Credit

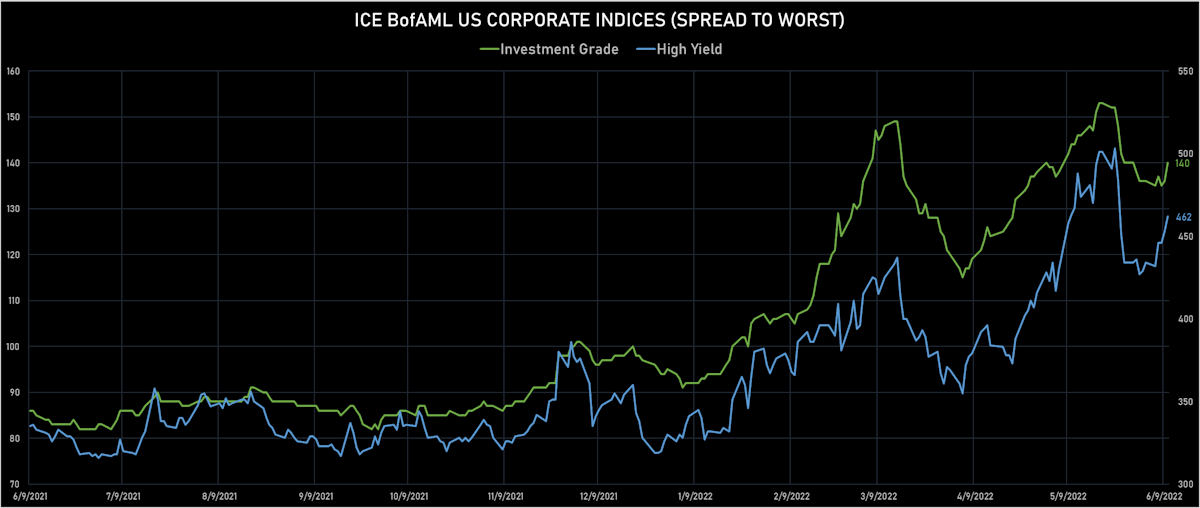

Significant Widening In US HY Credit Spreads This Week, With OAS On ICE BofA Cash Index 30bp Wider

Weekly volumes of USD corporate bonds (IFR data): 46 tranches for $34.75bn in IG (2022 YTD volume $716.79bn vs 2021 YTD $778.32bn), 6 tranches for $3.15bn in HY (2022 YTD volume $66.071bn vs 2021 YTD $263.313bn)

Published ET

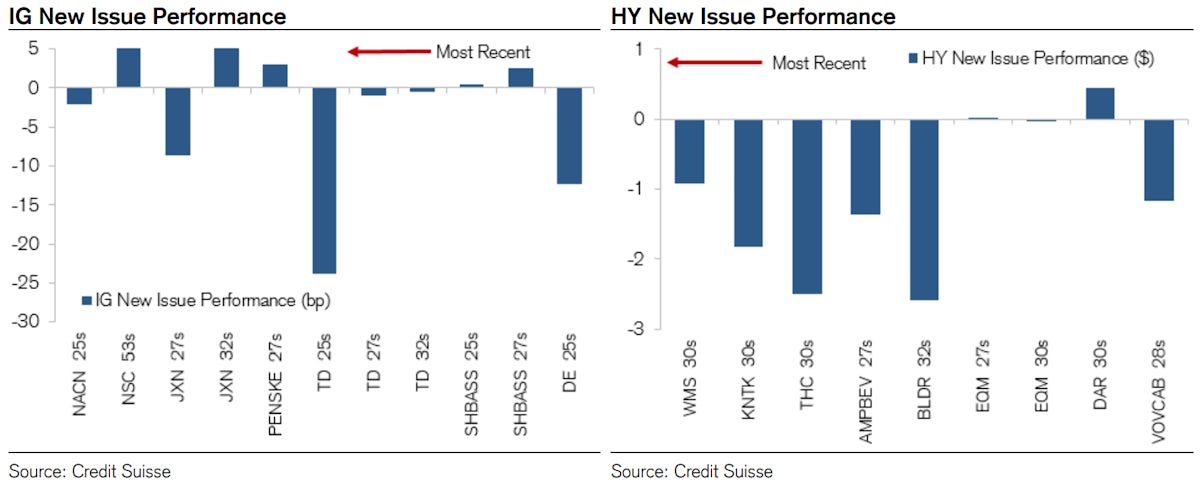

USD IG & HY New Issue Performance | Source: Credit Suisse

DAILY SUMMARY

- S&P 500 Bond Index was down -0.96% today, with investment grade down -0.94% and high yield down -1.09% (YTD total return: -12.98%)

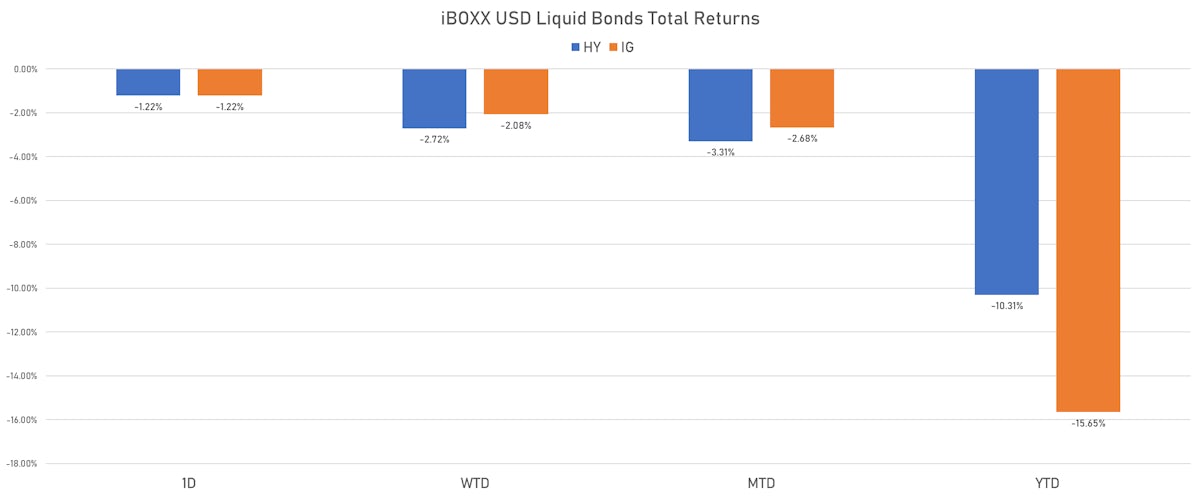

- The iBoxx USD Liquid Investment Grade Total Return Index was down -1.223% today (Month-to-date: -2.68%; Year-to-date: -15.65%)

- The iBoxx USD Liquid High Yield Total Return Index was down -1.221% today (Month-to-date: -3.31%; Year-to-date: -10.31%)

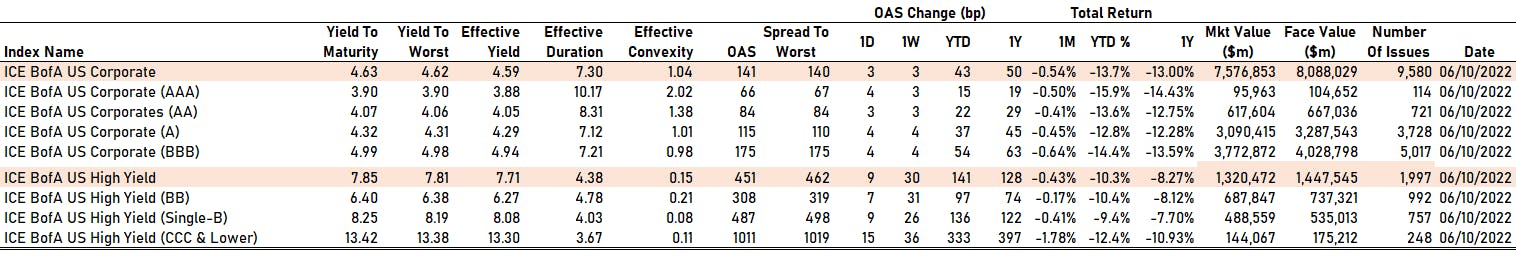

- ICE BofA US Corporate Index (Investment Grade) spread to worst up 4.0 bp, now at 140.0 bp (YTD change: +45.0 bp)

