Credit

US Credit Spreads Broadly Wider On Friday, Though IG Cash Spreads Were 3bp Tighter For The Week

Weekly IFR totals for US corporate bond issuance: 36 tranches for US$29.9bn in IG (2022 YTD volume $682.0bn vs 2021 YTD $742.4bn), 8 tranches for $6.55bn in HY (2022 YTD volume $62.9bn vs 2021 YTD $254.4bn)

Published ET

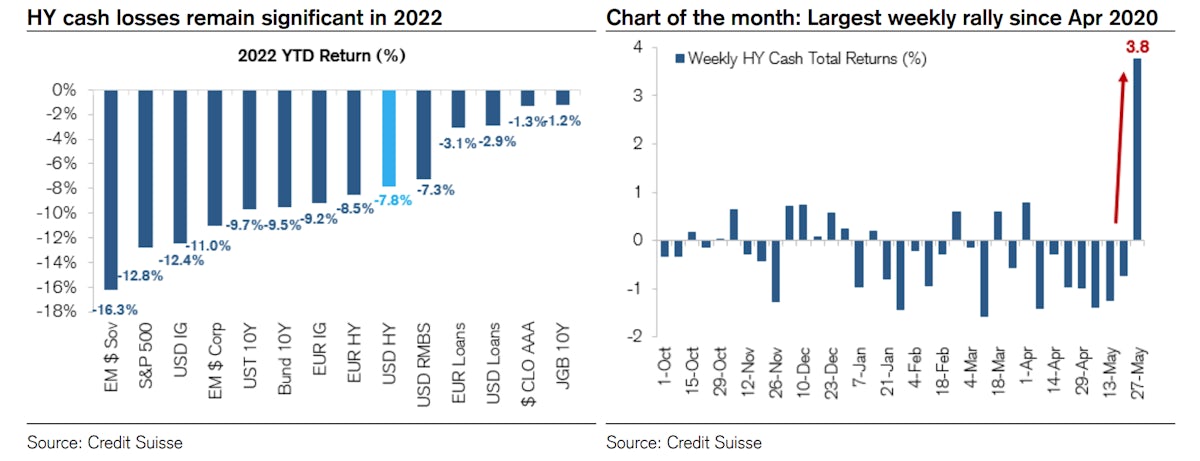

Late May Rally In USD HY | Source: Credit Suisse

DAILY SUMMARY

- S&P 500 Bond Index was down -0.20% today, with investment grade down -0.18% and high yield down -0.44% (YTD total return: -11.43%)

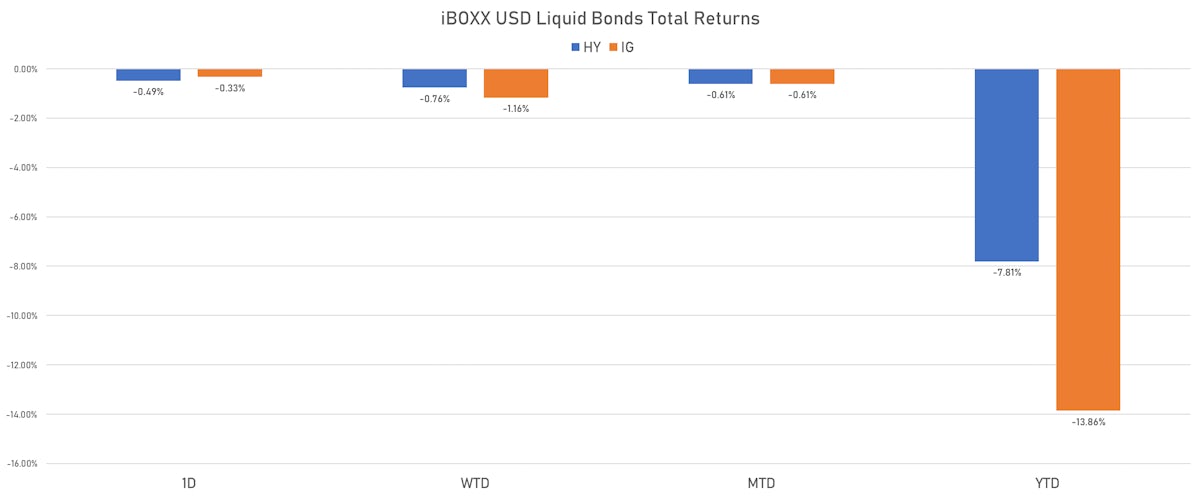

- The iBoxx USD Liquid Investment Grade Total Return Index was down -0.328% today (Month-to-date: -0.61%; Year-to-date: -13.86%)

