Credit

Positive Seasonality For Credit With Limited Issuance, As Earnings Season Hits Full Stride Next Week (14% Of S&P 500 Reporting 2Q22 Results)

Weekly volume of US$ corporate issuance (IFR data): 10 tranches for $10.05bn in IG (2022 YTD volume S$759.6bn vs 2021 YTD US$894.6bn) and no new issue in HY for the second straight week (2022 YTD volume $67.8bn vs 2021 YTD $294.1bn)

Published ET

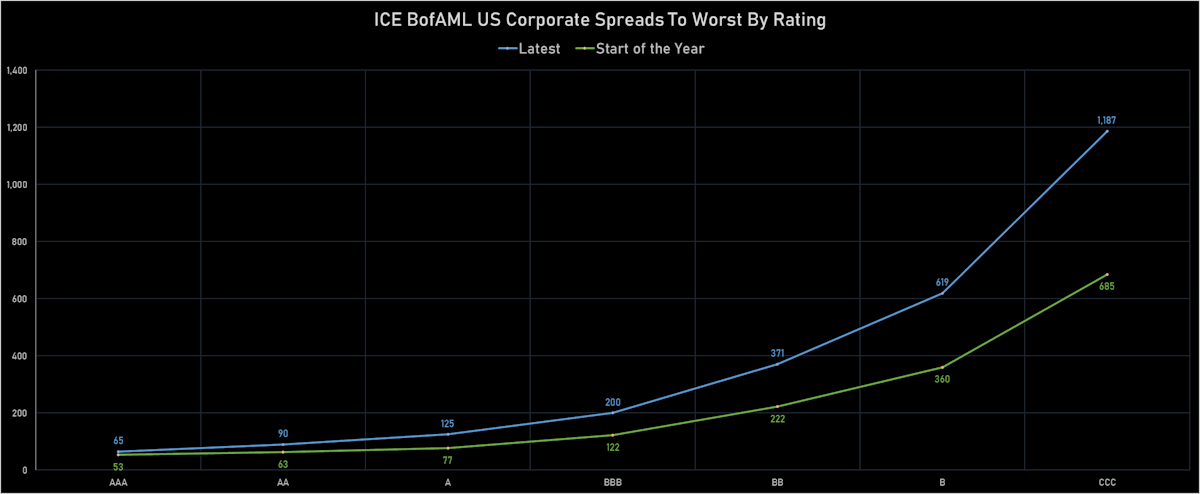

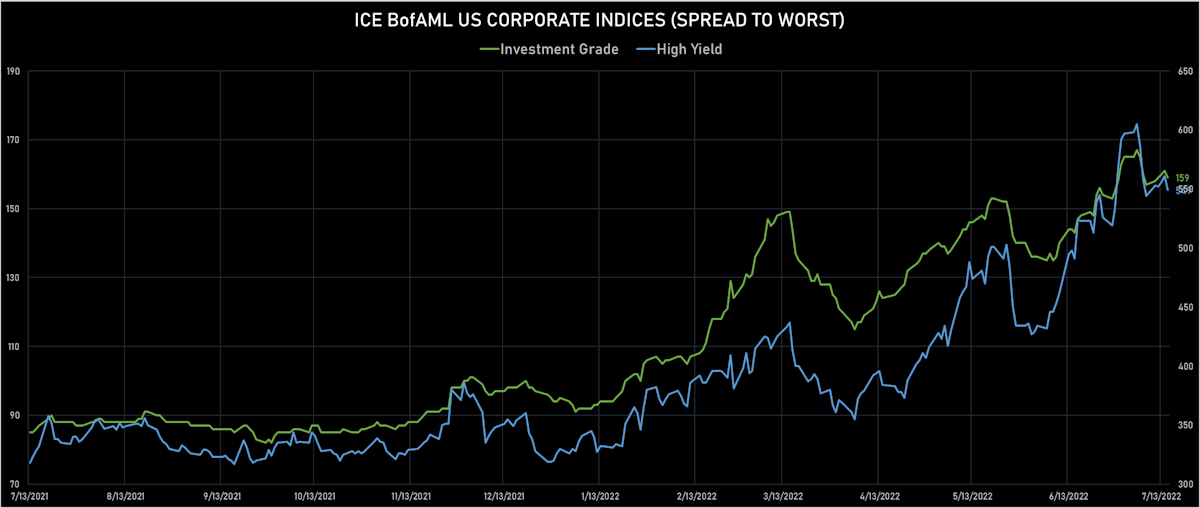

Spreads To Worst On ICE BofAML US Corporate Indices | Sources: ϕpost, Refinitiv data

DAILY SUMMARY

- S&P 500 Bond Index was up 0.43% today, with investment grade up 0.41% and high yield up 0.63% (YTD total return: -12.64%)

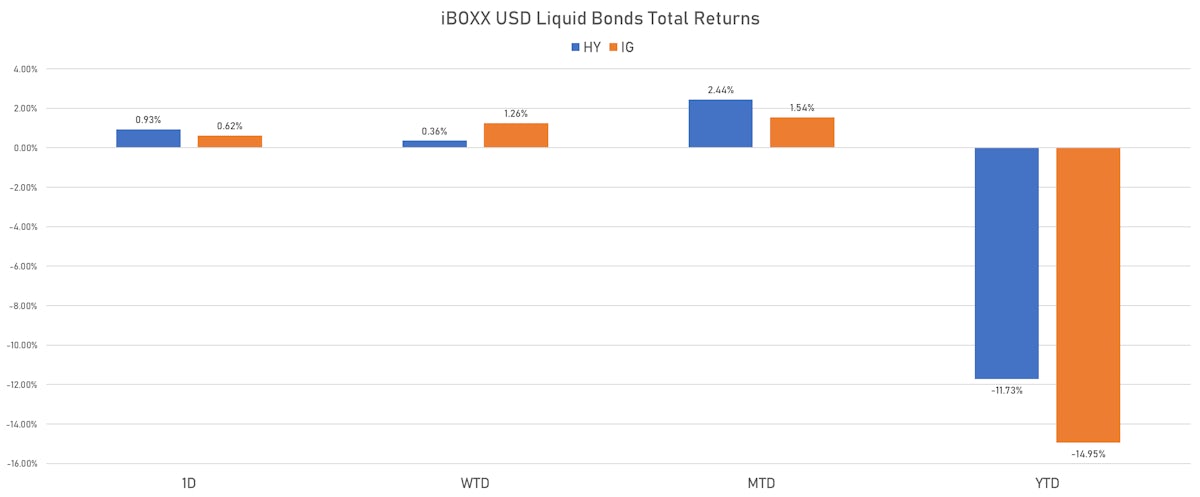

- The iBoxx USD Liquid Investment Grade Total Return Index was up 0.625% today (Month-to-date: 1.54%; Year-to-date: -14.95%)

