Credit

Meaningful Spread Compression Across The US Credit Complex This Week, Though Some Commentators Expect Widening Next Year Towards 200bp For IG, 800bp For HY

Weekly volumes of US$ corporate bond issuance (IFR Markets data): 31 tranches for US$45.8bn in IG (2022 YTD volume $805.5bn vs 2021 YTD $909.0bn) and 2 tranches for US$760m in HY (2022 YTD volume $68.6bn vs 2021 YTD $462.7bn)

Published ET

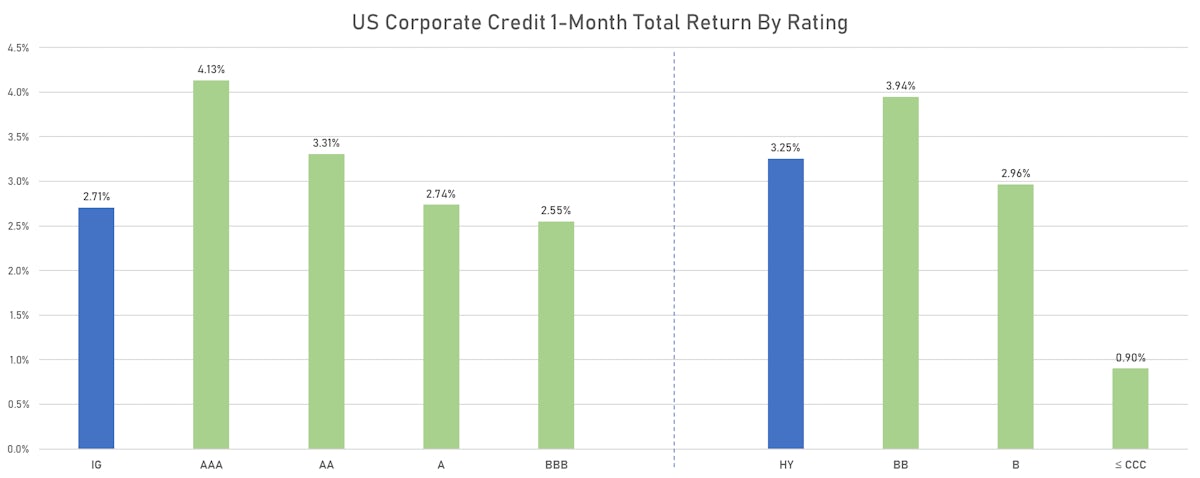

ICE BofAML US Corporate Credit 1-Month Total Returns By Rating | Sources: ϕpost, FactSet data

DAILY SUMMARY

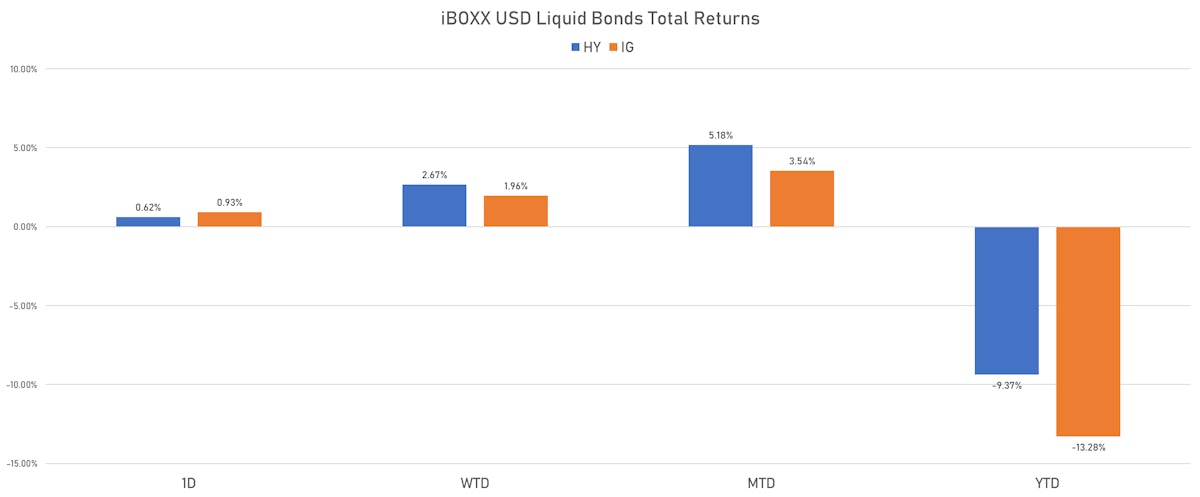

- S&P 500 Bond Index was up 0.92% today, with investment grade up 0.93% and high yield up 0.79% (YTD total return: -11.11%)

- The iBoxx USD Liquid Investment Grade Total Return Index was up 0.930% today (Month-to-date: 3.54%; Year-to-date: -13.28%)

- The iBoxx USD Liquid High Yield Total Return Index was up 0.622% today (Month-to-date: 5.18%; Year-to-date: -9.37%)