- The iBoxx USD Liquid High Yield Total Return Index was down -0.487% today (Month-to-date: -0.61%; Year-to-date: -7.81%)

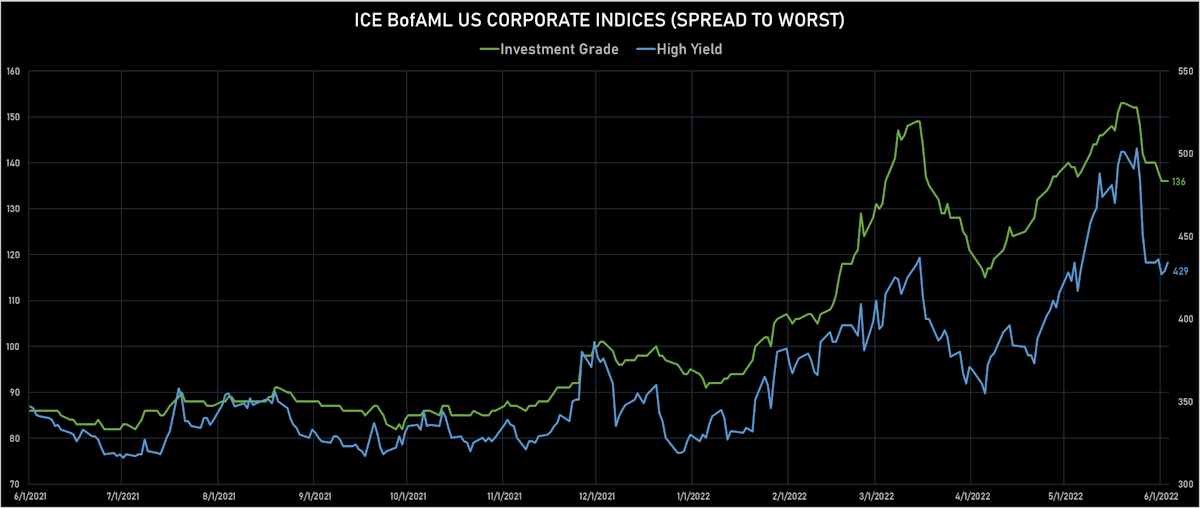

- ICE BofA US Corporate Index (Investment Grade) spread to worst unchanged at 136.0 bp (YTD change: +41.0 bp)

- ICE BofA US High Yield Index spread to worst up 5.0 bp, now at 434.0 bp (YTD change: +104.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index up 0.08% today (YTD total return: -2.0%)

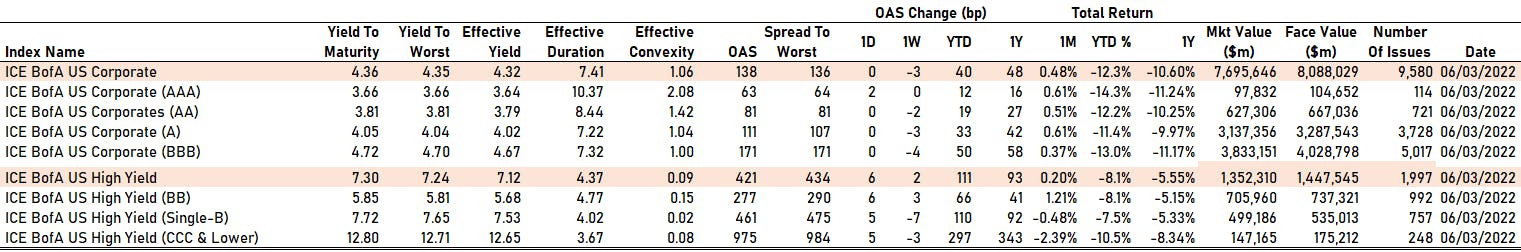

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING TODAY

- AAA up by 2 bp at 63 bp

- AA unchanged at 81 bp

- A unchanged at 111 bp

- BBB unchanged at 171 bp

- BB up by 6 bp at 277 bp

- B up by 5 bp at 461 bp

- CCC up by 5 bp at 975 bp

CDS INDICES TODAY (mid-spreads)