- The iBoxx USD Liquid High Yield Total Return Index was up 0.934% today (Month-to-date: 2.44%; Year-to-date: -11.73%)

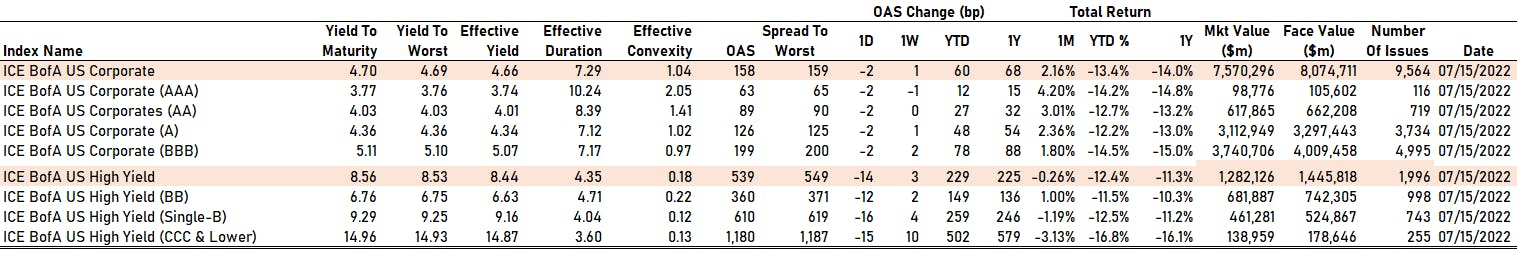

- ICE BofA US Corporate Index (Investment Grade) spread to worst down -2.0 bp, now at 159.0 bp (YTD change: +64.0 bp)

- ICE BofA US High Yield Index spread to worst down -12.0 bp, now at 549.0 bp (YTD change: +219.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index up 0.21% today (YTD total return: -4.6%)

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING TODAY

- AAA down by -2 bp at 63 bp

- AA down by -2 bp at 89 bp

- A down by -2 bp at 126 bp

- BBB down by -2 bp at 199 bp

- BB down by -12 bp at 360 bp

- B down by -16 bp at 610 bp

- ≤ CCC down by -15 bp at 1,180 bp

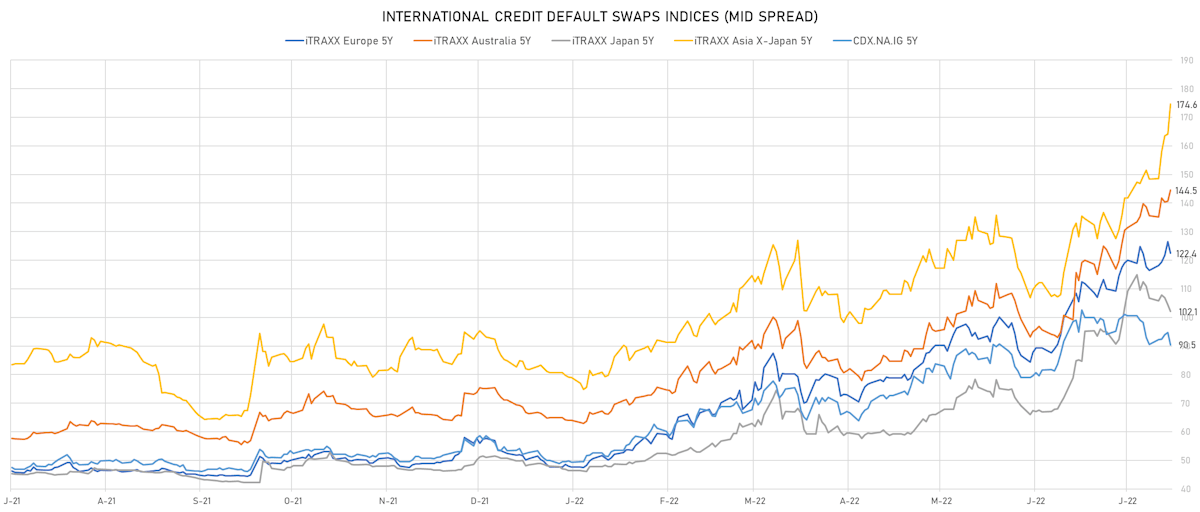

CDS INDICES TODAY (mid-spreads)

- Markit CDX.NA.IG 5Y down 4.2 bp, now at 90bp (1W change: 0.0bp; YTD change: +41.1bp)

- Markit CDX.NA.IG 10Y down 3.9 bp, now at 123bp (1W change: -0.3bp; YTD change: +34.2bp)

