Credit

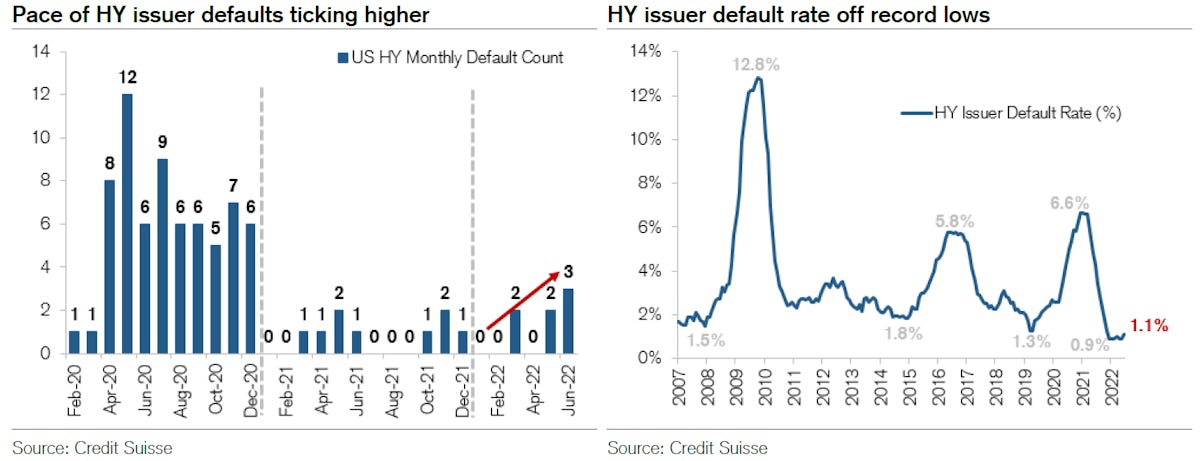

Significant Tightening In Spreads Across The Credit Complex, In Line With Equities Performance, As Credit Defaults Stay Very Low

No new corporate bond pricing in US$ HY this week, while IG only saw a modest level of issuance with $10.35bn priced in 13 tranches (2022 YTD volume $727.1bn vs 2021 YTD $824.7bn)

Published ET

High Yield Issuers Default Rate | Source: Credit Suisse

DAILY SUMMARY

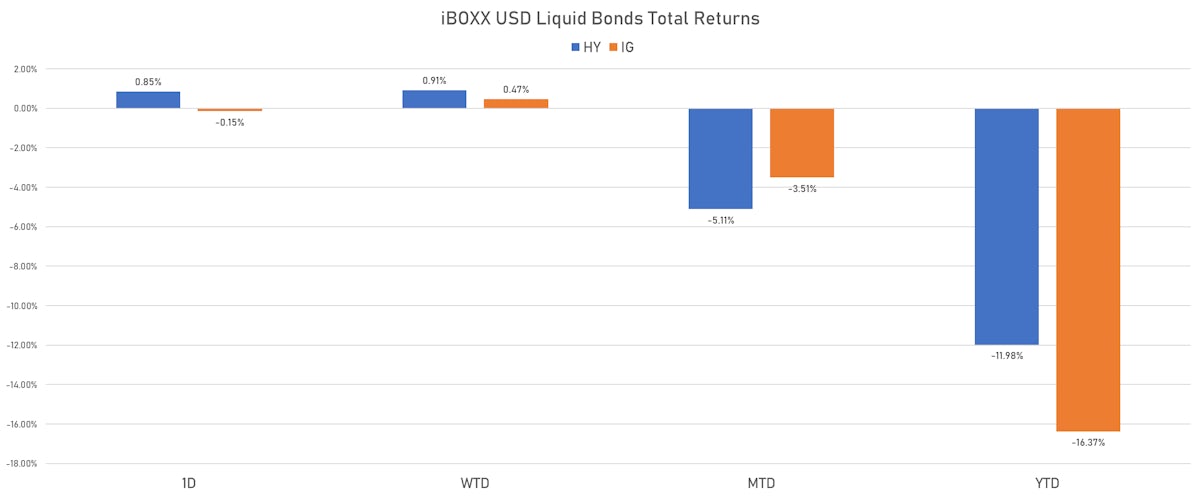

- S&P 500 Bond Index was down -0.18% today, with investment grade down -0.25% and high yield up 0.59% (YTD total return: -13.80%)

- The iBoxx USD Liquid Investment Grade Total Return Index was down -0.148% today (Month-to-date: -3.51%; Year-to-date: -16.37%)

- The iBoxx USD Liquid High Yield Total Return Index was up 0.847% today (Month-to-date: -5.11%; Year-to-date: -11.98%)

