-77.3).

- Issuer: Banca Monte dei Paschi di Siena SpA (Siena, Italy) | Coupon: 1.88% | Maturity: 9/1/2026 | Rating: CCC+ | ISIN: XS2270393379 | Z-spread up by 76.8 bp to 470.5 bp (CDS basis: 41.2bp), with the yield to worst at 5.6% and the bond now trading down to 87.2 cents on the dollar (1Y price range: 87.2-97.5).

- Issuer: Telecom Italia SpA (Rome, Italy) | Coupon: 1.63% | Maturity: 18/1/2029 | Rating: BB- | ISIN: XS2288109676 | Z-spread up by 75.1 bp to 483.1 bp (CDS basis: -15.0bp), with the yield to worst at 6.3% and the bond now trading down to 75.2 cents on the dollar (1Y price range: 74.6-92.3).

- Issuer: Petroleos Mexicanos (Miguel Hidalgo, Mexico) | Coupon: 4.88% | Maturity: 21/2/2028 | Rating: BB- | ISIN: XS1568888777 | Z-spread up by 71.9 bp to 624.2 bp (CDS basis: -126.3bp), with the yield to worst at 7.5% and the bond now trading down to 87.6 cents on the dollar (1Y price range: 87.6-100.4).

- Issuer: Atlantia SpA (Rome, Italy) | Coupon: 1.63% | Maturity: 3/2/2025 | Rating: BB | ISIN: XS1558491855 | Z-spread up by 70.1 bp to 270.1 bp (CDS basis: -115.2bp), with the yield to worst at 3.4% and the bond now trading down to 94.6 cents on the dollar (1Y price range: 94.6-101.6).

- Issuer: Bper Banca SpA (Modena, Italy) | Coupon: 1.88% | Maturity: 7/7/2025 | Rating: BB- | ISIN: XS2190502323 | Z-spread up by 67.3 bp to 213.3 bp, with the yield to worst at 3.1% and the bond now trading down to 96.0 cents on the dollar (1Y price range: 95.5-101.9).

- Issuer: Saipem Finance International BV (Amsterdam, Netherlands) | Coupon: 3.75% | Maturity: 8/9/2023 | Rating: B+ | ISIN: XS1487495316 | Z-spread down by 75.0 bp to 498.9 bp (CDS basis: 162.7bp), with the yield to worst at 5.3% and the bond now trading up to 97.8 cents on the dollar (1Y price range: 76.2-103.4).

- Issuer: SoftBank Group Corp (Minato-Ku, Japan) | Coupon: 2.13% | Maturity: 6/7/2024 | Rating: BB+ | ISIN: XS2361253862 | Z-spread down by 79.2 bp to 454.6 bp, with the yield to worst at 5.4% and the bond now trading up to 93.5 cents on the dollar (1Y price range: 89.8-99.1).

SELECTED RECENT USD DOMESTIC BOND ISSUES

- American Express Co (Banking | New York City, New York, United States | Rating: BBB): US$750m Subordinated Note (US025816CX59), floating rate maturing on 26 May 2033, priced at 100.00 (original spread of 202 bp), callable (11nc11)

- Carnival Corp (Leisure | Miami, United States | Rating: B): US$1,000m Senior Note (US143658BS00), fixed rate (10.50% coupon) maturing on 1 June 2030, priced at 100.00 (original spread of 812 bp), callable (8nc3)

- Church & Dwight Co Inc (Conglomerate/Diversified Mfg | Ewing, New Jersey, United States | Rating: BBB+): US$500m Senior Note (US17136MAB81), fixed rate (5.00% coupon) maturing on 15 June 2052, priced at 99.95 (original spread of 209 bp), callable (30nc30)

- Citigroup Inc (Banking | New York City, New York, United States | Rating: BBB+): US$1,500m Senior Note (US172967NS68), floating rate maturing on 24 May 2028, priced at 100.00 (original spread of 175 bp), callable (6nc5)

- Citigroup Inc (Banking | New York City, New York, United States | Rating: BBB+): US$500m Senior Note (US172967NR85), floating rate (SOFR + 137.2 bp) maturing on 24 May 2025, priced at 100.00, callable (3nc2)

