Credit

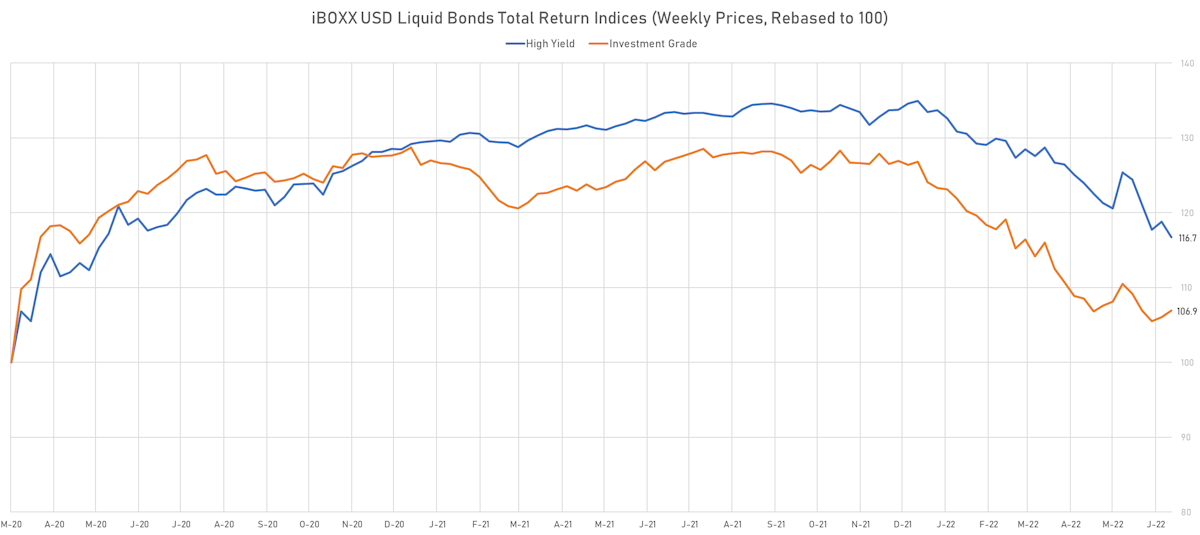

More Dispersion Of Performance Across The Credit Complex Over The Past 2 Weeks, As The Recession Trade Helps IG Outperform HY (Duration Over Spreads)

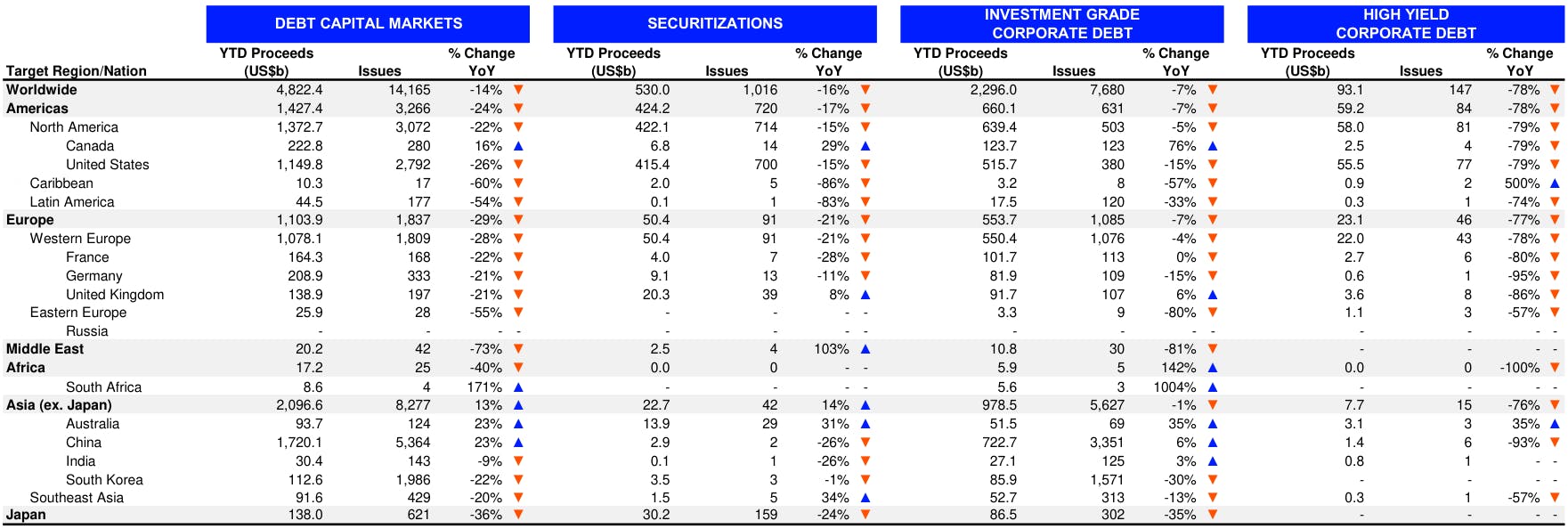

Weekly US$ corporate bond issuance was pretty slim (IFR Markets data): $8.35bn in 14 tranches for IG (2022 YTD volume $735.49bn, down -13.0% vs YTD 2021), and a single $450m tranche for HY (2022 YTD volume $67.816bn, down 76.2% vs YTD 2021)