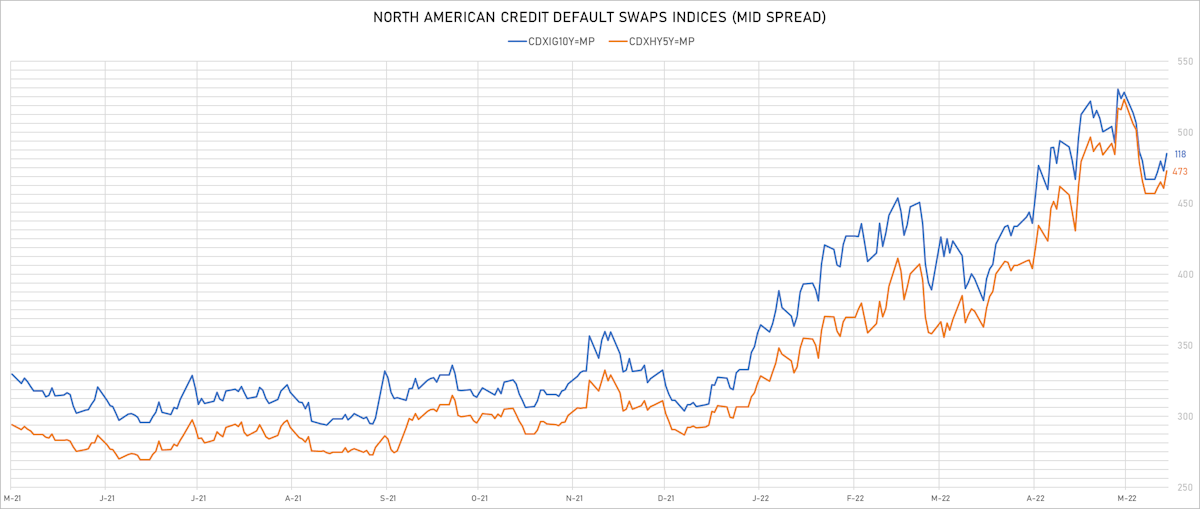

- Markit CDX.NA.IG 5Y up 2.0 bp, now at 82bp (1W change: +2.7bp; YTD change: +32.2bp)

- Markit CDX.NA.IG 10Y up 2.0 bp, now at 118bp (1W change: +2.9bp; YTD change: +28.5bp)

- Markit CDX.NA.HY 5Y up 12.4 bp, now at 473bp (1W change: +16.2bp; YTD change: +181.0bp)

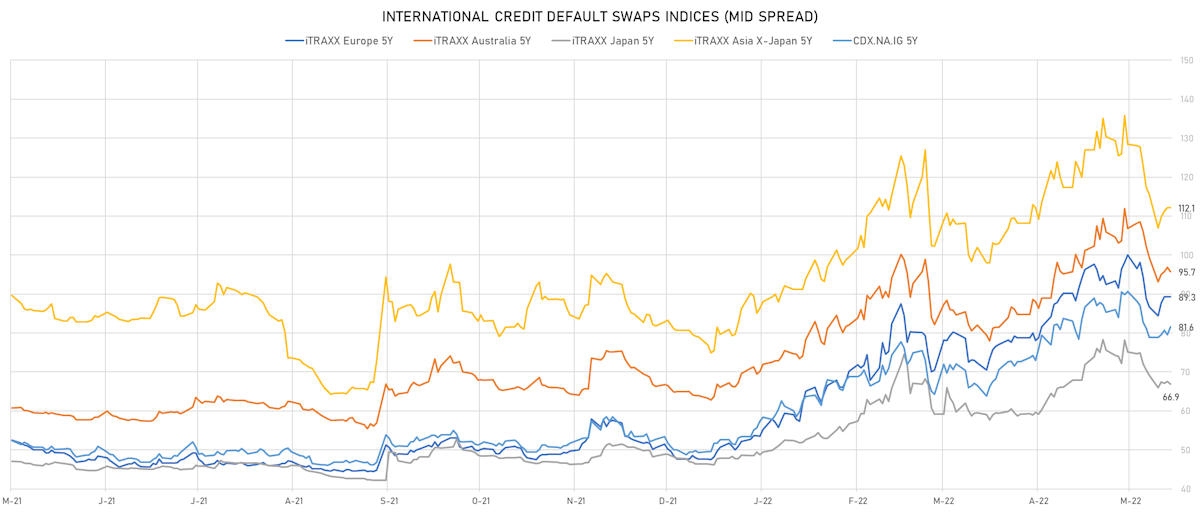

- Markit iTRAXX Europe 5Y unchanged at 89bp (1W change: +2.7bp; YTD change: +41.6bp)

