Credit

Another Week Of Weak Credit Performance: Widening Credit Spreads Across The Complex, Though Longer Duration Now Getting A Bid

After a difficult start to the year, long duration IG has been a better place than HY lately, with rates rising most at the front end, the yield curve flattening, and HY spreads widening considerably more

Published ET

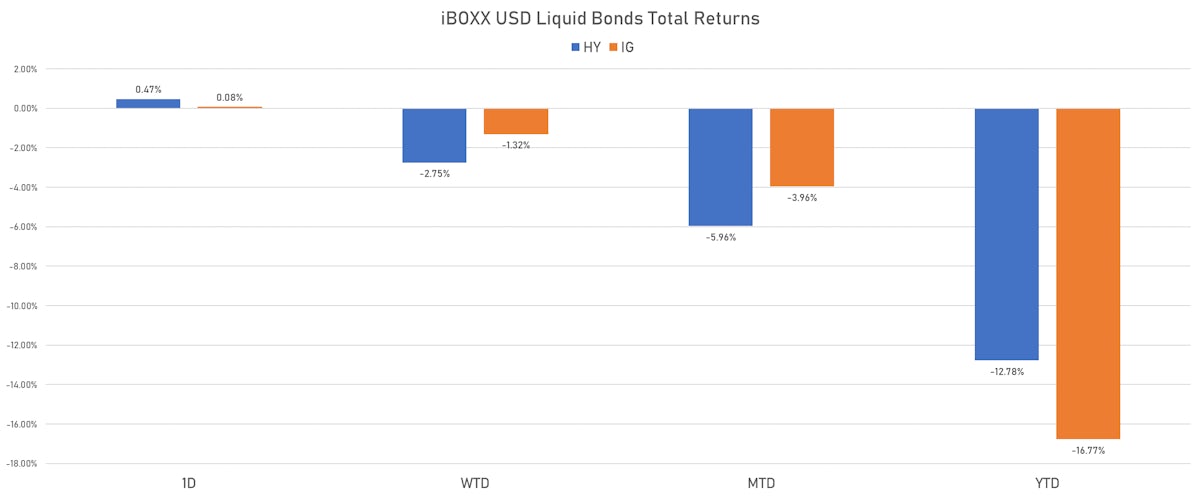

iBOXX USD Liquid Bonds Total Returns | Sources: ϕpost, Refinitiv data

DAILY SUMMARY

- S&P 500 Bond Index was up 0.17% today, with investment grade up 0.15% and high yield up 0.33% (YTD total return: -14.06%)

- The iBoxx USD Liquid Investment Grade Total Return Index was up 0.076% today (Month-to-date: -3.96%; Year-to-date: -16.77%)

- The iBoxx USD Liquid High Yield Total Return Index was up 0.466% today (Month-to-date: -5.96%; Year-to-date: -12.78%)