Published ET

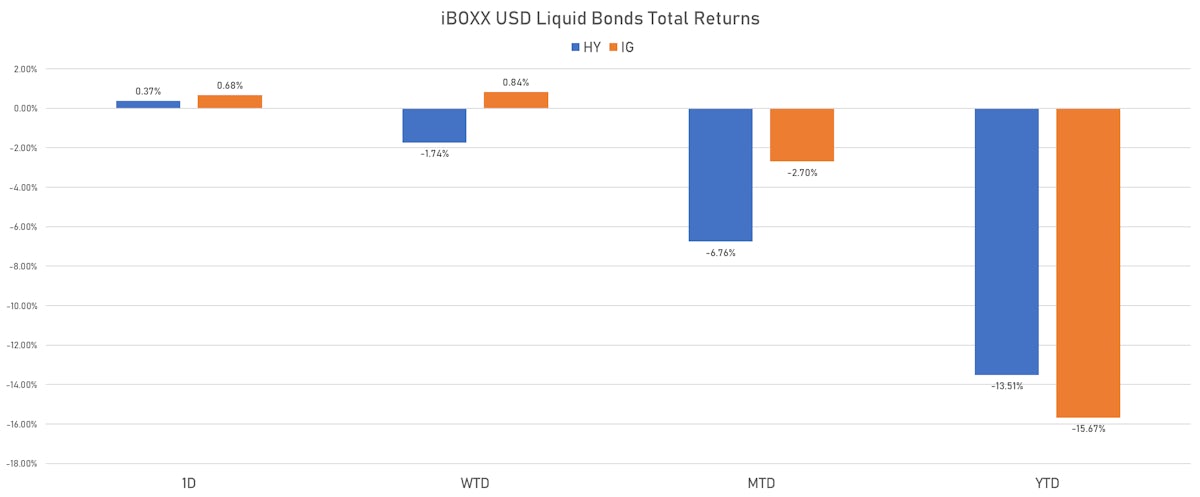

iBOXX USD Liquid Bonds Total Returns | Sources: ϕpost, Refinitiv data

DAILY SUMMARY

- S&P 500 Bond Index was up 0.59% today, with investment grade up 0.61% and high yield up 0.43% (YTD total return: -13.13%)

- The iBoxx USD Liquid Investment Grade Total Return Index was up 0.676% today (Month-to-date: -2.70%; Year-to-date: -15.67%)

- The iBoxx USD Liquid High Yield Total Return Index was up 0.369% today (Month-to-date: -6.76%; Year-to-date: -13.51%)

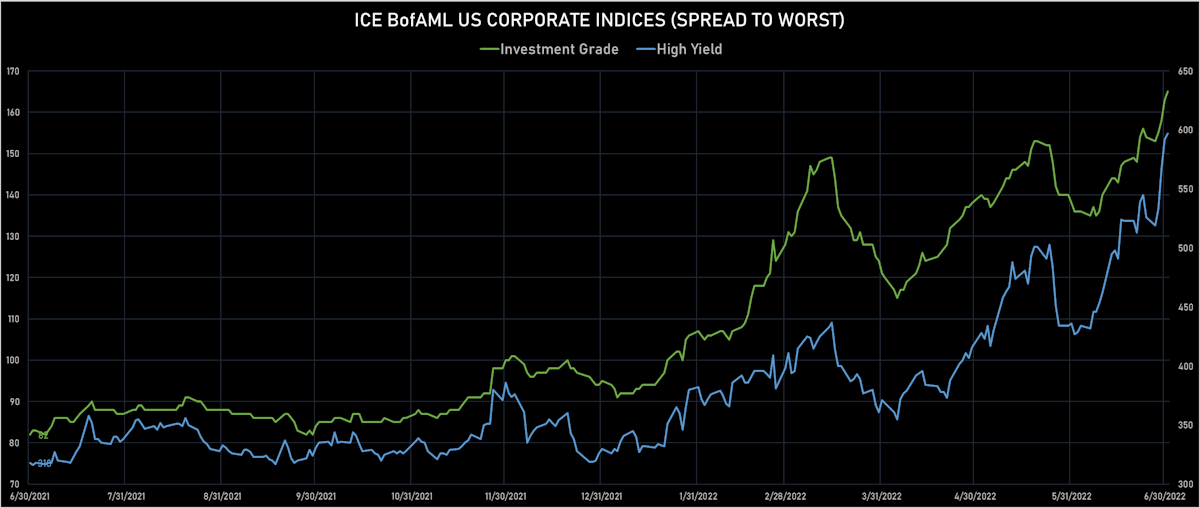

- ICE BofA US Corporate Index (Investment Grade) spread to worst up 2.0 bp, now at 165.0 bp (YTD change: +70.0 bp)

- ICE BofA US High Yield Index spread to worst up 5.0 bp, now at 597.0 bp (YTD change: +267.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index down -0.04% today (YTD total return: -5.5%)