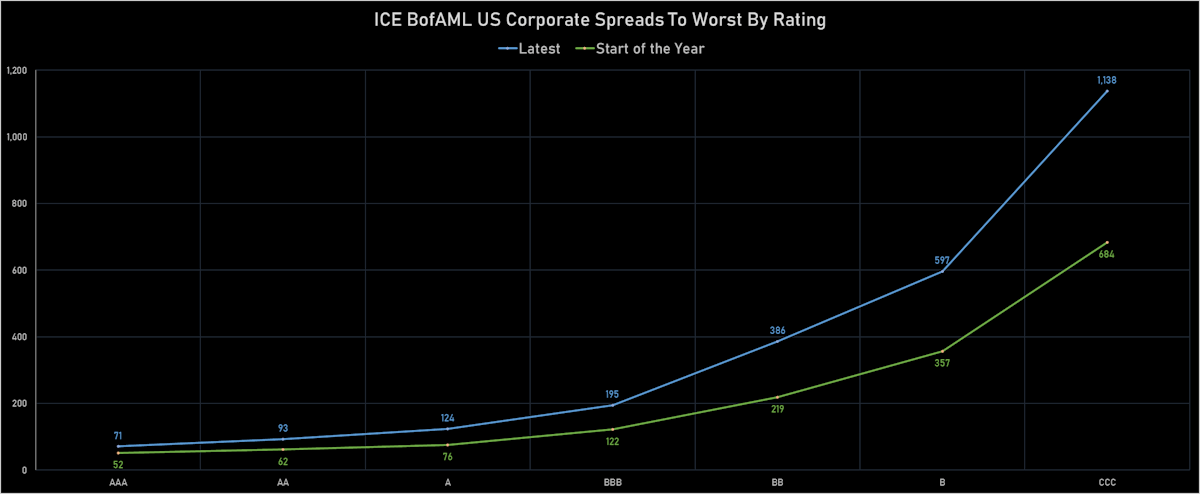

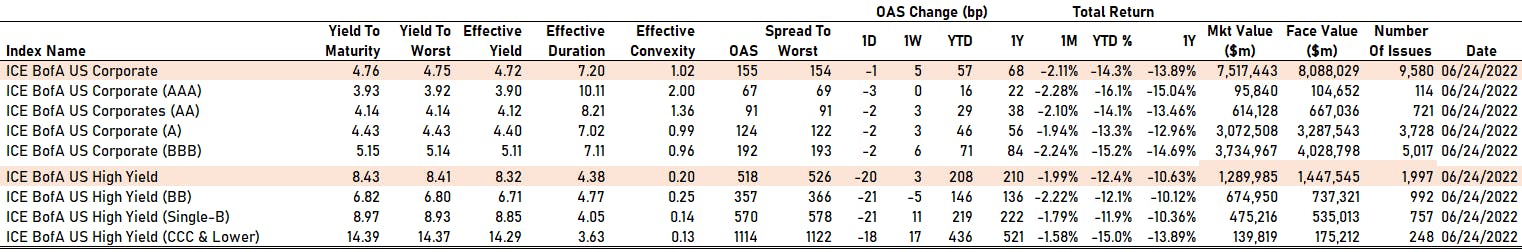

- ICE BofA US Corporate Index (Investment Grade) spread to worst up 2.0 bp, now at 156.0 bp (YTD change: +61.0 bp)

- ICE BofA US High Yield Index spread to worst up 6.0 bp, now at 545.0 bp (YTD change: +215.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index down -0.10% today (YTD total return: -4.5%)

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING TODAY

- AAA down by -3 bp at 67 bp

- AA down by -2 bp at 91 bp

- A down by -2 bp at 124 bp

- BBB down by -2 bp at 192 bp

- BB down by -21 bp at 357 bp

- B down by -21 bp at 570 bp

- ≤ CCC down by -18 bp at 1114 bp

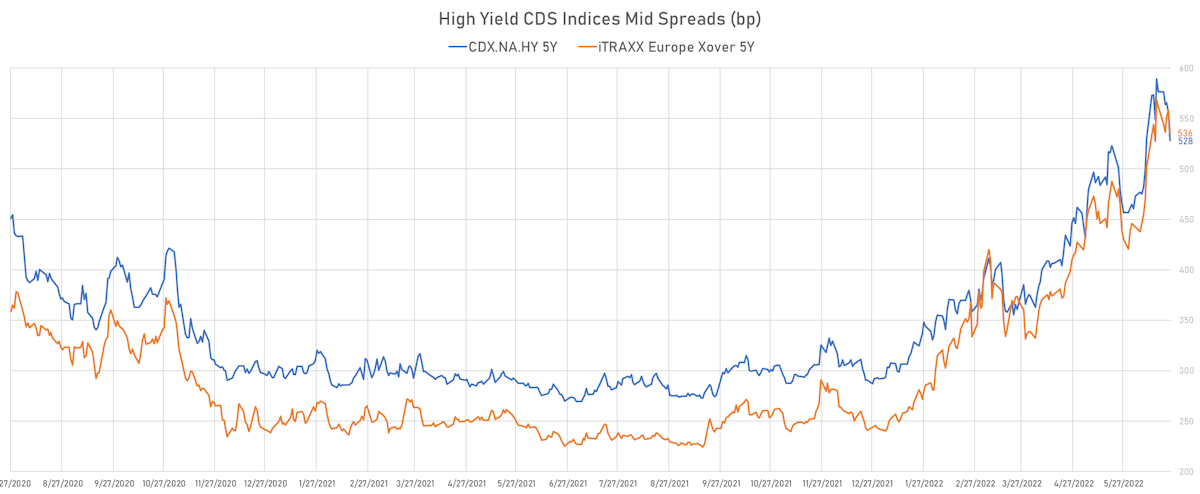

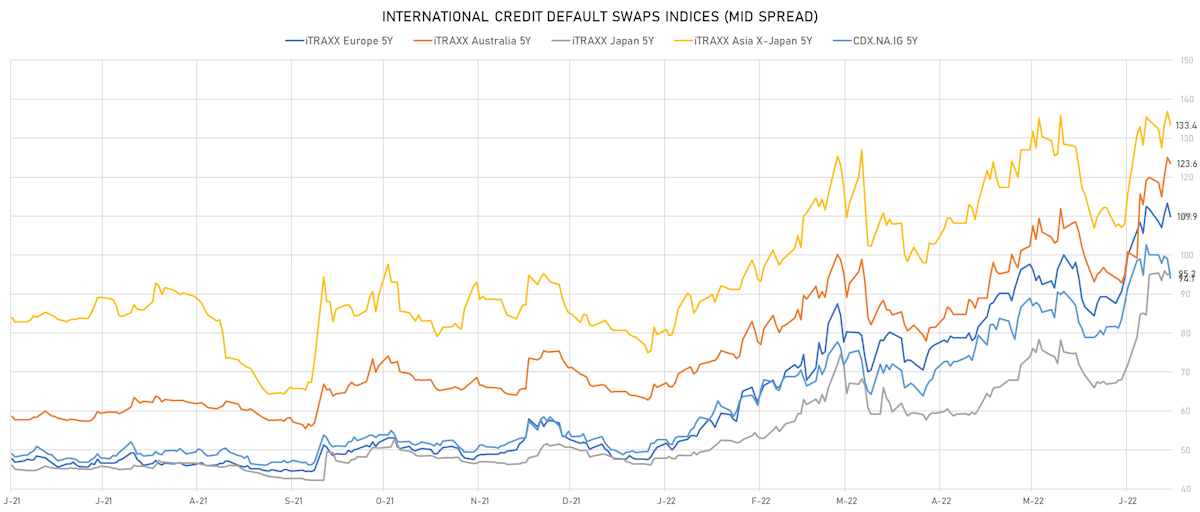

CDS INDICES TODAY (mid-spreads)

- Markit CDX.NA.IG 5Y down 4.8 bp, now at 94bp (1W change: -5.9bp; YTD change: +44.8bp)