- Citigroup Inc (Banking | New York City, New York, United States | Rating: BBB+): US$2,500m Senior Note (US172967NU15), floating rate maturing on 24 May 2033, priced at 100.00 (original spread of 196 bp), callable (11nc10)

- Citigroup Inc (Banking | New York City, New York, United States | Rating: BBB+): US$1,500m Senior Note (US172967NQ03), floating rate maturing on 24 May 2025, priced at 100.00 (original spread of 116 bp), callable (3nc2)

- Citizens Bank NA (Banking | Providence, United States | Rating: BBB+): US$650m Senior Note (US75524KNQ30), floating rate maturing on 23 May 2025, priced at 100.00 (original spread of 130 bp), callable (3nc2)

- Citizens Financial Group Inc (Banking | Providence, Rhode Island, United States | Rating: BBB): US$400m Subordinated Note (US174610BE40), fixed rate (5.64% coupon) maturing on 21 May 2037, priced at 100.00 (original spread of 275 bp), callable (15nc10)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$250m Bond (US3133ENXM73), floating rate (PRQ + -313.0 bp) maturing on 24 May 2024, priced at 100.00, non callable

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, New Jersey, United States | Rating: AA+): US$225m Bond (US3133ENXS44), fixed rate (3.38% coupon) maturing on 26 May 2026, priced at 100.00 (original spread of 132 bp), callable (4nc1)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$725m Bond (US3133ENXG06), floating rate (SOFR + 4.5 bp) maturing on 24 May 2024, priced at 100.00, non callable

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$190m Bond (US3133ENXE57), fixed rate (2.85% coupon) maturing on 23 May 2025, priced at 100.00 (original spread of 7 bp), non callable

- Federal Home Loan Mortgage Corp (Agency | Mc Lean, United States | Rating: AA+): US$110m Unsecured Note (US3134GXUW20), fixed rate (3.00% coupon) maturing on 14 June 2024, priced at 100.00, callable (2nc1m)

- Hci Group Inc (Property and Casualty Insurance | Tampa, Florida, United States | Rating: NR): US$150m Bond (US40416EAE32), fixed rate (4.75% coupon) maturing on 1 June 2042, priced at 100.00, callable (20nc5), convertible

- KeyCorp (Banking | Cleveland, United States | Rating: BBB+): US$600m Senior Note (US49326EEL39), floating rate maturing on 23 May 2025, priced at 100.00 (original spread of 98 bp), callable (3nc2)

- KeyCorp (Banking | Cleveland, United States | Rating: BBB+): US$750m Senior Note (US49326EEN94), floating rate maturing on 1 June 2033, priced at 100.00 (original spread of 190 bp), callable (11nc10)

- Motorola Solutions Inc (Electronics | Chicago, Illinois, United States | Rating: BBB-): US$600m Senior Note (US620076BW88), fixed rate (5.60% coupon) maturing on 1 June 2032, priced at 99.86 (original spread of 265 bp), callable (10nc10)

- Nucor Corp (Machinery | Charlotte, North Carolina, United States | Rating: BBB+): US$500m Senior Note (US670346AX38), fixed rate (3.95% coupon) maturing on 23 May 2025, priced at 99.94 (original spread of 115 bp), with a make whole call

- Nucor Corp (Machinery | Charlotte, United States | Rating: BBB+): US$500m Senior Note (US670346AY11), fixed rate (4.30% coupon) maturing on 23 May 2027, priced at 99.84 (original spread of 145 bp), callable (5nc5)

- PECO Energy Co (Utility - Other | Philadelphia, Pennsylvania, United States | Rating: A): US$350m First & Refunding Mortgage Bond (US693304BD82), fixed rate (4.60% coupon) maturing on 15 May 2052, priced at 99.28 (original spread of 175 bp), callable (30nc29)

- PayPal Holdings Inc (Service - Other | San Jose, California, United States | Rating: A-): US$500m Senior Note (US70450YAN31), fixed rate (5.25% coupon) maturing on 1 June 2062, priced at 99.65 (original spread of 272 bp), callable (40nc40)

- PayPal Holdings Inc (Service - Other | San Jose, California, United States | Rating: A-): US$1,000m Senior Note (US70450YAM57), fixed rate (5.05% coupon) maturing on 1 June 2052, priced at 99.68 (original spread of 239 bp), callable (30nc30)