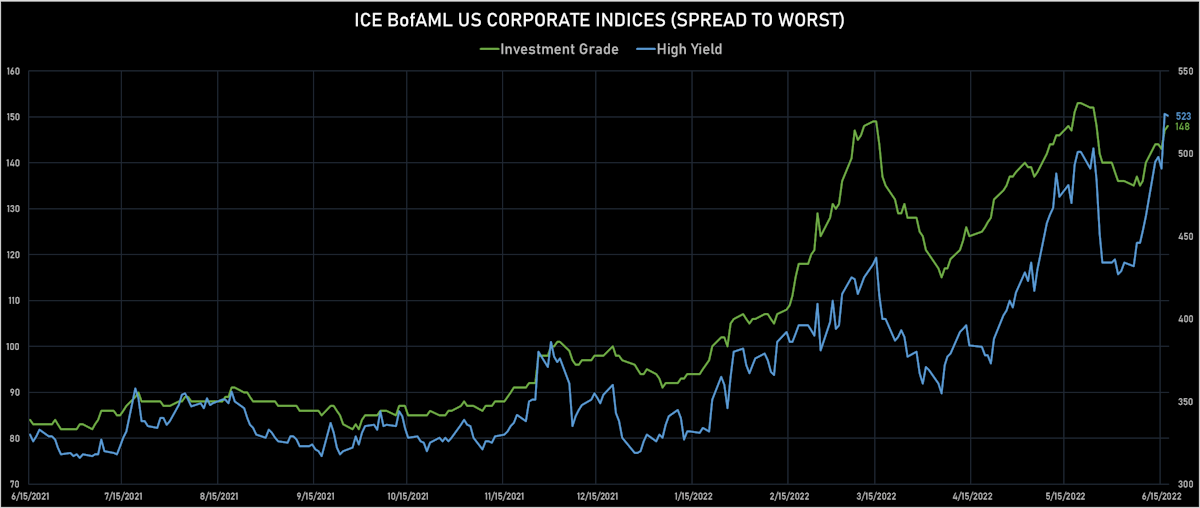

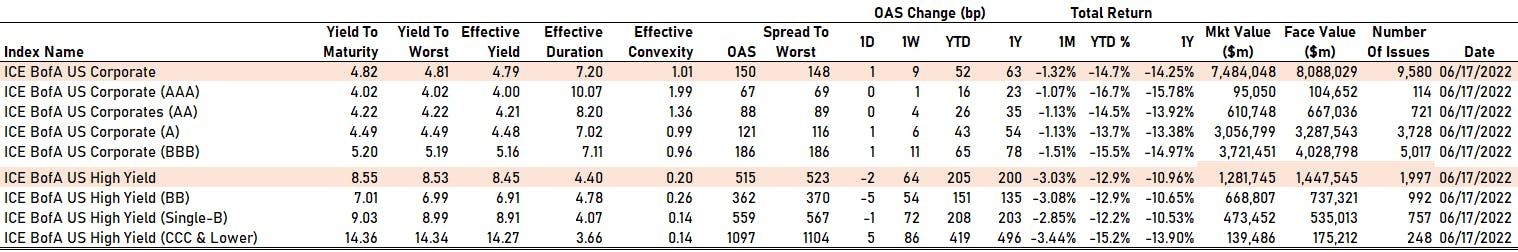

- ICE BofA US Corporate Index (Investment Grade) spread to worst up 1.0 bp, now at 148.0 bp (YTD change: +53.0 bp)

- ICE BofA US High Yield Index spread to worst down -1.0 bp, now at 523.0 bp (YTD change: +193.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index down -0.19% today (YTD total return: -4.2%)

