Credit

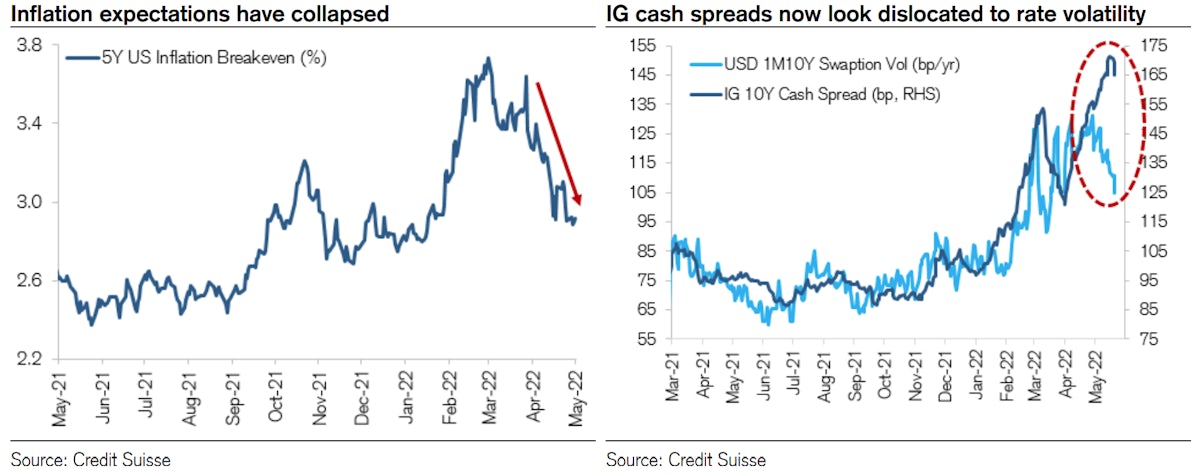

Spreads Tighter Across The Credit Complex, Although IG Cash Is Lagging In Comparison To HY Moves

According to the IFR, it was the slowest week for US domestic IG issuance since November 2020, with just 2 tranches priced for US$700m (2022 YTD volume $652.1bn vs 2021 YTD $720.5bn ), and zero issuance in HY (2022 YTD volume $56.4bn vs 2021 YTD $248.9bn)

Published ET

IG Cash Spreads Likely To Tighten With The Fall In Rates Volatility | Source: Credit Suisse

DAILY SUMMARY

- S&P 500 Bond Index was up 0.27% today, with investment grade up 0.24% and high yield up 0.52% (YTD total return: -10.69%)

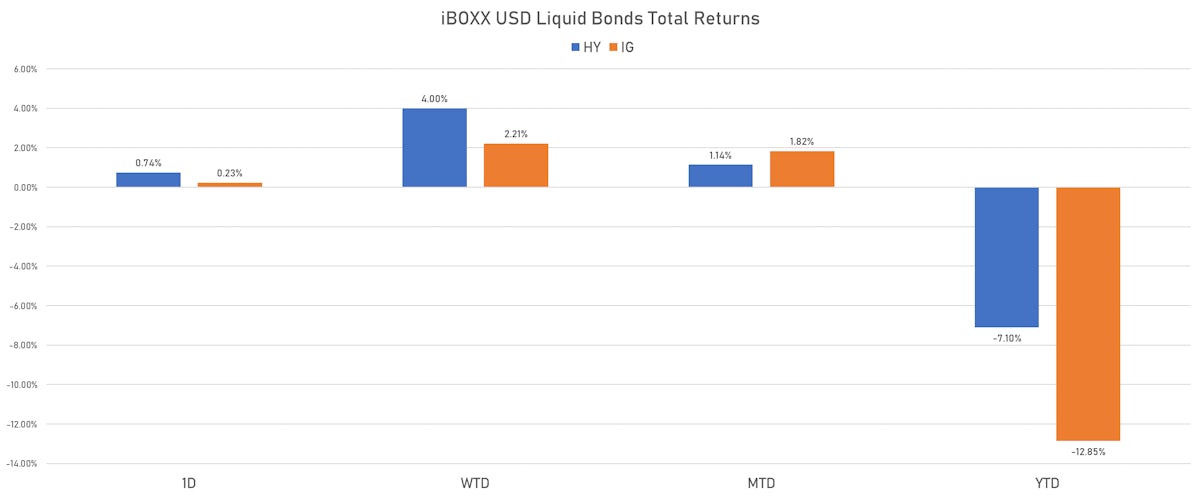

- The iBoxx USD Liquid Investment Grade Total Return Index was up 0.231% today (Month-to-date: 1.82%; Year-to-date: -12.85%)

- The iBoxx USD Liquid High Yield Total Return Index was up 0.741% today (Month-to-date: 1.14%; Year-to-date: -7.10%)