- ICE BofA US High Yield Index spread to worst up 9.0 bp, now at 462.0 bp (YTD change: +132.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index down -0.49% today (YTD total return: -2.3%)

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING TODAY

- AAA up by 4 bp at 66 bp

- AA up by 3 bp at 84 bp

- A up by 4 bp at 115 bp

- BBB up by 4 bp at 175 bp

- BB up by 7 bp at 308 bp

- B up by 9 bp at 487 bp

- CCC up by 15 bp at 1011 bp

CDS INDICES TODAY (mid-spreads)

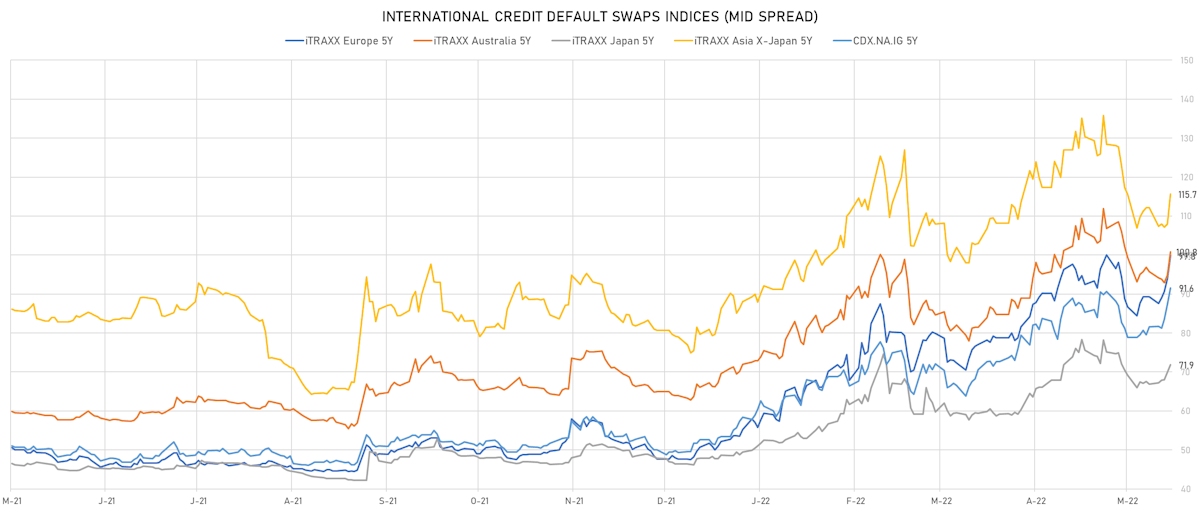

- Markit CDX.NA.IG 5Y up 4.2 bp, now at 92bp (1W change: +10.0bp; YTD change: +42.2bp)

- Markit CDX.NA.IG 10Y up 3.9 bp, now at 127bp (1W change: +9.6bp; YTD change: +38.1bp)

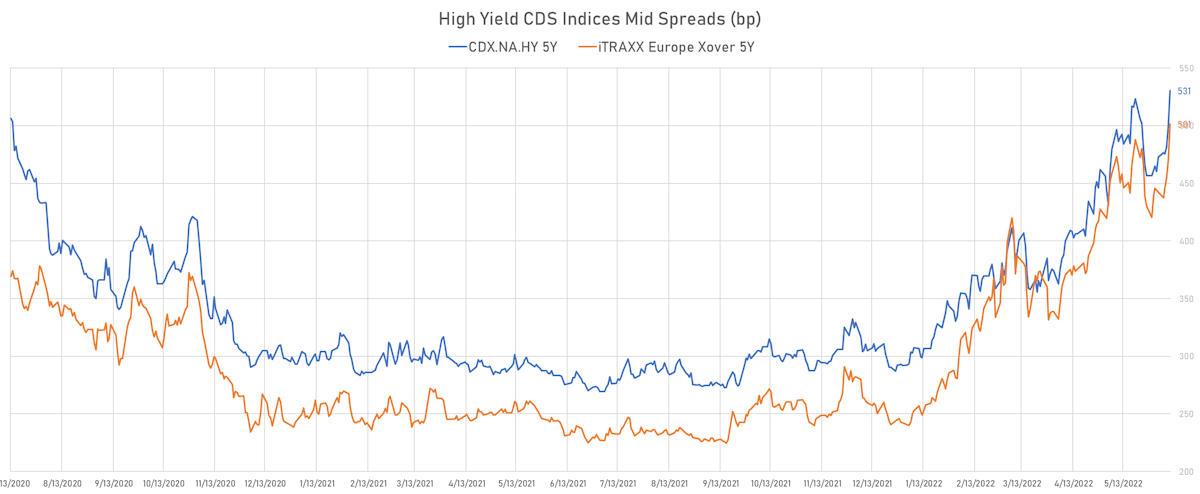

- Markit CDX.NA.HY 5Y up 30.2 bp, now at 531bp (1W change: +57.6bp; YTD change: +238.6bp)

- Markit iTRAXX Europe 5Y up 5.9 bp, now at 100bp (1W change: +10.5bp; YTD change: +52.1bp)

- Markit iTRAXX Europe Crossover 5Y up 30.7 bp, now at 501bp (1W change: +55.6bp; YTD change: +259.2bp)

- Markit iTRAXX Japan 5Y up 1.9 bp, now at 72bp (1W change: +5.0bp; YTD change: +25.5bp)

- Markit iTRAXX Asia Ex-Japan 5Y up 7.8 bp, now at 116bp (1W change: +3.6bp; YTD change: +36.7bp)

5Y USD CDS SINGLE NAMES - LARGEST MOVES OVER THE PAST WEEK

- Transocean Inc (Country: KY; rated: Caa3): down 104.9 bp to 1,479.5bp (1Y range: 941-1,784bp)

- Ford Motor Co (Country: US; rated: LGD4 - 54%): up 62.9 bp to 383.1bp (1Y range: 143-383bp)

- KB Home (Country: US; rated: Ba2): up 64.1 bp to 370.3bp (1Y range: 138-370bp)

- Ford Motor Credit Company LLC (Country: US; rated: NP): up 66.0 bp to 377.8bp (1Y range: 128-378bp)

- Realogy Group LLC (Country: US; rated: WR): up 71.8 bp to 767.1bp (1Y range: 278-767bp)

- Tegna Inc (Country: US; rated: Ba3): up 73.2 bp to 847.8bp (1Y range: 182-848bp)

- Pitney Bowes Inc (Country: US; rated: B1): up 75.5 bp to 904.1bp (1Y range: 363-904bp)

- DISH DBS Corp (Country: US; rated: B2): up 81.9 bp to 1,110.9bp (1Y range: 317-1,205bp)

- Calpine Corp (Country: US; rated: LGD5 - 88%): up 89.8 bp to 545.0bp (1Y range: 284-548bp)

- Carnival Corp (Country: US; rated: LGD5 - 72%): up 97.7 bp to 846.5bp (1Y range: 297-857bp)

- Royal Caribbean Cruises Ltd (Country: US; rated: LGD4 - 59%): up 102.7 bp to 803.0bp (1Y range: 299-803bp)