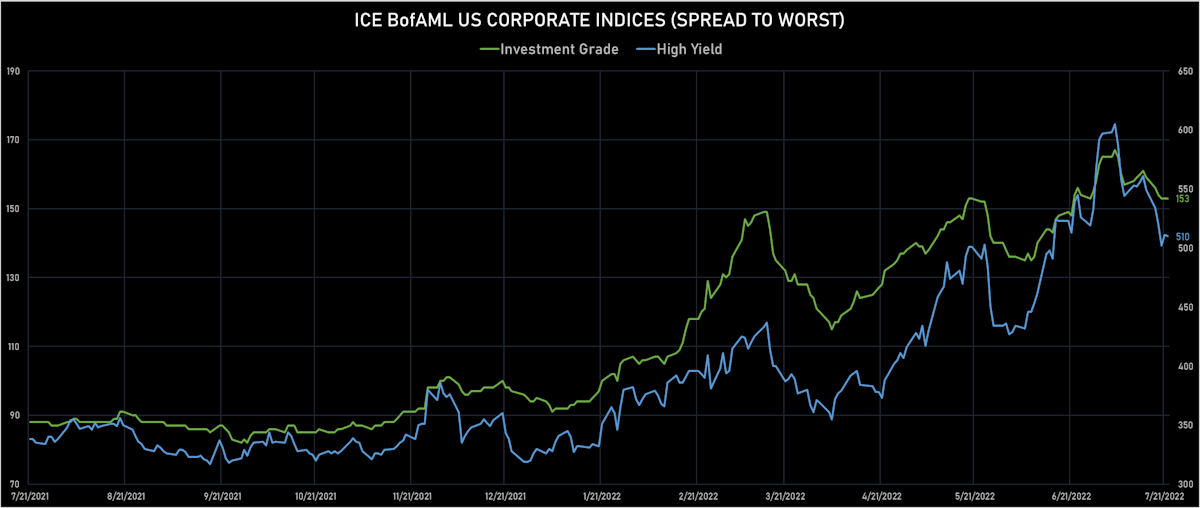

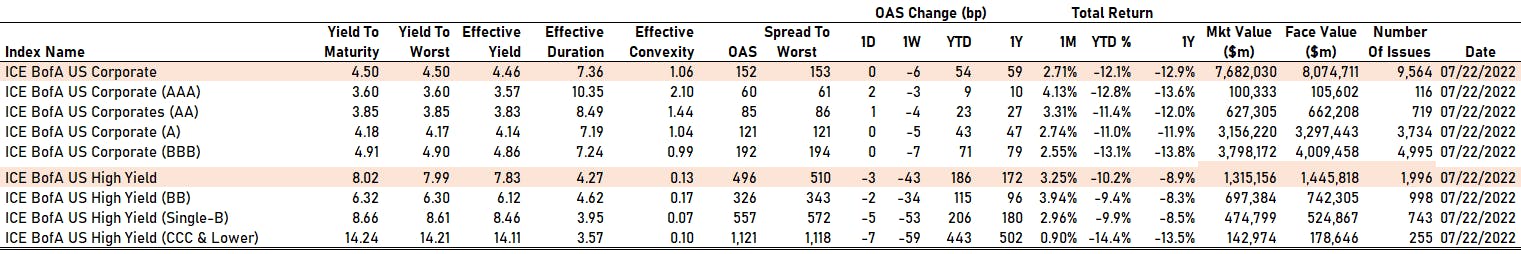

- ICE BofA US Corporate Index (Investment Grade) spread to worst unchanged 0.0 bp, now at 153.0 bp (YTD change: +58.0 bp)

- ICE BofA US High Yield Index spread to worst down -1.0 bp, now at 510.0 bp (YTD change: +180.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index up 0.32% today (YTD total return: -2.5%)

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING TODAY

- AAA up by 2 bp at 60 bp

- AA up by 1 bp at 85 bp

- A unchanged at 121 bp

- BBB unchanged at 192 bp

- BB down by -2 bp at 326 bp

- B down by -5 bp at 557 bp

- ≤ CCC down by -7 bp at 1,121 bp

CDS INDICES TODAY (mid-spreads)

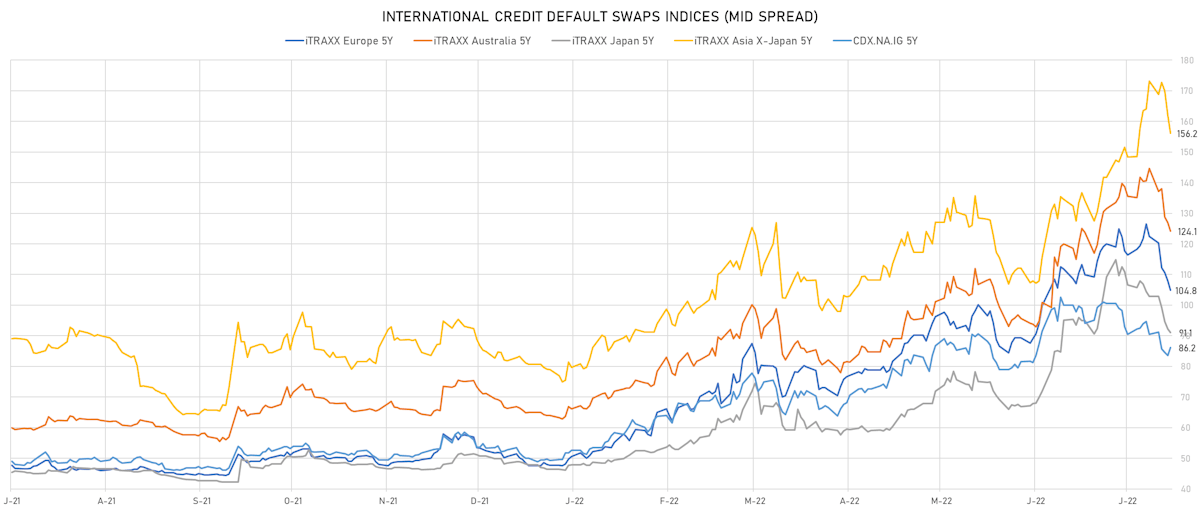

- Markit CDX.NA.IG 5Y up 2.7 bp, now at 86bp (1W change: -4.3bp; YTD change: +36.9bp)