- Markit CDX.NA.IG 10Y down 4.7 bp, now at 128bp (1W change: -5.7bp; YTD change: +38.7bp)

- Markit CDX.NA.HY 5Y down 28.6 bp, now at 528bp (1W change: -48.1bp; YTD change: +236.2bp)

- Markit iTRAXX Europe 5Y down 3.4 bp, now at 110bp (1W change: -1.8bp; YTD change: +62.2bp)

- Markit iTRAXX Europe Crossover 5Y down 22.2 bp, now at 536bp (1W change: -25.6bp; YTD change: +294.0bp)

- Markit iTRAXX Japan 5Y up 0.3 bp, now at 95bp (1W change: +0.1bp; YTD change: +48.8bp)

- Markit iTRAXX Asia Ex-Japan 5Y down 3.3 bp, now at 133bp (1W change: -1.1bp; YTD change: +54.4bp)

5Y USD CDS SINGLE NAMES - LARGEST MOVES OVER THE PAST WEEK

- American Airlines Group Inc (Country: US; rated: B2): down 180.7 bp to 1,510.9bp (1Y range: 602-1,644bp)

- Kohls Corp (Country: US; rated: Baa2): down 84.9 bp to 447.2bp (1Y range: 101-548bp)

- Macy's Inc (Country: US; rated: Ba1): down 65.6 bp to 470.4bp (1Y range: 181-576bp)

- Nordstrom Inc (Country: US; rated: A3): down 60.6 bp to 480.4bp (1Y range: 211-537bp)

- Gap Inc (Country: US; rated: WR): down 58.8 bp to 579.9bp (1Y range: 132-680bp)

- Bombardier Inc (Country: CA; rated: Caa1): down 48.1 bp to 860.5bp (1Y range: 395-1,007bp)

- Pitney Bowes Inc (Country: US; rated: B1): down 42.9 bp to 1,038.8bp (1Y range: 363-1,039bp)

- Staples Inc (Country: US; rated: B3): down 42.8 bp to 2,013.2bp (1Y range: 803-2,013bp)

- Lumen Technologies Inc (Country: US; rated: WR): down 39.5 bp to 569.2bp (1Y range: 195-569bp)

- Liberty Interactive LLC (Country: US; rated: Ba3): down 31.3 bp to 1,653.8bp (1Y range: 287-1,654bp)

- Ford Motor Credit Company LLC (Country: US; rated: NP): down 31.3 bp to 408.1bp (1Y range: 128-442bp)

- Beazer Homes USA Inc (Country: US; rated: B2): up 32.1 bp to 809.9bp (1Y range: 278-813bp)

- Marathon Oil Corp (Country: US; rated: WD): up 33.5 bp to 166.3bp (1Y range: 103-166bp)

- MGM Resorts International (Country: US; rated: B1): up 35.2 bp to 484.8bp (1Y range: 190-495bp)

- Transocean Inc (Country: KY; rated: Caa3): up 173.6 bp to 2,014.6bp (1Y range: 941-2,015bp)

5Y EURO CDS SINGLE NAMES - LARGEST MOVES OVER THE PAST WEEK

- Boparan Finance PLC (Country: GB; rated: Caa1): down 424.1 bp to 1,996.1bp (1Y range: 883-2,690bp)

- Telecom Italia SpA (Country: IT; rated: LGD4 - 53%): down 39.2 bp to 423.9bp (1Y range: 149-452bp)

- Stonegate Pub Company Financing PLC (Country: GB; rated: WR): down 29.5 bp to 664.5bp (1Y range: 370-688bp)

- Stena AB (Country: SE; rated: B2-PD): up 26.7 bp to 670.3bp (1Y range: 401-670bp)

- Virgin Media Finance PLC (Country: GB; rated: WR): up 28.4 bp to 504.9bp (1Y range: 222-505bp)

- Ardagh Packaging Finance PLC (Country: IE; rated: B1): up 28.6 bp to 812.4bp (1Y range: 213-812bp)

- ArcelorMittal SA (Country: LU; rated: WD): up 31.0 bp to 294.8bp (1Y range: 119-295bp)

- BASF SE (Country: DE; rated: P-2): up 31.3 bp to 131.6bp (1Y range: 26-132bp)

- Hammerson PLC (Country: GB; rated: Baa3): up 31.4 bp to 370.8bp (1Y range: 166-409bp)

- Air France KLM SA (Country: FR; rated: B-): up 40.9 bp to 720.4bp (1Y range: 386-720bp)

- Unibail-Rodamco-Westfield SE (Country: FR; rated: BBB-): up 48.5 bp to 326.8bp (1Y range: 46-327bp)

- Casino Guichard Perrachon SA (Country: FR; rated: WR): up 51.1 bp to 1,491.5bp (1Y range: 464-1,590bp)

- Rexel SA (Country: FR; rated: Ba2): up 51.6 bp to 388.0bp (1Y range: -388bp)

- ThyssenKrupp AG (Country: DE; rated: B1): up 72.1 bp to 541.0bp (1Y range: 205-541bp)

- TUI AG (Country: DE; rated: B3-PD): up 86.1 bp to 1,148.8bp (1Y range: 607-1,149bp)

TOP BONDS MOVES IN THE PAST WEEK - USD HY

- Issuer: Howard Midstream Energy Partners LLC (San Antonio (US)) | Coupon: 6.75% | Maturity: 15/1/2027 | Rating: B- | ISIN: USU4425TAA08 | Z-spread up by 131.4 bp to 669.3 bp, with the yield to worst at 9.6% and the bond now trading down to 89.3 cents on the dollar (1Y price range: 88.9-103.3).

- Issuer: Graphic Packaging International LLC (Atlanta (US)) | Coupon: 3.75% | Maturity: 1/2/2030 | Rating: BB | ISIN: USU41441AD58 | Z-spread up by 89.7 bp to 300.5 bp, with the yield to worst at 6.0% and the bond now trading down to 85.3 cents on the dollar (1Y price range: 84.9-101.0).

- Issuer: Necessity Retail REIT Inc (New York City, New York (US)) | Coupon: 4.50% | Maturity: 30/9/2028 | Rating: BB+ | ISIN: USU0262AAA52 | Z-spread up by 88.7 bp to 568.2 bp, with the yield to worst at 8.8% and the bond now trading down to 79.1 cents on the dollar (1Y price range: 79.1-100.4).