- Bombardier Inc (Country: CA; rated: Caa1): up 113.4 bp to 930.8bp (1Y range: 395-937bp)

- Kohls Corp (Country: US; rated: Baa2): up 129.4 bp to 567.5bp (1Y range: 101-568bp)

- Staples Inc (Country: US; rated: B3): up 171.4 bp to 1,771.9bp (1Y range: 776-1,842bp)

- American Airlines Group Inc (Country: US; rated: B2): up 275.2 bp to 1,510.8bp (1Y range: 596-1,511bp)

5Y EURO CDS SINGLE NAMES - LARGEST MOVES OVER THE PAST WEEK

- Ardagh Packaging Finance PLC (Country: IE; rated: B1): up 33.0 bp to 688.8bp (1Y range: 213-689bp)

- Telecom Italia SpA (Country: IT; rated: LGD4 - 53%): up 37.5 bp to 375.0bp (1Y range: 149-440bp)

- Air France KLM SA (Country: FR; rated: B-): up 39.8 bp to 600.7bp (1Y range: 386-652bp)

- Stonegate Pub Company Financing PLC (Country: GB; rated: WR): up 44.5 bp to 570.1bp (1Y range: 370-570bp)

- UPC Holding BV (Country: NL; rated: LGD6 - 93%): up 47.2 bp to 383.3bp (1Y range: 164-393bp)

- Ladbrokes Coral Group Ltd (Country: GB; rated: WR): up 54.4 bp to 374.1bp (1Y range: 107-374bp)

- CMA CGM SA (Country: FR; rated: Ba2): up 58.8 bp to 479.7bp (1Y range: 259-496bp)

- Altice Finco SA (Country: LU; rated: Caa1): up 59.2 bp to 675.3bp (1Y range: 333-675bp)

- Stena AB (Country: SE; rated: B2-PD): up 67.8 bp to 563.9bp (1Y range: 401-564bp)

- Jaguar Land Rover Automotive PLC (Country: GB; rated: WD): up 70.7 bp to 792.6bp (1Y range: 339-797bp)

- Novafives SAS (Country: FR; rated: Caa1): up 113.3 bp to 1,291.2bp (1Y range: 618-1,395bp)

- Casino Guichard Perrachon SA (Country: FR; rated: WR): up 113.7 bp to 1,331.2bp (1Y range: 464-1,452bp)

- TUI AG (Country: DE; rated: B3-PD): up 120.3 bp to 889.9bp (1Y range: 607-905bp)

- Iceland Bondco PLC (Country: GB; rated: LGD3 - 46%): up 135.7 bp to 1,098.9bp (1Y range: 418-1,099bp)

- Boparan Finance PLC (Country: GB; rated: Caa1): up 205.5 bp to 2,071.3bp (1Y range: 863-2,690bp)

TOP BONDS MOVES IN THE PAST WEEK - USD HY

- Issuer: Rockies Express Pipeline LLC (Leawood, Kansas (US)) | Coupon: 3.60% | Maturity: 15/5/2025 | Rating: BB | ISIN: USU75111AK72 | Z-spread up by 115.2 bp to 304.2 bp, with the yield to worst at 6.1% and the bond now trading down to 92.5 cents on the dollar (1Y price range: 91.8-103.0).

- Issuer: American Airlines Group Inc (Fort Worth, Texas (US)) | Coupon: 3.75% | Maturity: 1/3/2025 | Rating: CCC | ISIN: USU0242AAD47 | Z-spread up by 103.1 bp to 601.6 bp (CDS basis: 677.0bp), with the yield to worst at 9.1% and the bond now trading down to 87.0 cents on the dollar (1Y price range: 83.5-95.6).

- Issuer: Bath & Body Works Inc (Columbus, Ohio (US)) | Coupon: 9.38% | Maturity: 1/7/2025 | Rating: BB | ISIN: USU51407AD34 | Z-spread up by 96.0 bp to 439.0 bp, with the yield to worst at 7.5% and the bond now trading down to 104.5 cents on the dollar (1Y price range: 104.5-122.3).

- Issuer: NCL Corporation Ltd (Miami, Bermuda) | Coupon: 7.75% | Maturity: 15/2/2029 | Rating: CCC+ | ISIN: USG6436QAP12 | Z-spread up by 86.1 bp to 829.2 bp, with the yield to worst at 11.5% and the bond now trading down to 82.5 cents on the dollar (1Y price range: 82.3-103.0).

- Issuer: NCL Corporation Ltd (Miami, Bermuda) | Coupon: 5.88% | Maturity: 15/3/2026 | Rating: CCC+ | ISIN: USG6436QAL08 | Z-spread up by 85.7 bp to 737.4 bp, with the yield to worst at 10.4% and the bond now trading down to 85.3 cents on the dollar (1Y price range: 84.3-100.0).

- Issuer: Block Inc (San Francisco, California (US)) | Coupon: 2.75% | Maturity: 1/6/2026 | Rating: BB | ISIN: USU85223AA03 | Z-spread up by 74.5 bp to 292.9 bp, with the yield to worst at 6.0% and the bond now trading down to 87.8 cents on the dollar (1Y price range: 87.8-100.5).

- Issuer: Wynn Las Vegas LLC (Las Vegas, Nevada (US)) | Coupon: 5.50% | Maturity: 1/3/2025 | Rating: B | ISIN: USU98347AK05 | Z-spread up by 68.9 bp to 433.7 bp, with the yield to worst at 7.4% and the bond now trading down to 94.5 cents on the dollar (1Y price range: 93.5-103.5).

- Issuer: NCL Finance Ltd (#N/A, United Kingdom) | Coupon: 6.13% | Maturity: 15/3/2028 | Rating: CCC+ | ISIN: USG6437FAA78 | Z-spread up by 62.0 bp to 759.3 bp, with the yield to worst at 10.6% and the bond now trading down to 80.0 cents on the dollar (1Y price range: 80.0-99.5).

- Issuer: Molina Healthcare Inc (Long Beach, #N/A (US)) | Coupon: 3.88% | Maturity: 15/5/2032 | Rating: BB- | ISIN: USU60868AE36 | Z-spread up by 58.6 bp to 247.7 bp, with the yield to worst at 5.7% and the bond now trading down to 86.0 cents on the dollar (1Y price range: 86.0-100.5).

- Issuer: Taylor Morrison Communities Inc (Scottsdale, Arizona (US)) | Coupon: 5.13% | Maturity: 1/8/2030 | Rating: BB- | ISIN: USU8760NAF60 | Z-spread up by 51.2 bp to 345.9 bp, with the yield to worst at 6.7% and the bond now trading down to 90.0 cents on the dollar (1Y price range: 89.0-109.9).

- Issuer: EQM Midstream Partners LP (Pittsburgh, Pennsylvania (US)) | Coupon: 6.50% | Maturity: 1/7/2027 | Rating: BB- | ISIN: USU26886AB46 | Z-spread up by 49.2 bp to 390.8 bp, with the yield to worst at 7.1% and the bond now trading down to 96.8 cents on the dollar (1Y price range: 95.8-112.0).

- Issuer: Venture Global Calcasieu Pass LLC (Washington DC, Washington Dc (US)) | Coupon: 4.13% | Maturity: 15/8/2031 | Rating: BB- | ISIN: USU9220MAB91 | Z-spread up by 48.4 bp to 252.0 bp, with the yield to worst at 5.7% and the bond now trading down to 88.3 cents on the dollar (1Y price range: 88.3-106.4).

- Issuer: Molina Healthcare Inc (Long Beach, California (US)) | Coupon: 3.88% | Maturity: 15/11/2030 | Rating: BB- | ISIN: USU60868AD52 | Z-spread up by 47.3 bp to 267.0 bp, with the yield to worst at 5.8% and the bond now trading down to 86.5 cents on the dollar (1Y price range: 86.5-103.4).