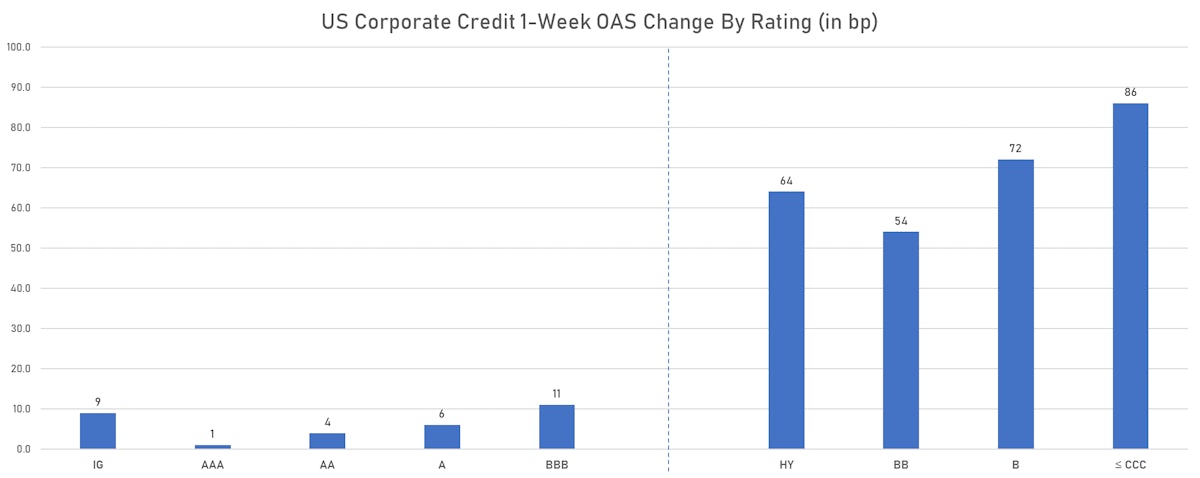

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING TODAY

- AAA unchanged at 67 bp

- AA unchanged at 88 bp

- A up by 1 bp at 121 bp

- BBB up by 1 bp at 186 bp

- BB down by -5 bp at 362 bp

- B down by -1 bp at 559 bp

- CCC up by 5 bp at 1097 bp

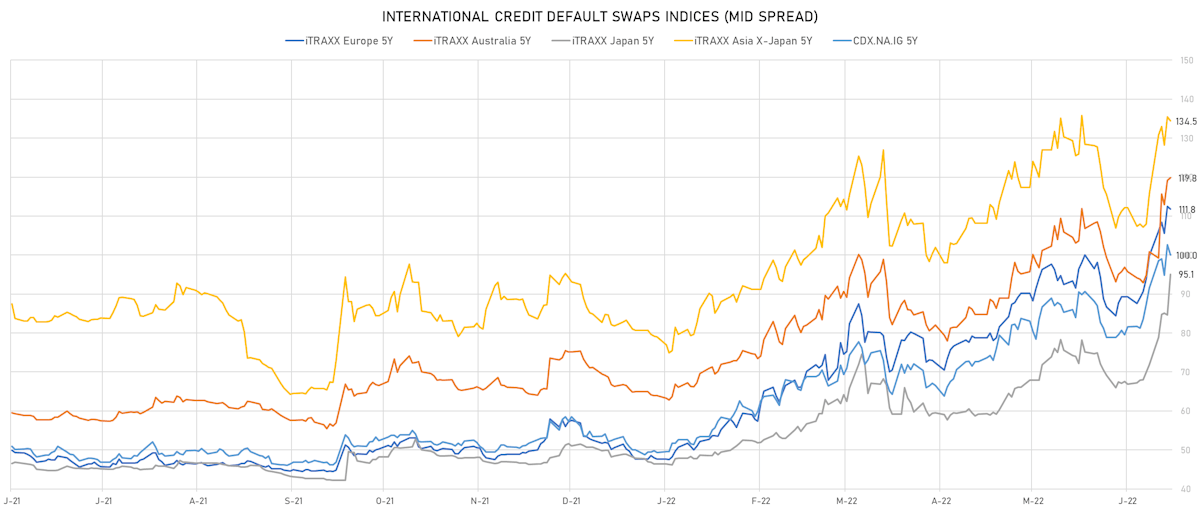

CDS INDICES TODAY (mid-spreads)

- Markit CDX.NA.IG 5Y down 2.6 bp, now at 100bp (1W change: +8.5bp; YTD change: +50.7bp)

- Markit CDX.NA.IG 10Y down 2.7 bp, now at 134bp (1W change: +6.3bp; YTD change: +44.4bp)

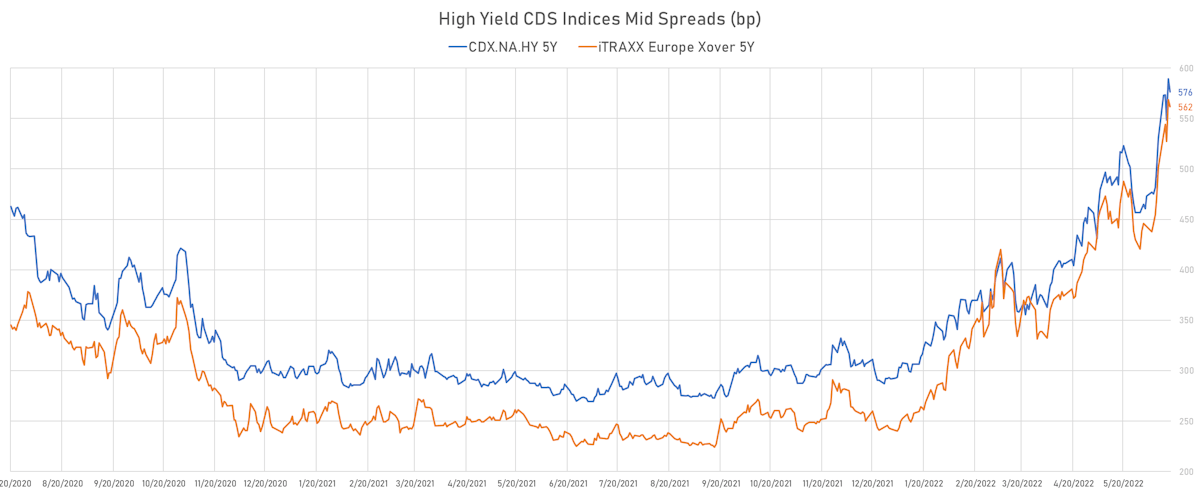

- Markit CDX.NA.HY 5Y down 13.0 bp, now at 576bp (1W change: +45.8bp; YTD change: +284.4bp)

- Markit iTRAXX Europe 5Y down 0.7 bp, now at 112bp (1W change: +12.0bp; YTD change: +64.1bp)