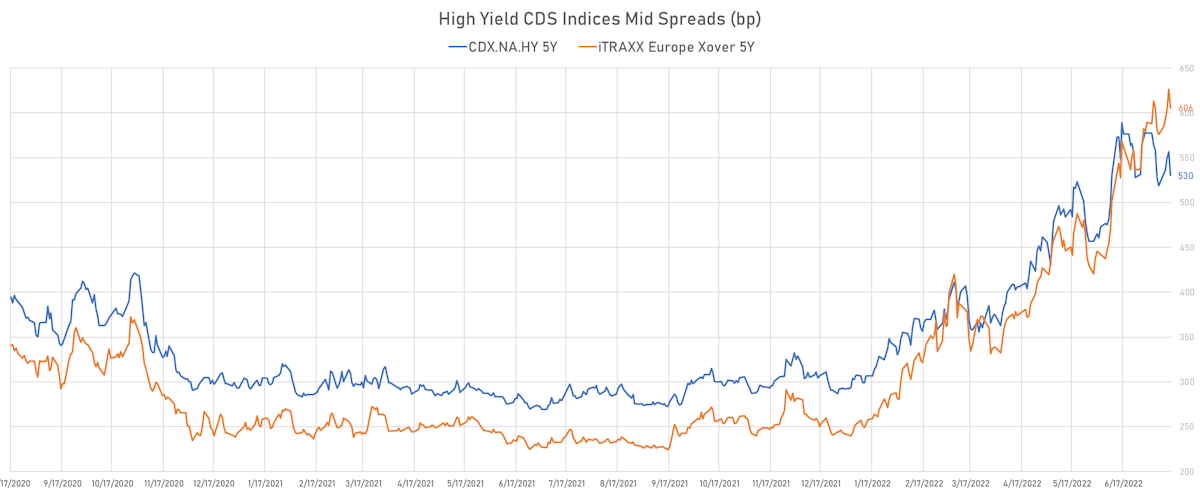

- Markit CDX.NA.HY 5Y down 26.2 bp, now at 530bp (1W change: +11.2bp; YTD change: +238.3bp)

- Markit iTRAXX Europe 5Y down 4.1 bp, now at 122bp (1W change: +6.0bp; YTD change: +74.7bp)

- Markit iTRAXX Europe Crossover 5Y down 20.5 bp, now at 606bp (1W change: +29.7bp; YTD change: +363.6bp)

- Markit iTRAXX Japan 5Y down 2.3 bp, now at 102bp (1W change: -4.6bp; YTD change: +55.7bp)

- Markit iTRAXX Asia Ex-Japan 5Y up 10.5 bp, now at 175bp (1W change: +26.1bp; YTD change: +95.5bp)

5Y USD CDS SINGLE NAMES - LARGEST MOVES OVER THE PAST WEEK

- Domtar Corp (Country: US; rated: LGD3 - 42%): up 113.6 bp to 689.9bp (1Y range: 233-690bp)

- Nordstrom Inc (Country: US; rated: A3): up 131.9 bp to 612.3bp (1Y range: 211-612bp)

- Petroleos Mexicanos (Country: MX; rated: WR): up 133.2 bp to 775.5bp (1Y range: 302-775bp)

- Bath & Body Works Inc (Country: US; rated: Ba2): up 153.2 bp to 727.4bp (1Y range: 124-727bp)

- Liberty Interactive LLC (Country: US; rated: Ba3): up 153.2 bp to 1,807.0bp (1Y range: 287-1,807bp)

- Murphy Oil Corp (Country: US; rated: Ba2): up 158.9 bp to 497.3bp (1Y range: 240-497bp)

- Macy's Inc (Country: US; rated: Ba1): up 159.8 bp to 630.1bp (1Y range: 181-630bp)

- Staples Inc (Country: US; rated: B3): up 198.7 bp to 2,211.9bp (1Y range: 803-2,212bp)

- Weatherford International Ltd (Country: US; rated: B2): up 221.8 bp to 728.5bp (1Y range: -729bp)

- Gap Inc (Country: US; rated: WR): up 233.1 bp to 813.0bp (1Y range: 132-813bp)

- DISH DBS Corp (Country: US; rated: B2): up 261.9 bp to 1,528.3bp (1Y range: 317-1,528bp)

- Nabors Industries Inc (Country: US; rated: B3): up 269.7 bp to 998.8bp (1Y range: 489-1,096bp)

- Carnival Corp (Country: US; rated: LGD5 - 72%): up 424.9 bp to 1,440.4bp (1Y range: 316-1,470bp)

- Royal Caribbean Cruises Ltd (Country: US; rated: LGD4 - 59%): up 566.3 bp to 1,520.6bp (1Y range: 299-1,521bp)

5Y EURO CDS SINGLE NAMES - LARGEST MOVES OVER THE PAST WEEK

- Unilabs SubHolding AB (publ) (Country: SE; rated: WR): up 94.5 bp to 238.5bp (1Y range: -239bp)

- Rolls-Royce PLC (Country: GB; rated: BB-): up 96.1 bp to 525.0bp (1Y range: 161-525bp)

- CMA CGM SA (Country: FR; rated: Ba2): up 96.9 bp to 659.8bp (1Y range: 259-660bp)

- Iceland Bondco PLC (Country: GB; rated: WR): up 101.1 bp to 1,302.2bp (1Y range: 437-1,302bp)

- Stena AB (Country: SE; rated: B2-PD): up 111.1 bp to 781.4bp (1Y range: 401-781bp)

- Lanxess AG (Country: DE; rated: Baa2): up 115.9 bp to 301.3bp (1Y range: 48-301bp)

- thyssenkrupp AG (Country: DE; rated: B1): up 126.9 bp to 668.0bp (1Y range: 205-668bp)

- Boparan Finance PLC (Country: GB; rated: Caa1): up 129.8 bp to 2,125.9bp (1Y range: 884-2,690bp)

- Altice Finco SA (Country: LU; rated: Caa1): up 228.7 bp to 948.5bp (1Y range: 333-948bp)

- Air France KLM SA (Country: FR; rated: B-): up 279.0 bp to 999.4bp (1Y range: 386-999bp)

- Casino Guichard Perrachon SA (Country: FR; rated: WR): up 279.6 bp to 1,771.1bp (1Y range: 464-1,801bp)

- Novafives SAS (Country: FR; rated: Caa1): up 323.9 bp to 1,845.8bp (1Y range: 618-1,846bp)

- Jaguar Land Rover Automotive PLC (Country: GB; rated: WD): up 325.2 bp to 1,276.3bp (1Y range: 339-1,276bp)

- Ardagh Packaging Finance PLC (Country: IE; rated: B1): up 367.7 bp to 1,180.2bp (1Y range: 213-1,180bp)

- TUI AG (Country: DE; rated: B3-PD): up 549.1 bp to 1,697.9bp (1Y range: 607-1,698bp)

TOP BONDS MOVES IN THE PAST WEEK - USD HY

- Issuer: Natura &Co Luxembourg Holdings SARL (Luxembourg, Luxembourg) | Coupon: 6.00% | Maturity: 19/4/2029 | Rating: BB | ISIN: USL6S52VAA02 | Z-spread up by 86.6 bp to 613.3 bp, with the yield to worst at 9.0% and the bond now trading down to 84.3 cents on the dollar (1Y price range: 84.3-99.9).