- Issuer: Taylor Morrison Communities Inc (Scottsdale, Arizona (US)) | Coupon: 5.75% | Maturity: 15/1/2028 | Rating: BB- | ISIN: USU8760NAB56 | Z-spread up by 45.4 bp to 334.5 bp, with the yield to worst at 6.5% and the bond now trading down to 95.8 cents on the dollar (1Y price range: 95.8-112.4).

- Issuer: Natura &Co Luxembourg Holdings SARL (Luxembourg, Luxembourg) | Coupon: 6.00% | Maturity: 19/4/2029 | Rating: BB | ISIN: USL6S52VAA02 | Z-spread up by 43.5 bp to 416.0 bp, with the yield to worst at 7.1% and the bond now trading down to 93.1 cents on the dollar (1Y price range: 93.1-99.9).

TOP BONDS MOVES IN THE PAST WEEK - EUR HY

- Issuer: Teva Pharmaceutical Finance Netherlands II BV (Amsterdam, Netherlands) | Coupon: 6.00% | Maturity: 31/1/2025 | Rating: BB- | ISIN: XS2198213956 | Z-spread up by 98.0 bp to 463.1 bp, with the yield to worst at 6.0% and the bond now trading down to 99.3 cents on the dollar (1Y price range: 98.0-107.7).

- Issuer: Teva Pharmaceutical Finance Netherlands II BV (Amsterdam, Netherlands) | Coupon: 1.13% | Maturity: 15/10/2024 | Rating: BB- | ISIN: XS1439749281 | Z-spread up by 94.9 bp to 361.9 bp, with the yield to worst at 5.1% and the bond now trading down to 91.0 cents on the dollar (1Y price range: 89.9-96.7).

- Issuer: Teva Pharmaceutical Finance Netherlands II BV (Amsterdam, Netherlands) | Coupon: 3.75% | Maturity: 9/5/2027 | Rating: BB- | ISIN: XS2406607098 | Z-spread up by 93.2 bp to 547.3 bp, with the yield to worst at 7.2% and the bond now trading down to 85.6 cents on the dollar (1Y price range: 85.5-99.6).

- Issuer: Teva Pharmaceutical Finance Netherlands II BV (Amsterdam, Netherlands) | Coupon: 1.63% | Maturity: 15/10/2028 | Rating: BB- | ISIN: XS1439749364 | Z-spread up by 80.3 bp to 492.2 bp, with the yield to worst at 6.8% and the bond now trading down to 73.4 cents on the dollar (1Y price range: 73.1-87.3).

- Issuer: Teva Pharmaceutical Finance Netherlands II BV (Amsterdam, Netherlands) | Coupon: 1.88% | Maturity: 31/3/2027 | Rating: BB- | ISIN: XS1211044075 | Z-spread up by 74.0 bp to 497.6 bp, with the yield to worst at 6.8% and the bond now trading down to 79.9 cents on the dollar (1Y price range: 79.8-92.0).

- Issuer: Jaguar Land Rover Automotive PLC (Coventry, United Kingdom) | Coupon: 5.88% | Maturity: 15/11/2024 | Rating: B+ | ISIN: XS2010037849 | Z-spread up by 63.8 bp to 634.5 bp (CDS basis: 20.4bp), with the yield to worst at 7.5% and the bond now trading down to 95.7 cents on the dollar (1Y price range: 94.8-108.0).

- Issuer: Deutsche Lufthansa AG (Cologne, Germany) | Coupon: 2.88% | Maturity: 11/2/2025 | Rating: BB- | ISIN: XS2296201424 | Z-spread up by 55.5 bp to 339.2 bp (CDS basis: -54.4bp), with the yield to worst at 4.7% and the bond now trading down to 94.5 cents on the dollar (1Y price range: 93.6-102.3).

- Issuer: Jaguar Land Rover Automotive PLC (Coventry, United Kingdom) | Coupon: 4.50% | Maturity: 15/1/2026 | Rating: B+ | ISIN: XS1881005976 | Z-spread up by 52.6 bp to 690.8 bp (CDS basis: 17.6bp), with the yield to worst at 8.4% and the bond now trading down to 87.7 cents on the dollar (1Y price range: 87.4-104.5).

- Issuer: Teva Pharmaceutical Finance Netherlands II BV (Amsterdam, Netherlands) | Coupon: 4.38% | Maturity: 9/5/2030 | Rating: BB- | ISIN: XS2406607171 | Z-spread up by 51.2 bp to 532.9 bp, with the yield to worst at 7.2% and the bond now trading down to 82.8 cents on the dollar (1Y price range: 82.5-98.9).

- Issuer: Iliad SA (Paris, France) | Coupon: 1.88% | Maturity: 25/4/2025 | Rating: BB | ISIN: FR0013331196 | Z-spread up by 50.2 bp to 271.9 bp, with the yield to worst at 4.3% and the bond now trading down to 93.1 cents on the dollar (1Y price range: 92.9-100.9).

- Issuer: Arcelik AS (Turkey) | Coupon: 3.00% | Maturity: 27/5/2026 | Rating: BB | ISIN: XS2346972263 | Z-spread up by 48.1 bp to 521.0 bp, with the yield to worst at 6.9% and the bond now trading down to 86.3 cents on the dollar (1Y price range: 86.3-98.4).

- Issuer: Wens Foodstuff Group Co Ltd (Yunfu, China (Mainland)) | Coupon: 3.26% | Maturity: 29/10/2030 | Rating: BB+ | ISIN: XS2239632859 | Z-spread down by 72.3 bp to 453.6 bp, with the yield to worst at 7.4% and the bond now trading up to 73.3 cents on the dollar (1Y price range: 68.3-75.5).

- Issuer: Bulgarian Energy Holding EAD (Sofia, Bulgaria) | Coupon: 3.50% | Maturity: 28/6/2025 | Rating: BB | ISIN: XS1839682116 | Z-spread down by 112.3 bp to 431.5 bp (CDS basis: -376.6bp), with the yield to worst at 6.0% and the bond now trading up to 93.0 cents on the dollar (1Y price range: 86.0-106.1).

- Issuer: Adler Group SA (Senningerberg, Luxembourg) | Coupon: 2.25% | Maturity: 14/1/2029 | Rating: CCC | ISIN: XS2283225477 | Z-spread down by 157.2 bp to 1,099.1 bp, with the yield to worst at 12.2% and the bond now trading up to 54.2 cents on the dollar (1Y price range: 46.4-84.9).

- Issuer: Adler Real Estate AG (Berlin, Germany) | Coupon: 3.00% | Maturity: 27/4/2026 | Rating: CCC | ISIN: XS1713464524 | Z-spread down by 166.9 bp to 911.3 bp, with the yield to worst at 10.4% and the bond now trading up to 75.9 cents on the dollar (1Y price range: 68.3-94.5).