- Markit iTRAXX Europe Crossover 5Y down 7.0 bp, now at 562bp (1W change: +60.4bp; YTD change: +319.6bp)

- Markit iTRAXX Japan 5Y up 10.4 bp, now at 95bp (1W change: +23.2bp; YTD change: +48.7bp)

- Markit iTRAXX Asia Ex-Japan 5Y down 0.9 bp, now at 134bp (1W change: +18.8bp; YTD change: +55.4bp)

5Y USD CDS SINGLE NAMES - LARGEST MOVES OVER THE PAST WEEK

- Calpine Corp (Country: US; rated: LGD5 - 88%): up 136.5 bp to 591.7bp (1Y range: 284-592bp)

- Realogy Group LLC (Country: US; rated: WR): up 148.9 bp to 844.3bp (1Y range: 278-844bp)

- Bath & Body Works Inc (Country: US; rated: Ba2): up 151.2 bp to 568.0bp (1Y range: 124-568bp)

- Tegna Inc (Country: US; rated: Ba3): up 156.3 bp to 931.0bp (1Y range: 182-931bp)

- KB Home (Country: US; rated: Ba2): up 165.0 bp to 471.3bp (1Y range: 138-471bp)

- Pactiv LLC (Country: US; rated: Caa1): up 175.8 bp to 900.9bp (1Y range: 356-901bp)

- Beazer Homes USA Inc (Country: US; rated: B2): up 180.2 bp to 772.5bp (1Y range: 278-772bp)

- Liberty Interactive LLC (Country: US; rated: Ba3): up 220.0 bp to 1,685.1bp (1Y range: 287-1,685bp)

- DISH DBS Corp (Country: US; rated: B2): up 222.3 bp to 1,251.3bp (1Y range: 317-1,251bp)

- Royal Caribbean Cruises Ltd (Country: US; rated: LGD4 - 59%): up 224.3 bp to 924.6bp (1Y range: 299-925bp)

- Pitney Bowes Inc (Country: US; rated: B1): up 247.7 bp to 1,076.3bp (1Y range: 363-1,076bp)

- Transocean Inc (Country: KY; rated: Caa3): up 256.5 bp to 1,841.0bp (1Y range: 941-1,841bp)

- Carnival Corp (Country: US; rated: LGD5 - 72%): up 263.1 bp to 1,011.9bp (1Y range: 297-1,012bp)

- Staples Inc (Country: US; rated: B3): up 455.5 bp to 2,056.0bp (1Y range: 776-2,056bp)

- American Airlines Group Inc (Country: US; rated: B2): up 456.1 bp to 1,691.6bp (1Y range: 596-1,692bp)

5Y EURO CDS SINGLE NAMES - LARGEST MOVES OVER THE PAST WEEK

- Altice Finco SA (Country: LU; rated: Caa1): up 113.9 bp to 730.0bp (1Y range: 333-730bp)

- Air France KLM SA (Country: FR; rated: B-): up 118.7 bp to 679.5bp (1Y range: 386-680bp)

- Telecom Italia SpA (Country: IT; rated: LGD4 - 53%): up 125.6 bp to 463.1bp (1Y range: 149-463bp)

- Ardagh Packaging Finance PLC (Country: IE; rated: B1): up 128.0 bp to 783.8bp (1Y range: 213-784bp)

- Ladbrokes Coral Group Ltd (Country: GB; rated: WR): up 132.1 bp to 451.9bp (1Y range: 107-452bp)

- Ceconomy AG (Country: DE; rated: Ba1): up 140.7 bp to 628.7bp (1Y range: 141-629bp)

- CMA CGM SA (Country: FR; rated: Ba2): up 142.8 bp to 563.8bp (1Y range: 259-564bp)

- Stena AB (Country: SE; rated: B2-PD): up 147.5 bp to 643.7bp (1Y range: 401-644bp)

- Stonegate Pub Company Financing PLC (Country: GB; rated: WR): up 168.5 bp to 694.0bp (1Y range: 370-694bp)

- Jaguar Land Rover Automotive PLC (Country: GB; rated: WD): up 216.9 bp to 938.8bp (1Y range: 339-939bp)

- Casino Guichard Perrachon SA (Country: FR; rated: WR): up 222.9 bp to 1,440.4bp (1Y range: 464-1,452bp)