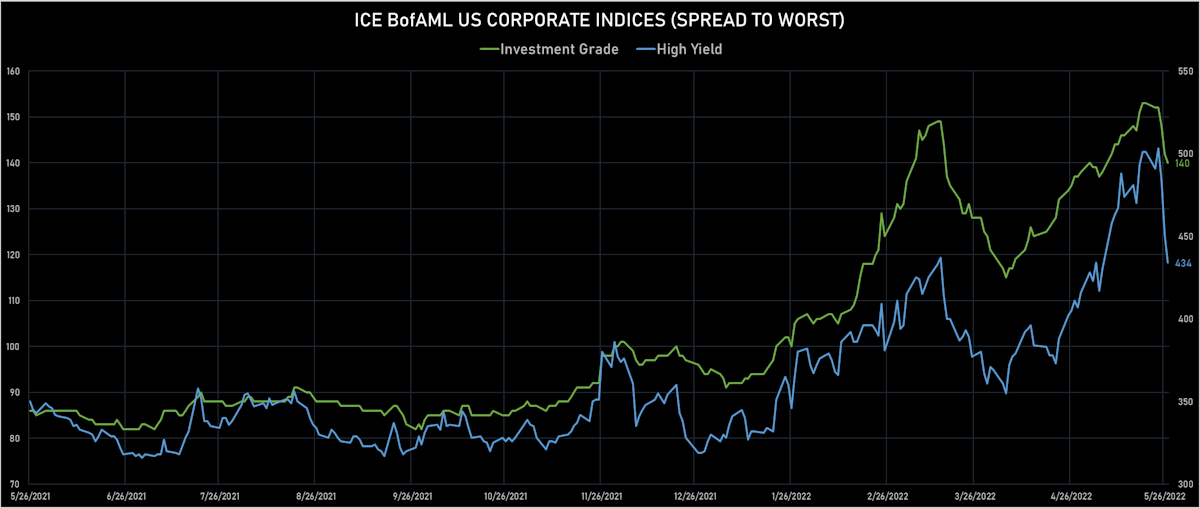

- ICE BofA US Corporate Index (Investment Grade) spread to worst down -2.0 bp, now at 140.0 bp (YTD change: +45.0 bp)

- ICE BofA US High Yield Index spread to worst down -17.0 bp, now at 434.0 bp (YTD change: +104.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index up 0.54% today (YTD total return: -3.2%)

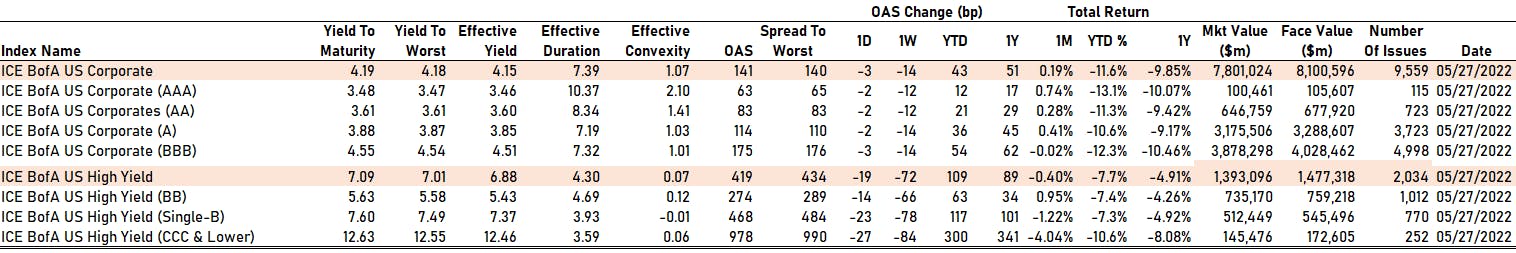

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING

- AAA down by -2 bp at 63 bp

- AA down by -2 bp at 83 bp

- A down by -2 bp at 114 bp

- BBB down by -3 bp at 175 bp

- BB down by -14 bp at 274 bp

- B down by -23 bp at 468 bp

- CCC down by -27 bp at 978 bp

CDS INDICES TODAY (mid-spreads)

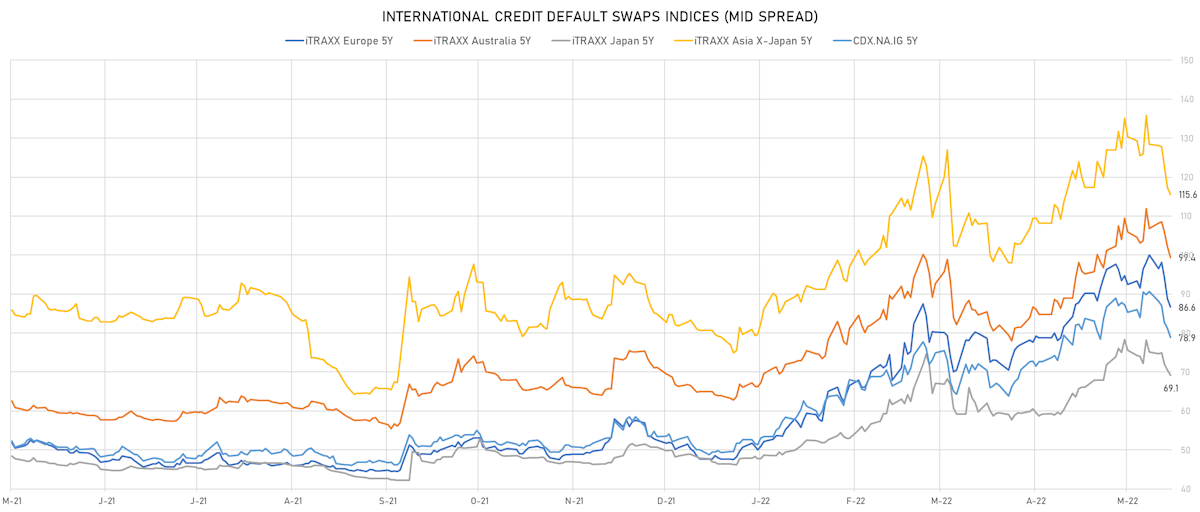

- Markit CDX.NA.IG 5Y down 2.4 bp, now at 79bp (YTD change: +29.6bp)

- Markit CDX.NA.IG 10Y down 2.1 bp, now at 115bp (YTD change: +25.6bp)

- Markit CDX.NA.HY 5Y down 9.2 bp, now at 457bp (YTD change: +164.8bp)

- Markit iTRAXX Europe 5Y down 2.2 bp, now at 87bp (YTD change: +38.9bp)

- Markit iTRAXX Europe Crossover 5Y down 8.4 bp, now at 430bp (YTD change: +188.0bp)

- Markit iTRAXX Japan 5Y down 1.4 bp, now at 69bp (YTD change: +22.7bp)