- Issuer: Owens-Brockway Glass Container Inc (Perrysburg, Ohio (US)) | Coupon: 6.38% | Maturity: 15/8/2025 | Rating: B- | ISIN: USU68337AL58 | Z-spread up by 64.6 bp to 548.7 bp, with the yield to worst at 7.8% and the bond now trading down to 94.3 cents on the dollar (1Y price range: 94.3-108.0).

- Issuer: Hat Holdings I LLC (Annapolis, Maryland (US)) | Coupon: 3.75% | Maturity: 15/9/2030 | Rating: BB+ | ISIN: USU2467RAD18 | Z-spread up by 64.2 bp to 471.4 bp, with the yield to worst at 7.5% and the bond now trading down to 77.0 cents on the dollar (1Y price range: 77.0-100.1).

- Issuer: Owens-Brockway Glass Container Inc (Perrysburg, Ohio (US)) | Coupon: 5.38% | Maturity: 15/1/2025 | Rating: B- | ISIN: USU6S19GAC10 | Z-spread up by 58.3 bp to 541.3 bp, with the yield to worst at 8.1% and the bond now trading down to 93.0 cents on the dollar (1Y price range: 93.0-104.1).

- Issuer: American Airlines Group Inc (Fort Worth, Texas (US)) | Coupon: 3.75% | Maturity: 1/3/2025 | Rating: CCC | ISIN: USU0242AAD47 | Z-spread up by 57.9 bp to 754.5 bp (CDS basis: 649.7bp), with the yield to worst at 10.4% and the bond now trading down to 84.8 cents on the dollar (1Y price range: 83.5-95.6).

- Issuer: Necessity Retail REIT Inc (New York City, New York (US)) | Coupon: 4.50% | Maturity: 30/9/2028 | Rating: BB+ | ISIN: USU0262AAA52 | Z-spread up by 47.6 bp to 612.1 bp, with the yield to worst at 9.0% and the bond now trading down to 78.3 cents on the dollar (1Y price range: 78.3-100.4).

- Issuer: Bath & Body Works Inc (Columbus, Ohio (US)) | Coupon: 9.38% | Maturity: 1/7/2025 | Rating: BB | ISIN: USU51407AD34 | Z-spread up by 46.9 bp to 572.3 bp, with the yield to worst at 8.6% and the bond now trading down to 101.5 cents on the dollar (1Y price range: 100.6-122.3).

- Issuer: Western Global Airlines LLC (Estero, Florida (US)) | Coupon: 10.38% | Maturity: 15/8/2025 | Rating: B- | ISIN: USU95558AA72 | Z-spread up by 46.6 bp to 871.4 bp, with the yield to worst at 11.6% and the bond now trading down to 96.0 cents on the dollar (1Y price range: 96.0-111.3).

- Issuer: OCP SA (Casablanca, Morocco) | Coupon: 6.88% | Maturity: 25/4/2044 | Rating: BB+ | ISIN: XS1061043367 | Z-spread up by 44.1 bp to 599.7 bp (CDS basis: -243.4bp), with the yield to worst at 8.8% and the bond now trading down to 81.1 cents on the dollar (1Y price range: 82.8-116.3).

- Issuer: Howard Midstream Energy Partners LLC (San Antonio, #N/A (US)) | Coupon: 6.75% | Maturity: 15/1/2027 | Rating: B- | ISIN: USU4425TAA08 | Z-spread up by 43.7 bp to 794.7 bp, with the yield to worst at 10.6% and the bond now trading down to 86.0 cents on the dollar (1Y price range: 86.0-103.3).

- Issuer: Braskem America Finance Co (PHILADELPHIA, Pennsylvania (US)) | Coupon: 7.13% | Maturity: 22/7/2041 | Rating: BB+ | ISIN: USU1065PAA94 | Z-spread up by 43.5 bp to 488.0 bp (CDS basis: -39.5bp), with the yield to worst at 8.0% and the bond now trading down to 90.5 cents on the dollar (1Y price range: 90.5-129.0).

- Issuer: Starwood Property Trust Inc (Greenwich, #N/A (US)) | Coupon: 3.75% | Maturity: 31/12/2024 | Rating: BB- | ISIN: USU85656AG86 | Z-spread down by 44.1 bp to 356.3 bp, with the yield to worst at 6.8% and the bond now trading up to 93.0 cents on the dollar (1Y price range: 90.0-101.4).

- Issuer: Molina Healthcare Inc (Long Beach, California (US)) | Coupon: 3.88% | Maturity: 15/11/2030 | Rating: BB- | ISIN: USU60868AD52 | Z-spread down by 46.4 bp to 237.4 bp, with the yield to worst at 5.2% and the bond now trading up to 89.9 cents on the dollar (1Y price range: 82.5-103.4).

- Issuer: Brinker International Inc (Dallas, Texas (US)) | Coupon: 5.00% | Maturity: 1/10/2024 | Rating: B+ | ISIN: USU6223WAB01 | Z-spread down by 51.6 bp to 437.0 bp, with the yield to worst at 7.7% and the bond now trading up to 94.5 cents on the dollar (1Y price range: 91.1-106.8).