- Iceland Bondco PLC (Country: GB; rated: LGD3 - 46%): up 228.0 bp to 1,191.3bp (1Y range: 418-1,191bp)

- TUI AG (Country: DE; rated: B3-PD): up 293.1 bp to 1,062.7bp (1Y range: 607-1,063bp)

- Novafives SAS (Country: FR; rated: Caa1): up 352.9 bp to 1,530.9bp (1Y range: 618-1,531bp)

- Boparan Finance PLC (Country: GB; rated: Caa1): up 554.5 bp to 2,420.2bp (1Y range: 863-2,690bp)

TOP BONDS MOVES IN THE PAST WEEK - USD HY

- Issuer: Brinker International Inc (Dallas, Texas (US)) | Coupon: 5.00% | Maturity: 1/10/2024 | Rating: B+ | ISIN: USU6223WAB01 | Z-spread up by 224.6 bp to 535.3 bp, with the yield to worst at 8.9% and the bond now trading down to 92.0 cents on the dollar (1Y price range: 91.1-106.8).

- Issuer: Wynn Las Vegas LLC (Las Vegas, Nevada (US)) | Coupon: 5.50% | Maturity: 1/3/2025 | Rating: B | ISIN: USU98347AK05 | Z-spread up by 200.2 bp to 622.6 bp, with the yield to worst at 9.4% and the bond now trading down to 90.0 cents on the dollar (1Y price range: 90.0-103.5).

- Issuer: Enact Holdings Inc (Raleigh, North Carolina (US)) | Coupon: 6.50% | Maturity: 15/8/2025 | Rating: BB | ISIN: USU3230LAA45 | Z-spread up by 183.1 bp to 514.8 bp (CDS basis: -167.3bp), with the yield to worst at 8.6% and the bond now trading down to 94.0 cents on the dollar (1Y price range: 93.0-109.5).

- Issuer: Natura &Co Luxembourg Holdings SARL (Luxembourg, Luxembourg) | Coupon: 6.00% | Maturity: 19/4/2029 | Rating: BB | ISIN: USL6S52VAA02 | Z-spread up by 160.9 bp to 570.2 bp, with the yield to worst at 8.8% and the bond now trading down to 84.6 cents on the dollar (1Y price range: 84.6-99.9).

- Issuer: Starwood Property Trust Inc (Greenwich (US)) | Coupon: 3.63% | Maturity: 15/7/2026 | Rating: BB- | ISIN: USU85656AF04 | Z-spread up by 147.8 bp to 423.4 bp, with the yield to worst at 7.4% and the bond now trading down to 86.0 cents on the dollar (1Y price range: 86.0-100.1).

- Issuer: Wynn Las Vegas LLC (Las Vegas, Nevada (US)) | Coupon: 5.25% | Maturity: 15/5/2027 | Rating: B | ISIN: USU98347AL87 | Z-spread up by 147.5 bp to 593.7 bp, with the yield to worst at 9.1% and the bond now trading down to 84.1 cents on the dollar (1Y price range: 84.1-102.8).

- Issuer: NCL Corporation Ltd (Miami, Bermuda) | Coupon: 5.88% | Maturity: 15/3/2026 | Rating: CCC+ | ISIN: USG6436QAL08 | Z-spread up by 142.6 bp to 869.4 bp, with the yield to worst at 11.8% and the bond now trading down to 81.5 cents on the dollar (1Y price range: 80.5-100.0).

- Issuer: HanesBrands Inc (Winston-Salem, North Carolina (US)) | Coupon: 4.88% | Maturity: 15/5/2026 | Rating: BB- | ISIN: USU24437AE26 | Z-spread up by 141.5 bp to 385.9 bp, with the yield to worst at 7.1% and the bond now trading down to 91.8 cents on the dollar (1Y price range: 91.0-106.9).

- Issuer: Starwood Property Trust Inc (Greenwich, Connecticut (US)) | Coupon: 4.38% | Maturity: 15/1/2027 | Rating: BB- | ISIN: USU85656AH69 | Z-spread up by 137.3 bp to 408.1 bp, with the yield to worst at 7.4% and the bond now trading down to 88.0 cents on the dollar (1Y price range: 87.0-100.9).

- Issuer: Xerox Holdings Corp (Norwalk, Connecticut (US)) | Coupon: 5.00% | Maturity: 15/8/2025 | Rating: BB | ISIN: USU98401AA75 | Z-spread up by 122.0 bp to 352.7 bp, with the yield to worst at 6.7% and the bond now trading down to 94.3 cents on the dollar (1Y price range: 93.1-105.7).