- Markit iTRAXX Asia Ex-Japan 5Y down 1.7 bp, now at 116bp (YTD change: +36.6bp)

5Y USD CDS SINGLE NAMES - LARGEST MOVES OVER THE PAST WEEK

- Transocean Inc (Country: KY; rated: Caa3): down 467.2 bp to 1,643.9bp (1Y range: 941-1,784bp)

- Staples Inc (Country: US; rated: B3): down 399.7 bp to 1,623.4bp (1Y range: 768-1,842bp)

- Macy's Inc (Country: US; rated: Ba1): down 196.7 bp to 392.8bp (1Y range: 181-565bp)

- DISH DBS Corp (Country: US; rated: B2): down 165.4 bp to 1,045.8bp (1Y range: 317-1,205bp)

- Nordstrom Inc (Country: US; rated: Ba1): down 158.6 bp to 375.5bp (1Y range: 211-509bp)

- American Airlines Group Inc (Country: US; rated: B2): down 158.1 bp to 1,113.2bp (1Y range: 596-1,343bp)

- Bombardier Inc (Country: CA; rated: Caa1): down 136.6 bp to 819.3bp (1Y range: 395-937bp)

- Nabors Industries Inc (Country: US; rated: B3): down 126.9 bp to 643.5bp (1Y range: 489-1,096bp)

- Realogy Group LLC (Country: US; rated: WR): down 101.9 bp to 665.0bp (1Y range: 278-758bp)

- Talen Energy Supply LLC (Country: US; rated: CCC-): down 100.0 bp to 4,625.0bp (1Y range: 1,007-13,972bp)

- Goodyear Tire & Rubber Co (Country: US; rated: WR): down 97.2 bp to 410.2bp (1Y range: 188-524bp)

- Pitney Bowes Inc (Country: US; rated: B1): down 91.7 bp to 815.4bp (1Y range: 363-842bp)

- Carnival Corp (Country: US; rated: LGD5 - 72%): down 89.5 bp to 694.4bp (1Y range: 291-857bp)

5Y EURO CDS SINGLE NAMES - LARGEST MOVES OVER THE PAST WEEK

- Boparan Finance PLC (Country: GB; rated: Caa1): down 209.1 bp to 1,892.8bp (1Y range: 863-2,690bp)

- Novafives SAS (Country: FR; rated: Caa1): down 149.1 bp to 1,163.6bp (1Y range: 618-1,395bp)

- Iceland Bondco PLC (Country: GB; rated: LGD3 - 46%): down 99.7 bp to 980.1bp (1Y range: 418-1,092bp)

- Casino Guichard Perrachon SA (Country: FR; rated: WR): down 64.8 bp to 1,168.7bp (1Y range: 464-1,452bp)

- Jaguar Land Rover Automotive PLC (Country: GB; rated: WD): down 58.4 bp to 711.4bp (1Y range: 339-797bp)

- Marks and Spencer PLC (Country: GB; rated: Ba1): down 54.2 bp to 350.3bp (1Y range: 139-405bp)

- Premier Foods Finance PLC (Country: GB; rated: B1): down 51.5 bp to 349.9bp (1Y range: 154-409bp)

- Telecom Italia SpA (Country: IT; rated: LGD4 - 53%): down 46.8 bp to 402.0bp (1Y range: 149-440bp)

- Altice Finco SA (Country: LU; rated: Caa1): down 42.8 bp to 602.9bp (1Y range: 333-649bp)

- Fortum Oyj (Country: FI; rated: baa3): down 39.4 bp to 178.3bp (1Y range: 40-252bp)

- CMA CGM SA (Country: FR; rated: Ba2): down 37.6 bp to 411.8bp (1Y range: 259-496bp)

- ThyssenKrupp AG (Country: DE; rated: B1): down 33.4 bp to 368.3bp (1Y range: 205-445bp)

- British Telecommunications PLC (Country: GB; rated: BB+): down 33.1 bp to 100.8bp (1Y range: 63-135bp)

- Glencore International AG (Country: CH; rated: WR): down 32.6 bp to 168.6bp (1Y range: 109-211bp)

- Air France KLM SA (Country: FR; rated: B-): down 32.1 bp to 561.8bp (1Y range: 386-652bp)

TOP BONDS MOVES IN THE PAST WEEK - USD HY

- Issuer: Wynn Las Vegas LLC (Las Vegas, Nevada (US)) | Coupon: 5.50% | Maturity: 1/3/2025 | Rating: B | ISIN: USU98347AK05 | Z-spread down by 78.9 bp to 417.1 bp, with the yield to worst at 6.6% and the bond now trading up to 96.3 cents on the dollar (1Y price range: 93.5-103.5).

- Issuer: HanesBrands Inc (Winston-Salem, North Carolina (US)) | Coupon: 4.63% | Maturity: 15/5/2024 | Rating: BB- | ISIN: USU24437AD43 | Z-spread down by 84.5 bp to 190.3 bp, with the yield to worst at 4.2% and the bond now trading up to 99.8 cents on the dollar (1Y price range: 97.5-104.5).

- Issuer: Nextera Energy Operating Partners LP (Juno Beach, Florida (US)) | Coupon: 4.50% | Maturity: 15/9/2027 | Rating: BB | ISIN: USU6500TAB18 | Z-spread down by 98.0 bp to 228.7 bp, with the yield to worst at 4.9% and the bond now trading up to 97.3 cents on the dollar (1Y price range: 92.5-107.8).

- Issuer: Enact Holdings Inc (Raleigh, North Carolina (US)) | Coupon: 6.50% | Maturity: 15/8/2025 | Rating: BB | ISIN: USU3230LAA45 | Z-spread down by 98.9 bp to 328.0 bp (CDS basis: -25.8bp), with the yield to worst at 6.0% and the bond now trading up to 100.8 cents on the dollar (1Y price range: 97.5-109.5).