- Issuer: NCL Corporation Ltd (Miami, Bermuda) | Coupon: 7.75% | Maturity: 15/2/2029 | Rating: CCC+ | ISIN: USG6436QAP12 | Z-spread up by 70.4 bp to 908.0 bp, with the yield to worst at 12.0% and the bond now trading down to 80.0 cents on the dollar (1Y price range: 80.0-103.0).

- Issuer: Starwood Property Trust Inc (Greenwich, Connecticut (US)) | Coupon: 4.38% | Maturity: 15/1/2027 | Rating: BB- | ISIN: USU85656AH69 | Z-spread up by 62.8 bp to 470.6 bp, with the yield to worst at 7.8% and the bond now trading down to 86.5 cents on the dollar (1Y price range: 86.5-100.9).

- Issuer: Wynn Resorts Finance LLC (Las Vegas, Nevada (US)) | Coupon: 5.13% | Maturity: 1/10/2029 | Rating: B | ISIN: USU98354AA80 | Z-spread up by 54.6 bp to 569.4 bp, with the yield to worst at 8.7% and the bond now trading down to 80.0 cents on the dollar (1Y price range: 79.8-102.3).

- Issuer: Compass Minerals International Inc (Overland Park, Kansas (US)) | Coupon: 4.88% | Maturity: 15/7/2024 | Rating: B+ | ISIN: USU2036YAC04 | Z-spread up by 52.3 bp to 513.8 bp, with the yield to worst at 8.0% and the bond now trading down to 93.3 cents on the dollar (1Y price range: 93.3-102.8).

- Issuer: Global Net Lease Inc (New York City, New York (US)) | Coupon: 3.75% | Maturity: 15/12/2027 | Rating: BB- | ISIN: USU3165EAA92 | Z-spread up by 51.7 bp to 406.0 bp, with the yield to worst at 7.2% and the bond now trading down to 84.2 cents on the dollar (1Y price range: 83.9-97.8).

- Issuer: Western Global Airlines LLC (Estero, Florida (US)) | Coupon: 10.38% | Maturity: 15/8/2025 | Rating: B- | ISIN: USU95558AA72 | Z-spread up by 49.8 bp to 811.6 bp, with the yield to worst at 11.0% and the bond now trading down to 97.3 cents on the dollar (1Y price range: 97.0-111.3).

- Issuer: Taylor Morrison Communities Inc (Scottsdale, Arizona (US)) | Coupon: 5.75% | Maturity: 15/1/2028 | Rating: BB- | ISIN: USU8760NAB56 | Z-spread up by 45.9 bp to 463.5 bp, with the yield to worst at 7.7% and the bond now trading down to 90.5 cents on the dollar (1Y price range: 90.0-112.4).

- Issuer: Southeast Supply Header LLC (Houston, Texas (US)) | Coupon: 4.25% | Maturity: 15/6/2024 | Rating: B | ISIN: USU83854AB29 | Z-spread up by 43.9 bp to 717.9 bp, with the yield to worst at 10.0% and the bond now trading down to 89.0 cents on the dollar (1Y price range: 88.8-102.8).

- Issuer: Masonite International Corp (Tampa, Canada) | Coupon: 3.50% | Maturity: 15/2/2030 | Rating: BB+ | ISIN: USC5389UAM20 | Z-spread up by 42.3 bp to 351.5 bp, with the yield to worst at 6.5% and the bond now trading down to 81.1 cents on the dollar (1Y price range: 81.1-99.0).

- Issuer: Wynn Las Vegas LLC (Las Vegas, Nevada (US)) | Coupon: 5.50% | Maturity: 1/3/2025 | Rating: B | ISIN: USU98347AK05 | Z-spread down by 48.1 bp to 578.4 bp, with the yield to worst at 8.7% and the bond now trading up to 91.5 cents on the dollar (1Y price range: 90.0-103.5).

- Issuer: HanesBrands Inc (Winston-Salem, North Carolina (US)) | Coupon: 4.88% | Maturity: 15/5/2026 | Rating: BB- | ISIN: USU24437AE26 | Z-spread down by 48.5 bp to 339.9 bp, with the yield to worst at 6.5% and the bond now trading up to 93.9 cents on the dollar (1Y price range: 91.0-106.9).

- Issuer: HanesBrands Inc (Winston-Salem, North Carolina (US)) | Coupon: 4.63% | Maturity: 15/5/2024 | Rating: BB- | ISIN: USU24437AD43 | Z-spread down by 68.7 bp to 202.4 bp, with the yield to worst at 4.9% and the bond now trading up to 98.5 cents on the dollar (1Y price range: 96.5-104.5).

TOP BONDS MOVES IN THE PAST WEEK - EUR HY

- Issuer: Adler Real Estate AG (Berlin, Germany) | Coupon: 3.00% | Maturity: 27/4/2026 | Rating: CCC | ISIN: XS1713464524 | Z-spread up by 359.4 bp to 1,274.5 bp, with the yield to worst at 12.2% and the bond now trading down to 68.0 cents on the dollar (1Y price range: 64.8-94.5).

- Issuer: Adler Group SA (Senningerberg, Luxembourg) | Coupon: 2.25% | Maturity: 14/1/2029 | Rating: CCC | ISIN: XS2283225477 | Z-spread up by 219.8 bp to 1,287.3 bp, with the yield to worst at 13.9% and the bond now trading down to 49.4 cents on the dollar (1Y price range: 46.4-84.9).

- Issuer: DIC Asset AG (Frankfurt, Germany) | Coupon: 2.25% | Maturity: 22/9/2026 | Rating: BB+ | ISIN: XS2388910270 | Z-spread up by 140.4 bp to 895.6 bp, with the yield to worst at 10.6% and the bond now trading down to 72.3 cents on the dollar (1Y price range: 71.9-95.9).

- Issuer: JSW Steel Ltd (Mumbai, India) | Coupon: 5.05% | Maturity: 5/4/2032 | Rating: BB | ISIN: USY44680RW11 | Z-spread up by 136.1 bp to 616.8 bp, with the yield to worst at 9.2% and the bond now trading down to 72.5 cents on the dollar (1Y price range: 72.5-99.4).