- Issuer: Meritage Homes Corp (Scottsdale, Arizona (US)) | Coupon: 3.88% | Maturity: 15/4/2029 | Rating: BB+ | ISIN: USU58995AJ72 | Z-spread down by 61.1 bp to 327.1 bp, with the yield to worst at 6.2% and the bond now trading up to 86.8 cents on the dollar (1Y price range: 81.3-104.5).

TOP BONDS MOVES IN THE PAST WEEK - EUR HY

- Issuer: Teva Pharmaceutical Finance Netherlands II BV (Amsterdam, Netherlands) | Coupon: 1.13% | Maturity: 15/10/2024 | Rating: BB- | ISIN: XS1439749281 | Z-spread up by 128.5 bp to 477.6 bp, with the yield to worst at 5.8% and the bond now trading down to 90.0 cents on the dollar (1Y price range: 88.8-96.7).

- Issuer: Carnival PLC (Southampton, United Kingdom) | Coupon: 1.00% | Maturity: 28/10/2029 | Rating: B- | ISIN: XS2066744231 | Z-spread up by 64.6 bp to 895.6 bp, with the yield to worst at 10.6% and the bond now trading down to 52.5 cents on the dollar (1Y price range: 52.2-77.3).

- Issuer: International Consolidated Airlines Group SA (Harmondsworth, Spain) | Coupon: 3.75% | Maturity: 25/3/2029 | Rating: B+ | ISIN: XS2322423539 | Z-spread up by 62.6 bp to 900.5 bp, with the yield to worst at 10.6% and the bond now trading down to 67.9 cents on the dollar (1Y price range: 67.4-100.3).

- Issuer: DIC Asset AG (Frankfurt, Germany) | Coupon: 2.25% | Maturity: 22/9/2026 | Rating: BB+ | ISIN: XS2388910270 | Z-spread up by 62.5 bp to 1,131.9 bp, with the yield to worst at 12.3% and the bond now trading down to 67.4 cents on the dollar (1Y price range: 66.0-95.9).

- Issuer: International Consolidated Airlines Group SA (Harmondsworth, Spain) | Coupon: 3.75% | Maturity: 25/3/2029 | Rating: B+ | ISIN: XS2322423539 | Z-spread up by 60.4 bp to 900.5 bp, with the yield to worst at 10.6% and the bond now trading down to 67.9 cents on the dollar (1Y price range: 67.4-100.3).

- Issuer: Immobiliare Grande Distribuzione SIIQ SpA (Bologna, Italy) | Coupon: 2.13% | Maturity: 28/11/2024 | Rating: BB+ | ISIN: XS2084425466 | Z-spread up by 59.5 bp to 608.1 bp, with the yield to worst at 6.8% and the bond now trading down to 89.0 cents on the dollar (1Y price range: 88.8-101.4).

- Issuer: Schaeffler AG (Herzogenaurach, Germany) | Coupon: 2.75% | Maturity: 12/10/2025 | Rating: BB+ | ISIN: DE000A289Q91 | Z-spread up by 51.4 bp to 414.8 bp, with the yield to worst at 5.4% and the bond now trading down to 92.0 cents on the dollar (1Y price range: 91.3-106.3).

- Issuer: Titan Global Finance PLC (Hull, United Kingdom) | Coupon: 2.75% | Maturity: 9/7/2027 | Rating: BB | ISIN: XS2199268470 | Z-spread up by 45.7 bp to 426.9 bp, with the yield to worst at 5.6% and the bond now trading down to 87.1 cents on the dollar (1Y price range: 86.7-104.1).

- Issuer: Carnival PLC (Southampton, United Kingdom) | Coupon: 1.00% | Maturity: 28/10/2029 | Rating: B- | ISIN: XS2066744231 | Z-spread up by 41.6 bp to 895.6 bp, with the yield to worst at 10.6% and the bond now trading down to 52.5 cents on the dollar (1Y price range: 52.2-77.3).

- Issuer: Renault SA (Boulogne-Billancourt, France) | Coupon: 1.13% | Maturity: 4/10/2027 | Rating: BB | ISIN: FR0013451416 | Z-spread up by 40.8 bp to 559.7 bp (CDS basis: -81.0bp), with the yield to worst at 7.1% and the bond now trading down to 74.3 cents on the dollar (1Y price range: 72.7-93.7).

- Issuer: Schaeffler AG (Herzogenaurach, Germany) | Coupon: 2.88% | Maturity: 26/3/2027 | Rating: BB+ | ISIN: DE000A2YB7B5 | Z-spread up by 37.7 bp to 446.9 bp, with the yield to worst at 5.9% and the bond now trading down to 87.4 cents on the dollar (1Y price range: 86.4-108.9).

- Issuer: Iliad SA (Paris, France) | Coupon: 1.88% | Maturity: 11/2/2028 | Rating: BB | ISIN: FR0014001YB0 | Z-spread up by 36.6 bp to 410.9 bp, with the yield to worst at 5.6% and the bond now trading down to 82.0 cents on the dollar (1Y price range: 79.3-95.7).

- Issuer: Nemak SAB de CV (San Pedro Garza Garcia, Mexico) | Coupon: 2.25% | Maturity: 20/7/2028 | Rating: BB+ | ISIN: XS2362994068 | Z-spread up by 32.8 bp to 706.4 bp, with the yield to worst at 8.6% and the bond now trading down to 70.7 cents on the dollar (1Y price range: 70.2-97.0).

- Issuer: Renault SA (Boulogne-Billancourt, France) | Coupon: 2.00% | Maturity: 28/9/2026 | Rating: BB | ISIN: FR0013368206 | Z-spread up by 32.1 bp to 549.2 bp (CDS basis: -114.9bp), with the yield to worst at 6.8% and the bond now trading down to 82.4 cents on the dollar (1Y price range: 80.2-99.2).

- Issuer: Wienerberger AG (Wien, Austria) | Coupon: 2.75% | Maturity: 4/6/2025 | Rating: BB+ | ISIN: AT0000A2GLA0 | Z-spread down by 37.5 bp to 313.0 bp, with the yield to worst at 3.9% and the bond now trading up to 95.5 cents on the dollar (1Y price range: 94.9-106.1).