- PayPal Holdings Inc (Service - Other | San Jose, California, United States | Rating: A-): US$500m Senior Note (US70450YAK91), fixed rate (3.90% coupon) maturing on 1 June 2027, priced at 99.87 (original spread of 110 bp), callable (5nc5)

- PayPal Holdings Inc (Service - Other | San Jose, California, United States | Rating: A-): US$1,000m Senior Note (US70450YAL74), fixed rate (4.40% coupon) maturing on 1 June 2032, priced at 99.65 (original spread of 168 bp), callable (10nc10)

- Southern California Edison Co (Utility - Other | Rosemead, California, United States | Rating: BBB+): US$300m First & Refunding Mortgage Bond (US842400HP13), fixed rate (4.20% coupon) maturing on 1 June 2025, priced at 99.88 (original spread of 140 bp), with a make whole call

- Southern California Edison Co (Utility - Other | Rosemead, California, United States | Rating: BBB+): US$600m First & Refunding Mortgage Bond (US842400HQ95), fixed rate (4.70% coupon) maturing on 1 June 2027, priced at 99.79 (original spread of 185 bp), callable (5nc5)

- Southern California Edison Co (Utility - Other | Rosemead, California, United States | Rating: BBB+): US$350m First & Refunding Mortgage Bond (US842400HR78), fixed rate (5.45% coupon) maturing on 1 June 2052, priced at 99.38 (original spread of 273 bp), callable (30nc30)

- Virginia Electric and Power Co (Utility - Other | Richmond, Virginia, United States | Rating: BBB+): US$600m Senior Note (US927804GJ70), fixed rate (4.63% coupon) maturing on 15 May 2052, priced at 98.61 (original spread of 187 bp), callable (30nc29)

- Virginia Electric and Power Co (Utility - Other | Richmond, Virginia, United States | Rating: BBB+): US$600m Senior Note (US927804GH15), fixed rate (3.75% coupon) maturing on 15 May 2027, priced at 99.69 (original spread of 98 bp), callable (5nc5)

SELECTED RECENT USD GLOBAL BOND ISSUES

- Banco Santander SA (Banking | Boadilla Del Monte, Madrid, Spain | Rating: A): US$650m Note (US05971KAN90), floating rate (SOFR + 124.0 bp) maturing on 24 May 2024, priced at 100.00, non callable

- Banco Santander SA (Banking | Boadilla Del Monte, Madrid, Spain | Rating: A): US$1,500m Note (US05971KAM18), fixed rate (3.89% coupon) maturing on 24 May 2024, priced at 100.00 (original spread of 130 bp), non callable

- CNH Industrial Capital LLC (Financial - Other | Mount Pleasant, Wisconsin, United Kingdom | Rating: BBB): US$500m Senior Note (US12592BAN47), fixed rate (3.95% coupon) maturing on 23 May 2025, priced at 99.47 (original spread of 125 bp), with a make whole call

- Coastal Emerald Ltd (Financial - Other | Road Town, China (Mainland) | Rating: NR): US$500m Unsecured Note (XS2480876254) maturing on 18 May 2025, priced at 100.00, non callable

- Commonwealth Bank of Australia (Banking | Sydney, New South Wales, Australia | Rating: A+): US$1,750m Covered Bond (Other) (US20271AAJ60), fixed rate (3.21% coupon) maturing on 27 May 2025, priced at 100.00 (original spread of 46 bp), non callable

- Export Development Canada (Agency | Ottawa, Ontario, Canada | Rating: AAA): US$2,750m Senior Note (US30216BJR42), fixed rate (3.00% coupon) maturing on 25 May 2027, priced at 99.85 (original spread of 12 bp), non callable

- HSBC USA Inc (Banking | New York City, United Kingdom | Rating: A-): US$1,000m Senior Note (US40428HTA04), fixed rate (3.75% coupon) maturing on 24 May 2024, priced at 100.00 (original spread of 105 bp), non callable

- Intesa Sanpaolo SpA (Banking | Torino, Torino, Italy | Rating: BBB): US$200m Unsecured Note (XS2482611378), fixed rate (3.96% coupon) maturing on 25 May 2025, priced at 100.00, non callable