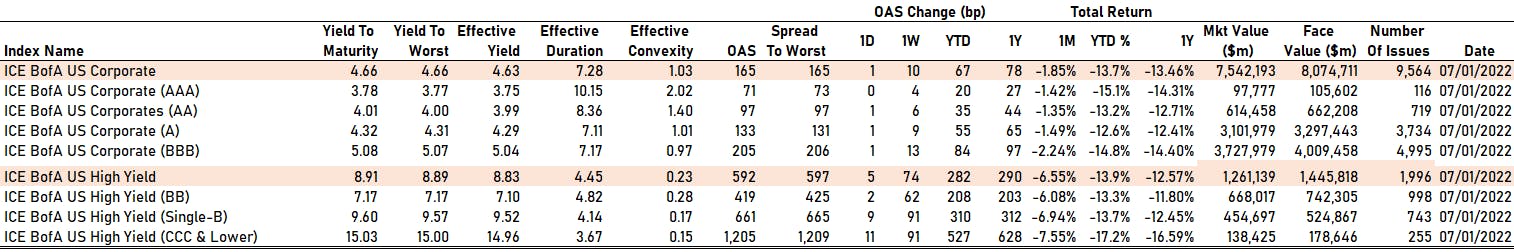

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING TODAY

- AAA unchanged at 71 bp

- AA up by 1 bp at 97 bp

- A up by 1 bp at 133 bp

- BBB up by 1 bp at 205 bp

- BB up by 2 bp at 419 bp

- B up by 9 bp at 661 bp

- CCC up by 11 bp at 1,205 bp

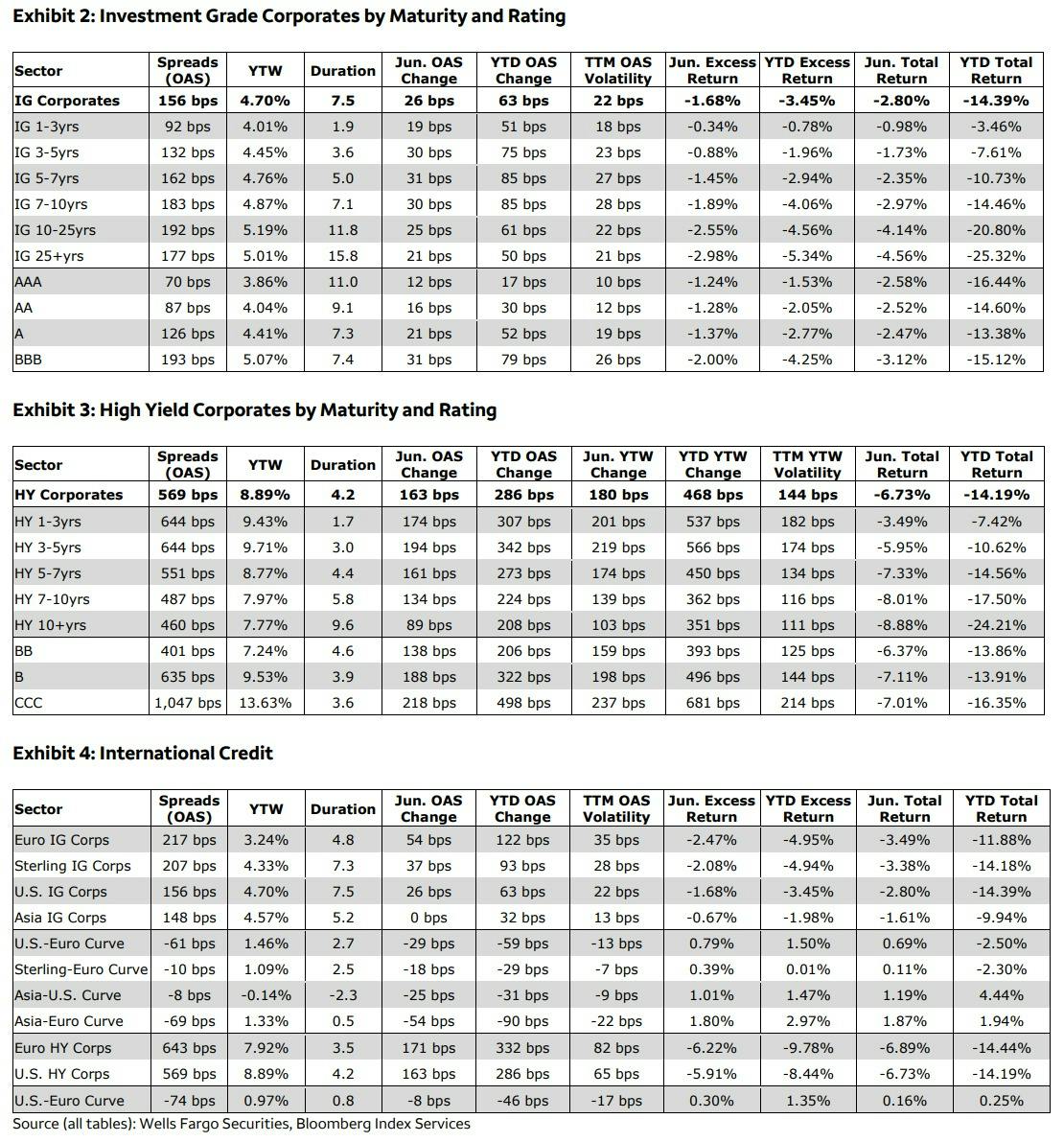

YTD PERFORMANCE OF GLOBAL CREDIT

CDS INDICES TODAY (mid-spreads)

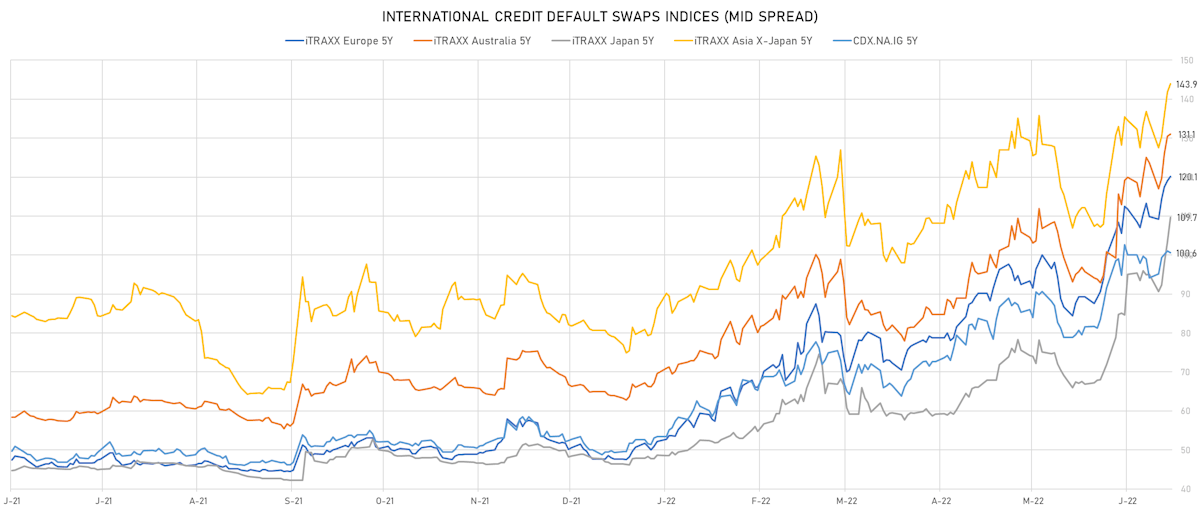

- Markit CDX.NA.IG 5Y down 0.4 bp, now at 101bp (1W change: +6.5bp; YTD change: +51.2bp)

- Markit CDX.NA.IG 10Y down 0.4 bp, now at 133bp (1W change: +5.0bp; YTD change: +43.7bp)