- Issuer: NCL Corporation Ltd (Miami, Bermuda) | Coupon: 5.88% | Maturity: 15/3/2026 | Rating: CCC+ | ISIN: USG6436QAL08 | Z-spread down by 101.8 bp to 675.2 bp, with the yield to worst at 9.2% and the bond now trading up to 88.5 cents on the dollar (1Y price range: 84.3-100.0).

- Issuer: Block Inc (San Francisco, California (US)) | Coupon: 2.75% | Maturity: 1/6/2026 | Rating: BB | ISIN: USU85223AA03 | Z-spread down by 102.4 bp to 199.3 bp, with the yield to worst at 4.5% and the bond now trading up to 92.6 cents on the dollar (1Y price range: 88.3-100.5).

- Issuer: American Airlines Group Inc (Fort Worth, Texas (US)) | Coupon: 3.75% | Maturity: 1/3/2025 | Rating: CCC | ISIN: USU0242AAD47 | Z-spread down by 107.9 bp to 588.2 bp (CDS basis: 404.3bp), with the yield to worst at 8.4% and the bond now trading up to 88.5 cents on the dollar (1Y price range: 83.5-95.6).

- Issuer: EQM Midstream Partners LP (Pittsburgh, Pennsylvania (US)) | Coupon: 6.50% | Maturity: 1/7/2027 | Rating: BB- | ISIN: USU26886AB46 | Z-spread down by 109.3 bp to 336.0 bp, with the yield to worst at 6.0% and the bond now trading up to 101.1 cents on the dollar (1Y price range: 95.8-112.0).

- Issuer: Rockies Express Pipeline LLC (Leawood, Kansas (US)) | Coupon: 3.60% | Maturity: 15/5/2025 | Rating: BB | ISIN: USU75111AK72 | Z-spread down by 111.8 bp to 263.0 bp, with the yield to worst at 5.1% and the bond now trading up to 95.0 cents on the dollar (1Y price range: 91.8-103.0).

- Issuer: Wynn Resorts Finance LLC (Las Vegas, Nevada (US)) | Coupon: 5.13% | Maturity: 1/10/2029 | Rating: B | ISIN: USU98354AA80 | Z-spread down by 113.9 bp to 451.0 bp, with the yield to worst at 7.1% and the bond now trading up to 87.8 cents on the dollar (1Y price range: 81.5-102.3).

- Issuer: ZF North America Capital Inc (Northville, Michigan (US)) | Coupon: 4.75% | Maturity: 29/4/2025 | Rating: BB+ | ISIN: USU98737AC03 | Z-spread down by 117.1 bp to 275.8 bp, with the yield to worst at 5.1% and the bond now trading up to 98.0 cents on the dollar (1Y price range: 94.8-107.1).

- Issuer: Goodyear Tire & Rubber Co (Akron, Ohio (US)) | Coupon: 5.25% | Maturity: 15/7/2031 | Rating: B | ISIN: USU38255AP71 | Z-spread down by 136.4 bp to 375.4 bp (CDS basis: 123.4bp), with the yield to worst at 6.5% and the bond now trading up to 91.0 cents on the dollar (1Y price range: 82.0-108.0).

TOP BONDS MOVES IN THE PAST WEEK - EUR HY

- Issuer: UPL Corporation Ltd (Port Louis, Mauritius) | Coupon: 4.50% | Maturity: 8/3/2028 | Rating: BB+ | ISIN: XS1789391148 | Z-spread up by 118.0 bp to 350.5 bp, with the yield to worst at 6.1% and the bond now trading down to 91.9 cents on the dollar (1Y price range: 91.3-105.4).

- Issuer: FMG Resources (August 2006) Pty Ltd (Australia) | Coupon: 4.38% | Maturity: 1/4/2031 | Rating: BB+ | ISIN: USQ3919KAN11 | Z-spread up by 103.7 bp to 321.8 bp, with the yield to worst at 5.9% and the bond now trading down to 88.8 cents on the dollar (1Y price range: 83.9-104.8).

- Issuer: Immobiliare Grande Distribuzione SIIQ SpA (Bologna, Italy) | Coupon: 2.13% | Maturity: 28/11/2024 | Rating: BB+ | ISIN: XS2084425466 | Z-spread up by 100.9 bp to 293.9 bp, with the yield to worst at 3.4% and the bond now trading down to 95.6 cents on the dollar (1Y price range: 95.4-101.4).

- Issuer: Ford Motor Credit Company LLC (Dearborn, Michigan (US)) | Coupon: 3.02% | Maturity: 6/3/2024 | Rating: BB | ISIN: XS1959498160 | Z-spread down by 56.4 bp to 247.2 bp (CDS basis: -28.4bp), with the yield to worst at 2.8% and the bond now trading up to 99.5 cents on the dollar (1Y price range: 96.9-104.5).

- Issuer: Saipem Finance International BV (Amsterdam, Netherlands) | Coupon: 2.63% | Maturity: 7/1/2025 | Rating: B+ | ISIN: XS1711584430 | Z-spread down by 66.8 bp to 536.1 bp (CDS basis: 63.2bp), with the yield to worst at 6.3% and the bond now trading up to 91.1 cents on the dollar (1Y price range: 73.9-101.2).

- Issuer: Iliad SA (Paris, France) | Coupon: 0.75% | Maturity: 11/2/2024 | Rating: BB | ISIN: FR0014001YE4 | Z-spread down by 68.5 bp to 232.9 bp, with the yield to worst at 2.9% and the bond now trading up to 96.1 cents on the dollar (1Y price range: 92.9-99.3).