RECENT DOMESTIC USD BOND ISSUES

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$125m Bond (US3133ENB335), fixed rate (3.05% coupon) maturing on 19 July 2027, priced at 100.00 (original spread of 16 bp), non callable

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$125m Bond (US3133ENC242), fixed rate (4.98% coupon) maturing on 20 July 2032, priced at 100.00, callable (10nc1)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$350m Bond (US3133ENB905), floating rate (PRQ + -310.0 bp) maturing on 22 July 2024, priced at 100.00, non callable

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$550m Bond (US3133ENB822), floating rate (SOFR + 8.5 bp) maturing on 22 July 2024, priced at 100.00, non callable

- Federal Home Loan Banks (Agency | Washington, United States | Rating: AA+): US$150m Bond (US3130ASQH55), fixed rate (3.80% coupon) maturing on 28 July 2025, priced at 100.00, callable (3nc1)

- Federal Home Loan Mortgage Corp (Agency | Mclean, United States | Rating: AA+): US$105m Unsecured Note (US3134GXG732), fixed rate (4.10% coupon) maturing on 12 August 2024, priced at 100.00 (original spread of 153 bp), callable (2nc1m)

- International Bank for Reconstruction and Development (Supranational | Washington, Washington Dc, United States | Rating: AAA): US$4,000m Senior Note (US459058KJ14), fixed rate (3.13% coupon) maturing on 15 June 2027, priced at 99.95 (original spread of 16 bp), non callable

- PepsiCo Inc (Beverage/Bottling | Purchase, United States | Rating: A+): US$500m Senior Note (US713448FN30), fixed rate (4.20% coupon) maturing on 18 July 2052, priced at 99.88 (original spread of 108 bp), callable (30nc30)

- PepsiCo Inc (Beverage/Bottling | Purchase, United States | Rating: A+): US$750m Senior Note (US713448FL73), fixed rate (3.60% coupon) maturing on 18 February 2028, priced at 99.87 (original spread of 55 bp), callable (6nc6)

- PepsiCo Inc (Beverage/Bottling | Purchase, United States | Rating: A+): US$1,250m Senior Note (US713448FM56), fixed rate (3.90% coupon) maturing on 18 July 2032, priced at 99.84 (original spread of 95 bp), callable (10nc10)

RECENT INTERNATIONAL USD BOND ISSUES

- Asian Development Bank (Supranational | Mandaluyong, Philippines | Rating: AAA): US$120m Unsecured Note (XS2501122977) zero coupon maturing on 21 July 2042, priced at 100.00, non callable

- Banque Federative du Credit Mutuel SA (Banking | Strasbourg, Grand Est, France | Rating: A+): US$800m Note (USF0803NAC68), fixed rate (4.52% coupon) maturing on 13 July 2025, priced at 100.00 (original spread of 155 bp), non callable

- Banque Federative du Credit Mutuel SA (Banking | Strasbourg, Grand Est, France | Rating: A+): US$900m Note (USF0803NAD42), fixed rate (4.75% coupon) maturing on 13 July 2027, priced at 100.00 (original spread of 180 bp), non callable

- Deutsche Bank AG (Banking | Frankfurt, Hessen, Germany | Rating: BBB+): US$500m Note (XS0459896238), floating rate maturing on 4 August 2026, priced at 100.00, non callable

- Deutsche Bank AG (Banking | Frankfurt, Germany | Rating: BBB+): US$500m Note (XS0459896311), fixed rate (2.90% coupon) maturing on 5 August 2024, priced at 100.00, non callable

- Emirates NBD Bank PJSC (Banking | Dubai, United Arab Emirates | Rating: A+): US$125m Unsecured Note (XS2500817668), floating rate maturing on 12 January 2027, priced at 100.00, non callable

- Guangxi Communications Investment Group Co Ltd (Transportation - Other | Nanning, China (Mainland) | Rating: BBB): US$300m Bond (XS2499222771), fixed rate (3.95% coupon) maturing on 12 July 2025, priced at 99.58 (original spread of 126 bp), non callable

- Intesa Sanpaolo SpA (Banking | Torino, Torino, Italy | Rating: BBB): US$200m Unsecured Note (XS2499922834), fixed rate (4.58% coupon) maturing on 13 July 2024, priced at 100.00, non callable

- KoreaGasCorp (Oil and Gas | Daegu, Daegu, South Korea | Rating: AA-): US$500m Senior Note (US50066AAT07), fixed rate (3.88% coupon) maturing on 13 July 2027, priced at 99.53 (original spread of 115 bp), non callable

- LG Chem Ltd (Chemicals | Seoul, South Korea | Rating: A-): US$300m Senior Note (USY52758AG77), fixed rate (4.38% coupon) maturing on 14 July 2025, priced at 99.83 (original spread of 140 bp), non callable

- Nomura International Funding Pte Ltd (Financial - Other | Japan | Rating: NR): US$300m Unsecured Note (XS2431127534), fixed rate (4.23% coupon) maturing on 20 June 2025, priced at 100.00, non callable

- Shanghai Pudong Development Bank Co Ltd (London branch) (Banking | London, China (Mainland) | Rating: NR): US$400m Bond (XS2495850179), fixed rate (3.25% coupon) maturing on 14 July 2025, priced at 99.70 (original spread of 32 bp), non callable

- Tampa Electric Co (Utility - Other | Tampa, Canada | Rating: BBB+): US$300m Senior Note (US875127BK73), fixed rate (3.88% coupon) maturing on 12 July 2024, priced at 99.96 (original spread of 85 bp), with a make whole call

- Tampa Electric Co (Utility - Other | Tampa, Canada | Rating: BBB+): US$300m Senior Note (US875127BL56), fixed rate (5.00% coupon) maturing on 15 July 2052, priced at 99.88 (original spread of 180 bp), callable (30nc30)

- UniCredit Bank AG (Banking | Muenchen, Bayern, Italy | Rating: BBB+): US$140m Inhaberschuldverschreibung (DE000HVB6WD8), fixed rate (3.47% coupon) maturing on 11 July 2024, priced at 100.00, non callable