- Issuer: SoftBank Group Corp (Minato-Ku, Japan) | Coupon: 5.00% | Maturity: 15/4/2028 | Rating: BB- | ISIN: XS1793255941 | Z-spread up by 132.1 bp to 741.9 bp, with the yield to worst at 8.8% and the bond now trading down to 81.7 cents on the dollar (1Y price range: 81.5-102.9).

- Issuer: Saipem Finance International BV (Amsterdam, Netherlands) | Coupon: 3.13% | Maturity: 31/3/2028 | Rating: B+ | ISIN: XS2325696628 | Z-spread up by 111.4 bp to 775.5 bp (CDS basis: 49.6bp), with the yield to worst at 9.5% and the bond now trading down to 72.1 cents on the dollar (1Y price range: 70.6-99.6).

- Issuer: SoftBank Group Corp (Minato-Ku, Japan) | Coupon: 3.38% | Maturity: 6/7/2029 | Rating: BB+ | ISIN: XS2361255057 | Z-spread up by 102.5 bp to 734.5 bp, with the yield to worst at 9.2% and the bond now trading down to 70.6 cents on the dollar (1Y price range: 70.3-93.4).

- Issuer: Dometic Group AB (publ) (Solna, Sweden) | Coupon: 3.00% | Maturity: 8/5/2026 | Rating: BB- | ISIN: XS1991114858 | Z-spread up by 100.2 bp to 459.3 bp, with the yield to worst at 6.0% and the bond now trading down to 89.0 cents on the dollar (1Y price range: 88.7-105.2).

- Issuer: Rexel SA (Paris, France) | Coupon: 2.13% | Maturity: 15/12/2028 | Rating: BB- | ISIN: XS2403428472 | Z-spread up by 97.5 bp to 443.4 bp (CDS basis: -17.6bp), with the yield to worst at 6.3% and the bond now trading down to 78.1 cents on the dollar (1Y price range: 77.9-101.0).

- Issuer: SoftBank Group Corp (Minato-Ku, Japan) | Coupon: 4.00% | Maturity: 19/9/2029 | Rating: BB- | ISIN: XS1684385591 | Z-spread up by 92.7 bp to 726.6 bp, with the yield to worst at 8.8% and the bond now trading down to 73.5 cents on the dollar (1Y price range: 75.6-97.1).

- Issuer: Banca Monte dei Paschi di Siena SpA (Siena, Italy) | Coupon: 1.88% | Maturity: 9/1/2026 | Rating: CCC+ | ISIN: XS2270393379 | Z-spread up by 90.6 bp to 567.0 bp (CDS basis: 25.2bp), with the yield to worst at 7.1% and the bond now trading down to 83.5 cents on the dollar (1Y price range: 83.9-97.5).

- Issuer: SoftBank Group Corp (Minato-Ku, Japan) | Coupon: 2.88% | Maturity: 6/1/2027 | Rating: BB+ | ISIN: XS2361254597 | Z-spread up by 78.1 bp to 694.4 bp, with the yield to worst at 8.5% and the bond now trading down to 79.0 cents on the dollar (1Y price range: 78.7-95.0).

- Issuer: Standard Industries Inc (Parsippany, New Jersey (US)) | Coupon: 2.25% | Maturity: 21/11/2026 | Rating: B+ | ISIN: XS2080766475 | Z-spread up by 76.6 bp to 597.7 bp, with the yield to worst at 7.4% and the bond now trading down to 80.0 cents on the dollar (1Y price range: 80.6-98.3).

- Issuer: Nexi SpA (Milan, Italy) | Coupon: 1.63% | Maturity: 30/4/2026 | Rating: BB- | ISIN: XS2332589972 | Z-spread up by 74.9 bp to 472.5 bp, with the yield to worst at 6.3% and the bond now trading down to 84.2 cents on the dollar (1Y price range: 84.1-99.7).

- Issuer: Petroleos Mexicanos (Miguel Hidalgo, Mexico) | Coupon: 4.75% | Maturity: 26/2/2029 | Rating: BB- | ISIN: XS1824424706 | Z-spread up by 72.2 bp to 784.4 bp (CDS basis: -142.9bp), with the yield to worst at 9.7% and the bond now trading down to 76.1 cents on the dollar (1Y price range: 75.8-98.8).

RECENT DOMESTIC USD BOND ISSUES

- Avaya Inc (Telecommunications | Basking Ridge, United States | Rating: B-): US$250m Bond, fixed rate (8.00% coupon) maturing on 15 December 2027, priced at 100.00, non callable, convertible

- Eversource Energy (Utility - Other | Springfield, Massachusetts, United States | Rating: BBB+): US$600m Senior Note (US30040WAR97), fixed rate (4.60% coupon) maturing on 1 July 2027, priced at 99.88 (original spread of 140 bp), callable (5nc5)

- Eversource Energy (Utility - Other | Springfield, Massachusetts, United States | Rating: BBB+): US$900m Senior Note (US30040WAS70), fixed rate (4.20% coupon) maturing on 27 June 2024, priced at 99.96 (original spread of 115 bp), with a make whole call

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$125m Bond (US3133ENZM55), fixed rate (4.47% coupon) maturing on 29 June 2029, priced at 100.00, callable (7nc3m)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$125m Bond (US3133ENZP86), fixed rate (4.90% coupon) maturing on 29 June 2032, priced at 100.00, callable (10nc3m)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$125m Bond (US3133ENZR43), fixed rate (5.24% coupon) maturing on 29 June 2037, priced at 100.00, callable (15nc6m)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$160m Bond (US3133ENZQ69), fixed rate (4.70% coupon) maturing on 29 June 2032, priced at 100.00, callable (10nc1)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$480m Bond (US3133ENZL72), floating rate (SOFR + 5.0 bp) maturing on 26 June 2024, priced at 100.00, non callable

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, New Jersey, United States | Rating: AA+): US$650m Bond (US3133ENZS26), fixed rate (3.10% coupon) maturing on 28 June 2024, priced at 100.00 (original spread of 4 bp), non callable

- Federal Home Loan Banks (Agency | Washington, Washington Dc, United States | Rating: AA+): US$200m Bond (US3130ASJE08), fixed rate (3.38% coupon) maturing on 1 April 2025, priced at 100.00 (original spread of 6 bp), non callable