- Issuer: Bper Banca SpA (Modena, Italy) | Coupon: 1.88% | Maturity: 7/7/2025 | Rating: BB- | ISIN: XS2190502323 | Z-spread down by 69.9 bp to 201.3 bp, with the yield to worst at 3.0% and the bond now trading up to 96.2 cents on the dollar (1Y price range: 95.5-101.9).

- Issuer: Adient Global Holdings Ltd (Saint Helier, Jersey) | Coupon: 3.50% | Maturity: 15/8/2024 | Rating: B- | ISIN: XS1468662801 | Z-spread down by 70.3 bp to 588.3 bp, with the yield to worst at 6.7% and the bond now trading up to 93.4 cents on the dollar (1Y price range: 89.5-101.5).

- Issuer: Teva Pharmaceutical Finance Netherlands II BV (Amsterdam, Netherlands) | Coupon: 1.13% | Maturity: 15/10/2024 | Rating: BB- | ISIN: XS1439749281 | Z-spread down by 90.2 bp to 297.2 bp, with the yield to worst at 3.8% and the bond now trading up to 93.6 cents on the dollar (1Y price range: 89.9-96.7).

- Issuer: Renault SA (Boulogne-Billancourt, France) | Coupon: 1.25% | Maturity: 24/6/2025 | Rating: BB | ISIN: FR0013428414 | Z-spread down by 90.9 bp to 341.7 bp (CDS basis: -55.2bp), with the yield to worst at 4.4% and the bond now trading up to 90.7 cents on the dollar (1Y price range: 88.5-98.6).

- Issuer: Telecom Italia SpA (Rome, Italy) | Coupon: 3.63% | Maturity: 19/1/2024 | Rating: BB- | ISIN: XS1347748607 | Z-spread down by 92.2 bp to 228.5 bp (CDS basis: -33.2bp), with the yield to worst at 3.0% and the bond now trading up to 100.9 cents on the dollar (1Y price range: 97.4-103.9).

SELECTED RECENT USD BOND ISSUES

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, New Jersey, United States | Rating: AA+): US$125m Bond (US3133ENXV72), fixed rate (4.33% coupon) maturing on 2 June 2031, priced at 100.00 (original spread of 160 bp), callable (9nc1)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$700m Bond (US3133ENXZ86), floating rate (SOFR + 4.5 bp) maturing on 3 June 2024, priced at 100.00, non callable

- Southwestern Public Service Co (Utility - Other | Amarillo, Texas, United States | Rating: A-): US$200m First Mortgage Bond (US845743BW27), fixed rate (5.15% coupon) maturing on 1 June 2052, priced at 99.47 (original spread of 216 bp), callable (30nc30)

- Bank of Nova Scotia (Banking | Toronto, Canada | Rating: A): US$1,500m Covered Bond (Other) (US06418BAG32), fixed rate (3.19% coupon) maturing on 3 June 2025, priced at 100.00 (original spread of 56 bp), non callable

- CMHI Finance (BVI) Co Ltd (Financial - Other | China (Mainland) | Rating: NR): US$500m Senior Note (XS2477918846), fixed rate (4.00% coupon) maturing on 1 June 2027, priced at 99.97 (original spread of 130 bp), callable (5nc5)

- Chongqing Hechuan City Construction Investment Group Co Ltd (Financial - Other | Chongqing, Chongqing, China (Mainland) | Rating: BB): US$207m Senior Note (XS2470154779), fixed rate (6.00% coupon) maturing on 31 May 2025, priced at 100.00, non callable

- Credit Suisse Ag London Branch (Banking | London, Switzerland | Rating: NR): US$500m Unsecured Note (XS2472409346) zero coupon maturing on 12 June 2024, non callable

- Deutsche Bank AG (Banking | Frankfurt, Hessen, Germany | Rating: BBB+): US$500m Note (XS0459894969), fixed rate (3.30% coupon) maturing on 1 July 2025, priced at 100.00, non callable

- Industrial and Commercial Bank of China Ltd (Hong Kong Branch) (Banking | China (Mainland) | Rating: A+): US$1,200m Senior Note (XS2446005907), fixed rate (2.95% coupon) maturing on 1 June 2025, priced at 99.79 (original spread of 46 bp), non callable

- Industrial and Commercial Bank of China Ltd (Singapore Branch) (Banking | China (Mainland) | Rating: A+): US$600m Senior Note (XS2484328021), floating rate (SOFR + 75.0 bp) maturing on 1 June 2025, priced at 100.00, non callable

- Korea Development Bank (Agency | Seoul, Seoul, South Korea | Rating: AA-): US$300m Senior Note (XS2487342300), fixed rate (3.13% coupon) maturing on 7 June 2025, priced at 100.00 (original spread of 53 bp), non callable

- Nomura International Funding Pte Ltd (Financial - Other | Japan | Rating: NR): US$200m Unsecured Note (XS2430498068), floating rate maturing on 20 June 2027, priced at 100.00, non callable

- Perusahaan Penerbit Surat Berharga Syariah Negara Indonesia III (Agency | Jakarta Utara, Indonesia | Rating: NR): US$1,500m Islamic Sukuk (Wakala bil istithmar) (US71567RAV87), fixed rate (4.70% coupon) maturing on 6 June 2032, priced at 100.00 (original spread of 193 bp), non callable

- Perusahaan Penerbit Surat Berharga Syariah Negara Indonesia III (Agency | Jakarta Utara, Indonesia | Rating: NR): US$1,750m Islamic Sukuk (Wakala bil istithmar) (US71567PAU49), fixed rate (4.40% coupon) maturing on 6 June 2027, priced at 100.00 (original spread of 164 bp), non callable

- Santander UK PLC (Banking | London, Spain | Rating: A): US$1,000m Covered Bond (Other) (USG7809LAA29), fixed rate (3.21% coupon) maturing on 12 June 2026, priced at 100.00 (original spread of 56 bp), non callable