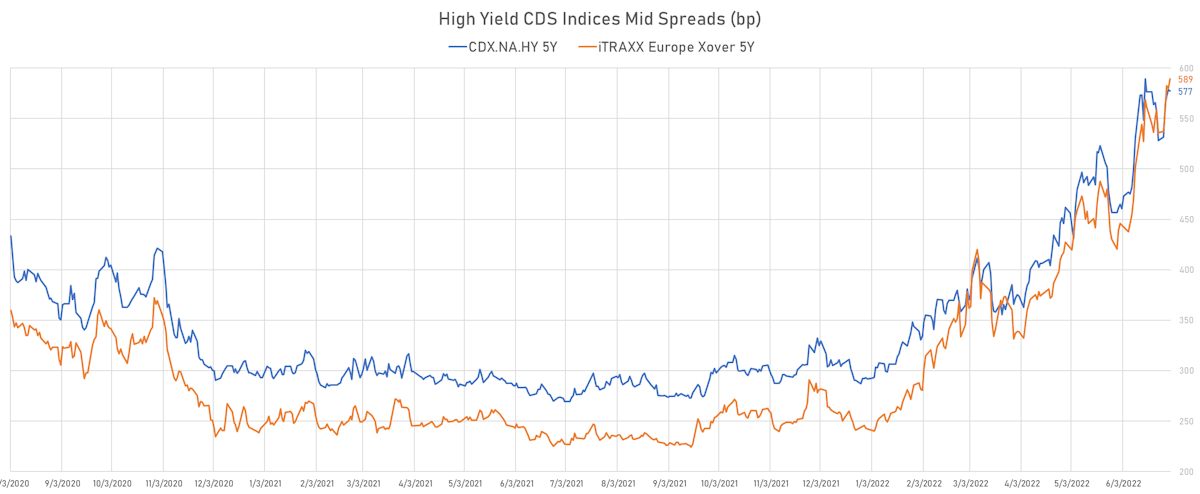

- Markit CDX.NA.HY 5Y down 1.1 bp, now at 577bp (1W change: +49.2bp; YTD change: +285.4bp)

- Markit iTRAXX Europe 5Y up 1.1 bp, now at 120bp (1W change: +10.2bp; YTD change: +72.4bp)

- Markit iTRAXX Europe Crossover 5Y up 9.4 bp, now at 589bp (1W change: +53.3bp; YTD change: +347.3bp)

- Markit iTRAXX Japan 5Y up 6.4 bp, now at 110bp (1W change: +14.7bp; YTD change: +63.3bp)

- Markit iTRAXX Asia Ex-Japan 5Y up 2.2 bp, now at 144bp (1W change: +9.7bp; YTD change: +64.9bp)

5Y USD CDS SINGLE NAMES - LARGEST MOVES OVER THE PAST WEEK

- Petroleos Mexicanos (Country: MX; rated: WR): up 68.0 bp to 710.3bp (1Y range: 302-710bp)

- Beazer Homes USA Inc (Country: US; rated: B2): up 71.6 bp to 881.4bp (1Y range: 278-881bp)

- Macy's Inc (Country: US; rated: Ba1): up 75.7 bp to 546.1bp (1Y range: 181-576bp)

- Gap Inc (Country: US; rated: WR): up 78.1 bp to 658.0bp (1Y range: 132-680bp)

- Genworth Holdings Inc (Country: US; rated: B2): up 78.5 bp to 554.2bp (1Y range: 335-563bp)

- Pactiv LLC (Country: US; rated: Caa1): up 106.8 bp to 1,038.0bp (1Y range: 356-1,041bp)

- Staples Inc (Country: US; rated: B3): up 129.4 bp to 2,142.6bp (1Y range: 803-2,143bp)

- Bombardier Inc (Country: CA; rated: Caa1): up 136.9 bp to 997.4bp (1Y range: 395-1,007bp)

- Bath & Body Works Inc (Country: US; rated: Ba2): up 146.1 bp to 720.4bp (1Y range: 124-720bp)

- Liberty Interactive LLC (Country: US; rated: Ba3): up 156.9 bp to 1,810.7bp (1Y range: 287-1,811bp)

- DISH DBS Corp (Country: US; rated: B2): up 167.0 bp to 1,433.4bp (1Y range: 317-1,433bp)

- American Airlines Group Inc (Country: US; rated: B2): up 185.9 bp to 1,704.3bp (1Y range: 607-1,704bp)

- Transocean Inc (Country: KY; rated: Caa3): up 224.9 bp to 2,239.5bp (1Y range: 941-2,239bp)

- Royal Caribbean Cruises Ltd (Country: US; rated: LGD4 - 59%): up 238.5 bp to 1,192.8bp (1Y range: 299-1,193bp)

- Carnival Corp (Country: US; rated: LGD5 - 72%): up 375.7 bp to 1,391.2bp (1Y range: 316-1,470bp)

5Y EURO CDS SINGLE NAMES - LARGEST MOVES OVER THE PAST WEEK

- CMA CGM SA (Country: FR; rated: Ba2): up 44.2 bp to 607.1bp (1Y range: 259-607bp)

- Virgin Media Finance PLC (Country: GB; rated: WR): up 46.7 bp to 551.6bp (1Y range: 222-552bp)

- Lanxess AG (Country: DE; rated: Baa2): up 48.6 bp to 234.1bp (1Y range: 48-237bp)

- Air France KLM SA (Country: FR; rated: B-): up 75.6 bp to 796.0bp (1Y range: 386-796bp)

- Fortum Oyj (Country: FI; rated: baa3): up 80.2 bp to 323.4bp (1Y range: 40-323bp)

- Altice Finco SA (Country: LU; rated: Caa1): up 89.1 bp to 808.8bp (1Y range: 333-809bp)

- thyssenkrupp AG (Country: DE; rated: B1): up 89.7 bp to 630.8bp (1Y range: 205-631bp)

- Jaguar Land Rover Automotive PLC (Country: GB; rated: WD): up 96.4 bp to 1,047.4bp (1Y range: 339-1,047bp)

- Iceland Bondco PLC (Country: GB; rated: WR): up 97.9 bp to 1,299.0bp (1Y range: 437-1,299bp)