- Federal Home Loan Mortgage Corp (Agency | Mclean, Virginia, United States | Rating: AA+): US$300m Unsecured Note (US3134GXC368), fixed rate (4.00% coupon) maturing on 30 December 2024, priced at 100.00 (original spread of 212 bp), callable (3nc3m)

- Inter-American Development Bank (Supranational | Washington, Washington Dc, United States | Rating: AAA): US$2,000m Senior Note (US4581X0EE44), fixed rate (3.25% coupon) maturing on 1 July 2024, priced at 99.99 (original spread of 19 bp), non callable

- JP Morgan Chase Financial Company LLC (Financial - Other | New York City, United States | Rating: AA-): US$500m Bond (US48133DL244), fixed rate (0.50% coupon) maturing on 15 June 2027, priced at 105.00, non callable, convertible

- Ormat Technologies Inc (Utility - Other | Reno, Nevada, United States | Rating: NR): US$375m Bond (US686688AA03), fixed rate (2.50% coupon) maturing on 15 July 2027, priced at 100.00, non callable, convertible

- Targa Resources Corp (Financial - Other | Houston, United States | Rating: BBB-): US$500m Senior Note (US87612KAC62), fixed rate (6.25% coupon) maturing on 1 July 2052, priced at 99.77 (original spread of 316 bp), callable (30nc30)

- Targa Resources Corp (Financial - Other | Houston, United States | Rating: BBB-): US$750m Senior Note (US87612KAA07), fixed rate (5.20% coupon) maturing on 1 July 2027, priced at 99.85 (original spread of 200 bp), callable (5nc5)

RECENT GLOBAL USD BOND ISSUES

- Agence Francaise de Developpement Epic (Agency | Paris, Ile-De-France, France | Rating: AA): US$1,000m Bond (FR001400BC90), fixed rate (3.13% coupon) maturing on 30 June 2024, priced at 99.77 (original spread of 15 bp), non callable

- Asian Infrastructure Investment Bank (Supranational | Beijing, Beijing, China (Mainland) | Rating: AAA): US$1,250m Senior Note (US04522KAF30), fixed rate (3.38% coupon) maturing on 29 June 2025, priced at 99.69 (original spread of 30 bp), non callable

- Bahrain, Kingdom of (Government) (Sovereign | Manama, Bahrain | Rating: B): US$500m Senior Note (XS2496695714), fixed rate (1.00% coupon) maturing on 5 January 2026, priced at 100.00, non callable

- Changde Economic Construction Investment Group Co Ltd (Financial - Other | Changde, Hunan, China (Mainland) | Rating: NR): US$300m Bond (XS2486428407), fixed rate (6.30% coupon) maturing on 28 June 2025, priced at 100.00, non callable

- Deutsche Bank AG (Banking | Frankfurt, Germany | Rating: BBB+): US$500m Note (XS0459895420), fixed rate (3.30% coupon) maturing on 15 July 2024, priced at 100.00, non callable

- Deutsche Bank AG (Banking | Frankfurt, Germany | Rating: BBB+): US$500m Note (XS0459895776), floating rate maturing on 14 July 2026, priced at 100.00, non callable

- Hanwha Energy Usa Holdings Corp (Utility - Other | Irvine, California, South Korea | Rating: AA): US$300m Senior Note (USU3821WAC11), fixed rate (4.13% coupon) maturing on 5 July 2025, priced at 99.69 (original spread of 88 bp), non callable

- KfW (Agency | Frankfurt, Hessen, Germany | Rating: AAA): US$3,000m Senior Note (US500769JU96), fixed rate (3.13% coupon) maturing on 10 June 2025, priced at 99.99 (original spread of 21 bp), non callable

- KommuneKredit (Agency | Kobenhavn K, Denmark | Rating: AAA): US$500m Unsecured Note (XS2496451415), floating rate maturing on 27 July 2026, priced at 100.00, non callable

- Korea Western Power Co Ltd (Utility - Other | Taean, Chungcheongnam-Do, South Korea | Rating: AA): US$300m Senior Note (XS2489897343), fixed rate (4.13% coupon) maturing on 28 June 2025, priced at 99.59 (original spread of 94 bp), non callable

- Nomura International Funding Pte Ltd (Financial - Other | Japan | Rating: NR): US$150m Unsecured Note (XS2430471701), floating rate maturing on 5 July 2025, priced at 100.00, non callable

- PSP Capital Inc (Financial - Other | Montreal, Canada | Rating: AAA): US$1,000m Senior Note (US69376P2D61), fixed rate (3.50% coupon) maturing on 29 June 2027, priced at 99.61 (original spread of 45 bp), non callable

- United Arab Emirates (Government) (Sovereign | Abu Dhabi, Abu Dhabi, United Arab Emirates | Rating: AA-): US$1,750m Senior Note (XS2492384818), fixed rate (4.05% coupon) maturing on 7 July 2032, priced at 100.00 (original spread of 100 bp), non callable

- United Arab Emirates (Government) (Sovereign | Abu Dhabi, Abu Dhabi, United Arab Emirates | Rating: AA-): US$1,250m Senior Note (XS2492385203), fixed rate (4.95% coupon) maturing on 7 July 2052, priced at 100.00 (original spread of 185 bp), non callable

RECENT EUR BOND ISSUES

- Aktia Bank Abp (Banking | Helsinki, Etela-Suomen, Finland | Rating: AAA): €150m Unsecured Note (XS2496032017), floating rate maturing on 28 June 2027, priced at 100.00, non callable

- Arval Service Lease SA (Financial - Other | Paris, Ile-De-France, France | Rating: A-): €500m Bond (FR001400BDD5), fixed rate (3.38% coupon) maturing on 4 January 2026, priced at 99.90 (original spread of 255 bp), callable (4nc3)

- BASF SE (Chemicals | Ludwigshafen Am Rhein, Rheinland-Pfalz, Germany | Rating: A-): €750m Senior Note (XS2491542457), fixed rate (3.75% coupon) maturing on 29 June 2032, priced at 99.49 (original spread of 219 bp), callable (10nc10)

- BASF SE (Chemicals | Ludwigshafen Am Rhein, Rheinland-Pfalz, Germany | Rating: A-): €750m Senior Note (XS2491542374), fixed rate (3.13% coupon) maturing on 29 June 2028, priced at 99.44 (original spread of 176 bp), callable (6nc6)