- Intesa Sanpaolo SpA (Banking | Torino, Torino, Italy | Rating: BBB): US$200m Unsecured Note (XS2482615957), fixed rate (4.68% coupon) maturing on 25 May 2029, priced at 100.00, non callable

- Japan International Cooperation Agency (Agency | Chiyoda-Ku, Japan | Rating: A+): US$900m Bond (US47109LAF13), fixed rate (3.25% coupon) maturing on 25 May 2027, priced at 99.66 (original spread of 46 bp), non callable

- Munchener Ruckversicherungs-Gesellschaft Munich Reinsurance Co (Financial - Other | Sydney | Rating: NR): US$1,250m Subordinated Note (US62582PAA84), fixed rate (5.88% coupon) maturing on 23 May 2042, priced at 100.00 (original spread of 303 bp), callable (20nc10)

- Nederlandse Waterschapsbank NV (Agency | S-Gravenhage, Zuid-Holland, Netherlands | Rating: AAA): US$500m Senior Note (XS2485170695), fixed rate (2.88% coupon) maturing on 24 May 2024, priced at 99.98 (original spread of 19 bp), non callable

- Oesterreichische Kontrollbank AG (Agency | Wien, Wien, Austria | Rating: AA+): US$1,000m Senior Note (US676167CE73), fixed rate (2.88% coupon) maturing on 23 May 2025, priced at 99.82 (original spread of 12 bp), non callable

- Romania (Government) (Sovereign | Bucuresti, Bucuresti, Romania | Rating: BBB-): US$750m Senior Note (XS2485249523), fixed rate (6.00% coupon) maturing on 25 May 2034, priced at 99.84 (original spread of 320 bp), non callable

- Romania (Government) (Sovereign | Bucuresti, Bucuresti, Romania | Rating: BBB-): US$1,000m Senior Note (XS2485248806), fixed rate (5.50% coupon) maturing on 25 November 2027, priced at 99.76 (original spread of 284 bp), non callable

- Romania (Government) (Sovereign | Bucuresti, Romania | Rating: BBB-): US$1,000m Senior Note (US77586RAN08), fixed rate (5.50% coupon) maturing on 25 November 2027, priced at 99.76 (original spread of 284 bp), non callable

- Soar Wise Ltd (Financial - Other | George Town, China (Mainland) | Rating: NR): US$450m Senior Note (XS2471903331), fixed rate (4.05% coupon) maturing on 24 May 2025, priced at 99.92 (original spread of 147 bp), non callable

- Standard Chartered Bank (Banking | London, United Kingdom | Rating: A+): US$1,115m Unsecured Note (XS2483463704), floating rate maturing on 23 May 2027, priced at 100.00, non callable

- Westpac Banking Corp (Banking | Sydney, New South Wales, Australia | Rating: AA-): US$550m Senior Note (US961214FB49), floating rate (SOFR + 100.0 bp) maturing on 26 August 2025, priced at 100.00, non callable

- Westpac Banking Corp (Banking | Sydney, New South Wales, Australia | Rating: AA-): US$700m Senior Note (US961214FA65), fixed rate (3.74% coupon) maturing on 26 August 2025, priced at 100.00 (original spread of 92 bp), non callable

- Westpac Banking Corp (Banking | Sydney, New South Wales, Australia | Rating: AA-): US$1,000m Senior Note (US961214FC22), fixed rate (4.04% coupon) maturing on 26 August 2027, priced at 100.00 (original spread of 115 bp), non callable

SELECTED RECENT EUR BOND ISSUES

- Achmea Bank NV (Banking | Tilburg, Noord-Brabant, Netherlands | Rating: AAA): €500m Covered Bond (Other) (XS2484321950), fixed rate (1.63% coupon) maturing on 24 May 2029, priced at 99.79 (original spread of 85 bp), non callable

- BNP Paribas SA (Banking | Paris, Ile-De-France, France | Rating: A+): €1,500m Bond (FR001400AKP6), floating rate maturing on 25 July 2028, priced at 99.74 (original spread of 208 bp), callable (6nc5)

- BPCE SFH SA (Financial - Other | Paris, Ile-De-France, France | Rating: NR): €1,000m Obligation de Financement de l'Habitat (Covered Bond) (FR001400AJW4), fixed rate (1.75% coupon) maturing on 27 May 2032, priced at 99.00 (original spread of 83 bp), non callable