- Markit CDX.NA.IG 10Y up 2.5 bp, now at 121bp (1W change: -2.1bp; YTD change: +32.2bp)

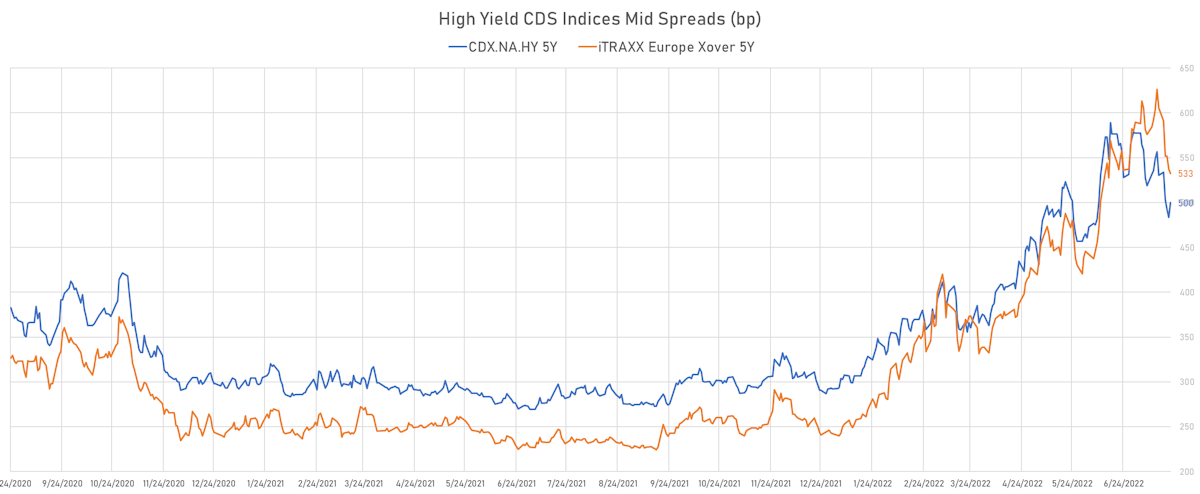

- Markit CDX.NA.HY 5Y up 16.6 bp, now at 500bp (1W change: -30.3bp; YTD change: +208.0bp)

- Markit iTRAXX Europe 5Y down 3.0 bp, now at 105bp (1W change: -17.6bp; YTD change: +57.1bp)

- Markit iTRAXX Europe Crossover 5Y down 4.7 bp, now at 533bp (1W change: -73.1bp; YTD change: +290.5bp)

- Markit iTRAXX Japan 5Y down 1.1 bp, now at 91bp (1W change: -11.7bp; YTD change: +44.7bp)

- Markit iTRAXX Asia Ex-Japan 5Y down 5.8 bp, now at 156bp (1W change: -17.0bp; YTD change: +77.1bp)

5Y USD CDS SINGLE NAMES - LARGEST MOVES OVER THE PAST WEEK

- Transocean Inc (Country: KY; rated: Caa3): down 6718.6 bp to .0bp (1Y range: -2,858bp)

- Carnival Corp (Country: US; rated: LGD5 - 72%): down 361.8 bp to 1,078.6bp (1Y range: 316-1,583bp)

- Royal Caribbean Cruises Ltd (Country: US; rated: LGD4 - 59%): down 293.6 bp to 1,227.0bp (1Y range: 299-1,584bp)

- Staples Inc (Country: US; rated: B3): down 245.2 bp to 1,982.1bp (1Y range: 865-1,986bp)

- DISH DBS Corp (Country: US; rated: B2): down 206.2 bp to 1,322.1bp (1Y range: 317-1,506bp)

- Gap Inc (Country: US; rated: A3): down 188.4 bp to 624.6bp (1Y range: 132-819bp)

- Bombardier Inc (Country: CA; rated: B3): down 174.5 bp to 748.6bp (1Y range: 395-1,007bp)

- Liberty Interactive LLC (Country: US; rated: Ba3): down 168.2 bp to 1,640.5bp (1Y range: 296-1,689bp)

- Bath & Body Works Inc (Country: US; rated: Ba2): down 143.6 bp to 583.8bp (1Y range: 124-584bp)

- Pitney Bowes Inc (Country: US; rated: B1): down 141.5 bp to 897.5bp (1Y range: 367-1,025bp)

- Tegna Inc (Country: US; rated: Ba3): down 121.9 bp to 781.4bp (1Y range: 182-786bp)

- Beazer Homes USA Inc (Country: US; rated: B2): down 121.3 bp to 626.4bp (1Y range: 278-860bp)