- Bank of New Zealand (Banking | Auckland, Australia | Rating: A+): €750m Covered Bond (Other) (XS2491074923), fixed rate (2.55% coupon) maturing on 29 June 2027, priced at 100.00 (original spread of 103 bp), non callable

- Bayerische Landesbank (Banking | Muenchen, Bayern, Germany | Rating: NR): €500m Pfandbrief Anleihe (Covered Bond) (DE000BLB6JP7), fixed rate (2.50% coupon) maturing on 28 June 2032, priced at 99.62 (original spread of 88 bp), non callable

- Bper Banca SpA (Banking | Modena, Modena, Italy | Rating: BB+): €300m Note (XS2495521515), floating rate maturing on 22 January 2025, priced at 99.82 (original spread of 402 bp), callable (3nc1)

- Bpifrance SA (Banking | Maisons-Alfort, Ile-De-France, France | Rating: NR): €1,250m Bond (FR001400BB83), fixed rate (2.13% coupon) maturing on 29 November 2027, priced at 99.88 (original spread of 64 bp), non callable

- Clydesdale Bank PLC (Banking | Glasgow, Strathclyde, United Kingdom | Rating: A-): €500m Covered Bond (Other) (XS2493830827), fixed rate (2.50% coupon) maturing on 22 June 2027, priced at 99.92 (original spread of 102 bp), non callable

- Credit Mutuel Home Loan SFH SA (Financial - Other | Paris, Ile-De-France, France | Rating: AAA): €1,250m Obligation de Financement de l'Habitat (Covered Bond) (FR001400B9U1), fixed rate (2.38% coupon) maturing on 8 February 2028, priced at 99.79 (original spread of 89 bp), non callable

- Deutsche Bank AG (Banking | Frankfurt, Hessen, Germany | Rating: A-): €500m Inhaberschuldverschreibung (DE000DB9U7N1), floating rate maturing on 14 July 2027, priced at 100.00, non callable

- Deutsche Bank AG (Banking | Frankfurt, Hessen, Germany | Rating: A-): €500m Inhaberschuldverschreibung (DE000DB9U7K7), floating rate (EU06MLIB + 0.0 bp) maturing on 14 July 2025, priced at 100.00, non callable

- Deutsche Bank AG (Banking | Frankfurt, Hessen, Germany | Rating: A-): €500m Inhaberschuldverschreibung (DE000DB9U7L5), fixed rate (2.25% coupon) maturing on 14 July 2025, priced at 100.00, non callable

- Eurofins Scientific SE (Service - Other | Luxembourg, Luxembourg | Rating: BBB-): €600m Senior Note (XS2491664137), fixed rate (4.00% coupon) maturing on 6 July 2029, priced at 98.54 (original spread of 275 bp), callable (7nc7)

- European Union (Supranational | Brussels, Bruxelles-Capitale, Belgium | Rating: AAA): €5,000m Senior Note (EU000A3K4DM9), fixed rate (2.63% coupon) maturing on 4 February 2048, priced at 98.40 (original spread of 79 bp), non callable

- HSBC SFH (France) SA (Financial - Other | Courbevoie, Ile-De-France, United Kingdom | Rating: AAA): €750m Obligation de Financement de l'Habitat (Covered Bond) (FR001400AEA1), fixed rate (2.50% coupon) maturing on 28 June 2028, priced at 99.65 (original spread of 97 bp), non callable

- Hamburg Commercial Bank AG (Banking | Hamburg, Germany | Rating: BBB): €500m Hypothekenpfandbrief (Covered Bond) (DE000HCB0BN7), fixed rate (2.00% coupon) maturing on 20 July 2027, priced at 99.47 (original spread of 90 bp), non callable

- Italy, Republic of (Government) (Sovereign | Rome, Roma, Italy | Rating: BBB-): €9,440m Index Linked Security (IT0005497000), fixed rate (1.60% coupon) maturing on 28 June 2030, priced at 100.00, non callable, inflation protected

- JAB Holdings BV (Financial - Other | Amsterdam, Noord-Holland, Luxembourg | Rating: NR): €500m Senior Note (DE000A3K5HW7), fixed rate (4.75% coupon) maturing on 29 June 2032, priced at 99.99 (original spread of 329 bp), non callable

- Kbc Groep NV (Banking | Brussels, Bruxelles-Capitale, Belgium | Rating: BBB+): €750m Bond (BE0974423569), floating rate maturing on 29 June 2025, priced at 99.81 (original spread of 208 bp), callable (3nc2)

- Kookmin Bank (Banking | Seoul, South Korea | Rating: A): €500m Covered Bond (Other) (XS2488807244), fixed rate (2.38% coupon) maturing on 27 January 2026, priced at 99.91 (original spread of 107 bp), non callable

- Landesbank Hessen Thueringen Girozentrale (Banking | Frankfurt, Hessen, Germany | Rating: AAA): €975m Hypothekenpfandbrief (Covered Bond) (DE000HLB7515), floating rate (EU06MLIB + -3.0 bp) maturing on 27 December 2024, priced at 100.00, non callable

- Lunar Luxembourg SA (Financial - Other | Luxembourg, Netherlands | Rating: NR): €260m Unsecured Note (XS2497076864) zero coupon maturing on 25 July 2026, non callable

- Manuchar NV (Transportation - Other | Antwerp, Belgium | Rating: B): €350m Note (BE6336312788), fixed rate (7.25% coupon) maturing on 30 June 2027, priced at 86.00 (original spread of 1,010 bp), callable (5nc2)

- Mediobanca Banca di Credito Finanziario SpA (Banking | Milan, Milano, Italy | Rating: BBB): €500m Covered Bond (Other) (IT0005499543), fixed rate (2.38% coupon) maturing on 30 June 2027, priced at 99.83 (original spread of 120 bp), non callable

- Permanent TSB Group Holdings PLC (Banking | Dublin, Dublin, Ireland | Rating: BB-): €300m Senior Note (XS2493846310), fixed rate (5.25% coupon) maturing on 30 June 2025, priced at 99.94 (original spread of 456 bp), callable (3nc2)

- Raiffeisenlandesbank Oberoesterreich AG (Banking | Linz, Oberoesterreich, Austria | Rating: A-): €500m Fundierte Namensschuldverschreibung (covered bond) (AT0000A2YD59), fixed rate (2.50% coupon) maturing on 28 June 2029, priced at 99.46 (original spread of 100 bp), non callable