- Markit iTRAXX Europe Crossover 5Y up 7.2 bp, now at 446bp (1W change: -19.1bp; YTD change: +203.6bp)

- Markit iTRAXX Japan 5Y down 0.7 bp, now at 67bp (1W change: -2.2bp; YTD change: +20.5bp)

- Markit iTRAXX Asia Ex-Japan 5Y unchanged at 112bp (1W change: -3.5bp; YTD change: +33.1bp)

TOP BONDS MOVES IN THE PAST WEEK - USD HY

- Issuer: JBS USA Lux SA (Luxembourg, Luxembourg) | Coupon: 7.50% | Maturity: 15/6/2032 | Rating: B+ | ISIN: USL56608AJ82 | Z-spread up by 496.1 bp to 546.6 bp, with the yield to worst at 7.7% and the bond now trading down to 95.8 cents on the dollar (1Y price range: 95.1-107.3).

- Issuer: WeWork Companies Inc (New York City, New York (US)) | Coupon: 5.75% | Maturity: 15/6/2026 | Rating: B | ISIN: USU96217AA99 | Z-spread up by 277.1 bp to 423.2 bp, with the yield to worst at 6.8% and the bond now trading down to 95.5 cents on the dollar (1Y price range: 95.5-105.3).

- Issuer: Xerox Holdings Corp (Norwalk, Connecticut (US)) | Coupon: 4.13% | Maturity: 20/9/2031 | Rating: BB | ISIN: USU98401AB58 | Z-spread up by 201.8 bp to 341.7 bp, with the yield to worst at 6.0% and the bond now trading down to 85.9 cents on the dollar (1Y price range: 85.0-96.9).

- Issuer: Sealed Air Corp (Elmwood Park, New Jersey (US)) | Coupon: 6.50% | Maturity: 13/10/2026 | Rating: BB- | ISIN: USU81193AP68 | Z-spread up by 178.4 bp to 323.4 bp, with the yield to worst at 5.7% and the bond now trading down to 102.1 cents on the dollar (1Y price range: 101.4-111.9).

- Issuer: NCL Corporation Ltd (Miami, Bermuda) | Coupon: 6.50% | Maturity: 1/7/2027 | Rating: BB- | ISIN: USG6436QAL08 | Z-spread down by 189.5 bp to 336.0 bp, with the yield to worst at 6.0% and the bond now trading up to 101.1 cents on the dollar (1Y price range: 95.8-112.0).

- Issuer: Nextera Energy Operating Partners LP (Juno Beach, Florida (US)) | Coupon: 4.50% | Maturity: 30/9/2028 | Rating: BB+ | ISIN: USU6500TAG05 | Z-spread down by 190.3 bp to 477.6 bp, with the yield to worst at 7.4% and the bond now trading up to 84.8 cents on the dollar (1Y price range: 83.5-100.4).

- Issuer: Taylor Morrison Communities Inc (Scottsdale, Arizona (US)) | Coupon: 4.75% | Maturity: 20/10/2030 | Rating: BB | ISIN: USU8760NAB56 | Z-spread down by 208.3 bp to 510.3 bp, with the yield to worst at 7.7% and the bond now trading up to 80.9 cents on the dollar (1Y price range: 80.0-92.4).

- Issuer: EQM Midstream Partners LP (Pittsburgh, Pennsylvania (US)) | Coupon: 4.88% | Maturity: 22/1/2030 | Rating: BB | ISIN: USU26886AB46 | Z-spread down by 210.2 bp to 460.9 bp, with the yield to worst at 7.1% and the bond now trading up to 86.1 cents on the dollar (1Y price range: 84.4-97.4).

- Issuer: EQM Midstream Partners LP (Pittsburgh, Pennsylvania (US)) | Coupon: 4.00% | Maturity: 6/7/2026 | Rating: BB+ | ISIN: USU26886AA62 | Z-spread down by 287.5 bp to 445.8 bp, with the yield to worst at 7.0% and the bond now trading up to 88.6 cents on the dollar (1Y price range: 85.6-97.6).