- Stena AB (Country: SE; rated: B2-PD): up 110.1 bp to 780.4bp (1Y range: 401-780bp)

- Ardagh Packaging Finance PLC (Country: IE; rated: B1): up 142.5 bp to 955.0bp (1Y range: 213-955bp)

- Novafives SAS (Country: FR; rated: Caa1): up 168.7 bp to 1,690.6bp (1Y range: 618-1,691bp)

- TUI AG (Country: DE; rated: B3-PD): up 208.6 bp to 1,357.3bp (1Y range: 607-1,357bp)

- Boparan Finance PLC (Country: GB; rated: Caa1): up 229.8 bp to 2,225.9bp (1Y range: 884-2,690bp)

- Casino Guichard Perrachon SA (Country: FR; rated: WR): up 232.4 bp to 1,723.8bp (1Y range: 464-1,801bp)

TOP BONDS MOVES IN THE PAST WEEK - USD HY

- Issuer: NCL Corporation Ltd (Miami, Bermuda) | Coupon: 5.88% | Maturity: 15/3/2026 | Rating: CCC+ | ISIN: USG6436QAL08 | Z-spread up by 195.6 bp to 1,067.6 bp, with the yield to worst at 13.2% and the bond now trading down to 78.0 cents on the dollar (1Y price range: 77.5-100.0).

- Issuer: NCL Finance Ltd (#N/A, United Kingdom) | Coupon: 6.13% | Maturity: 15/3/2028 | Rating: CCC+ | ISIN: USG6437FAA78 | Z-spread up by 173.2 bp to 1,001.5 bp, with the yield to worst at 12.7% and the bond now trading down to 73.0 cents on the dollar (1Y price range: 72.5-99.5).

- Issuer: Southeast Supply Header LLC (Houston, Texas (US)) | Coupon: 4.25% | Maturity: 15/6/2024 | Rating: B | ISIN: USU83854AB29 | Z-spread up by 136.4 bp to 841.3 bp, with the yield to worst at 11.0% and the bond now trading down to 87.5 cents on the dollar (1Y price range: 87.5-102.8).

- Issuer: NCL Corporation Ltd (Miami, Bermuda) | Coupon: 7.75% | Maturity: 15/2/2029 | Rating: CCC+ | ISIN: USG6436QAP12 | Z-spread up by 132.7 bp to 1,034.6 bp, with the yield to worst at 13.0% and the bond now trading down to 76.0 cents on the dollar (1Y price range: 76.0-103.0).

- Issuer: Owens-Brockway Glass Container Inc (Perrysburg, Ohio (US)) | Coupon: 5.38% | Maturity: 15/1/2025 | Rating: B- | ISIN: USU6S19GAC10 | Z-spread up by 108.9 bp to 506.6 bp, with the yield to worst at 7.6% and the bond now trading down to 94.0 cents on the dollar (1Y price range: 93.9-104.1).

- Issuer: Howard Midstream Energy Partners LLC (San Antonio, #N/A (US)) | Coupon: 6.75% | Maturity: 15/1/2027 | Rating: B- | ISIN: USU4425TAA08 | Z-spread up by 108.1 bp to 777.3 bp, with the yield to worst at 10.3% and the bond now trading down to 87.0 cents on the dollar (1Y price range: 86.5-103.3).

- Issuer: Compass Minerals International Inc (Overland Park, Kansas (US)) | Coupon: 4.88% | Maturity: 15/7/2024 | Rating: B+ | ISIN: USU2036YAC04 | Z-spread up by 105.8 bp to 614.0 bp, with the yield to worst at 8.7% and the bond now trading down to 92.0 cents on the dollar (1Y price range: 92.5-102.8).

- Issuer: Owens-Brockway Glass Container Inc (Perrysburg, Ohio (US)) | Coupon: 6.38% | Maturity: 15/8/2025 | Rating: B- | ISIN: USU68337AL58 | Z-spread up by 101.7 bp to 528.2 bp, with the yield to worst at 7.5% and the bond now trading down to 95.0 cents on the dollar (1Y price range: 95.0-108.0).

- Issuer: EQM Midstream Partners LP (Pittsburgh, Pennsylvania (US)) | Coupon: 6.00% | Maturity: 1/7/2025 | Rating: BB- | ISIN: USU26886AA62 | Z-spread up by 101.2 bp to 438.5 bp, with the yield to worst at 7.0% and the bond now trading down to 96.3 cents on the dollar (1Y price range: 96.0-108.5).

- Issuer: WeWork Companies LLC (New York City, New York (US)) | Coupon: 5.00% | Maturity: 10/7/2025 | Rating: CCC- | ISIN: USU9621PAA94 | Z-spread up by 100.7 bp to 1,833.0 bp, with the yield to worst at 20.7% and the bond now trading down to 65.0 cents on the dollar (1Y price range: 64.0-84.9).

- Issuer: EQM Midstream Partners LP (Pittsburgh, Pennsylvania (US)) | Coupon: 4.50% | Maturity: 15/1/2029 | Rating: BB- | ISIN: USU26886AC29 | Z-spread up by 95.5 bp to 536.9 bp, with the yield to worst at 8.1% and the bond now trading down to 81.0 cents on the dollar (1Y price range: 81.0-103.5).

- Issuer: Xerox Holdings Corp (Norwalk, Connecticut (US)) | Coupon: 5.50% | Maturity: 15/8/2028 | Rating: BB | ISIN: USU98401AB58 | Z-spread up by 94.4 bp to 599.6 bp, with the yield to worst at 8.7% and the bond now trading down to 84.0 cents on the dollar (1Y price range: 84.0-105.5).

- Issuer: Xerox Holdings Corp (Norwalk, Connecticut (US)) | Coupon: 5.50% | Maturity: 15/8/2028 | Rating: BB | ISIN: USU98401AD15 | Z-spread up by 94.4 bp to 599.6 bp, with the yield to worst at 8.7% and the bond now trading down to 84.0 cents on the dollar (1Y price range: 84.0-105.5).