- Bpce SA (Banking | Paris, Ile-De-France, France | Rating: BBB+): US$1,000m Note (US05584KAM09), floating rate maturing on 19 July 2033, priced at 100.00, callable (11nc10)

- Bpce SA (Banking | Paris, Ile-De-France, France | Rating: A): US$750m Note (US05578AE465), fixed rate (4.75% coupon) maturing on 19 July 2027, priced at 99.75 (original spread of 179 bp), non callable

- Fujian Zhanglong Group Co Ltd (Industrials - Other | Zhangzhou, China (Mainland) | Rating: BBB-): US$500m Senior Note (XS2495307865), fixed rate (4.80% coupon) maturing on 20 June 2025, priced at 99.60, non callable

- Mitsubishi UFJ Financial Group Inc (Banking | Chiyoda-Ku, Tokyo-To, Japan | Rating: A-): US$1,500m Senior Note (US606822CK87), fixed rate (5.13% coupon) maturing on 20 July 2033, priced at 100.00 (original spread of 213 bp), callable (11nc10)

- Mitsubishi UFJ Financial Group Inc (Banking | Chiyoda-Ku, Tokyo-To, Japan | Rating: A-): US$1,250m Senior Note (US606822CL60), fixed rate (5.02% coupon) maturing on 20 July 2028, priced at 100.00 (original spread of 196 bp), callable (6nc5)

- Mitsubishi UFJ Financial Group Inc (Banking | Chiyoda-Ku, Tokyo-To, Japan | Rating: A-): US$350m Senior Note (US606822CJ15), floating rate (SOFR + 165.0 bp) maturing on 18 July 2025, priced at 100.00, callable (3nc2)

- Mitsubishi UFJ Financial Group Inc (Banking | Chiyoda-Ku, Tokyo-To, Japan | Rating: A-): US$1,400m Senior Note (US606822CH58), fixed rate (4.79% coupon) maturing on 18 July 2025, priced at 100.00 (original spread of 170 bp), callable (3nc2)

- Nomura International Funding Pte Ltd (Financial - Other | Japan | Rating: NR): US$1,000m Unsecured Note (XS2431121842), floating rate maturing on 25 July 2025, priced at 100.00, non callable

- Nomura International Funding Pte Ltd (Financial - Other | Japan | Rating: NR): US$400m Unsecured Note (XS2431119358), floating rate maturing on 20 June 2027, priced at 100.00, non callable

- Nomura International Funding Pte Ltd (Financial - Other | Japan | Rating: NR): US$320m Unsecured Note (XS2431126213), floating rate maturing on 20 June 2029, priced at 100.00, non callable

- Nomura International Funding Pte Ltd (Financial - Other | Japan | Rating: NR): US$180m Unsecured Note (XS2431139893), floating rate maturing on 28 July 2024, priced at 100.00, non callable

SELECTED RECENT EUR BOND ISSUES

- 888 Acquisitions Ltd (Financial - Other | Gibraltar | Rating: NR): €400m Note (XS2498543102), fixed rate (7.56% coupon) maturing on 15 July 2027, priced at 85.35 (original spread of 1,061 bp), callable (5nc2)

- 888 Acquisitions Ltd (Financial - Other | Gibraltar | Rating: NR): €300m Note (XS2498547350), floating rate (EU03MLIB + 550.0 bp) maturing on 15 July 2028, priced at 85.00, callable (6nc1)

- Bank of Nova Scotia (Banking | Toronto, Ontario, Canada | Rating: A): €150m Unsecured Note (XS2501341189), floating rate maturing on 13 July 2024, priced at 100.00, non callable

- Bng Bank NV (Agency | S-Gravenhage, Zuid-Holland, Netherlands | Rating: AAA): €1,000m Senior Note (XS2500674887), fixed rate (1.88% coupon) maturing on 13 July 2032, priced at 99.03 (original spread of 87 bp), non callable

- Caisse Amortissement de la Dette Sociale (Agency | Paris, Ile-De-France, France | Rating: AA+): €1,500m Bond (FR001400BLG1), fixed rate (0.60% coupon) maturing on 25 November 2029, priced at 90.98 (original spread of 76 bp), non callable

- Corporacion Andina de Fomento (Supranational | Caracas, Venezuela | Rating: A+): €500m Senior Note (XS2495583978), fixed rate (2.38% coupon) maturing on 13 July 2027, priced at 99.73 (original spread of 187 bp), non callable

- Deutsche Bank AG (Banking | Frankfurt, Hessen, Germany | Rating: A-): €500m Inhaberschuldverschreibung (DE000DB9U7T8), fixed rate (1.35% coupon) maturing on 4 August 2025, priced at 100.00, non callable

- Deutsche Bank AG (Banking | Frankfurt, Hessen, Germany | Rating: A-): €500m Inhaberschuldverschreibung (DE000DB9U7U6), floating rate maturing on 4 August 2027, priced at 100.00, non callable

- Hessen, State of (Official and Muni | Wiesbaden, Hessen, Germany | Rating: AA+): €300m Inhaberschuldverschreibung (DE000A1RQEF7), fixed rate (1.75% coupon) maturing on 12 July 2029, priced at 99.84 (original spread of 79 bp), non callable

- Intesa Sanpaolo SpA (Banking | Torino, Torino, Italy | Rating: BBB): €300m Unsecured Note (XS2500409037), fixed rate (2.96% coupon) maturing on 12 July 2025, priced at 100.00, non callable

- Lamda Development SA (Financial - Other | Athina, Attiki, Greece | Rating: NR): €230m Bond (GRC2451227D9) maturing on 12 July 2029, priced at 100.00, callable (7nc2)

- Landwirtschaftliche Rentenbank (Agency | Frankfurt, Hessen, Germany | Rating: AAA): €1,000m Senior Note (XS2500341990), fixed rate (1.90% coupon) maturing on 12 July 2032, priced at 99.42 (original spread of 76 bp), non callable