- Tenet Healthcare Corp (Country: US; rated: BB+): down 120.6 bp to 425.0bp (1Y range: 242-576bp)

- Nordstrom Inc (Country: US; rated: A3): down 111.4 bp to 500.9bp (1Y range: 211-627bp)

- Macy's Inc (Country: US; rated: Ba1): down 109.8 bp to 520.4bp (1Y range: 181-617bp)

5Y EURO CDS SINGLE NAMES - LARGEST MOVES OVER THE PAST WEEK

- Novafives SAS (Country: FR; rated: Caa1): down 386.9 bp to 1,458.9bp (1Y range: 618-1,903bp)

- TUI AG (Country: DE; rated: B3-PD): down 365.8 bp to 1,332.0bp (1Y range: 607-1,641bp)

- Jaguar Land Rover Automotive PLC (Country: GB; rated: WD): down 259.9 bp to 1,016.4bp (1Y range: 359-1,296bp)

- Boparan Finance PLC (Country: GB; rated: Caa1): down 251.1 bp to 1,874.8bp (1Y range: 918-2,690bp)

- Iceland Bondco PLC (Country: GB; rated: WR): down 163.7 bp to 1,138.5bp (1Y range: 440-1,326bp)

- Ardagh Packaging Finance PLC (Country: IE; rated: B1): down 146.1 bp to 1,034.0bp (1Y range: 213-1,186bp)

- Stena AB (Country: SE; rated: B2-PD): down 144.1 bp to 637.3bp (1Y range: 401-865bp)

- Altice Finco SA (Country: LU; rated: Caa1): down 138.7 bp to 809.7bp (1Y range: 333-934bp)

- Air France KLM SA (Country: FR; rated: B-): down 124.0 bp to 875.4bp (1Y range: 386-990bp)

- Ladbrokes Coral Group Ltd (Country: GB; rated: WR): down 100.2 bp to 461.5bp (1Y range: 107-540bp)

- CMA CGM SA (Country: FR; rated: Ba2): down 92.5 bp to 567.3bp (1Y range: 259-648bp)

- Fortum Oyj (Country: FI; rated: baa3): down 88.0 bp to 240.3bp (1Y range: 40-326bp)

- Rolls-Royce PLC (Country: GB; rated: BB-): down 81.7 bp to 443.3bp (1Y range: 161-506bp)

- thyssenkrupp AG (Country: DE; rated: B1): down 80.6 bp to 587.3bp (1Y range: 205-652bp)

- Casino Guichard Perrachon SA (Country: FR; rated: WR): down 79.0 bp to 1,692.1bp (1Y range: 464-2,070bp)

TOP BONDS MOVES IN THE PAST WEEK - USD HY

- Issuer: Western Global Airlines LLC (Estero, Florida (US)) | Coupon: 10.38% | Maturity: 15/8/2025 | Rating: B- | ISIN: USU95558AA72 | Z-spread up by 132.8 bp to 977.1 bp, with the yield to worst at 12.6% and the bond now trading down to 93.5 cents on the dollar (1Y price range: 93.5-111.3).

- Issuer: Natura &Co Luxembourg Holdings SARL (Luxembourg, Luxembourg) | Coupon: 6.00% | Maturity: 19/4/2029 | Rating: BB | ISIN: USL6S52VAA02 | Z-spread down by 65.6 bp to 531.1 bp, with the yield to worst at 8.2% and the bond now trading up to 88.0 cents on the dollar (1Y price range: 84.3-99.9).

- Issuer: Wynn Las Vegas LLC (Las Vegas, Nevada (US)) | Coupon: 5.50% | Maturity: 1/3/2025 | Rating: B | ISIN: USU98347AK05 | Z-spread down by 68.9 bp to 343.0 bp, with the yield to worst at 6.3% and the bond now trading up to 97.0 cents on the dollar (1Y price range: 90.0-103.5).

- Issuer: EQM Midstream Partners LP (Canonsburg, Pennsylvania (US)) | Coupon: 4.75% | Maturity: 15/1/2031 | Rating: BB- | ISIN: USU26886AD02 | Z-spread down by 69.7 bp to 392.2 bp, with the yield to worst at 6.8% and the bond now trading up to 86.0 cents on the dollar (1Y price range: 79.8-105.0).

- Issuer: Bombardier Inc (MONTREAL, Canada) | Coupon: 7.45% | Maturity: 1/5/2034 | Rating: CCC+ | ISIN: USC10602AJ68 | Z-spread down by 84.3 bp to 737.4 bp (CDS basis: 67.8bp), with the yield to worst at 9.8% and the bond now trading up to 82.5 cents on the dollar (1Y price range: 74.5-122.9).

- Issuer: Wynn Resorts Finance LLC (Las Vegas, Nevada (US)) | Coupon: 5.13% | Maturity: 1/10/2029 | Rating: B | ISIN: USU98354AA80 | Z-spread down by 84.7 bp to 485.4 bp, with the yield to worst at 7.7% and the bond now trading up to 85.0 cents on the dollar (1Y price range: 78.0-102.3).

- Issuer: NCL Finance Ltd (#N/A, United Kingdom) | Coupon: 6.13% | Maturity: 15/3/2028 | Rating: CCC+ | ISIN: USG6437FAA78 | Z-spread down by 89.2 bp to 875.4 bp, with the yield to worst at 11.5% and the bond now trading up to 77.0 cents on the dollar (1Y price range: 72.5-99.5).