- Banco Bilbao Vizcaya Argentaria SA (Banking | Madrid, Madrid, Spain | Rating: A-): €500m Note (XS2485259670), floating rate (EU03MLIB + 100.0 bp) maturing on 26 November 2025, priced at 101.27, non callable

- Banco Bilbao Vizcaya Argentaria SA (Banking | Madrid, Madrid, Spain | Rating: A-): €1,250m Note (XS2485259241), fixed rate (1.75% coupon) maturing on 26 November 2025, priced at 99.70 (original spread of 130 bp), non callable

- Banco de Sabadell SA (Banking | Alicante, Alicante, Spain | Rating: AA+): €1,000m Cedula Hipotecaria (Covered Bond) (ES0413860802), fixed rate (1.75% coupon) maturing on 30 May 2029, priced at 99.86 (original spread of 93 bp), non callable

- Bouygues SA (Conglomerate/Diversified Mfg | Paris, Ile-De-France, France | Rating: A-): €1,000m Bond (FR001400AJY0), fixed rate (3.25% coupon) maturing on 30 June 2037, priced at 98.89 (original spread of 215 bp), callable (15nc15)

- Bouygues SA (Conglomerate/Diversified Mfg | Paris, Ile-De-France, France | Rating: A-): €1,000m Bond (FR001400AJX2), fixed rate (2.25% coupon) maturing on 29 June 2029, priced at 99.49 (original spread of 147 bp), callable (7nc7)

- Bper Banca SpA (Banking | Modena, Modena, Italy | Rating: BB+): €500m Note (XS2485537828), floating rate maturing on 30 June 2025, priced at 99.89, callable (3nc2)

- Caisse Francaise de Financement Local SA (Financial - Other | Issy-Les-Moulineaux, Ile-De-France, France | Rating: NR): €500m Covered Bond (Other) (FR001400AJT0), fixed rate (1.88% coupon) maturing on 25 May 2034, priced at 98.75 (original spread of 91 bp), non callable

- Deutsche Bahn Finance GmbH (Financial - Other | Berlin, Berlin, Germany | Rating: NR): €900m Senior Note (XS2484327999), fixed rate (1.88% coupon) maturing on 24 May 2030, priced at 99.14 (original spread of 110 bp), non callable

- Deutsche Bank AG (Banking | Frankfurt, Hessen, Germany | Rating: BBB-): €500m Senior Note (DE000DL19WU8), floating rate maturing on 24 May 2028, priced at 99.59 (original spread of 261 bp), non callable

- Elis SA (Service - Other | Saint-Cloud, Ile-De-France, France | Rating: BB+): €300m Bond (FR001400AK26), fixed rate (4.13% coupon) maturing on 24 May 2027, priced at 99.45 (original spread of 352 bp), callable (5nc5)

- Equitable Bank (Banking | Toronto, Ontario, Canada | Rating: BBB-): €300m Covered Bond (Other) (XS2484201467), fixed rate (1.38% coupon) maturing on 27 May 2025, priced at 99.82 (original spread of 92 bp), non callable

- European Investment Bank (Supranational | Luxembourg, Luxembourg | Rating: AAA): €4,000m Senior Note (XS2484093393), fixed rate (1.50% coupon) maturing on 15 June 2032, priced at 99.63 (original spread of 54 bp), non callable

- European Stability Mechanism (Supranational | Luxembourg, Luxembourg | Rating: AAA): €2,000m Senior Note (EU000A1Z99Q7), fixed rate (1.00% coupon) maturing on 23 June 2027, priced at 99.49 (original spread of 46 bp), non callable

- Evonik Industries AG (Chemicals | Essen, Nordrhein-Westfalen, Germany | Rating: BBB): €750m Senior Note (XS2485162163), fixed rate (2.25% coupon) maturing on 25 September 2027, priced at 99.39 (original spread of 160 bp), callable (5nc5)

- Export-Import Bank of Korea (Agency | Seoul, Seoul, South Korea | Rating: AA-): €550m Senior Note (XS2484106633), floating rate (EU03MLIB + 15.0 bp) maturing on 24 May 2024, priced at 101.73, non callable