- Issuer: Starwood Property Trust Inc (Greenwich (US)) | Coupon: 3.75% | Maturity: 31/12/2024 | Rating: BB- | ISIN: USU85656AG86 | Z-spread up by 117.5 bp to 388.7 bp, with the yield to worst at 7.3% and the bond now trading down to 91.6 cents on the dollar (1Y price range: 90.0-101.4).

- Issuer: Century Communities Inc (Greenwood Village (US)) | Coupon: 3.88% | Maturity: 15/8/2029 | Rating: BB- | ISIN: USU15662AF37 | Z-spread up by 110.2 bp to 450.8 bp, with the yield to worst at 7.8% and the bond now trading down to 78.5 cents on the dollar (1Y price range: 78.5-101.0).

- Issuer: Nextera Energy Operating Partners LP (Juno Beach, Florida (US)) | Coupon: 4.25% | Maturity: 15/7/2024 | Rating: BB | ISIN: USU6500TAF22 | Z-spread up by 108.6 bp to 272.4 bp, with the yield to worst at 5.9% and the bond now trading down to 96.0 cents on the dollar (1Y price range: 95.5-103.9).

- Issuer: Xerox Holdings Corp (Norwalk, Connecticut (US)) | Coupon: 5.50% | Maturity: 15/8/2028 | Rating: BB | ISIN: USU98401AB58 | Z-spread up by 95.7 bp to 482.6 bp, with the yield to worst at 8.0% and the bond now trading down to 87.1 cents on the dollar (1Y price range: 86.8-105.5).

- Issuer: Xerox Holdings Corp (Norwalk, Connecticut (US)) | Coupon: 5.50% | Maturity: 15/8/2028 | Rating: BB | ISIN: USU98401AD15 | Z-spread up by 95.7 bp to 482.6 bp, with the yield to worst at 8.0% and the bond now trading down to 87.1 cents on the dollar (1Y price range: 86.8-105.5).

TOP BONDS MOVES IN THE PAST WEEK - EUR HY

- Issuer: Fortune Star (BVI) Ltd (British Virgin Islands) | Coupon: 3.95% | Maturity: 2/10/2026 | Rating: BB- | ISIN: XS2357132849 | Z-spread up by 513.3 bp to 1,219.1 bp, with the yield to worst at 14.2% and the bond now trading down to 69.0 cents on the dollar (1Y price range: 69.0-95.0).

- Issuer: Ceconomy AG (Dusseldorf, Germany) | Coupon: 1.75% | Maturity: 24/6/2026 | Rating: BB+ | ISIN: XS2356316872 | Z-spread up by 242.9 bp to 866.3 bp (CDS basis: -288.3bp), with the yield to worst at 10.6% and the bond now trading down to 71.9 cents on the dollar (1Y price range: 71.0-98.3).

- Issuer: Titan Global Finance PLC (Hull, United Kingdom) | Coupon: 2.38% | Maturity: 16/11/2024 | Rating: BB | ISIN: XS1716212243 | Z-spread up by 141.2 bp to 374.0 bp, with the yield to worst at 5.1% and the bond now trading down to 93.1 cents on the dollar (1Y price range: 93.1-101.8).

- Issuer: International Consolidated Airlines Group SA (Harmondsworth, Spain) | Coupon: 2.75% | Maturity: 25/3/2025 | Rating: B+ | ISIN: XS2322423455 | Z-spread up by 134.3 bp to 601.8 bp, with the yield to worst at 7.7% and the bond now trading down to 87.7 cents on the dollar (1Y price range: 87.6-99.8).

- Issuer: Nexi SpA (Milan, Italy) | Coupon: 1.75% | Maturity: 31/10/2024 | Rating: BB- | ISIN: XS2066703989 | Z-spread up by 125.5 bp to 312.8 bp, with the yield to worst at 4.5% and the bond now trading down to 93.1 cents on the dollar (1Y price range: 93.1-101.9).

- Issuer: Atlantia SpA (Rome, Italy) | Coupon: 1.88% | Maturity: 12/2/2028 | Rating: BB | ISIN: XS2301390089 | Z-spread up by 122.3 bp to 394.8 bp (CDS basis: -106.0bp), with the yield to worst at 5.9% and the bond now trading down to 80.1 cents on the dollar (1Y price range: 80.0-102.6).