- Issuer: Taylor Morrison Communities Inc (Scottsdale, Arizona (US)) | Coupon: 5.88% | Maturity: 15/6/2027 | Rating: BB- | ISIN: USU8760NAA73 | Z-spread up by 93.2 bp to 489.6 bp, with the yield to worst at 7.6% and the bond now trading down to 92.0 cents on the dollar (1Y price range: 92.0-111.9).

- Issuer: Rockies Express Pipeline LLC (Leawood, Kansas (US)) | Coupon: 3.60% | Maturity: 15/5/2025 | Rating: BB | ISIN: USU75111AK72 | Z-spread up by 89.1 bp to 474.8 bp, with the yield to worst at 7.3% and the bond now trading down to 89.5 cents on the dollar (1Y price range: 89.0-103.0).

TOP BONDS MOVES IN THE PAST WEEK - EUR HY

- Issuer: DIC Asset AG (Frankfurt, Germany) | Coupon: 2.25% | Maturity: 22/9/2026 | Rating: BB+ | ISIN: XS2388910270 | Z-spread up by 264.7 bp to 1,162.7 bp, with the yield to worst at 12.6% and the bond now trading down to 66.4 cents on the dollar (1Y price range: 66.4-95.9).

- Issuer: Mahle GmbH (Stuttgart, Germany) | Coupon: 2.38% | Maturity: 14/5/2028 | Rating: BB+ | ISIN: XS2341724172 | Z-spread up by 171.8 bp to 859.8 bp, with the yield to worst at 10.1% and the bond now trading down to 66.4 cents on the dollar (1Y price range: 65.9-97.6).

- Issuer: MAS Securities BV (S-Gravenhage, Netherlands) | Coupon: 4.25% | Maturity: 19/5/2026 | Rating: BB | ISIN: XS2339025277 | Z-spread up by 145.3 bp to 1,085.1 bp, with the yield to worst at 12.2% and the bond now trading down to 76.1 cents on the dollar (1Y price range: 82.6-96.2).

- Issuer: Vivion Investments SARL (Luxembourg, Luxembourg) | Coupon: 3.50% | Maturity: 1/11/2025 | Rating: BB+ | ISIN: XS2070311431 | Z-spread up by 143.6 bp to 768.0 bp, with the yield to worst at 8.3% and the bond now trading down to 84.6 cents on the dollar (1Y price range: 84.1-99.2).

- Issuer: Deutsche Lufthansa AG (Cologne, Germany) | Coupon: 2.88% | Maturity: 11/2/2025 | Rating: BB- | ISIN: XS2296201424 | Z-spread up by 134.3 bp to 644.6 bp (CDS basis: -245.0bp), with the yield to worst at 7.3% and the bond now trading down to 89.0 cents on the dollar (1Y price range: 88.7-102.3).

- Issuer: International Consolidated Airlines Group SA (Harmondsworth, Spain) | Coupon: 2.75% | Maturity: 25/3/2025 | Rating: B+ | ISIN: XS2322423455 | Z-spread up by 133.8 bp to 815.4 bp, with the yield to worst at 9.3% and the bond now trading down to 84.6 cents on the dollar (1Y price range: 84.2-99.8).

- Issuer: Dometic Group AB (publ) (Solna, Sweden) | Coupon: 3.00% | Maturity: 8/5/2026 | Rating: BB- | ISIN: XS1991114858 | Z-spread up by 127.4 bp to 595.3 bp, with the yield to worst at 7.0% and the bond now trading down to 85.8 cents on the dollar (1Y price range: 85.2-105.2).

- Issuer: Deutsche Lufthansa AG (Cologne, Germany) | Coupon: 2.88% | Maturity: 16/5/2027 | Rating: BB- | ISIN: XS2408458730 | Z-spread up by 125.1 bp to 685.3 bp (CDS basis: -184.8bp), with the yield to worst at 8.2% and the bond now trading down to 78.6 cents on the dollar (1Y price range: 78.2-99.9).

- Issuer: Deutsche Lufthansa AG (Cologne, Germany) | Coupon: 3.00% | Maturity: 29/5/2026 | Rating: BB- | ISIN: XS2265369657 | Z-spread up by 120.7 bp to 648.8 bp (CDS basis: -182.3bp), with the yield to worst at 7.6% and the bond now trading down to 84.0 cents on the dollar (1Y price range: 83.8-102.0).

- Issuer: Deutsche Lufthansa AG (Cologne, Germany) | Coupon: 3.50% | Maturity: 14/7/2029 | Rating: BB- | ISIN: XS2363235107 | Z-spread up by 115.7 bp to 660.7 bp (CDS basis: -115.4bp), with the yield to worst at 8.2% and the bond now trading down to 74.8 cents on the dollar (1Y price range: 74.4-101.7).

- Issuer: Nexi SpA (Milan, Italy) | Coupon: 1.63% | Maturity: 30/4/2026 | Rating: BB- | ISIN: XS2332589972 | Z-spread up by 113.3 bp to 587.4 bp, with the yield to worst at 7.2% and the bond now trading down to 81.7 cents on the dollar (1Y price range: 81.0-99.7).

- Issuer: Spie SA (Cergy-Pontoise, France) | Coupon: 2.63% | Maturity: 18/6/2026 | Rating: BB | ISIN: FR0013426376 | Z-spread up by 112.7 bp to 437.3 bp, with the yield to worst at 5.5% and the bond now trading down to 89.0 cents on the dollar (1Y price range: 90.4-104.0).

- Issuer: Deutsche Lufthansa AG (Cologne, Germany) | Coupon: 3.75% | Maturity: 11/2/2028 | Rating: BB- | ISIN: XS2296203123 | Z-spread up by 110.2 bp to 671.1 bp (CDS basis: -153.2bp), with the yield to worst at 8.1% and the bond now trading down to 80.0 cents on the dollar (1Y price range: 79.9-103.5).