RECENT DOMESTIC USD BOND ISSUES

- Altair Engineering Inc (Service - Other | Troy, Michigan, United States | Rating: NR): US$200m Bond (US021369AB99), fixed rate (1.75% coupon) maturing on 15 June 2027, priced at 100.00, non callable, convertible

- Bank of New York Mellon Corp (Financial - Other | New York City, United States | Rating: A): US$700m Senior Note (US06406RBF38), floating rate maturing on 13 June 2025, priced at 100.00 (original spread of 40 bp), callable (3nc2)

- Bank of New York Mellon Corp (Financial - Other | New York City, United States | Rating: A): US$750m Senior Note (US06406RBH93), floating rate maturing on 13 June 2033, priced at 100.00 (original spread of 125 bp), callable (11nc10)

- Bank of New York Mellon Corp (Financial - Other | New York City, United States | Rating: A): US$500m Senior Note (US06406RBG11), floating rate maturing on 13 June 2028, priced at 100.00 (original spread of 100 bp), callable (6nc5)

- CDK Global Inc (Information/Data Technology | Hoffman Estates, Illinois, United States | Rating: B+): US$750m Note (US15477CAA36), fixed rate (7.25% coupon) maturing on 15 June 2029, priced at 100.00 (original spread of 416 bp), callable (7nc3)

- Cabot Corp (Chemicals | Boston, Massachusetts, United States | Rating: BBB): US$400m Senior Note (US127055AM33), fixed rate (5.00% coupon) maturing on 30 June 2032, priced at 99.33 (original spread of 213 bp), callable (10nc10)

- Callon Petroleum Co (Oil and Gas | Natchez, Mississippi, United States | Rating: B): US$600m Senior Note (US13123XBF87), fixed rate (7.50% coupon) maturing on 15 June 2030, priced at 100.00, callable (8nc3)

- Case Western Reserve University (Service - Other | Cleveland, United States | Rating: AA-): US$350m Bond (US14745XAA63), fixed rate (5.41% coupon) maturing on 1 June 2122, priced at 100.00 (original spread of 263 bp), callable (100nc100)

- Cogent Communications Group Inc (Service - Other | Washington, Washington Dc, United States | Rating: B-): US$450m Senior Note (USU19283AH02), fixed rate (7.00% coupon) maturing on 15 June 2027, priced at 100.00 (original spread of 403 bp), callable (5nc2)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, New Jersey, United States | Rating: AA+): US$185m Bond (US3133ENYQ78), fixed rate (2.95% coupon) maturing on 13 June 2025, priced at 100.00 (original spread of 2 bp), non callable

- Federal Home Loan Banks (Agency | Washington, Washington Dc, United States | Rating: AA+): US$315m Bond (US3130ASEC96), fixed rate (3.25% coupon) maturing on 30 September 2024, priced at 100.00, callable (2nc3m)

- Federal Home Loan Mortgage Corp (Agency | Mclean, Virginia, United States | Rating: AA+): US$556m Unsecured Note (US3134GXYR98), fixed rate (3.56% coupon) maturing on 27 June 2025, priced at 100.00, callable (3nc1m)

- Federal Home Loan Mortgage Corp (Agency | Mclean, Virginia, United States | Rating: AA+): US$150m Unsecured Note (US3134GXXZ24), fixed rate (3.13% coupon) maturing on 1 October 2025, priced at 100.00, callable (3nc1)

- Federal Home Loan Mortgage Corp (Agency | Mclean, Virginia, United States | Rating: AA+): US$300m Unsecured Note (US3134GXYA63), fixed rate (3.05% coupon) maturing on 14 June 2024, priced at 100.00, callable (2nc3m)

- Federal Home Loan Mortgage Corp (Agency | Mclean, Virginia, United States | Rating: AA+): US$150m Unsecured Note (US3134GXYB47), fixed rate (3.02% coupon) maturing on 3 March 2025, priced at 100.00, callable (3nc9m)

- Federal Home Loan Mortgage Corp (Agency | Mclean, Virginia, United States | Rating: AA+): US$150m Unsecured Note (US3134GXXU37), fixed rate (3.09% coupon) maturing on 1 July 2025, priced at 100.00, callable (3nc1)

- Goldman Sachs Group Inc (Banking | New York City, New York, United States | Rating: BBB+): US$700m Senior Note (US38141GZT48), floating rate maturing on 15 June 2027, priced at 100.00 (original spread of 144 bp), callable (5nc4)

- HP Inc (Information/Data Technology | Palo Alto, California, United States | Rating: BBB): US$900m Senior Note (US40434LAM72), fixed rate (4.75% coupon) maturing on 15 January 2028, priced at 99.84 (original spread of 189 bp), callable (6nc5)

- HP Inc (Information/Data Technology | Palo Alto, California, United States | Rating: BBB): US$1,100m Senior Note (US40434LAN55), fixed rate (5.50% coupon) maturing on 15 January 2033, priced at 99.73 (original spread of 264 bp), callable (11nc10)

- JPMorgan Chase & Co (Banking | New York City, New York, United States | Rating: A-): US$2,000m Senior Note (US46647PDF09), floating rate maturing on 14 June 2030, priced at 100.00 (original spread of 168 bp), callable (8nc7)

- JPMorgan Chase & Co (Banking | New York City, New York, United States | Rating: A-): US$500m Senior Note (US46647PDD50), floating rate (SOFR + 97.0 bp) maturing on 14 June 2025, priced at 100.00, callable (3nc2)

- JPMorgan Chase & Co (Banking | New York City, New York, United States | Rating: A-): US$2,000m Senior Note (US46647PDE34), floating rate maturing on 14 June 2025, priced at 100.00 (original spread of 81 bp), callable (3nc2)

- KB Home (Home Builders | Los Angeles, California, United States | Rating: BB): US$350m Senior Note (US48666KBA60), fixed rate (7.25% coupon) maturing on 15 July 2030, priced at 100.00 (original spread of 424 bp), callable (8nc3)

- MET Tower Global Funding (Financial - Other | Wilmington, Delaware, United States | Rating: AA-): US$400m Note (US58989V2E38), fixed rate (3.70% coupon) maturing on 13 June 2025, priced at 99.90 (original spread of 81 bp), non callable

- Maxar Technologies Inc (Telecommunications | Westminster, Colorado, United States | Rating: B): US$500m Note (US57778KAC99), fixed rate (7.75% coupon) maturing on 15 June 2027, priced at 100.00 (original spread of 467 bp), callable (5nc2)

- O'Reilly Automotive Inc (Retail Stores - Other | Springfield, Missouri, United States | Rating: BBB): US$850m Senior Note (US67103HAL15), fixed rate (4.70% coupon) maturing on 15 June 2032, priced at 99.68 (original spread of 179 bp), callable (10nc10)

- PACCAR Financial Corp (Financial - Other | Bellevue, Washington, United States | Rating: A+): US$500m Senior Note (US69371RR811), fixed rate (3.15% coupon) maturing on 13 June 2024, priced at 99.98 (original spread of 43 bp), non callable

- Parker-Hannifin Corp (Machinery | Cleveland, Ohio, United States | Rating: BBB+): US$1,400m Senior Note (US701094AQ75), fixed rate (3.65% coupon) maturing on 15 June 2024, priced at 99.93 (original spread of 95 bp), with a special call

- Parker-Hannifin Corp (Machinery | Cleveland, Ohio, United States | Rating: BBB+): US$1,000m Senior Note (US701094AS32), fixed rate (4.50% coupon) maturing on 15 September 2029, priced at 99.78 (original spread of 159 bp), callable (7nc7)

- Parker-Hannifin Corp (Machinery | Cleveland, Ohio, United States | Rating: BBB+): US$1,200m Senior Note (US701094AR58), fixed rate (4.25% coupon) maturing on 15 September 2027, priced at 99.79 (original spread of 125 bp), callable (5nc5)

- Synchrony Financial (Financial - Other | Stamford, Connecticut, United States | Rating: BBB-): US$750m Senior Note (US87165BAS25), fixed rate (4.88% coupon) maturing on 13 June 2025, priced at 99.93 (original spread of 197 bp), callable (3nc3)

- Univision Communications Inc (Cable/Media | New York City, United States | Rating: B+): US$500m Note (USU91505AR50), fixed rate (7.38% coupon) maturing on 30 June 2030, priced at 99.26 (original spread of 445 bp), callable (8nc3)

RECENT INTERNATIONAL USD BOND ISSUES

- ASB Bank Ltd (Banking | Auckland, Australia | Rating: A+): US$600m Subordinated Note (USQ0553JAA99), fixed rate (5.28% coupon) maturing on 17 June 2032, priced at 100.00 (original spread of 241 bp), callable (10nc5)