- Export-Import Bank of Korea (Agency | Seoul, Seoul, South Korea | Rating: AA-): €950m Senior Note (XS2484106716), fixed rate (1.38% coupon) maturing on 24 November 2025, priced at 99.80 (original spread of 90 bp), non callable

- Fresenius SE & Co KGaA (Health Care Facilities | Bad Homburg Vor Der Hohe, Hessen, Germany | Rating: BBB-): €750m Senior Note (XS2482872418), fixed rate (1.88% coupon) maturing on 24 May 2025, priced at 99.95 (original spread of 145 bp), callable (3nc3)

- Fresenius SE & Co KGaA (Health Care Facilities | Bad Homburg Vor Der Hohe, Hessen, Germany | Rating: BBB-): €550m Senior Note (XS2482872251), fixed rate (2.88% coupon) maturing on 24 May 2030, priced at 98.84 (original spread of 218 bp), callable (8nc8)

- Hamburg Commercial Bank AG (Banking | Hamburg, Hamburg, Germany | Rating: BBB): €500m Pfandbrief Anleihe (Covered Bond) (DE000HCB0BL1), fixed rate (1.38% coupon) maturing on 27 May 2025, priced at 99.72 (original spread of 97 bp), non callable

- HSBC Bank Canada (Banking | Vancouver, British Columbia, United Kingdom | Rating: A+): €1,000m Covered Bond (Other) (XS2481285349), fixed rate (1.50% coupon) maturing on 15 September 2027, priced at 99.65 (original spread of 85 bp), non callable

- ING Groep NV (Banking | Amsterdam, Noord-Holland, Netherlands | Rating: BBB+): €1,500m Senior Note (XS2483607474), floating rate maturing on 23 May 2026, priced at 99.93 (original spread of 183 bp), callable (4nc3)

- Investitions Und Strukturbank Rheinland Pfalz Isb (Financial - Other | Mainz, Rheinland-Pfalz, Germany | Rating: NR): €150m Inhaberschuldverschreibung (DE000A30VJG6), fixed rate (1.25% coupon) maturing on 26 May 2027, priced at 99.77 (original spread of 64 bp), non callable

- JPMorgan Chase Bank NA (Banking | Columbus, Ohio, United States | Rating: A+): €160m Unsecured Note (XS2476783365) zero coupon maturing on 16 March 2026, priced at 2.00, non callable

- Luxembourg, Grand Duchy of (Government) (Sovereign | Luxembourg, Luxembourg | Rating: AAA): €1,250m Senior Note (LU2475493826), fixed rate (1.38% coupon) maturing on 25 May 2029, priced at 99.70 (original spread of 57 bp), non callable

- Luxembourg, Grand Duchy of (Government) (Sovereign | Luxembourg, Luxembourg | Rating: AAA): €1,250m Senior Note (LU2475494477), fixed rate (1.75% coupon) maturing on 25 May 2042, priced at 98.14 (original spread of 74 bp), non callable

- Metropolitan Life Global Funding I (Financial - Other | Wilmington, Delaware, United States | Rating: NR): €500m Note (XS2484586669), fixed rate (1.75% coupon) maturing on 25 May 2025, priced at 99.95 (original spread of 125 bp), non callable

- NATWEST MARKETS PLC (Banking | Edinburgh, Midlothian, United Kingdom | Rating: A-): €750m Senior Note (XS2485553866), fixed rate (2.00% coupon) maturing on 27 August 2025, priced at 99.72 (original spread of 166 bp), non callable

- NATWEST MARKETS PLC (Banking | Edinburgh, Midlothian, United Kingdom | Rating: A-): €500m Senior Note (XS2485554088), floating rate (EU03MLIB + 94.0 bp) maturing on 27 August 2025, priced at 100.00, non callable

- National Australia Bank Ltd (Banking | Melbourne, Victoria, Australia | Rating: A+): €1,000m Senior Note (XS2484111047), fixed rate (2.13% coupon) maturing on 24 May 2028, priced at 99.54 (original spread of 142 bp), non callable

- Nordea Bank Abp (Banking | Helsinki, Etela-Suomen, Finland | Rating: A-): €1,000m Note (XS2482618464), fixed rate (2.50% coupon) maturing on 23 May 2029, priced at 99.81 (original spread of 179 bp), non callable