- OTP Bank Nyrt (Banking | Budapest, Hungary | Rating: BBB): €400m Note (XS2499691330), floating rate maturing on 13 July 2025, priced at 100.00 (original spread of 503 bp), callable (3nc2)

- Region Ile de France (Official and Muni | Saint-Ouen, Ile-De-France, France | Rating: AA): €700m Bond (FR001400BCS5), fixed rate (2.23% coupon) maturing on 19 July 2032, priced at 99.94, non callable

- Schleswig-Holstein, State of (Official and Muni | Kiel, Schleswig-Holstein, Germany | Rating: AAA): €1,000m Bond (DE000SHFM840), fixed rate (1.38% coupon) maturing on 14 July 2027, priced at 99.73 (original spread of 68 bp), non callable

- Westpac Securities NZ Ltd (London Branch) (Financial - Other | London, Australia | Rating: NR): €750m Covered Bond (Other) (XS2500847657), fixed rate (1.78% coupon) maturing on 14 January 2026, priced at 100.00 (original spread of 112 bp), non callable

- Asian Development Bank (Supranational | Mandaluyong, Philippines | Rating: AAA): €1,000m Senior Note (XS2504099669), fixed rate (1.95% coupon) maturing on 22 July 2032, priced at 99.72 (original spread of 89 bp), non callable

- Celanese US Holdings LLC (Chemicals | Irving, Texas, United States | Rating: BBB-): €500m Senior Note (XS2497520887), fixed rate (5.34% coupon) maturing on 19 January 2029, priced at 100.00 (original spread of 453 bp), callable (7nc6)

- Celanese US Holdings LLC (Chemicals | Irving, Texas, United States | Rating: BBB-): €1,000m Senior Note (XS2497520705), fixed rate (4.78% coupon) maturing on 19 July 2026, priced at 100.00 (original spread of 424 bp), callable (4nc4)

- DekaBank Deutsche Girozentrale (Financial - Other | Frankfurt, Hessen, Germany | Rating: AAA): €250m Oeffenlicher Pfandbrief (Covered Bond) (XS2502402360), fixed rate (2.13% coupon) maturing on 19 July 2032, priced at 99.07 (original spread of 98 bp), non callable

- Eurofima European Company for the Financing of Railroad Rolling Stock (Supranational | Basel, Basel-Stadt, Switzerland | Rating: AA): €500m Senior Note (XS2502850865), fixed rate (1.63% coupon) maturing on 20 July 2027, priced at 99.81 (original spread of 94 bp), non callable

- European Union (Supranational | Brussels, Bruxelles-Capitale, Belgium | Rating: AAA): €5,000m Senior Note (EU000A3K7MW2), fixed rate (1.63% coupon) maturing on 4 December 2029, priced at 99.59 (original spread of 81 bp), non callable

- Korea Housing Finance Corp (Agency | Busan, Busan, South Korea | Rating: AAA): €500m Covered Bond (Other) (XS2502844116), fixed rate (1.96% coupon) maturing on 19 July 2026, priced at 100.00 (original spread of 128 bp), non callable

- NRW Bank (Agency | Dusseldorf, Nordrhein-Westfalen, Germany | Rating: AA): €120m Inhaberschuldverschreibung (DE000NWB2RV0), fixed rate (2.05% coupon) maturing on 20 July 2026, priced at 100.00, callable (4nc1)

- Nerval SAS (Securities | Paris, France | Rating: A-): €350m Bond (FR001400BS43), fixed rate (3.63% coupon) maturing on 20 July 2028, priced at 99.31 (original spread of 302 bp), callable (6nc6)

- Nova Ljubljanska Banka dd Ljubljana (Banking | Ljubljana, United States | Rating: BBB): €300m Note (XS2498964209), fixed rate (6.00% coupon) maturing on 19 July 2025, priced at 100.00 (original spread of 565 bp), callable (3nc2)

NEW LOANS

- Ferrocarril Cntrl Railway P3, signed a US$ 250m Bridge Loan maturing on 07/13/23, to be used for project finance

- Mendubim Solar PV Project, signed a US$ 250m Term Loan, to be used for project finance

NEW ISSUES IN SECURITIZED CREDIT

- Sabadell Consumo 2 issued a floating-rate ABS backed by consumer loan in 7 tranches, for a total of € 764 m. Highest-rated tranche offering a spread over the floating rate of 87bp, and the lowest-rated tranche a spread of 1,325bp. Bookrunners: Societe Generale SA, Deutsche Bank Securities Inc

- Marathon Static CLO 18 issued a floating-rate CLO in 6 tranches, for a total of US$ 352 m. Highest-rated tranche offering a spread over the floating rate of 222bp, and the lowest-rated tranche a spread of 631bp. Bookrunners: Bank of America Merrill Lynch

- United Auto Credit Securitization Trust 2022-2 issued a fixed-rate ABS backed by auto receivables in 5 tranches, for a total of US$ 241 m. Highest-rated tranche offering a yield to maturity of 4.39%, and the lowest-rated tranche a yield to maturity of 10.47%. Bookrunners: JP Morgan & Co Inc, Capital One Financial Corp, Wells Fargo Securities LLC

- Visio 2022-1 Trust issued a fixed-rate RMBS in 3 tranches, for a total of US$ 178 m. Bookrunners: Credit Suisse, Barclays Capital Group

- Kubota Credit Owner Trust 2022-2 issued a fixed-rate ABS backed by equipment leases in 4 tranches, for a total of US$ 650 m. Highest-rated tranche offering a yield to maturity of 3.05%, and the lowest-rated tranche a yield to maturity of 4.18%. Bookrunners: Mizuho Securities USA Inc, SMBC Nikko Securities America Inc, MUFG Securities Americas Inc

- Conns Receivables Funding 2022-A LLC issued a floating-rate ABS backed by consumer loan in 2 tranches, for a total of US$ 408 m. Bookrunners: JP Morgan & Co Inc, Deutsche Bank Securities Inc, MUFG Securities Americas Inc