- Allegion US Holding Company Inc (Financial - Other | Carmel, Indiana, Ireland | Rating: BBB-): US$600m Senior Note (US01748TAC53), fixed rate (5.41% coupon) maturing on 1 July 2032, priced at 100.00 (original spread of 245 bp), callable (10nc10)

- American National Group Inc (Financial - Other | Galveston, Texas, Canada | Rating: BBB): US$500m Senior Note (US02772AAA79), fixed rate (6.14% coupon) maturing on 13 June 2032, priced at 100.00 (original spread of 310 bp), callable (10nc10)

- Bahamas, Commonwealth of the (Government) (Sovereign | Nassau, Bahamas | Rating: B+): US$250m Senior Note (USP06518AJ61), fixed rate (9.00% coupon) maturing on 16 June 2029, priced at 80.02, with a make whole call

- Bangkok Bank PCL (Banking | Bangkok, Bangkok Metropolis, Thailand | Rating: BBB+): US$750m Senior Note (US06000BAB80), fixed rate (4.30% coupon) maturing on 15 June 2027, priced at 99.87 (original spread of 130 bp), callable (5nc5)

- Bank of China Ltd (Frankfurt am Main Branch) (Banking | Frankfurt, China (Mainland) | Rating: A): US$500m Senior Note (XS2484016642), fixed rate (3.13% coupon) maturing on 16 June 2025, priced at 99.86 (original spread of 21 bp), non callable

- CPPIB Capital Inc (Financial - Other | Toronto, Canada | Rating: AAA): US$1,500m Senior Note (US22411WAW64), fixed rate (3.25% coupon) maturing on 15 June 2027, priced at 99.74 (original spread of 31 bp), non callable

- Chang Development International Ltd (Financial - Other | Tortola, China (Mainland) | Rating: BBB+): US$200m Senior Note (XS2476853085), fixed rate (5.00% coupon) maturing on 14 June 2025, priced at 100.00, non callable

- Coastal Emerald Ltd (Financial - Other | Road Town, China (Mainland) | Rating: NR): US$500m Senior Note (XS2480876254), fixed rate (4.10% coupon) maturing on 15 June 2025, priced at 100.00, non callable

- Council of Europe Development Bank (Supranational | Paris, Ile-De-France, France | Rating: AA+): US$1,000m Senior Note (US222213BA75), fixed rate (3.00% coupon) maturing on 16 June 2025, priced at 99.78 (original spread of 13 bp), non callable

- ENEL Finance International NV (Financial - Other | Amsterdam, Noord-Holland, Italy | Rating: NR): US$750m Senior Note (USN30707AP36), fixed rate (4.63% coupon) maturing on 15 June 2027, priced at 99.79 (original spread of 165 bp), callable (5nc5)

- ENEL Finance International NV (Financial - Other | Amsterdam, Noord-Holland, Italy | Rating: NR): US$1,000m Senior Note (USN30707AQ19), fixed rate (5.00% coupon) maturing on 15 June 2032, priced at 98.70 (original spread of 215 bp), callable (10nc10)

- ENEL Finance International NV (Financial - Other | Amsterdam, Noord-Holland, Italy | Rating: NR): US$750m Senior Note (US29278GAV05), fixed rate (4.25% coupon) maturing on 15 June 2025, priced at 99.58 (original spread of 145 bp), with a make whole call

- ENEL Finance International NV (Financial - Other | Amsterdam, Noord-Holland, Italy | Rating: NR): US$1,000m Senior Note (US29278GAY44), fixed rate (5.50% coupon) maturing on 15 June 2052, priced at 98.78 (original spread of 270 bp), callable (30nc30)

- Guohui International (BVI) Co Ltd (Financial - Other | Road Town, China (Mainland) | Rating: BBB+): US$500m Senior Note (XS2484991844), fixed rate (4.70% coupon) maturing on 15 June 2025, priced at 100.00 (original spread of 146 bp), non callable

- Hungary (Government) (Sovereign | Budapest, Hungary | Rating: BBB): US$1,250m Senior Note (XS2010026487), fixed rate (5.50% coupon) maturing on 16 June 2034, priced at 97.19 (original spread of 280 bp), non callable

- Hungary (Government) (Sovereign | Budapest, Budapest, Hungary | Rating: BBB): US$1,750m Senior Note (US445545AP18), fixed rate (5.25% coupon) maturing on 16 June 2029, priced at 98.79 (original spread of 240 bp), non callable

- JBS USA Lux SA (Beverage/Bottling | Luxembourg, Brazil | Rating: BBB-): US$500m Senior Note (US46590XAG16), fixed rate (5.13% coupon) maturing on 1 February 2028, priced at 99.20 (original spread of 236 bp), callable (6nc6)

- JBS USA Lux SA (Beverage/Bottling | Luxembourg, Brazil | Rating: BBB-): US$750m Senior Note (US46590XAJ54), fixed rate (6.50% coupon) maturing on 1 December 2052, priced at 98.73 (original spread of 362 bp), callable (30nc30)

- JBS USA Lux SA (Beverage/Bottling | Luxembourg, Brazil | Rating: BBB-): US$1,250m Senior Note (USL56608AL39), fixed rate (5.75% coupon) maturing on 1 April 2033, priced at 98.58 (original spread of 288 bp), callable (11nc11)

- Jordan, Hashemite Kingdom of (Government) (Sovereign | Jordan | Rating: B+): US$650m Senior Note (XS2490731721), fixed rate (7.75% coupon) maturing on 15 January 2028, priced at 99.10 (original spread of 492 bp), non callable

- Kommuninvest i Sverige AB (Agency | Orebro, Orebro, Sweden | Rating: AAA): US$1,250m Senior Note (XS2490493959), fixed rate (2.88% coupon) maturing on 3 July 2024, priced at 99.78 (original spread of 29 bp), non callable

- Korea Electric Power Corp (Utility - Other | Naju, Jeollanam-Do, South Korea | Rating: AA): US$300m Senior Note (US500631AW65), fixed rate (4.00% coupon) maturing on 14 June 2027, priced at 99.85 (original spread of 105 bp), non callable

- Korea Electric Power Corp (Utility - Other | Naju, Jeollanam-Do, South Korea | Rating: AA): US$500m Senior Note (US500631AV82), fixed rate (3.63% coupon) maturing on 14 June 2025, priced at 99.79 (original spread of 80 bp), non callable

- Kyobo Life Insurance Co Ltd (Life Insurance | Seoul, Seoul, South Korea | Rating: A-): US$500m Bond (USY50800AA26), fixed rate (5.90% coupon) maturing on 15 June 2052, priced at 100.00 (original spread of 253 bp), callable (30nc5)

- Nomura International Funding Pte Ltd (Financial - Other | Japan | Rating: NR): US$250m Unsecured Note (XS2430484274), floating rate maturing on 22 June 2025, priced at 100.00, non callable

- Nwd Mtn Ltd (Financial - Other | Hong Kong | Rating: NR): US$200m Senior Note (XS2488074662), fixed rate (5.88% coupon) maturing on 16 June 2027, priced at 99.81 (original spread of 290 bp), callable (5nc5)

- Oversea-Chinese Banking Corporation Ltd (Banking | Singapore | Rating: BBB+): US$750m Subordinated Note (XS2490811168), fixed rate (4.60% coupon) maturing on 15 June 2032, priced at 100.00 (original spread of 158 bp), callable (10nc5)

- Qingdao Jiaozhou Bay Development Group Co Ltd (Financial - Other | Qingdao, China (Mainland) | Rating: BBB-): US$300m Senior Note (XS2489151709), fixed rate (4.90% coupon) maturing on 16 June 2025, priced at 100.00 (original spread of 175 bp), non callable