- PPG Industries Inc (Industrials - Other | Pittsburgh, Pennsylvania, United States | Rating: BBB+): €700m Senior Note (XS2484340075), fixed rate (2.75% coupon) maturing on 1 June 2029, priced at 99.74 (original spread of 194 bp), callable (7nc7)

- PPG Industries Inc (Industrials - Other | Pittsburgh, Pennsylvania, United States | Rating: BBB+): €300m Senior Note (XS2484339499), fixed rate (1.88% coupon) maturing on 1 June 2025, priced at 99.74 (original spread of 147 bp), callable (3nc3)

- Poland, Republic of (Government) (Sovereign | Warsaw, Woj. Mazowieckie, Poland | Rating: A-): €2,000m Senior Note (XS2447602793), fixed rate (2.75% coupon) maturing on 25 May 2032, priced at 99.14 (original spread of 182 bp), non callable

- Prologis International Funding II SA (Financial - Other | Luxembourg, Luxembourg | Rating: A-): €550m Senior Note (XS2485265214), fixed rate (3.13% coupon) maturing on 1 June 2031, priced at 99.77 (original spread of 229 bp), callable (9nc9)

- RRE 12 Loan Management DAC (Financial - Other | Ireland | Rating: NR): €269m Bond (XS2480045413), floating rate maturing on 15 July 2037, priced at 100.00, non callable

- RWE AG (Utility - Other | Essen, Nordrhein-Westfalen, Germany | Rating: BBB): €1,000m Senior Note (XS2482887879), fixed rate (2.75% coupon) maturing on 24 May 2030, priced at 99.29 (original spread of 193 bp), non callable

- RWE AG (Utility - Other | Essen, Nordrhein-Westfalen, Germany | Rating: BBB): €1,000m Senior Note (XS2482936247), fixed rate (2.13% coupon) maturing on 24 May 2026, priced at 99.65 (original spread of 161 bp), callable (4nc4)

- Raiffeisen Bank International AG (Banking | Wien, Wien, Austria | Rating: AA+): €500m Covered Bond (Other) (XS2481491160), fixed rate (1.50% coupon) maturing on 24 May 2027, priced at 99.54 (original spread of 93 bp), non callable

- Raiffeisenverband Salzburg Egen (Banking | Salzburg, Salzburg, Austria | Rating: A-): €300m Hypothekenpfandbrief (Covered Bond) (AT0000A2Y735), fixed rate (1.50% coupon) maturing on 25 May 2027, priced at 99.65 (original spread of 80 bp), non callable

- Suez SA (Service - Other | Paris, Ile-De-France, France | Rating: BBB): €850m Bond (FR001400AFN1), fixed rate (2.38% coupon) maturing on 24 May 2030, priced at 99.48 (original spread of 169 bp), callable (8nc8)

- Suez SA (Service - Other | Paris, Ile-De-France, France | Rating: BBB): €1,000m Bond (FR001400AFO9), fixed rate (2.88% coupon) maturing on 24 May 2034, priced at 99.13 (original spread of 206 bp), callable (12nc12)

- Suez SA (Service - Other | Paris, Ile-De-France, France | Rating: BBB): €750m Bond (FR001400AFL5), fixed rate (1.88% coupon) maturing on 24 May 2027, priced at 99.60 (original spread of 138 bp), callable (5nc5)

- Swedbank AB (Banking | Sundbyberg, Stockholm, Sweden | Rating: A+): €1,000m Note (XS2485152362), fixed rate (2.10% coupon) maturing on 25 May 2027, priced at 99.81 (original spread of 139 bp), non callable

- Telefonica Emisiones SAU (Financial - Other | Madrid, Madrid, Spain | Rating: BBB-): €1,000m Senior Note (XS2484587048), fixed rate (2.59% coupon) maturing on 25 May 2031, priced at 100.00 (original spread of 168 bp), callable (9nc9)

- UPM-Kymmene Oyj (Building Products | Helsinki, Etela-Suomen, Sweden | Rating: BBB+): €500m Senior Note (XS2478685931), fixed rate (2.25% coupon) maturing on 23 May 2029, priced at 99.29 (original spread of 165 bp), callable (7nc7)