- Issuer: Schaeffler AG (Herzogenaurach, Germany) | Coupon: 2.75% | Maturity: 12/10/2025 | Rating: BB+ | ISIN: DE000A289Q91 | Z-spread up by 99.7 bp to 418.1 bp, with the yield to worst at 5.4% and the bond now trading down to 91.8 cents on the dollar (1Y price range: 91.5-106.3).

- Issuer: International Consolidated Airlines Group SA (Harmondsworth, Spain) | Coupon: 1.50% | Maturity: 4/7/2027 | Rating: B+ | ISIN: XS2020581752 | Z-spread up by 95.4 bp to 835.7 bp, with the yield to worst at 9.8% and the bond now trading down to 67.9 cents on the dollar (1Y price range: 67.6-91.3).

RECENT DOMESTIC USD BOND ISSUES

- Citigroup Global Markets Holdings Inc (Securities | New York City, New York, United States | Rating: A): US$250m Unsecured Note (XS2474853095), fixed rate (3.50% coupon) maturing on 13 July 2024, priced at 100.00, non callable

- Cytokinetics Inc (Chemicals | South San Francisco, United States | Rating: NR): US$450m Bond, fixed rate (3.50% coupon) maturing on 1 July 2027, priced at 100.00, non callable, convertible

- F&G Global Funding (Financial - Other | Wilmington, Delaware, United States | Rating: NR): US$300m Note (US30321L2E12), fixed rate (5.15% coupon) maturing on 7 July 2025, priced at 99.93 (original spread of 210 bp), non callable

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$170m Bond (US3133ENZU71), fixed rate (3.64% coupon) maturing on 5 July 2024, priced at 100.00 (original spread of 78 bp), callable (2nc6m)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: NR): US$500m Bond (US3133ENZW38), floating rate (SOFR + 6.0 bp) maturing on 8 July 2024, priced at 100.00, non callable

- Goldman Sachs Group Inc (Banking | New York City, New York, United States | Rating: BBB+): US$150m Senior Note (XS2470196002), fixed rate (3.45% coupon) maturing on 29 July 2026, priced at 100.00, non callable

- Protective Life Global Funding (Financial - Other | Wilmington, United States | Rating: NR): US$300m Note (US74368EBK55), fixed rate (4.71% coupon) maturing on 6 July 2027, priced at 100.00 (original spread of 148 bp), non callable

RECENT INTERNATIONAL USD BOND ISSUES

- African Development Bank (Supranational | Abidjan, Ivory Coast | Rating: AAA): US$1,000m Senior Note (US00828EEN58), fixed rate (3.38% coupon) maturing on 7 July 2025, priced at 99.98 (original spread of 16 bp), non callable

- African Development Bank (Supranational | Abidjan, Ivory Coast | Rating: AAA): US$150m Unsecured Note (XS2497502638), fixed rate (3.50% coupon) maturing on 7 July 2025, priced at 100.00 (original spread of 27 bp), non callable

- Bank of East Asia Ltd (Banking | Hong Kong | Rating: BBB): US$250m Note (XS2381248835), fixed rate (5.13% coupon) maturing on 7 July 2028, priced at 99.77 (original spread of 207 bp), callable (6nc5)

- Chengdu Economic Development Industry Investment Group Co Ltd (Financial - Other | Chengdu, Sichuan, China (Mainland) | Rating: NR): US$200m Senior Note (XS2496620977), fixed rate (5.50% coupon) maturing on 6 July 2025, priced at 100.00, non callable

- China Railway Xunjie Co Ltd (Financial - Other | Beijing, China (Mainland) | Rating: A-): US$500m Bond (XS2486840544), fixed rate (4.00% coupon) maturing on 6 July 2027, priced at 99.56 (original spread of 83 bp), non callable

- Dar Al-Arkan Sukuk Company Ltd (Financial - Other | George Town, Cayman Islands | Rating: NR): US$400m Islamic Sukuk (Hybrid) (XS2491049651), fixed rate (7.75% coupon) maturing on 7 February 2026, priced at 99.22, non callable

- FTAI Infra Escrow Holdings LLC (Financial - Other | Rating: B-): US$450m Note (US30327TAA79), fixed rate (10.50% coupon) maturing on 1 June 2027, priced at 94.59 (original spread of 886 bp), callable (5nc3)

- Hongkong International Qingdao Co Ltd (Financial - Other | Shandong, China (Mainland) | Rating: NR): US$750m Senior Note (XS2487638764), fixed rate (4.80% coupon) maturing on 8 July 2025, priced at 100.00 (original spread of 225 bp), non callable

- Nomura Holdings Inc (Securities | Chiyoda-Ku, Tokyo-To, Japan | Rating: BBB+): US$800m Senior Note (US65535HBE80), fixed rate (5.10% coupon) maturing on 3 July 2025, priced at 100.00 (original spread of 195 bp), non callable

- Nomura Holdings Inc (Securities | Chiyoda-Ku, Tokyo-To, Japan | Rating: BBB+): US$500m Senior Note (US65535HBF55), fixed rate (5.39% coupon) maturing on 6 July 2027, priced at 100.00 (original spread of 250 bp), non callable

- Nomura Holdings Inc (Securities | Chiyoda-Ku, Tokyo-To, Japan | Rating: BBB+): US$600m Senior Note (US65535HBC25), fixed rate (5.61% coupon) maturing on 6 July 2029, priced at 100.00 (original spread of 267 bp), non callable

- NongHyup Bank (Banking | Seoul, Seoul, South Korea | Rating: A+): US$300m Bond (US65540KAH86), fixed rate (4.00% coupon) maturing on 6 January 2026, priced at 99.76 (original spread of 96 bp), non callable

- NongHyup Bank (Banking | Seoul, Seoul, South Korea | Rating: A+): US$300m Senior Note (US65540KAJ43), fixed rate (4.25% coupon) maturing on 6 July 2027, priced at 99.70 (original spread of 115 bp), non callable

- Pentair Finance SARL (Financial - Other | Luxembourg, United Kingdom | Rating: BBB-): US$400m Senior Note (US709629AS88), fixed rate (5.90% coupon) maturing on 15 July 2032, priced at 97.81 (original spread of 300 bp), callable (10nc10)