- Issuer: Wynn Las Vegas LLC (Las Vegas, Nevada (US)) | Coupon: 5.25% | Maturity: 15/5/2027 | Rating: B | ISIN: USU98347AL87 | Z-spread down by 92.1 bp to 440.7 bp, with the yield to worst at 7.2% and the bond now trading up to 91.0 cents on the dollar (1Y price range: 84.1-102.8).

- Issuer: HanesBrands Inc (Winston-Salem, North Carolina (US)) | Coupon: 4.88% | Maturity: 15/5/2026 | Rating: BB- | ISIN: USU24437AE26 | Z-spread down by 94.2 bp to 188.8 bp, with the yield to worst at 4.9% and the bond now trading up to 99.3 cents on the dollar (1Y price range: 91.0-106.9).

- Issuer: NCL Corporation Ltd (Miami, Bermuda) | Coupon: 5.88% | Maturity: 15/3/2026 | Rating: CCC+ | ISIN: USG6436QAL08 | Z-spread down by 103.0 bp to 886.6 bp, with the yield to worst at 11.7% and the bond now trading up to 82.3 cents on the dollar (1Y price range: 76.5-100.0).

- Issuer: Taylor Morrison Communities Inc (Scottsdale, Arizona (US)) | Coupon: 5.88% | Maturity: 15/6/2027 | Rating: BB- | ISIN: USU8760NAA73 | Z-spread down by 112.3 bp to 225.8 bp, with the yield to worst at 5.1% and the bond now trading up to 102.0 cents on the dollar (1Y price range: 92.0-111.9).

- Issuer: Starwood Property Trust Inc (Greenwich (US)) | Coupon: 3.75% | Maturity: 31/12/2024 | Rating: BB- | ISIN: USU85656AG86 | Z-spread down by 120.5 bp to 218.2 bp, with the yield to worst at 5.4% and the bond now trading up to 96.0 cents on the dollar (1Y price range: 90.0-101.4).

- Issuer: NCL Corporation Ltd (Miami, Bermuda) | Coupon: 7.75% | Maturity: 15/2/2029 | Rating: CCC+ | ISIN: USG6436QAP12 | Z-spread down by 131.8 bp to 927.0 bp, with the yield to worst at 12.1% and the bond now trading up to 79.8 cents on the dollar (1Y price range: 74.5-103.0).

- Issuer: WeWork Companies Inc (New York City, New York (US)) | Coupon: 7.88% | Maturity: 1/5/2025 | Rating: CCC- | ISIN: USU96217AA99 | Z-spread down by 134.7 bp to 1,783.5 bp, with the yield to worst at 19.3% and the bond now trading up to 75.3 cents on the dollar (1Y price range: 72.0-96.5).

- Issuer: WeWork Companies LLC (New York City, New York (US)) | Coupon: 5.00% | Maturity: 10/7/2025 | Rating: CCC- | ISIN: USU9621PAA94 | Z-spread down by 279.0 bp to 1,716.7 bp, with the yield to worst at 19.8% and the bond now trading up to 67.0 cents on the dollar (1Y price range: 62.5-84.9).

TOP BONDS MOVES IN THE PAST WEEK - EUR HY

- Issuer: ZF Europe Finance BV (Amsterdam, Netherlands) | Coupon: 2.00% | Maturity: 23/2/2026 | Rating: BB+ | ISIN: XS2010039381 | Z-spread down by 106.1 bp to 484.2 bp, with the yield to worst at 5.9% and the bond now trading up to 86.9 cents on the dollar (1Y price range: 82.4-100.9).

- Issuer: ZF Finance GmbH (Friedrichshafen, Germany) | Coupon: 2.00% | Maturity: 6/5/2027 | Rating: BB+ | ISIN: XS2338564870 | Z-spread down by 107.8 bp to 513.2 bp, with the yield to worst at 6.5% and the bond now trading up to 81.6 cents on the dollar (1Y price range: 76.7-100.4).

- Issuer: ZF Finance GmbH (Friedrichshafen, Germany) | Coupon: 3.00% | Maturity: 21/9/2025 | Rating: BB+ | ISIN: XS2231715322 | Z-spread down by 108.8 bp to 474.9 bp, with the yield to worst at 5.9% and the bond now trading up to 91.4 cents on the dollar (1Y price range: 87.4-105.2).

- Issuer: ZF Finance GmbH (Friedrichshafen, Germany) | Coupon: 2.25% | Maturity: 3/5/2028 | Rating: BB+ | ISIN: XS2399851901 | Z-spread down by 109.7 bp to 538.7 bp, with the yield to worst at 6.7% and the bond now trading up to 78.3 cents on the dollar (1Y price range: 73.0-100.0).

- Issuer: Atlantia SpA (Rome, Italy) | Coupon: 1.63% | Maturity: 3/2/2025 | Rating: BB | ISIN: XS1558491855 | Z-spread down by 110.7 bp to 340.1 bp (CDS basis: -61.4bp), with the yield to worst at 4.2% and the bond now trading up to 92.9 cents on the dollar (1Y price range: 90.4-101.6).