- Issuer: Xerox Holdings Corp (Norwalk, Connecticut (US)) | Coupon: 5.50% | Maturity: 1/10/2026 | Rating: B | ISIN: USU98401AA75 | Z-spread down by 304.6 bp to 759.0 bp, with the yield to worst at 10.0% and the bond now trading up to 84.1 cents on the dollar (1Y price range: 84.0-93.8).

- Issuer: Firstenergy Transmission LLC (Fairmont, West Virginia (US)) | Coupon: 2.35% | Maturity: 29/10/2025 | Rating: BB+ | ISIN: USU3200VAB63 | Z-spread down by 347.6 bp to 611.7 bp, with the yield to worst at 8.3% and the bond now trading up to 81.5 cents on the dollar (1Y price range: 79.0-86.0).

- Issuer: Owens-Brockway Glass Container Inc (Perrysburg, Ohio (US)) | Coupon: 8.63% | Maturity: 27/10/2025 | Rating: B- | ISIN: USU6S19GAC10 | Z-spread down by 393.5 bp to 715.3 bp, with the yield to worst at 9.4% and the bond now trading up to 96.9 cents on the dollar (1Y price range: 96.8-105.8).

- Issuer: American Airlines Group Inc (Fort Worth, Texas (US)) | Coupon: 5.88% | Maturity: 15/3/2026 | Rating: CCC+ | ISIN: USU0242AAD47 | Z-spread down by 458.5 bp to 675.2 bp, with the yield to worst at 9.2% and the bond now trading up to 88.5 cents on the dollar (1Y price range: 84.3-100.0).

- Issuer: Wynn Las Vegas LLC (Las Vegas, Nevada (US)) | Coupon: 5.38% | Maturity: 2/3/2026 | Rating: B | ISIN: USU98347AK05 | Z-spread down by 498.5 bp to 742.2 bp, with the yield to worst at 9.6% and the bond now trading up to 85.9 cents on the dollar (1Y price range: 85.5-93.9).

RECENT DOMESTIC USD BOND ISSUES

- Advanced Drainage Systems Inc (Industrials - Other | Hilliard, United States | Rating: B+): US$500m Senior Note (US00790RAB06), fixed rate (6.38% coupon) maturing on 15 June 2030, priced at 100.00 (original spread of 348 bp), callable (8nc3)

- Baltimore Gas and Electric Co (Utility - Other | Baltimore, Maryland, United States | Rating: A-): US$500m Senior Note (US059165EP12), fixed rate (4.55% coupon) maturing on 1 June 2052, priced at 99.82 (original spread of 159 bp), callable (30nc30)

- Builders FirstSource Inc (Building Products | Dallas, United States | Rating: BB-): US$700m Senior Note (US12008RAR84), fixed rate (6.38% coupon) maturing on 15 June 2032, priced at 100.00 (original spread of 353 bp), callable (10nc5)

- Burlington Northern Santa Fe LLC (Railroads | Fort Worth, Texas, United States | Rating: A-): US$1,000m Senior Debenture (US12189LBJ98), fixed rate (4.45% coupon) maturing on 15 January 2053, priced at 99.45 (original spread of 154 bp), callable (31nc30)

- Conmed Corp (Health Care Supply | Largo, Florida, United States | Rating: NR): US$700m Bond (US207410AG64), fixed rate (2.25% coupon) maturing on 15 June 2027, priced at 100.00, non callable, convertible

- Darling Ingredients Inc (Food Processors | Irving, Texas, United States | Rating: BB-): US$750m Senior Note (USU23536AB88), fixed rate (6.00% coupon) maturing on 15 June 2030, priced at 100.00 (original spread of 318 bp), callable (8nc3)

- EQM Midstream Partners LP (Gas Utility - Pipelines | Pittsburgh, Pennsylvania, United States | Rating: BB-): US$500m Senior Note (USU26886AF59), fixed rate (7.50% coupon) maturing on 1 June 2030, priced at 100.00 (original spread of 467 bp), callable (8nc7)

- EQM Midstream Partners LP (Gas Utility - Pipelines | Pittsburgh, Pennsylvania, United States | Rating: BB-): US$500m Senior Note (US26885BAM28), fixed rate (7.50% coupon) maturing on 1 June 2027, priced at 100.00 (original spread of 469 bp), callable (5nc2)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$190m Bond (US3133ENYM64), fixed rate (3.78% coupon) maturing on 8 June 2028, priced at 100.00, callable (6nc1)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, New Jersey, United States | Rating: AA+): US$450m Bond (US3133ENYN48), floating rate (PRQ + -313.5 bp) maturing on 10 June 2024, priced at 100.00, non callable