- Shanhai Hong Kong International Investments Ltd (Financial - Other | China (Mainland) | Rating: BBB): US$250m Senior Note (XS2480444970), fixed rate (5.00% coupon) maturing on 16 June 2025, priced at 100.00, non callable

- Societe Generale SA (Banking | Paris, France | Rating: A): US$600m Note (US83368RBN17), fixed rate (4.35% coupon) maturing on 13 June 2025, priced at 100.00 (original spread of 143 bp), non callable

- Societe Generale SA (Banking | Paris, Ile-De-France, France | Rating: A): US$800m Note (US83368TBM99), fixed rate (4.68% coupon) maturing on 15 June 2027, priced at 100.00 (original spread of 165 bp), non callable

- Societe Generale SA (Banking | Paris, Ile-De-France, France | Rating: BBB-): US$1,250m Subordinated Note (US83368RBL50), floating rate maturing on 15 June 2033, priced at 100.00, callable (11nc10)

- Tokyo Metropolitan Government (Official and Muni | Shinjuku, Tokyo-To, Japan | Rating: A+): US$500m Bond (US59173LAF76), fixed rate (3.38% coupon) maturing on 16 June 2025, priced at 99.93, non callable

- Zhoushan Islands District Penglai State-owned Assets Investment Group Co Ltd (Financial - Other | Zhoushan, Zhejiang, China (Mainland) | Rating: NR): US$150m Bond (XS2475950155), fixed rate (3.90% coupon) maturing on 14 June 2025, priced at 100.00, non callable

SELECTED RECENT EUR BOND ISSUES

- A2A SpA (Utility - Other | Milan, Milano, Italy | Rating: BBB): €600m Senior Note (XS2491189408), fixed rate (2.50% coupon) maturing on 15 June 2026, priced at 99.58 (original spread of 173 bp), callable (4nc4)

- Agence France Locale SA (Agency | Lyon, Auvergne-Rhone-Alpes, France | Rating: AA-): €130m Bond (FR001400AYF8), fixed rate (0.38% coupon) maturing on 25 May 2036, priced at 76.59, non callable

- Bank of Montreal (Banking | Toronto, Ontario, Canada | Rating: A-): €800m Senior Note (XS2473715675), fixed rate (2.75% coupon) maturing on 15 June 2027, priced at 100.00 (original spread of 189 bp), non callable

- Banque Federative du Credit Mutuel SA (Banking | Strasbourg, Grand Est, France | Rating: A+): €1,250m Bond (FR001400AY79), fixed rate (3.88% coupon) maturing on 16 June 2032, priced at 99.96 (original spread of 304 bp), callable (10nc5)

- Caixa Geral de Depositos SA (Banking | Lisbon, Portugal | Rating: BBB-): €300m Note (PTCGDNOM0026), fixed rate (2.88% coupon) maturing on 15 June 2026, priced at 99.93 (original spread of 212 bp), callable (4nc3)

- Commerzbank AG (Banking | Frankfurt, Hessen, Germany | Rating: BBB-): €500m Inhaberschuldverschreibung (DE000CZ45W57), floating rate maturing on 14 September 2027, priced at 99.47 (original spread of 224 bp), callable (5nc4)

- Duke Energy Corp (Utility - Other | Charlotte, North Carolina, United States | Rating: BBB): €600m Senior Note (XS2488626610), fixed rate (3.10% coupon) maturing on 15 June 2028, priced at 99.85 (original spread of 199 bp), callable (6nc6)

- Duke Energy Corp (Utility - Other | Charlotte, North Carolina, United States | Rating: BBB): €500m Senior Note (XS2488626883), fixed rate (3.85% coupon) maturing on 15 June 2034, priced at 99.60 (original spread of 254 bp), callable (12nc12)

- HSBC Holdings PLC (Banking | London, United Kingdom | Rating: A-): €2,000m Senior Note (XS2486589596), floating rate maturing on 15 June 2027, priced at 100.00 (original spread of 218 bp), callable (5nc4)

- Hungary (Government) (Sovereign | Budapest, Budapest, Hungary | Rating: BBB): €750m Senior Note (XS2010026214), fixed rate (4.25% coupon) maturing on 16 June 2031, priced at 98.16 (original spread of 323 bp), non callable

- ING Bank NV (Banking | Amsterdam Zuidoost, Noord-Holland, Netherlands | Rating: A+): €3,000m Unsecured Note (XS2489808852) maturing on 22 June 2032, priced at 100.00, non callable

- ING Bank NV (Banking | Amsterdam Zuidoost, Noord-Holland, Netherlands | Rating: A+): €1,500m Unsecured Note (XS2489808779) maturing on 22 October 2028, priced at 100.00, non callable

- ING Bank NV (Banking | Amsterdam Zuidoost, Noord-Holland, Netherlands | Rating: A+): €1,500m Unsecured Note (XS2489808696) maturing on 22 October 2026, priced at 100.00, non callable

- Ibercaja Banco SA (Banking | Zaragoza, Zaragoza, Spain | Rating: BB+): €500m Bond (ES0344251006), floating rate maturing on 15 June 2025, priced at 99.86 (original spread of 250 bp), callable (3nc2)

- Intesa Sanpaolo SpA (Banking | Torino, Italy | Rating: BBB): €1,500m Bond (IT0005495244), floating rate (EU03MLIB + 345.0 bp) maturing on 16 June 2032, priced at 100.00, non callable

- Intesa Sanpaolo SpA (Banking | Torino, Italy | Rating: BBB): €750m Bond (IT0005495210), floating rate (EU03MLIB + 102.0 bp) maturing on 16 June 2027, priced at 100.00, non callable

- Landesbank Hessen Thueringen Girozentrale (Banking | Frankfurt, Hessen, Germany | Rating: A): €550m Subordinated Note (XS2489772991), fixed rate (4.50% coupon) maturing on 15 September 2032, priced at 99.88 (original spread of 369 bp), callable (10nc5)

- LfA Foerderbank Bayern (Agency | Muenchen, Bayern, Germany | Rating: AAA): €20m Inhaberschuldverschreibung (DE000LFA2022), fixed rate (1.50% coupon) maturing on 1 June 2027, non callable

- Media and Games Invest SE (Securities | Valletta, Malta | Rating: NR): €175m Bond (SE0018042277), floating rate (EU03MLIB + 625.0 bp) maturing on 21 June 2026, priced at 98.00, callable (4nc1m)

- Merck Financial Services GmbH (Financial - Other | Darmstadt, Hessen, Germany | Rating: A-): €500m Senior Note (XS2491029208), fixed rate (1.88% coupon) maturing on 15 June 2026, priced at 99.83 (original spread of 105 bp), callable (4nc4)

- Merck Financial Services GmbH (Financial - Other | Darmstadt, Hessen, Germany | Rating: A-): €500m Senior Note (XS2491029380), fixed rate (2.38% coupon) maturing on 15 June 2030, priced at 99.50 (original spread of 124 bp), callable (8nc8)

- Mitsubishi UFJ Financial Group Inc (Banking | Chiyoda-Ku, Tokyo-To, Japan | Rating: A-): €750m Senior Note (XS2489982293), fixed rate (3.56% coupon) maturing on 14 June 2032, priced at 100.00 (original spread of 214 bp), non callable

- Mitsubishi UFJ Financial Group Inc (Banking | Chiyoda-Ku, Tokyo-To, Japan | Rating: A-): €1,000m Senior Note (XS2489981485), floating rate maturing on 14 June 2025, priced at 100.00 (original spread of 83 bp), callable (3nc2)