- Issuer: Ford Motor Credit Company LLC (Dearborn, Michigan (US)) | Coupon: 2.39% | Maturity: 17/2/2026 | Rating: BB | ISIN: XS2013574384 | Z-spread down by 112.2 bp to 341.3 bp (CDS basis: -45.0bp), with the yield to worst at 4.6% and the bond now trading up to 92.4 cents on the dollar (1Y price range: 87.1-104.8).

- Issuer: Ford Motor Credit Company LLC (Dearborn, Michigan (US)) | Coupon: 1.36% | Maturity: 7/2/2025 | Rating: BB | ISIN: XS1767930586 | Z-spread down by 113.3 bp to 319.7 bp (CDS basis: -53.0bp), with the yield to worst at 4.3% and the bond now trading up to 92.7 cents on the dollar (1Y price range: 88.3-100.9).

- Issuer: Teva Pharmaceutical Finance Netherlands II BV (Amsterdam, Netherlands) | Coupon: 1.13% | Maturity: 15/10/2024 | Rating: BB- | ISIN: XS1439749281 | Z-spread down by 120.1 bp to 357.5 bp, with the yield to worst at 4.6% and the bond now trading up to 92.4 cents on the dollar (1Y price range: 88.8-96.7).

- Issuer: Deutsche Lufthansa AG (Cologne, Germany) | Coupon: 3.50% | Maturity: 14/7/2029 | Rating: BB- | ISIN: XS2363235107 | Z-spread down by 122.5 bp to 560.6 bp (CDS basis: -22.9bp), with the yield to worst at 7.1% and the bond now trading up to 80.0 cents on the dollar (1Y price range: 72.5-101.7).

- Issuer: Ford Motor Credit Company LLC (Dearborn, Michigan (US)) | Coupon: 2.33% | Maturity: 25/11/2025 | Rating: BB | ISIN: XS2052337503 | Z-spread down by 124.6 bp to 315.2 bp (CDS basis: -25.0bp), with the yield to worst at 4.3% and the bond now trading up to 93.5 cents on the dollar (1Y price range: 88.1-104.4).

- Issuer: Iliad SA (Paris, France) | Coupon: 1.88% | Maturity: 25/4/2025 | Rating: BB | ISIN: FR0013331196 | Z-spread down by 125.8 bp to 233.1 bp, with the yield to worst at 3.5% and the bond now trading up to 95.5 cents on the dollar (1Y price range: 89.9-100.9).

- Issuer: Ford Motor Credit Company LLC (Dearborn, Michigan (US)) | Coupon: 3.25% | Maturity: 15/9/2025 | Rating: BB | ISIN: XS2229875989 | Z-spread down by 128.0 bp to 311.3 bp (CDS basis: -26.3bp), with the yield to worst at 4.3% and the bond now trading up to 96.7 cents on the dollar (1Y price range: 91.0-107.6).

- Issuer: ZF Finance GmbH (Friedrichshafen, Germany) | Coupon: 3.75% | Maturity: 21/9/2028 | Rating: BB+ | ISIN: XS2231331260 | Z-spread down by 135.7 bp to 518.0 bp, with the yield to worst at 6.6% and the bond now trading up to 85.2 cents on the dollar (1Y price range: 78.2-108.1).

- Issuer: Adler Real Estate AG (Berlin, Germany) | Coupon: 3.00% | Maturity: 27/4/2026 | Rating: CCC | ISIN: XS1713464524 | Z-spread down by 162.9 bp to 1,151.7 bp, with the yield to worst at 11.8% and the bond now trading up to 71.9 cents on the dollar (1Y price range: 60.9-94.5).

- Issuer: International Consolidated Airlines Group SA (Harmondsworth, Spain) | Coupon: 3.75% | Maturity: 25/3/2029 | Rating: B+ | ISIN: XS2322423539 | Z-spread down by 170.3 bp to 709.6 bp, with the yield to worst at 8.6% and the bond now trading up to 75.6 cents on the dollar (1Y price range: 67.4-100.3).

RECENT DOMESTIC USD BOND ISSUES

- Autozone Inc (Vehicle Parts | Memphis, United States | Rating: BBB): US$750m Senior Note (US053332BB79), fixed rate (4.75% coupon) maturing on 1 August 2032, priced at 99.91 (original spread of 175 bp), callable (10nc10)

- Bank of New York Mellon Corp (Financial - Other | New York City, New York, United States | Rating: A): US$500m Senior Note (US06406RBK23), floating rate maturing on 26 July 2030, priced at 100.00 (original spread of 148 bp), callable (8nc7)

- Bank of New York Mellon Corp (Financial - Other | New York City, New York, United States | Rating: A): US$1,250m Senior Note (US06406RBJ59), floating rate maturing on 24 July 2026, priced at 100.00 (original spread of 109 bp), callable (4nc3)

- CSX Corp (Railroads | Jacksonville, United States | Rating: BBB+): US$950m Senior Note (US126408HU08), fixed rate (4.10% coupon) maturing on 15 November 2032, priced at 99.94 (original spread of 120 bp), callable (10nc10)

- CSX Corp (Railroads | Jacksonville, Florida, United States | Rating: BBB+): US$900m Senior Note (US126408HV80), fixed rate (4.50% coupon) maturing on 15 November 2052, priced at 99.35 (original spread of 145 bp), callable (30nc30)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$200m Bond (US3133ENC739), fixed rate (3.25% coupon) maturing on 26 July 2024, priced at 100.00 (original spread of 1 bp), non callable