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$470m Bond (US3133ENYH79), fixed rate (2.63% coupon) maturing on 10 June 2024, priced at 100.00, non callable

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$135m Bond (US3133ENYE49), fixed rate (3.37% coupon) maturing on 8 December 2025, priced at 100.00 (original spread of 61 bp), callable (4nc3m)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$170m Bond (US3133ENYK09), fixed rate (4.45% coupon) maturing on 8 June 2032, priced at 100.00, callable (10nc1)

- Florida Power & Light Co (Utility - Other | Juno Beach, United States | Rating: A): US$444m Senior Note (US341081GJ03), floating rate (SOFR + 35.0 bp) maturing on 15 June 2072, priced at 100.00, callable (50nc30)

- Jackson Financial Inc (Life Insurance | Lansing, Michigan, United States | Rating: BBB): US$350m Senior Note (US46817MAS61), fixed rate (5.67% coupon) maturing on 8 June 2032, priced at 99.99 (original spread of 284 bp), callable (10nc10)

- Jackson Financial Inc (Life Insurance | Lansing, Michigan, United States | Rating: BBB): US$400m Senior Note (US46817MAR88), fixed rate (5.17% coupon) maturing on 8 June 2027, priced at 100.00 (original spread of 228 bp), callable (5nc5)

- John Deere Capital Corp (Financial - Other | Reno, Nevada, United States | Rating: A): US$1,000m Senior Note (US24422EWF23), fixed rate (3.40% coupon) maturing on 6 June 2025, priced at 99.98 (original spread of 55 bp), non callable

- John Deere Capital Corp (Financial - Other | Reno, Nevada, United States | Rating: A): US$500m Senior Note (US24422EWH88), fixed rate (3.90% coupon) maturing on 7 June 2032, priced at 99.75 (original spread of 100 bp), non callable

- Kinetik Holdings LP (Financial - Other | Houston, United States | Rating: BB+): US$1,000m Senior Note (US49461MAA80), fixed rate (5.88% coupon) maturing on 15 June 2030, priced at 99.59 (original spread of 302 bp), callable (8nc3)

- Liberty Mutual Group Inc (Property and Casualty Insurance | Boston, United States | Rating: BBB): US$1,000m Senior Note (USU52932BQ97), fixed rate (5.50% coupon) maturing on 15 June 2052, priced at 99.78 (original spread of 240 bp), non callable

- New York Life Global Funding (Financial - Other | Wilmington, Delaware, United States | Rating: AA+): US$650m Note (US64952XEP24), fixed rate (3.15% coupon) maturing on 6 June 2024, priced at 99.92 (original spread of 53 bp), non callable

- New York Life Global Funding (Financial - Other | Wilmington, United States | Rating: AA+): US$350m Note (US64953BAX64), floating rate (SOFR + 43.0 bp) maturing on 6 June 2024, priced at 100.00, non callable

- Norfolk Southern Corp (Railroads | Norfolk, United States | Rating: BBB+): US$750m Senior Note (US655844CP18), fixed rate (4.55% coupon) maturing on 1 June 2053, priced at 99.99 (original spread of 145 bp), callable (31nc30)

- PNC Financial Services Group Inc (Banking | Pittsburgh, Pennsylvania, United States | Rating: BBB+): US$850m Subordinated Note (US693475BE43), floating rate maturing on 6 June 2033, priced at 100.00, callable (11nc10)

- Penske Truck Leasing Co LP (Leasing | Reading, United States | Rating: BBB): US$750m Senior Note (US709599BN39), fixed rate (4.40% coupon) maturing on 1 July 2027, priced at 99.72 (original spread of 155 bp), callable (5nc5)

- Tenet Healthcare Corp (Health Care Facilities | Dallas, United States | Rating: B+): US$2,000m Note (US88033GDP28), fixed rate (6.13% coupon) maturing on 15 June 2030, priced at 100.00 (original spread of 318 bp), callable (8nc3)

- Truist Financial Corp (Banking | Charlotte, North Carolina, United States | Rating: A-): US$850m Senior Note (US89788MAG78), floating rate maturing on 6 June 2028, priced at 100.00 (original spread of 120 bp), callable (6nc5)