- NIBC Bank NV (Banking | S-Gravenhage, Zuid-Holland, United States | Rating: BBB+): €500m Covered Bond (Other) (XS2491156142), fixed rate (1.88% coupon) maturing on 16 June 2027, priced at 99.92 (original spread of 83 bp), non callable

- NORD LB Luxembourg Covered Bond Bank SA (Banking | Findel, Germany | Rating: A-): €250m Senior Note (XS2491059023), floating rate (EU06MLIB + 95.0 bp) maturing on 17 June 2024, priced at 101.59, non callable

- North-Rhine Westphalia, State of (Official and Muni | Dusseldorf, Nordrhein-Westfalen, Germany | Rating: AA): €1,500m Inhaberschuldverschreibung (DE000NRW0NG6), fixed rate (2.25% coupon) maturing on 14 June 2052, priced at 99.27 (original spread of 70 bp), non callable

- North-Rhine Westphalia, State of (Official and Muni | Dusseldorf, Nordrhein-Westfalen, Germany | Rating: AA): €2,000m Inhaberschuldverschreibung (DE000NRW0NF8), fixed rate (2.00% coupon) maturing on 15 June 2032, priced at 99.90 (original spread of 66 bp), non callable

- Orsted A/S (Service - Other | Fredericia, Denmark | Rating: BBB+): €750m Senior Note (XS2490472102), fixed rate (2.88% coupon) maturing on 14 June 2033, priced at 99.93 (original spread of 166 bp), callable (11nc11)

- Orsted A/S (Service - Other | Fredericia, Denmark | Rating: BBB+): €600m Senior Note (XS2490471807), fixed rate (2.25% coupon) maturing on 14 June 2028, priced at 99.56 (original spread of 130 bp), callable (6nc6)

- SES SA (Service - Other | Betzdorf, Luxembourg | Rating: BBB): €750m Senior Note (XS2489775580), fixed rate (3.50% coupon) maturing on 14 January 2029, priced at 99.73 (original spread of 250 bp), callable (7nc4m)

- Spain, Kingdom of (Government) (Sovereign | Madrid, Madrid, Spain | Rating: BBB+): €8,000m Bono del Estado (ES0000012K61), fixed rate (2.55% coupon) maturing on 31 October 2032, priced at 99.99 (original spread of 136 bp), non callable

- UBS Group AG (Banking | Zurich, Zuerich, Switzerland | Rating: A-): €1,000m Bond (CH1194000340), fixed rate (2.75% coupon) maturing on 15 June 2027, priced at 99.95 (original spread of 209 bp), callable (5nc4)

- UBS Group AG (Banking | Zurich, Zuerich, Switzerland | Rating: A-): €1,000m Bond (CH1194000357), fixed rate (3.13% coupon) maturing on 15 June 2030, priced at 99.73 (original spread of 230 bp), callable (8nc7)

- Vienna Insurance Group AG Wiener Versicherung Gruppe (Property and Casualty Insurance | Wien, Wien, Austria | Rating: A-): €500m Inhaberschuldverschreibung (AT0000A2XST0), floating rate maturing on 15 June 2042, priced at 98.94 (original spread of 380 bp), callable (20nc10)

NEW LOANS

- Fiserv Inc (BBB) signed a US$ 6,000m Revolving Credit Facility, to be used for general corporate purposes. It matures on 06/10/27 and initial pricing is set at Term SOFR +125.0bp

- Nielsen NV, signed a US$ 5,850m Term Loan B, to be used for acquisition financing. It matures on 06/30/29 and initial pricing is set at Term SOFR +475.0bp

- Marathon Petroleum Corp (BBB), signed a US$ 5,000m Revolving Credit Facility, to be used for general corporate purposes. It matures on 06/30/27 and initial pricing is set at Term SOFR +125.0bp

- Phillips 66 Co (BBB+), signed a US$ 5,000m Revolving Credit Facility, to be used for general corporate purposes. It matures on 06/17/27 and initial pricing is set at Term SOFR +100.0bp

- The Kraft Heinz Co (BBB-), signed a US$ 4,000m Revolving Credit Facility, to be used for general corporate purposes. It matures on 06/30/29 and initial pricing is set at CA Prime +25.0bp

- Berkshire Hathaway Energy Co (A-), signed a US$ 3,500m Revolving Credit Facility, to be used for general corporate purposes. It matures on 06/30/25 and initial pricing is set at Term SOFR +100.0bp

- Nuveen Investments Inc, signed a US$ 2,650m 364d Revolver, to be used for general corporate purposes. It matures on 06/21/23 and initial pricing is set at Term SOFR +120.0bp

- EQT Corp (BBB-), signed a US$ 2,500m Revolving Credit Facility, to be used for general corporate purposes. It matures on 06/27/27 and initial pricing is set at Term SOFR +150.0bp

- Marathon Petroleum Corp (BBB), signed a US$ 2,000m Revolving Credit Facility, to be used for general corporate purposes. It matures on 06/30/27 and initial pricing is set at Term SOFR +125.0bp

- FMC Corp (BBB-), signed a US$ 2,000m Revolving Credit Facility, to be used for general corporate purposes. It matures on 06/17/27 and initial pricing is set at Term SOFR +125.0bp

- Midamerican Energy Co (A), signed a US$ 1,500m Revolving Credit Facility, to be used for general corporate purposes. It matures on 06/30/25 and initial pricing is set at Term SOFR +75.0bp

- Arconic Inc (Pre-Reincorp) (BBB-), signed a US$ 1,250m Revolving Credit Facility, to be used for general corporate purposes. It matures on 06/23/27 and initial pricing is set at Term SOFR +150.0bp

- The Travelers Cos Inc (A), signed a US$ 1,000m Revolving Credit Facility, to be used for general corporate purposes. It matures on 06/14/27 and initial pricing is set at Term SOFR +100.0bp

- Blue Owl Capital Inc (BBB), signed a US$ 1,000m Revolving Credit Facility, to be used for general corporate purposes. It matures on 06/15/27 and initial pricing is set at Term SOFR +150.0bp

- Trac Intermodal Llc, signed a US$ 922m Revolving Credit Facility, to be used for general corporate purposes. It matures on 09/21/26 and initial pricing is set at Term SOFR +175.0bp

- Nielsen NV, signed a US$ 750m Revolving Credit Facility, to be used for acquisition financing. It matures on 06/30/27 and initial pricing is set at Term SOFR +450.0bp

- John Hancock Funds signed a US$ 750m 364d Revolver, to be used for general corporate purposes. It matures on 06/22/23 and initial pricing is set at Term SOFR +100.0bp

NEW ISSUES IN SECURITIZED CREDIT

- BSPRT 2022-Fl9 Issuer LLC issued a floating-rate CLO in 6 tranches, for a total of US$ 664 m. Highest-rated tranche offering a spread over the floating rate of 230bp, and the lowest-rated tranche a spread of 541bp. Bookrunners: Barclays Capital Group, Wells Fargo Securities LLC

- Onemain Direct Auto Receivables Trust 2022-1 issued a floating-rate ABS backed by auto receivables in 5 tranches, for a total of US$ 600 m. Bookrunners: Barclays Capital Group, SG Americas Securities LLC, HSBC Securities (USA) Inc, Truist Securities Inc

- Progress Residential 2022-Sfr5 issued a floating-rate ABS backed by rental income in 6 tranches, for a total of US$ 505 m. Highest-rated tranche offering a spread over the floating rate of 140bp, and the lowest-rated tranche a spread of 385bp. Bookrunners: Goldman Sachs & Co, Barclays Capital Group, Deutsche Bank Securities Inc

- Master Credit Cards Pass Compartment France Notes Series 2022-1 issued a floating-rate ABS backed by receivables in 1 tranche offering a spread over the floating rate of 105bp, for a total of € 315 m. Bookrunners: Societe Generale SA, Natixis, Credit Agricole Corporate & Investment Bank