- Federal Home Loan Banks (Agency | Washington, Washington Dc, United States | Rating: AA+): US$200m Bond (US3130ASRJ03), fixed rate (4.10% coupon) maturing on 8 August 2025, priced at 100.00 (original spread of 119 bp), callable (3nc3m)

- Federal Home Loan Mortgage Corp (Agency | Mclean, United States | Rating: AA+): US$150m Unsecured Note (US3134GXJ397), fixed rate (4.00% coupon) maturing on 8 August 2024, priced at 100.00 (original spread of 77 bp), callable (2nc1m)

- International Business Machines Corp (Information/Data Technology | Armonk, New York, United States | Rating: A-): US$750m Senior Note (US459200KV23), fixed rate (4.90% coupon) maturing on 27 July 2052, priced at 98.61 (original spread of 206 bp), callable (30nc30)

- International Business Machines Corp (Information/Data Technology | Armonk, New York, United States | Rating: A-): US$750m Senior Note (US459200KU40), fixed rate (4.40% coupon) maturing on 27 July 2032, priced at 99.28 (original spread of 145 bp), callable (10nc10)

- International Business Machines Corp (Information/Data Technology | Armonk, New York, United States | Rating: A-): US$1,000m Senior Note (US459200KS93), fixed rate (4.00% coupon) maturing on 27 July 2025, priced at 100.00 (original spread of 75 bp), with a make whole call

- International Business Machines Corp (Information/Data Technology | Armonk, New York, United States | Rating: A-): US$750m Senior Note (US459200KT76), fixed rate (4.15% coupon) maturing on 27 July 2027, priced at 99.87 (original spread of 100 bp), callable (5nc5)

- JPMorgan Chase & Co (Banking | New York City, New York, United States | Rating: A-): US$3,500m Senior Note (US46647PDH64), floating rate maturing on 25 July 2033, priced at 100.00, callable (11nc10)

- JPMorgan Chase & Co (Banking | New York City, New York, United States | Rating: A-): US$3,500m Senior Note (US46647PDG81), floating rate maturing on 25 July 2028, priced at 100.00, callable (6nc5)

- Wells Fargo & Co (Banking | San Francisco, California, United States | Rating: BBB+): US$3,000m Senior Note (US95000U3A91), floating rate maturing on 25 July 2028, priced at 100.00, callable (6nc5)

- Wells Fargo & Co (Banking | San Francisco, California, United States | Rating: BBB+): US$3,500m Senior Note (US95000U3B74), floating rate maturing on 25 July 2033, priced at 100.00, callable (11nc10)

RECENT INTERNATIONAL USD BOND ISSUES

- Bank Leumi Le Israel BM (Banking | Tel Aviv-Yafo, Israel | Rating: A): US$500m Senior Note (IL0060406878), fixed rate (5.13% coupon) maturing on 27 July 2027, priced at 99.34 (original spread of 210 bp), callable (5nc5)

- Bank of Montreal (Banking | Toronto, Canada | Rating: A+): US$2,500m Covered Bond (Other) (US06368D6Y53), fixed rate (3.75% coupon) maturing on 25 July 2025, priced at 99.94 (original spread of 66 bp), non callable

- Camelot Return Merger Sub Inc (Financial - Other | Rating: NR): US$710m Note (US13323NAA00), fixed rate (8.75% coupon) maturing on 1 August 2028, priced at 90.30, callable (6nc2)

- Cooperatieve Rabobank UA (Banking | Utrecht, Utrecht, Netherlands | Rating: A+): US$150m Unsecured Note (XS2505405071), fixed rate (4.82% coupon) maturing on 29 July 2042, priced at 100.00, non callable

- Guangzhou Development Zone Investment Group Co Ltd (Financial - Other | Guangzhou, Guangdong, China (Mainland) | Rating: NR): US$400m Bond (XS2495197159), fixed rate (4.50% coupon) maturing on 28 July 2025, priced at 100.00 (original spread of 228 bp), non callable

- Imperial Brands Finance PLC (Financial - Other | Bristol, United Kingdom | Rating: BBB): US$1,000m Senior Note (USG471ABWD89), fixed rate (6.13% coupon) maturing on 27 July 2027, priced at 98.96 (original spread of 320 bp), callable (5nc5)

- Korea Hydro & Nuclear Power Co Ltd (Utility - Other | Gyeongju, Gyeongsangbuk-Do, South Korea | Rating: AA): US$700m Senior Note (US50064YAQ61), fixed rate (4.25% coupon) maturing on 27 July 2027, priced at 99.36 (original spread of 126 bp), non callable

- Lenovo Group Ltd (Information/Data Technology | Beijing, Beijing, China (Mainland) | Rating: BBB): US$625m Senior Note (US526250AD71), fixed rate (5.83% coupon) maturing on 27 January 2028, priced at 100.00 (original spread of 317 bp), callable (6nc5)

- Lenovo Group Ltd (Information/Data Technology | Beijing, Beijing, China (Mainland) | Rating: BBB): US$625m Senior Note (US526250AE54), fixed rate (6.54% coupon) maturing on 27 July 2032, priced at 100.00 (original spread of 379 bp), callable (10nc10)