- Single Platform Investment Repackaging Entity SA (Financial - Other | Luxembourg, Netherlands | Rating: NR): US$270m Unsecured Note (XS2484084566) zero coupon maturing on 21 March 2052, priced at 36.99, non callable

- Zhangzhou City Transportation Development Group Co Ltd (Transportation - Other | Zhangzhou, China (Mainland) | Rating: BB+): US$500m Senior Note (XS2485520261), fixed rate (4.98% coupon) maturing on 1 June 2025, priced at 100.00, non callable

SELECTED RECENT EUR BOND ISSUES

- ABN Amro Bank NV (Banking | Amsterdam, Noord-Holland, Netherlands | Rating: BBB): €750m Note (XS2487054939), fixed rate (3.00% coupon) maturing on 1 June 2032, priced at 99.82 (original spread of 208 bp), non callable

- ABN Amro Bank NV (Banking | Amsterdam, Noord-Holland, Netherlands | Rating: BBB): €750m Note (XS2487054004), fixed rate (2.38% coupon) maturing on 1 June 2027, priced at 99.64 (original spread of 178 bp), non callable

- AXA SA (Life Insurance | Paris, Ile-De-France, France | Rating: A-): €1,250m Subordinated Note (XS2487052487), floating rate maturing on 10 March 2043, priced at 99.14 (original spread of 336 bp), callable (21nc10)

- Alcon Finance BV (Financial - Other | Amsterdam, Switzerland | Rating: BBB): €500m Senior Note (XS2486839298), fixed rate (2.38% coupon) maturing on 31 May 2028, priced at 99.48 (original spread of 170 bp), callable (6nc6)

- Allianz SE (Property and Casualty Insurance | Muenchen, Bayern, Germany | Rating: AAA): €1,250m Senior Note (DE000A30VJZ6), floating rate maturing on 5 July 2052, priced at 100.01 (original spread of 330 bp), non callable

- Aprr SA (Service - Other | Saint-Apollinaire, Bourgogne-Franche-Comte, France | Rating: A-): €500m Senior Note (FR001400AOL7), fixed rate (1.88% coupon) maturing on 3 January 2029, priced at 98.76 (original spread of 130 bp), callable (7nc6)

- Asb Finance Ltd (London Branch) (Financial - Other | London, Australia | Rating: NR): €500m Unsecured Note (XS2485814763) maturing on 3 June 2032, priced at 100.00, non callable

- Athora Netherlands NV (Property and Casualty Insurance | Amstelveen, Noord-Holland, Bermuda | Rating: BBB-): €500m Subordinated Note (XS2468390930), fixed rate (5.38% coupon) maturing on 31 August 2032, priced at 100.00 (original spread of 470 bp), callable (10nc5)

- Austria, Republic of (Government) (Sovereign | Wien, Wien, Austria | Rating: AA+): €4,000m Bundesanleihe (AT0000A2Y8G4), fixed rate (1.85% coupon) maturing on 23 May 2049, priced at 99.45 (original spread of 71 bp), non callable

- BAWAG PSK Bank fuer Arbeit und Wirtschaft und Oesterreichische Postsparkasse AG (Banking | Wien, Wien, Austria | Rating: A): €750m Mortgage Note (XS2487770104), fixed rate (1.25% coupon) maturing on 8 June 2026, non callable

- Bank Gospodarstwa Krajowego (Agency | Warsaw, Woj. Mazowieckie, Poland | Rating: A-): €500m Senior Note (XS2486282358), fixed rate (3.00% coupon) maturing on 30 May 2029, priced at 99.42 (original spread of 232 bp), non callable

- Barclays PLC (Banking | London, United Kingdom | Rating: BBB): €1,000m Senior Note (XS2487667276), fixed rate (2.89% coupon) maturing on 31 January 2027, priced at 100.00 (original spread of 236 bp), callable (5nc4)

- Bayerische Landesbodenkreditanstalt (Financial - Other | Muenchen, Germany | Rating: NR): €250m Inhaberschuldverschreibung (DE000A161RP2), fixed rate (1.88% coupon) maturing on 2 June 2042, priced at 98.98 (original spread of 79 bp), non callable

- Berlin, State of (Official and Muni | Berlin, Berlin, Germany | Rating: AAA): €650m Jumbo Landesschatzanweisung (DE000A3MQYK2), fixed rate (1.25% coupon) maturing on 1 June 2028, priced at 99.62 (original spread of 57 bp), non callable

- Blackstone Holdings Finance Co LLC (Financial - Other | New York City, New York, United States | Rating: A+): €500m Senior Note (XS2485132760), fixed rate (3.50% coupon) maturing on 1 June 2034, priced at 98.53 (original spread of 270 bp), with a make whole call

- Credit Agricole Home Loan SFH SA (Financial - Other | Montrouge, Ile-De-France, France | Rating: AAA): €1,000m Obligation de Financement de l'Habitat (Covered Bond) (FR001400AO71), fixed rate (1.63% coupon) maturing on 31 May 2030, priced at 99.50 (original spread of 88 bp), non callable

- Credit Suisse Ag London Branch (Banking | London, Switzerland | Rating: A-): €750m Senior Note (XS2480523419), floating rate (EU03MLIB + 123.0 bp) maturing on 31 May 2024, priced at 100.00, non callable

- Credit Suisse Ag London Branch (Banking | London, Switzerland | Rating: A-): €1,000m Senior Note (XS2480543102), fixed rate (2.13% coupon) maturing on 31 May 2024, priced at 99.94 (original spread of 189 bp), non callable

- Credito Emiliano SpA (Banking | Reggio Nell'Emilia, Reggio Emilia, Italy | Rating: NR): €500m Covered Bond (Other) (IT0005495889), fixed rate (1.75% coupon) maturing on 31 May 2029, priced at 99.94 (original spread of 94 bp), non callable