- UMass Memorial Health Care Inc (Health Care Facilities | Worcester Massachusetts, United States | Rating: BBB+): US$300m Bond (US90407JAA60), fixed rate (5.36% coupon) maturing on 1 July 2052, priced at 100.00 (original spread of 225 bp), callable (30nc30)

RECENT GLOBAL USD BOND ISSUES

- Ardagh Metal Packaging Finance PLC (Financial - Other | Dublin, Luxembourg | Rating: BB): US$600m Note (US03969YAC21), fixed rate (6.00% coupon) maturing on 15 June 2027, priced at 100.00 (original spread of 306 bp), callable (5nc2)

- Bank of Montreal (Banking | Toronto, Ontario, Canada | Rating: A-): US$1,300m Senior Note (US06368D3S13), fixed rate (3.70% coupon) maturing on 7 June 2025, priced at 99.98 (original spread of 100 bp), with a make whole call

- Bank of Montreal (Banking | Toronto, Ontario, Canada | Rating: A-): US$300m Senior Note (US06368D3T95), floating rate (SOFR + 106.0 bp) maturing on 7 June 2025, priced at 100.00, non callable

- Erste Abwicklungsanstalt (Agency | Dusseldorf, Nordrhein-Westfalen, Germany | Rating: AA): US$1,000m Unsecured Note (XS2489135686) zero coupon maturing on 10 June 2024, priced at 100.00, non callable

- HSBC Holdings PLC (Banking | London, United Kingdom | Rating: A-): US$1,250m Senior Note (US404280DE63), floating rate maturing on 9 December 2025, priced at 100.00 (original spread of 117 bp), callable (4nc3)

- HSBC Holdings PLC (Banking | London, United Kingdom | Rating: A-): US$2,250m Senior Note (US404280DF39), floating rate maturing on 9 June 2028, priced at 100.00 (original spread of 185 bp), callable (6nc5)

- KB Kookmin Card Co Ltd (Financial - Other | Seoul, Seoul, South Korea | Rating: A): US$400m Bond (XS2473375124), fixed rate (4.00% coupon) maturing on 9 June 2025, priced at 99.92 (original spread of 130 bp), non callable

- National Australia Bank Ltd (Banking | Melbourne, Victoria, Australia | Rating: A+): US$500m Senior Note (US6325C1DB25), floating rate (SOFR + 86.0 bp) maturing on 9 June 2025, priced at 100.00, non callable

- National Australia Bank Ltd (New York Branch) (Banking | New York City, New York, Australia | Rating: NR): US$1,250m Senior Note (US63254ABE73), fixed rate (3.91% coupon) maturing on 9 June 2027, priced at 100.00 (original spread of 110 bp), non callable

- National Bank of Canada (Banking | Montreal, Canada | Rating: A-): US$750m Senior Note (US63307A2R50), floating rate maturing on 9 June 2025, priced at 99.92, callable (3nc2)

- Nomura International Funding Pte Ltd (Financial - Other | Japan | Rating: NR): US$200m Unsecured Note (XS2430491725), floating rate maturing on 16 June 2029, priced at 100.00, non callable

- Nordea Bank Abp (Banking | Helsinki, Etela-Suomen, Finland | Rating: AA-): US$700m Note (USX5S8VLAB16), fixed rate (3.60% coupon) maturing on 6 June 2025, priced at 99.99 (original spread of 90 bp), non callable

- Nordea Bank Abp (Banking | Helsinki, Etela-Suomen, Finland | Rating: AA-): US$300m Note (USX5S8VLAC98), floating rate (SOFR + 96.0 bp) maturing on 6 June 2025, priced at 100.00, non callable

- Royal Bank of Canada (Banking | Toronto, Ontario, Canada | Rating: A+): US$1,600m Covered Bond (Other) (US780082AK95), fixed rate (3.40% coupon) maturing on 9 June 2025, priced at 100.00 (original spread of 56 bp), non callable

- Saskatchewan, Province of (Official and Muni | Regina, Saskatchewan, Canada | Rating: AA): US$1,000m Bond (US803854KQ02), fixed rate (3.25% coupon) maturing on 8 June 2027, priced at 100.00 (original spread of 34 bp), non callable

- Skandinaviska Enskilda Banken AB (Banking | Stockholm, Stockholm, Sweden | Rating: A+): US$700m Note (USW8454EAR90), fixed rate (3.70% coupon) maturing on 9 June 2025, priced at 99.87 (original spread of 90 bp), non callable