- Issuer: Webuild SpA (Milan, Italy) | Coupon: 3.88% | Maturity: 28/7/2026 | Rating: BB- | ISIN: XS2437324333 | Z-spread up by 119.9 bp to 692.8 bp, with the yield to worst at 8.8% and the bond now trading down to 83.1 cents on the dollar (1Y price range: 82.9-100.4).

- Issuer: Renault SA (Boulogne-Billancourt, France) | Coupon: 2.38% | Maturity: 25/5/2026 | Rating: BB | ISIN: FR0014000NZ4 | Z-spread up by 119.2 bp to 469.9 bp (CDS basis: -121.2bp), with the yield to worst at 6.6% and the bond now trading down to 85.3 cents on the dollar (1Y price range: 85.4-101.4).

- Issuer: International Consolidated Airlines Group SA (Harmondsworth, Spain) | Coupon: 1.50% | Maturity: 4/7/2027 | Rating: B+ | ISIN: XS2020581752 | Z-spread up by 118.0 bp to 671.4 bp, with the yield to worst at 8.7% and the bond now trading down to 71.0 cents on the dollar (1Y price range: 71.0-91.3).

- Issuer: ZF Finance GmbH (Friedrichshafen, Germany) | Coupon: 3.00% | Maturity: 21/9/2025 | Rating: BB+ | ISIN: XS2231715322 | Z-spread up by 116.6 bp to 516.4 bp, with the yield to worst at 7.0% and the bond now trading down to 88.4 cents on the dollar (1Y price range: 88.4-105.2).

- Issuer: Nexi SpA (Milan, Italy) | Coupon: 2.13% | Maturity: 30/4/2029 | Rating: BB- | ISIN: XS2332590475 | Z-spread up by 116.4 bp to 498.2 bp, with the yield to worst at 7.1% and the bond now trading down to 73.3 cents on the dollar (1Y price range: 73.0-98.6).

- Issuer: SoftBank Group Corp (Minato-Ku, Japan) | Coupon: 3.13% | Maturity: 19/9/2025 | Rating: BB- | ISIN: XS1684385161 | Z-spread up by 115.4 bp to 618.5 bp, with the yield to worst at 7.5% and the bond now trading down to 86.4 cents on the dollar (1Y price range: 85.8-100.4).

- Issuer: Dometic Group AB (publ) (Solna, Sweden) | Coupon: 2.00% | Maturity: 29/9/2028 | Rating: BB- | ISIN: XS2391403354 | Z-spread up by 113.9 bp to 484.5 bp, with the yield to worst at 6.9% and the bond now trading down to 75.0 cents on the dollar (1Y price range: 74.9-98.3).

- Issuer: Webuild SpA (Milan, Italy) | Coupon: 3.63% | Maturity: 28/1/2027 | Rating: BB- | ISIN: XS2102392276 | Z-spread up by 113.0 bp to 617.9 bp, with the yield to worst at 8.0% and the bond now trading down to 82.8 cents on the dollar (1Y price range: 82.6-104.2).

- Issuer: Mahle GmbH (Stuttgart, Germany) | Coupon: 2.38% | Maturity: 14/5/2028 | Rating: BB+ | ISIN: XS2341724172 | Z-spread up by 112.7 bp to 640.8 bp, with the yield to worst at 8.5% and the bond now trading down to 72.0 cents on the dollar (1Y price range: 72.0-97.6).

RECENT DOMESTIC USD BOND ISSUES

- Entegris Escrow Corp (Financial - Other | Billerica, United States | Rating: BB): US$895m Senior Note (US29365BAB99), fixed rate (5.95% coupon) maturing on 15 June 2030, priced at 90.83 (original spread of 417 bp), callable (8nc3)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$175m Bond (US3133ENZF05), fixed rate (4.40% coupon) maturing on 22 June 2026, priced at 100.00, callable (4nc3m)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$125m Bond (US3133ENZG87), fixed rate (3.38% coupon) maturing on 20 June 2025, priced at 100.00, non callable

- Federal Home Loan Banks (Agency | Washington, Washington Dc, United States | Rating: AA+): US$119m Bond (US3130ASH442), fixed rate (4.70% coupon) maturing on 30 June 2027, priced at 100.00 (original spread of 138 bp), callable (5nc3m)

- Federal Home Loan Mortgage Corp (Agency | Mclean, United States | Rating: AA+): US$140m Unsecured Note (US3134GXZZ06), fixed rate (4.00% coupon) maturing on 12 July 2024, priced at 100.00, callable (2nc3m)