- Rentokil Initial Finance BV (Financial - Other | S-Gravenhage, Zuid-Holland, United Kingdom | Rating: BBB): €600m Senior Note (XS2494946820), fixed rate (4.38% coupon) maturing on 27 June 2030, priced at 99.66 (original spread of 280 bp), callable (8nc8)

- Rentokil Initial Finance BV (Financial - Other | S-Gravenhage, Zuid-Holland, United Kingdom | Rating: BBB): €850m Senior Note (XS2494945939), fixed rate (3.88% coupon) maturing on 27 June 2027, priced at 99.59 (original spread of 244 bp), callable (5nc5)

- Single Platform Investment Repackaging Entity SA (Financial - Other | Luxembourg, Netherlands | Rating: NR): €200m Unsecured Note (XS2497080387), floating rate maturing on 4 July 2034, priced at 100.00, non callable

- Single Platform Investment Repackaging Entity SA (Financial - Other | Luxembourg, Netherlands | Rating: NR): €300m Unsecured Note (XS2494452076), fixed rate (1.75% coupon) maturing on 15 September 2041, priced at 100.00, non callable

- Swedish Export Credit Corp (Agency | Stockholm, Stockholm, Sweden | Rating: AA+): €700m Note (XS2491737461), fixed rate (2.00% coupon) maturing on 30 June 2027, priced at 99.99 (original spread of 80 bp), non callable

- Universal Music Group NV (Publishing | Hilversum, Noord-Holland, Netherlands | Rating: BBB): €500m Senior Note (XS2496289138), fixed rate (3.75% coupon) maturing on 30 June 2032, priced at 99.11 (original spread of 244 bp), callable (10nc10)

- Universal Music Group NV (Publishing | Hilversum, Netherlands | Rating: BBB): €500m Senior Note (XS2496288593), fixed rate (3.00% coupon) maturing on 30 June 2027, priced at 99.53 (original spread of 194 bp), callable (5nc5)

- Van Lanschot Kempen NV (Banking | S-Hertogenbosch, Noord-Brabant, Netherlands | Rating: BBB+): €500m Covered Bond (Other) (XS2495966637), fixed rate (2.50% coupon) maturing on 27 February 2028, priced at 99.88 (original spread of 95 bp), non callable

- Virtuo Finance SARL (Financial - Other | Luxembourg, Luxembourg | Rating: NR): €250m Unsecured Note (XS2497280391), fixed rate (1.00% coupon) maturing on 15 January 2030, priced at 100.00, non callable

- Volkswagen International Finance NV (Financial - Other | Amsterdam, Noord-Holland, Germany | Rating: BBB+): €750m Senior Note (XS2491738352), fixed rate (3.13% coupon) maturing on 28 March 2025, priced at 99.94 (original spread of 193 bp), non callable

- Volkswagen International Finance NV (Financial - Other | Amsterdam, Noord-Holland, Germany | Rating: BBB+): €750m Senior Note (XS2491738949), fixed rate (3.75% coupon) maturing on 28 September 2027, priced at 99.55 (original spread of 228 bp), non callable

NEW LOANS

- Ingevity Corp, signed a US$ 1,000m Revolving Credit Facility, to be used for general corporate purposes. It matures on 06/24/27 and initial pricing is set at Term SOFR +125.0bp

- Bed Bath & Beyond Inc (B+), signed a US$ 1,000m Revolving Credit Facility, to be used for general corporate purposes. It matures on 08/09/26 and initial pricing is set at Term SOFR +125.0bp

- Xerox Corp (BB), signed a US$ 750m Revolving Credit Facility, to be used for general corporate purposes. It matures on 06/28/24 and initial pricing is set at Term SOFR +200.0bp

- Msg National Properties LLC, signed a US$ 750m Term Loan, to be used for general corporate purposes. It matures on 06/29/27 and initial pricing is set at Term SOFR +350.0bp

- Garden Spinco Corp, signed a US$ 650m Term Loan A, to be used for acquisition financing. It matures on 06/30/27 and initial pricing is set at Term SOFR +225.0bp

- LXP Industrial Trust (BBB-), signed a US$ 600m Revolving Credit Facility, to be used for general corporate purposes. It matures on 06/23/26 and initial pricing is set at Term SOFR +85.0bp

- Archaea Energy Operating LLC, signed a US$ 516m Revolving Credit Facility, to be used for general corporate purposes. It matures on 09/15/26 and initial pricing is set at Term SOFR +275.0bp

- Archaea Energy Operating LLC, signed a US$ 400m Term Loan A, to be used for general corporate purposes. It matures on 09/15/26 and initial pricing is set at Term SOFR +325.0bp

- Gaming1 BVBA, signed a € 300m Term Loan B, to be used for general corporate purposes

- LXP Industrial Trust (BBB-), signed a US$ 300m Term Loan A, to be used for general corporate purposes

- working capital. It matures on 01/31/25 and initial pricing is set at Term SOFR +95.0bp

- Dealer Tire LLC, signed a US$ 250m Revolving Credit Facility, to be used for general corporate purposes. It matures on 06/23/27 and initial pricing is set at Term SOFR +325.0bp

- LSQ Funding Group, signed a US$ 230m Revolving Credit Facility, to be used for general corporate purposes. It matures on 11/13/23 and initial pricing is set at Term SOFR +200.0bp

- Garden Spinco Corp, signed a US$ 150m Revolving Credit Facility, to be used for acquisition financing. It matures on 06/30/27 and initial pricing is set at Term SOFR +225.0bp

- 950 Property LLC, signed a US$ 116m Term Loan, to be used for general corporate purposes. It matures on 07/01/25.

NEW ISSUES IN SECURITIZED CREDIT

- Corevest American Finance 2022-1 issued a fixed-rate ABS backed by rental income in 5 tranches, for a total of US$ 271 m. Bookrunners: Goldman Sachs & Co, Morgan Stanley International Ltd, Wells Fargo Securities LLC

- Marlin Receivables 2022-1 LLC issued a floating-rate ABS backed by equipment leases in 6 tranches, for a total of US$ 492 m. Highest-rated tranche offering a spread over the floating rate of 125bp, and the lowest-rated tranche a spread of 375bp. Bookrunners: Bank of America Merrill Lynch, BNP Paribas Securities Corp