- NTT Finance Corp (Financial - Other | Minato-Ku, Tokyo-To, Japan | Rating: A): US$500m Senior Note (USJ5S39RAK09), fixed rate (4.37% coupon) maturing on 27 July 2027, priced at 100.00 (original spread of 120 bp), callable (5nc5)

- NTT Finance Corp (Financial - Other | Minato-Ku, Tokyo-To, Japan | Rating: A): US$500m Senior Note (USJ5S39RAH79), fixed rate (4.14% coupon) maturing on 26 July 2024, priced at 100.00 (original spread of 90 bp), with a make whole call

- NTT Finance Corp (Financial - Other | Minato-Ku, Tokyo-To, Japan | Rating: A): US$500m Senior Note (US62954WAJ45), fixed rate (4.24% coupon) maturing on 25 July 2025, priced at 100.00 (original spread of 100 bp), with a make whole call

- Nationwide Building Society (Financial - Other | Swindon, Wiltshire, United Kingdom | Rating: A+): US$850m Note (US63861WAH88), fixed rate (4.85% coupon) maturing on 27 July 2027, priced at 99.91 (original spread of 170 bp), non callable

- Three Gorges Finance I (Cayman Islands) Ltd (Financial - Other | George Town, China (Mainland) | Rating: A+): US$300m Senior Note (XS2492955237), fixed rate (3.63% coupon) maturing on 28 July 2025, priced at 99.80 (original spread of 82 bp), callable (3nc3)

- Toronto-Dominion Bank (Banking | Toronto, Ontario, Canada | Rating: A+): US$2,000m Covered Bond (Other) (US891160TC78), fixed rate (3.82% coupon) maturing on 25 July 2025, priced at 100.00 (original spread of 79 bp), non callable

- ZhangZhou JiuLongJiang Group Co Ltd (Real Estate Investment Trust | Zhangzhou, China (Mainland) | Rating: BBB-): US$500m Bond (XS2497051289), fixed rate (4.70% coupon) maturing on 27 July 2025, priced at 99.45, non callable

SELECTED RECENT EUR BOND ISSUES

- Aareal Bank AG (Banking | Wiesbaden, Hessen, Germany | Rating: A-): €500m Bond (DE000AAR0355), fixed rate (4.50% coupon) maturing on 25 July 2025, priced at 99.82 (original spread of 388 bp), non callable

- Deutsche Bank AG (Banking | Frankfurt, Hessen, Germany | Rating: A-): €500m Inhaberschuldverschreibung (DE000A30VS64), floating rate (EU03MLIB + 0.0 bp) maturing on 28 July 2027, priced at 100.00, non callable

- Deutsche Pfandbriefbank AG (Banking | Garching Bei Muenchen, Bayern, Germany | Rating: BBB+): €750m Hypothekenpfandbrief (Covered Bond) (DE000A30WFU3), fixed rate (1.75% coupon) maturing on 1 March 2027, priced at 99.87 (original spread of 92 bp), non callable

- Finsbury Castle DAC (Financial - Other | Dublin, Dublin, Ireland | Rating: NR): €200m Unsecured Note (XS2503895232) zero coupon maturing on 9 December 2024, non callable

- Greece, Republic of (Government) (Sovereign | Athina, Attiki, Greece | Rating: BB-): €1,000m Senior Note (GR0514024216), floating rate (EU03MLIB + 123.0 bp) maturing on 15 December 2027, priced at 100.00, non callable

- HSBC Holdings PLC (Banking | London, United Kingdom | Rating: A-): €1,000m Unsecured Note (XS2461439197), fixed rate (3.00% coupon) maturing on 22 March 2032, priced at 100.00 (original spread of 196 bp), non callable

- Landesbank Baden Wuerttemberg (Banking | Stuttgart, Baden-Wuerttemberg, Germany | Rating: AA-): €1,000m Hypothekenpfandbrief Jumbo (Covered Bond) (DE000LB2ZV93), fixed rate (1.75% coupon) maturing on 28 February 2028, priced at 99.69 (original spread of 87 bp), non callable

- Sparkasse Pforzheim Calw (Banking | Pforzheim, Baden-Wuerttemberg, Germany | Rating: AAA): €250m Hypothekenpfandbrief (Covered Bond) (DE000A30VST0), floating rate (EU03MLIB + 60.0 bp) maturing on 25 July 2028, priced at 102.11, non callable

- Toronto-Dominion Bank (Banking | Toronto, Ontario, Canada | Rating: A+): €2,500m Covered Bond (Other) (XS2508690612), fixed rate (1.71% coupon) maturing on 28 July 2025, priced at 100.00 (original spread of 107 bp), non callable

NEW LOANS

- ETC Group, signed a US$ 995m Term Loan B, to be used for 126. It matures on 08/03/29 and initial pricing is set at Term SOFR +600.0bp

- Patagonia HoldCo, signed a US$ 800m Term Loan B and a US$ 200m Revolving Credit Facility, to be used for acquisition financing.

- Carmila SAS (BBB), signed a € 550m Term Loan, to be used for general corporate purposes

- Coats PLC, signed a US$ 250m Term Loan, to be used for acquisition financing

NEW ISSUES IN SECURITIZED CREDIT

- Ellington Financial Mortgage Trust 2022-3 issued a fixed-rate RMBS in 3 tranches, for a total of US$ 303 m. Bookrunners: Credit Suisse, Nomura Securities New York Inc, Barclays Capital Group