- QIB Sukuk Ltd (Financial - Other | George Town, Qatar | Rating: NR): US$1,000m Unsecured Note (XS2407041701), fixed rate (1.00% coupon) maturing on 23 November 2026, priced at 100.00, non callable

SELECTED RECENT EUR BOND ISSUES

- ALD SA (Leasing | Reuil-Malmaison, France | Rating: BBB): €500m Senior Note (XS2498554992), fixed rate (4.00% coupon) maturing on 5 July 2027, priced at 99.59 (original spread of 273 bp), non callable

- Aib Group PLC (Banking | Dublin, Ireland | Rating: BBB-): €750m Senior Note (XS2491963638), fixed rate (3.63% coupon) maturing on 4 July 2026, priced at 99.70 (original spread of 279 bp), callable (4nc3)

- Aries Capital DAC (Financial - Other | Dublin, Dublin, Ireland | Rating: NR): €1,030m Unsecured Note (XS2497486337), fixed rate (2.00% coupon) maturing on 8 July 2027, priced at 100.00, non callable

- Assicurazioni Generali SpA (Life Insurance | Trieste, Trieste, Italy | Rating: BBB): €500m Subordinated Note (XS2468223107), fixed rate (5.80% coupon) maturing on 6 July 2032, priced at 100.00 (original spread of 450 bp), callable (10nc10)

- Barclays Bank PLC (Banking | London, United Kingdom | Rating: A): €180m Unsecured Note (XS2497509567) zero coupon maturing on 17 December 2025, non callable

- Credito Emiliano Holding SpA (Banking | Reggio Nell'Emilia, Reggio Emilia, Italy | Rating: BB+): €200m Subordinated Note (XS2488465423), fixed rate (7.63% coupon) maturing on 5 October 2032, priced at 100.00 (original spread of 649 bp), callable (10nc5)

- Fluvius System Operator CVBA (Utility - Other | Melle, Oost-Vlaanderen, Belgium | Rating: A-): €500m Bond (BE0002871524), fixed rate (4.00% coupon) maturing on 6 July 2032, priced at 99.34 (original spread of 256 bp), callable (10nc10)

- Hessen, State of (Official and Muni | Wiesbaden, Hessen, Germany | Rating: AA+): €1,125m Inhaberschuldverschreibung (DE000A1RQEE0), fixed rate (1.75% coupon) maturing on 5 July 2027, priced at 99.58 (original spread of 57 bp), non callable

- Italy, Republic of (Government) (Sovereign | Rome, Roma, Italy | Rating: BBB-): €5,200m Buono del Tesoro Poliennali (IT0005500068), fixed rate (2.65% coupon) maturing on 1 December 2027, priced at 99.62 (original spread of 153 bp), non callable

- KfW (Agency | Frankfurt, Hessen, Germany | Rating: AAA): €4,000m Senior Note (XS2498154207), fixed rate (2.00% coupon) maturing on 15 November 2029, priced at 99.17 (original spread of 63 bp), non callable

- Maxima Grupe UAB (Retail Stores - Food/Drug | Vilnius, Lithuania | Rating: BB+): €240m Senior Note (XS2485155464), fixed rate (6.25% coupon) maturing on 12 July 2027, priced at 98.96 (original spread of 569 bp), callable (5nc5)

- PKO Bank Hipoteczny SA (Mortgage Banking | Warsaw, Woj. Mazowieckie, Poland | Rating: A-): €500m Covered Bond (Other) (XS2495085784), fixed rate (2.13% coupon) maturing on 25 June 2025, priced at 99.98 (original spread of 115 bp), non callable

- RCI Banque SA (Financial - Other | Paris, Ile-De-France, France | Rating: BBB): €500m Bond (FR001400B1L7), fixed rate (4.75% coupon) maturing on 6 July 2027, priced at 99.76 (original spread of 363 bp), callable (5nc5)

- Raiffeisen landesbank Tirol AG (Banking | Innsbruck, Tirol, Austria | Rating: A-): €250m Fundierte Schuldverschreibungen (Covered Bond) (AT0000A2YPB2), floating rate (EU03MLIB + 0.0 bp) maturing on 5 July 2027, priced at 100.00, non callable

- Raiffeisenlandesbank Niederoesterreich Wien AG (Banking | Wien, Wien, Austria | Rating: A-): €750m Covered Bond (Other) (XS2498470116), fixed rate (2.00% coupon) maturing on 5 January 2026, priced at 99.66 (original spread of 107 bp), non callable

- Raiffeisenlandesbank Niederoesterreich Wien AG (Banking | Wien, Austria | Rating: A-): €1,000m Fundierte Schuldverschreibungen (Covered Bond) (AT000B078779), floating rate (EU03MLIB + 28.0 bp) maturing on 6 July 2026, priced at 100.00, non callable

- UniCredit SpA (Banking | Milan, Italy | Rating: BBB): €625m Senior Note (XS2499011059), fixed rate (3.35% coupon) maturing on 27 July 2027, priced at 100.00, non callable

NEW LOANS

- I Squared Capital Advisors LLC, signed a US$ 250m Revolving Credit / Term Loan, to be used for capital expenditures.

NEW ISSUES IN SECURITIZED CREDIT

- Sabey Data Center Issuer 2022-1 LLC issued a fixed-rate ABS backed by certificates in 1 tranche, for a total of US$ 171 m. Bookrunners: Guggenheim Securities LLC

- Sesac Finance LLC Series 2022-1 issued a fixed-rate ABS backed by business cashflow in 2 tranches, for a total of US$ 302 m. Highest-rated tranche offering a yield to maturity of 5.50%, and the lowest-rated tranche a yield to maturity of 6.69%. Bookrunners: Barclays Capital Group, Guggenheim Securities LLC

- New Residential Mortgage Loan Trust 2022-Nqm4 issued a fixed-rate RMBS in 3 tranches, for a total of US$ 234 m. Bookrunners: Nomura Securities New York Inc, Amherst Securities Corp, Goldman Sachs & Co, Morgan Stanley International Ltd, Deutsche Bank Securities Inc