- Skandinaviska Enskilda Banken AB (Banking | Stockholm, Stockholm, Sweden | Rating: A+): US$400m Note (USW8454EAS73), floating rate (SOFR + 96.0 bp) maturing on 9 June 2025, priced at 100.00, non callable

- Svenska Handelsbanken AB (Banking | Stockholm, Stockholm, Sweden | Rating: AA-): US$800m Note (US86959NAL38), fixed rate (3.95% coupon) maturing on 10 June 2027, priced at 99.85 (original spread of 105 bp), non callable

- Svenska Handelsbanken AB (Banking | Stockholm, Sweden | Rating: AA-): US$850m Note (US86959LAJ26), fixed rate (3.65% coupon) maturing on 10 June 2025, priced at 99.89 (original spread of 85 bp), non callable

- Svenska Handelsbanken AB (Banking | Stockholm, Sweden | Rating: AA-): US$350m Note (US86959LAK98), floating rate (SOFR + 91.0 bp) maturing on 10 June 2025, priced at 100.00, non callable

- Taiyuan State-owned Investment Group Co Ltd (Financial - Other | Taiyuan, China (Mainland) | Rating: NR): US$160m Senior Note (XS2484326678), fixed rate (4.55% coupon) maturing on 7 June 2025, priced at 100.00, non callable

- Toronto-Dominion Bank (Banking | Toronto, Ontario, Canada | Rating: A): US$2,000m Senior Note (US89115A2E11), fixed rate (4.46% coupon) maturing on 8 June 2032, priced at 100.00 (original spread of 155 bp), with a make whole call

- Toronto-Dominion Bank (Banking | Toronto, Ontario, Canada | Rating: A): US$1,650m Senior Note (US89115A2A98), fixed rate (3.77% coupon) maturing on 6 June 2025, priced at 100.00 (original spread of 95 bp), with a make whole call

- Toronto-Dominion Bank (Banking | Toronto, Ontario, Canada | Rating: A): US$350m Senior Note (US89115A2B71), floating rate (SOFR + 102.0 bp) maturing on 6 June 2025, priced at 100.00, non callable

- Toronto-Dominion Bank (Banking | Toronto, Ontario, Canada | Rating: A): US$1,500m Senior Note (US89115A2C54), fixed rate (4.11% coupon) maturing on 8 June 2027, priced at 100.00 (original spread of 120 bp), with a make whole call

- Volkswagen Group of America Finance LLC (Financial - Other | Herndon, Germany | Rating: BBB+): US$500m Senior Note (US928668BQ46), floating rate (SOFR + 95.0 bp) maturing on 7 June 2024, priced at 100.00, non callable

- Volkswagen Group of America Finance LLC (Financial - Other | Herndon, Virginia, Germany | Rating: BBB+): US$900m Senior Note (US928668BR29), fixed rate (3.95% coupon) maturing on 6 June 2025, priced at 99.96 (original spread of 125 bp), with a make whole call

- Volkswagen Group of America Finance LLC (Financial - Other | Herndon, Virginia, Germany | Rating: BBB+): US$1,100m Senior Note (US928668BS02), fixed rate (4.35% coupon) maturing on 8 June 2027, priced at 99.93 (original spread of 155 bp), callable (5nc5)

- Volkswagen Group of America Finance LLC (Financial - Other | Herndon, Virginia, Germany | Rating: BBB+): US$500m Senior Note (US928668BT84), fixed rate (4.60% coupon) maturing on 8 June 2029, priced at 99.87 (original spread of 175 bp), callable (7nc7)

- Westpac Banking Corp (Banking | Sydney, New South Wales, Australia | Rating: A+): US$1,200m Covered Bond (Other) (US96122XAP33), fixed rate (3.37% coupon) maturing on 7 June 2027, priced at 100.00, non callable

NEW LOANS

- Altus Midstream Lp, signed a US$ 2,000m Term Loan maturing on 06/15/25, to be used for general corporate purposes

- Intertape Polymer Group Inc (B+), signed a US$ 1,500m Term Loan B, to be used for leveraged buyout, with initial pricing set at Term SOFR +475.0bp

- Imperial Dade LLC, signed a US$ 650m Term Loan B, to be used for general corporate purposes and a leveraged buyout. It matures on 06/11/26 and initial pricing is set at Term SOFR +462.5bp

- Intertape Polymer Group Inc (B+), signed a US$ 250m Term Loan, to be used for a leveraged buyout