RECENT INTERNATIONAL USD BOND ISSUES

- IRIS Escrow Issuer Corp (Financial - Other | Rating: NR): US$400m Senior Note (USU46105AA73), fixed rate (10.00% coupon) maturing on 15 December 2028, priced at 98.84 (original spread of 685 bp), callable (6nc3)

- Mitsubishi UFJ Financial Group Inc (Banking | Chiyoda-Ku, Japan | Rating: A-): US$250m Unsecured Note (XS2493197599), fixed rate (4.56% coupon) maturing on 23 June 2025, priced at 100.00, non callable

- Nomura International Funding Pte Ltd (Financial - Other | Japan | Rating: NR): US$300m Unsecured Note (XS2430475363), fixed rate (4.03% coupon) maturing on 20 June 2024, priced at 100.00, non callable

- Nomura International Funding Pte Ltd (Financial - Other | Japan | Rating: NR): US$200m Unsecured Note (XS2430478896), floating rate maturing on 30 June 2025, priced at 100.00, non callable

- Nomura International Funding Pte Ltd (Financial - Other | Japan | Rating: NR): US$1,500m Unsecured Note (XS2430475447), floating rate maturing on 29 June 2025, priced at 100.00, non callable

- Nomura International Funding Pte Ltd (Financial - Other | Japan | Rating: NR): US$1,000m Unsecured Note (XS2430480959), fixed rate (5.30% coupon) maturing on 20 June 2027, priced at 100.00, non callable

- Nomura International Funding Pte Ltd (Financial - Other | Japan | Rating: NR): US$200m Unsecured Note (XS2430478110), floating rate maturing on 20 June 2024, priced at 100.00, non callable

SELECTED RECENT EUR BOND ISSUES

- Aareal Bank AG (Banking | Wiesbaden, Germany | Rating: A-): €500m Hypothekenpfandbrief (Covered Bond) (DE000AAR0348), fixed rate (2.25% coupon) maturing on 1 February 2027, priced at 99.89 (original spread of 85 bp), non callable

- Banco Santander SA (Banking | Boadilla Del Monte, Madrid, Spain | Rating: A-): €200m Unsecured Note (XS2491644022), fixed rate (2.12% coupon) maturing on 10 August 2027, priced at 100.00, non callable

- Bausparkasse Wuestenrot AG (Banking | Salzburg, Salzburg, Austria | Rating: BBB): €250m Hypothekenpfandbrief (Covered Bond) (AT0000A2YBY4), fixed rate (2.13% coupon) maturing on 23 June 2025, priced at 99.68 (original spread of 97 bp), non callable

- China Development Bank (Hong Kong Branch) (Banking | China (Mainland) | Rating: NR): €1,000m Bond (XS2493828847), floating rate maturing on 23 June 2025, priced at 100.00, non callable

- Credit Agricole SA (Banking | Montrouge, Ile-De-France, France | Rating: A+): €233m Bond (FR1CASAO0028), fixed rate (2.50% coupon) maturing on 21 June 2032, priced at 100.00, non callable

- European Financial Stability Facility SA (Supranational | Luxembourg, Luxembourg | Rating: NR): €2,000m Senior Note (EU000A2SCAC2), fixed rate (2.38% coupon) maturing on 21 June 2032, priced at 99.37 (original spread of 78 bp), non callable

- Holcim Finance Luxembourg SA (Financial - Other | Luxembourg, Switzerland | Rating: BBB+): €500m Unsecured Note (XS2492385542), fixed rate (1.00% coupon) maturing on 21 June 2027, priced at 100.00, non callable

- Landesbank Hessen Thueringen Girozentrale (Banking | Frankfurt, Germany | Rating: A): €500m Hypothekenpfandbrief (Covered Bond) (DE000HLB42D1), floating rate (EU06MLIB + -5.0 bp) maturing on 20 June 2024, priced at 100.00, non callable

- Mediobanca Banca di Credito Finanziario SpA (Banking | Milan, Milano, Italy | Rating: BBB): €170m Senior Note (XS2493296730), floating rate maturing on 13 July 2026, priced at 100.00, non callable

- Preem Holding AB (publ) (Financial - Other | Stockholm, Cyprus | Rating: B+): €340m Senior Note (XS2493887348), fixed rate (12.00% coupon) maturing on 21 June 2027, priced at 96.00 (original spread of 1,154 bp), callable (5nc2)