- UniCredit Bank Austria AG (Banking | Wien, Wien, Italy | Rating: AAA): €500m Pfandbrief Anleihe (Covered Bond) (AT000B049911), fixed rate (1.50% coupon) maturing on 24 May 2028, priced at 99.84 (original spread of 79 bp), non callable

- VR Yhtyma Oy (Transportation - Other | Helsinki, Etela-Suomen, Finland | Rating: A+): €300m Bond (FI4000523287) maturing on 30 May 2029, callable (7nc7)

- Wurth Finance International BV (Financial - Other | S-Hertogenbosch, Noord-Brabant, Germany | Rating: A): €600m Senior Note (XS2480515662), fixed rate (2.13% coupon) maturing on 23 August 2030, priced at 99.64 (original spread of 136 bp), callable (8nc8)

NEW ISSUES IN SECURITIZED CREDIT

- Aimco Clo 17 Ltd issued a floating-rate CLO in 5 tranches, for a total of US$ 368 m. Highest-rated tranche offering a spread over the floating rate of 152bp, and the lowest-rated tranche a spread of 759bp. Bookrunners: Bank of America Merrill Lynch

- Pfs Financing Corp Series 2022-C issued a fixed-rate ABS backed by receivables in 2 tranches, for a total of US$ 475 m. Highest-rated tranche offering a yield to maturity of 3.90%, and the lowest-rated tranche a yield to maturity of 4.39%. Bookrunners: JP Morgan & Co Inc, Citigroup Global Markets Inc, BMO Capital Markets

- Verizon Master Trust 2022-3 issued a floating-rate ABS backed by certificates in 2 tranches, for a total of US$ 416 m. Highest-rated tranche offering a spread over the floating rate of 67bp, and the lowest-rated tranche a spread of 117bp. Bookrunners: Loop Capital Markets, RBC Capital Markets, Citigroup Global Markets Inc, BNP Paribas Securities Corp

- Verizon Master Trust 2022-4 issued a floating-rate ABS backed by certificates in 3 tranches, for a total of US$ 550 m. Highest-rated tranche offering a spread over the floating rate of 65bp, and the lowest-rated tranche a spread of 115bp. Bookrunners: Loop Capital Markets, RBC Capital Markets, Citigroup Global Markets Inc, BNP Paribas Securities Corp

- Luminace Abs-2022 Issuer LLC issued a fixed-rate ABS backed by certificates in 2 tranches, for a total of US$ 401 m. Highest-rated tranche offering a yield to maturity of 4.88%, and the lowest-rated tranche a yield to maturity of 5.95%. Bookrunners: Credit Suisse

- Wells Fargo Securities LLC, Scotia Capital (USA) Inc., HSBC Securities (USA) Inc, TD Securities (USA) LLC

- Oportun Issuance Trust 2022-A issued a floating-rate ABS backed by consumer loan in 3 tranches, for a total of US$ 389 m. Highest-rated tranche offering a spread over the floating rate of 250bp, and the lowest-rated tranche a spread of 530bp. Bookrunners: Goldman Sachs & Co, Jefferies & Co Inc, JP Morgan & Co Inc

- Trp 2022-1 LLC issued a fixed-rate ABS backed by leases in 2 tranches, for a total of US$ 327 m. Highest-rated tranche offering a yield to maturity of 4.76%, and the lowest-rated tranche a yield to maturity of 5.75%. Bookrunners: Credit Suisse

- Morgan Stanley International Ltd, Deutsche Bank Securities Inc, Wells Fargo Securities LLC, Bank of America Merrill Lynch

- Discover Card Execution Note Trust 2022-A2 issued a fixed-rate ABS backed by receivables in a single tranche offering a yield to maturity of 3.32%, for a total of US$ 1,400 m. Bookrunners: RBC Capital Markets, Citigroup Global Markets Inc, Wells Fargo Securities LLC

- Carvana Auto Receivables Trust 2022-P2 issued a floating-rate ABS backed by auto receivables in 8 tranches, for a total of US$ 585 m. Highest-rated tranche offering a spread over the floating rate of 55bp, and the lowest-rated tranche a spread of 405bp. Bookrunners: Credit Suisse, Santander Investment Securities Inc, Deutsche Bank Securities Inc, Citigroup Global Markets Inc, Wells Fargo Securities LLC, BNP Paribas Securities Corp