- DNB Bank ASA (Banking | Oslo, Oslo, Norway | Rating: AA-): €750m Note (XS2486092492), floating rate maturing on 31 May 2026, priced at 99.64 (original spread of 128 bp), non callable

- DZ Hyp AG (Mortgage Banking | Hamburg, Hamburg, Germany | Rating: A+): €750m Hypothekenpfandbrief (Covered Bond) (DE000A3MP684), fixed rate (1.63% coupon) maturing on 30 May 2031, priced at 99.45 (original spread of 83 bp), non callable

- Deutsche Bank AG (Banking | Frankfurt, Hessen, Germany | Rating: A-): €500m Inhaberschuldverschreibung (DE000DB9U7H3), floating rate maturing on 1 July 2027, priced at 100.00, non callable

- Deutsche Bank AG (Banking | Frankfurt, Hessen, Germany | Rating: A-): €500m Inhaberschuldverschreibung (DE000DB9U7G5), fixed rate (1.35% coupon) maturing on 1 July 2025, priced at 100.00, non callable

- Finland, Republic of (Government) (Sovereign | Helsinki, Etela-Suomen, Finland | Rating: AA+): €3,000m Bond (FI4000523238), fixed rate (1.50% coupon) maturing on 15 September 2032, priced at 99.72 (original spread of 61 bp), non callable

- France, Republic of (Government) (Sovereign | Paris, Ile-De-France, France | Rating: AA): €4,000m Obligation Assim du Tresor indexee sur l'inflation zone euro (FR001400AQH0), fixed rate (0.10% coupon) maturing on 25 July 2038, priced at 108.62 (original spread of 12 bp), non callable, inflation protected

- Industrial and Commercial Bank of China Ltd (London Branch) (Banking | London, China (Mainland) | Rating: A+): €500m Senior Note (XS2446008083), fixed rate (1.63% coupon) maturing on 1 June 2025, priced at 99.97 (original spread of 58 bp), non callable

- Instituto de Credito Oficial (Agency | Madrid, Madrid, Spain | Rating: BBB+): €500m Senior Note (XS2487056041), fixed rate (1.30% coupon) maturing on 31 October 2026, priced at 99.92 (original spread of 60 bp), non callable

- Italy, Republic of (Government) (Sovereign | Rome, Roma, Italy | Rating: BBB-): €5,000m Buono del Tesoro Poliennali (IT0005496770), fixed rate (3.25% coupon) maturing on 1 March 2038, priced at 99.65 (original spread of 198 bp), non callable

- Japan Bank for International Cooperation (Agency | Chiyoda-Ku, Tokyo-To, Japan | Rating: A+): €1,000m Senior Note (XS2485856681), fixed rate (1.50% coupon) maturing on 1 June 2029, priced at 99.35 (original spread of 86 bp), non callable

- La Poste SA (Agency | Paris, Ile-De-France, France | Rating: A+): €150m Bond (FR001400AMT4), fixed rate (0.63% coupon) maturing on 21 October 2026, priced at 100.00 (original spread of 98 bp), non callable

- Landesbank Baden Wuerttemberg (Banking | Stuttgart, Baden-Wuerttemberg, Germany | Rating: A-): €500m Oeffenlicher Pfandbrief (Covered Bond) (DE000LB2ZVE4), floating rate (EU03MLIB + 50.0 bp) maturing on 30 May 2034, priced at 104.45, non callable

- Landesbank Baden Wuerttemberg (Banking | Stuttgart, Baden-Wuerttemberg, Germany | Rating: A-): €500m Oeffenlicher Pfandbrief (Covered Bond) (DE000LB2ZVD6), floating rate maturing on 30 August 2027, priced at 102.15, non callable

- Landesbank Saar (Banking | Saarbruecken, Saarland, Germany | Rating: AAA): €250m Oeffenlicher Pfandbrief (Covered Bond) (DE000SLB4SA6), fixed rate (1.75% coupon) maturing on 31 May 2032, priced at 99.25 (original spread of 87 bp), non callable

- Lansforsakringar Hypotek AB (publ) (Mortgage Banking | Stockholm, Stockholm, Sweden | Rating: NR): €500m Sakerstallda Obligation (Covered Bond) (XS2486449072), fixed rate (1.38% coupon) maturing on 31 May 2027, priced at 99.56 (original spread of 78 bp), non callable

- Lithuania, Republic of (Government) (Sovereign | Vilnius, Vilniaus, Lithuania | Rating: A): €650m Senior Note (XS2487342649), fixed rate (2.13% coupon) maturing on 1 June 2032, priced at 98.70 (original spread of 135 bp), non callable

- McDonald's Corp (Restaurants | Oak Brook, Illinois, United States | Rating: BBB+): €700m Senior Note (XS2486285294), fixed rate (2.38% coupon) maturing on 31 May 2029, priced at 99.49 (original spread of 170 bp), callable (7nc7)

- McDonald's Corp (Restaurants | Oak Brook, Illinois, United States | Rating: BBB+): €600m Senior Note (XS2486285377), fixed rate (3.00% coupon) maturing on 31 May 2034, priced at 99.05 (original spread of 215 bp), callable (12nc12)

- National Grid PLC (Service - Other | London, United Kingdom | Rating: BBB): €500m Senior Note (XS2486461283), fixed rate (2.95% coupon) maturing on 30 March 2030, priced at 100.00 (original spread of 208 bp), callable (8nc8)

- National Grid PLC (Service - Other | London, United Kingdom | Rating: BBB): €700m Senior Note (XS2486461523), fixed rate (3.25% coupon) maturing on 30 March 2034, priced at 100.00 (original spread of 229 bp), callable (12nc12)

- National Grid PLC (Service - Other | London, United Kingdom | Rating: BBB): €650m Senior Note (XS2486461010), fixed rate (2.18% coupon) maturing on 30 June 2026, priced at 100.00 (original spread of 156 bp), callable (4nc4)

- Oberoesterreichische Landesbank AG (Banking | Linz, Oberoesterreich, Austria | Rating: AA+): €250m Pfandbrief Anleihe (Covered Bond) (AT0000A2Y7L6), fixed rate (1.63% coupon) maturing on 1 June 2029, priced at 99.47 (original spread of 91 bp), non callable

- Regie Autonome des Transports Parisiens EPIC (Agency | Paris, Ile-De-France, France | Rating: AA): €500m Bond (FR001400AON3), fixed rate (1.88% coupon) maturing on 25 May 2032, priced at 99.75 (original spread of 88 bp), non callable

- Safari Holding Verwaltungs GmbH (Leisure | Bingen Am Rhein, Rheinland-Pfalz, Germany | Rating: NR): €258m Senior Note (XS2480044101), fixed rate (7.75% coupon) maturing on 15 December 2025, callable (4nc2)

- Safari Holding Verwaltungs GmbH (Leisure | Bingen Am Rhein, Rheinland-Pfalz, Germany | Rating: CCC+): €258m Senior Note (XS2480044010), fixed rate (7.75% coupon) maturing on 15 December 2025 (original spread of 865 bp), callable (4nc2)

- Societe Generale SA (Banking | Paris, Ile-De-France, France | Rating: A): €1,000m Bond (FR001400AO14), fixed rate (2.63% coupon) maturing on 30 May 2029, priced at 99.97 (original spread of 203 bp), callable (7nc2)

- Societe Generale SA (Banking | Paris, Ile-De-France, France | Rating: A): €1,000m Bond (FR001400AO22), floating rate maturing on 30 May 2025, priced at 99.89 (original spread of 128 bp), callable (3nc2)

- Stedin Holding NV (Utility - Other | Rotterdam, Zuid-Holland, Netherlands | Rating: A-): €500m Senior Note (XS2487016250), fixed rate (2.38% coupon) maturing on 3 June 2030, priced at 99.32 (original spread of 165 bp), callable (8nc8)

- Svenska Handelsbanken AB (Banking | Stockholm, Sweden | Rating: AA-): €500m Subordinated Note (XS2486857431), fixed rate (3.25% coupon) maturing on 1 June 2033, priced at 99.91 (original spread of 251 bp), callable (11nc6)

- Swedbank Hypotek AB (Mortgage Banking | Sundbyberg, Stockholm, Sweden | Rating: AAA): €1,000m Sakerstallda Obligation (Covered Bond) (XS2487057106), fixed rate (1.38% coupon) maturing on 31 May 2027, priced at 99.57 (original spread of 78 bp), non callable

- TDC NET AS (Financial - Other | Kobenhavn Sv, United Kingdom | Rating: BBB-): €500m Senior Note (XS2484502823), fixed rate (5.06% coupon) maturing on 31 May 2028, priced at 100.00 (original spread of 434 bp), callable (6nc6)

- Visa Inc (Financial - Other | San Francisco, California, United States | Rating: AA-): €1,000m Senior Note (XS2479941572), fixed rate (2.00% coupon) maturing on 15 June 2029, priced at 99.68 (original spread of 129 bp), callable (7nc7)

- Visa Inc (Financial - Other | San Francisco, California, United States | Rating: AA-): €650m Senior Note (XS2479942034), fixed rate (2.38% coupon) maturing on 15 June 2034, priced at 99.03 (original spread of 152 bp), callable (12nc12)

- Visa Inc (Financial - Other | San Francisco, California, United States | Rating: AA-): €1,350m Senior Note (XS2479941499), fixed rate (1.50% coupon) maturing on 15 June 2026, priced at 99.54 (original spread of 107 bp), callable (4nc4)

- Volvo Car AB (Automotive Manufacturer | Goeteborg, Vastra Gotalands, China (Mainland) | Rating: BB+): €500m Senior Note (XS2486825669), fixed rate (4.25% coupon) maturing on 31 May 2028, priced at 99.35 (original spread of 348 bp), callable (6nc6)

- Volvo Treasury AB (Financial - Other | Goeteborg, Vastra Gotalands, Sweden | Rating: A-): €500m Senior Note (XS2486812683), floating rate (EU03MLIB + 75.0 bp) maturing on 31 May 2024, priced at 100.71, non callable

- Wuxi Jinyuan Industrial Investment Development Group Co Ltd (Financial - Other | Wuxi, China (Mainland) | Rating: NR): €139m Bond (XS2478677599), fixed rate (2.40% coupon) maturing on 1 June 2025, priced at 100.00 (original spread of 203 bp), non callable

NEW ISSUES IN SECURITIZED CREDIT

- SMB Private Education Loan Trust 2022-B issued a floating-rate ABS backed by student loans in 5 tranches, for a total of US$ 2,214 m. Highest-rated tranche offering a spread over the floating rate of 145bp, and the lowest-rated tranche a spread of 330bp. Bookrunners: Credit Suisse

- Freddie Mac Spc Series K-F137 issued a floating-rate Agency CMBS in 1 tranche offering a spread over the floating rate of 45bp, for a total of US$ 767 m. Bookrunners: Credit Suisse, Bank of America Merrill Lynch

- Upstart Securitization Trust 2022-2 issued a fixed-rate ABS backed by consumer loan in 3 tranches, for a total of US$ 542 m. Highest-rated tranche offering a yield to maturity of 4.40%, and the lowest-rated tranche a yield to maturity of 8.48%. Bookrunners: Goldman Sachs & Co

- CSMC 2022-Ath2 Trust issued a fixed-rate RMBS in 2 tranches, for a total of US$ 213 m. Highest-rated tranche offering a coupon of 4.98%, and the lowest-rated tranche a yield to maturity of 5.38%. Bookrunners: Credit Suisse, HSBC Securities (USA) Inc